Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

12 March 2024 - 7:12AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

| |

Atreca, Inc. |

|

| |

(Name of Registrant as Specified in Its Charter) |

|

| |

|

|

| |

|

|

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a6(i)(1) and 0-11. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 8, 2024

Atreca, Inc.

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

001-38935 |

27-3723255 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| |

|

|

900 E. Hamilton Ave., Suite 100

Campbell, California |

|

95008 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(650) 595-2595

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Securities Exchange Act of 1934:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share |

|

BCEL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As previously reported, on September 8, 2023, Atreca,

Inc. (the “Company”) received written notification (the “Initial Notice”) from The

Nasdaq Stock Market LLC (“Nasdaq”) notifying it that on September 7, 2023, the average closing price of the

Company’s Class A common stock, $0.0001 par value per share (the “Class A Common Stock”), over the prior

30 consecutive trading days had fallen below $1.00 per share, which is the minimum average closing price required to maintain listing

on Nasdaq under Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Requirement”).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A),

the Company had 180 calendar days from the date of the Initial Notice, or March 6, 2024, to regain compliance with the Minimum Bid Requirement

(the “Grace Period”), subject to a potential 180-day extension. To regain compliance, the closing bid price

of the Class A Common Stock must have been at least $1.00 per share for a minimum of ten consecutive business days within the Grace Period.

On March 8, 2024, the Company received written

notification from Nasdaq indicating that it had failed to achieve compliance with the Minimum Bid Requirement prior to the expiration

of the Grace Period, and therefore the Class A Common Stock will be delisted from trading on Nasdaq. The Company does not intend to request

an extension of the Grace Period or any administrative hearing to delay such delisting. As a result, the Class A Common Stock will be

suspended from trading at the opening of business on March 19, 2024. Nasdaq will file a Form 25-NSE with the Securities and Exchange Commission

(the “SEC”) to remove the Class A Common Stock from listing and registration, though Nasdaq has not specified

the date on which the Form 25-NSE will be filed. If Nasdaq has not filed the Form 25-NSE by March 20, 2024, the Company intends to file

a Form 25 with the SEC on such date to remove the Class A Common Stock from listing and registration on Nasdaq. The Company plans to file

a Form 15 with the SEC to suspend its reporting obligations under the Securities Exchange Act of 1934, as amended, shortly thereafter.

The Company expects that its Class A Common Stock

will be eligible to be quoted “over-the-counter,” however, no assurance can be given that quotation of the Class A Common

Stock will be commenced or maintained on an over-the-counter market or any other quotation medium.

Forward-Looking Statements

This Current Report on Form 8-K contains statements

regarding matters that are not historical facts that are “forward-looking statements” within the meaning of the federal securities

laws. These forward-looking statements include, but are not limited to, statements regarding the delisting and trading suspension of the

Company’s Class A Common Stock from Nasdaq, the deregistration of the Class A Common Stock and the suspension of the Company’s

reporting obligations pursuant to the Securities Exchange Act of 1934, as amended, and the timing of such matters, and the quotation of

the Class A Common Stock on an over-the-counter market or any other quotation medium. These forward-looking statements are based on the

current beliefs and expectations of the Company’s management team and are inherently subject to uncertainties and changes in circumstances.

These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance

to be materially different from those expressed or implied by these forward-looking statements, including the risks and uncertainties

included under the header “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended

September 30, 2023 filed with the SEC on November 14, 2023 and the Company’s Definitive Proxy Statement on Schedule 14A filed with

the SEC on February 23, 2024. Copies of reports and other filings the Company files with the SEC are available on the SEC’s website

at www.sec.gov and posted on its website. Investors are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this Current Report on Form 8-K, and the Company undertakes no obligation to update any forward-looking statement

in this Current Report on Form 8-K, except as required by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

Atreca, Inc. |

| |

|

| |

|

| Dated: March 11, 2024 |

By: |

/s/ Courtney J. Phillips |

| |

|

Courtney J. Phillips |

| |

|

General Counsel and Corporate Secretary |

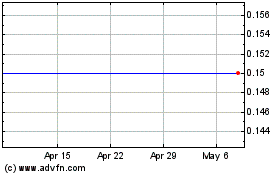

Atreca (NASDAQ:BCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atreca (NASDAQ:BCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024