0001779128False00017791282024-08-072024-08-070001779128us-gaap:CommonStockMember2024-08-072024-08-070001779128us-gaap:WarrantMember2024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 7, 2024

Date of Report (date of earliest event reported)

___________________________________

BLADE AIR MOBILITY, INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39046 (Commission File Number) | 84-1890381 (I.R.S. Employer Identification Number) |

31 Hudson Yards, 14th Floor New York, NY 10001 |

(Address of principal executive offices and zip code) |

(212) 967-1009 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | BLDE | The Nasdaq Stock Market |

| Warrants, each exercisable for one share of Common Stock at a price of $11.50 | BLDEW | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

On August 7, 2024, Blade Air Mobility, Inc. (“Blade”) issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

This information is intended to be furnished under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | BLADE AIR MOBILITY, INC. |

| | | | | |

Dated: August 7, 2024 | | | | By: | /s/ William A. Heyburn |

| | | | Name: | William A. Heyburn |

| | | | Title: | Chief Financial Officer |

August 7, 2024

Blade Air Mobility Announces Second Quarter 2024 Results

•Net loss improved by $0.9 million versus the prior year to $(11.3) million in Q2 2024

•First Q2 with positive Adjusted EBITDA as a public company

•Adjusted EBITDA improved by $5.4 million versus the prior year to $1.0 million in Q2 2024

•Highest quarterly Medical revenue since inception of $38.3 million in Q2 2024, a 6.4% sequential increase versus Q1 2024

•Highest quarterly Medical Segment Adjusted EBITDA since inception of $5.5 million in Q2 2024, up 82.7% versus the prior year period

•First Q2 with positive Passenger Segment Adjusted EBITDA as a public company, improved by $2.9 million versus the prior year period

NEW YORK — (August 7, 2024) — Blade Air Mobility, Inc. (Nasdaq: BLDE, "Blade" or the "Company"), today announced financial results for the second quarter ended June 30, 2024.

GAAP FINANCIAL RESULTS

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, | | | |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | 11.4 | % | | $ | 119,459 | | | $ | 106,260 | | | 12.4 | % | |

| Cost of revenue | $ | 51,591 | | | $ | 50,620 | | | 1.9 | % | | $ | 92,966 | | | $ | 88,727 | | | 4.8 | % | |

| | | | | | | | | | | | |

| Software development | 971 | | | 1,440 | | | (32.6) | % | | 1,641 | | | 2,563 | | | (36.0) | % | |

| General and administrative | 25,136 | | | 18,410 | | | 36.5 | % | | 42,345 | | | 34,667 | | | 22.1 | % | |

| Selling and marketing | 2,396 | | | 2,728 | | | (12.2) | % | | 4,524 | | | 5,339 | | | (15.3) | % | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Total operating expenses | $ | 80,094 | | | $ | 73,198 | | | 9.4 | % | | $ | 141,476 | | | $ | 131,296 | | | 7.8 | % | |

| Loss from operations | $ | (12,149) | | | $ | (12,209) | | | (0.5) | % | | $ | (22,017) | | | $ | (25,036) | | | (12.1) | % | |

| Net loss | $ | (11,326) | | | $ | (12,232) | | | (7.4) | % | | $ | (15,560) | | | $ | (22,424) | | | (30.6) | % | |

| | | | | | | | | | | | |

| Gross profit | $ | 11,336 | | | $ | 5,081 | | | 123.1 | % | | $ | 17,188 | | | $ | 8,310 | | | 106.8 | % | |

| Gross margin | 16.7 | % | | 8.3 | % | | 840 | bps | | 14.4 | % | | 7.8 | % | | 660 | bps | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

