As

filed with the Securities and Exchange Commission on January 24, 2025

Registration

No. 333- 280184

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 1 to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

IMAC

HOLDINGS, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

8093 |

|

83-0784691 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

3401

Mallory Lane, Suite 100

Franklin,

Tennessee 37067

(303)

898-5896

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

FAITH

ZASLAVSKY

Chief

Executive Officer

IMAC

Holdings, Inc.

3401

Mallory Lane, Suite 100

Franklin,

Tennessee 37067

(303)

898-5896

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies

to:

MICHAEL

A. ADELSTEIN, ESQ.

CAROL

W. SHERMAN, ESQ.

Kelley

Drye & Warren LLP

3

World Trade Center

175

Greenwich Street

New

York, New York 10007

(212)

808-7800 |

|

M.

Ali Panjwani, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, NY 10036

(212)

326-0820 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

Accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant files a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION DATED JANUARY 24, 2025

PRELIMINARY

PROSPECTUS

Up

to 35,007,025 Shares of Common Stock

This

prospectus relates to the potential resale from time to time by Keystone Capital Partners, LLC, or Keystone or the Selling Stockholder,

of up to 35,007,025 shares of common stock, par value $0.001 per share, or common stock. The shares of common stock to which this prospectus

relates consist of shares that have been or may be issued by us to the Selling Stockholder pursuant to a Common Stock Purchase Agreement,

dated as of November 12, 2024, by and between us and the Selling Stockholder, or the Purchase Agreement, establishing an equity line

of credit, or the Equity Financing. Such shares of our common stock include (i) 164,000 shares of common stock, or the Initial Commitment

Shares, issuable to Keystone under the Purchase Agreement on the date on which the registration statement of which this prospectus is

apart is declared effective by the Securities and Exchange Commission, or the SEC, and (ii) $1 million of shares of common stock (769,231

shares of common stock assuming a price per share of $1.30), or the Back-End Commitment Shares (and together with the Initial Commitment

Shares, the Commitment Shares), issuable to Keystone under the Purchase Agreement on the trading day following stockholder approval of

our issuance of more than 402,438 shares of common stock to Keystone at an average per share price lower than the Minimum Price (as defined

below) and (iii) up to $60 million of shares of common stock (or up to the 34,073,794 shares of common stock remaining of the common

stock registered for resale pursuant to this prospectus after issuance of the Commitment Shares), or the Purchase Shares, that we may

elect, in our sole discretion, to issue and sell to Keystone, from time to time from after the date the registration statement that includes

this prospectus is declared effective by the SEC and after satisfaction of other conditions in the Purchase Agreement, or the Commencement

Date, and subject to applicable stock exchange rules.

The

actual number of shares of our common stock issuable will vary depending on the then-current market price of shares of our common stock

sold to the Selling Stockholder under the Purchase Agreement, but will not exceed 35,007,025 shares of common stock unless we file an

additional registration statement under the Securities Act of 1933, as amended, or the Securities Act, with the Securities Exchange Commission,

or the SEC, and we obtain the approval of our stockholders of the issuance of shares of common stock in accordance with the applicable

stock exchange rules. In no event will any shares be issued or sold to the Selling Stockholder if we do not have a sufficient number

of shares of our common stock authorized under our Certificate of Incorporation, as amended from time to time, which are not reserved

for other purposes. Under the applicable rules of The Nasdaq Stock Market LLC, or Nasdaq, in no event may we issue to the Selling Stockholder

shares of our common stock representing more than 19.99% of the total number of shares of common stock outstanding as of the date of

the Purchase Agreement (402,438 shares of common stock), or the Exchange Cap, unless (i) we obtain the approval of the issuance of such

shares by our stockholders in accordance with the applicable stock exchange rules or (ii) sales of common stock are made at an average

price, or the Minimum Price, equal to or in excess of the lower of (A) the closing prices of our common stock on Nasdaq immediately preceding

the delivery by us to the Selling Stockholder of the applicable notice of our election to sell our common stock to Selling Stockholder

under the Purchase Agreement, or the Sale Notices, (plus an incremental amount to take into account the Commitment Shares) and (B) the

average of the closing prices of the common stock for the five business days immediately preceding the delivery of each Sale Notices

(plus an incremental amount to take into account the Commitment Shares), such that the sales of such common stock to the Selling Stockholder

would not count toward such limit because they are “at market” under applicable stock exchange rules. See “The Committed

Equity Financing” for a description of the Purchase Agreement and “Selling Stockholder” for additional information

regarding the Selling Stockholder.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of our common

stock by the Selling Stockholder. However, we may receive up to $60 million in aggregate gross proceeds from the sale of the Purchase

Shares to the Selling Stockholder under the Purchase Agreement, from time to time in our discretion after the Commencement Date. The

actual proceeds from the Selling Stockholder may be less than this amount depending on the number of shares of our common stock sold

and the price at which the shares of our common stock are sold.

This

prospectus provides you with a general description of such securities and the general manner in which the Selling Stockholder may offer

or sell the securities. More specific terms of any securities that the Selling Stockholder may offer or sell may be provided in a prospectus

supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering.

The prospectus supplement may also add, update or change information contained in this prospectus.

The

Selling Stockholder may offer, sell or distribute all or a portion of the shares of our common stock acquired under the Purchase Agreement

and hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will bear all

costs, expenses and fees in connection with the registration of the shares of our common stock, including with regard to compliance with

state securities or “blue sky” laws. The timing and amount of any sales are within the sole discretion of the Selling Stockholder.

The Selling Stockholder is an underwriter under the Securities Act with respect to the resale of shares held by it. Although the Selling

Stockholder is obligated to purchase shares of our common stock under the terms and subject to the conditions and limitations of the

Purchase Agreement to the extent we choose to sell such shares of our common stock to it (subject to certain conditions), there can be

no assurances that we will choose to sell any shares of our common stock to the Selling Stockholder, or that the Selling Stockholder

will sell any or all of the shares of our common stock, if any, purchased under the Purchase Agreement pursuant to this prospectus. The

Selling Stockholder will bear all commissions and discounts, if any, attributable to its sale of shares of our common stock. See “Plan

of Distribution.”

You

should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

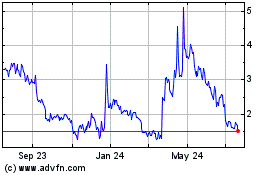

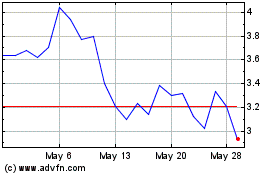

Our

Common is listed on The Nasdaq Capital Market under the symbol “BACK.” On January 23, 2025, the last reported sale price

of our Common Stock on the Nasdaq Capital Market was $0.78 per share.

We

are a “smaller reporting company” as defined under the federal securities laws and, as such, have elected to comply with

certain reduced public company reporting requirements for this prospectus and the documents incorporated by reference herein and may

elect to comply with reduced public company reporting requirements in future filings. See “Prospectus Summary ⸺ Implications

of Being a Smaller Reporting Company.”

