AppHarvest, Inc. (NASDAQ: APPH, APPHW), a sustainable food company,

public benefit corporation and Certified B Corp building some of

the world’s largest high-tech indoor farms to grow affordable,

nutritious fruits and vegetables at scale while providing good jobs

in Appalachia, today announced its operating and financial results

for the quarter ending March 31, 2023, reiterating its full year

2023 guidance and showing strong progress toward operational

efficiencies resulting in higher sales, cost savings and product

quality as the company works to increase production across its

three new farms.

First Quarter 2023 Results For the first

quarter 2023, net sales were $13.0 million versus net sales of $5.2

million in the first quarter of 2022 – a more than 250% increase

and nearly 90% of the company’s net sales for full year 2022. This

$7.8 million increase in net sales during the quarter was primarily

driven by tomato sales from the third harvest season at AppHarvest

Morehead and the start-up of operations at AppHarvest Berea,

AppHarvest Richmond and AppHarvest Somerset. January 2023 marked

the first time that all facilities in the AppHarvest four-farm

network were commercially shipping products from an increasingly

diversified crop portfolio including strawberries, salad greens,

cucumbers and more tomatoes.

Net sales by crop type were almost $11.0 million in tomatoes,

more than $1.0 million in strawberries, over $800,000 in salad

greens and nearly $200,000 in cucumbers.

In line with expectations, the company recorded a net loss of

$33.6 million and non-GAAP Adjusted EBITDA loss of $23.2 million in

the first quarter of 2023, compared to a prior year net loss of

$30.6 million and non-GAAP Adjusted EBITDA loss of $18.0 million.

See reconciliation of non-GAAP financial measures at the end of

this press release.

Project New Leaf UpdateAppHarvest Board Member

and controlled environment agriculture (CEA) industry veteran Tony

Martin was appointed chief operating officer in January of 2023 to

optimize production, sales and costs across the AppHarvest

four-farm network. Under “Project New Leaf,” the company’s

strategic program focused on profitability, Martin is working to

implement a five-point strategy to focus efforts across all

operations: 1) further leveraging synergies with its marketing and

distribution partner, Mastronardi Produce; 2) enabling labor

efficiency; 3) improving enterprise-wide feedback through clear key

performance indicators (KPIs) and cross-organization information

sharing; 4) initiating comprehensive spending reviews; and 5)

aligning team members to milestones outlined in the five-year

strategic vision.

“Under Tony’s leadership, we’re already seeing improved

performance in the first quarter with net sales of $13 million,”

said AppHarvest Founder and CEO Jonathan Webb. “Tony is focusing on

a data-driven approach for optimizing production and driving more

efficiency across the four-farm network. I believe Tony’s strong

CEA experience will help accelerate our path to profitability.”

OperationsIn its third season, Morehead is

achieving significant production records in terms of key

performance indicators. The company is applying lessons learned

from Morehead to accelerate its path to operational excellence at

each of the new farms, especially at Richmond where the team has

made meaningful progress in labor efficiency, plant health and

premium production.

The Morehead, Somerset and Richmond facilities have successfully

completed their food safety audits and have increased the number of

direct shipments from each farm, reducing transportation costs and

the number of food miles travelled so AppHarvest fruits and

vegetables arrive on store shelves fresher and with less waste. The

Berea farm is currently pursuing its food safety certification.

Operations continue to ramp up with both Berea and Richmond

opening on a planned phased approach. Richmond is expected to be

fully planted in the third quarter and to start harvesting later in

the fourth quarter.

Balance Sheet and Liquidity As of March 31,

2023, cash and cash equivalents were $50.0 million. The company has

taken steps to address liquidity and continues to explore

additional financing opportunities, including third-party

transactions such as a sales-leaseback on another of our high-tech

farms.

In February, the company completed an underwritten public

offering of 46,000,000 shares of common stock at a public offering

price of $1.00 per share. The gross proceeds to AppHarvest from

this offering were $46.0 million, before deducting underwriting

discounts and commissions, and offering expenses. AppHarvest

expects to use the net proceeds of the offering for working capital

and general corporate purposes. The company has been focused

primarily on non-dilutive capital, so this is the first

underwritten public offering the company has made since going

public in 2021.