NON-GAAP(1) FINANCIAL RESULTS

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, | | | |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | % Change | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | 11.4 | % | | $ | 119,459 | | | $ | 106,260 | | | 12.4 | % | |

| Cost of revenue | 51,591 | | | 50,620 | | | 1.9 | % | | 92,966 | | | 88,727 | | | 4.8 | % | |

| | | | | | | | | | | | |

Flight Profit(2) | 16,354 | | | 10,369 | | | 57.7 | % | | 26,493 | | | 17,533 | | | 51.1 | % | |

| Flight Margin | 24.1 | % | | 17.0 | % | | 707 | bps | | 22.2 | % | | 16.5 | % | | 568 | bps | |

| Adjusted SG&A | 15,834 | | | 14,869 | | | 6.5 | % | | 29,602 | | | 29,789 | | | (0.6) | % | |

| | | | | | | | | | | | |

| Depreciation and amortization included in cost of revenue | 438 | | | 52 | | | NM(3) | | 521 | | | 84 | | | NM(3) | |

| Adjusted EBITDA | $ | 958 | | | $ | (4,448) | | | NM(3) | | $ | (2,588) | | | $ | (12,172) | | | (78.7) | % | |

| Adjusted EBITDA as a percentage of Revenue | 1.4 | % | | (7.3) | % | | NM(3) | | (2.2) | % | | (11.5) | % | | 929 | bps | |

| | | | | | | | | | | | |

| Passenger Adjusted EBITDA | $ | 782 | | | $ | (2,075) | | | NM(3) | | $ | (1,869) | | | $ | (5,130) | | | (63.6) | % | |

| Medical Adjusted EBITDA | $ | 5,524 | | | $ | 3,023 | | | 82.7 | % | | $ | 9,933 | | | $ | 4,903 | | | 102.6 | % | |

| Adjusted unallocated corporate expenses and software development | $ | (5,348) | | | $ | (5,396) | | | (0.9) | % | | $ | (10,652) | | | $ | (11,945) | | | (10.8) | % | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) See "Use of Non-GAAP Financial Measures" and "Key Metrics and Non-GAAP Financial Information" sections attached to this release for an explanation of Non-GAAP measures used and reconciliations to the most directly comparable GAAP financial measure.

(2) Includes $438 and $52 of depreciation and amortization for owned aircraft and vehicles in the three months ended June 30, 2024 and 2023, respectively and $521 and $84 in the six months ended June 30, 2024 and 2023, respectively.

(3) Not meaningful.

"This quarter marks Blade’s first Adjusted EBITDA positive Q2 as a public company with both the Medical and Passenger segments enjoying strong performance and contributing positive Segment Adjusted EBITDA in the quarter," said Rob Wiesenthal, Blade's Chief Executive Officer. "We are also pleased to see continued sequential growth in Medical as well as increasing adoption of Blade's ground and organ placement offerings. We've exited certain Passenger routes that didn't meet our return thresholds and we remain relentless in our pursuit of profitability in core markets that are showing growth by improving customer acquisition globally, including by launching a new codeshare with Emirates to and from Monaco, by opening two new terminals at Nice Airport and by opening a new heliport in Atlantic City at Ocean Casino."

"We continued our drive towards full-year profitability in the Passenger Segment this quarter, posting our first ever Q2 with positive Passenger Segment Adjusted EBITDA, a $2.9 million improvement versus the prior year period," said Will Heyburn, Chief Financial Officer. "As part of this effort, we restructured our Canadian operations to eliminate further losses and lay the groundwork for our ultimate exit from the Canadian market within the next year. We simply did not see a near-term path to profitability using conventional rotorcraft, however, we remain enthusiastic about the long-term opportunity for Electric Vertical Aircraft in Western Canada and have structured our departure to maintain multiple paths to re-launch Canadian operations in the future, following the introduction of electric vertical aircraft."

"During the quarter, we closed on seven of the eight previously announced jet aircraft acquisitions and we’re encouraged by both the value these aircraft provide to our customers and the initial financial performance of the fleet to date, generating a return on invested capital above 30%," said Melissa Tomkiel, Blade's President. "While we continue to believe that the vast majority of our flying will remain with third-party owned and operated aircraft, we see an opportunity to further improve our customer value proposition while generating strong returns by expanding our fleet of owned aircraft."

