UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the

appropriate box:

| |

☐ |

Preliminary

Information Statement |

| |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

☒ |

Definitive

Information Statement |

| |

|

APPLIED

UV, INC. |

|

|

| |

|

(Name

of Registrant as Specified In Its Charter) |

|

|

Payment

of Filing Fee (Check the appropriate box):

| |

☐ |

Fee

paid previously with preliminary materials. |

| |

☐ |

Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange

Act Rules 14c-5(g) and 0-11 |

APPLIED

UV, INC.

150

N. Macquesten Parkway

Mount

Vernon, NY 10550

720-531-4152

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED

NOT TO SEND US A PROXY

NOTICE

OF STOCKHOLDER ACTION BY Written Consent

GENERAL

INFORMATION

To

the Holders of Common Stock of Applied UV, Inc.:

This

Information Statement is first being mailed on or about December 26, 2023 to the holders of record of the outstanding voting stock, $0.0001

par value per share (“Common Stock”), of Applied UV, Inc., a Nevada corporation (the “Company”), as of the close

of business on December 14, 2023 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). This Information Statement relates to actions taken by written consent in lieu

of a meeting (the “Written Consent”) of the stockholder of the Company owning a majority of the voting power of the outstanding

shares of stock (the “Majority Stockholder”) as of the Record Date. Except as otherwise indicated by the context, references

in this Information Statement to “we,” “us” or “our” are references to Applied UV, Inc., a Nevada

corporation.

The

Written Consent:

| 1. |

|

approved the issuance (the “Option Issuance Approval”) of options

(the “Options”) to purchase 12.25 million shares of Common Stock to certain individuals Stock pursuant to restructuring agreements

dated December 11, 2023 that were entered into in connection with the restructuring of the consideration paid by the Company for the acquisitions

of PURO Lighting, LLC and LED Supply Co., LLC. Pursuant to the restructuring agreements the Options will be issued 20 days after the mailing

of this Information Statement and have a five year term, an exercise price of $5.00 per share (on a post reverse stock split basis), which

is subject to adjustment after the occurrence of reverse stock splits (including the reverse stock split that occurred on December 12,

2023). The stockholder consent for the issuance of the Options was obtained by the Company in order to comply with the continued listing

rules of The Nasdaq Stock Market LLC (“Nasdaq”); |

| 2. |

|

approved

the amendment to the Articles of Amendment of the Company (“Articles of Amendment”) to increase the total number of authorized

shares of Common Stock from 6,000,000 to 150,000,000 (the “Increase in Authorized Shares of Common Stock”); and |

| 3. |

|

approved the terms of the Series A Warrants and the Series B Warrants

in order for the application of such sections to comply with the continued listing rules of Nasdaq (the “Approval of the Warrant

Terms”). |

The Written Consent constitutes the consent of

a majority of the voting power of the outstanding shares of stock and is sufficient under the Nevada Revised Statutes (“NRS”)

and our Bylaws to approve the actions described herein. Accordingly, the Issuance of Options, the Increase in Authorized Shares of Common

Stock and the Approval of the Warrant Terms, are not presently being submitted to our other stockholders for a vote. Pursuant to Rule

14c-2 under the Exchange Act, the action described herein will not be implemented until a date at least twenty (20) days after the date

on which this Information Statement has been first mailed to the stockholders.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

This Information Statement has been filed with

the U.S. Securities and Exchange Commission (the “SEC”) and is being furnished, pursuant to Section 14C of the Exchange Act

to the holders of voting and non-voting stock (“Stockholders”) to notify the Stockholders of the approval of the Issuance

of Options, the Increase in Authorized Shares of Common Stock and the Approval of the Warrant Terms. Stockholders of record at the close

of business on December 14, 2023 are entitled to notice of the Written Consent. Because this action has been approved by the holders of

the required majority of the voting power of our outstanding shares of stock, no proxies were or are being solicited. The Option Issuance

Approval, the Increase in Authorized Shares of Common Stock and the Approval of the Warrant Terms will not be effected until at least

20 calendar days after the mailing of the Information Statement accompanying this Notice. We will mail the Notice of Stockholder Action

by Written Consent to the Stockholders on or about December 26, 2023.

