0001015739false00010157392024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): October 30, 2024

AWARE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Massachusetts |

000-21129 |

04-2911026 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

76 Blanchard Road, Burlington, MA, 01803

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (781) 687-0300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $.01 per share |

AWRE |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS, ELECTION OF DIRECTOR; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

Aware, Inc. (the “Company”) and Robert A. Eckel, the Company’s Chief Executive Officer and President and a member of the Company’s Board of Directors (the “Board”), agreed that Mr. Eckel would leave the Company and the Board, effective December 31, 2024. In connection with Mr. Eckel’s pending departure, the Company entered into a separation agreement with Mr. Eckel on October 30, 2024 (the “Separation Agreement”). Pursuant to the terms of the Separation Agreement, Mr. Eckel is entitled to receive the following severance from the Company once the Separation Agreement becomes effective: (i) $318,270, which represents his annual base salary and is payable as salary continuation for twelve months beginning January 1, 2025; (ii) vesting of all time-based stock options and other time-based stock-based awards held by Mr. Eckel that would have vested had he remained employed with Aware through December 31, 2025; (iii) entitlement to any bonus that Mr. Eckel earned in respect of his and the Company’s performance in 2024 based on the currently established bonus metrics approved by the Board; and (iv) continuation of certain health benefit coverage through December 31, 2025. The Separation Agreement includes Mr. Eckel’s agreement not to compete with the Company through December 31, 2025 and a general release by Mr. Eckel of claims against the Company. The description of the Separation Agreement contained herein is qualified in its entirety by reference to the full text of the Separation Agreement, which is attached as Exhibit 10.1 hereto and incorporated herein by reference.

The Board has engaged an executive search firm to identify Mr. Eckel’s successor. Additionally, the Board has appointed an experienced executive strategic advisor who will work closely with Mr. Eckel, the Board, and the Company’s leadership team to refine the Company’s market position, product roadmap and growth strategy. This advisor will provide strategic guidance to help the Company remain competitive, without taking on direct operational responsibilities.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

No financial statements are required to be filed as part of this Report. The following exhibits are filed as part of this report:

(d) EXHIBITS.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

AWARE, INC. |

|

|

|

|

Dated: October 30, 2024 |

|

By: |

/s/ David K. Traverse |

|

|

|

David K. Traverse |

|

|

|

Chief Financial Officer |

October 30, 2024

Robert A. Eckel

Dear Bob:

The purpose of this letter agreement (the “Agreement”) is to confirm the terms regarding your separation of employment with Aware, Inc. (together with its subsidiaries, the “Company”).

1.Separation of Employment. You acknowledge that your employment with the Company will terminate without cause effective December 31, 2024 (the “Separation Date”). You further acknowledge that this Agreement serves as notice, effective as of the Separation Date, of your resignation from the Board of Directors of the Company (the “Board”), any committee of the Board in which you are serving, and any membership on a board of directors or committee thereof of any subsidiary of the Company. Your salary and any accrued and unused vacation time, less all required local, state, federal and other employment-related taxes and deductions, will be paid through the Separation Date. You acknowledge that from and after the Separation Date, you shall have no authority and shall not represent yourself as an employee, officer or agent of the Company or any of its subsidiaries.

2.Severance. Subject to your execution and delivery to the Company of a Noncompete Agreement in the form attached hereto as Exhibit A (the “Noncompete Agreement”) and a General Release and Waiver of All Claims in the form attached hereto as Exhibit B (the “Release”), with such release becoming irrevocable and fully effective, the Company agrees to provide you with the following (the “Severance”):

(a)You will be paid severance in the gross amount of $318,270.00 less all required local, state, federal and other employment-related taxes and deductions. This sum represents twelve months’ salary, and it will be paid as salary continuation in accordance with the regular payroll process of the Company, commencing on the Company’s next regular payday following the Separation Date.

(b)You will be entitled to be paid any bonus that you earned in respect of your and the Company’s performance in 2024 based on the currently established bonus metrics approved by the Compensation Committee of the Board. The Company shall pay any such bonus to you, less all required local, state, federal and other employment-related taxes and deductions, at the same time it pays executive officer bonuses in respect of 2024 performance, but in no event later than March 31, 2025.

(c)Notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement, all time-based stock options and other time-based stock-based awards held by you in which such stock option or other stock-based award would have vested if you had

remained employed for an additional twelve (12) months following the Separation Date shall vest and become exercisable or nonforfeitable as of the Separation Date.

(d)The Company will pay the difference between the cost of COBRA continuation coverage, should you elect to receive it, for you and any dependent who received health insurance coverage though the Company prior to the Separation Date, and any premium contribution amount applicable to you as of the Separation Date, for a period of twelve (12) months following the Separation Date (“Continuation Benefits”). Continuation Benefits otherwise receivable by you will be reduced to the extent benefits of the same type are received by or made available to you from another employer during the applicable twelve-month period (and any such benefits received by or made available to you shall be reported by you to the Company). Continuation Benefits will be paid to you in accordance with the regular payroll process of the Company, commencing after the Separation Date.

