Second Quarter 2024 Highlights

- Revenue of $77.1 million versus $69.3 million in the prior year

period.

- GAAP net loss of $3.6 million versus GAAP net loss of $2.7

million in the prior year period.

- Adjusted Net Loss of $2.6 million versus Adjusted Net Loss of

$0.6 million in the prior year period.

- Adjusted EBITDA1 of $3.2 million versus $(0.5) million in the

prior year period.

- Flight equipment sales consisted of five engines and no

aircraft compared to four engines and two unserviceable airframes

in the prior year period.

- Feedstock acquisitions of $36 million and additional $71

million under contract as of June 30, 2024.

- Flight Equipment inventory of $378.8 million as of June 30,

2024.

AerSale Corporation (Nasdaq: ASLE) (the “Company”) today

reported results for the second quarter ended June 30, 2024. The

Company’s revenue for the second quarter of 2024 was $77.1 million

compared to $69.3 million in the second quarter of 2023. Revenue

for the second quarter of 2024 included $17.9 million of flight

equipment sales compared to $17.6 million of flight equipment sales

in the prior-year period. Flight equipment sales in the second

quarter of 2024 consisted of five engines compared to four engines

and two unserviceable airframes in the prior year period. The

increase in sales was primarily the result of higher volume of USM

sold and strong MRO revenue amid a robust commercial backdrop. As a

reminder to investors, the Company’s revenues are likely to

fluctuate from quarter-to-quarter and year-to-year based on flight

equipment sales and therefore, progress should be monitored based

on MRO activity, asset purchases and related sales.

Nick Finazzo, AerSale’s Chief Executive Officer, commented, “Our

results improved over the prior year driven by higher feedstock

acquisitions over the past 18 months, continued demand in MRO and

incremental volume of AerSafe™. We have also advanced on a set of

initiatives to drive future growth and more consistently exceed our

fixed cost hurdles. We have progressed on the multi-year expansion

of both capacity and capabilities at our on and off-airport MRO

facilities, which includes our new on-airport MRO in Millington,

Tennessee, pneumatics capability at our Miami, Florida accessories

shop, and tripling the size of our aerostructures shop also located

in Miami. Our Millington on-airport MRO was completed in May and is

presently serving our first airline customer. We expect both of our

Miami component MROs to be serving customers before year-end, at

which time we anticipate a sharp rise in sales from these business

units.”

Finazzo added, “Beside our investment in new facilities,

capacity and capabilities, we have continued to use our balance

sheet to acquire feedstock to supply our asset management group,

which will enhance our ability to generate investor returns through

USM, leased equipment and whole asset sales.”

Asset Management Solutions (“Asset Management") revenue

increased to $41.8 million during the second quarter of 2024

compared to $37.1 million in the second quarter of 2023, primarily

because of stronger USM sales as the Company monetizes feedstock

acquired in the past 12-months. Used Serviceable Material (“USM”)

revenue increased 19.2% compared to the prior year quarter, while

the Company had one additional engine on lease in 2024 compared to

2023. There were no aircraft on lease in either period.

TechOps revenue increased 9.4% to $35.3 million in the second

quarter of 2024 from $32.3 million in the second quarter of 2023

primarily due to a continued strong demand for MRO services during

the quarter specifically in AerSale’s Roswell, New Mexico

on-airport MRO facility, as well as higher revenue from component

MROs. The company also benefitted from higher sales of its AerSafe™

product, as operators begin upgrades in advance of 2026 compliance

deadlines.

Gross margin was 28.2% versus 29.1% in the same period last year

primarily due to lower margins at our component MROs as the team

goes through an efficiency improvement curve on recently awarded

contracts.

Selling, general and administrative expenses were $23.6 million

in the second quarter of 2024 versus $27.1 million in the second

quarter of 2023 primarily due to a reduction in payroll related

expenses. AerSale incurred $1.1 million of stock-based compensation

expense in the second quarter of 2024, versus $3.0 million in the

second quarter of 2023.