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks that we have described beginning on page 9 of this prospectus under the caption “Risk Factors”, and under

similar headings in any amendment or supplement to this prospectus or in any other documents incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus

dated , 2025

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement of which this prospectus forms a part, or the Registration Statement, includes exhibits that provide more detail

of the matters discussed in this prospectus. You should read this prospectus, the related exhibits to the Registration Statement filed

with the Securities and Exchange Commission, or the SEC, and the documents incorporated by reference herein before making your investment

decision. You should rely only on the information provided in this prospectus and the documents incorporated by reference herein or any

amendment thereto.

You

should not assume that the information contained in this prospectus or any related free writing prospectus is accurate on any date subsequent

to the date set forth on the front of the document or that any information we have incorporated by reference herein or therein is correct

on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any related free writing

prospectus is delivered, or securities are sold, on a later date. This prospectus contains or incorporates by reference summaries of

certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have

been or will be filed or have been or will be incorporated by reference as exhibits to the registration statement of which this prospectus

forms a part, and you may obtain copies of those documents as described in this prospectus under the heading “Where You Can Find

More Information.”

You

should rely only on the information that we have included or incorporated by reference in this prospectus and any related free writing

prospectus that we may authorize to be provided to you. We have not, and the Selling Stockholder has not, authorized anyone to give any

information or to make any representation other than those given or made to you and contained or incorporated by reference in this prospectus

or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any information or representation

not contained or incorporated by reference in this prospectus or any related free writing prospectus. This prospectus and any related

free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor do this prospectus or any related free writing prospectus constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

In

addition, while we believe the industry, market and competitive position data included in this prospectus, including the information

incorporated by reference herein is reliable and based on reasonable assumptions, such data involve risks and uncertainties and are subject

to change based on various factors. These factors could cause results to differ materially from those expressed in the estimates made

by the independent parties or by us.

Unless

the context otherwise requires, references in this prospectus to “IMAC, “the Company,” “we,” “our,”

and “us” refer to IMAC Holdings, Inc., a Delaware corporation, and our consolidated subsidiaries.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you

should consider in making your investment decision. You should carefully read the entire prospectus, including the risks of investing

in our securities discussed under the heading “Risk Factors” and under similar headings in other documents that are incorporated

by reference into this prospectus. You should also carefully read the information incorporated by reference in this prospectus, including

our financial statements, and exhibits to the registration statement of which this prospectus is a part.

Overview

We

provide services related to proteomic products that identify and support oncology clinical treatment decisions and biopharmaceutical

drug development.

Until

recently, we were a holding company for IMAC Regeneration Centers, The BackSpace retail stores and our Investigational New Drug division,

providing movement and orthopedic therapies and minimally invasive procedures to improve the physical health of patients at locations

we owned or managed. As of December 31, 2023, we sold or discontinued patient care at all our locations.

In

May 2024, we acquired certain assets and rights of Theralink Technologies, Inc. (“Theralink”), consisting primarily of a

nationally CLIA-certified, CAP-accredited and NY CLEP certified laboratory in Golden, Colorado and equipment located in the lab. Theralink

was in the process of developing technology to monetize a license from Vanderbilt University (“Vanderbilt”), which provided

a predictor of response to immunotherapy in cancer, and a license for business in the United States from George Mason University (“GMU”),

which included intellectual property around improvements to the technology platform and biomarker signatures that form the basis for

future proteomics products (collectively, the “Original Proteomics Licenses”). We have also entered into agreements with

Vanderbilt and GMU to transfer the Original Proteomics Licenses and to extend the scope of the license from GMU to Europe and Canada.

On

May 30, 2024, we formed a wholly-owned subsidiary, Ignite Proteomics LLC, a Delaware limited liability company (“Ignite”),

to operate the medical lab acquired from Theralink, deliver services related to proteomic products under the licenses from GMU and Vanderbilt

and collect fees for services rendered. We are using the acquired assets under our own branding, the Ignite name. Ignite is in the process

of obtaining credentials for reimbursement for our Ignite proteomics test by Medicare and certain third-party payors. Until such time

as Ignite is credentialed, we will accept payment from private insurers. Our Board of Directors, or the Board, has also approved the

creation of the Ignite Compassionate Care program to enable those without private insurance or private funds to access our Ignite Proteomics

test when needed until we are credentialed and thereafter for those without access to any form of insurance.

Strategy

We

expect to increase levels of potential revenue with high volume sample analysis. The expansion of scope to Europe and Canada and, potentially

in the future, other regions, provides a greater opportunity to achieve higher volume sample analysis than was ultimately unobtainable

by Theralink in the United States. The expanded licenses also protect us from the risk of potential competitors in Europe that could

compete in the proteomics analysis business.

Product

Portfolio

Our

product is a unique and patented Reverse Phase Protein Array (RPPA) technology platform, which can quantify protein signaling to support

oncology clinical treatment decisions and biopharmaceutical drug development. Because protein signaling is responsible for the development

and progression of cancer, nearly all FDA-approved cancer therapeutics target proteins, not genes. The Ignite RPPA technology can reveal

the protein drug target(s) that are essentially turned “on” in a patient’s cancer and may help support the most effective

treatment plan to turn those proteins “off”. Therefore, the Ignite RPPA technology is a critical tool that may empower oncologists

with actionable information to effectively treat a cancer patient, which is often missed by standard proteomic and genomic testing. Our

commercially available Lab Developed Test (LDT), the Ignite RPPA Assay for Breast Cancer, is currently being utilized by oncologists

across the United States to assist in making the most targeted treatment plan for their patients with advanced breast cancer. In 2023,

Theralink began receiving reimbursement for this test by Medicare and certain third-party payors. The Ignite Proteomics test determines

which drug target(s) are present and/or activated and may reveal to the oncologist which patients are predicted to be responders versus

non-responders to a particular therapeutic. The test may provide therapeutic recommendations to support oncologist treatment selection

of the best therapy option – which may improve patient response and consequently save the healthcare system substantial dollars.

The

currently available Ignite RPPA Assay for Breast Cancer will be followed by the Ignite RPPA Pan-Tumor Assay 1.0, expected to launch in

2025 to include ovarian, endometrial, and head & neck cancers. The test is expected to expand further in 2026 to the Ignite RPPA

Pan-Tumor Assay 2.0 to support the treatment of colorectal, prostate, pancreatic, lung, and other solid tumor cancer indications.

Recent

Developments

On

May 23, 2023, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Theralink and IMAC Merger Sub,

Inc., a Delaware corporation and a newly formed, wholly owned subsidiary of the Company (“Merger Sub”). Upon the terms and

subject to the conditions set forth in the Merger Agreement, we and Theralink agreed to merge (the “Merger”), with Theralink

continuing as the surviving entity (the “Surviving Entity”) and a wholly owned subsidiary of the Company. The completion

of the Merger was subject to the satisfaction or waiver of customary closing conditions. However, such conditions were not met and such

closing did not occur.