3.Business Expenses. Any approvable expenses you have incurred through the Separation Date will be reimbursed in a timely manner once you submit an expense report with corresponding receipts.

4.Covenants by You. You expressly acknowledge and agree to the following:

(a) Except for your Company laptop, which you may keep after confidential information of the Company has been removed from it, you agree to return all Company documents (and any copies thereof whether in hard or electronic form), property (including, without limitation, keys, computers, iPads, computer disks and CD-ROMs, USB storage devices, pagers, phones and credit cards) and transfer any other Company information (including documents, files, etc.) within five (5) business days of the Separation Date. You may return Company documents, property and other Company information to the Company via FedEx using the Company account number. You agree to cooperate with Company representatives in the return of Company property.

(b) You agree to keep confidential all confidential and proprietary information of the Company, and you agree to abide by any and all common law and/or statutory obligations relating to protection and non-disclosure of the Company’s trade secrets and/or confidential and proprietary documents and information.

(c) You agree that you will not make any statements that are professionally or personally disparaging about, or adverse to, the interests of the Company (and/or its officers, directors and managers) including, but not limited to, any statements that disparage any such person, product, service, finances, financial condition, capability or any other aspect of the business of the Company, and that you will not engage in any conduct which is intended to harm professionally or personally the reputation of the Company (and/or its officers, directors and managers). The Company’s executive officers, marketing personnel and members of its Board of Directors will not make any public statements that are professionally or personally disparaging about you.

(d) You agree that the breach of any of the foregoing covenants by you shall constitute a material breach of this Agreement and shall relieve the Company of any further obligations hereunder and, in addition to any other legal or equitable remedy available to the Company, shall entitle the Company to recover any compensation already paid to you pursuant to Section 2 of this letter.

5.Entire Agreement/Choice of Law/Enforceability. You acknowledge and agree that this Agreement, the Noncompete Agreement and the Release set forth the entire agreement between you and the Company. No variations or modifications hereof shall be deemed valid unless reduced to writing and signed by the parties hereto. This Agreement shall be construed, interpreted and enforced in accordance with the laws of The Commonwealth of Massachusetts, without regard to its choice of law principles. You hereby consent to (a) service of process, and to be sued, in The Commonwealth of Massachusetts and (b) to the jurisdiction of the courts of The Commonwealth of Massachusetts and the United States District Court for the District of Massachusetts, as well as to the jurisdiction of all courts to which an appeal may be taken from such courts, for the purpose of any suit, action or other proceeding arising out of any of your obligations hereunder, and you expressly waive any and all objections you may have as to venue in any such courts. The provisions of this Agreement are severable, and if for any reason any part hereof shall be found to be unenforceable, the remaining provisions shall be enforced in full.

6.Understanding this Agreement. By executing this Agreement, you are acknowledging that you have been afforded sufficient time to understand the terms and effects of this letter, that your agreements and obligations hereunder are made voluntarily, knowingly, and without duress, and that neither the Company nor its agents or representatives have made any representations inconsistent with the provisions of this letter.

Your signature below reflects your understanding of, and agreement to, the terms and conditions set forth above.

Very truly yours,

AWARE, INC.

By: /s/ David K. Traverse /s/ Robert A. Eckel

Name: David K. Traverse Robert A. Eckel

Title: Chief Financial Officer

Dated: 10/30/2024

Exhibit A

NONCOMPETE AGREEMENT

This NONCOMPETE AGREEMENT (the "AGREEMENT"), made as of the 31st day of December 2024, is entered into between Aware, Inc., a Massachusetts corporation with offices at 76 Blanchard Road, Burlington, Massachusetts 01803 (the "Company") and Robert A. Eckel (the "Employee").

RECITALS:

A. The Company is willing to grant certain severance and other benefits to the Employee, under the circumstances specified in that certain Employment Agreement dated as of September 17, 2019 and as amended as of March 27, 2020 between the Company and the Employee (the “Employment Agreement”) and pursuant to a Separation Agreement dated as of October 30, 2024 by and between the Company and the Employee (the “Separation Agreement”); and

B. As set forth in the Employment Agreement and the Separation Agreement, the Employee's execution of this Agreement is a condition to his receipt of such benefits;

NOW, THEREFORE, in consideration of the mutual covenants and promises contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.NON-COMPETITION COVENANTS.