In the first quarter, AppHarvest spent $21.2 million on capital

expenditures. The company expects to incur approximately $40.0

million to $45.0 million more in capital expenditures over the next

twelve months for final project details at the Berea, Richmond and

Somerset facilities. Approximately $17.7 million of this capex

spend range will come from amounts included in restricted cash and

other assets as of March 31, 2023.

In line with expectations, costs of goods sold (COGS) increased

by $20.8 million during the quarter. This year-over-year increase

in COGS was due primarily to production ramp up at the three new

farms as well as the change to long English cucumber production at

Somerset announced last quarter.

The company reported reductions in selling, general and

administrative expenses (SG&A) of $11.0 million for the quarter

compared to the prior year period. SG&A expenses were $10.0

million during the quarter compared to $21.0 million for the

comparable prior year periods. This spend decrease of more than

half was primarily driven by a $5.5 million decrease in stock

compensation expense for the quarter and lower salaries and wages

because of restructuring initiatives in the prior year.

Financial OutlookAppHarvest reiterates its

full-year 2023 guidance of net sales to be in the range of $40.0

million to $50.0 million and non-GAAP Adjusted EBITDA loss to be in

the range of $67.0 million to $76.0 million. The company believes

in its ability to be self-sufficient and generate positive

operating cash flow over the longer term with the four-farm

network.

With all four farms in the AppHarvest network shipping under a

variety of brands for Mastronardi Produce, the company expects to

see significant year-over-year net sales increases throughout 2023,

and it expects that trend to continue in 2024 as the company

leverages more of the farm acreage and works to optimize

production. The company believes it has the potential to see the

enterprise achieve positive Adjusted gross profit in 2024. In 2025,

the company expects to achieve positive Adjusted EBITDA status for

farm operations. With this trajectory, AppHarvest believes it may

be able to achieve positive Adjusted EBITDA status on a

consolidated basis in 2026.

Conference Call and WebcastAppHarvest will host

a webcast and conference call today at 4:30 p.m. ET to discuss its

first quarter financial results and operations.

The conference call will be streamed over the internet and

accessible through the “Investor Relations” section of the

AppHarvest website at https://investors.appharvest.com. To join the

live call, register here for the dial-in number and a personal PIN

code. To join the live webcast, click here. An audio-only replay of

the webcast will be available on the company’s website

approximately 90 minutes after the end of the conference call for

30 days.

Upcoming EventsAppHarvest management plans to

participate in the Oppenheimer 8th Annual Emerging Growth

Conference on Thursday, May 11, 2023, and the Cowen Sustainability

Conference on Thursday, June 8, 2023.

Details on upcoming events are available at the “Events” section

of the AppHarvest Investor Relations website at

https://investors.appharvest.com.

About AppHarvest AppHarvest is a sustainable

food company in Appalachia developing and operating some of the

world’s largest high-tech indoor farms with high levels of

automation to build a reliable, climate-resilient food system.

AppHarvest’s farms are designed to grow produce using sunshine,

rainwater and up to 90% less water than open-field growing, all

while producing yields up to 30 times that of traditional

agriculture and preventing pollution from agricultural runoff.

AppHarvest currently operates its 60-acre flagship farm in

Morehead, Ky., producing tomatoes, a 15-acre indoor farm for salad

greens in Berea, Ky., a 30-acre farm for strawberries and cucumbers

in Somerset, Ky., and a 60-acre farm in Richmond, Ky., for

tomatoes. The four-farm network consists of 165 acres under glass.

For more information, visit https://www.appharvest.com.

