0001897982false00018979822023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 26, 2023

ASPEN TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 333-262106 | | 87-3100817 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 20 Crosby Drive, | Bedford, | MA | | 01730 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (781) 221-6400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common stock, $0.0001 par value per share | | AZPN | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 1, 2023, Aspen Technology, Inc. (the “Company” or "AspenTech") issued a press release announcing financial results for the fourth quarter and fiscal year 2023, ended June 30, 2023. The full text of the press release issued in connection with this announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| Item 5.05 | Amendments to the Registrant's Code of Ethics, or Waiver of a Provision of the Code of Ethics. |

On July 26, 2023, the Company amended and restated its Code of Business Conduct and Ethics (the “Code”), which governs the conduct of all directors, officers and employees of the Company and its subsidiaries and other business entities controlled by it.

The amendments include a new requirement for officers to advise our Chief Executive Officer and Chief Legal Officer and obtain approval from the Chief Executive Officer in advance of accepting an invitation to serve on the board of directors or a committee of the board of directors of another company. In addition, any such service should be consistent with the Company's conflict-of-interest and related party transaction policies. The amendments also clarify that the reporting and investigation of any concerns regarding compliance with the Code will be handled under the Company’s new Whistleblower Reporting, Investigation & Protection Policy, which details the Company’s handling of concerns relating to financial, accounting, auditing, legal and human resources matters. Finally, the amendments include certain other non-substantive revisions and administrative changes, including a requirement that managerial employees who receive concerns covered by the Code from another employee report the concern using our whistleblower hotline, regardless of whether the managerial employee believes the other employee intends to file a report through the whistleblower hotline.

The foregoing summary of the nature of the amendments to the Code is qualified in all respects by the full text of the Code, which is filed herewith as Exhibit 14.1.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On August 1, 2023, the Company announced that its Board of Directors approved a share repurchase authorization (the “Share Repurchase Authorization”), pursuant to which the Company may repurchase up to $300 million in the aggregate of the Company’s outstanding shares of common stock, by means of open market transactions, block transactions, privately negotiated purchase transactions or any other purchase techniques, including 10b5-1 trading plans. The Share Repurchase Authorization will commence after the conclusion of the Company’s accelerated share repurchase program previously announced on May 5, 2023.

Investors and others should note that the Company routinely announces material information to investors and the marketplace using filings with the U.S. Securities and Exchange Commission (the “SEC”), press releases, public conference calls, presentations, webcasts and the Aspen Technology, Inc. Investor Relations website. The information posted on the Aspen Technology, Inc. Investor Relations website is not incorporated by reference in this report or in any other report or document the Company files with the SEC. While not all of the information that the Company posts to the Aspen Technology, Inc. Investor Relations website is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in the Company to review the information that it shares on its webpage at https://ir.aspentech.com. Users may automatically receive email alerts and other information about the Company when enrolling an email address by selecting “Email Alerts” at the webpage at https://ir.aspentech.com/.

The information in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On August 1, 2023, the Company announced that its Board of Directors approved the Share Repurchase Authorization, pursuant to which the Company may repurchase up to $300 million in the aggregate of the Company’s outstanding shares of common stock, by means of open market transactions, block transactions, privately negotiated purchase transactions or any other purchase techniques, including 10b5-1 trading plans. The Share Repurchase Authorization will commence after the conclusion of the Company’s accelerated share repurchase program previously announced on May 5, 2023.

On August 1, 2023, the Company announced the termination of its Share Sale Agreement (the “Purchase Agreement”) by and among the Company, AspenTech Australia Holding Pty Ltd, Australian company number 661 089 167, a company organized under the laws of Australia (the “Buyer”), Mining Software Holdings Pty Ltd, Australian company number 630 328 326), a company organized under the laws of the State of New South Wales (the “Target”), and the holders of stock and options to purchase capital stock of the Target (the “Sellers”) pursuant to which the Buyer would have acquired all of the outstanding capital of the Target from the Sellers. The Company and the Sellers had been waiting to secure a final Russian regulatory approval as a condition to the closing of the transaction. As this process continued, the timing and requirements necessary to get this approval became increasingly unclear. This lack of clarity on the potential for, and timing of, a successful review led the Company and the Sellers to this mutual course of action. The Company is not expected to pay any termination fee as part of this arrangement.

The foregoing summary has been included to provide investors and security holders with information regarding the Purchase Agreement. It is not intended to provide any other factual information about the Company, or its subsidiaries and affiliates.

Cautionary Note on Forward-Looking Statements

Statements in this Current Report on Form 8-K that are not strictly historical may be “forward-looking” statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties, and AspenTech undertakes no obligation to update any such statements to reflect later developments. These forward-looking statements include, but are not limited to, our guidance for fiscal 2024, our expectations regarding cash collections and completion of our accelerated share repurchase program. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “strategy,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “opportunity” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These risks and uncertainties include, without limitation: the failure to realize the anticipated benefits of our transaction with Emerson Electric Co.; risks resulting from our status as a controlled company; the scope, duration and ultimate impacts of the COVID-19 pandemic and the Russia-Ukraine conflict; as well as economic and currency conditions, market demand (including related to the pandemic and adverse changes in the process or other capital-intensive industries such as materially reduced spending budgets due to oil and gas price declines and volatility), pricing, protection of intellectual property, cybersecurity, natural disasters, tariffs, sanctions, competitive and technological factors, and inflation; and others, as set forth in AspenTech’s most recent Transition Report on Form 10-KT and subsequent reports filed with the Securities and Exchange Commission. The outlook contained herein represents AspenTech’s expectation for its consolidated results, other than as noted herein.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 14.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | ASPEN TECHNOLOGY, INC. |

