Aware, Inc. (NASDAQ: AWRE), a global biometric platform company

that uses data science, machine learning, and artificial

intelligence to tackle everyday business and identity challenges

through biometric solutions, today reported financial results for

the first quarter ended March 31, 2024.

First Quarter 2024 and Recent Operational

Highlights

- Total revenue increased 3%

year-over-year to $4.4 million.

- Recurring revenue increased 3%

year-over-year to $3.1 million (or 71% of total revenue),

underscoring the Company’s continued drive to secure and expand its

recurring revenue base.

- Operating expenses decreased $0.5 million, or 8%

year-over-year, to $5.7 million, highlighting the Company's ongoing

cost optimization efforts. Management anticipates that recently

implemented cost-reduction measures will further reduce the

Company's operating expenses.

- Expanded the use of Aware’s

technology with a major federal government agency to include

enrolling their employees' and contractors' biometric and

biographic data. Aware’s technology is used by dozens of agencies

within all three branches of the U.S. federal government.

- Broadened Aware’s footprint in Latin

America and Turkey with the onboarding of new customers such as

Imply, a Brazilian company that provides ticketing, access control,

cashless solutions, ATMs, and more; OpenPass, a prominent online

financial platform in Argentina; as well as another leading bank in

Turkey.

- Showcased Aware’s cutting-edge

authentication solutions for government agencies, commercial

organizations, and law enforcement at Training Magazine’s, Training

2024 Conference & Expo, Channel Partners Conference & Expo,

and recently, International Security Conference (“ISC West”).

- Maintained a strong balance sheet with cash, cash equivalents,

and marketable securities of $28.5 million as of March 31,

2024.

Management Commentary “Following a

transformative year in 2023, our first quarter results demonstrate

Aware's continued commitment to achieving sustainable growth by

expanding our recurring revenue customer base while optimizing our

cost structure," said Robert Eckel, Chief Executive Officer and

President of Aware. "During the first quarter, we successfully

onboarded several new customers and expanded our relationships with

existing customers, including a major federal government agency and

a leading bank in Turkey. We expect these engagements to contribute

to the ongoing growth of our recurring revenue base. Moreover, the

strategic cost-optimization initiatives we implemented last year

and the first quarter of 2024, including a cumulative reduction of

over ten percent of our headcount, have considerably streamlined

our cost structure, consequently lowering our revenue breakeven

point. We anticipate that, upon completion by the end of the second

quarter, our quarterly operating expenses should represent a

substantial improvement compared to our quarterly operating expense

run rate in 2023, as demonstrated in the first quarter of 2024.

“As we look to the future, our expanding pipeline of

opportunities and increasing partner acquisition momentum, combined

with our growing base of recurring revenue and enhanced operating

leverage, position us well to achieve sustainable growth and

positive cash flow. With these advantages, we are well positioned

and have the resources to strategically invest in customer

acquisition, enablement, and backend fulfillment to support our

growth objectives.”

First Quarter 2024 Financial ResultsRevenue for

the first quarter of 2024 was $4.4 million, compared to $4.3

million in the same year-ago period. The increase in revenue was

primarily due to higher software maintenance revenue recognized

related to contracts awarded in Q3 of 2023.

Recurring revenue for the first quarter of 2024 totaled $3.145

million, an increase of 3% compared to $3.062 million in the first

quarter of 2023.

Net loss for the first quarter of 2024 totaled $1.0 million, or

$(0.05) per diluted share, which represents a 30% improvement

compared to net loss of $1.6 million, or $(0.07) per diluted share,

in the same year-ago period.

Adjusted EBITDA loss (a non-GAAP metric reconciled to net loss

below) for the first quarter of 2024 totaled $1.0 million, compared

to adjusted EBITDA loss of $1.4 million in the same year-ago

period. The year-over-year improvement in Adjusted EBITDA loss was

primarily due to lower operating expenses.

Cash, cash equivalents, and marketable securities totaled $28.5

million as of March 31, 2024, compared to $30.9 million as of

December 31, 2023. The decrease in cash, cash equivalents, and

marketable securities is primarily related to our operating loss

and the timing of collections of accounts receivable.

WebcastAware management will host a webcast

today, May 2, 2024, at 5:00 p.m. Eastern time to discuss these

results and provide an update on business conditions. A

question-and-answer session will follow management’s prepared

remarks.

Date: Thursday, May 2, 2024Time: 5:00 p.m. Eastern time (2:00

p.m. Pacific time)Webcast: Register Here

The presentation will be made available for replay in the

investor relations section of the Company’s website. The audio

recording will be available for approximately 90 days following the

live event.

About AwareAware is a global biometric identity

platform company that uses data science, machine learning, and

artificial intelligence to tackle everyday business and identity

challenges through biometric solutions. For over 30 years we’ve

been a trusted name in the field. Aware’s offerings address the

growing challenges that government and commercial enterprises face

in knowing, authenticating and securing individuals through

frictionless and highly secure user experiences. Our algorithms are

based on diverse operational data sets from around the world, and

we prioritize making biometric technology in an ethical and

responsible manner. Aware is a publicly held company (NASDAQ: AWRE)

based in Burlington, Massachusetts. To learn more, visit

our website or follow us

on LinkedIn and X.