Non-GAAP Financial MeasuresTo supplement the

company’s consolidated financial statements, which are prepared and

presented in accordance with United States generally accepted

accounting principles (“U.S. GAAP” or “GAAP”), the company uses

certain non-GAAP measures, such as Adjusted EBITDA and Adjusted

gross loss, to understand and evaluate the company’s core operating

performance. The company defines and calculates Adjusted EBITDA as

net loss before the impact of interest income or expense, income

tax expense or benefit, depreciation and amortization, adjusted to

exclude: stock-based compensation expense, Business Combination

transaction-related costs, restructuring and impairment costs,

remeasurement of warrant liabilities, start-up costs for new CEA

facilities, and certain other non-core items. The company defines

and calculates Adjusted gross loss as gross loss adjusted to

exclude the impact of depreciation and amortization and stock-based

compensation expense related to cost of goods sold. The company

believes these non-GAAP measures of financial results provide

useful information to management and investors regarding certain

financial and business trends relating to the company’s financial

condition and results of operations. The company’s management uses

these non-GAAP measures for trend analyses and for budgeting and

planning purposes. The company believes that the use of these

non-GAAP financial measures provides additional tools for investors

to use in evaluating operating results and trends. Other similar

companies may present different non-GAAP measures or calculate

similar non-GAAP measures differently. Management does not consider

these non-GAAP measures in isolation or as an alternative to

financial measures determined in accordance with GAAP. The

principal limitation of these non-GAAP financial measures is that

they exclude significant expenses that are required to be presented

in the company’s GAAP financial statements. Because of this

limitation, you should consider Adjusted EBITDA and Adjusted gross

loss alongside other financial performance measures, including net

loss, gross loss, and our other financial results presented in

accordance with GAAP.

Adjusted EBITDA and Adjusted gross profit/(loss) as used in

connection with the company's financial outlook, including its 2023

guidance, are non-GAAP financial measures that exclude or have

otherwise been adjusted for items impacting comparability. The

company is unable to reconcile these forward-looking non-GAAP

financial measures to net income, their most directly comparable

forward-looking GAAP financial measure, without unreasonable

efforts, because the company is currently unable to predict with a

reasonable degree of certainty its stock-based compensation expense

for future periods. In addition, AppHarvest may incur additional

expenses which may impact Adjusted EBITDA and Adjusted gross

profit/(loss).

Forward-Looking Statements

Certain statements included in this press

release that are not historical facts are forward-looking

statements for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such

as “expect,” “believe,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “should,” “could,” “would,” “plan,”

“potential,” “seem,” “future,” “outlook,” “can,” “may, ”“target,”

“strategy,” “working to” and similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters. All statements, other than statements of

present or historical fact included in this press release,

regarding AppHarvest’s intention to build high-tech CEA farms, the

anticipated benefits of and production at such facilities,

including implementation of a phased approach at each facility,

timing and availability of tomatoes at top national grocery stores

and restaurants, anticipated benefits of the third season harvest,

the benefits of using a data-driven approach to optimize production

across the farm network, the anticipated benefits and timing of the

Company’s strategic program referred to as Project New Leaf, the

potential for a sale-leaseback of an additional farm, AppHarvest’s

future financial performance, as well as AppHarvest’s growth and

evolving business plans and strategy, ability to capitalize on

commercial opportunities, future operations, estimated financial

position, projected costs, prospects, plans and objectives of

management are forward-looking statements. These statements are

based on various assumptions, whether or not identified in this

press release, and on the current expectations of AppHarvest’s

management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on

as, a guarantee, an assurance, a prediction, or a definitive

statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from

assumptions. Many actual events and circumstances are beyond the

control of AppHarvest. These forward-looking statements are subject

to a number of risks and uncertainties, including those discussed

in the company’s Quarterly Report on Form 10-Q filed with the SEC

by AppHarvest on May 10, 2023, under the heading “Risk Factors,”

and other documents AppHarvest has filed, or that AppHarvest will

file, with the SEC. If any of these risks materialize or our

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. In

addition, forward-looking statements reflect AppHarvest’s

expectations, plans, or forecasts of future events and views as of

the date of this press release. AppHarvest anticipates that

subsequent events and developments will cause its assessments to

change. However, while AppHarvest may elect to update these

forward-looking statements at some point in the future, AppHarvest

specifically disclaims any obligation to do so. These

forward-looking statements should not be relied upon as

representing AppHarvest’s assessments of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements.