| | |

| | | |

Date: August 1, 2023 | By: | /s/ Chantelle Breithaupt |

| | | Chantelle Breithaupt |

| | | Senior Vice President and Chief Financial Officer |

| | |

Exhibit 14.1 CODE OF BUSINESS CONDUCT AND ETHICS (Adopted as of July 26, 2023) This Code of Business Conduct and Ethics (this “Code”) sets forth legal and ethical standards of conduct for directors, officers and employees of Aspen Technology, Inc. (the “Company”). This Code is intended to deter wrongdoing and to promote the conduct of all Company business in accordance with high standards of integrity and in compliance with all applicable laws and regulations. This Code applies to the Company and all of its subsidiaries and other business entities controlled by it worldwide. If you have any questions regarding this Code or its application to you in any situation, you should contact your supervisor, your Human Resources representative or the Chief Legal Officer. 1. COMPLIANCE WITH LAWS, RULES AND REGULATIONS The Company requires that all employees, officers and directors comply with all laws, rules and regulations applicable to the Company wherever it does business. You are expected to use good judgment and common sense in seeking to comply with all applicable laws, rules and regulations and to ask for advice when you are uncertain about them. If you become aware of the violation of any law, rule or regulation by the Company, whether by its officers, employees, directors, or any third party doing business on behalf of the Company, it is your responsibility to promptly report the matter to your supervisor or the Chief Legal Officer. While it is the Company’s desire to address matters internally, nothing in this Code should discourage you from reporting any illegal activity, including any violation of the securities laws, antitrust laws, environmental laws or any other federal, state or foreign law, rule or regulation, to the appropriate regulatory authority. Employees, officers and directors shall not discharge, demote, suspend, threaten, harass or in any other manner discriminate or retaliate against an employee because he or she reports any such violation, unless it is determined that the report was made with knowledge that it was false. This Code should not be construed to prohibit you from testifying, participating or otherwise assisting in any state or federal administrative, judicial or legislative proceeding or investigation. 2. CONFLICTS OF INTEREST 2.1. All Employees Employees, officers and directors must act in the best interests of the Company. You must refrain from engaging in any activity or having a personal interest that presents a “conflict of interest.” A conflict of interest occurs when your personal interest interferes, or appears to interfere, with the interests of the Company. A conflict of interest can arise whenever you, as an officer, director or employee, take action or have an interest that prevents you from performing your Company duties and responsibilities honestly, objectively and effectively.

2 Conflict of Interest Policy for Officers and Directors 2.2. Officers. Officers must not: • perform services as a consultant, employee, officer, director, advisor or in any other capacity, or permit any close relative to perform services as an officer or director, for a significant customer, significant supplier or direct competitor of the Company, other than at the request of the Company; • have, or permit any close relative to have, a financial interest in a significant supplier or significant customer of the Company, other than an investment representing less than one percent of the outstanding shares of a publicly-held company or less than five percent of the outstanding shares of a privately-held company; • have, or permit any close relative to have, a financial interest in a direct competitor of the Company, other than an investment representing less than one percent of the outstanding shares of a publicly-held company; • supervise, review or influence the job evaluation or compensation of a member of his or her immediate family; or • engage in any other activity or have any other interest that the Board of Directors of the Company determines to constitute a conflict of interest. In addition, performing the duties and fulfilling the responsibilities of a director of another company requires a significant commitment of time and attention and the Company recognizes that excessive time commitments can interfere with an officer’s ability to perform and fulfill his or her duties for the Company. Officers of the Company must advise the Chief Executive Officer and the Chief Legal Officer and obtain approval from the Chief Executive Officer in advance of accepting an invitation to serve on the board or board committee of another company. Service on boards and board committees of other companies should be consistent with the Company's conflict-of-interest and related party transaction policies. 2.3. Directors. Directors must not: • perform services as a consultant, employee, officer, director, advisor or in any other capacity, or permit any close relative to perform services as an officer or director, for a direct competitor of the Company; • have, or permit any close relative to have, a financial interest in a direct competitor of the Company, other than an investment representing less than one percent of the outstanding shares of a publicly-held company; • use his or her position with the Company to influence any decision of the Company relating to a contract or transaction with a supplier or customer of the Company if the director or a close relative of the director:

3 • performs services as a consultant, employee, officer, director, advisor or in any other capacity for such supplier or customer; or • has a financial interest in such supplier or customer, other than an investment representing less than one percent of the outstanding shares of a publicly-held company; • supervise, review or influence the job evaluation or compensation of a member of his or her immediate family; or • engage in any other activity or have any other interest that the Board of Directors of the Company determines to constitute a conflict of interest. A “close relative” means a spouse, dependent child or any other person living in the same home with the employee, officer or director. “Immediate family” means a close relative and a parent, sibling, child, mother- or father-in-law, son- or daughter-in-law or brother- or sister-in- law. A “significant customer” is a customer that has made during the Company’s last full fiscal year, or proposes to make during the Company’s current fiscal year, payments to the Company for property or services in excess of five percent of (i) the Company’s consolidated gross revenues for its last full fiscal year or (ii) the customer’s consolidated gross revenues for its last full fiscal year. A “significant supplier” is a supplier to which the Company has made during the Company’s last full fiscal year, or proposes to make during the Company’s current fiscal year, payments for property or services in excess of five percent of (i) the Company’s consolidated gross revenues for its last full fiscal year or (ii) the supplier’s consolidated gross revenues for its last full fiscal year. It is your responsibility to disclose any material transaction or relationship that reasonably could be expected to give rise to a conflict of interest to the Chief Legal Officer or, if you are an executive officer or director, to the Board of Directors, who shall be responsible for determining whether such transaction or relationship constitutes a conflict of interest. All employees and members of the Board of Directors must also comply with the Company’s Related Person Transaction Policy found in the Corporate Governance section of the Company’s Intranet. 3. INSIDER TRADING Employees, officers and directors who have material non-public information about the Company or other companies, including our suppliers and customers, as a result of their relationship with the Company are prohibited by law and Company policy from trading in securities of the Company or such other companies, as well as from communicating such information to others who might trade on the basis of that information. To help ensure that you do not engage in prohibited insider trading and avoid even the appearance of an improper transaction, the Company has adopted an Insider Trading Policy, which is available in the Corporate Governance section of the Company’s Intranet. Please see the Insider Trading Policy. If you are uncertain about the constraints on your purchase or sale of any Company securities or the securities of any other company that you are familiar with by virtue of your

4 relationship with the Company, you should consult with the Chief Legal Officer before making any such purchase or sale. 4. CONFIDENTIALITY Employees, officers and directors must maintain the confidentiality of confidential information entrusted to them by the Company or other companies, including our suppliers and customers, except when disclosure is authorized by a supervisor or legally mandated. Unauthorized disclosure of any confidential information is prohibited. Additionally, employees should take appropriate precautions to ensure that confidential or sensitive business information, whether it is proprietary to the Company or another company, is not communicated within the Company except to employees who have a need to know such information to perform their responsibilities for the Company. Third parties may ask you for information concerning the Company. Employees, officers and directors (other than the Company’s authorized spokespersons) must not discuss internal Company matters with, or disseminate internal Company information to, anyone outside the Company, except as required in the performance of their Company duties and after an appropriate confidentiality agreement is in place. This prohibition applies particularly to inquiries concerning the Company from the media, market professionals (such as securities analysts, institutional investors, investment advisers, brokers and dealers) and security holders. All responses to inquiries on behalf of the Company must be made only by the Company’s authorized spokespersons. If you receive any inquiries of this nature, you must decline to comment and refer the inquirer to your supervisor or one of the Company’s authorized spokespersons. You also must abide by any lawful obligations that you have to your former employer. These obligations may include restrictions on the use and disclosure of confidential information, restrictions on the solicitation of former colleagues to work at the Company and non-competition obligations. 5. STATEMENT OF ETHICAL CONDUCT AND FAIR DEALING Employees, officers and directors should endeavor to deal honestly, ethically and fairly with the Company’s suppliers, customers, competitors and employees. Statements regarding the Company’s products and services must not be untrue, misleading, deceptive or fraudulent. You must not take unfair advantage of anyone through manipulation, concealment, abuse of privileged information, misrepresentation of material facts or any other unfair-dealing practice. Employees, officers and directors shall be treated with respect, dignity and free of harassment on the grounds of race, color, national or ethnic origin, sex, religion, age, marital or family status, sexual orientation, disability, or any other ground proscribed by law that applies to the Company. 6. PROTECTION AND PROPER USE OF CORPORATE ASSETS Employees, officers and directors should seek to protect the Company’s assets. Theft, carelessness and waste have a direct impact on the Company’s financial performance.

