Additional Proxy Soliciting Materials (definitive) (defa14a)

02 May 2023 - 7:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

AMERISERV FINANCIAL,

Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On or about April 26, 2023, AmeriServ Financial, Inc. (the

“Company”) began mailing a letter to shareholders of the Company, a copy of which is filed as Exhibit 1.

Important Additional Information

The Company, its directors and certain of its

executive officers are participants in the solicitation of proxies from the Company’s shareholders in connection with its upcoming

annual meeting of shareholders (the “Annual Meeting”). The Company filed its definitive proxy statement and a GOLD

proxy card with the U.S. Securities and Exchange Commission (the “SEC”) on April 26, 2023 in connection with such solicitation

of proxies from the Company’s shareholders. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT,

ACCOMPANYING GOLD PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. The Company’s definitive proxy statement for the Annual

Meeting contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors

and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s

securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the Company’s website at http://investors.ameriserv.com/sec-filings/insider-filings

or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022, filed on March 27, 2023. Shareholders will be able to obtain the definitive proxy statement, any amendments

or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at

www.sec.gov. Copies will also be available at no charge at the Company’s website at http://investors.ameriserv.com/sec-filings/documents.

EXHIBIT 1

| April 26, 2023

Dear Shareholder,

AmeriServ Financial Inc.’s (“AmeriServ” or the “Company”) 2023 Annual Meeting of Shareholders (the

“Annual Meeting”) is scheduled for May 26, 2023. Your vote is especially important this year to ensure the

long-term success of the Company and our ability to deliver value for you.

The GOLD proxy card included in this mailing contains instructions on how to cast your vote for the

Company’s slate of three candidates for election to the Board of Directors (the “Board”) and the other items

up for consideration at the Annual Meeting.

Your vote is important – no matter how many shares you own. We urge you to vote FOR the election

of all three director nominees and FOR each of the other proposals on the enclosed GOLD proxy

card.

Our Director Nominees Each Bring Important Perspectives and Experience to the Board

To ensure we have a strong and well-qualified Board to protect AmeriServ’s long-term value, we ask

that you vote FOR each of the following candidates:

Mr. Bloomingdale's finance and labor experience will strengthen AmeriServ's human capital

management efforts and position the Company to further expand its union business

throughout Pennsylvania.

Recently retired President of the Pennsylvania American

Federation of Labor and Congress of Industrial Organizations

(“Pennsylvania AFL-CIO”), a labor federation

Previously served as Secretary-Treasurer of the Pennsylvania

AFL-CIO

Has a more than four-decade career in labor relations

Richard “Rick” W. Bloomingdale |

| Mr. Hickton's experience in cybersecurity, legal affairs, regulatory matters, and data security

and privacy approaches will directly benefit the Company as it meets customers'

expectations for online and mobile services.

Since 2017, has been the Founding Director of the Institute for

Cyber Law, Policy and Security at the University of Pittsburgh

Former U.S. Attorney for the Western District of Pennsylvania

Served as staff director and senior counsel to the House Select

Subcommittee on the Coronavirus Crisis

David Hickton

Mr. Onorato’s professional experience in healthcare, government, accounting and law makes

him a valuable addition to our Board given the relevance of these areas for our banking

business.

Has been an integral member of the Board of Directors at

AmeriServ since 2020, serving on the investment/asset liability

committee and the audit committee and is the Board’s designated

audit committee financial expert under the applicable rules of the

U.S. Securities and Exchange Commission (the “SEC”)

Since 2012, has been Executive Vice President, Chief Corporate

Affairs Officer for Highmark Health, a health and wellness

organization headquartered in Pittsburgh, Pennsylvania

Served two terms as chief executive of Allegheny County and,

prior to that, served as Allegheny County’s controller and two

terms on the Pittsburgh City Council

Daniel Onorato |

| As you likely know, a shareholder group selected by Driver Management Company LLC and its affiliates

(collectively, the “Driver Group”) has submitted documents to the Company purporting to nominate three

director candidates (collectively, the “Purported Driver Nominees”) for election to the Board at the Annual

Meeting. We have informed the Driver Group that their nomination notice is invalid because it fails to comply

with the Company’s Amended and Restated Bylaws due to certain material omissions and other material

deficiencies. The Company and the Driver Group have both filed lawsuits relating to the validity of the Driver

Group’s nomination notice. Unless the result of the litigation is that the Driver Group’s purported nomination

notice is deemed valid, any director nominations made by the Driver Group will be disregarded, and no

proxies voted in favor of the Purported Driver Nominees will be recognized or tabulated at the Annual

Meeting.

On behalf of the entire Board, we encourage you to protect your investment by voting FOR

our refreshed slate of director candidates for this year’s Annual Meeting, including Richard

"Rick" Bloomingdale, David Hickton and Daniel Onorato and FOR all other proposals on the

GOLD proxy card

Thank you for your support.

Sincerely,

The Board has unanimously determined that it is in the best interests of the Company and its

shareholders to eliminate cumulative voting to create a more level playing field for director elections. We

ask you to support our mission of strengthening our corporate governance by voting FOR the proposal to

remove cumulative voting.