APPHARVEST, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)(in thousands except per share

amounts)

| |

March 31,2023 |

|

December 31,2022 |

| Assets |

|

|

|

| Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

50,017 |

|

|

$ |

54,334 |

|

|

Restricted cash |

|

23,450 |

|

|

|

24,198 |

|

|

Accounts receivable, net |

|

3,669 |

|

|

|

2,786 |

|

|

Inventories, net |

|

16,105 |

|

|

|

18,078 |

|

|

Prepaid expenses and other current assets |

|

17,341 |

|

|

|

14,716 |

|

| Total current assets |

|

110,582 |

|

|

|

114,112 |

|

|

Operating lease right-of-use assets, net |

|

2,503 |

|

|

|

2,626 |

|

|

Property and equipment, net |

|

476,334 |

|

|

|

456,178 |

|

|

Other assets, net |

|

20,385 |

|

|

|

22,412 |

|

| Total non-current assets |

|

499,222 |

|

|

|

481,216 |

|

| Total

assets |

$ |

609,804 |

|

|

$ |

595,328 |

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

30,445 |

|

|

$ |

16,571 |

|

|

Accrued expenses |

|

14,517 |

|

|

|

21,996 |

|

|

Current portion of lease liabilities |

|

505 |

|

|

|

514 |

|

|

Current portion of long-term debt |

|

3,685 |

|

|

|

3,685 |

|

|

Other current liabilities |

|

45 |

|

|

|

202 |

|

| Total current liabilities |

|

49,197 |

|

|

|

42,968 |

|

|

Long-term debt, net of current portion |

|

178,819 |

|

|

|

180,537 |

|

|

Lease liabilities, net of current portion |

|

2,509 |

|

|

|

2,628 |

|

|

Financing obligation |

|

105,680 |

|

|

|

103,787 |

|

|

Deferred income tax liabilities |

|

4,682 |

|

|

|

4,925 |

|

|

Private Warrant liabilities |

|

110 |

|

|

|

119 |

|

|

Other liabilities |

|

63 |

|

|

|

73 |

|

| Total non-current

liabilities |

|

291,863 |

|

|

|

292,069 |

|

| Total

liabilities |

|

341,060 |

|

|

|

335,037 |

|

| Stockholders’

equity |

|

|

|

|

Preferred stock, par value $0.0001, 10,000 shares authorized, 0

issued and outstanding, as of March 31, 2023 and

December 31, 2022, respectively |

|

— |

|

|

|

— |

|

|

Common stock, par value $0.0001, 750,000 shares authorized, 155,084

and 108,511 shares issued and outstanding as of March 31, 2023

and December 31, 2022, respectively |

|

16 |

|

|

|

11 |

|

|

Additional paid-in capital |

|

658,972 |

|

|

|

615,452 |

|

|

Accumulated deficit |

|

(397,590 |

) |

|

|

(363,960 |

) |

|

Accumulated other comprehensive income (loss) |

|

7,346 |

|

|

|

8,788 |

|

| Total stockholders’ equity |

|

268,744 |

|

|

|

260,291 |

|

| Total liabilities and

stockholders’ equity |

$ |

609,804 |

|

|

$ |

595,328 |

|

APPHARVEST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)(In thousands except per share

data)