5 Employees, officers and directors must use the Company’s assets and services solely for legitimate business purposes of the Company and not for any personal benefit or the personal benefit of anyone else. Employees, officers and directors must advance the Company’s legitimate interests when the opportunity to do so arises. You must not take for yourself personal opportunities that are discovered through your position with the Company or the use of property or information of the Company. 7. GIFTS AND GRATUITIES The use of Company funds or assets for gifts, gratuities or other favors to employees or government officials is prohibited, except to the extent such gifts are in compliance with applicable law, nominal in amount and not given in consideration or expectation of any action by the recipient. Employees, officers and directors must not accept, or permit any member of his or her immediate family to accept, any gifts, gratuities or other favors from any customer, supplier or other person doing or seeking to do business with the Company, other than items of nominal value. Any gifts that are not of nominal value should be returned immediately and reported to your supervisor. If immediate return is not practical, they should be given to the Company for charitable disposition or such other disposition as the Company believes appropriate in its sole discretion. Common sense and moderation should prevail in business entertainment engaged in on behalf of the Company. Employees, officers and directors should provide, or accept, business entertainment to or from anyone doing business with the Company only if the entertainment is infrequent, reasonable and intended to serve legitimate business goals. Bribes and kickbacks are criminal acts, strictly prohibited by law. You must not offer, give, solicit or receive any form of bribe or kickback anywhere in the world. You must not offer anything of value to a foreign government official in order to influence a discretionary decision in favor of the Company. 8. ACCURACY OF BOOKS AND RECORDS AND PUBLIC REPORTS Employees, officers and directors must honestly and accurately report all business transactions. You are responsible for the accuracy of your records and reports. Accurate information is essential to the Company’s ability to meet legal and regulatory obligations. All Company books, records and accounts shall be maintained in accordance with all applicable regulations and standards and accurately reflect the true nature of the transactions they record. The financial statements of the Company shall conform to generally accepted accounting rules and the Company’s accounting policies. No undisclosed or unrecorded account or fund shall be established for any purpose. No false or misleading entries shall be made in the Company’s books or records for any reason, and no disbursement of corporate funds or other corporate property shall be made without adequate supporting documentation.

6 It is the policy of the Company to provide full, fair, accurate, timely and understandable disclosure in reports and documents filed with, or submitted to, the Securities and Exchange Commission and in other public communications. 9. WAIVERS OF THIS CODE OF BUSINESS CONDUCT AND ETHICS While some of the policies contained in this Code must be strictly adhered to and no exceptions can be allowed, in other cases exceptions may be possible. Any employee or officer who believes that an exception to any of these policies is appropriate in his or her case should first contact his or her immediate supervisor. If the supervisor agrees that an exception is appropriate, the approval of the Chief Legal Officer must be obtained. The Chief Legal Officer shall be responsible for maintaining a complete record of all requests for exceptions to any of these policies and the disposition of such requests. Any executive officer or director who seeks an exception to any of these policies should contact the Chief Legal Officer. Any waiver of this Code for executive officers or directors or any change to this Code that applies to executive officers or directors may be made only by the Board of Directors of the Company and will be disclosed as required by law or stock market regulation. 10. REPORTING AND COMPLIANCE PROCEDURES Every employee, officer and director has the responsibility to ask questions, seek guidance, report suspected violations and express concerns regarding compliance with this Code. The Company’s Whistleblower Reporting, Investigation & Protection Policy (“Whistleblower Policy”) applies to reports of concerns regarding compliance with this Code. Any employee, officer or director who knows or believes that any other employee or representative of the Company has engaged or is engaging in Company-related conduct that violates applicable law or this Code or otherwise has concerns regarding questionable accounting or auditing matters or complaints regarding accounting, internal accounting controls or auditing matters should report such information in the manner described below. You may report such conduct openly or anonymously. The Company will not penalize or take disciplinary action against any employee who reports such conduct or concern, unless it is determined that the report was made with knowledge that it was false. Any supervisor who receives a report of a violation of this Code must immediately inform the Chief Legal Officer. You may report violations of this Code, on a confidential or anonymous basis, using any of the following methods: • By accessing the Company’s third-party Whistleblower Hotline, which can be found at http://www.openboard.info/azpn/; by email message to azpn@openboard.info; or using the following toll-free telephone number: (866) 276-9891. • By sending: (a) a letter addressed to Aspen Technology, Inc., 20 Crosby Drive, Bedford, MA 01730 to the attention of the Chief Legal Officer; or (b) an email to the Chief Legal Officer at Mark.Mouritsen@aspentech.com.

7 • By discussing their concerns with their direct manager, any other managerial employee with whom they are comfortable, their Human Resources Business Partner, or the Chief Legal Officer. Any managerial employee who becomes aware of a concern covered by this Policy from another employee is required to report the concern using the Whistleblower Hotline, regardless of whether the managerial employee believes the other employee intends to file a report through the Whistleblower Hotline.. While we prefer that you identify yourself when reporting violations because doing so assists the Company’s investigation and handling of the report,, you may report concerns anonymously if you wish. Employees, officers and directors are expected to cooperate fully with any inquiry or investigation by the Company regarding an alleged violation of this Code. The Company will not discipline, discriminate against or retaliate against any employee who cooperates in any investigation or inquiry regarding such conduct. Failure to cooperate with any such inquiry or investigation may result in disciplinary action, up to and including discharge. The Company shall determine whether violations of this Code have occurred and, if so, shall determine the disciplinary measures to be taken against any employee who has violated this Code. All reports of concerns regarding compliance with this Code will be investigated and handled in accordance with the procedures described in the Whistleblower Policy. Failure to comply with the standards outlined in this Code will result in disciplinary action including reprimands, warnings, probation or suspension with or without pay, demotions, reductions in salary, discharge and restitution. Certain violations of this Code may require the Company to refer the matter to the appropriate governmental or regulatory authorities for investigation or prosecution. Moreover, any supervisor who directs or approves of any conduct in violation of this Code, or who has knowledge of such conduct and does not immediately report it, also will be subject to disciplinary action, up to and including discharge. The Company prohibits and will not tolerate retaliation against any employee who makes a good faith report in accordance with this Policy or who participates in good faith in the Company’s handling and investigation of a report. Employees who believe that they have experienced retaliation should notify the Chief Legal Officer. Employees who engage in retaliatory conduct will be subject to disciplinary action up to and including termination of employment. 11. DISSEMINATION AND AMENDMENT This Code shall be distributed to each new employee, officer and director of the Company upon commencement of his or her employment or other relationship with the Company and shall also be distributed annually to each employee, officer and director of the Company, and each employee, officer and director shall certify that he or she has received, read and understood this Code and has complied with its terms. The Company reserves the right to amend, alter or terminate this Code at any time for any reason. The most current version of this Code can be found in the Corporate Governance section of the Company’s Intranet.

