0001835856False00018358562023-09-252023-09-250001835856us-gaap:CommonClassAMember2023-09-252023-09-250001835856us-gaap:WarrantMember2023-09-252023-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2023

BETTER HOME & FINANCE HOLDING COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40143 | 93-3029990 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | |

| 3 World Trade Center | |

| 175 Greenwich Street, 57th Floor | |

| New York, | NY | 10007 |

| (Address of principal executive offices) | (Zip Code) |

(415) 523-8837

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | BETR | | The Nasdaq Stock Market LLC |

| Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 | | BETRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

In connection with the closing of the transactions contemplated by the Agreement and Plan of Merger, dated as of May 10, 2021, as amended as of October 27, 2021, November 9, 2021, November 30, 2021, August 26, 2022, February 24, 2023 and June 23, 2023 (as amended, the “Merger Agreement”), by and among Aurora Acquisition Corp. (after the completion of such transactions, Better Home & Finance Holding Company, or the “Company”), Better Holdco, Inc. and Aurora Merger Sub I, Inc., the Company awarded transaction bonuses of $17 million in the aggregate to certain employees commencing on September 25, 2023, as contemplated by the Merger Agreement (collectively, the “Transaction Bonuses”), including to the Company’s named executive officers. Vishal Garg, Kevin Ryan and Nicholas Calamari received Transaction Bonuses in the amount of $9.7 million, $2.95 million and $120,000 respectively, and Paula Tuffin received a Transaction Bonus in the amount of $200,000. Each Transaction Bonus is payable in two installments: 50% of the Transaction Bonus is payable in cash no later than fifteen (15) days following the recipient’s entry into the Transaction Bonus agreement and the remaining 50% is payable within fifteen (15) days after the Company publicly discloses its financial results for the quarter in which the end of the Retention Period occurs. “Retention Period” is defined as the last day of the second consecutive quarter in which the Company achieves positive non-GAAP operating cash flow, as determined in the sole discretion of the Company. In the event the Company does not achieve positive non-GAAP operating cash flow for two consecutive quarters on or prior to September 30, 2028, the unpaid portion of the Transaction Bonus will be forfeited for no consideration.

The foregoing description of the Transaction Bonuses does not purport to be complete and is qualified in its entirety by the full text of the form of Transaction Bonus agreement, which is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit | | Description |

| 10.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

Date: September 29, 2023 |

| |

| Better Home & Finance Holding Company |

| |

| By: | /s/ Kevin Ryan |

| Name: | Kevin Ryan |

| Title: | Chief Financial Officer and President |

Exhibit 10.1

| | | | | | | | | | | | | | |

|

| | | | |

| Better Home & Finance Holding Company. | | 3 World Trade Center, 57th Floor New York, NY 10007 | |

September , 2023

[NAME]

Re: DeSPAC Transaction Bonus

Dear [NAME]:

This DeSPAC Transaction Bonus Agreement (this “Agreement”) establishes the terms of your transaction bonus opportunity with Better Home & Finance Holding Company and its subsidiaries or assigns (“Better,” the “Company,” “we” or “us”). Your work significantly contributed to the DeSPAC transaction and we greatly appreciate your efforts. In addition, we consider your continued service and dedication to Better essential to our business. To incentivize you to remain employed with Better, we are pleased to offer you a transaction bonus with a retention component, approved by the Better Board of Directors, as described in this Agreement.

In recognition of your work on the DeSPAC transaction and your continued service with Better from now and until the last day of the second consecutive quarter in which Better achieves positive operating cashflow as defined and determined by Better in its sole discretion (the period from the date hereof until the end of such quarter, the “Retention Period”), we are offering you a cash bonus in the amount of $[l], fifty percent (50%) to be paid no later than fifteen (15) days following your timely execution of this Agreement, and the remainder to be paid in full within fifteen (15) days after Better publicly discloses financial results for the quarter in which the end of the Retention Period occurs (the “Transaction Bonus”). The terms and conditions of the issuance of the Transaction Bonus are detailed below.

1. Eligibility

In order to be eligible to receive the final 50% of the Transaction Bonus, you must (a) be actively employed by Better on the last day of the Retention Period; and (b) remain in compliance with the employee handbook, as determined by Better in its sole discretion, and not be part of any corrective action process, from the date of this Agreement through the end of the Retention Period.