Second Quarter Ended June 30, 2024 Financial Highlights

▪Total revenue increased 11.4% to $67.9 million in the current quarter versus $61.0 million in the prior year period. Excluding the impact of discontinuing our BladeOne scheduled by-the-seat jet service between New York and South Florida and the temporary support of a large hospital customer in the year ago period, total revenue increased 17.5% year-over-year.

▪Flight Profit(1) increased 57.7% to $16.4 million in the current quarter versus $10.4 million in the prior year period, driven by strong growth in both the Medical and Passenger segments.

▪Flight Margin(1) improved to 24.1% in the current quarter from 17.0% in the prior year period, driven by strong performance of our owned aircraft fleet, growth in ground revenue and improved pricing in the Medical segment, coupled with improved profitability in our New York Airport transfer product, Europe and Jet Charter in the Passenger segment.

▪Medical revenue increased 11.5% to $38.3 million in the current quarter versus $34.4 million in the prior year period. Medical revenue increased 6.4% sequentially versus Q1 2024. Excluding the impact of our temporary support of a large hospital customer in the prior year period, Medical revenue increased 19.0% year-over-year driven by growth in both block hours flown and revenue per block hour.

▪Short Distance revenue increased 9.0% to $20.9 million in the current quarter versus $19.2 million in the prior year period. The increase was primarily driven by our New York Airport transfer product and growth in Europe.

(1) See "Use of Non-GAAP Financial Measures" and "Key Metrics and Non-GAAP Financial Information" sections attached to this release for an explanation of Non-GAAP measures used and reconciliations to the most directly comparable GAAP financial measure.

2

▪Jet and Other revenue increased 17.4% to $8.7 million in the current quarter versus $7.4 million in the prior year period driven by growth in Jet Charter and non-flight revenue, partially offset by the discontinuation of our BladeOne seasonal by-the-seat jet service between New York and South Florida.

▪Net loss decreased 7.4% to $(11.3) million in the current quarter versus $(12.2) million in the prior year period and improved as a percentage of revenue to (16.7)% in the current quarter from (20.1)% in the prior year period.

▪Adjusted EBITDA(1) improved by $5.4 million year-over-year to $1.0 million in the current quarter versus $(4.4) million in the prior year period, primarily due to an 82.7% increase in Medical Segment Adjusted EBITDA to $5.5 million in the current quarter, and a $2.9 million improvement in Passenger Segment Adjusted EBITDA to $0.8 million. Adjusted Unallocated Corporate Expenses and Software Development decreased (0.9)% versus the prior year period.

▪Capital expenditures of $16.9 million were driven primarily by the $14.6 million purchase of aircraft in the Medical segment.

▪Repurchased 80,102 shares for $0.2 million during the quarter. In addition, we changed our Restricted Stock Unit tax withholding method to “withhold-to-cover” from “sell-to-cover” during the quarter, deploying approximately $1.0 million of balance sheet cash to retire 332,212 shares.

▪Ended Q2 2024 with $142.0 million in cash and short term investments.

Business Highlights and Recent Updates

▪In mid July, Blade opened two new private passenger lounges in terminals 1 and 2 at Nice Côte d'Azur Airport. These lounges enhance the Blade passenger experience by providing a place to relax, enjoy food and refreshments and access free Wi-Fi before the flight.

▪Blade opened a new rooftop helipad at the Ocean Casino Resort in Atlantic City, NJ and announced a partnership with the resort to offer scheduled service in the summer months.

▪Blade announced a global codeshare agreement with Emirates that enables passengers to fly seamlessly between Dubai and Monaco. When Emirates passengers fly Blade back from Monaco, checked luggage will flow to the final destination and upon arrival at Nice Airport, passengers will be escorted to the helipad-side security clearance for security and customs and driven directly to their gate, bypassing in-terminal congestion and public security queues.

▪During Q2 2024, we closed on seven of the eight aircraft acquisitions that we announced earlier this year and expect to close on the eighth aircraft during Q3 2024.