Safe Harbor WarningPortions of this release

contain forward-looking statements regarding future events and are

subject to risks and uncertainties, such as estimates or

projections of future revenue, earnings and non-recurring charges,

and the growth of the biometrics markets. Aware wishes to caution

you that there are factors that could cause actual results to

differ materially from the results indicated by such

statements.

Risk factors related to our business include, but are not

limited to: i) our operating results may fluctuate significantly

and are difficult to predict; ii) we derive a significant portion

of our revenue from government customers, and our business may be

adversely affected by changes in the contracting or fiscal policies

of those governmental entities; iii) a significant commercial

market for biometrics technology may not develop, and if it does,

we may not be successful in that market; iv) we derive a

significant portion of our revenue from third party channel

partners; v) the biometrics market may not experience significant

growth or our products may not achieve broad acceptance; vi) we

face intense competition from other biometrics solution providers;

vii) our business is subject to rapid technological change; viii)

our software products may have errors, defects or bugs which could

harm our business; ix) our business may be adversely affected by

our use of open source software; x) we rely on third party software

to develop and provide our solutions and significant defects in

third party software could harm our business; xi) part of our

future business is dependent on market demand for, and acceptance

of, the cloud-based model for the use of software: xii) our

operational systems and networks and products may be subject to an

increasing risk of continually evolving cybersecurity or other

technological risks which could result in the disclosure of company

or customer confidential information, damage to our reputation,

additional costs, regulatory penalties and financial losses; xiii)

our intellectual property is subject to limited protection; xiv) we

may be sued by third parties for alleged infringement of their

proprietary rights; xv) we must attract and retain key personnel;

xvi) our business may be affected by government regulations and

adverse economic conditions; and xvii) we may make acquisitions

that could adversely affect our results, xviii) we may have

additional tax liabilities and xix) our cost optimization

initiatives may not produce expected long-term expense

reductions..

We refer you to the documents Aware files from time to time with

the Securities and Exchange Commission, specifically the section

titled Risk Factors in our annual report on Form 10-K for the

fiscal year ended December 31, 2023 and other reports and filings

made with the Securities and Exchange Commission.

|

AWARE, INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per share

data) (unaudited) |

| |

| |

Three Months

EndedMarch 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

Software licenses |

$ |

2,147 |

|

|

$ |

2,105 |

|

|

Software maintenance |

|

2,160 |

|

|

|

1,835 |

|

|

Services and other |

|

114 |

|

|

|

365 |

|

|

Total revenue |

|

4,421 |

|

|

|

4,305 |

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

Cost of services and other revenue |

|

276 |

|

|

|

298 |

|

|

Research and development |

|

2,182 |

|

|

|

2,381 |

|

|

Selling and marketing |

|

1,891 |

|

|

|

1,991 |

|

|

General and administrative |

|

1,334 |

|

|

|

1,504 |

|

|

Total costs and expenses |

|

5,683 |

|

|

|

6,174 |

|

| Operating loss |

|

(1,262 |

) |

|

|

(1,869 |

) |

| Interest income |

|

280 |

|

|

|

301 |

|

| Net loss |

$ |

(982 |

) |

|

$ |

(1,568 |

) |

|

|

|

|

|

| Net loss per share – basic |

$ |

(0.05 |

) |

|

$ |

(0.07 |

) |

| Net loss per share – diluted |

$ |

(0.05 |

) |

|

$ |

(0.07 |

) |

| Weighted-average shares –

basic |

|

21,085 |

|

|

|

21,033 |

|

| Weighted-average shares –

diluted |

|

21,085 |

|

|

|

21,033 |

|

|

AWARE, INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(In

thousands)(unaudited) |

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

| ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

14,315 |

|

|

$ |

10,002 |

|

Marketable securities |

|

|

14,214 |

|

|

|

20,913 |

|

Accounts and unbilled receivables, net |

|

|

5,324 |

|

|

|

3,855 |

|

Property and equipment, net |

|

|

543 |

|

|

|

579 |

|

Goodwill and intangible assets, net |

|

|

5,408 |

|

|

|

5,511 |

|

Right of use assets |

|

|

4,188 |

|

|

|

4,260 |

|

All other assets, net |

|

|

1,108 |

|

|

|

1,176 |

| |

|

|

|

|

|

|

Total assets |

|

$ |

45,100 |

|

|

$ |

46,296 |

| |

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Accounts payable and accrued expense |