2. Transaction Bonus

If you are eligible to receive the Transaction Bonus and sign and return this Agreement within 7 days of receiving this Agreement, the Company will provide you with your Transaction Bonus amount subject to the following terms:

a.50% of the Transaction Bonus amount will be paid in cash no later than fifteen (15) days following your timely execution of this Agreement; and

b.The remaining 50% of the Transaction Bonus will be paid in cash within fifteen (15) days after Better publicly discloses financial results for the quarter in which the end of the Retention Period occurs, as defined and determined by Better in its sole discretion. In the event Better does not meet such condition on or prior to September 30, 2028, the remaining 50% of the Transaction

| | | | | | | | | | | | | | |

|

| | | | |

| Better Home & Finance Holding Company. | | 3 World Trade Center, 57th Floor New York, NY 10007 | |

Bonus will be forfeited for no further consideration.

3. Termination

You acknowledge that if your employment with Better ends before the end of the Retention Period because you resign or if you are terminated by Better for any reason, you are not eligible for the unpaid portion of the Transaction Bonus.

4. Effect on Other Benefits

You acknowledge that payment of the Transaction Bonus is not part of normal or expected compensation for purposes of calculating any severance, resignation, redundancy, end-of-service payments, bonuses, long-service awards, retirement benefits, matching contributions or similar payments, to the extent any are applicable.

5. Assignment

The obligation to pay the Transaction Bonus is solely that of Better, provided that Better may assign its obligations to any entity that succeeds to Better’s business. You may not assign your right to receive the Transaction Bonus.

6. No Right to Continued Employment

The grant of the retention element of this Transaction Bonus opportunity does not give you any right to continue your employment relationship with Better or its subsidiaries or assigns, and you shall remain subject to discharge to the same extent as if this opportunity were not granted to you. You are, and will remain, an at-will employee.

7. Governing Law

The validity, interpretation and performance of this Agreement shall, in all respects, be governed by the relevant laws of the State of New York, without regard to conflicts of law principles.

8. Understandings

This Agreement contains all of the understandings and representations between Better and you relating to the Transaction Bonus and supersedes all prior and contemporaneous understandings, discussions, agreements, representations, and warranties, both written and oral, with respect to any such Transaction Bonus.

9. Modification

No provision of this Agreement may be modified, altered or amended, except by collective agreement between Better’s General Counsel and you in writing.

10. Section 409A

This Agreement is not intended to provide for any deferral of compensation subject to Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”). Notwithstanding any other provision of this Agreement, this Agreement shall be interpreted in accordance with, and incorporate the terms and conditions required by, Section 409A. Better may, in its discretion, modify this Agreement to comply with the requirements of Section 409A. For purposes of Section 409A, each payment under this Agreement shall be treated as a separate and distinct payment.

| | | | | | | | | | | | | | |

|

| | | | |

| Better Home & Finance Holding Company. | | 3 World Trade Center, 57th Floor New York, NY 10007 | |

We hope that this arrangement encourages your continued commitment to Better. If you accept the terms of this Agreement, please sign below in the space provided.

| | |

| Very truly yours, |

|

|

| BETTER HOME & FINANCE HOLDING COMPANY |

|

|

| By: |

| Paula Tuffin, General Counsel & Chief Compliance Officer |

| | | | | |

| Agreed to and accepted by: |

| |

| [Printed NAME] | |

| |

| Date: | |

| |

| |

Cover

|

Sep. 25, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 25, 2023

|

| Entity Registrant Name |

BETTER HOME & FINANCE HOLDING COMPANY

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40143

|

| Entity Tax Identification Number |

93-3029990

|

| Entity Address, Address Line One |

3 World Trade Center

|

| Entity Address, Address Line Two |

175 Greenwich Street, 57th Floor

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10007

|

| City Area Code |

415

|

| Local Phone Number |

523-8837

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001835856

|

| Amendment Flag |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

BETR

|

| Security Exchange Name |

NASDAQ

|

| Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50

|

| Trading Symbol |

BETRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

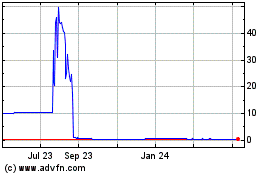

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Apr 2024 to May 2024

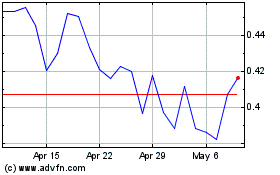

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From May 2023 to May 2024