Aziyo Biologics, Inc. (Nasdaq: AZYO) (“Aziyo”), a company that

develops and commercializes biologic products to improve

compatibility between medical devices and the patients who need

them, today provided a business update and reported financial

results for the second quarter ended June 30, 2023.

“Our strategy to transform Aziyo into a high

growth drug-eluting biomatrix product company continues to move

forward," said Dr. Randy Mills, President and Chief Executive

Officer of Aziyo Biologics. “We are in discussions with several

interested parties to divest our Orthopedic business and have made

significant progress in preparing our resubmission of CanGaroo RM

for 510(k) clearance with the FDA. Furthermore, SimpliDerm had a

strong quarter with sales up 32%, and we are pleased with higher

sales volume of our Cardiovascular segment following our product

distribution agreement with LeMaitre Vascular.”

“Regarding the voluntary recall of our viable

bone matrix products, we continue to work closely with the FDA and

the CDC to fully investigate the matter. Patients are at the center

of everything we do at Aziyo and their safety will continue to be

our foremost priority,” added Dr. Mills.

Second Quarter 2023 Financial Results

Net sales for the second quarter of 2023 were

$10.3 million, compared to $12.6 million in the second quarter of

2022. The decrease was primarily due to the viable bone matrix

recall and market withdrawal in July 2023, which resulted in the

reversal of $3.0 million of second quarter revenue.

While the voluntary recall and market withdrawal

of the Company’s viable bone matrix products negatively impacted

the Orthopedic segment, the Women’s Health segment and its

SimpliDerm product experienced 32% growth in the second quarter of

2023 compared to the corresponding prior-year period. Device

Protection revenue during the second quarter was relatively

consistent compared to the prior-year period, and net sales from

the Cardiovascular segment declined due to the commencement of the

Company’s distribution agreement with LeMaitre Vascular, which

resulted in increased sales volume but at distributor transfer

pricing rather than the previous end-user pricing.

Gross profit for the second quarter of 2023 was

$1.0 million and gross margin was 9.5%, as compared to $4.9 million

and 38.8%, respectively, in the corresponding prior-year period.

Gross margin, excluding intangible asset amortization (a measure

not presented in accordance with U.S. generally accepted accounting

principles (“GAAP”)) was 17.8% for the second quarter of 2023, as

compared to 45.5% in the second quarter of 2022. The decline in

gross margin was due to the impact of the viable bone matrix recall

and market withdrawal, which decreased second quarter gross profit

by $5.0 million and gross margin by 35%.

Total operating expenses were $10.1 million for

the second quarter of 2023, as compared to $13.1 million in the

corresponding prior-year period.

Net loss was $10.6 million in the second quarter

of 2023, as compared to $9.4 million in the corresponding prior

year period. Net loss per share in the second quarter of 2023 was

$0.65 per share, as compared to a loss of $0.69 per share in the

second quarter of 2022.

Aziyo’s cash balance as of June 30, 2023, was

$9.3 million.

Conference Call

Aziyo will host a conference call today at 4:30

p.m. Eastern Time / 1:30 p.m. Pacific Time to discuss its second

quarter 2023 financial results and performance.

Individuals interested in listening to the

conference call are required to register online. Participants are

recommended to register at least 15 minutes before the start of the

call. A live and archived webcast of the event and the accompanying

presentation materials will be available on the “Investors” section

of the Aziyo website at https://investors.aziyo.com/.

About Aziyo Biologics

Aziyo develops and commercializes biologic

products to improve compatibility between medical devices and the

patients who need them. With a growing population in need of

implantable technologies, Aziyo’s mission is to humanize medical

devices to improve patient outcomes. For more information, visit

www.Aziyo.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements can be identified

by words such as “projects,” “may,” “will,” “could,” “would,”

“should,” “believes,” “expects,” “anticipates,” “estimates,”

“intends,” “plans,” “potential,” “promise” or similar references to

future periods. All statements contained in this press release that

do not relate to matters of historical fact should be considered

forward-looking statements, including any statements and

information concerning the effectiveness of our products, the

ability to expand availability of our products as a result of our

distribution arrangements with LeMaitre Vascular and Sientra, the

potential success of our distribution arrangements with LeMaitre

Vascular and Sientra, our expectations regarding the potential

disposition of our Orthopedics business and our expectations

relating to the FDA regulatory process for the CanGaroo RM

Antibacterial Envelope. Forward-looking statements are based on

management’s current assumptions and expectations of future events

and trends, which affect or may affect our business, strategy,

operations or financial performance, and actual results may differ

materially from those expressed or implied in such statements due

to numerous risks and uncertainties. Forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot

be predicted or quantified, and other important factors that may

cause actual results, performance or achievements to differ

materially from those contemplated or implied in this press

release, including, but not limited to, risks regarding the ability

to successfully execute or realize the anticipated benefits under

our distribution arrangements with LeMaitre Vascular and Sientra;