| |

Three Months EndedMarch 31, |

| |

|

2023 |

|

|

|

2022 |

|

| Net sales |

$ |

13,011 |

|

|

$ |

5,164 |

|

| Cost of goods sold |

|

34,345 |

|

|

|

13,554 |

|

| Gross loss |

|

(21,334 |

) |

|

|

(8,390 |

) |

| Operating expenses: |

|

|

|

|

Selling, general and administrative expenses |

|

10,016 |

|

|

|

21,039 |

|

| Total operating expenses |

|

10,016 |

|

|

|

21,039 |

|

| Loss from operations |

|

(31,350 |

) |

|

|

(29,429 |

) |

| Other income (expense): |

|

|

|

|

Interest expense |

|

(2,698 |

) |

|

|

— |

|

|

Change in fair value of Private Warrants |

|

9 |

|

|

|

(1,329 |

) |

|

Other |

|

166 |

|

|

|

14 |

|

| Loss before income taxes |

|

(33,873 |

) |

|

|

(30,744 |

) |

|

Income tax benefit |

|

243 |

|

|

|

109 |

|

| Net loss |

|

(33,630 |

) |

|

|

(30,635 |

) |

| |

|

|

|

| Other comprehensive income

(loss): |

|

|

|

|

Net unrealized gains (losses) on derivatives contracts, net of

tax |

|

(1,442 |

) |

|

|

4,360 |

|

| Comprehensive loss |

$ |

(35,072 |

) |

|

$ |

(26,275 |

) |

| |

|

|

|

| Net loss per common share: |

|

|

|

|

Basic and diluted |

$ |

(0.26 |

) |

|

$ |

(0.30 |

) |

|

Weighted average common shares outstanding: |

|

|

|

|

Basic and diluted |

|

131,124 |

|

|

|

101,321 |

|

APPHARVEST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (Unaudited)(In thousands)

| |

Three Months Ended March 31, |

| |

|

2023 |

|

|

|

2022 |

|

| Operating

Activities |

|

|

|

|

Net loss |

$ |

(33,630 |

) |

|

$ |

(30,635 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Change in fair value of Private Warrants |

