UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 19, 2023

StoneBridge

Acquisition Corporation

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40613 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

One World Trade Center

Suite 8500

New York, NY 10007

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (646) 314-3555

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

APACU |

|

The Nasdaq Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

APAC |

|

The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

APACW |

|

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 5.07. Submission of Matters to a Vote of Security Holders.

On December 19, 2023,

StoneBridge Acquisition Corporation (the “Company” or “StoneBridge”) held an extraordinary

general meeting of shareholders (the “Extraordinary General Meeting”) in connection with the proposed business

combination (the “Business Combination”) as described in (i) the business combination agreement, dated

as of January 5, 2023 (as amended on June 22, 2023 by First Amendment to Business Combination Agreement, and as may be further

amended, supplemented, or otherwise modified from time to time, the “Business Combination Agreement”), by and

among the Company, StoneBridge Acquisition Pte. Ltd., a Singapore private company limited by shares, with company registration number

202239721R and a direct wholly owned subsidiary of Stonebridge (“Amalgamation Sub”), DigiAsia Bios Pte. Ltd.,

a Singapore private company limited by shares, with company registration number 201730295C (“DigiAsia”), and

Prashant Gokarn (the “Management Representative”), solely in his capacity as the Management Representative;

and (ii) the Company’s final proxy statement/prospectus filed with the Securities and Exchange Commission (the “SEC”)

on November 28, 2023 (the “Definitive Proxy Statement/Prospectus”) and mailed to the shareholders of record

on or about November 28, 2023.

Each proposal (individually

a “Proposal” and, collectively, the “Proposals”) voted upon at the Extraordinary General

Meeting and the final voting results are indicated below. Each Proposal voted on at the Extraordinary General Meeting is described in

detail in the Definitive Proxy Statement/Prospectus.

As of the close of business

on October 13, 2023, the record date for the Extraordinary General Meeting, there were approximately 7,425,969 ordinary shares outstanding,

consisting of (i) 2,425,969 shares of Class A ordinary shares, par value $0.0001 per share and (ii) 5,000,000 shares of

Class B ordinary shares, par value $0.0001 per share.

A total of 6,554,770 ordinary

shares, representing approximately 88.27% of the outstanding ordinary shares entitled to vote, was present in person or by proxy, at Extraordinary

General Meeting, constituting a quorum. Capitalized terms used herein that are not otherwise defined have the meaning set forth in the

Definitive Proxy Statement/Prospectus.

Proposal No. 1 – Business Combination

Proposal

To

approve, by ordinary resolution, the Business Combination and other transactions contemplated by, and StoneBridge’s entry into,

the Business Combination Agreement (the “Business Combination Proposal”). The Business Combination Proposal

was approved by ordinary resolution of StoneBridge’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,226 |

|

1,200 |

|

0 |

|

Proposal No. 2 – Amalgamation Proposal

To

approve, by ordinary resolution, assuming the Business Combination Proposal is approved and adopted, the Amalgamation and certain matters

relating to the Amalgamation (the “Amalgamation Proposal”). The Amalgamation Proposal was approved by

ordinary resolution of StoneBridge’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,225 |

|

1,201 |

|

0 |

|

Proposal No. 3 – Governing Documents

Proposals

To approve, by special resolutions, assuming the

Business Combination Proposal is approved and adopted, material differences between StoneBridge’s amended and restated memorandum

and articles of association which are in effect immediately prior to the Business Combination (the “Existing StoneBridge Charter”),

and the second amended and restated memorandum and articles of association of PubCo upon completion of the Business Combination (the “New

PubCo Charter”) and such six separate proposals collectively referred to herein as the “Governing Documents