8 This document is not an employment contract between the Company and any of its employees, officers or directors and does not alter the Company’s at-will employment policy. 12. STOCKHOLDERS AGREEMENT With respect to directors, Sections 2 (Conflicts of Interest) and 4 (Confidentiality) are subject to the terms of the Stockholders Agreement dated as of May 16, 2022 by and among the Company, Emerson Electric Co., a Missouri corporation, and EMR Worldwide Inc., a Delaware corporation, as amended from time to time.

Exhibit 99.1

Contacts:

| | | | | | | | |

| Media Contact | | Investor Contact |

| Len Dieterle | | Brian Denyeau |

| Aspen Technology | | ICR for Aspen Technology |

| +1 781-221-4291 | | +1 646-277-1251 |

| len.dieterle@aspentech.com | | brian.denyeau@icrinc.com |

Aspen Technology Announces Financial Results for the Fourth Quarter and Fiscal 2023

Bedford, Mass. – August 1, 2023 - Aspen Technology, Inc. (AspenTech) (NASDAQ: AZPN), a global leader in industrial software, today announced financial results for its fourth quarter and fiscal year 2023, ended June 30, 2023.

“The fourth quarter was a strong finish to an important year and showed benefits from our transformation efforts and learnings in fiscal 2023. We delivered a full year of double-digit ACV growth, ending above the midpoint of our guidance range. Demand in most of our end markets and geographies was strong in the quarter and throughout the year. This performance, during an unpredictable macro environment, validates the mission criticality of AspenTech solutions to our customers’ operations and strategic priorities,” said Antonio Pietri, President and Chief Executive Officer of AspenTech.

Fiscal Year 2023 Recent Business Highlights

•Annual Contract Value1 ("ACV") was $884.9 million at the end of fiscal 2023, increasing 11.8% year over year and 3.5% quarter over quarter.

•Annual Spend for Heritage AspenTech2 was $730.9 million at the end of fiscal 2023, increasing 8.5% year over year and 2.7% quarter over quarter.

•Operating cash flow was $299.2 million for fiscal 2023.

•Free cash flow3 was $292.3 million for fiscal 2023.

•AspenTech Board of Directors approved new $300.0 million share repurchase authorization for fiscal 2024; AspenTech set to complete previously announced $100.0 million accelerated share repurchase program in the first quarter of fiscal 2024.

Summary of Fourth Quarter and Fiscal Year 2023 Financial Results4, 5

AspenTech’s total revenue was $320.6 million for the fourth quarter of fiscal 2023 and included the following:

•License and solutions revenue, which represents the portion of a term license agreement allocated to the initial license and Open Systems International, Inc. (OSI) revenue where software and professional services are recognized as one performance obligation, was $222.8 million, compared to $179.3 million in the fourth quarter of fiscal 2022.

•Maintenance revenue, which represents the portion of customer agreements related to ongoing support and the right to future product enhancements, was $82.6 million, compared to $50.2 million in the fourth quarter of fiscal 2022.

•Services and other revenue was $15.2 million, compared to $9.5 million in the fourth quarter of fiscal 2022.

Income from operations was $6.0 million in the fourth quarter of fiscal 2023, compared to income from operations of $39.2 million in the fourth quarter of fiscal 2022.

Net income was $27.3 million or $0.42 per diluted share in the fourth quarter of fiscal 2023, compared to net income of $57.2 million, or $1.13 per diluted share, in the fourth quarter of fiscal 2022. The Company has elevated amortization of intangible assets following the close of the transaction with Emerson. As a result, the Company expects its amortization of intangible assets to remain elevated for the next several years as the related asset balance is amortized over time.

Non-GAAP income from operations was $148.9 million in the fourth quarter of fiscal 2023. Non-GAAP net income was $138.2 million, or $2.13 per share, for the fourth quarter of fiscal 2023. These non-GAAP results add back the impact of stock-based compensation expense, amortization of intangibles, fees related to acquisitions and integration planning and realized and unrealized gains and losses in connection with derivatives on foreign currency forward contracts. A reconciliation of GAAP to non-GAAP results is presented in the financial tables included in this press release.

As of June 30, 2023, AspenTech had cash and cash equivalents of $241.2 million, no borrowings, and $193.1 million available on its revolving credit facility.

During the fourth quarter, AspenTech generated $113.6 million in cash flow from operations and $111.5 million in free cash flow3. Free cash flow is calculated as net cash provided by operating activities adjusted for the net impact of purchases of property, equipment and leasehold improvements and payments for capitalized computer software development costs. Free cash flow was below our guidance for fiscal 2023 due to lower-than-expected cash collections. AspenTech has already received a significant portion of these payments in July 2023.

Recent Developments

Micromine Transaction Update

AspenTech, in collaboration with Potentia, Micromine’s majority owner, has terminated its share sale agreement to acquire Micromine. AspenTech and Potentia were waiting to secure a final Russian regulatory approval as a condition to closing the transaction. As this process continued, the timing and requirements necessary to get this approval became increasingly unclear. This lack of clarity on the potential for, and timing of, a successful review led AspenTech and Potentia to this mutual course of action. AspenTech will not be paying any termination fee as part of this arrangement.

Share Repurchase Programs Update

AspenTech announced today that its Board of Directors has approved a new share repurchase authorization, through which the Company may repurchase up to $300 million of its outstanding shares of common stock in fiscal 2024. This authorization is in addition to the Company’s $100 million accelerated share repurchase program announced on May 5, 2023. The Company expects to complete the accelerated share repurchase program in its first quarter of fiscal 2024. Upon its completion, the Company will begin executing the $300 million share repurchase authorization.

Fiscal Year 2024 Business Outlook

Based on information as of today, August 1, 2023, AspenTech is issuing the following guidance for fiscal 2024.

•ACV1 growth of at least 11.5% year-over-year.

