0001835972

true

0001835972

2023-11-02

2023-11-02

0001835972

ARRWU:UnitsEachConsistingOfOneShareOfClassCommonStock0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember

2023-11-02

2023-11-02

0001835972

ARRWU:SharesOfClassCommonStockIncludedAsPartOfUnitsMember

2023-11-02

2023-11-02

0001835972

ARRWU:RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member

2023-11-02

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November

2, 2023

ARROWROOT ACQUISITION CORP.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-40129 |

|

85-3961600 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

4553 Glencoe Ave, Suite 200

Marina Del Rey, California 90292

(Address of principal executive office) (Zip Code)

(310) 566-5966

(Registrant’s telephone number, including area

code)

Not Applicable

(Former name, former address and former fiscal year,

if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one redeemable warrant |

|

ARRWU |

|

The Nasdaq Stock Market LLC |

| Shares of Class A common stock included as part of the units |

|

ARRW |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants included as part of the units, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

ARRWW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note

This

Current Report on Form 8-K/A is being filed to amend the Current Report on Form 8-K filed by Arrowroot

Acquisition Corp., a Delaware corporation (the “Company”) with the U.S. Securities

and Exchange Commission (the “SEC”) on November 7, 2023 in order to check the Rule 425 filing box on the cover page

hereof, which was erroneously unmarked in the original filing.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The board of directors of the Company, approved a

draw of an aggregate of $160,000 (the “Extension Funds”) pursuant to the Promissory Note, dated as of March 6, 2023

(the “Note”), between the Company and Arrowroot Acquisition LLC (the “Lender”), which Extension

Funds were deposited into the Company’s trust account for its public stockholders on November 2, 2023. This deposit enables the

Company to extend the date by which it must complete its initial business combination from November 6, 2023 to December 6, 2023 (the “Extension”).

The Extension is the fifth of seven one-month extensions permitted under the Company’s amended and restated certificate of incorporation,

as amended, and provides the Company with additional time to complete its initial business combination. The Note does not bear interest

and matures upon closing of the Company’s initial business combination. In the event that the Company does not consummate an initial

business combination, the Note will be repaid only from funds remaining outside of the Company’s trust account, if any, or will

be forfeited, eliminated, or otherwise forgiven. Up to $1,760,000 of the total principal amount of the Note may be converted, in whole

or in part, at the option of the Lender into warrants of the Company at a price of $1.00 per warrant, which warrants will be identical

to the private placement warrants issued to the Lender at the time of the initial public offering of the Company.

Item 7.01 Regulation FD Disclosure.

As previously announced, on April 27, 2023, the Company,

entered into an Agreement and Plan of Merger (“Merger Agreement”), by and among the Company, ARAC Merger Sub, Inc.,

a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), and iLearningEngines, Inc., a Delaware

corporation (“iLearningEngines”). Pursuant to the Merger Agreement, Merger Sub will merge with and into iLearningEngines,

the separate corporate existence of Merger Sub will cease and iLearningEngines will be the surviving corporation and a wholly owned subsidiary

of the Company (the “Merger”).

On November 6, 2023, the Company and iLearningEngines

released an updated corporate presentation (the “Corporate Presentation”).

A copy of the Corporate Presentation and transcript

of a video clip included therein, are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated into this

Item 7.01 by reference. The information in this Item 7.01, and Exhibit 99.1 and Exhibit 99.2, attached hereto, is intended to be furnished

and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements Legend

Certain statements included in this Current Report

on Form 8-K that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States

Private Securities Litigation Reform Act of 1995 with respect to the proposed transaction (“Proposed Business Combination”).