▪We amended the agreement with our partner in Canada during Q2 2024 to eliminate further losses in 2024 and lay the groundwork for Blade's ultimate exit within the next year.

Financial Outlook(2)

The Company is reaffirming its guidance. For the full year 2024, we expect:

▪Revenue of $240 million to $250 million

▪Positive Adjusted EBITDA

For the full year 2025, we expect:

▪Double-digit year-over-year revenue growth

▪Double-digit Adjusted EBITDA

(1) See "Use of Non-GAAP Financial Measures" and "Key Metrics and Non-GAAP Financial Information" sections attached to this release for an explanation of Non-GAAP measures used and reconciliations to the most directly comparable GAAP financial measure.

(2) We have not reconciled the forward-looking Adjusted EBITDA guidance included above to the most directly comparable GAAP measure because this cannot be done without unreasonable effort due to the variability and low visibility with respect to certain costs, the most significant of which are incentive compensation (including stock-based compensation), transaction-related expenses, certain fair value measurements, which are potential adjustments to future earnings. We expect the variability of these items to have a potentially unpredictable, and a potentially significant, impact on our future GAAP financial results.

Conference Call

The Company will conduct a conference call starting at 4:30 p.m. ET on Wednesday August 7, 2024 to discuss the results for the second quarter ended June 30, 2024.

A live audio-only webcast of the call may be accessed from the Investor Relations section of the Company’s website at https://ir.blade.com/. An archived replay of the call will be available on the Investor Relations section of the Company's website for one year.

Use of Non-GAAP Financial Information

Blade believes that the non-GAAP measures discussed below, viewed in addition to and not in lieu of our reported U.S. Generally Accepted Accounting Principles ("GAAP") results, provide useful information to investors by providing a more focused measure of operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. The non-GAAP measures presented herein may not be comparable to similarly titled measures presented by other companies. Adjusted EBITDA, Adjusted Unallocated Corporate Expenses, SG&A, Adjusted SG&A, Flight Profit, Flight Margin and Free Cash Flow have been reconciled to the nearest GAAP measure in the tables within this press release.

Adjusted EBITDA – Blade reports Adjusted EBITDA, which is a non-GAAP financial measure. Blade defines Adjusted EBITDA as net loss adjusted to exclude depreciation and amortization, stock-based compensation, change in fair value of warrant liabilities, interest income and expense, income tax, realized gains and losses on short-term investments, impairment of intangible assets and certain other non-recurring items that management does not believe are indicative of ongoing Company operating performance and would impact the comparability of results between periods.

Adjusted Unallocated Corporate Expenses – Blade defines Adjusted Unallocated Corporate Expenses as expenses that cannot be allocated to either of our reporting segments (Passenger and Medical) and therefore attributable to our Corporate expenses and software development, less non-cash items and certain other non-recurring items that management does not believe are indicative of ongoing Company operating performance and would impact the comparability of results between periods.

SG&A and Adjusted SG&A – Blade defines SG&A as total operating expenses excluding cost of revenue. Blade defines Adjusted SG&A as total operating expenses excluding cost of revenue and excluding non-cash items and certain other non-recurring items that management does not believe are indicative of ongoing Company operating performance and would impact the comparability of results between periods.

Flight Profit and Flight Margin – Blade defines Flight Profit as revenue less cost of revenue. Cost of revenue consists of flight costs paid to operators of aircraft and vehicles, landing fees, depreciation of aircraft and vehicles, ROU asset amortization, internal costs incurred in generating organ ground transportation revenue using the Company’s owned vehicles and costs of operating our owned aircraft including fuel, management fees paid to the operator, maintenance costs and pilot salaries. Blade defines Flight Margin for a period as Flight Profit for the period divided by revenue for the same period. Blade believes that Flight Profit and Flight Margin provide an important measure of the profitability of the Company's flight and ground operations, as they focus solely on the non discretionary direct variable costs associated with those operations.