PLEASE

NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED

HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED

HEREIN PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Eugene E. Burleson |

| |

Chairman

of the Board of Directors |

| |

December

26, 2023 |

INTRODUCTION

This Information Statement is being first mailed

on or about December 26, 2023, to the Stockholders by the Board of Directors of the Company (“Board”) to provide material

information regarding the Issuance of Options, the Increase in Authorized Shares of Common Stock and the Approval of the Warrant Terms

that has been approved by the Written Consent of the Majority Stockholder.

Only

one copy of this Information Statement is being delivered to two or more stockholders who share an address unless we have received contrary

instruction from one or more of such stockholders. We will promptly deliver, upon written or oral request, a separate copy of the Information

Statement to a security holder at a shared address to which a single copy of the document was delivered. If you would like to request

additional copies of the Information Statement, or if in the future you would like to receive multiple copies of information statements

or proxy statements, or annual reports, or, if you are currently receiving multiple copies of these documents and would, in the future,

like to receive only a single copy, please so instruct us by writing to the corporate secretary at the Company’s executive offices

at the address specified above.

PLEASE

NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE

MATTERS DESCRIBED HEREIN.

The

entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians,

fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the shares of stock held of record

by them.

AUTHORIZATION

BY THE BOARD OF DIRECTORS

AND

THE MAJORITY STOCKHOLDER

Under the Nevada Revised Statutes and the Company’s

Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice

and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that will be necessary to authorize

or take such action at a meeting at which all shares entitled to vote thereon were present and voted to consent to such action in writing.

The approval of the Option Issuance Approval, the Increase in Authorized Shares of Common Stock and the Approval of the Warrant Terms,

requires the affirmative vote or written consent of a majority of the voting power of the issued and outstanding shares of stock. Each

holder of Common Stock is entitled to one vote per share of Common Stock held of record and each holder of Series X Super Voting Preferred

Stock is entitled to 1,000 votes per share, voting together with the Common Stock, on any matter which may properly come before the stockholders.

On the Record Date, the Company had 1,246,110

shares of Common Stock issued and outstanding, with the holders thereof being entitled to cast one vote per share. On the Record Date,

the Company had 10,000 shares of Series X Super Voting Preferred Stock issued and outstanding, with the holder thereof being entitled

to cast one thousand votes per share. On December 14, 2023, the Majority Stockholder adopted resolutions approving the Option Issuance

Approval, the Increase in Authorized Shares of Common Stock and the Approval of the Warrant Terms.

CONSENTING

STOCKHOLDER

On December 14, 2023, the Majority Stockholder,

Max Munn, the Founder, Chief Executive Officer and a director of the Company, being the record holder of 15,160 shares of Common Stock

and 10,000 shares of our Series X preferred stock, which entitle the holder to 1,000 votes per share of Series X, or a total of 10,000,000

votes, adopted resolutions approving the adoption of the Issuance of Options, the Increase in Authorized Shares of Common Stock and the

Approval of the Warrant Terms. The voting power held by the Majority Stockholder represented approximately 89.1% of the total voting power

of all issued and outstanding stock of the Company as of the Record Date.

We are not seeking written consent from any other

stockholder of the Company, and the other stockholders will not be given an opportunity to vote with respect to the Issuance of Options,

the Increase in Authorized Shares of Common Stock and the Approval of the Warrant Terms. All necessary corporate approvals have been obtained.

This Information Statement is furnished solely for the purposes of advising stockholders of the action taken by Written Consent and giving

stockholders notice of such actions taken as required by the Exchange Act.

As the Issuance of Options, the Increase in Authorized

Shares of Common Stock and the Approval of the Warrant Terms actions were taken by Written Consent, there will be no security holders’

meeting and representatives of the principal accountants for the current year and for the most recently completed fiscal year will not

have the opportunity to make a statement if they desire to do so and will not be available to respond to appropriate questions from our

stockholders.

PROPOSAL

TO AUTHORIZE THE ISSUANCE OF OPTIONS

Restructuring of Acquisition Consideration

On

January 27, 2023, (i) PURO Lighting, LLC, a Colorado limited liability company (“Old PURO”) merged (the “First PURO

Merger”) with and into PURO Acquisition Sub I, Inc., a Colorado corporation (“PURO Sub I”) and wholly owned subsidiary

of the Company and then (ii) PURO Sub I merged (the “Second PURO Merger” and together with the First PURO Merger, the “PURO

Mergers”) with and into PURO Acquisition Sub II, LLC, a Delaware limited liability corporation (“PURO Sub II”) and

wholly owned subsidiary of the Company, pursuant to the previously announced Agreement and Plan of Merger dated as of December 19, 2022,

as amended on January 26, 2023 (the “PURO Merger Agreement”), by and between the Company, PURO Acquisition Sub I, PURO Acquisition

Sub II, PURO, Brian Stern and Andrew Lawrence. In connection with the PURO Mergers, PURO Sub II was renamed Puro Lighting, LLC (“New

PURO”) and New PURO is a wholly-owned subsidiary of the Company.