•GAAP operating cash flow of at least $378 million

•Free cash flow3 of at least $360 million

•Total bookings of at least $1.04 billion

•Total revenue of at least $1.12 billion

•GAAP total expense of approximately $1.22 billion

•Non-GAAP total expense of approximately $675 million

•GAAP operating loss at or better than $100 million

•Non-GAAP operating income of at least $445 million

•GAAP net loss at or better than $7 million

•Non-GAAP net income of at least $424 million

•GAAP net loss per share at or better than $0.11

•Non-GAAP net income per share of at least $6.51

These statements are forward-looking and actual results may differ materially. Refer to the Forward-Looking Statements safe harbor below for information on the factors that could cause AspenTech’s actual results to differ materially from these forward-looking statements.

Conference Call and Webcast

AspenTech will host a conference call and webcast presentation on Tuesday, August 1, 2023, at 4:30 p.m. ET to discuss its financial results, business outlook, and related corporate and financial matters. A live webcast of the call will be available on AspenTech's Investor Relations website, http://ir.aspentech.com/, via its "Webcasts" page. To access the call by phone, please use the following registration link. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time. A replay of the webcast also will be available for a limited time at http://ir.aspentech.com/.

Expanded Earnings Presentation

AspenTech has provided an expanded earnings presentation for its fourth quarter and fiscal 2023. The Company asks that shareholders refer to this presentation in conjunction with today’s conference call, which can be found at ir.aspentech.com.

Footnotes

1.AspenTech defines ACV as the estimate of the annual value of our portfolio of term license and software maintenance and support, or SMS, contracts, the annual value of SMS agreements purchased with perpetual licenses and the annual value of standalone SMS agreements purchased with certain legacy term license agreements, which have become an immaterial part of our business.

2.AspenTech defines Annual Spend for Heritage AspenTech as the annualized value of all term license and SMS contracts at the end of the quarter for the businesses other than OSI and Subsurface Science and Engineering (SSE). AspenTech will no longer disclose its Annual Spend metric starting in the first quarter of fiscal year 2024.

3.Effective January 1, 2023, we no longer exclude acquisition and integration planning related payments from our computation of free cash flow. Free cash flow for all prior periods presented has been revised to the current period computation.

4.As a result of the transaction between AspenTech and Emerson Electric Co. (“Emerson”), EmerSubCX, the subsidiary Emerson created as part of the transaction, became the surviving entity when the transaction closed on May 16, 2022. The comparable three-month period shown in the financial statements for fiscal 2022 reflects the full quarter results of the OSI and SSE businesses that were contributed to new AspenTech and the results of Heritage AspenTech for the period from May 16, 2022 to June 30, 2022. In addition, in conjunction with the closing of the transaction, EmerSubCX adjusted its fiscal year end from September 30 to June 30 to align with Heritage AspenTech’s fiscal year end. As a result, the financial results for fiscal 2022 are for the nine months from October 1, 2021 to June 30, 2022 and include the nine-month results of the OSI and SSE businesses Emerson contributed to new AspenTech and the results of Heritage AspenTech for the period from May 16, 2022 to June 30, 2022.

5.Prior period financial information throughout this press release has been revised to conform with the current period presentation.

About AspenTech

Aspen Technology, Inc. (NASDAQ: AZPN) is a global software leader helping industries at the forefront of the world’s dual challenge meet the increasing demand for resources from a rapidly growing population in a profitable and sustainable manner. AspenTech solutions address complex environments where it is critical to optimize the asset design, operation and maintenance lifecycle. Through our unique combination of deep domain expertise and innovation, customers in capital-intensive industries can run their assets safer, greener, longer and faster to improve their operational excellence. To learn more, visit AspenTech.com.

Forward-Looking Statements

Statements in this press release that are not strictly historical may be “forward-looking” statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties, and AspenTech undertakes no obligation to update any such statements to reflect later developments. These forward-looking statements include, but are not limited to, our guidance for fiscal 2024, our expectations regarding cash collections and completion of our accelerated share repurchase program. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “strategy,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “opportunity” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These risks and uncertainties include, without limitation: the failure to realize the anticipated benefits of our transaction with Emerson Electric Co.; risks resulting from our status as a controlled company; the scope, duration and ultimate impacts of the COVID-19 pandemic and the

Russia-Ukraine conflict; as well as economic and currency conditions, market demand (including related to the pandemic and adverse changes in the process or other capital-intensive industries such as materially reduced spending budgets due to oil and gas price declines and volatility), pricing, protection of intellectual property, cybersecurity, natural disasters, tariffs, sanctions, competitive and technological factors, and inflation; and others, as set forth in AspenTech’s most recent Annual Report on Form 10-KT and subsequent reports filed with the Securities and Exchange Commission. The outlook contained herein represents AspenTech’s expectation for its consolidated results, other than as noted herein.

© 2023 Aspen Technology, Inc. AspenTech, aspenONE, asset optimization and the Aspen leaf logo are trademarks of Aspen Technology, Inc. All rights reserved. All other trademarks are property of their respective owners.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under the rules of the U.S. Securities and Exchange Commission (the "SEC"). Non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles. This non-GAAP information supplements, and is not intended to represent a measure of performance in accordance with, disclosures required by generally accepted accounting principles, or GAAP. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in accordance with GAAP. A reconciliation of GAAP to non-GAAP results is included in the financial tables included in this press release.

Management considers both GAAP and non-GAAP financial results in managing AspenTech’s business. As the result of adoption of new licensing models, management believes that a number of AspenTech’s performance indicators based on GAAP, including revenue, gross profit, operating income and net income, should be viewed in conjunction with certain non-GAAP and other business measures in assessing AspenTech’s performance, growth and financial condition. Accordingly, management utilizes a number of non-GAAP and other business metrics, including the non-GAAP metrics set forth in this press release, to track AspenTech’s business performance. None of these non-GAAP metrics should be considered as an alternative to any measure of financial performance calculated in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONSOLIDATED AND COMBINED STATEMENTS OF OPERATIONS (Unaudited in Thousands, Except per Share Data) |

| | | | | | | |

| Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| License and solutions | $ | 222,825 | | | $ | 179,260 | | | $ | 669,185 | | | $ | 278,589 | |

| Maintenance | 82,634 | | | 50,201 | | | 316,911 | | | 103,786 | |

| Services and other | 15,184 | | | 9,459 | | | 58,082 | | | 22,921 | |

| Total revenue | 320,643 | | | 238,920 | | | 1,044,178 | | | 405,296 | |

| Cost of revenue: | | | | | | | |

| License and solutions | 70,238 | | | 56,491 | | | 279,564 | | | 125,258 | |

| Maintenance | 8,846 | | | 6,660 | | | 36,650 | | | 15,030 | |

| Services and other | 16,478 | | | 7,867 | | | 57,375 | | | 16,108 | |

| Total cost of revenue | 95,562 | | | 71,018 | | | 373,589 | | | 156,396 | |

| Gross profit | 225,081 | | | 167,902 | | | 670,589 | | | 248,900 | |

| Operating expenses: | | | | | | | |

| Selling and marketing | 126,396 | | | 71,569 | | | 482,656 | | | 108,463 | |

| Research and development | 55,606 | | | 33,440 | | | 209,347 | | | 64,285 | |

| General and administrative | 37,094 | | | 23,703 | | | 161,651 | | | 39,878 | |