In

furtherance of the proposed arrangement with Theralink, on April 11, 2024 we entered into a credit agreement, secured by the assets of

Theralink and its subsidiaries, pursuant to which Theralink may borrow from the Company up to an aggregate of $1,000,000 with an initial

borrowing on April 12, 2024 of $350,000 (the “Theralink Credit Agreement”).

On

April 10, 2024, we entered into a series of transactions including the exchange of the Company’s outstanding Series B-1 Convertible

Preferred Stock, par value $0.001 per share (the “Series B-1 Preferred Stock”) and Series B-2 Convertible Preferred Stock,

par value $0.001 per share (the “Series B-2 Preferred Stock” and, collectively with the Series B-1 Preferred Stock, the “Series

B Preferred Stock”), for Series C-1 Convertible Preferred Stock (the “Series C-1 Preferred Stock”), the exchange of

certain of the Company’s outstanding warrants for new warrants to purchase 2,075,704 shares of our common stock, and the sale of

new Series C-2 Convertible Preferred Stock (the “Series C-2 Preferred Stock” and, together with the Series C-1 Preferred

Stock, the “Series C Preferred Stock”) and warrants to purchase 498,243 shares of our common stock. All such transactions

were consummated on April 11, 2024 and resulted in gross proceeds to the Company of $900,000.

On

April 30, 2024, we entered into securities purchase agreements (each, a “Securities Purchase Agreement”) with various holders

(the “Theralink Note Holders”) of senior secured convertible debentures (the “Theralink Notes”) of Theralink

for the sale of 17,364 shares of the Company’s newly created Series D Convertible Preferred Stock, $0.001 par value (the “Series

D Preferred Stock”). The consideration paid by the Theralink Note Holders was in the form of all of the Theralink Notes held by

them, which had an aggregate principal amount outstanding of $16,221,873.89 and which the Theralink Note Holders accelerated earlier

on April 30, 2024. Upon the consummation of the transactions contemplated by the Securities Purchase Agreement, we held approximately

74.01% of the outstanding Theralink Notes.

On

May 1, 2024, we entered into a Settlement and Release Agreement with Theralink (the “Settlement Agreement”) pursuant to which

the parties agreed to a settlement of the default by Theralink under the Theralink Credit Agreement. The settlement consisted of the

transfer to us of certain assets and rights of Theralink and certain liabilities, including various trade payables, in exchange for (i)

the forgiveness by us of the outstanding amounts due under (a) the Theralink Notes that we acquired pursuant to the Securities Purchase

Agreement, (b) certain other pre-existing notes made by Theralink in our favor, having an aggregate outstanding principal amount of $3,000,000

(the “Pre-Existing Theralink Notes”), and (c) the Theralink Credit Agreement and (ii) the issuance to Theralink and certain

holders of Theralink debt of an aggregate of 24,172 shares of the Company’s newly created Series E Convertible Preferred Stock,

$0.001 par value (the “Series E Preferred Stock”). In addition, pursuant to the Settlement Agreement, the parties agreed

to mutual releases with respect to the outstanding payments being forgiven, we and Theralink agreed to terminate the merger agreement

between us and withdraw the Registration Statement on Form S-4 related thereto as soon as commercially practicable, and we agreed to

assume certain liabilities of Theralink, including various trade payables, and to hire certain of the employees of Theralink. On May

6, 2024, the Merger Agreement was terminated and on May 7, 2024, we withdrew the Registration Statement on Form S-4 related to the Merger.

We

subsequently obtained transfers to us of the Original Proteomics Licenses.

On

May 14, 2024, the Company issued and sold to accredited investors an aggregate of 450 shares of Series F convertible preferred stock,

par value $0.001 per share (“Series F Preferred Stock”) and warrants to purchase 135,315 shares of our common stock, for

aggregate cash proceeds of $450,000.

On

June 18, 2024, we issued promissory notes (the “June 2024 Notes”) to certain lenders in the aggregate principal amount of

$1,400,000, for an aggregate purchase price from the Lenders of $1,000,000. The June 2024 Notes are unsecured and mature on the earlier

of (i) the date of consummation of the offering contemplated by the Registration Statement on Form S-1, File No. 333-280184, filed with

the SEC by the Company on June 13, 2024, and (ii) June 18, 2025. As of November 14, 2024, we have repaid the June 2024 Notes.

Between

September 12, 2024 and October 30, 2024, we issued promissory notes (the “September-October 2024 Notes”) to certain lenders

in the aggregate principal amount of $840,000, for an aggregate purchase price from the Lenders of $600,000. The September-October 2024

Notes are unsecured and mature on the earlier of (i) the date of consummation of any offering or offerings, individually or in the aggregate,

of securities with gross proceeds of at least $1,000,000, and (ii) June 18, 2025. As of November 14, 2024, we had repaid the September-October

Notes.

On

November 12, 2024, we entered into a Common Stock Purchase Agreement (the “Purchase Agreement”) and a Registration Rights

Agreement (the “Registration Rights Agreement”) with Keystone Capital Partners, LLC (“Keystone” or the “Selling

Stockholder”), pursuant to which from time to time during the 36-months after all of the conditions to our right to commence sales

of our common stock, par value $0.001 per share, or common stock, to Keystone have been satisfied, including that the registration statement

of which this prospectus forms a part is declared effective by the Securities and Exchange Commission (the “SEC”), and the

final form of this prospectus is filed with the SEC (the “Commencement Date”), we have the right, but not the obligation,

to sell to Keystone (subject to certain conditions and limitations), and Keystone is obligated to purchase, shares of our common stock

as more fully described in this prospectus.

On

November 12, 2024, we entered into a securities purchase agreement (the “Series G Securities Purchase Agreement”) with accredited

investors (the “Series G Investors”), pursuant to which the Company agreed to issue and sell, and the Series G Investors

agreed to purchase, an aggregate of 4,676 shares of Series G convertible preferred stock, par value $0.001 per share (“Series G

Preferred Stock”) and warrants to purchase 2,977,711 shares of our common stock (the “Series G Warrants”, and, together

with the Series G Preferred Stock, the “Series G Securities”), for aggregate cash proceeds of $3,740,000. On November 14,

2024, the Company consummated the sale of the Series G Securities. Additional sales of Series G Preferred Stock and related Series G

Warrants may be made in future closings. The Company used $2,240,000 of the proceeds to repay $2,240,000 of outstanding promissory notes

of the Company and, accordingly, the Company had no debt outstanding after such repayments.

Reverse

Stock Split

In

September 2023, we effected a 1-for-30 reverse stock split of our common stock, whereby each 30 shares of our common stock and common

stock equivalents were converted into one share of common stock (the “Reverse Stock Split”). All share and per share amounts

in this prospectus have been retroactively adjusted to give effect to the Reverse Stock Split.

Leadership

changes

On

May 24, 2024, Matthew C. Wallis, DC, and Jeffrey S. Ervin resigned from the Board.

On

May 23, 2024, Jeffrey S. Ervin resigned as Chief Executive Officer of the Company and the Company appointed Faith Zaslavsky, the former

Chief Executive Officer of Theralink, as the Chief Executive Officer of the Company.

