0001708527

false

0001708527

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

AZIYO

BIOLOGICS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39577 |

|

47-4790334 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

12510

Prosperity Drive, Suite 370,

Silver Spring, MD

20904

(Address

of principal executive offices) (Zip Code)

(240)

247-1170

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class A

Common Stock, $0.001 par value per share |

|

AZYO |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 | Results of Operations and Financial Condition. |

On August 14, 2023, Aziyo Biologics, Inc.

(the “Company” or “Aziyo”) issued a press release announcing its results for the second quarter ended June 30,

2023. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

The information in this Item 2.02 of this Current

Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall

it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits |

| 104 | Cover Page Interactive Data File (formatted as an Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AZIYO BIOLOGICS, INC. |

| |

(Registrant) |

| |

|

| Date: August 14, 2023 |

By: |

/s/ Matthew Ferguson |

| |

Matthew Ferguson |

| |

Chief Financial Officer |

Exhibit 99.1

Aziyo

Biologics Reports Second Quarter 2023 Financial Results - Transformation Continues to Drug-Eluting Biomatrix Company

Negotiating

multiple LOIs to divest Orthopedic business

CanGaroo®

RM 510(k) resubmission to the FDA remains on track

SimpliDerm®

quarterly net sales up 32% year-over-year

Successful

transfer of Cardiovascular product distribution to LeMaitre Vascular

SILVER

SPRING, Md., Aug. 14, 2023 — Aziyo Biologics, Inc. (Nasdaq: AZYO) (“Aziyo”), a company that develops and

commercializes biologic products to improve compatibility between medical devices and the patients who need them, today provided a business

update and reported financial results for the second quarter ended June 30, 2023.

“Our

strategy to transform Aziyo into a high growth drug-eluting biomatrix product company continues to move forward," said

Dr. Randy Mills, President and Chief Executive Officer of Aziyo Biologics. “We are in discussions with several interested

parties to divest our Orthopedic business and have made significant progress in preparing our resubmission of CanGaroo RM for

510(k) clearance with the FDA. Furthermore, SimpliDerm had a strong quarter with sales up 32%, and we are pleased with higher

sales volume of our Cardiovascular segment following our product distribution agreement with LeMaitre Vascular.”

“Regarding

the voluntary recall of our viable bone matrix products, we continue to work closely with the FDA and the CDC to fully investigate the

matter. Patients are at the center of everything we do at Aziyo and their safety will continue to be our foremost priority,” added

Dr. Mills.

Second

Quarter 2023 Financial Results

Net

sales for the second quarter of 2023 were $10.3 million, compared to $12.6 million in the second quarter of 2022. The decrease was primarily

due to the viable bone matrix recall and market withdrawal in July 2023, which resulted in the reversal of $3.0 million of second

quarter revenue.

While

the voluntary recall and market withdrawal of the Company’s viable bone matrix products negatively impacted the Orthopedic segment, the Women’s

Health segment and its SimpliDerm product experienced 32% growth in the second quarter of 2023 compared to the corresponding prior-year

period. Device Protection revenue during the second quarter was relatively consistent compared to the prior-year period, and net sales

from the Cardiovascular segment declined due to the commencement of the Company’s distribution agreement with LeMaitre Vascular,

which resulted in increased sales volume but at distributor transfer pricing rather than the previous end-user pricing.

Gross

profit for the second quarter of 2023 was $1.0 million and gross margin was 9.5%, as compared to $4.9 million and 38.8%, respectively,

in the corresponding prior-year period. Gross margin, excluding intangible asset amortization (a measure not presented in accordance

with U.S. generally accepted accounting principles (“GAAP”)) was 17.8% for the second quarter of 2023, as compared to 45.5%

in the second quarter of 2022. The decline in gross margin was due to the impact of the viable bone matrix recall and market withdrawal,

which decreased second quarter gross profit by $5.0 million and gross margin by 35%.

Total

operating expenses were $10.1 million for the second quarter of 2023, as compared to $13.1 million in the corresponding prior-year period.

Net

loss was $10.6 million in the second quarter of 2023, as compared to $9.4 million in the corresponding prior year period. Net loss per

share in the second quarter of 2023 was $0.65 per share, as compared to a loss of $0.69 per share in the second quarter of 2022.

Aziyo’s

cash balance as of June 30, 2023, was $9.3 million.

Conference

Call

Aziyo

will host a conference call today at 4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time to discuss its second quarter 2023 financial

results and performance.

Individuals

interested in listening to the conference call are required to register online. Participants are recommended to register at least 15

minutes before the start of the call. A live and archived webcast of the event and the accompanying presentation materials will be available

on the “Investors” section of the Aziyo website at https://investors.aziyo.com/.

About

Aziyo Biologics

Aziyo

develops and commercializes biologic products to improve compatibility between medical devices and the patients who need them. With a

growing population in need of implantable technologies, Aziyo’s mission is to humanize medical devices to improve patient outcomes.