|

$ |

1,822 |

|

|

$ |

1,986 |

|

Deferred revenue |

|

|

5,433 |

|

|

|

5,537 |

|

Operating lease liability |

|

|

4,421 |

|

|

|

4,475 |

|

Total stockholders’ equity |

|

|

33,424 |

|

|

|

34,298 |

| |

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

45,100 |

|

|

$ |

46,296 |

Non-GAAP Measures

We define adjusted EBITDA as U.S. GAAP net loss plus

depreciation of fixed assets and amortization of intangible assets,

stock-based compensation expenses, other (expense) income, net, and

income tax provision. We discuss adjusted EBITDA in our quarterly

earnings releases and certain other communications, as we believe

adjusted EBITDA is an important measure. We use adjusted EBITDA in

internal forecasts and models when establishing internal operating

budgets, supplementing the financial results and forecasts reported

to our Board of Directors, and evaluating short-term and long-term

operating trends in our operations. We believe that the adjusted

EBITDA financial measure assists in providing an enhanced

understanding of our underlying operational measures to manage the

business, to evaluate performance compared to prior periods and the

marketplace, and to establish operational goals. We believe that

the adjusted EBITDA adjustments are useful to investors because

they allow investors to evaluate the effectiveness of the

methodology and information used by management in our financial and

operational decision-making.

We define recurring revenue as the portion of Aware revenue that

is based on a term arrangement and is likely to continue in the

future, such as annual maintenance or subscription contracts. We

use recurring revenue as a metric to communicate the portion of our

revenue that has greater stability and predictability. We believe

that recurring revenue assists in providing an enhanced

understanding of effectiveness of our efforts to transition to a

subscription-based business model.

We define ARR as the amount of annualized recurring revenue that

is likely to continue in the future, such as annual maintenance and

subscription contracts. We use ARR as a metric to assess the

trajectory of our recurring revenue and we believe that ARR assists

in providing an enhanced understanding of effectiveness of our

efforts to transition to a subscription-based business model.

Adjusted EBITDA and recurring revenue are non-GAAP financial

measures and should not be considered in isolation or as a

substitute for financial information provided in accordance with

U.S. GAAP. These non-GAAP financial measures may not be computed in

the same manner as similarly titled measures used by other

companies. We expect to continue to incur expenses similar to the

financial adjustments described above in arriving at adjusted

EBITDA and investors should not infer from our presentation of this

non-GAAP financial measure that these costs are unusual, infrequent

or non-recurring. The following table includes the reconciliations

of our U.S. GAAP net loss, the most directly comparable U.S. GAAP

financial measure, to our adjusted EBITDA for the three months

ended March 31, 2024 and 2023 and for the three months ended

December 31, 2023 and our U.S. GAAP revenue, the most directly

comparable U.S. GAAP financial measure, to our recurring revenue

for the three months and year ended March 31, 2024 and 2023.

|

AWARE, INC.Reconciliation of GAAP Net loss to

Adjusted EBITDA(In

thousands)(unaudited) |

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

December 31, |

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

Net loss |

|

$ |

(982 |

) |

|

$ |

(4,238 |

) |

|

$ |

(1,568 |

) |

|

Depreciation and Amortization |

|

|

140 |

|

|

|

141 |

|

|

|

149 |

|

|

Stock based compensation |

|

|

162 |

|

|

|

428 |

|

|

|

335 |

|

|

Loss on write-off of note receivable |

|

|

— |

|

|

|

2,695 |

|

|

|

— |

|

|

Interest Income |

|

|

(280 |

) |

|

|

(303 |

) |

|

|

(301 |

) |

|

Provision for income taxes |

|

|

— |

|

|

|

59 |

|

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

(960 |

) |

|

$ |

(1,218 |

) |

|

$ |

(1,385 |

) |

|

AWARE, INC.Revenue Breakout (In

thousands)(unaudited) |

|

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

December 31, |

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Recurring revenue: |

|

|

|

|

|

|

|

|

|

|

Software subscriptions |

|

$ |

985 |

|

|

$ |

1,492 |

|

|

$ |

1,227 |

|

|

Software maintenance |

|

|

2,160 |

|

|

|

2,183 |

|

|

|

1,835 |

|

| Total recurring revenue |

|

|

3,145 |

|

|

|

3,675 |

|

|

|

3,062 |

|

| |

|

|

|

|

|

|

|

|

|

| Non-recurring revenue: |

|

|

|

|

|

|

|

|

|

|

Software licenses |

|

|

1,162 |

|

|

|

502 |

|

|

|

878 |

|

|

Services and other |

|

|

114 |

|

|

|

197 |

|

|

|

365 |

|

| Total non-recurring revenue |

|

|

1,276 |

|

|

|

699 |

|

|

|

1,243 |

|

| Total revenue |

|

$ |

4,421 |

|

|

$ |

4,374 |

|

|

$ |

4,305 |

|

Aware is a registered trademark of Aware,

Inc.

| Company

ContactGina RodriguesAware,

Inc.781-687-0300grodrigues@aware.com |

Investor ContactMatt GloverGateway Group,

Inc.949-574-3860AWRE@gateway-grp.com |

| |

|

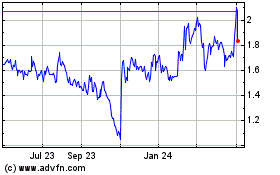

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Jan 2025 to Feb 2025

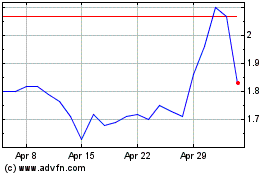

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Feb 2024 to Feb 2025