On

January 27, 2023, (i) LED Supply Co. LLC, a Colorado limited liability company (“Old LED Supply”) merged (the “First

LED Supply Merger”) with and into LED Supply Acquisition Sub I, Inc., a Colorado corporation (“LED Supply Sub I”) and

wholly owned subsidiary of the Company and then (ii) LED Supply Sub I merged (the “Second LED Supply Merger” and together

with the First LED Supply Merger, the “LED Supply Mergers”) with and into LED Supply Acquisition Sub II, LLC, a Delaware

limited liability corporation (“LED Supply Sub II”) and wholly owned subsidiary of the Company, pursuant to the previously

announced Agreement and Plan of Merger dated as of December 19, 2022, as amended on January 26, 2023 (the “LED Supply Merger Agreement”

and, together with the PURO Supply Merger Agreement, the “Merger Agreements”), by and between the Company, LED Supply Acquisition

Sub I, LED Supply Acquisition Sub II, LED Supply, Brian Stern and Andrew Lawrence. In connection with the LED Supply Mergers, LED Supply

Sub II was renamed Led Supply Co. LLC (“New LED Supply”) and New LED Supply is a wholly-owned subsidiary of the Company.

Pursuant

to the Merger Agreements, at the closing, the Company issued, among other things, a total of 2,497,222 shares of Common Stock (the “PURO

Common Stock Consideration”) to the equity holders of Old PURO and a total of 1,377,778 shares of Common Stock (the “LED

Supply Common Stock Consideration”) to equity holders of Old LED Supply. In addition, the Company agreed to pay earnouts payable

pursuant to the Merger Agreements (the “Earnout Payments”).

On December 11, 2023, the Company entered into

restructuring agreements that restructured the Common Stock and first year earnout consideration paid by the Company under the Meger Agreements.

Under the restructuring agreements all of the common stock that was issued to the sellers and the first year earnout payments payable

to the sellers, in each case under the Merger Agreements was cancelled and the Company agreed to issue the Options 20 days after the mailing

of this Information Statement to the Company’s stockholders.

APPROVAL

OF INCREASE IN AUTHORIZED SHARES OF COMMON STOCK

The

Amendment to Increase Shares of our Common Stock

On

December 13, 2023, our Board approved, subject to shareholder approval, the Amended and Restated Articles of Incorporation (the “A&R

Articles”), which amends and restates our Articles of Incorporation, as amended, to increase the number of authorized shares of

common stock from 6,000,000 to 150,000,000. The text of the proposed A&R Articles is set forth in Appendix A attached hereto.

Purposes

of the Increase in Shares of our Common Stock

The Company currently has authorized capital stock of

6,000,000 shares of our common stock, with 1,708,949 shares outstanding and 20,000,000 shares of blank check preferred

stock, 10,000 shares of which are designated as Series X Super Voting Preferred Stock, with 10,000 shares issued and outstanding,

1,250,000 shares of which are designated as Series A Cumulative Preferred, with 552,000 shares issued and outstanding, 1,250,000

shares of which are designated as 2% Series B Cumulative Perpetual, with 1,250,000 shares issued and outstanding, and 2,500,000

shares of which are designated as of 5% Series C Cumulative Perpetual, with 399,996 shares issued and outstanding.

The

Majority Stockholder voted in favor of amending and restating our Articles of Incorporation to increase the authorized shares of our

common stock to 150,000,000, in order to improve our financial flexibility with respect to our capital structure by having additional

shares for future equity financings and acquisitions. The extra shares of authorized our common stock would be available for issuance

from time to time as determined by the Board for any proper corporate purpose. Such purposes might include, without limitation, issuance

in public or private sales for cash as a means of obtaining additional capital for use in our business and operations, and issuance as

part or all of the consideration required to be paid by us for acquisitions of other businesses or assets. Notwithstanding the foregoing,

we have no obligation to issue such additional shares and there are no plans, proposals or arrangements currently contemplated by us

that would involve the issuance of the additional shares to acquire another company or its assets, or for any other corporate purpose

stated.