On

June 26, 2024, Peter Beitsch, MD, and Matthew Schwartz, MD, were appointed to the Board.

On

September 19, 2024, the Board appointed Jeffrey Busch to fill the vacancy on the Board created when Cary Sucoff resigned from the Board

effective as of September 9, 2024.

Compliance

with Nasdaq Listing Requirements

On

May 31, 2023, the Company received notice from Nasdaq that the Company had failed to maintain a required minimum of $2,500,000 in stockholders’

equity for continued listing, as required under Listing Rule 5550(b)(1) (the “Minimum Equity Rule”). On August 3, 2023, the

Company submitted a plan to Nasdaq to grant the Company an extension of time until November 27, 2023 to provide evidence of compliance

with the Minimum Equity Rule, and by filing this Current Report on Form 8-K, which includes (1) disclosure of Nasdaq’s deficiency

letter and the specific deficiency or deficiencies cited; (2) a description of the completed transaction or event that enabled the Company

to satisfy the stockholders’ equity requirement for continued listing; (3) an affirmative statement that, as of the date of the

report, the Company believes it has regained compliance with the stockholders’ equity requirement based upon the specific transaction

or event referenced in item (2) above; and (4) a disclosure stating that Nasdaq will continue to monitor the Company’s ongoing

compliance with the stockholders’ equity requirement and, if at the time of its next periodic report the Company does not evidence

compliance, that it may be subject to delisting. The Company attended a Nasdaq Listing Hearing on February 20, 2024. Nasdaq agreed to

extend the Company’s listing based on specific conditions for continued listing.

On

July 17, 2024, we were notified by Nasdaq that we had regained compliance with Minimum Equity Rule. We remain subject to a one-year “Panel

Monitor” as that term is defined by Nasdaq Listing Rule 5815(d)(4)(B).

On

January 21, 2025, we received notice (the “Minimum Equity Rule Notice”) from Nasdaq advising the Company that it no longer

complies with the Minimum Equity Rule. Due to the Panel Monitor, the Company is not eligible to submit a plan to the Staff to request

an extension of up to 180 calendar days in which to regain compliance with the Minimum Equity Rule, and as a result, the Staff has determined

to delist the Company’s securities from Nasdaq. Accordingly, unless the Company requests an appeal of this determination by January

28, 2025, the Company’s securities will be scheduled for delisting from Nasdaq and will be suspended at the opening of business

on January 30, 2025.

We

may request an appeal of this determination to the Hearings Panel (the “Panel”) by January 28, 2025, to prevent our securities

from being delisted and suspended at the opening of business on January 30, 2025. The Company intends, within the allotted time, to appeal

Nasdaq’s determination to the Panel. The Company’s common stock will continue to trade on Nasdaq during the appeal process.

The Company intends, within the allotted time, to appeal Nasdaq’s determination to the Panel.

On

August 21, 2024, we received written notice (the “2nd Quarter Form 10-Q Filing Notice”) from Nasdaq indicating

that the Company no longer complied with Nasdaq Listing Rule 5250(c)(1) (the “Periodic Report Listing Rule”), which requires

companies with securities listed on the Nasdaq Capital Market to timely file all required periodic reports with the U.S. Securities and

Exchange Commission (the “SEC”). The 2nd Quarter Form 10-Q was filed on December 18, 2024.

On

November 22, 2024, we received written notice (the “3rd Quarter Form 10-Q Filing Notice”) from Nasdaq indicating

that the Company no longer complied the Periodic Report Listing Rule. As previously disclosed in a Form 12b-25 Notification of Late Fling

filed by the Company on November 15, 2024 (the “Form 12b-25”), the Company is delayed in filing its Quarterly Report on Form

10-Q for the period ended September 30, 2024 (the “3rd Quarter Form 10-Q”) with the SEC. The filing of the 3rd

Quarter Form 10-Q was delayed due to the matters described in the Form 12b-25. The 3rd Quarter Form 10-Q was filed on

January 17, 2025.

On

January 21, 2025, we were notified by Nasdaq that the Company had regained compliance with the Periodic Reporting Listing

Rule.

On

November 21, 2024, we received written notice (the “Audit Committee Notice”) from Nasdaq indicating that the Company no longer

complies with Nasdaq Listing Rule 5605 (the “Audit Committee Listing Rule”), which requires, among other things, companies

with securities listed on the Nasdaq Capital Market to have an audit committee consisting of at least three members. The Company became

out of compliance with the Audit Committee Listing Rule as a result of the vacancy caused by the resignation of Cary Sucoff from the

Board of Directors of the Company effective September 9, 2024. As of December 11, 2024, Jeffrey Busch was appointed to the Audit Committee,

and on December 17, 2024, the Company was notified by Nasdaq that it has regained compliance with the Audit Committee Listing Rule.

Corporate

Information

Our

primary executive offices are located at 3401 Mallory Lane, Suite 100, Franklin, Tennessee and our telephone number is (303) 898-5896.

Our website address is www.imacholdings.com. The information contained in, or that can be accessed through, our website is not a part

of or incorporated by reference in this prospectus, and you should not consider it part of this prospectus or of any prospectus supplement.

We have included our website address in this prospectus solely as an inactive textual reference.

Implications

of Being a Smaller Reporting Company

We

are a smaller reporting company as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act. We may take advantage

of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures

for so long as (i) the market value of our voting and non-voting common stock held by non-affiliates is less than $250 million measured

on the last business day of our second fiscal quarter or (ii) our annual revenue is less than $100 million during the most recently completed

fiscal year and the market value of our voting and non-voting common stock held by non-affiliates is less than $700 million measured

on the last business day of our second fiscal quarter. Specifically, as a smaller reporting company, we may choose to present only the

two most recent fiscal years of audited financial statements in our Annual Reports on Form 10-K and have reduced disclosure obligations

regarding executive compensation, and, as long as we are a smaller reporting company with less than $100 million in annual revenue, we

are not required to obtain an attestation report on internal control over financial reporting from our independent registered public

accounting firm.