Loss from operations was $1.9 million in the second quarter of

2024 compared to $7.0 million in the second quarter of 2023.

Income tax expense was $0.5 million in the second quarter of

2024, compared to income tax benefit of $2.4 million in the second

quarter of 2023.

GAAP net loss for the second quarter of 2024 was $3.6 million,

compared to GAAP net loss of $2.7 million in the prior year period.

AerSale recognized a mark-to-market adjustment benefit of $0.1

million related to the private warrant liability, $1.1 million of

stock-based compensation expenses within payroll expenses, and $0.4

million in facility relocation costs during the second quarter of

2024. In the second quarter of 2023, the mark-to-market adjustment

expense related to the private warrant liability was $1.4 million,

stock-based compensation expenses were $3.0 million and relocations

costs were $0.3 million. Excluding these non-cash and unusual items

adjusted for tax, Adjusted Net Loss was $2.6 million in the second

quarter of 2024, compared to Adjusted Net Loss of $0.6 million in

the second quarter of 2023.

Diluted loss per share was $0.07 for the second quarter of 2024

and diluted loss per was $0.08 in the second quarter of 2023.

Adjusted for the non-cash and unusual items noted above, adjusted

diluted loss per share was $0.05 for the second quarter of 2024,

while adjusted diluted loss per share of $0.03 in the second

quarter of 2023.

Adjusted EBITDA in the second quarter of 2024 was $3.2 million

versus $(0.5) million in the second quarter of 2023. Higher

adjusted EBITDA was primarily due higher sales volume during the

period and lower period costs.

AerSale ended the quarter with $101.8 million of liquidity

consisting of $4.3 million of cash and available capacity of $97.5

million on our $180 million revolving credit facility, expandable

to $200 million. Cash used in operating activities was $36.8

million, mainly due to continued investment in inventory.

Martin Garmendia, AerSale’s Chief Financial Officer, said, “Our

continued investment in feedstock has resulted in improvements

being realized compared to the prior period. Based on available

inventory balances and MRO capacity we have the tools needed to

continue this upward momentum through the remainder of 2024. In

addition, a strong liquidity position of over $100 million

available will enable us to continue to acquire properly priced

feedstock, amid a constrained supply side environment that has

resulted from reduced OEM deliveries.”

Update on Engineered Solutions

The Company continues to progress forward with prospective

customers while educating multiple aircraft operators on how its

Enhanced Flight Vision System (“EFVS”), AerAware™, could capture

significant safety and efficiency benefits after implementing the

system in their fleets.

In December 2023, the Federal Aviation Administration (“FAA”)

issued AerSale a Supplemental Type Certificate (“STC”) for

“AerAware™”, the Company’s revolutionary Enhanced Flight Vision

System (“EFVS”) for the Boeing B737NG product line. This

achievement marked the world's first commercial EFVS system to

achieve a 50% visual advantage (over unaided natural vision) and

the first large transport aircraft to be certified with a complete

dual-pilot EFVS solution featuring a Head-Wearable Display. AerSale

developed the AerAware™ certification program under license with

The Boeing Company, which included access to necessary technical

services, maintenance, and engineering data.

Please see the link below to get a visual sense as to how

AerAware's SkyLens Head Wearable Display enables pilots to benefit

from significantly enhanced situational awareness, with full visual

mobility for primary flight data and expansive, "eyes out" views of

the enhanced 3D synthetic terrain: AerAware™ (AerAware

Testimonial).

Conference Call Information

The Company will host a conference call today, August 7, 2024,

at 4:30 pm Eastern Time to discuss these results. A live webcast

will also be available at

https://ir.aersale.com/news-events/events. Participants may access

the call at 1-877-300-8521, international callers may use

1-412-317-6026, and request to join the AerSale Corporation

earnings call.