Principal

Effects of the Increase in Authorized Shares

The

Company’s stockholders will not realize any dilution in their ownership or voting rights as a result of the increase in authorized

shares of our common stock, but will experience dilution to the extent additional shares are issued in the future.

Having

an increased number of authorized but unissued shares of our common stock would allow us to take prompt action with respect to corporate

opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving

an increase in our capitalization. The issuance of additional shares of our common stock may, if such shares are issued at prices below

what current stockholders’ paid for their shares, reduce stockholders’ equity per share and dilute the value of current stockholders’

shares. It is not the present intention of the Board to seek stockholder approval prior to any issuance of shares of our common stock

that would become authorized by the A&R Articles unless otherwise required by law or regulation. Frequently, opportunities arise

that require prompt action, and it is the belief of the Majority Stockholder that the delay necessitated for stockholder approval of

a specific issuance could be to the detriment of us and our stockholders.

When

issued, the additional shares of our common stock authorized by the A&R Articles will have the same rights and privileges as the

shares of our common stock currently authorized and outstanding. Holders of our common stock have no preemptive rights and, accordingly,

stockholders would not have any preferential rights to purchase any of the additional shares of our common stock when such shares are

issued.

Shares

of authorized and unissued our common stock could be issued in one or more transactions that could make it more difficult, and therefore

less likely, that any takeover of us could occur. Issuance of additional our common stock could have a deterrent effect on persons seeking

to acquire control. The Board also could, although it has no present intention of so doing, authorize the issuance of shares of our common

stock to a holder who might thereby obtain sufficient voting power to assure that any proposal to effect certain business combinations

or amendment to our Articles of Incorporation, as amended, or Bylaws would not receive the required stockholder approval. Accordingly,

the power to issue additional shares of our common stock could enable the Board to make it more difficult to replace incumbent directors

and to accomplish business combinations opposed by the incumbent Board.

APPROVAL

OF TERMS OF SERIES A WARRANTS AND SERIES B WARRANTS

On November 16, 2023, the Company issued a total

of 4,417,652 Series A warrants (the “Series A Warrants”) and 4,417,652 Series B warrants (the “Series B Warrants”

and, together with the Series A Warrants, the “Warrants”) to investors in connection with an approximately $4 million public

offering of the Company’s securities. The initial exercise price of the Series A Warrants is $37.50 (on a post reverse stock split

basis) per share of Common Stock and the initial exercise price of the Series B Warrants is $75.00 (on a post reverse stock split basis)

per share of Common Stock. However, the Warrants have adjustment terms which lower the exercise price of the Warrants after the occurrence

of (i) the issuance by the Company of equity securities (with certain exceptions) at a price that is lower than the current exercise price

of the Warrants, (ii) a reverse stock split of the Common Stock in which the lowest volume weighted average price for the Common Stock

for the five trading days after the reverse stock split is lower than the exercise price of the Warrants of (iii) the Company voluntarily

agreeing to do so. Such adjustment provisions could cause the exercise price of the Warrants to be less than $3.066 (50% of the Minimum

Price (as defined below)). Any adjustment to the exercise price of the Warrants pursuant to such adjustment terms below $3.066 will violate

Nasdaq continued listing policy, unless, prior to such adjustment, stockholder approval is obtained. The Majority Stockholder has consented

to all of the terms of the Warrants, including the adjustment terms described above, which will allow such adjustment terms of the Warrants

to adjust the exercise price of the Warrants below $3.066.

Nasdaq defines "Minimum Price” as a

price that is the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the

binding agreement; or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading

days immediately preceding the signing of the binding agreement.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

table below sets forth information regarding the beneficial ownership of the common stock by (i) our directors and named executive officers;

(ii) all the named executives and directors as a group and (iii) any other person or group that to our knowledge beneficially owns more

than five percent of our outstanding shares of common stock.