|

(9 |

) |

|

|

1,329 |

|

|

Deferred income tax expense |

|

(243 |

) |

|

|

(109 |

) |

|

Depreciation and amortization |

|

7,641 |

|

|

|

3,112 |

|

|

Interest expense from financing obligation |

|

1,974 |

|

|

|

— |

|

|

Stock-based compensation expense |

|

503 |

|

|

|

6,035 |

|

|

Rent expense (less than) in excess of payments |

|

(5 |

) |

|

|

26 |

|

|

Changes in operating assets and liabilities |

|

|

|

|

Accounts receivable |

|

(883 |

) |

|

|

(307 |

) |

|

Inventories, net |

|

1,973 |

|

|

|

(78 |

) |

|

Prepaid expenses and other current assets |

|

(2,625 |

) |

|

|

1,613 |

|

|

Other assets, net |

|

51 |

|

|

|

(9,230 |

) |

|

Accounts payable |

|

2,804 |

|

|

|

301 |

|

|

Accrued expenses |

|

(2,386 |

) |

|

|

(2,124 |

) |

|

Other current liabilities |

|

(157 |

) |

|

|

— |

|

|

Other non-current liabilities |

|

(10 |

) |

|

|

2,564 |

|

|

Net cash used in operating activities |

|

(25,002 |

) |

|

|

(27,503 |

) |

| Investing

Activities |

|

|

|

|

Purchases of property and equipment |

|

(21,171 |

) |

|

|

(39,018 |

) |

|

Net cash used in investing activities |

|

(21,171 |

) |

|

|

(39,018 |

) |

| Financing

Activities |

|

|

|

|

Proceeds from debt |

|

— |

|

|

|

25,902 |

|

|

Payments on long-term debt |

|

(937 |

) |

|

|

— |

|

|

Debt issuance costs |

|

(895 |

) |

|

|

— |

|

|

Payments on financing obligation to a related party |

|

(82 |

) |

|

|

— |

|

|

Proceeds from stock options exercised |

|

63 |

|

|

|

36 |

|

|

Payments of withholding taxes on restricted stock conversions |

|

(79 |

) |

|

|

(953 |

) |

|

Proceeds from issuance of common stock |

|

46,000 |

|

|

|

— |

|

|

Stock issuance costs |

|

(2,962 |

) |

|

|

— |

|

|

Net cash provided by financing activities |

|

41,108 |

|

|

|

24,985 |

|

|

Change in cash and cash equivalents |

|

(5,065 |

) |

|

|

(41,536 |

) |

| Cash, cash equivalents

and restricted cash at the beginning of period |

|

78,532 |

|

|

|

176,311 |

|

| Cash, cash equivalents and

restricted cash at the end of period |

|

73,467 |

|

|

|

134,775 |

|

|

Less restricted cash at the end of the period |

|

23,450 |

|

|

|

37,130 |

|

| Cash and cash

equivalents at the end of the period |

$ |

50,017 |

|

|

$ |

97,645 |

|

| Non-cash

Activities: |

|

|

|

|

Fixed assets purchases in accounts payable |

$ |

24,056 |

|

|

$ |

5,272 |

|

|

Fixed assets purchases in accrued liabilities |

$ |

4,108 |

|

|

$ |

2,207 |

|

|

Terminated right of use assets and operating lease liabilities |

$ |

— |

|

|

$ |

237 |

|

|

New right of use assets and lease liabilities |

$ |

— |

|

|

$ |

— |

|

APPHARVEST, INC. AND

SUBSIDIARIES

Reconciliation of Selected GAAP Measures

to Non-GAAP Measures(In millions)

| |

|

Three Months Ended |

| (Dollars in

millions) |

|

March 31,2023 |

|

March 31,2022 |

| Net loss |

|

$ |

(33.6 |

) |

|

$ |

(30.6 |

) |

|

Interest expense |

|

|

2.7 |

|

|

|

— |

|

|

Interest income |

|

|

(0.5 |

) |

|

|

(0.1 |

) |

|

Income tax (benefit) expense |

|

|

(0.2 |

) |

|

|

(0.1 |

) |

|

Depreciation and amortization expense |

|

|

7.6 |

|

|

|

3.1 |

|

| EBITDA |

|

|

(24.0 |

) |

|

|

(27.7 |

) |

|

Change in fair value of Private Warrants |

|

|

— |

|

|

|

1.3 |

|

|

Stock-based compensation expense |

|

|

0.5 |

|

|

|

6.0 |

|

|

Restructuring costs(1) |

|

|

0.4 |

|

|

|

2.0 |

|

|

Start-up costs for new CEA facilities(2) |

|

|

— |

|

|

|

0.4 |

|

| Adjusted EBITDA |

|

$ |

(23.2 |

) |

|

$ |

(18.0 |

) |

(1) Restructuring costs(2) Start-up costs are related to the

pre-commencement commercial activities for tomatoes, salad greens

and strawberries at the Richmond, Berea and Somerset CEA

facilities.

The following table presents a reconciliation of gross loss, the

most directly comparable financial measure calculated and presented

in accordance with GAAP, to Adjusted gross loss:

|

|

Three Months Ended |

|

|

| (Dollars in

millions) |

March 31, 2023 |

|

March 31, 2022 |

|

$ Change |

| Net sales |

$ |

13.0 |

|

|

$ |

5.2 |

|

|

$ |

7.8 |

|

|

Cost of goods sold |

|

34.3 |

|

|

|

13.6 |

|

|

|

20.7 |

|

|

Gross loss |

|

(21.3 |

) |

|

|

(8.4 |

) |

|

|

(12.9 |

) |

|

Depreciation and amortization |

|

6.5 |

|

|

|

2.3 |

|

|

|

4.2 |

|

|

Stock-based compensation expense |

|

0.2 |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

Adjusted gross loss |

$ |

(14.7 |

) |

|

$ |

(6.0 |

) |

|

$ |

(8.7 |

) |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/0d2129ca-fe8b-4f82-9d21-5ace5f87ff30

https://www.globenewswire.com/NewsRoom/AttachmentNg/830bfdad-73e5-4254-b7c7-2711022b2ef3

Media Contact: Darla Turner, Darla.Turner@appharvest.com

Investor Contact: AppHarvestIR@appharvest.com

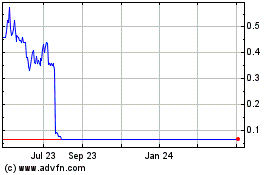

AppHarvest (NASDAQ:APPH)

Historical Stock Chart

From Nov 2024 to Dec 2024

AppHarvest (NASDAQ:APPH)

Historical Stock Chart

From Dec 2023 to Dec 2024