| Restructuring costs | — | | | 36 | | | — | | | 117 | |

| Total operating expenses | 219,096 | | | 128,748 | | | 853,654 | | | 212,743 | |

| Income (loss) from operations | 5,985 | | | 39,154 | | | (183,065) | | | 36,157 | |

| Other income (expense), net | 3,850 | | | 4,414 | | | (29,418) | | | 310 | |

| Interest income, net | 12,807 | | | 3,542 | | | 31,917 | | | 3,494 | |

| Income (loss) before provision for income taxes | 22,642 | | | 47,110 | | | (180,566) | | | 39,961 | |

| (Benefit) for income taxes | (4,674) | | | (10,076) | | | (72,806) | | | (13,185) | |

| Net income (loss) | $ | 27,316 | | | $ | 57,186 | | | $ | (107,760) | | | $ | 53,146 | |

| Net income (loss) per common share: | | | | | | | |

| Basic | $ | 0.42 | | | $ | 1.14 | | | $ | (1.67) | | | $ | 1.30 | |

| Diluted | $ | 0.42 | | | $ | 1.13 | | | $ | (1.67) | | | $ | 1.30 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 64,614 | | | 50,179 | | | 64,621 | | | 40,931 | |

| Diluted | 64,943 | | | 50,406 | | | 64,621 | | | 41,008 | |

| | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONSOLIDATED AND COMBINED BALANCE SHEETS (Unaudited in Thousands, Except Share and Per Share Data) |

| | | |

| June 30, |

| 2023 | | 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 241,209 | | | $ | 449,725 | |

| Accounts receivable, net | 122,789 | | | 111,027 | |

| Current contract assets, net | 367,539 | | | 428,833 | |

| Prepaid expenses and other current assets | 27,728 | | | 23,461 | |

| Receivables from related parties | 62,375 | | | 16,941 | |

| Prepaid income taxes | 11,424 | | | 17,503 | |

| Total current assets | 833,064 | | | 1,047,490 | |

| Property, equipment and leasehold improvements, net | 18,670 | | | 17,148 | |

| Goodwill | 8,330,811 | | | 8,266,809 | |

| Intangible assets, net | 4,659,657 | | | 5,112,781 | |

| Non-current contract assets, net | 536,104 | | | 428,232 | |

| Contract costs | 15,992 | | | 5,473 | |

| Operating lease right-of-use assets | 67,642 | | | 78,286 | |

| Deferred tax assets | 10,638 | | | 4,937 | |

| Other non-current assets | 13,474 | | | 8,766 | |

| Total assets | $ | 14,486,052 | | | $ | 14,969,922 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 20,299 | | | $ | 21,416 | |

| Accrued expenses and other current liabilities | 99,526 | | | 90,123 | |

| Due to related parties | 22,019 | | | 4,111 | |

| Current operating lease liabilities | 12,928 | | | 7,191 | |

| Income taxes payable | 46,205 | | | 6,768 | |

| Current borrowings | — | | | 28,000 | |

| Current contract liabilities | 151,450 | | | 143,327 | |

| Total current liabilities | 352,427 | | | 300,936 | |

| Non-current contract liabilities | 30,103 | | | 21,081 | |

| Deferred income tax liabilities | 957,911 | | | 1,145,408 | |

| Non-current operating lease liabilities | 55,442 | | | 71,933 | |

| Non-current borrowings, net | — | | | 245,647 | |

| Other non-current liabilities | 19,240 | | | 15,560 | |

| Stockholders’ equity: | | | |

Common stock, 0.0001 par value—Authorized—600,000,000 shares

Issued— 64,952,868 shares at June 30, 2023 and 64,425,378 shares at June 30, 2022

Outstanding— 64,465,242 shares at June 30, 2023 and 64,425,378 shares at June 30, 2022 | 6 | | | 6 | |

| Additional paid-in capital | 13,194,028 | | | 13,107,570 | |

| (Accumulated deficit) retained earnings | (41,391) | | | 66,369 | |

| Accumulated other comprehensive income (loss) | 2,436 | | | (4,588) | |

Treasury stock, at cost- 487,626 shares of common stock at June 30, 2023 and none at June 30, 2022 | (84,150) | | | — | |

| Total stockholders’ equity | 13,070,929 | | | 13,169,357 | |

| Total liabilities and stockholders’ equity | $ | 14,486,052 | | | $ | 14,969,922 | |

| | | | | | | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES CONSOLIDATED AND COMBINED STATEMENTS OF CASH FLOWS (Unaudited in Thousands) |

| Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | 27,316 | | | $ | 57,186 | | | $ | (107,760) | | | $ | 53,146 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

| Depreciation and amortization | 123,153 | | | 73,015 | | | 491,419 | | | 119,930 | |

| Reduction in the carrying amount of right-of-use assets | 3,406 | | | 3,387 | | | 13,869 | | | 5,915 | |

| Net foreign currency losses (gains) | 368 | | | (4,533) | | | 4,079 | | | (306) | |

| Net realized loss on settlement of foreign currency forward contracts | 36,997 | | | — | | | 26,176 | | | — | |

| Stock-based compensation | 20,830 | | | 14,786 | | | 84,850 | | | 15,763 | |

| Deferred income taxes | (36,880) | | | (72,865) | | | (192,926) | | | (79,021) | |

| Provision for uncollectible receivables | 3,883 | | | (54) | | | 7,827 | | | 794 | |

| Other non-cash operating activities | (1,336) | | | 123 | | | (228) | | | 228 | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable | (14,478) | | | 13,206 | | | (25,538) | | | 11,204 | |

| Contract assets | (10,986) | | | (68,129) | | | (21,658) | | | (78,122) | |

| Contract costs | (4,808) | | | (4,992) | | | (10,165) | | | (4,992) | |

| Lease liabilities | (3,352) | | | (2,833) | | | (13,655) | | | (5,558) | |

| Prepaid expenses, prepaid income taxes, and other assets | (20,016) | | | (6,303) | | | 7,625 | | | (8,776) | |

| Liability from foreign currency forward contract | (40,454) | | | — | | | — | | | — | |

| Accounts payable, accrued expenses, income taxes payable and other liabilities | 30,353 | | | (18,280) | | | 18,315 | | | (23,674) | |