A telephonic replay will be available shortly after the

conclusion of the call and until November 7, 2024. Participants may

access the replay at 1-844-512-2921, international callers may use

1-412-317-6671, and enter access code 10190507. An archived replay

of the call will also be available on the Investors portion of the

AerSale website at https://ir.aersale.com/.

Non-GAAP Financial Measures

This press release includes non-GAAP financial measures,

including adjusted EBITDA, adjusted Net Income, and adjusted

diluted Earnings per Share. AerSale defines adjusted EBITDA as net

income (loss) after giving effect to interest expense, depreciation

and amortization, income tax expense (benefit), and other

non-recurring or unusual items. Adjusted Net Income is defined as

net income (loss) after giving effect to mark-to-market adjustments

relating to our Private Warrants, stock-based compensation expense

and other non-recurring or unusual items. Adjusted diluted earnings

per share also exclude these material non-recurring or unusual

items.

AerSale believes these non-GAAP measures provide useful

information to management and investors regarding certain financial

and business trends relating to AerSale’s financial condition and

results of operations. AerSale’s management uses certain of these

non-GAAP measures to compare AerSale’s performance to that of prior

periods for trend analyses and for budgeting and planning purposes.

These non- GAAP measures should not be construed as an alternative

to net income or net income margin as an indicator of operating

performance or as an alternative to cash flow from operating

activities as a measure of liquidity (each as determined in

accordance with GAAP).

You should review AerSale’s financial statements, and not rely

on any single financial measure to evaluate AerSale’s business.

Other companies may calculate adjusted EBITDA, Adjusted Net Income,

or Adjusted diluted earnings per share differently, and therefore

AerSale’s adjusted EBITDA, adjusted Net Income, or adjusted diluted

earnings per share measures may not be directly comparable to

similarly titled measures of other companies.

Reconciliations of Net Income, the Company’s closest GAAP

measure, to adjusted EBITDA, Adjusted Net Income, and adjusted

diluted earnings per share, are outlined in the tables below

following the Company’s condensed consolidated financial

statements.

Second Quarter 2024 Financial Results

AERSALE CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue:

Products

$

43,298

$

37,623

$

104,908

$

83,118

Leasing

4,286

3,286

7,368

8,908

Services

29,517

28,417

55,365

55,571

Total revenue

77,101

69,326

167,641

147,597

Cost of sales and operating expenses:

Cost of products

28,531

26,931

68,150

58,479

Cost of leasing

1,894

1,079

3,087

2,202

Cost of services

24,956

21,176

45,888

42,385

Total cost of sales

55,381

49,186

117,125

103,066

Gross profit

21,720

20,140

50,516

44,531

Selling, general, and administrative

expenses

23,572

27,097

47,705

52,321

(Loss) income from operations

(1,852

)

(6,957

)

2,811

(7,790

)

Other (expenses) income:

Interest (expense) income, net

(1,528

)

381

(2,463

)

1,428

Other income, net

102

138

271

371

Change in fair value of warrant

liability

138

1,393

2,117

1,059

Total other (expenses) income

(1,288

)

1,912

(75

)

2,858

(Loss) income before income tax

provision

(3,140

)

(5,045

)

2,736

(4,932

)

Income tax (expense) benefit

(497

)

2,357

(96

)

2,249

Net (loss) income

$

(3,637

)

$

(2,688

)

$

2,640

$

(2,683

)

(Loss) earnings per share:

Basic

$

(0.07

)

$

(0.05

)

$

0.05

$

(0.05

)

Diluted

$

(0.07

)

$

(0.08

)

$

0.05

$

(0.07

)

Weighted average shares outstanding:

Basic

53,029,359

51,227,484

53,010,425

51,217,990

Diluted

53,029,359

51,404,653

53,111,439

51,417,889

AERSALE CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEET

(in thousands, except share

data)

(Unaudited)

