0001835856False00018358562024-02-012024-02-010001835856us-gaap:CommonClassAMember2024-02-012024-02-010001835856us-gaap:WarrantMember2024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2024

Better Home & Finance Holding Company

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40143 | 93-3029990 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | | | | |

| 3 World Trade Center | |

| 175 Greenwich Street, 57th Floor | |

| New York, | NY | 10007 | |

| (Address of principal executive offices) (Zip Code) | |

(415) 523-8837

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | BETR | | The Nasdaq Stock Market LLC |

| Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 | | BETRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On February 1, 2024, the Board of Directors of Better Home & Finance Holding Company (the “Company”) established June 4, 2024, as the date of the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”). The time and location of the 2024 Annual Meeting will be specified in the Company’s proxy statement for the 2024 Annual Meeting. The Board has fixed the close of business on April 8, 2024, as the record date for determining stockholders of the Company who are entitled to vote at the 2024 Annual Meeting, including any adjournments or postponements thereof.

The Company previously reported in its quarterly report on Form 10-Q for the quarterly period ended September 30, 2023, filed with the Securities and Exchange Commission (the “SEC”) on November 14, 2023, that the Company anticipated holding the 2024 Annual Meeting on May 16, 2024.

A copy of the press release announcing the new date of the 2024 Annual Meeting is filed as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference in its entirety.

As a result of the change in the scheduled date of the 2024 Annual Meeting, the previously disclosed deadlines for submission of stockholder proposals and director nominations have been updated as follows:

On August 11, 2023, the Company held an extraordinary general meeting of stockholders in lieu of its 2023 annual meeting (the “2023 Meeting”). Since the newly scheduled date of the 2024 Annual Meeting differs by more than thirty calendar days from the anniversary date of the 2023 Meeting, the Company is providing the following disclosure in accordance with Rule 14a-5(f) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

Rule 14a-8 Deadline for the Submission of Stockholder Proposals

As noted above, the 2024 Annual Meeting date will represent a change of more than thirty calendar days from the anniversary date of the 2023 Meeting. As a result, pursuant to Rule 14a-8 under the Exchange Act, a new deadline will apply for the receipt of any stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act for inclusion in the Company’s proxy materials for the 2024 Annual Meeting. Pursuant to Rule 14a-8(e)(2) under the Exchange Act, such proposals must be received no later than 5:00 p.m. Eastern Time on March 1, 2024, which the Company has determined to be a reasonable time before it expects to begin to print and distribute its proxy materials for the 2024 Annual Meeting. Such proposals must be received by such date at our principal executive offices, Attn: Secretary, 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007.

Bylaws Advance Notice Deadline for Submission of Director Nominations or Stockholder Proposals

Any stockholder who wishes to propose a nominee to the Company’s board of directors or propose any other business to be considered by the stockholders (other than a stockholder proposal included in our proxy materials pursuant to Rule 14a-8 described above) must comply with the advance notice provisions and other requirements of Section 1.11 of our bylaws. These notice provisions require, among other things, that nominations of individuals for election to the Company’s board of directors and the proposal of business to be considered by the stockholders for the 2024 Annual Meeting must be delivered no earlier than 5:00 p.m. Eastern Time on February 5, 2024, and no later than 5:00 p.m. Eastern Time on March 6, 2024, to our principal executive offices, Attn: Secretary, 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007.

In addition to the information required by our bylaws for such nominations or proposals, stockholders who intend to solicit proxies in support of director nominees other than those nominated by the board of directors must provide the information required by Rule 14a-19 under the Exchanged Act.

All stockholder proposals should be submitted to the attention of our Secretary at our principal executive offices at the address above and must be in writing and otherwise in compliance with applicable SEC requirements and our bylaws. Stockholders are also advised to review our certificate of incorporation or bylaws, as applicable, which contain additional requirements about stockholder proposals and advance notices.