Proposals.”. Each of the Governing Documents Proposals were approved by special resolution. The votes for each sub-proposal

were as follows:

| |

(a) |

A proposal for the approval for the effective change of PubCo’s corporate name from “StoneBridge Acquisition Corporation” to “DigiAsia Corp”: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,226 |

|

1,200 |

|

0 |

|

| |

(b) |

A proposal for the approval for the effective change in authorized share capital from the authorized share capital of StoneBridge to the authorized share capital of PubCo: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,225 |

|

1,200 |

|

0 |

|

| |

(c) |

A proposal for the approval for the effective change from the share structure of StoneBridge, comprising of Class A ordinary shares, par value $0.0001 per share, Class B ordinary shares, par value $0.0001 per share, and preference shares, par value $0.0001 per share, to a share structure of PubCo, comprising of ordinary shares, par value $0.0001 per share and preference shares, par value $0.0001 per share: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,226 |

|

1,200 |

|

0 |

|

| |

(d) |

A proposal for the approval for the effective change to consider and vote for the effective change from the holders of StoneBridge’s Class B ordinary shares having the power to appoint or remove any director of StoneBridge by ordinary resolution under the terms of the Existing Charter, to the holders of PubCo Ordinary Shares having the power to appoint or remove the directors of PubCo by ordinary resolution under the terms of the New Charter: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,225 |

|

1,201 |

|

0 |

|

| |

(e) |

A proposal for the approval for the effective change to consider and vote for the effective change from the classified board of directors of StoneBridge, which is required to be divided into three classes, with directors serving staggered terms, to a declassified board of directors of PubCo, with each director serving until the next succeeding annual general meeting of PubCo after such director’s election and until their successors are appointed and qualified or until their earlier resignation or removal: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,198,426 |

|

0 |

|

0 |

|

| |

(f) |

A proposal for the approval for changes arising from or in connection with the replacement of the Existing Charter with the New Charter, including the removal of certain provisions relating to StoneBridge’s status as a blank check company that will not be applicable following consummation of the Business Combination: |

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,225 |

|

1,201 |

|

0 |

|

Proposal No. 4 – Nasdaq Proposal

To consider and vote upon a proposal to approve,

by ordinary resolution, for purposes of complying with Nasdaq Listing Rule 5635, the issuance of PubCo Ordinary Shares in connection

with the Business Combination (the “Nasdaq Proposal”). The Nasdaq Proposal was approved by ordinary resolution

of StoneBridge’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,226 |

|

1,200 |

|

0 |

|

Proposal No. 5 – Incentive Plan

Proposal

To consider and vote upon a proposal to approve,

by ordinary resolution, the DigiAsia Corp. 2023 Omnibus Incentive Plan (the “Incentive Plan Proposal”). The

Incentive Plan Proposal was approved by ordinary resolution of StoneBridge’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,192,184 |

|

6,122 |

|

120 |

|

Proposal No. 6 – Adjournment Proposal

To consider and approve, if presented, a proposal

to adjourn the Extraordinary General Meeting to a later date or dates in the event that there are insufficient votes for, or otherwise

in connection with, the approval of one or more proposals (the “Adjournment Proposal”). The Adjournment Proposal

was approved by ordinary resolution of StoneBridge’s shareholders, and received the following votes:

| FOR |

|

AGAINST |

|

ABSTAIN |

|

| 6,197,226 |

|

1,200 |

|

0 |

|

Item 7.01. Regulation FD Disclosure.

On

December 22, 2023, the Company issued a press release (the “Press Release”), announcing the approval

of the Business Combination by the shareholders of the Company at the Extraordinary General Meeting. A copy of the Press Release

is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 8.01 Other Events

On December 15, 2023,

the deadline to elect to redeem shares of the Company’s Class A ordinary shares in connection with the Extraordinary General

Meeting, shareholders holding 2,393,307 shares of the Company’s Class A ordinary shares (or approximately 98.5% of the

Company’s outstanding Class A ordinary shares) exercised their right to redeem such shares for a pro rata portion of the funds

in the Company’s trust account, which left the Company with 32,662 shares of Class A ordinary shares outstanding after redemptions.