June 30,

December 31,

2024

2023

Current assets:

Cash and cash equivalents

$

4,285

$

5,873

Accounts receivable, net of allowance for

credit losses of $978 as of June 30, 2024 and December 31, 2023

37,266

31,239

Income tax receivable

1,700

1,628

Inventory:

Aircraft, airframes, engines, and parts,

net

221,371

177,770

Advance vendor payments

13,589

35,757

Deposits, prepaid expenses, and other

current assets

17,617

12,507

Total current assets

295,828

264,774

Fixed assets:

Aircraft and engines held for lease,

net

31,491

26,475

Property and equipment, net

32,683

27,692

Inventory:

Aircraft, airframes, engines, and parts,

net

157,442

151,398

Operating lease right-of-use assets

26,022

27,519

Deferred income taxes

12,032

12,203

Deferred financing costs, net

1,342

1,506

Deferred customer incentives and other

assets, net

525

525

Goodwill

19,860

19,860

Other intangible assets, net

21,469

21,986

Total assets

$

598,694

$

553,938

Current liabilities:

Accounts payable

$

29,388

$

29,899

Accrued expenses

6,360

5,478

Lessee and customer purchase deposits

644

1,467

Current operating lease liabilities

4,237

4,593

Current portion of long-term debt

93

1,278

Deferred revenue

2,286

2,998

Total current liabilities

43,008

45,713

Revolving credit facility

80,955

29,000

Long-term debt

522

7,281

Long-term lease deposits

767

102

Long-term operating lease liabilities

23,315

24,377

Maintenance deposit payments and other

liabilities

59

64

Warrant liability

269

2,386

Total liabilities

148,895

108,923

Stockholders’ equity:

Common stock, $0.0001 par value.

Authorized 200,000,000 shares; issued and outstanding 53,084,214

and 52,954,430 shares as of June 30, 2024 and December 31, 2023

5

5

Additional paid-in capital

313,883

311,739

Retained earnings

135,911

133,271

Total stockholders' equity

449,799

445,015

Total liabilities and stockholders’

equity

$

598,694

$

553,938

AERSALE CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

2,640

$

(2,683

)

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization

6,434

5,069

Amortization of debt issuance costs

164

225

Amortization of operating lease assets

79

198

Inventory reserve

627

709

Deferred income taxes

171

(1,729

)

Change in fair value of warrant

liability

(2,117

)

(1,059

)

Share-based compensation

1,943

5,759

Changes in operating assets and

liabilities:

Accounts receivable

(6,027

)

(3,615

)

Income tax receivable

(72

)

-

Inventory

(56,566

)

(134,278

)

Deposits, prepaid expenses, and other

current assets

(5,110

)

4,144

Deferred customer incentives and other

assets

(543

)

78

Advance vendor payments

22,167

(11,326

)

Accounts payable

(509

)

4,957

Accrued expenses

795

(3,296

)

Deferred revenue

(712

)

1,719

Lessee and customer purchase deposits

(158

)

6,530

Other liabilities

(6

)

(599

)

Net cash used in operating activities

(36,800

)

(129,197

)

Cash flows from investing activities:

Proceeds from sale of assets

3,800

12,700

Acquisition of aircraft and engines held

for lease, including capitalized cost

(5,610

)

-

Purchase of property and equipment

(7,190

)

(4,814

)

Net cash (used in) provided by investing

activities

(9,000

)

7,886

Cash flows from financing activities:

Proceeds from long-term debt

615

8,559

Repayments of long-term debt

(8,559

)

-

Proceeds from revolving credit

facility

106,936

-

Repayments of revolving credit

facility

(54,981

)

-

Taxes paid related to net share settlement

of equity awards

(124

)

(70

)

Proceeds from the issuance of Employee

Stock Purchase Plan shares

325

278

Net cash provided by financing

activities

44,212

8,767

Decrease in cash and cash equivalents

(1,588

)