For more information, visit www.Aziyo.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements can be identified by

words such as “projects,” “may,” “will,” “could,” “would,” “should,”

“believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,”

“potential,” “promise” or similar references to future periods. All statements contained in this press release

that do not relate to matters of historical fact should be considered forward-looking statements, including any statements and information

concerning the effectiveness of our products, the ability to expand availability of our products as a result of our distribution arrangements

with LeMaitre Vascular and Sientra, the potential success of our distribution arrangements with LeMaitre Vascular and Sientra, our expectations

regarding the potential disposition of our Orthopedics business and our expectations relating to the FDA regulatory process for the CanGaroo

RM Antibacterial Envelope. Forward-looking statements are based on management’s current assumptions and expectations of future

events and trends, which affect or may affect our business, strategy, operations or financial performance, and actual results may differ

materially from those expressed or implied in such statements due to numerous risks and uncertainties. Forward-looking statements are

inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, and other important factors that may

cause actual results, performance or achievements to differ materially from those contemplated or implied in this press release, including,

but not limited to, risks regarding the ability to successfully execute or realize the anticipated benefits under our distribution arrangements

with LeMaitre Vascular and Sientra; our inability to generate sufficient revenue to achieve or sustain profitability; adverse changes

in economic conditions and instability and disruption of credit markets; our ability to continue as a going concern; our ability to successfully

execute or achieve expected benefits from a divestiture of our Orthopedics business; our products and our ability to enhance, expand,

develop and commercialize our product offerings; the impact on our business of the recall of a single lot of our FiberCel product and

the discontinuation of its sales by our distribution partner; consequences of our recall of a single lot of one of our viable bone matrix

products and market withdrawal of all of our viable bone matrix products; our dependence on our commercial partners; the impact of the

bankruptcy of Surgalign Holdings, Inc., a significant customer of the Company, on our future revenues; physician awareness of the

distinctive characteristics, and acceptance by the medical community, of our products; the ability to obtain regulatory approval or other

marketing authorizations; and our intellectual property rights, and other important factors which can be found in the “Risk Factors”

section of Aziyo’s public filings with the Securities and Exchange Commission (“SEC”), including Aziyo’s Annual

Report on Form 10-K for the year ended December 31, 2022, as such factors may be updated from time to time in Aziyo’s

other filings with the SEC, including, Aziyo’s Quarterly Reports on Form 10-Q, accessible on the SEC’s website at www.sec.gov

and the Investor Relations page of Aziyo’s website at https://investors.aziyo.com. Because forward-looking statements are

inherently subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events.

Any forward-looking statement made by Aziyo in this press release is based only on information currently available and speaks only as

of the date on which it is made. Except as required by applicable law, Aziyo expressly disclaims any obligations to publicly update any

forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future

developments or otherwise.

Investors:

Matt Steinberg

FINN Partners

matt.steinberg@finnpartners.com

AZIYO BIOLOGICS, INC.

CONSOLIDATED BALANCE SHEET DATA

(Unaudited, in thousands)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 9,296 | | |

$ | 16,989 | |

| Accounts receivable, net | |

| 6,317 | | |

| 6,830 | |

| Inventory | |

| 9,274 | | |

| 10,052 | |

| Receivables of FiberCel litigation costs | |

| 8,876 | | |

| 13,813 | |

| Prepaid expense and other assets | |

| 2,363 | | |

| 3,015 | |

| Total current assets | |

| 36,126 | | |

| 50,699 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,467 | | |

| 1,403 | |

| Intangible assets, net | |

| 13,370 | | |

| 15,069 | |

| Operating lease right-of-use assets, and other | |

| 1,366 | | |

| 1,670 | |

| Total assets | |

$ | 52,329 | | |

$ | 68,841 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Deficit | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses and other current liabilities | |

$ | 17,411 | | |

$ | 15,583 | |

| Current portion of long-term debt and revenue interest obligation | |

| 10,366 | | |

| 8,990 | |

| Contingent liability for FiberCel litigation | |

| 14,470 | | |

| 17,360 | |

| Current operating lease liabilities | |

| 620 | | |

| 682 | |

| Total current liabilities | |

| 42,867 | | |

| 42,615 | |

| | |

| | | |

| | |

| Long-term debt | |

| 24,927 | | |

| 24,260 | |

| Long-term revenue interest obligation | |

| 5,601 | | |

| 5,916 | |

| Long-term operating lease liabilities | |

| 711 | | |

| 956 | |

| Other long-term liabilities | |

| 351 | | |

| 127 | |

| Total liabilities | |

| 74,457 | | |

| 73,874 | |

| | |

| | | |

| | |

| Stockholders' equity (deficit): | |

| | | |

| | |

| Common stock | |

| 16 | | |

| 16 | |

| Additional paid-in capital | |

| 134,439 | | |

| 132,939 | |

| Accumulated deficit | |

| (156,583 | ) | |

| (137,988 | ) |

| Total stockholders' equity (deficit) | |

| (22,128 | ) | |

| (5,033 | ) |

| Total liabilities and stockholders' equity | |

$ | 52,329 | | |

$ | 68,841 | |

AZIYO BIOLOGICS, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(Unaudited, in thousands, except share and per share data)