We have determined beneficial ownership in accordance

with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person

has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire

such powers within 60 days. Shares of common stock subject to options that are currently exercisable or exercisable within 60 days of

December 14, 2023, are deemed to be outstanding and beneficially owned by the person holding the options. Shares issuable pursuant to

stock options or warrants are deemed outstanding for computing the percentage ownership of the person holding such options or warrants

but are not deemed outstanding for computing the percentage ownership of any other person. Except as indicated by the footnotes below,

we believe, based on the information furnished to us, that the persons and entities named in the table below will have sole voting and

investment power with respect to all shares of common stock that they will beneficially own, subject to applicable community property

laws. The percentage of beneficial ownership is based on 1,246,110 shares of common stock outstanding on December 14, 2023.

| |

|

Number of Shares

Beneficially Owned |

|

|

Beneficial Ownership Percentages |

|

| Name and Address of Beneficial Owner(1) |

|

Common

Stock |

|

|

Series X

Super

Voting

Preferred

Stock(2) |

|

|

Percent of

Common

Stock |

|

|

Percent of

Series X

Super

Voting

Preferred

Stock |

|

|

Percent of

Voting

Stock(3) |

|

| Officers and Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Max Munn, Chief Executive Officer, President and Director |

|

|

17,435 |

(4) |

|

|

10,000 |

(5) |

|

|

1.4 |

% |

|

|

100 |

% |

|

|

89.1 |

% |

| Michael Riccio, Chief Financial Officer |

|

|

1,607 |

|

|

|

— |

|

|

|

* |

% |

|

|

— |

|

|

|

* |

% |

| Brian Stern, Director(6) |

|

|

14,605 |

|

|

|

— |

|

|

|

1.2 |

% |

|

|

— |

|

|

|

* |

% |

| Eugene Burleson, Director |

|

|

560 |

|

|

|

— |

|

|

|

* |

% |

|

|

— |

|

|

|

* |

% |

| Dallas Hack, Director |

|

|

360 |

|

|

|

— |

|

|

|

* |

% |

|

|

— |

|

|

|

* |

% |

| Joseph Luhukay, Director |

|

|

180 |

|

|

|

— |

|

|

|

* |

% |

|

|

— |

|

|

|

* |

% |

| Officers and Directors as a Group |

|

|

34,747 |

|

|

|

10,000 |

|

|

|

2.8 |

% |

|

|

100 |

% |

|

|

89.2 |

% |

| 5%+ Stockholders(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Less than 1%.

| (1) | | The principal address of the named officers, directors and

5% stockholders of the Company is c/o Applied UV, Inc. 150 N. Macquesten Parkway Mount Vernon, New York 10550. |

| (2) | | Entitles the holder to 1,000 votes per share and votes with

the common as a single class. |

| (3) | | Represents total ownership percentage with respect to all shares

of common stock and Series X Super Voting Preferred Stock, as a single class. |

| (4) | | Includes (i) 15,000 shares which are held in the name of The

Munn Family 2020 Irrevocable Trust, for which the spouse of Max Munn is the trustee; (ii) 160 shares owned by Mr. Munn directly; (iii)

640 shares underlying a warrant issued to Mr. Munn, which is exercisable at $625.00 per share; (iv) 8 vested shares underlying an option

granted to Mr. Munn as director compensation, which are exercisable at $625.00 per share; (v) 827 vested shares underlying an option

granted to Mr. Munn pursuant to his employment agreement, which are exercisable at $975.00 per share; (vi) 300 vested shares underlying

an option granted to Mr. Munn on December 31, 2022, which are exercisable at $250 per share; and (vii) 500 vested shares underlying an

option granted to Mr. Munn on January 9, 2023, which are exercisable at $250 per share. |

| (5) | | Held by The Munn Family 2020 Irrevocable Trust. |

| (6) | | Mr. Stern was appointed to the board of directors on February

1, 2023. |

| (7) | | No shareholders hold more than 5% of the common stock of the

Company. |

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

No

person who has been our officer or director, or to our knowledge, any of their associates, has any substantial interest, direct or indirect,

by security holdings or otherwise in any matter to be acted upon. None of our directors opposed the actions to be taken by the Company.

ADDITIONAL

INFORMATION

The

Company files annual, quarterly and current reports and other information with the SEC under the Exchange Act. You may obtain copies

of this information by mail from the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may

obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet

website that contains reports and other information about issuers that file electronically with the SEC. The address of that website

is www.sec.gov.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If

hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to Stockholders

who share a single address unless we received contrary instructions from any Stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate

copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered.