THE

OFFERING

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus.

| Shares

of common stock offered by the Selling Stockholder |

|

Up

to 35,007,025 shares of common stock, consisting of (i) 164,000 shares of common stock, or the Initial Commitment Shares, issuable

to Keystone under the Purchase Agreement on the date on which the registration statement of which this prospectus is apart is declared

effective by the Securities and Exchange Commission, or the SEC, and (ii) $1 million of shares of common stock (769,231 shares of

common stock assuming a price per share of $1.30), or the Back-End Commitment Shares (and together with the Initial Commitment Shares,

the Commitment Shares), issuable to Keystone under the Purchase Agreement on the trading day following stockholder approval, or Stockholder

Approval, of our issuance of more than 402,438 shares of common stock to Keystone at an average per share price lower than the Minimum

Price (as defined below), or the Exchange Cap, and (iii) up to $60 million of shares of common stock (or up to the 34,073,794 shares

of common stock remaining of the common stock registered for resale pursuant to this prospectus after issuance of the Commitment

Shares), or the Purchase Shares, that we may elect, in our sole discretion, to issue and sell to Keystone, from time to time from

after the date the registration statement that includes this prospectus is declared effective by the SEC and after satisfaction of

other conditions in the Purchase Agreement, or the Commencement Date, and subject to applicable stock exchange rules. |

| |

|

|

| Shares

of common stock outstanding immediately prior to this offering |

|

2,029,864 shares (as of January 16, 2025).

|

| |

|

|

| Shares

of common stock outstanding immediately following this offering |

|

37,036,889

shares. |

| |

|

|

| Terms

of the officer |

|

The

Selling Stockholder will determine when and how it will dispose of any shares of our common stock that are registered under this

prospectus for resale. See “Plan of Distribution.” |

| |

|

|

| Use

of Proceeds |

|

We

will not receive any of the proceeds from the sale of shares of our common stock offered by Keystone. We may receive up to $60 million

in aggregate gross proceeds, or the Commitment Amount, from Keystone under the Purchase Agreement in connection with sales of Purchase

Shares to Keystone pursuant to the Purchase Agreement, from time to time, in our sole discretion, after the Commencement Date. However,

the actual proceeds may be less than this amount depending on the number of Purchase Shares sold and the price at which the Purchase

Shares are sold. The Purchase Agreement requires that we use 25% of any net proceeds that we receive under the Purchase Agreement

to redeem shares of our Series G Preferred Stock and shares of our Series C Preferred Stock, Series D Preferred Stock, Series E Preferred

Stock and Series F Preferred Stock held by holders of our Series G Preferred Stock, or collectively the Redeemable Preferred Stock.

We intend to use the remainder of the net proceeds for working capital and other general corporate purposes. However, as of the date

of this prospectus, we cannot specify with certainty all of the particular uses, and the respective amounts we may allocate to those

uses, for any net proceeds we receive. See “Use of Proceeds” on page 18, of this prospectus. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

Our

shares of common stock are traded on The Nasdaq Capital Market under the symbol “BACK”. |

| |

|

|

| Transfer

Agent and Registrar |

|

Equity

Stock Transfer |

The

number of shares of our common stock to be outstanding after this offering is based on shares of common stock outstanding as of January

16, 2025, and excludes:

| ● | 507,816

shares of Common Stock reserved issuance under our equity incentive plans; |

| ● | 2,151,064

shares of Common Stock reserved for issuance upon conversion of our outstanding Series C-1

Preferred Stock; |

| ● | 1,070,496

shares of Common Stock reserved for issuance upon conversion of our outstanding Series C-2

Preferred Stock; |

| ● | 10,148,924

shares of Common Stock reserved for issuance upon conversion of our outstanding Series D

Preferred Stock; |

| ● | 13,443,690

shares of Common Stock reserved for issuance upon conversion of our outstanding Series E

Preferred Stock; |

| ● | 281,734

shares of Common Stock reserved for issuance upon conversion of our outstanding Series F

Preferred Stock; |

| ● | 6,550,965

shares of Common Stock reserved for issuance upon conversion of our outstanding Series G

Preferred Stock; |

| ● | 5,905,946

shares of Common Stock reserved for issuance upon exercise of outstanding warrants. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the risks described below, and those discussed under

the section entitled “Risk Factors” contained in our Annual Report on Form 10-K/A for the year ended December 31, 2023, which

is incorporated by reference in this prospectus, and our subsequent Quarterly Reports on Form 10-Q, together with other information in

this prospectus, the information and documents incorporated by reference herein, and in any free writing prospectus that we have authorized

for use in connection with this offering. The occurrence of any of the events or developments described below could materially and adversely

affect our business, financial condition, results of operations and prospects. In such an event, the market price of our common stock

could decline and you may lose all or part of your investment.

The

risks included in this prospectus and the documents we have incorporated by reference into this prospectus are not the only risks we

face. We may experience additional risks and uncertainties not currently known to us, or as a result of developments occurring in the

future. Conditions that we currently deem to be immaterial may also materially and adversely affect our business, financial condition,

cash flows and results of operations, and our ability to pay distributions to stockholders.

Risks

Related to the Committed Equity Financing

It

is not possible to predict the actual number of shares of our common stock, if any, we will issue to the Selling Stockholder under the

Purchase Agreement, the actual gross proceeds resulting from sales of the Purchase Shares to the Selling Stockholder or the dilution

to you from those issuances. Further, we may not have access to the full amount available under the Purchase Agreement.

Pursuant

to the Purchase Agreement, we are required to issue to the Selling Stockholder the Commitment Shares and the Selling Stockholder shall

purchase from us, from time to time, at our sole discretion, up to $60 million of Purchase Shares. The actual number of shares of our

common stock issuable under the Purchase Agreement will vary depending on the then-current market price of shares of our common stock

at the time of sales of Purchase Shares to the Selling Stockholder and the price per share of common stock used to calculate the number

of Back End Commitment Shares, but will not exceed 35,007,025 shares of common stock the resale of which is registered pursuant to this

prospectus unless we file an additional registration statement under the Securities Act of 1933, as amended, or the Securities Act, with

the SEC. In no event will any shares be issued or sold to the Selling Stockholder if we do not have a sufficient number of shares of

our common stock authorized under our Certificate of Incorporation, as amended from time to time, which are not reserved for other purposes.

Additionally,

under the applicable rules of The Nasdaq Stock Market LLC, or Nasdaq, in no event may we issue to the Selling Stockholder shares of our

common stock representing more than 19.99% of the total number of shares of common stock outstanding as of the date of the Purchase Agreement

(402,438 shares of common stock), or the Exchange Cap, unless (i) we obtain the Stockholder Approval or (ii) sales of common stock are

made at an average price, or the Minimum Price, equal to or in excess of the lower of (A) the closing prices of our common stock on Nasdaq

immediately preceding the delivery by us to the Selling Stockholder of the applicable notice of our election to sell our common stock

to Selling Stockholder under the Purchase Agreement, or the Sale Notices, (plus an incremental amount to take into account the Commitment

Shares) and (B) the average of the closing prices of the common stock for the five business days immediately preceding the delivery of

each Sale Notices (plus an incremental amount to take into account the Commitment Shares), such that the sales of such common stock to

the Selling Stockholder would not count toward such limit because they are “at market” under applicable stock exchange rules.

We

do not have a right to commence any sales of common stock to the Selling Stockholder under the Purchase Agreement until the Commencement

Date. The number of Purchase Shares that may be sold by us to the Selling Stockholder and the timing of such sales is at our discretion

from time to time after the Commencement Date until the earliest to occur of (i) the first day of the month next following the 36-month

anniversary of the Commencement Date, (ii) the date on which the Selling Stockholder shall have purchased $60 million of Purchase Shares,

(iii) the date on which our common stock fails to be listed or quoted on Nasdaq or any other eligible market (as defined in the Purchase

Agreement), (iv) the thirtieth trading day next following the date on which, pursuant to or within the meaning of any bankruptcy law,

we commence a voluntary case or any person commences a proceeding against us, in each case that is not discharged or dismissed prior

to such thirtieth trading day, and (v) the date on which, pursuant to or within the meaning of any bankruptcy law, a custodian is appointed

for us or for all or substantially all of our property, or we make a general assignment for the benefit of our creditors, or each, a

Termination Event.