| Contract liabilities | (437) | | | 15,942 | | | 16,979 | | | 22,431 | |

| Net cash provided by (used in) operating activities | 113,559 | | | (344) | | | 299,209 | | | 28,962 | |

| Cash flows from investing activities: | | | | | | | |

| Purchase of property, equipment and leasehold improvements | (2,062) | | | (982) | | | (6,577) | | | (2,263) | |

| Proceeds from sale of property and equipment | — | | | 36 | | | — | | | 91 | |

| Net payments for settlement of foreign currency forward contracts | (36,997) | | | — | | | (26,176) | | | — | |

| Payments for business acquisitions, net of cash acquired | — | | | (5,571,931) | | | (72,498) | | | (5,571,931) | |

| Payments for equity method investments | (24) | | | (24) | | | (700) | | | (24) | |

| Payments for capitalized computer software development costs | (19) | | | (508) | | | (366) | | | (508) | |

| Purchase of other assets | — | | | (553) | | | (1,000) | | | (553) | |

| Net cash (used in) investing activities | (39,102) | | | (5,573,962) | | | (107,317) | | | (5,575,188) | |

| Cash flows from financing activities: | | | | | | | |

| Issuance of shares of common stock | 5,194 | | | 5,701 | | | 36,736 | | | 5,702 | |

| Repurchases of common stock | (100,000) | | | — | | | (100,000) | | | — | |

| Payment of tax withholding obligations related to restricted stock | (6,430) | | | (1,676) | | | (20,836) | | | (1,676) | |

| Deferred business acquisition payments | — | | | (1,200) | | | (1,363) | | | (1,200) | |

| Repayments of amounts borrowed under term loan | — | | | (6,000) | | | (276,000) | | | (6,000) | |

| Net transfers (to) from Parent Company | (14,184) | | | 6,004,439 | | | (19,933) | | | 5,971,995 | |

| Payments of debt issuance costs | — | | | — | | | (2,375) | | | — | |

| Net cash (used in) provided by financing activities | (115,420) | | | 6,001,264 | | | (383,771) | | | 5,968,821 | |

| Effect of exchange rate changes on cash and cash equivalents | (4,564) | | | 2,405 | | | (16,637) | | | 1,417 | |

| (Decrease) increase in cash and cash equivalents | (45,527) | | | 429,363 | | | (208,516) | | | 424,012 | |

| Cash and cash equivalents, beginning of period | 286,736 | | | 20,362 | | | 449,725 | | | 25,713 | |

| Cash and cash equivalents, end of period | $ | 241,209 | | | $ | 449,725 | | | $ | 241,209 | | | $ | 449,725 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES Reconciliation of GAAP to Non-GAAP Results of Operations and Cash Flows (Unaudited in Thousands, Except per Share Data) |

| | Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total expenses | | | | | | | | |

| GAAP total expenses (a) | | $ | 314,658 | | | $ | 199,766 | | | $ | 1,227,243 | | | $ | 369,139 | |

| Less: | | | | | | | | |

| Stock-based compensation (b) | | (20,830) | | | (14,786) | | | (84,850) | | | (15,763) | |

| Amortization of intangibles (c) | | (121,526) | | | (71,342) | | | (485,486) | | | (116,743) | |

| Acquisition and integration planning related fees | | (526) | | | (3,749) | | | (7,556) | | | (3,749) | |

| | | | | | | | |

| Non-GAAP total expenses | | $ | 171,776 | | | $ | 109,889 | | | $ | 649,351 | | | $ | 232,884 | |

| | | | | | | | |

| Income from operations | | | | | | | | |

| GAAP income (loss) from operations | | $ | 5,985 | | | $ | 39,154 | | | $ | (183,065) | | | $ | 36,157 | |

| Plus: | | | | | | | | |

| Stock-based compensation (b) | | 20,830 | | | 14,786 | | | 84,850 | | | 15,763 | |

| Amortization of intangibles (c) | | 121,526 | | | 71,342 | | | 485,486 | | | 116,743 | |

| Acquisition and integration planning related fees | | 526 | | | 3,749 | | | 7,556 | | | 3,749 | |

| | | | | | | | |

| Non-GAAP income from operations | | $ | 148,867 | | | $ | 129,031 | | | $ | 394,827 | | | $ | 172,412 | |

| | | | | | | | |

| Net income | | | | | | | | |

| GAAP net income (loss) | | $ | 27,316 | | | $ | 57,186 | | | $ | (107,760) | | | $ | 53,146 | |

| Plus (less): | | | | | | | | |

| Stock-based compensation (b) | | 20,830 | | | 14,786 | | | 84,850 | | | 15,763 | |

| Amortization of intangibles (c) | | 121,526 | | | 71,342 | | | 485,486 | | | 116,743 | |

| Acquisition and integration planning related fees | | 526 | | | 3,749 | | | 7,556 | | | 3,749 | |

| Unrealized (gain) on foreign currency forward contract | | (40,454) | | | — | | | — | | | — | |

| Realized loss on foreign currency forward contract | | 36,997 | | | — | | | 26,176 | | | — | |

| Less: | | | | | | | | |

| Income tax effect on Non-GAAP items (d) | | (28,565) | | | (18,295) | | | (124,231) | | | (28,316) | |

| | | | | | | | |

| Non-GAAP net income | | $ | 138,176 | | | $ | 128,768 | | | $ | 372,077 | | | $ | 161,085 | |

| | | | | | | | |

| Diluted income per share | | | | | | | | |

| GAAP diluted income (loss) per share | | $ | 0.42 | | | $ | 1.13 | | | $ | (1.67) | | | $ | 1.30 | |

| Plus (less): | | | | | | | | |

| Stock-based compensation (b) | | 0.32 | | | 0.29 | | | 1.30 | | | 0.38 | |

| Amortization of intangibles (c) | | 1.87 | | | 1.42 | | | 7.46 | | | 2.85 | |

| Acquisition and integration planning related fees | | 0.01 | | | 0.07 | | | 0.12 | | | 0.09 | |

| Unrealized (gain) on foreign currency forward contract | | (0.62) | | | — | | | — | | | — | |

| Realized loss on foreign currency forward contract | | 0.57 | | | — | | | 0.40 | | | — | |

| Impact of diluted shares | | — | | | — | | | 0.02 | | | — | |

| Less: | | | | | | | | |

| Income tax effect on Non-GAAP items (d) | | (0.44) | | | (0.36) | | | (1.91) | | | (0.69) | |

| | | | | | | | |

| Non-GAAP diluted income per share | | $ | 2.13 | | | $ | 2.55 | | | $ | 5.72 | | | $ | 3.93 | |

| | | | | | | | |

| Shares used in computing Non-GAAP diluted income per share | | 64,943 | | | 50,406 | | | 65,094 | | | 41,008 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Free Cash Flow (6) | | | | | | | | |