Allan R. Dennison

J. Michael Adams, Jr.

Amy Bradley

Kim W. Kunkle

Margaret A. O’Malley

Daniel A. Onorato

Mark E. Pasquerilla

Sara A. Sargent

Jeffrey A. Stopko

Eliminating Cumulative Voting to Enhance Corporate Governance

Protect Your Investment |

| If you have any questions or require any assistance in voting your shares, or if you would like additional

copies of the proxy materials, please contact our proxy solicitor:

Morrow Sodali LLC

509 Madison Avenue Suite 1206

New York, NY 10022

Shareholders Call Toll Free: (800) 662-5200

Brokers, Banks, and Other Nominees Call Collect: (203) 658-9400

Email: ASRV@investor.morrowsodali.com

About AmeriServ Financial, Inc.

AmeriServ Financial, Inc. is the parent of AmeriServ Financial Bank and AmeriServ Trust and

Financial Services Company in Johnstown, Pennsylvania. The Company’s subsidiaries provide full-service banking and wealth management services through 17 community offices in southwestern

Pennsylvania and Hagerstown, Maryland. The Company also operates loan production offices in

Altoona and Monroeville, Pennsylvania. On December 31, 2022, AmeriServ had total assets of $1.4

billion and a book value of $6.20 per common share. For more information, visit www.ameriserv.com.

Forward Looking Statements

This press release contains forward-looking statements as defined in the Securities Exchange Act of

1934, as amended, and is subject to the safe harbors created therein. Such statements are not

historical facts and include expressions about management’s confidence and strategies and

management’s current views and expectations about new and existing programs and products,

relationships, opportunities, technology, market conditions, dividend program, and future payment

obligations. These statements may be identified by such forward-looking terminology as “continuing,”

“expect,” “look,” “believe,” “anticipate,” “may,” “will,” “should,” “projects,” “strategy,” or similar

statements. Actual results may differ materially from such forward-looking statements, and no

reliance should be placed on any forward-looking statement. Factors that may cause results to differ

materially from such forward-looking statements include, but are not limited to, unanticipated changes in

the financial markets, the level of inflation, and the direction of interest rates; volatility in earnings due to

certain financial assets and liabilities held at fair value; competition levels; loan and investment

prepayments differing from our assumptions; insufficient allowance for credit losses; a higher level of loan

charge-offs and delinquencies than anticipated; material adverse changes in our operations or earnings;

a decline in the economy in our market areas; changes in relationships with major customers;

changes in effective income tax rates; higher or lower cash flow levels than anticipated; inability to hire

or retain qualified employees; a decline in the levels of deposits or loss of alternate funding sources; a |

| decrease in loan origination volume or an inability to close loans currently in the pipeline; changes in laws and

regulations; adoption, interpretation and implementation of accounting pronouncements; operational risks,

including the risk of fraud by employees, customers or outsiders; unanticipated effects of our banking platform;

risks and uncertainties relating to the duration of the COVID-19 pandemic, and actions that may be taken by

governmental authorities to contain the pandemic or to treat its impact; and the inability to successfully

implement or expand new lines of business or new products and services. These forward-looking statements

involve risks and uncertainties that could cause AmeriServ’s results to differ materially from management’s

current expectations. Such risks and uncertainties are detailed in AmeriServ’s filings with the SEC, including our

Annual Report on Form 10-K for the year ended December 31, 2022, filed on March 27, 2023.

Forward-looking statements are based on the beliefs and assumptions of AmeriServ’s management and on

currently available information. The statements in this press release are made as of the date of this press

release, even if subsequently made available by AmeriServ on its website or otherwise. AmeriServ undertakes

no responsibility to publicly update or revise any forward-looking statement.

Important Additional Information

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies

from the Company’s shareholders in connection with the Annual Meeting. The Company filed its definitive

proxy statement and a GOLD proxy card with the SEC on April 26, 2023 in connection with such solicitation

of proxies from the Company’s shareholders. SHAREHOLDERS OF THE COMPANY ARE STRONGLY

ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING GOLD PROXY CARD AND

ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL

MEETING. The Company’s definitive proxy statement for the Annual Meeting contains information regarding

the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive

officers in the Company’s securities. Information regarding subsequent changes to their holdings of the

Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, which are available on the

Company’s website at http://investors.ameriserv.com/sec-filings/insider-filings or through the SEC’s website

at www.sec.gov. Information can also be found in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022, filed on March 27, 2023. Shareholders will be able to obtain the definitive proxy

statement, any amendments or supplements to the proxy statement and other documents filed by the

Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at

no charge at the Company’s website at http://investors.ameriserv.com/sec-filings/documents. |

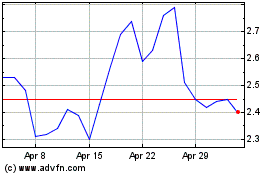

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

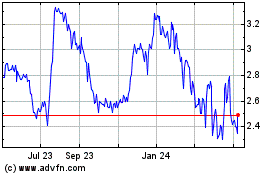

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024