Forward looking statements generally are accompanied by words such as “believe,” “may,” “will, “estimate,”

“continue,” “anticipate,” “intend,” expect,” “should,” “would,” “plan,”

“predict,” “potential,” “seem,” “seek,” “future,” “outlook,” the

negative forms of these words and similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. These forward-looking statements include, but are not limited to statements regarding estimates and forecasts of financial and

performance metrics, projections of market opportunity, trends and developments in iLearningEngines’ industry, operating results,

potential revenues, growth forecasts, growth of customers, continued adherence of customers to iLearningEngines’ services, business

strategy, various addressable markets, anticipated trends, developments in markets in which iLearningEngines operates, the market adoption

of iLearningEngines’ technology, platform and products, the capabilities, performance, and advancement of iLearningEngines’

technology, platform and products, iLearningEngines’ projected economics and expansion in global markets, iLearningEngines’

pro forma information, the expected management and governance of iLearningEngines and iLearningEngines’ future technology and platform

development and roadmap. These statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K,

and on the current expectations of the respective management of iLearningEngines and the Company and are not predictions of actual performance.

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied

on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances

are difficult or impossible to predict and will differ from assumptions this Current Report on Form 8-K relies on. Many actual events

and circumstances are beyond the control of iLearningEngines and the Company. These forward-looking statements are subject to a number

of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political, and legal conditions;

(ii) the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any

regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined

company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of the Company or iLearningEngines

is not obtained; (iii) failure to realize the anticipated benefits of the Proposed Business Combination; (iv) risks relating to the uncertainty

of the projected financial information with respect to iLearningEngines; (v) risks related to the rollout of iLearningEngines’ business

and the timing of expected business milestones; (vi) the amount of redemption requests made by the Company’s stockholders; (vii)

the ability of the Company or iLearningEngines to issue equity or equity-linked securities or obtain debt financing in connection with

the Proposed Business Combination or in the future; (viii) the ability to maintain the listing of the combined company’s securities

on NASDAQ or another national securities exchange; (ix) the risk that the Proposed Business Combination disrupts current plans and operations

of iLearningEngines or the Company as a result of the announcement and consummation of the Proposed Business Combination; (x) the risk

that any of the conditions to closing are not satisfied in the anticipated manner or on the anticipated timeline; (xi) the effects of

competition on iLearningEngines future business and the ability of the combined company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its management and key employees; (xii) risks related to political and macroeconomic

uncertainty; (xiii) the outcome of any legal proceedings that may be instituted against iLearningEngines, the Company or any of their

respective directors or officers, following the announcement of the Proposed Business Combination; (xiv) the impact of the global COVID-19

pandemic on any of the foregoing risks; (xv) any changes to the accounting matters of the Company as a result of guidance from the SEC;

and (xvi) those factors discussed in the Registration Statement under the heading “Risk Factors,” and other documents the

Company has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. There may be additional risks that neither the Company

nor iLearningEngines presently know, or that the Company nor iLearningEngines currently believe are immaterial, that could also cause

actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s

and iLearningEngines’ expectations, plans, or forecasts of future events and views as of the date of this Current Report on Form

8-K. The Company and iLearningEngines anticipate that subsequent events and developments will cause the Company’s and iLearningEngines’

assessments to change. However, while the Company and iLearningEngines may elect to update these forward-looking statements at some point

in the future, the Company and iLearningEngines specifically disclaim any obligation to do so. These forward-looking statements should

not be relied upon as representing the Company’s and iLearningEngines’ assessments as of any date subsequent to the date of

this Current Report on Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Additional Information and Where to Find It

A full description of the terms of the Proposed Business

Combination is provided in the Registration Statement that includes a preliminary prospectus with respect to the combined company’s

securities to be issued in connection with the Proposed Business Combination and a preliminary proxy statement with respect to the shareholder

meeting of the Company to vote on the Proposed Business Combination. The Company urges its investors, stockholders and other interested

persons to read the Registration Statement, including the preliminary proxy statement/prospectus, amendments thereto as well as other

documents filed with the SEC because these documents will contain important information about the Company, iLearningEngines and the Proposed