| Net cash provided by (used in) operating activities (GAAP) | | $ | 113,559 | | | $ | (344) | | | $ | 299,209 | | | $ | 28,962 | |

| Purchases of property, equipment and leasehold improvements | | (2,062) | | | (982) | | | (6,577) | | | (2,263) | |

| Payments for capitalized computer software development costs | | (19) | | | (508) | | | (366) | | | (508) | |

| Free cash flow (non-GAAP) | | $ | 111,478 | | | $ | (1,834) | | | $ | 292,266 | | | $ | 26,191 | |

| (6) Effective January 1, 2023, we no longer exclude acquisition and integration planning related payments from our computation of free cash flow. Free cash flow for all prior periods presented has been revised to the current period computation methodology. |

| | | | | | | | |

| (a) GAAP total expenses | | | | | | | | |

| | Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total costs of revenue | | $ | 95,562 | | | $ | 71,018 | | | $ | 373,589 | | | $ | 156,396 | |

| Total operating expenses | | 219,096 | | | 128,748 | | | 853,654 | | | 212,743 | |

| GAAP total expenses | | $ | 314,658 | | | $ | 199,766 | | | $ | 1,227,243 | | | $ | 369,139 | |

| | | | | | | | |

| (b) Stock-based compensation expense was as follows: | | | | | | | | |

| | Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of license and solutions | | $ | 813 | | | $ | 1,351 | | | $ | 3,565 | | | $ | 1,351 | |

| Cost of maintenance | | 431 | | | 344 | | | 1,893 | | | 344 | |

| Cost of services and other | | 538 | | | 282 | | | 1,995 | | | 282 | |

| Selling and marketing | | 5,316 | | | 2,850 | | | 16,202 | | | 2,850 | |

| Research and development | | 7,959 | | | 3,507 | | | 21,790 | | | 3,507 | |

| General and administrative | | 5,773 | | | 6,452 | | | 39,405 | | | 7,429 | |

| Total stock-based compensation | | $ | 20,830 | | | $ | 14,786 | | | $ | 84,850 | | | $ | 15,763 | |

| | | | | | | | |

(c) Amortization of intangible assets was as follows:(7) | | | | | | | | |

| | Three Months Ended

June 30, | | Year Ended

June 30, | | Nine Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of license and solutions | | $ | 48,035 | | | $ | 30,068 | | | $ | 191,412 | | | $ | 56,453 | |

| Selling and marketing | | 73,491 | | | 41,274 | | | 294,074 | | | 60,290 | |

| Total amortization of intangible assets | | $ | 121,526 | | | $ | 71,342 | | | $ | 485,486 | | | $ | 116,743 | |

| (7) Amortization of intangible assets for the three and nine months ended June 30, 2022 has been updated to reflect the amounts as presented in our Form 10-KT for our fiscal 2022. |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

(d) The income tax effect on non-GAAP items is calculated utilizing the Company's combined US federal and state statutory tax rate as follows:(8) |

|

| | | | | | | | |

| | Three Months Ended

June 30, | | Year Ended June 30, | | Nine Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| U.S. statutory rate | | 21.79 | % | | 21.79 | % | | 21.79 | % | | 21.79 | % |

| (8) The income tax effect on non-GAAP items for the three and nine months ended June 30, 2022 has been updated to conform to the current methodology of calculating the income tax effect on non-GAAP items. |

| | | | | | | | | | | |

ASPEN TECHNOLOGY, INC. AND SUBSIDIARIES Reconciliation of Forward-Looking Guidance (Unaudited in Thousands, Except per Share Data) |

| | | |

| | Twelve Months Ended June 30, 2024 (9) |

| | |

| Guidance - Total expenses | | | |

| GAAP expectation - total expenses | | $ | 1,220,000 | | |

| Less: | | | |

| Stock-based compensation | | (59,000) | | |

| Amortization of intangibles | | (486,000) | | |

| | | |

| Non-GAAP expectation - total expenses | | $ | 675,000 | | |

| | | |

| Guidance - Income from operations | | | |

| GAAP expectation - (loss) from operations | | $ | (100,000) | | |

| Plus: | | | |

| Stock-based compensation | | 59,000 | | |

| Amortization of intangibles | | 486,000 | | |

| | | |

| Non-GAAP expectation - income from operations | | $ | 445,000 | | |

| | | |

| Guidance - Net income and diluted income per share | | | |

| GAAP expectation - net (loss) and diluted (loss) per share | | $ | (7,000) | | $ | (0.11) | |

| Plus (less): | | | |

| Stock-based compensation | | 59,000 | | |

| Amortization of intangibles | | 486,000 | | |

| Less: | | | |

Income tax effect on Non-GAAP items (10) | | (114,000) | | |

| | | |

| Non-GAAP expectation - net income and diluted income per share | | $ | 424,000 | | $ | 6.51 | |

| | | |

| Shares used in computing guidance for Non-GAAP diluted income per share | | 65,100 | |

| | | |

Guidance - Free Cash Flow (11) | | | |

| GAAP expectation - Net cash provided by operating activities | | $ | 378,000 | | |

| Less: | | | |

| Purchases of property, equipment and leasehold improvements | | (17,500) | | |

| Payments for capitalized computer software development costs | | (500) | | |

| | | |

| Free cash flow expectation (non-GAAP) | | $ | 360,000 | | |

| | | |

| (9) Rounded amounts used, except per share data. |

| (10) The income tax effect on non-GAAP items for the twelve months ended June 30, 2024 is calculated utilizing the Company’s statutory tax rate of 21.79 percent. |

| (11) Free cash flow guidance has been updated to reflect a change in methodology to calculate free cash flow and does not represent a change in management's expectations. Effective January 1, 2023, we no longer exclude acquisition and integration planning related payments from our computation of free cash flow. We have updated our guidance computation for free cash flow to reflect that such payments are no longer excluded from free cash flow. |

Cover Page

|

Jul. 26, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 26, 2023

|

| Entity Registrant Name |

ASPEN TECHNOLOGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

333-262106

|

| Entity Tax Identification Number |

87-3100817

|

| Entity Address, Address Line One |

20 Crosby Drive,

|

| Entity Address, City or Town |

Bedford,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01730

|

| City Area Code |

781

|

| Local Phone Number |

221-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value per share

|

| Trading Symbol |

AZPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001897982

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

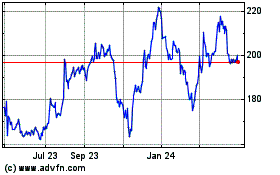

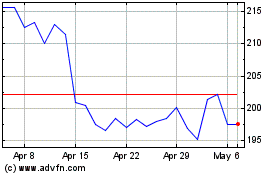

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Apr 2023 to Apr 2024