You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and

(iii) the address to which the Company should direct the additional copy of the Information Statement, to the Company at 150 N. Macquesten

Parkway, Mount Vernon, NY 10550.

If

multiple Stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would

prefer the Company to mail each Stockholder a separate copy of future mailings, you may mail notification to, or call the Company at,

its principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information

Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to Stockholders at the shared

address, notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

This

Information Statement is provided to the stockholders of the Company only for information purposes in connection with the Majority Stockholder’s

approval of the Reverse Stock Split, pursuant to and in accordance with Rule 14c-2 of the Exchange Act. Please carefully read this Information

Statement.

WHERE

YOU CAN FIND MORE INFORMATION ABOUT US

The

Company is subject to the informational requirements of the Securities Exchange Act of 1934, and in accordance therewith files reports

and other information with the SEC. Such reports and other information and a copy of the registration statement and the exhibits and

schedules that were filed with the registration statement may be inspected without charge at the public reference facilities maintained

by the SEC in 100 F Street, N.E., Washington, D.C. 20549. Information regarding the operation of the public reference rooms may be obtained

by calling the SEC at 1-800-SEC-0330. The SEC maintains a web site that contains reports, proxy and information statements and other

information regarding registrants that file electronically with the SEC. The address of the web site is www.sec.gov.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Eugene E. Burleson |

| |

Chairman

of the Board of Directors |

| |

December

26, 2023 |

Appendix

A

AMENDED

AND RESTATED ARTICLES OF INCORPORATION

OF

APPLIED

UV, INC.

(Pursuant

to Section 78.390 of the

Nevada Revised Statutes of the State of Nevada)

Applied

UV, Inc., a corporation organized and existing under and by virtue of the provisions of the Nevada Revised Statutes of the State of Nevada

(the “NRS”),

DOES

HEREBY CERTIFY:

1.

That the name of this corporation is Applied UV, Inc., and that this corporation was originally

incorporated pursuant to the NRS on August 31, 2023 under the name Applied UV, Inc.

2.

That the Board of Directors duly adopted resolutions proposing to amend and restate the Articles

of Incorporation of this corporation, declaring said amendment and restatement to be advisable and in the best interests of this corporation

and its stockholders, and authorizing the appropriate officers of this corporation to solicit the consent of the stockholders therefor.

3.

The stockholders of the corporation holding the requisite number of shares of the corporation

duly approved these Amended and Restated Articles of Incorporation of the Corporation (this “Restated Charter”) by written

consent in accordance with Section 78.390 of the NRS.

4.

Immediately upon the filing of this Restated Charter, the text of the Articles of Incorporation

of this corporation is hereby amended and restated in its entirety to read as follows:

ARTICLE

I

The

name of this corporation is Applied UV, Inc. (the “Corporation”).

ARTICLE

II

The

address of the registered office of the Corporation in the State of Nevada is 701 South Carson Street, Suite 200, Carson City, NV 89701.

The registered agent of the corporation in the State of Nevada at such address is Vcorp Agent Services, Inc.

ARTICLE

III

The

purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the Nevada Revised

Statutes, as amended (the “NRS”).

ARTICLE

IV

Section

1. Number of Authorized Shares. The total number of shares of stock which the Corporation shall have the authority to issue shall be One

Hundred Seventy Million (170,000,000) shares. The Corporation shall be authorized to issue two classes of shares of stock, designated

as “Common Stock” and “Preferred Stock.” The Corporation shall be authorized to issue One Hundred

Fifty Million (150,000,000) shares of Common Stock, each share to have a par value of $0.0001 per share, and Twenty Million (20,000,000)

shares of Preferred Stock, each share to have a par value of $0.0001 per share.

Section

2. Common Stock. The Board of Directors of the Corporation (the “Board of Directors”) may authorize the issuance of shares

of Common Stock from time to time. The Corporation may reissue shares of Common Stock that are redeemed, purchased, or otherwise acquired

by the Corporation unless otherwise provided by law.