(112,544

)

Cash and cash equivalents, beginning of

period

5,873

147,188

Cash and cash equivalents, end of

period

$

4,285

$

34,644

Supplemental disclosure of cash

activities

Income tax payments, net

73

1,276

Interest paid

2,435

286

Supplemental disclosure of noncash

investing activities

Reclassification of aircraft and aircraft

engines inventory to (from) aircraft and engine held for lease,

net

2,494

3,711

AERSALE CORPORATION Adjusted

EBITDA Net Income and Diluted EPS Reconciliation Table

(In thousands, except per share data) (Unaudited)

Three months ended June

30,

Six months ended June

30,

2024

% of Total Revenue

2023

% of Total Revenue

2024

% of Total Revenue

2023

% of Total Revenue

Reported Net (Loss)/Income

(3,637

)

(4.7

)%

(2,688

)

(3.9

)%

2,640

1.6

%

(2,683

)

(1.8

)%

Addbacks:

Change in FV of Warrant Liability

(138

)

(0.2

)%

(1,393

)

(2.0

)%

(2,117

)

(1.3

)%

(1,059

)

(0.7

)%

Stock Compensation

1,144

1.5

%

3,028

4.4

%

1,943

1.2

%

5,759

3.9

%

Payroll taxes related to stock-based

compensation

-

(0.0

)%

-

0.0

%

36

0.0

%

-

0.0

%

Inventory Write-Off

(237

)

(0.3

)%

-

0.0

%

(237

)

(0.1

)%

-

0.0

%

Secondary Offering Costs

-

0.0

%

309

0.4

%

55

0.0

%

309

0.2

%

Facility Relocation Costs

364

0.5

%

342

0.5

%

824

0.5

%

722

0.5

%

Income Tax Effect of Adjusting Items

(1)

(87

)

(0.1

)%

(188

)

(0.3

)%

(211

)

(0.1

)%

(297

)

(0.2

)%

Adjusted Net (Loss)/Income

(2,591

)

(3.3

)%

(590

)

(0.9

)%

2,933

1.7

%

2,751

1.8

%

Interest Expense

1,528

2.0

%

(381

)

(0.5

)%

2,463

1.5

%

(1,428

)

(1.0

)%

Income Tax Expense (Benefit)

497

0.6

%

(2,357

)

(3.4

)%

96

0.1

%

(2,249

)

(1.5

)%

Depreciation and Amortization

3,655

4.7

%

2,600

3.8

%

6,434

3.8

%

5,069

3.4

%

Reversal of Income Tax Effect of Adjusting

Items (1)

87

0.1

%

188

0.3

%

211

0.1

%

297

0.2

%

Adjusted EBITDA

3,176

4.1

%

(540

)

(0.8

)%

12,137

7.3

%

4,440

2.9

%

Reported Basic (loss) earnings per

share

(0.07

)

(0.05

)

0.05

(0.05

)

Addbacks:

Change in fair value of warrant

liability

(0.00

)

(0.03

)

(0.04

)

(0.02

)

Stock-based compensation

0.02

0.06

0.04

0.11

Payroll taxes related to stock-based

compensation

-

-

0.00

-

Inventory Write-Off

(0.00

)

-

(0.00

)

-

Secondary Offering Costs

-

0.01

0.00

0.01

Facility Relocation Costs

0.01

0.01

0.02

0.01

Income Tax Effect of Adjusting Items

-

(0.00

)

(0.00

)

(0.01

)

Adjusted Basic (loss) earnings per

share

(0.05

)

(0.00

)

0.06

0.05

Reported Diluted (loss) earnings per

share

(0.07

)

(0.08

)

0.05

(0.07

)

Addbacks:

Change in FV of warrant liability

(0.00

)

(0.03

)

(0.04

)

(0.02

)

Stock-based compensation

0.02

0.06

0.04

0.11

Payroll taxes related to stock-based

compensation

(0.00

)