Business Combination. After the Registration Statement is declared effective, the definitive proxy statement/prospectus to be included

in the Registration Statement will be mailed to stockholders of the Company as of a record date to be established for voting on the Proposed

Business Combination. Once available, stockholders will also be able to obtain a copy of the Registration Statement, including the proxy

statement/prospectus, and other documents filed with the SEC without charge, by directing a request to: Arrowroot Acquisition Corp., 4553

Glencoe Ave, Suite 200, Marina Del Rey, California 90292. The preliminary and definitive proxy statement/prospectus to be included in

the Registration Statement, once available, can also be obtained, without charge, at the SEC’s website (http://www.sec.gov).

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS

NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

Participants in Solicitation

The Company and iLearningEngines, and their respective

directors and executive officers, and other members of their management and employees, under SEC rules, may be deemed participants in

the solicitation of proxies of the Company’s stockholders in respect of the Proposed Business Combination. Information about the

directors and executive officers of the Company is set forth in the Company’s filings with the SEC. Information about the directors

and executive officers of iLearningEngines and more detailed information regarding the identity of all potential participants, and their

direct and indirect interests by security holdings or otherwise, will be set forth in the definitive proxy statement/prospectus for the

Proposed Business Combination. Additional information regarding the identity of all potential participants in the solicitation of proxies

to the Company’s stockholders in connection with the Proposed Business Combination and other matters to be voted upon at the special

meeting, and their direct and indirect interests, by security holdings or otherwise, will be included in the definitive proxy statement/prospectus,

when it becomes available. Such interests may, in some cases, be different from those of iLearningEngines’ or the Company’s

stockholders generally.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ARROWROOT

ACQUISITION CORP. |

| |

|

|

| Dated: November 7, 2023 |

By: |

/s/ Matthew

Safaii |

| |

Name: |

Matthew Safaii |

| |

Title: |

Chief Executive Officer |

5

v3.23.3

Cover

|

Nov. 02, 2023 |

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

This

Current Report on Form 8-K/A is being filed to amend the Current Report on Form 8-K filed by Arrowroot

Acquisition Corp., a Delaware corporation (the “Company”) with the U.S. Securities

and Exchange Commission (the “SEC”) on November 7, 2023 in order to check the Rule 425 filing box on the cover page

hereof, which was erroneously unmarked in the original filing.

|

| Document Period End Date |

Nov. 02, 2023

|

| Entity File Number |

001-40129

|

| Entity Registrant Name |

ARROWROOT ACQUISITION CORP.

|

| Entity Central Index Key |

0001835972

|

| Entity Tax Identification Number |

85-3961600

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4553 Glencoe Ave

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Marina Del Rey

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90292

|

| City Area Code |

310

|

| Local Phone Number |

566-5966

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one redeemable warrant

|

| Trading Symbol |

ARRWU

|

| Security Exchange Name |

NASDAQ

|

| Shares of Class A common stock included as part of the units |

|

| Title of 12(b) Security |

Shares of Class A common stock included as part of the units

|

| Trading Symbol |

ARRW

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants included as part of the units, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants included as part of the units, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50

|

| Trading Symbol |

ARRWW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ARRWU_UnitsEachConsistingOfOneShareOfClassCommonStock0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ARRWU_SharesOfClassCommonStockIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ARRWU_RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

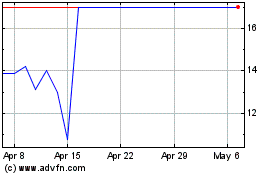

Arrowroot Acquisition (NASDAQ:ARRWU)

Historical Stock Chart

From Apr 2024 to May 2024

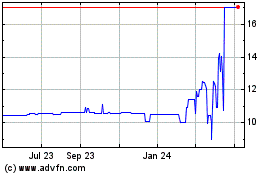

Arrowroot Acquisition (NASDAQ:ARRWU)

Historical Stock Chart

From May 2023 to May 2024