Section

3. Preferred Stock. The Board of Directors may by resolution authorize the issuance of shares of Preferred Stock from time to time in

one or more series. The Corporation may reissue shares of Preferred Stock that are redeemed, purchased, or otherwise acquired by the

Corporation unless otherwise provided by law. The Board of Directors is hereby authorized to fix or alter the designations, powers and

preferences, and relative, participating, optional or other rights, if any, and qualifications, limitations or restrictions thereof,

as shall be stated and expressed in the resolution or resolutions adopted by the Board of Directors providing for the issuance of such

class or series as may be permitted by the NRS, including, without limitation, dividend rights (and whether dividends are cumulative)

conversion rights, if any, voting rights (including the number of votes, if any, per share, as well as the number of members, if any,

of the Board of Directors or the percentage of members, if any, of the Board of Directors each class or series of Preferred Stock may

be entitled to elect), rights and terms of redemption (including sinking fund provisions, if any), redemption price and liquidation preferences

of any wholly unissued series of Preferred Stock, the number of shares constituting any such series and the designation thereof, and

to increase or decrease the number of shares of any such series subsequent to the issuance of shares of such series, but not below the

number of shares of such series then outstanding and other powers, preferences and relative, participating, optional or other special

rights of each series of Preferred Stock, and any qualifications, limitations or restrictions of such shares as are permitted by law,

all as may be stated in such resolution.

Section

4. Dividends and Distributions. Subject to the preferences applicable to Preferred Stock outstanding at any time, the holders of shares

of Common Stock shall be entitled to receive such dividends, payable in cash or otherwise, as may be declared thereon by the Board from

time to time out of assets or funds of the Corporation legally available therefore.

Section

5. Voting Rights. Each share of Common Stock shall entitle the holder thereof to one vote on all matters submitted to a vote of the shareholders

of the Corporation.

ARTICLE

V

Meetings

of shareholders may be held within or without the State of Nevada, as the bylaws of the Corporation (the “Bylaws”) may provide.

The books of the Corporation may be kept (subject to any provision contained in the NRS) outside the State of Nevada at such place or

places as may be designated from time to time by the Board of Directors or in the Bylaws.

ARTICLE

VI

The

number of directors of the Corporation shall be fixed from time to time by or in the manner provided in the Bylaws or amendment thereof

duly adopted by the Board of Directors or by the shareholders of the Corporation. Newly created dictatorships resulting from any increase

in the authorized number of directors or any vacancies in the Board of Directors resulting from death, resignation, retirement, disqualification,

removal from office or other cause shall be filled solely by the Board of Directors, acting by not less than a majority of the Directors

then in office, although less than a quorum.

Any

director so chosen shall hold office until his successor shall be elected and qualified. No decrease in the number of directors shall

shorten the term of any incumbent director. Elections of directors need not be by written ballot unless the Bylaws of the Corporation

shall so provide.

ARTICLE

VII

No

action, which has not been previously approved by the Board of Directors, shall be taken by the shareholders except at an annual meeting

or a special meeting of the shareholders. Any action required to be taken at any annual or special meeting of the shareholders of the

Corporation, or any action which may be taken at any annual or special meeting of such shareholders, may be taken without a meeting,

without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the

holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action

at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation by delivery

to its registered office in the State of Nevada, its principal place of business or an officer or agent of the Corporation having custody

of the book in which proceedings of meetings of shareholders are recorded.

ARTICLE

VIII

In

furtherance of, and not in limitation of, the powers conferred by statute, the board of directors is expressly authorized to adopt, amend

or repeal the Bylaws or adopt new Bylaws without any action on the part of the shareholders; provided that any Bylaw adopted or amended

by the board of directors, and any powers thereby conferred, may be amended, altered or repealed by the shareholders.

ARTICLE

IX

Unless

otherwise provided by law, a director or officer is not individually liable to the Corporation or its shareholders or creditors for any

damages as a result of any act or failure to act in his individual capacity as a director or officer unless it is proven that his act

or failure to act constituted a breach of his fiduciary duties as a director or officer and his breach of those duties involved intentional

misconduct, fraud, or a knowing violation of law. If the NRS is amended to further eliminate or limit or authorize corporate action to

further eliminate or limit the liability of directors or officers, the liability of directors and officers of the corporation shall be

eliminated or limited to the fullest extent permitted by the NRS as so amended from time to time. Neither any amendment nor repeal of

this Article IX, nor the adoption of any provision of these Articles of Incorporation inconsistent with this Article IX, shall eliminate,

reduce or otherwise adversely affect any limitation on the personal liability of a director or officer of the corporation existing at

the time of such amendment, repeal or adoption of such an inconsistent provision.