(a) NON-COMPETITION COVENANTS. The Employee agrees that he will not, during the Non-Competition Period (as hereinafter defined), directly or indirectly:

(i)as owner, employee, officer, director, partner, sales representative, agent, stockholder, capital investor, lessor, consultant or advisor, either alone or in association with others (other than as a holder of not more than one percent of the outstanding shares of any series or class of securities of a company, which securities of such class or series are publicly traded in the securities markets), develop, design, produce, market, sell or render (or assist any other person or entity in developing, designing, producing, marketing, selling or rendering), products or services which are competitive with the Business of the Company (as hereinafter defined) anywhere in the world;

(ii)solicit, divert or take away, or attempt to solicit, divert or take away, the business or patronage of any of the customers, prospective customers or referral sources of the Company with whom the Company has had a relationship during the period of the Employee's employment by the Company; or

(iii)recruit, solicit or hire any employee of the Company, or induce or attempt to induce any employee of the Company to terminate his or her employment with, or otherwise cease his or her relationship with, the Company.

(b)DEFINITIONS. For the purposes of this Section 1, the following terms shall have the respective meanings indicated below:

(i)"NON-COMPETITION PERIOD" shall mean the period during which the Employee is employed by the Company and the one-year period commencing on the last day of the Employee's employment by the Company, regardless of whether the Employee's termination was at the election of the Company, with or without cause, or at the election of the Employee, with or without good reason.

(ii) "BUSINESS OF THE COMPANY" shall mean the development, manufacture, marketing and/or distribution of (A) biometric technologies or wavelet compression technologies or (B) any other products or services which the Company sells, has under development or which are subject to active planning at any time during the term of the Employee's employment with the Company.

2.INJUNCTIVE AND OTHER EQUITABLE RELIEF.

(a) The Employee consents and agrees that if he violates any of the provisions of Section 1 hereof, the Company shall be entitled, in addition to any other remedies it may have at law, to the remedies of injunction, specific performance and other equitable relief for a breach by the Employee of Section 1 of this Agreement. This Section 2(a) shall not, however, be construed as a waiver of any of the rights which the Company may have for damages or otherwise.

(b)Any waiver by the Company of a breach of any provision of Section 1 hereof shall not operate or be construed as a waiver of any subsequent breach of such provision or any other provision hereof.

(c) The Employee agrees that each provision of Section 1 shall be treated as a separate and independent clause, and the unenforceability of any one clause shall in no way impair the enforceability of the other clauses herein. Moreover, if one or more of the provisions contained in Section 1 shall for any reason be held to be excessively broad as to scope, activity or subject so as to be unenforceable at law, such provision or provisions shall be construed by the appropriate judicial body by limiting and reducing it or them so as to be enforceable to the maximum extent compatible with the applicable law as it shall then appear.

(d)If the Company shall prevail in any action, suit or other proceeding (whether at law, in equity or otherwise) instituted concerning or arising out of this Agreement, it shall recover, in addition to any other remedy granted to it therein, all its costs and reasonable attorneys’ fees incurred in connection with the prosecution or defense of such action, suit or other proceeding.

The Employee represents and warrants that his performance of all the terms of this Agreement does not and will not breach any other agreement by which he is bound.

4.NOT A CONTRACT OF EMPLOYMENT.

The Employee understands that this Agreement does not constitute a contract of employment or give the Employee rights to employment or continued employment by the Company.

This Agreement constitutes the entire agreement between the parties and supersedes all prior agreements and understandings, whether written or oral, relating to the subject matter of this Agreement.

This Agreement may be amended or modified only by a written instrument executed by both the Company and the Employee.

This Agreement shall be construed, interpreted and enforced in accordance with the laws of The Commonwealth of Massachusetts, without regard to its choice of law principles. The Employee hereby consents to (a) service of process, and to be sued, in The Commonwealth of Massachusetts and (b) to the jurisdiction of the courts of The Commonwealth of Massachusetts and the United States District Court for the District of Massachusetts, as well as to the jurisdiction of all courts to which an appeal may be taken from such courts, for the purpose of any suit, action or other proceeding arising out of any of Employee's obligations hereunder, and Employee expressly waives any and all objections he may have as to venue in any such courts.

8.SUCCESSORS AND ASSIGNS.

This Agreement shall be binding upon and inure to the benefit of both parties and their respective successors and assigns, including any corporation with which or into which the Company may be merged or which may succeed to its assets or business, provided, however, that the obligations of the Employee are personal and shall not be assigned by him.

(a) No delay or omission by the Company in exercising any right under this Agreement shall operate as a waiver of that or any other right. A waiver or consent given by the Company on any one occasion shall be effective only in that instance and shall not be construed as a bar or waiver of any right on any other occasion.

(b)The captions of the sections of this Agreement are for convenience of reference only and in no way define, limit or affect the scope or substance of any section of this Agreement.

(c) This Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision hereof shall be prohibited or invalid under any such law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating or nullifying the remainder of such provision or any other provisions of this Agreement. If any one or more of the provisions contained in this Agreement shall for any reason be held to be excessively broad as to duration, geographical scope, activity or subject, such provisions shall be construed by limiting and reducing it so as to be enforceable to the maximum extent permitted by applicable law.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as

of the day and year set forth above.