Free Cash Flow – Blade defines Free Cash Flow as net cash provided by / (used in) operating activities less capital expenditures and capitalized software development costs.

Financial Results

BLADE AIR MOBILITY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data, unaudited)

| | | | | | | | | | | | |

| June 30,

2024 | | December 31, 2023 | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | $ | 26,308 | | | $ | 27,873 | | |

| Restricted cash | 2,058 | | | 1,148 | | |

| Accounts receivable, net of allowance of $278 and $98 at June 30, 2024 and December 31, 2023, respectively | 27,723 | | | 21,005 | | |

| Short-term investments | 115,643 | | | 138,264 | | |

| Prepaid expenses and other current assets | 11,180 | | | 17,971 | | |

| Total current assets | 182,912 | | | 206,261 | | |

| | | | |

| Non-current assets: | | | | |

| Property and equipment, net | 22,093 | | | 2,899 | | |

| | | | |

| Intangible assets, net | 13,701 | | | 20,519 | | |

| Goodwill | 39,574 | | | 40,373 | | |

| Operating right-of-use asset | 21,123 | | | 23,484 | | |

| Other non-current assets | 928 | | | 1,402 | | |

| Total assets | $ | 280,331 | | | $ | 294,938 | | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable and accrued expenses | $ | 16,875 | | | $ | 23,859 | | |

| Deferred revenue | 9,266 | | | 6,845 | | |

| Operating lease liability, current | 4,145 | | | 4,787 | | |

| | | | |

| Total current liabilities | 30,286 | | | 35,491 | | |

| | | | |

| Non-current liabilities: | | | | |

| Warrant liability | 2,393 | | | 4,958 | | |

| Operating lease liability, long-term | 17,864 | | | 19,738 | | |

| Deferred tax liability | 402 | | | 451 | | |

| Total liabilities | 50,945 | | | 60,638 | | |

| | | | |

| | | | |

| | | | |

| Stockholders' Equity | | | | |

| Preferred stock, $0.0001 par value, 2,000,000 shares authorized; no shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | — | | | — | | |

| Common stock, $0.0001 par value; 400,000,000 authorized; 77,934,085 and 75,131,425 shares issued at June 30, 2024 and December 31, 2023, respectively | 7 | | | 7 | | |

| Additional paid in capital | 401,753 | | | 390,083 | | |

| Accumulated other comprehensive income | 2,777 | | | 3,964 | | |

| Accumulated deficit | (175,151) | | | (159,754) | | |

| Total stockholders' equity | 229,386 | | | 234,300 | | |

| | | | |

| Total Liabilities and Stockholders' Equity | $ | 280,331 | | | $ | 294,938 | | |

BLADE AIR MOBILITY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | |

| Cost of revenue | 51,591 | | | 50,620 | | | | | 92,966 | | | 88,727 | | | |

| Software development | 971 | | | 1,440 | | | | | 1,641 | | | 2,563 | | | |

| General and administrative | 25,136 | | | 18,410 | | | | | 42,345 | | | 34,667 | | | |

| Selling and marketing | 2,396 | | | 2,728 | | | | | 4,524 | | | 5,339 | | | |

| Total operating expenses | 80,094 | | | 73,198 | | | | | 141,476 | | | 131,296 | | | |

| | | | | | | | | | | |

| Loss from operations | (12,149) | | | (12,209) | | | | | (22,017) | | | (25,036) | | | |

| | | | | | | | | | | |

| Other non-operating income (expense) | | | | | | | | | | | |

| Interest income | 1,788 | | | 2,077 | | | | | 3,860 | | | 4,031 | | | |

| Change in fair value of warrant liabilities | (913) | | | (2,462) | | | | | 2,565 | | | (1,896) | | | |

| Realized loss from sales of short-term investments | — | | | (14) | | | | | — | | | (95) | | | |

| | | | | | | | | | | |

| Total other non-operating income (expense) | 875 | | | (399) | | | | | 6,425 | | | 2,040 | | | |