ARTICLE

X

Every

person who was or is a party to, or is threatened to be made a party to, or is involved in any action, suit or proceeding, whether civil,

criminal, administrative or investigative, by the reason of the fact that he or she, or a person with whom he or she is a legal representative,

is or was a director or officer of the Corporation, or who is serving at the request of the Corporation as a director or officer of another

corporation, or is a representative in a partnership, joint venture, trust or other enterprise, shall be indemnified and held harmless

to the fullest extent legally permissible under the laws of the State of Nevada from time to time against all expenses, liability and

loss (including attorneys’ fees, judgments, fines, and amounts paid or to be paid in a settlement) reasonably incurred or suffered

by him or her in connection therewith. The right of indemnification shall be a contract right which may be enforced in any manner desired

by such person. The expenses of officers and directors incurred in defending a civil suit or proceeding must be paid by the Corporation

as incurred and in advance of the final disposition of the action, suit, or proceeding, under receipt of an undertaking by or on behalf

of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is

not entitled to be indemnified by the Corporation. Such right of indemnification shall not be exclusive of any other right of such directors,

officers or representatives may have or hereafter acquire, and, without limiting the generality of such statement, they shall be entitled

to their respective rights of indemnification under any bylaw agreement, vote of shareholders, provision of law, or otherwise, as well

as their rights under this article.

Without

limiting the application of the foregoing, the Board of Directors may adopt Bylaws from time to time with respect to indemnification,

to provide at all times the fullest indemnification permitted by the laws of the State of Nevada, and may cause the corporation to purchase

or maintain insurance on behalf of any person who is or was a director or officer of the corporation or who is serving at the request

of the corporation as an officer, director or representative of any other entity or other enterprise against any liability asserted against

such person and incurred in any such capacity or arising out of such status, whether or not the corporation would have the power to indemnify

such person.

Any

repeal or modification of the above provisions of this Article X, approved by the shareholders of the corporation shall be prospective

only, and shall not adversely affect any limitation on the liability of a director or officer of the corporation existing as of the time

of such repeal or modification. In the event of any conflict between the above indemnification provisions, and any other Article of the

Articles, the terms and provisions of this Article X shall control.

ARTICLE

XI

No

contract or other transaction of the corporation with any other person, firm or corporation, or in which this corporation is interested,

shall be affected or invalidated by: (i) the fact that any one or more of the directors or officers of the corporation is interested

in or is a director or officer of such other firm or corporation; or, (ii) the fact that any director or officer of the corporation,

individually or jointly with others, may be a party to or may be interested in any such contract or transaction, so long as the contract

or transaction is authorized, approved or ratified at a meeting of the Board of Directors by sufficient vote thereon by directors not

interested therein, to which such fact of relationship or interest has been disclosed, or the contract or transaction has been approved

or ratified by vote or written consent of the shareholders entitled to vote, to whom such fact of relationship or interest has been disclosed,

or so long as the contract or transaction is fair and reasonable to the corporation. Each person who may become a director or officer

of the corporation is hereby relieved from any liability that might otherwise arise by reason of his contracting with the corporation

for the benefit of himself or any firm or corporation in which he may in any way be interested.

ARTICLE

XII

The

Bylaws shall be adopted by the Board of Directors. The power to alter, amend, or repeal the Bylaws or adopt new Bylaws shall be vested

in the board of directors, but the shareholders of the Corporation may also alter, amend, or repeal the Bylaws or adopt new Bylaws. The

Bylaws may contain any provisions for the regulation or management of the affairs of the Corporation not inconsistent with the laws of

the State of Nevada now or hereafter existing. The Corporation reserves the right to amend, alter, change, or repeal all or any portion

of the provisions contained in these articles of incorporation from time to time in accordance with the laws of the State of Nevada,

and all rights conferred on shareholders herein are granted subject to this reservation.

ARTICLE

XIII

The

name and mailing address of the sole incorporator is Max Munn, 150 N. MacQuesten Parkway, Mount Vernon, NY 10550.

[Signature

page follows]

IN

WITNESS WHEREOF, these Amended and Restated Articles of Incorporation has been executed by a duly authorized officer of this corporation

on this [*] day of [*], 2024.

| |

Max

Munn, Chief Executive Officer |

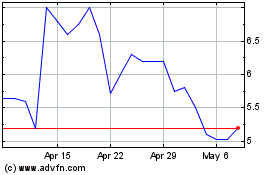

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Apr 2023 to Apr 2024