As of December 22, 2023,

after receiving and granting certain redemption reversals, the Company has 37,429 shares of Class A ordinary shares outstanding after

redemptions. Prior to the closing of the Business Combination (the “Closing”), the Company may consider additional

requests from shareholders to grant further requests for redemption reversals.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

STONEBRIDGE ACQUISITION CORPORATION |

| |

|

|

| |

By: |

/s/ Bhargav Marepally |

| |

Name: |

Bhargav Marepally |

| |

Title: |

Chief Executive Officer |

| Date: December 22, 2023 |

|

|

Exhibit 99.1

StoneBridge Acquisition Corporation Shareholders

Approve Previously Announced Business Combination with DigiAsia Bios Pte. Ltd

New

York, NY, December 22, 2023 /EINPresswire.com/ – StoneBridge Acquisition Corporation (Nasdaq: APAC) (“StoneBridge”),

a publicly-traded special purpose acquisition company, today announced that its shareholders voted to approve the previously announced

business combination (the “Business Combination”) with DigiAsia Bios Pte. Ltd (“DigiAsia”) at StoneBridge’s

extraordinary general meeting of shareholders held on December 19, 2023 at 10:00 a.m. Eastern Time (the “Extraordinary General Meeting”).

Each of the proposals presented at the Extraordinary

General Meeting was approved, and the Business Combination is expected to be consummated as soon as practicable following the satisfaction

of the closing conditions described in the proxy statement for the Extraordinary General Meeting. StoneBridge plans to file the results

of the Extraordinary General Meeting, as tabulated by the inspector of election, with the Securities and Exchange Commission (the “SEC”)

on a Form 8-K.

About StoneBridge Acquisition Corporation

StoneBridge

Acquisition Corporation is a blank check company incorporated as Cayman Islands exempted for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. StoneBridge

focused its search on a target with operations or prospective operations in the consumer technology, communications, software, SaaS,

fintech or media sectors. The geographic focus for StoneBridge was the Asia Pacific region. StoneBridge helps visionary entrepreneurs

navigate the U.S. capital markets to create enterprise value for themselves and for their investors. To learn more, visit http://stonebridgespac.com/.

Safe Harbor Statement

This press release includes "forward-looking

statements" that involve risks and uncertainties that could cause actual results to differ materially from what is expected. Words

such as "expects," "believes," "anticipates," "intends," "estimates," "seeks,"

"may," "might," "plan," "possible," "should" and variations and similar words and expressions

are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

Such forward-looking statements relate to future events or future results, based on currently available information and reflect the Company's

management's current beliefs. A number of factors could cause actual events or results to differ materially from the events and results

discussed in the forward-looking statements. Important factors - including the availability of funds, the results of financing efforts

and the risks relating to our business - that could cause actual results to differ materially from the Company's expectations are disclosed

in the Company's documents filed from time to time on EDGAR (see www.edgar-online.com) and with the Securities and Exchange Commission

(see www.sec.gov). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

of this press release. In addition, please refer to the Risk Factors section of the Company's Form 10-K as filed with the SEC on March

28, 2023 and the Risk Factors section of the final prospectus filed on November 28, 2023 for additional information identifying important

factors that could cause actual results to differ materially from those anticipated in the forward-looking statements. Except as expressly

required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise.

For investor and media inquiries, please contact:

Prabhu Antony

President & CFO

(646) 314-3555

p.antony@stonebridgespac.com

Prabhu Antony

Stonebridge Acquisition Corporation

+1 646-314-3555

StoneBridge Acquisition (NASDAQ:APACU)

Historical Stock Chart

From Apr 2024 to May 2024

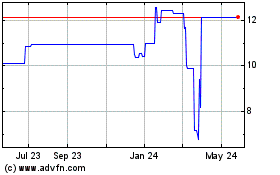

StoneBridge Acquisition (NASDAQ:APACU)

Historical Stock Chart

From May 2023 to May 2024