Current Report Filing (8-k)

24 September 2022 - 6:02AM

Edgar (US Regulatory)

0001633070

false

0001633070

2022-09-20

2022-09-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 20, 2022

AXCELLA

HEALTH INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38901 |

|

26-3321056 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

840

Memorial Drive

Cambridge,

Massachusetts |

02139 |

| (Address

of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: (857) 320-2200

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions ( see General Instruction A.2. below):

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of

each class |

|

Trading Symbol(s) |

|

Name of each

exchange on which

registered |

| Common

Stock, $0.001 Par Value |

|

AXLA |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Securities Purchase Agreement

On September 20, 2022, Axcella Health Inc., doing business as “Axcella

Therapeutics,” (the “Company” or “Axcella”) entered into a Securities Purchase Agreement (the “Purchase

Agreement”) with funds associated with existing investor Flagship Pioneering (together, the “Purchasers” and each a

“Purchaser”), pursuant to which the Company may sell unsecured convertible promissory notes in aggregate principal amount

of up to $12 million (the “Notes”) in a private placement (the “Private Placement”) with the initial closing on

the same date as the date of the Purchase Agreement, September 20, 2022 (the “Initial Closing” and such date, the “Initial

Closing Date”). The Company sold $6 million in Notes at the Initial Closing. The Company may conduct any number of additional closings

(each, including the Initial Closing, a “Closing”) so long as the final Closing occurs on or before the six month anniversary

of the Initial Closing Date. The Notes mature one year from the date of issuance and bear interest at the rate of 8% per annum payable

upon the earlier of (i) voluntary conversion of the Notes in accordance with the terms thereof and (ii) the maturity date. All principal

and accrued interest under the Notes (the “Outstanding Balance”) will automatically convert at the Company’s next equity

financing (the “Subsequent Financing”), without any action on the part of the Purchasers, into such securities of the Company

as are issued in the Subsequent Financing. The Notes are subordinate and junior in right of payment to the senior secured debt issued

pursuant to that certain Loan and Security Agreement, dated September 2, 2021, by and between the Company, its wholly owned subsidiaries

as borrowers, SLR Investment Corp. (“SLR”) as designated agent, and the lenders listed on Schedule 1.1 thereof (the “Loan Agreement”).

The Notes have not been registered under the Securities Act of 1933,

as amended (the “Securities Act”) and were issued and sold in reliance upon the exemption from registration contained in Section

4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder. The Purchasers acquired the Notes for investment

and each Purchaser acknowledged that it is an accredited investor as defined by Rule 501 under the Securities Act. Neither this Current

Report on Form 8-K nor any of its exhibits is an offer to sell or the solicitation of an offer to buy any securities described in this

Current Report on Form 8-K.

The Purchase Agreement includes customary covenants, representations

and warranty provisions for agreements of its kind.

The foregoing summaries of the Purchase Agreement and the Notes do

not purport to be complete and are qualified in their entirety by reference to the documents attached hereto as exhibits 10.1 and 10.2,

respectively. The representations, warranties and covenants made by the Company in these agreements were made solely for the benefit of

the parties to these agreements, including, in some cases, for the purpose of allocating risk among the parties thereto, and should not

be deemed to be a representation, warranty or covenant to any other persons or investors.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

To

the extent required by Item 2.03 of Form 8-K, the information set forth under Item 1.01 of this Current Report on Form 8-K is hereby incorporated

by reference.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

To

the extent required by Item 3.02 of Form 8-K, the information set forth under Item 1.01 of this Current Report on Form 8-K is hereby incorporated

by reference.

In September 2022, the Company made a $6.4 million prepayment to SLR

under the Loan Agreement.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

| * |

Certain exhibits and schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish supplementally a copy of any omitted exhibit or schedule upon request by the SEC. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AXCELLA HEALTH INC. |

| |

|

| Date: September 23, 2022 |

By: |

/s/ William R. Hinshaw, Jr. |

| |

|

William R. Hinshaw, Jr. |

| |

|

Chief Executive Officer, President and Director |

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From Apr 2024 to May 2024

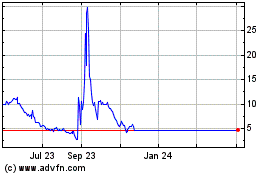

Axcella Health (NASDAQ:AXLA)

Historical Stock Chart

From May 2023 to May 2024