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales | |

$ | 10,296 | | |

$ | 12,638 | | |

$ | 23,346 | | |

$ | 24,133 | |

| Cost of goods sold | |

| 9,316 | | |

| 7,740 | | |

| 16,035 | | |

| 14,954 | |

| Gross profit | |

| 980 | | |

| 4,898 | | |

| 7,311 | | |

| 9,179 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing | |

| 3,618 | | |

| 5,406 | | |

| 8,974 | | |

| 10,224 | |

| General and administrative | |

| 4,005 | | |

| 4,711 | | |

| 7,684 | | |

| 8,736 | |

| Research and development | |

| 1,171 | | |

| 2,617 | | |

| 2,974 | | |

| 4,889 | |

| FiberCel litigation costs | |

| 1,271 | | |

| 346 | | |

| 3,182 | | |

| 434 | |

| Total operating expenses | |

| 10,065 | | |

| 13,080 | | |

| 22,814 | | |

| 24,283 | |

| Loss from operations | |

| (9,085 | ) | |

| (8,182 | ) | |

| (15,503 | ) | |

| (15,104 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 1,524 | | |

| 1,204 | | |

| 3,068 | | |

| 2,419 | |

| Loss before provision of income taxes | |

| (10,609 | ) | |

| (9,386 | ) | |

| (18,571 | ) | |

| (17,523 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 12 | | |

| 12 | | |

| 24 | | |

| 24 | |

| Net loss | |

| (10,621 | ) | |

| (9,398 | ) | |

| (18,595 | ) | |

| (17,547 | ) |

| Net loss attributable to common stockholders | |

| (10,621 | ) | |

| (9,398 | ) | |

| (18,595 | ) | |

| (17,547 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to

common stockholders - basic and diluted | |

$ | (0.65 | ) | |

$ | (0.69 | ) | |

$ | (1.15 | ) | |

$ | (1.29 | ) |

| |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares

outstanding - basic and diluted | |

| 16,223,919 | | |

| 13,620,196 | | |

| 16,208,905 | | |

| 13,597,243 | |

Non-GAAP

Financial Measures

This

press release presents our gross margin, excluding intangible asset amortization. We calculate gross margin, excluding intangible asset

amortization, as gross profit, excluding amortization expense relating to intangible assets we acquired in our acquisition of all of

the commercial assets of CorMatrix Cardiovascular, Inc. in 2017, divided by net sales.

We

present gross margin, excluding intangible asset amortization, because we believe that it provides meaningful supplemental information

regarding our operating performance by removing the impact of amortization expense, which is not indicative of our overall operating

performance. We believe this provides our management and investors with useful information to facilitate period-to-period comparisons

of our operating results. Our management uses this metric in assessing the health of our business and our operating performance, and

we believe investors’ understanding of our operating performance is similarly enhanced by our presentation of this metric.

Gross

margin, excluding intangible asset amortization, is a supplemental measure of our performance, is not defined by or presented in accordance

GAAP, has limitations as an analytical tool and should not be considered in isolation or as an alternative to our GAAP gross margin,

gross profit or any other financial performance measure presented in accordance with GAAP. In addition, other companies, including companies

in our industry, may use other measures to evaluate their performance, which could reduce the usefulness of this non-GAAP financial measure

as a tool for comparison.

The

following table presents a reconciliation of our gross margin, excluding intangible asset amortization, to the most directly comparable

GAAP financial measure, which is our GAAP gross margin (in thousands).

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net sales | |

$ | 10,296 | | |

$ | 12,638 | | |

$ | 23,346 | | |

$ | 24,133 | |

| Gross profit | |

| 980 | | |

| 4,898 | | |

| 7,311 | | |

| 9,179 | |

| Intangible asset amortization expense | |

| 849 | | |

| 849 | | |

| 1,698 | | |

| 1,698 | |

| Gross profit, excluding intangible asset amortization | |

$ | 1,829 | | |

$ | 5,747 | | |

$ | 9,009 | | |

$ | 10,877 | |

| Gross margin | |

| 9.5 | % | |

| 38.8 | % | |

| 31.3 | % | |

| 38.0 | % |

| |

| | | |

| | | |

| | | |

| | |

| Gross margin percentage, excluding intangible asset amortization | |

| 17.8 | % | |

| 45.5 | % | |

| 38.6 | % | |

| 45.1 | % |

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-39577

|

| Entity Registrant Name |

AZIYO

BIOLOGICS, INC.

|

| Entity Central Index Key |

0001708527

|

| Entity Tax Identification Number |

47-4790334

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

12510

Prosperity Drive

|

| Entity Address, Address Line Two |

Suite 370

|

| Entity Address, City or Town |

Silver Spring

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20904

|

| City Area Code |

240

|

| Local Phone Number |

247-1170

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A

Common Stock, $0.001 par value per share

|

| Trading Symbol |

AZYO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

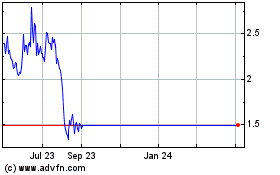

Aziyo Biologics (NASDAQ:AZYO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aziyo Biologics (NASDAQ:AZYO)

Historical Stock Chart

From Apr 2023 to Apr 2024