Forward-Looking Statements

This Report and the information and documents incorporated by reference herein include “forward-looking statements.” These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements include, without limitation, statements regarding predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this Report, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Report. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the Registration Statement on Form S-1 filed with the SEC by the Company on December 20, 2023, as well as the Company’s most recent quarterly report on Form 10-Q and current reports on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| BETTER HOME & FINANCE HOLDING COMPANY |

| | |

| Date: February 5, 2024 | By: | /s/ Kevin Ryan |

| Name: | Kevin Ryan |

| Title: | Chief Financial Officer and President |

Better Home & Finance Holding Company Announces New Date for 2024 Annual Meeting of Stockholders

2024 Annual Meeting of Stockholders to be held on June 4, 2024

New York, NY - February 5, 2024. Better Home & Finance Holding Company (NASDAQ: BETR; BETRW) (“Better” or the “Company”), a New York-based digitally native homeownership company, today announced that the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”), originally anticipated to be held on Thursday, May 16, 2024, is now expected to be held on Tuesday, June 4, 2024. The exact time and location of the 2024 Annual Meeting will be specified in the Company’s proxy statement for the 2024 Annual Meeting.

The record date for the determination of stockholders of the Company entitled to receive notice of and to vote at the 2024 Annual Meeting has been set as the close of business on Monday, April 8, 2024.

About Better

Since 2017, Better Home & Finance Holding Company (NASDAQ: BETR; BETRW) has leveraged its industry-leading technology platform, Tinman™, to fund more than $100 billion in mortgage volume. Tinman™ allows customers to see their rate options in seconds, get pre-approved in minutes, lock in rates and close their loan in as little as three weeks. Better’s mortgage offerings include GSE-conforming mortgage loans, FHA and VA loans, and jumbo mortgage loans. Better launched its “One-Day Mortgage” program in January 2023, which allows eligible customers to “go from click to Commitment Letter” all within 24 hours. From 2019-2022, Better completed approximately $98 billion in mortgage volume and $39 billion in coverage written through its insurance arm, Better Cover. Better was named Best Online Mortgage Lender by Forbes and Best Mortgage Lender for Affordability by WSJ in 2023, and ranked #1 on LinkedIn’s Top Startups List for 2021 and 2020, #1 on Fortune’s Best Small and Medium Workplaces in New York, #15 on CNBC’s Disruptor 50 2020 list, and was listed on Forbes FinTech 50 for 2020. Better serves customers in all 50 US states and the United Kingdom.

Forward-looking Statements

This press release contains certain forward-looking statements within the meaning of federal securities laws. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication. Such factors can be found in the Registration Statement on Form S-1 filed with the SEC by the Company on December 20, 2023, as well as the Company’s most recent quarterly report on Form 10-Q and current reports on Form 8-K, which are available, free of charge, at the SEC’s website at www.sec.gov. New risks and uncertainties arise from time to time, and it is impossible for Better to predict these events or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and Better undertakes no obligation, except as required by law, to update or revise the forward-looking statements, whether as a result of new information, changes in expectations, future events or otherwise.

For Investor Relations Inquiries please email ir@better.com

v3.24.0.1

Cover

|

Feb. 01, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 01, 2024

|

| Entity Registrant Name |

Better Home & Finance Holding Company

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40143

|

| Entity Tax Identification Number |

93-3029990

|

| Entity Address, Address Line One |

3 World Trade Center

|

| Entity Address, Address Line Two |

175 Greenwich Street, 57th Floor

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10007

|

| City Area Code |

415

|

| Local Phone Number |

523-8837

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001835856

|

| Amendment Flag |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

BETR

|

| Security Exchange Name |

NASDAQ

|

| Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50

|

| Trading Symbol |

BETRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

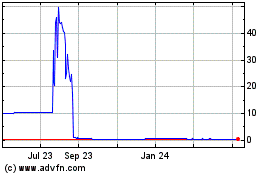

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Mar 2024 to Apr 2024

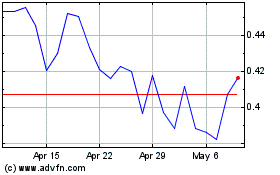

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Apr 2023 to Apr 2024