Sales

of Purchase Shares, if any, to Keystone under the Purchase Agreement will depend upon market conditions and other factors to be determined

by us. We may ultimately decide to sell to Keystone all, some or none of the common stock that may be available for us to sell to Keystone

pursuant to the Purchase Agreement. Accordingly, we cannot guarantee that we will be able to sell all of the Commitment Amount or how

much in proceeds we may obtain under the Purchase Agreement. If we cannot sell Purchase Shares, we may be required to utilize more costly

and time-consuming means of accessing the capital markets, which could have a material adverse effect on our liquidity and cash position.

In

addition, Keystone is not obligated to buy any common stock under the Purchase Agreement if such shares, when aggregated with all other

common stock then beneficially owned by Keystone and its affiliates (as calculated pursuant to Section 13(d) of the Securities Exchange

Act, and Rule 13d-3 promulgated thereunder), would result in Keystone beneficially owning common stock in excess of 4.99% of the then-outstanding

shares of common stock.

We

are registering 35,007,025 shares of our common stock under this prospectus. As of January 16, 2025, there were 2,029,864 shares of common

stock outstanding. If all of the 35,007,025 shares of our common stock offered for resale by the Selling Stockholder under this prospectus

were issued and outstanding as of January 16, 2025, such shares would represent approximately 94.52% of total number of shares of our

common stock outstanding.

If

it becomes necessary for us to issue and sell to Keystone under the Purchase Agreement more than the 35,007,025 shares of our common

stock being registered for resale under this prospectus in order to receive aggregate gross proceeds equal to the Commitment Amount,

we must file with the SEC one or more additional registration statements to register under the Securities Act the resale by Keystone

of any such additional shares of our common stock we wish to sell from time to time under the Purchase Agreement, which the SEC must

declare effective, in each case before we may elect to sell any additional shares of our common stock under the Purchase Agreement.

Because

the purchase price per share of common stock to be paid by Keystone for the Purchase Shares that we may elect to sell to Keystone under

the Purchase Agreement, if any, will fluctuate based on the market prices of our common stock at the time we make such election and the

limitations discussed above with respect to the number of Purchase Shares that may be sold to Keystone, it is not possible for us to

predict, as of the date of this prospectus and prior to any such sales, the number of Purchase Shares that we will sell to Keystone under

the Purchase Agreement, the purchase price per share that Keystone will pay for such Purchase Shares, or the aggregate gross proceeds

that we will receive from those purchases by Keystone. Our inability to access a portion or the full amount available under the Purchase

Agreement, in the absence of any other financing sources, could have a material adverse effect on our business or results of operation.

Keystone

will pay less than the then-prevailing market price for our common stock, which could cause the price of our common stock to decline.

The

purchase price of our common stock to be sold to Keystone under the Purchase Agreement is derived from the market price of our common

stock on Nasdaq. Shares to be sold to Keystone pursuant to the Purchase Agreement will be purchased at a discounted price.

For

example, we may effect sales to Keystone pursuant to a Fixed Purchase Notice (as defined below) at a purchase price equal to the lesser

of 92.5% of (i) the daily volume weighted average price of the common stock for the five trading days immediately preceding the applicable

Purchase Date (as defined below) and (ii) the closing trading price of a share of common stock on the trading day immediately following

the applicable Purchase Date. See “The Committed Equity Financing” for more information.

As

a result of this pricing structure, Keystone may sell the shares they receive immediately after receipt of such shares, which could cause

the price of our common stock to decrease.

Investors

who buy shares of common stock from Keystone at different times will likely pay different prices.

Pursuant

to the Purchase Agreement, we have discretion, to vary the timing, price and number of shares of common stock we sell to Keystone. If

and when we elect to sell shares of common stock to Keystone pursuant to the Purchase Agreement, after Keystone has acquired such shares,

Keystone may resell all, some or none of such shares at any time or from time to time in its sole discretion and at different prices.

As a result, investors who purchase shares from Keystone in this offering at different times will likely pay different prices for those

shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment

results. Investors may experience a decline in the value of the shares they purchase Keystone in this offering as a result of future

sales made by us to Keystone at prices lower than the prices such investors paid for their shares in this offering. In addition, if we

sell a substantial number of shares to Keystone under the Purchase Agreement, or if investors expect that we will do so, the actual sales

of shares or the mere existence of our arrangements with Keystone may make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect such sales.

Future

resales and/or issuances of shares of common stock, including pursuant to this prospectus, or the perception that such sales may occur,

may cause the market price of our shares to drop significantly.

Keystone

may resell all, some or none of such shares of the Purchase Shares and Commitment Shares held by Keystone at any time or from time to

time in its discretion and at different prices. Therefore, issuances to Keystone by us could result in substantial dilution to the interests

of other holders of shares of our common stock. In addition, if we sell a substantial number of shares of our common stock to Keystone

under the Purchase Agreement, or if investors expect that we will do so, the shares held by Keystone will represent a significant portion

of our public float and may result in substantial decreases to the price of our common stock. The actual sales of shares of our common

stock or the mere existence of our arrangement with Keystone may also make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect such sales.

In

addition, shares of our common stock issuable upon exercise or vesting of incentive awards under our incentive plans are, once issued,

eligible for sale in the public market, subject to any lock-up agreements and, in some cases, limitations on volume and manner of sale

applicable to affiliates under Rule 144. Furthermore, shares of our common stock reserved for future issuance under our incentive plan

may become available for sale in future.

As

of January 16, 2025, there were approximately 507,816 shares subject to outstanding options or restricted stock units and shares reserved

for future issuance or otherwise issuable under our 2018 Incentive Compensation Plan, as amended from time to time, or the Plan. We have

registered or will register the shares of common stock available for issuance under the Plan under the Securities Act on Registration

Statements on Form S-8. The registered shares can be freely sold in the public market upon issuance, subject to volume limitations applicable

to affiliates and the lock-up agreements described above, to the extent applicable.

As

of January 16, 2025, we had outstanding shares of preferred stock, including the Redeemable Preferred Stock, currently convertible into

33,646,873 shares of common stock which may be eligible to be freely tradeable without restriction if held by non-affiliates of the Company.

We are obligated under the Purchase Agreement to use 25% of the net proceeds from sales of Purchase Shares to Keystone to redeem the

Redeemable Preferred Stock which is currently convertible into 8,580,416 shares of common stock.

As

of January 16, 2025, we had 5,905,946 outstanding warrants exercisable for shares with a weighted-average exercise price of $2.77 per

share. The shares of the common stock underlying such warrants held by non-affiliates of the Company which may be eligible to be freely

tradeable without restriction if held by non-affiliates of the Company

The

market price of shares of our common stock could drop significantly if the holders described above sell or are perceived by the market

as intending to sell. These factors could also make it more difficult for us to raise additional funds through future offerings of shares

of our common stock or other securities.