-

0.00

-

Inventory Write-Off

(0.00

)

-

(0.00

)

-

Secondary Offering Costs

0.00

0.01

0.00

0.01

Facility Relocation Costs

0.01

0.01

0.02

0.01

Income Tax Effect of Adjusting Items

(0.00

)

-

(0.00

)

(0.01

)

Adjusted Diluted (loss) earnings per

share

(0.05

)

(0.03

)

0.06

0.03

Forward Looking Statements

This press release includes “forward-looking statements”. We

intend such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in

Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). All statements other than

statements of historical facts contained in this press release may

constitute forward-looking statements, and include, but are not

limited to, statements regarding our anticipated financial

performance, including anticipations regarding greater demand for

AerSale’s USM business; expectations regarding feedstock and

commercial demand; expectations from letters of intent on an

additional $71 million in inventory during the year; our belief

that we are well positioned to take advantage of the current market

dynamic; our belief that we are well positioned to take advantage

of asset availability; our growth trajectory; the expected

operating capacity of our MRO facilities and demand for such

services; expectation that AerAware™ is a technology that will be

broadly adopted and that sales of AerAware™ will be a meaningful

contributor to long-term performance; and expected benefits from an

improving backdrop in commercial aerospace, and end markets;

AerSale’s actual results may differ from their expectations,

estimates and projections and consequently, you should not rely on

these forward-looking statements as predictions of future events.

Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue,” or the

negative of these or other similar expressions are intended to

identify such forward-looking statements. The forward-looking

statements in this press release are only predictions. We have

based these forward-looking statements largely on our current

expectations and projections about future events and financial

trends that we believe may affect our business, financial condition

and results of operations. You should carefully consider the

foregoing factors and the other risks and uncertainties described

in the Risk Factors, Management’s Discussion and Analysis of

Financial Condition and Results of Operations sections of the

Company's most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission ("SEC"), and its other filings

with the SEC, including its subsequent quarterly reports on Form

10-Q. These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Moreover, we operate in an evolving environment. New risk factors

and uncertainties may emerge from time to time, and it is not

possible for management to predict all risk factors and

uncertainties.

Forward-looking statements speak only as of the date they are

made. Readers are cautioned not to put undue reliance on

forward-looking statements and we qualify all of our

forward-looking statements by these cautionary statements. Except

as required by applicable law, we do not plan to publicly update or

revise any forward-looking statements contained herein, whether as

a result of any new information, future events, changed

circumstances or otherwise.

About AerSale

AerSale serves airlines operating large jets manufactured by

Boeing, Airbus and McDonnell Douglas and is dedicated to providing

integrated aftermarket services and products designed to help

aircraft owners and operators to realize significant savings in the

operation, maintenance and monetization of their aircraft, engines,

and components. AerSale’s offerings include: Aircraft &

Component MRO, Aircraft and Engine Sales and Leasing, Used

Serviceable Material sales, and internally developed ‘Engineered

Solutions’ to enhance aircraft performance and operating economics

(e.g. AerSafe™, AerTrak™, and now AerAware™).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806465305/en/

Media Contacts:

For more information about AerSale, please visit our website:

www.AerSale.com. Follow us on: LinkedIn | Twitter | Facebook |

Instagram

AerSale: Jackie Carlon Telephone: (305) 764-3200 Email:

media.relations@aersale.com

Investor Contact: AerSale: AersaleIR@icrinc.com

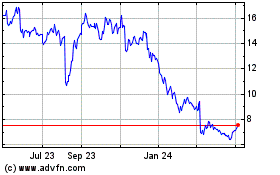

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Nov 2024 to Dec 2024

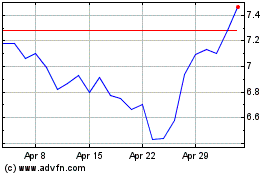

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Dec 2023 to Dec 2024