our inability to generate sufficient revenue to achieve or sustain

profitability; adverse changes in economic conditions and

instability and disruption of credit markets; our ability to

continue as a going concern; our ability to successfully execute or

achieve expected benefits from a divestiture of our Orthopedics

business; our products and our ability to enhance, expand, develop

and commercialize our product offerings; the impact on our business

of the recall of a single lot of our FiberCel product and the

discontinuation of its sales by our distribution partner;

consequences of our recall of a single lot of one of our viable

bone matrix products and market withdrawal of all of our viable

bone matrix products; our dependence on our commercial partners;

the impact of the bankruptcy of Surgalign Holdings, Inc., a

significant customer of the Company, on our future revenues;

physician awareness of the distinctive characteristics, and

acceptance by the medical community, of our products; the ability

to obtain regulatory approval or other marketing authorizations;

and our intellectual property rights, and other important factors

which can be found in the “Risk Factors” section of Aziyo’s public

filings with the Securities and Exchange Commission (“SEC”),

including Aziyo’s Annual Report on Form 10-K for the year ended

December 31, 2022, as such factors may be updated from time to time

in Aziyo’s other filings with the SEC, including, Aziyo’s Quarterly

Reports on Form 10-Q, accessible on the SEC’s website at

www.sec.gov and the Investor Relations page of Aziyo’s website at

https://investors.aziyo.com. Because forward-looking statements are

inherently subject to risks and uncertainties, you should not rely

on these forward-looking statements as predictions of future

events. Any forward-looking statement made by Aziyo in this press

release is based only on information currently available and speaks

only as of the date on which it is made. Except as required by

applicable law, Aziyo expressly disclaims any obligations to

publicly update any forward-looking statements, whether written or

oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

Investors:Matt SteinbergFINN

Partnersmatt.steinberg@finnpartners.com

|

AZIYO BIOLOGICS, INC. |

|

CONSOLIDATED BALANCE SHEET DATA |

|

(Unaudited, in thousands) |

|

|

|

|

|

| Assets |

June 30, 2023 |

|

December 31, 2022 |

| Current assets: |

|

|

|

|

Cash |

$ |

9,296 |

|

|

$ |

16,989 |

|

|

Accounts receivable, net |

|

6,317 |

|

|

|

6,830 |

|

|

Inventory |

|

9,274 |

|

|

|

10,052 |

|

|

Receivables of FiberCel litigation costs |

|

8,876 |

|

|

|

13,813 |

|

|

Prepaid expense and other assets |

|

2,363 |

|

|

|

3,015 |

|

|

Total current assets |

|

36,126 |

|

|

|

50,699 |

|

|

|

|

|

|

| Property and equipment,

net |

|

1,467 |

|

|

|

1,403 |

|

| Intangible assets, net |

|

13,370 |

|

|

|

15,069 |

|

| Operating lease right-of-use

assets, and other |

|

1,366 |

|

|

|

1,670 |

|

|

Total assets |

$ |

52,329 |

|

|

$ |

68,841 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Deficit |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses and other current