AWARE, INC.

By:

Name: David K. Traverse

Title: Chief Financial Officer

EMPLOYEE

Name: Robert A. Eckel

Exhibit B

GENERAL RELEASE AND WAIVER OF ALL CLAIMS

(INCLUDING OLDER WORKER BENEFITS PROTECTION ACT CLAIMS)

For good and valuable consideration, including without limitation the compensation and benefits set forth in the Separation Agreement dated October 30, 2024 (the “Agreement”) between the undersigned and Aware, Inc. (the “Company”), to which this General Release and Waiver of All Claims is attached, the terms of which Agreement shall survive this General Release and Waiver of Claims, the undersigned, on behalf of and for himself and his heirs, administrators, executors, representatives, estates, attorneys, insurers, successors and assigns (hereafter referred to separately and collectively as the “Releasor”), hereby voluntarily releases and forever discharges the Company, and its subsidiaries (direct and indirect), affiliates, related companies, divisions, predecessor and successor companies, and each of its and their present, former, and future shareholders, officers, directors, employees, agents, representatives, attorneys, insurers and assigns (collectively as “Releasees”), jointly and individually, from any and all actions, causes of action, claims, suits, charges, complaints, contracts, covenants, agreements, promises, debts, accounts, damages, losses, sums of money, obligations, demands, and judgments all of any kind whatsoever, known or unknown, at law or in equity, in tort, contract, by statute, or on any other basis, for contractual, compensatory, punitive or other damages, expenses (including attorney’s fees and cost), reimbursements, or costs of any kind, which the undersigned employee ever had, now has, or may have, from the beginning of the world to the date of this Release, known or unknown, in law or equity, whether statutory or common law, whether federal, state, local or otherwise, including but not limited to any and all claims arising out of or in any way related to the undersigned’s engagement by the Company (including the hiring or termination of that engagement), or any related matters including, but not limited to claims, if any arising under the Age Discrimination in Employment Act of 1967, as amended by the Older Worker Benefits Protection Act; the Civil Rights Act of 1964, as amended; the Civil Rights Act of 1991, as amended; the Family and Medical Leave Act of 1993, as amended; the Immigration Reform and Control Act of 1986; the Americans with Disabilities Act of 1990, as amended; the Employee Retirement Income Security Act (ERISA), as amended; the Massachusetts laws against discrimination and harassment (including Mass. Gen. L. c. 151B), protecting equal rights or concerning the payment of wages (including Mass. Gen. L. c. 149, section 148 et seq. and Mass. Gen. L. c. 151, section 1A, et seq.), and federal, state or local common law, laws, statutes, ordinances or regulations. Notwithstanding the foregoing, nothing contained in this General Release and Waiver of Claims shall be construed to bar any claim by the undersigned to enforce the terms of the Agreement.

Releasor represents and acknowledges the following:

(a)that Releasor understands the various claims Releasor could have asserted under federal or state law, including but not limited to the Age Discrimination in Employment Act, Mass. Gen. L. c. 151B, the Massachusetts Wage Act and Massachusetts overtime pay law and other similar laws;

(b)that Releasor has read this General Release carefully and understands all of its provisions;

(c)that Releasor understands that Releasor has the right to and is advised to consult an attorney concerning this General Release and in particular the waiver of rights Releasor might have under the laws described herein and that to the extent, if any, that Releasor desired, Releasor availed himself or herself of this right;

(d)that Releasor has been provided at least twenty-one (21) days to consider whether to sign this General Release and that to the extent Releasor has signed this General Release before the expiration of such twenty-one (21) day period Releasor has done so knowingly and willingly;

(e)that Releasor enters into this General Release and waives any claims knowingly and willingly; and

(f)that this General Release shall become effective seven (7) business days after it is signed. Releasor may revoke this General Release within seven (7) business days after it is signed by delivering a written notice of rescission to Senior Director, Human Resources, Aware, Inc., 76 Blanchard Road, Burlington, Massachusetts 01803. To be effective, the notice of rescission must be hand delivered, or postmarked within the seven (7) business day period and sent by certified mail, return receipt requested, to the referenced address.

Signed and sealed this 31st day of December, 2024.

Signed: __________________________

Name (print): Robert A. Eckel

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

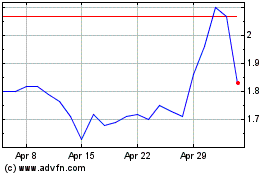

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

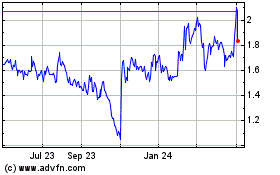

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Nov 2023 to Nov 2024