We

may use proceeds from sales of our common stock made pursuant to the Purchase Agreement in ways with which you may not agree or in ways

which may not yield a significant return.

We

will have broad discretion over the use of proceeds from sales of our common stock made pursuant to the Purchase Agreement, including

for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds are being used appropriately. Because of the number and variability

of factors that will determine our use of the net proceeds, their ultimate use may vary substantially from their currently intended use.

While we expect to use the net proceeds from this offering as set forth in “Use of Proceeds,” other than using 25%

of the net proceeds for redemption of our Redeemable Preferred Stock we are not obligated to do so. The failure by us to apply these

funds effectively could harm our business, and the net proceeds may be used for corporate purposes that do not increase our operating

results or enhance the value of our common stock.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. All statements other than statements of historical facts contained in this prospectus

are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplate,” “believe,” “estimate,” “predict,”

“potential” or “continue” or the negative of these terms or other similar expressions, although not all forward-looking

statements contain these words. Forward-looking statements include, but are not limited to, statements concerning:

| ● | projected

operating or financial results, including anticipated cash flows used in operations; |

| | | |

| ● | expectations

regarding capital expenditures, research and development expenses and other payments; |

| | | |

| ● | our

beliefs and assumptions relating to our liquidity position, including our ability to obtain

additional financing; |

| | | |

| ● | our

beliefs, assumptions and expectations about the regulatory approval for our technology including,

but not limited to our ability to obtain regulatory approval in a timely manner or at all; |

| | | |

| ● | our

ability to continue as a going concern; |

| | | |

| ● | our

estimates regarding expenses, future revenue, capital requirements and needs for additional

financing; |

| | | |

| ● | our

ability to employ skilled and qualified workers; |

| | | |

| ● | the

loss of key management personnel upon whom we depend; |

| | | |

| ● | the

actual and perceived effectiveness of our technology, and how the technology compares to

competitive technologies; |

| | | |

| ● | the

rate and degree of market acceptance and clinical utility of our technology; |

| | | |

| ● | the

strength of our intellectual property protection, and our success in avoiding infringement

of the intellectual property rights of others; |

| | | |

| ● | regulations

affecting the health care industry; |

| | | |

| ● | our

ability to effectively compete with a growing number of competitors in the industry; |

| | | |

| ● | the

ability of our third-party payors to cover and reimburse us for our services and third-party

suppliers to adequately meet our resource needs; |

| | | |

| ● | our

ability to manage potential litigation claims related to product liability and potential

infringement claims; |

| | | |

| ● | our

continued listing with Nasdaq; |

| | | |

| ● | adverse

developments in our research and development activities; |

| | | |

| ● | projected

operating or financial results, including anticipated cash flows used in operations; and |

| | | |

| ● | other

risks and uncertainties, including those described or incorporated by reference under the

caption “Risk Factors” in this prospectus. |

We

have based these forward-looking statements largely on our current expectations, estimates, forecasts, and projections about future events

and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs.

In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as

predictions of future events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this

prospectus, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the

forward-looking statements will be achieved or occur at all. You should refer to the section entitled “Risk Factors” in this

prospectus and the risk factors set forth in the documents incorporated by reference in this prospectus for a discussion of important

factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Furthermore,

if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. Except as required by law, we undertake no

obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

You

should read this prospectus and the documents incorporated by reference in this prospectus completely and with the understanding that

our actual future results, performance or achievements may be materially different from what we expect. We qualify all of the forward-looking

statements in this prospectus by these cautionary statements.

THE

COMMITTED EQUITY FINANCING

Overview

In

November 2024, we entered into the Purchase Agreement with Keystone. Sales of our common stock to Keystone under the Purchase Agreement,

if any, and the timing of any sales, will be determined by us from time to time in our sole discretion and will depend on a variety of

factors, including, among other things, market conditions, the trading price of our common stock and determinations by us regarding the

use of proceeds from any sale of such common stock. The net proceeds from any sales under the Committed Equity Financing will depend

on the timing of, and prices at which, our sales of shares of common stock to Keystone. To the extent we sell shares under the Purchase

Agreement, we have agreed to use 25% of the net cash proceeds from such sales, or the Redemption Funds, to redeem on a pro rata basis

the Redeemable Preferred Stock, at a price equal to 120% of the “Conversion Amount” (as set forth in the certificate of designations

for the applicable series of Preferred Stock) being redeemed (provided, that any holder of Redeemable Preferred Stock shall have the

right to allocate all, or any part, of the Redemption Funds otherwise payable to such holder to any one or more series of Redeemable

Preferred Stock). We currently plan to use the remaining net proceeds for working capital and other general corporate purposes.

In

accordance with our obligations under the Purchase Agreement and the Registration Rights Agreement, dated as of November 12, 2024, between

us and Keystone, or the Registration Rights Agreement, pursuant to which we agreed to provide Keystone with customary registration rights

related to the shares issued under the Purchase Agreement, we have filed a registration statement of which this prospectus forms a part

in order to register the resale of up to: (i) 164,000 shares of common stock, or the Initial Commitment Shares, issuable to Keystone

under the Purchase Agreement on the date on which the registration statement of which this prospectus is apart is declared effective

by the Securities and Exchange Commission, or the SEC, and (ii) $1 million of shares of common stock (769,231 shares of common stock

assuming a price per share of $1.30), or the Back-End Commitment Shares (and together with the Initial Commitment Shares, the Commitment

Shares), issuable to Keystone under the Purchase Agreement on the trading day following stockholder approval of our issuance of more

than 402,438 shares of common stock to Keystone at an average per share price lower than the Minimum Price (as defined below) and (iii)

up to $60 million of shares of common stock (or up to the 34,073,794 shares of common stock remaining of the common stock registered

for resale pursuant to this prospectus after issuance of the Commitment Shares), or the Purchase Shares, that we may elect, in our sole

discretion, to issue and sell to Keystone, from time to time from after the date the registration statement that includes this prospectus

is declared effective by the SEC and after satisfaction of other conditions in the Purchase Agreement, or the Commencement Date, and

subject to applicable stock exchange rules.

Under

the applicable rules of The Nasdaq Stock Market LLC, or Nasdaq, in no event may we issue to the Selling Stockholder shares of our common

stock representing more than 19.99% of the total number of shares of common stock outstanding as of the date of the Purchase Agreement

(402,438 shares of common stock), or the Exchange Cap, unless (i) we obtain the approval of the issuance of such shares by our stockholders

in accordance with the applicable stock exchange rules or (ii) sales of common stock are made at an average price, or the Minimum Price,

equal to or in excess of the lower of (A) the closing prices of our common stock on Nasdaq immediately preceding the delivery by us to

the Selling Stockholder of the applicable notice of our election to sell our common stock to Selling Stockholder under the Purchase Agreement,

or the Sale Notices, (plus an incremental amount to take into account the Commitment Shares) and (B) the average of the closing prices

of the common stock for the five business days immediately preceding the delivery of each Sale Notices (plus an incremental amount to

take into account the Commitment Shares), such that the sales of such common stock to the Selling Stockholder would not count toward

such limit because they are “at market” under applicable stock exchange rules.