liabilities |

$ |

17,411 |

|

|

$ |

15,583 |

|

|

Current portion of long-term debt and revenue interest

obligation |

|

10,366 |

|

|

|

8,990 |

|

|

Contingent liability for FiberCel litigation |

|

14,470 |

|

|

|

17,360 |

|

|

Current operating lease liabilities |

|

620 |

|

|

|

682 |

|

|

Total current liabilities |

|

42,867 |

|

|

|

42,615 |

|

|

|

|

|

|

| Long-term debt |

|

24,927 |

|

|

|

24,260 |

|

| Long-term revenue interest

obligation |

|

5,601 |

|

|

|

5,916 |

|

| Long-term operating lease

liabilities |

|

711 |

|

|

|

956 |

|

| Other long-term

liabilities |

|

351 |

|

|

|

127 |

|

|

Total liabilities |

|

74,457 |

|

|

|

73,874 |

|

|

|

|

|

|

| Stockholders' equity

(deficit): |

|

|

|

| Common stock |

|

16 |

|

|

|

16 |

|

| Additional paid-in

capital |

|

134,439 |

|

|

|

132,939 |

|

| Accumulated deficit |

|

(156,583 |

) |

|

|

(137,988 |

) |

|

Total stockholders' equity (deficit) |

|

(22,128 |

) |

|

|

(5,033 |

) |

|

Total liabilities and stockholders' equity |

$ |

52,329 |

|

|

$ |

68,841 |

|

|

|

|

|

AZIYO BIOLOGICS, INC. |

|

|

CONSOLIDATED STATEMENT OF OPERATIONS |

|

|

(Unaudited, in thousands, except share and per share

data) |

|

| |

|

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

10,296 |

|

|

$ |

12,638 |

|

|

$ |

23,346 |

|

|

$ |

24,133 |

|

|

| Cost of goods sold |

|

9,316 |

|

|

|

7,740 |

|

|

|

16,035 |

|

|

|

14,954 |

|

|

|

Gross profit |

|

980 |

|

|

|

4,898 |

|

|

|

7,311 |

|

|

|

9,179 |

|

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

3,618 |

|

|

|

5,406 |

|

|

|

8,974 |

|

|

|

10,224 |

|

|

|

General and administrative |

|

4,005 |

|

|

|

4,711 |

|

|

|

7,684 |

|

|

|

8,736 |

|

|

|

Research and development |

|

1,171 |

|

|

|

2,617 |

|

|

|

2,974 |

|

|

|

4,889 |

|

|

|

FiberCel litigation costs |

|

1,271 |

|

|

|

346 |

|

|

|

3,182 |

|

|

|

434 |

|

|

|

Total operating expenses |

|

10,065 |

|

|

|

13,080 |

|

|

|

22,814 |

|

|

|

24,283 |

|

|

|

Loss from operations |

|

(9,085 |

) |

|

|

(8,182 |

) |

|

|

(15,503 |

) |

|

|

(15,104 |

) |

|

| |

|

|

|

|

|

|

|

|

| Interest expense |

|

1,524 |

|

|

|

1,204 |

|

|

|

3,068 |

|

|

|

2,419 |

|

|

|

Loss before provision of income taxes |

|

(10,609 |

) |

|

|

(9,386 |

) |

|

|

(18,571 |

) |

|

|

(17,523 |

) |

|

| |

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

12 |

|

|

|

12 |

|

|

|

24 |

|

|

|

24 |

|

|

| Net loss |

|

(10,621 |

) |

|

|

(9,398 |

) |

|

|

(18,595 |

) |

|

|

(17,547 |

) |

|

| Net loss attributable to

common stockholders |

|

(10,621 |

) |

|

|

(9,398 |

) |

|

|

(18,595 |

) |

|

|

(17,547 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders - |

|

|

|

|

|

|

|

|

|

basic and diluted |

$ |

(0.65 |

) |

|

$ |

(0.69 |

) |

|

$ |

(1.15 |

) |

|

$ |

(1.29 |

) |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - |

|

|

|

|

|

|

|

|

|

basic and diluted |

|

16,223,919 |

|

|

|

13,620,196 |

|

|

|

16,208,905 |

|

|

|

13,597,243 |

|

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

This press release presents our gross margin,

excluding intangible asset amortization. We calculate gross margin,

excluding intangible asset amortization, as gross profit, excluding

amortization expense relating to intangible assets we acquired in

our acquisition of all of the commercial assets of CorMatrix

Cardiovascular, Inc. in 2017, divided by net sales.

We present gross margin, excluding intangible

asset amortization, because we believe that it provides meaningful

supplemental information regarding our operating performance by

removing the impact of amortization expense, which is not

indicative of our overall operating performance. We believe this

provides our management and investors with useful information to

facilitate period-to-period comparisons of our operating results.

Our management uses this metric in assessing the health of our

business and our operating performance, and we believe investors’

understanding of our operating performance is similarly enhanced by

our presentation of this metric.

Gross margin, excluding intangible asset

amortization, is a supplemental measure of our performance, is not

defined by or presented in accordance GAAP, has limitations as an

analytical tool and should not be considered in isolation or as an

alternative to our GAAP gross margin, gross profit or any other

financial performance measure presented in accordance with GAAP. In

addition, other companies, including companies in our industry, may

use other measures to evaluate their performance, which could

reduce the usefulness of this non-GAAP financial measure as a tool

for comparison.

The following table presents a reconciliation of

our gross margin, excluding intangible asset amortization, to the

most directly comparable GAAP financial measure, which is our GAAP

gross margin (in thousands).

| |

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

| |

|

|

|

|

|

|

|

|

| Net sales |

$ |

10,296 |

|

|

$ |

12,638 |

|

|

$ |

23,346 |

|

|

$ |

24,133 |

|

|

| Gross profit |

|

980 |

|

|

|

4,898 |

|

|

|

7,311 |

|

|

|

9,179 |

|

|

| Intangible asset amortization

expense |

|

849 |

|

|

|

849 |

|

|

|

1,698 |

|

|

|

1,698 |

|

|

| Gross profit, excluding

intangible asset amortization |

$ |

1,829 |

|

|

$ |

5,747 |

|

|

$ |

9,009 |

|

|

$ |

10,877 |

|

|

| Gross margin |

|

9.5 |

% |

|

|

38.8 |

% |

|

|

31.3 |

% |

|

|

38.0 |

% |

|

| Gross margin percentage,

excluding intangible asset |

|

|

|

|

|

|

|

|

|

amortization |

|

17.8 |

% |

|

|

45.5 |

% |

|

|

38.6 |

% |

|

|

45.1 |

% |

|

| |

|

|

|

|

|

|

|

|

Aziyo Biologics (NASDAQ:AZYO)

Historical Stock Chart

From Mar 2024 to Apr 2024

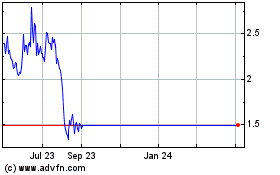

Aziyo Biologics (NASDAQ:AZYO)

Historical Stock Chart

From Apr 2023 to Apr 2024