In

addition, Keystone is not obligated to buy any common stock under the Purchase Agreement if such shares, when aggregated with all other

common stock then beneficially owned by Keystone and its respective affiliates (as calculated pursuant to Section 13(d) of the Exchange

Act and Rule 13d-3 promulgated thereunder), would result in Keystone beneficially owning common stock in excess of 4.99% of the then-outstanding

shares of common stock, or the Beneficial Ownership Limitation.

The

Purchase Agreement and Registration Rights Agreement contain customary registration rights, representations, warranties, conditions and

indemnification obligations by each party. The representations, warranties and covenants contained in such agreements were made only

for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and are subject

to certain important limitations.

Purchase

Agreement

Pursuant

to the Purchase Agreement, Keystone shall purchase from us, if we determine to sell, in our sole discretion, up to the lesser of (i)

the Commitment Amount and (ii) the Exchange Cap, upon the terms and subject to the conditions and limitations set forth in the Purchase

Agreement; provided, however, that such limitations will not apply if we obtain Stockholder Approval and, accordingly, we have registered

35,007,025 shares for issuance under the Purchase Agreement and resale pursuant to this prospectus, assuming that such Stockholder Approval

is obtained and that $1 million of Back End Commitment Shares are issued based on an assumed price per share of $1.30 and including 164,000

Initial Commitment Shares issuable upon effectiveness of the registration statement of which this prospectus forms a part, and up to

the lesser of 34,073,794 or $60 million of Purchase Shares sold at prices based on then-market stock prices of our common stock on Nasdaq.

In no event will any shares be issued or sold to the Selling Stockholder if we do not have a sufficient number of shares of our common

stock authorized under our Certificate of Incorporation, as amended from time to time, which are not reserved for other purposes. The

shares of our common stock that may be issued under the Purchase Agreement may be sold by us to Keystone at our discretion from time

to time from the Commencement Date until the earliest to occur of (i) the first day of the month next following the 36-month anniversary

of the Commencement Date, (ii) the date on which Keystone shall have purchased the Commitment Amount, (iii) the date on which, pursuant

to or within the meaning of any bankruptcy law, we commence a voluntary case or any person commences a proceeding against us, and (iv)

the date on which, pursuant to or within the meaning of any bankruptcy law, we make a general assignment for the benefit of our creditors.

Purchases

of Shares of our Common Stock Under the Purchase Agreement

During

the term described above, on any business day on which the closing sale price of the common stock is equal to or greater than $0.25,

we will have the right, but not the obligation, from time to time at our sole discretion, to direct Keystone, by delivery of an irrevocable

written notice, or a Fixed Purchase Notice, to purchase a number of shares of our common stock, or the Fixed Purchase, up to the lesser

of 100,000 shares of common stock or $25,000, or the Fixed Purchase Maximum Amount, at a purchase price equal to the lesser of 92.5%

of (i) the daily VWAP (as defined below) of the common stock for the five trading days immediately preceding the date of the delivery

of the Fixed Purchase Notice, or the Fixed Purchase Date, and (ii) the closing price of a share of common stock on the first full trading

day immediately following the applicable Fixed Purchase Date, or the Fixed Purchase Price.

In

addition, at any time from and after the Commencement Date, on any business day on which the closing sale price of the common stock is

equal to or greater than $0.25 and such business day is also a Fixed Purchase Date for a Fixed Purchase of an amount of shares of common

stock not less than the applicable Fixed Purchase Maximum Amount, we may also direct Keystone, by delivery of an irrevocable written

notice, or a VWAP Purchase Notice, to purchase, on the immediately following business day, or the VWAP Purchase Date, an additional number

of shares of common stock, or a VWAP Purchase, in an amount equal to the lesser of (i) 300% of the number of shares of common stock directed

by us to be purchased by Keystone for the applicable Fixed Purchase and (ii) 30% of the trading volume in our common stock on Nasdaq

during the applicable VWAP Purchase Period (as defined in the Purchase Agreement) on the applicable VWAP Purchase Date, or the VWAP Purchase,

at a purchase price, or the VWAP Purchase Price, equal to the lesser of 92.5% of (i) the closing sale price of the common stock on the

applicable VWAP Purchase Date and (ii) the VWAP during the applicable VWAP Purchase Period.

At

any time from and after the Commencement Date, on any business day that is also the VWAP Purchase Date for a VWAP Purchase, we may also

direct Keystone, by delivery of an irrevocable written notice, or an Additional VWAP Purchase Notice and, together with a Fixed Purchase

Notice and a VWAP Purchase Notice, a Purchase Notice, to purchase, on the same business day, or the Additional VWAP Purchase Date and,

together with a Fixed Purchase Date and a VWAP Purchase Date, the Purchase Dates, an additional number of shares of common stock in an

amount equal to the lesser of (i) 300% of the number of shares of common stock directed by us to be purchased by Keystone for the corresponding

Fixed Purchase and (ii) 30% of the trading volume in our common stock on Nasdaq during the applicable Additional VWAP Purchase Period

(as defined in the Purchase Agreement) on the applicable VWAP Purchase Date, or an Additional VWAP Purchase, and together with a Fixed

Purchase and a VWAP Purchase, the Purchases, at a purchase price equal to the lesser of 92.5% of (i) the closing sale price of the common

stock on the applicable Additional VWAP Purchase Date and (ii) the VWAP during the Additional VWAP Purchase Period (as defined in the

Purchase Agreement).

For

purposes of the Purchase Agreement, “VWAP” is, for the common stock for a specified period, the dollar volume-weighted average

price for the common stock on Nasdaq, for such period, as reported by Bloomberg Financial LP through its “AQR” function.

All such determinations shall be appropriately adjusted for any reorganization, non-cash dividend, stock split, reverse stock split,

stock combination, recapitalization or other similar transaction during such period.

Registered

Common Stock and Fees

As

consideration for its irrevocable commitment to purchase our common stock under the Purchase Agreement, 164,000 Initial Commitment Shares

are issuable to Keystone upon the SEC’s declaration of effectiveness of the registration statement of which this prospectus forms

a part. We have also agreed to issue $1 million of Back End Commitment Shares issuable upon receipt of Stockholder Approval.

We

have also paid to Keystone $25,000 in cash as reimbursement for the reasonable, out-of-pocket expenses incurred by Keystone, including

the legal fees and disbursements of Keystone’ legal counsel, in connection with its due diligence investigation of our company

and in connection with the preparation, negotiation and execution of the Purchase Agreement.

Conditions

Precedent to Commencement

Our

right to commence delivering Purchase Notices under the Purchase Agreement and Keystone’ obligation to accept such Purchase Notices,

are subject to the initial satisfaction, at the Commencement Date, of the conditions precedent thereto set forth in the Purchase Agreement,

which conditions include, among others, the following:

| ● | the

accuracy in all material respects of our representations and warranties included in the Purchase

Agreement; |

| ● | us