| | | | | | | | | | | |

| Loss before income taxes | (11,274) | | | (12,608) | | | | | (15,592) | | | (22,996) | | | |

| | | | | | | | | | | |

| Income tax expense (benefit) | 52 | | | (376) | | | | | (32) | | | (572) | | | |

| | | | | | | | | | | |

| Net loss | $ | (11,326) | | | $ | (12,232) | | | | | $ | (15,560) | | | $ | (22,424) | | | |

| | | | | | | | | | | |

| Net loss per share: | | | | | | | | | | | |

| Basic | $ | (0.15) | | | $ | (0.17) | | | | | $ | (0.20) | | | $ | (0.31) | | | |

| Diluted | $ | (0.15) | | | $ | (0.17) | | | | | $ | (0.20) | | | $ | (0.31) | | | |

| Weighted-average number of shares outstanding: | | | | | | | | | | | |

| Basic | 77,603,604 | | | 73,169,003 | | | | | 76,700,008 | | | 72,584,138 | | | |

| Diluted | 77,603,604 | | | 73,169,003 | | | | | 76,700,008 | | | 72,584,138 | | | |

BLADE AIR MOBILITY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | |

| 2024 | | 2023 | | | | 2024 | | 2023 | | | |

| Cash Flows From Operating Activities: | | | | | | | | | | | | |

| Net loss | $ | (11,326) | | | $ | (12,232) | | | | | $ | (15,560) | | | $ | (22,424) | | | | |

| Adjustments to reconcile net loss to net cash and restricted cash used in operating activities: | | | | | | | | | | | | |

| Depreciation and amortization | 1,559 | | | 1,810 | | | | | 3,153 | | | 3,462 | | | | |

| Stock-based compensation | 5,647 | | | 2,797 | | | | | 9,965 | | | 6,018 | | | | |

| Change in fair value of warrant liabilities | 913 | | | 2,462 | | | | | (2,565) | | | 1,896 | | | | |

| Excess of lease liability over operating right-of-use assets | (123) | | | — | | | | | (123) | | | — | | | | |

| Gain on lease modification | (6) | | | — | | | | | (53) | | | — | | | | |

| | | | | | | | | | | | |

| Realized loss from sales of short-term investments | — | | | 14 | | | | | — | | | 95 | | | | |

| Realized foreign exchange loss | 1 | | | — | | | | | 4 | | | 5 | | | | |

| Accretion of interest income on held-to-maturity securities | (816) | | | (1,638) | | | | | (2,297) | | | (3,024) | | | | |

| Deferred tax expense (benefit) | 52 | | | (376) | | | | | (32) | | | (572) | | | | |

| Impairment of intangible assets | 5,759 | | | — | | | | | 5,759 | | | — | | | | |

| | | | | | | | | | | | |

| Bad debt expense | 171 | | | — | | | | | 202 | | | — | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | |

| Prepaid expenses and other current assets | 6,374 | | | (1,004) | | | | | 5,958 | | | (2,625) | | | | |

| Accounts receivable | (4,358) | | | (6,045) | | | | | (6,967) | | | (11,630) | | | | |

| Other non-current assets | 510 | | | 18 | | | | | 466 | | | (24) | | | | |

| Operating right-of-use assets/lease liabilities | 66 | | | 300 | | | | | 39 | | | 377 | | | | |

| Accounts payable and accrued expenses | 2,712 | | | 3,470 | | | | | (7,525) | | | 87 | | | | |

| Deferred revenue | 1,294 | | | 2,227 | | | | | 2,454 | | | 3,307 | | | | |

| | | | | | | | | | | | |

| Net cash provided by / (used in) operating activities | 8,429 | | | (8,197) | | | | | (7,122) | | | (25,052) | | | | |

| | | | | | | | | | | | |

| Cash Flows From Investing Activities: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Capitalized software development costs | (745) | | | — | | | | | (1,056) | | | — | | | | |

| | | | | | | | | | | | |

| Purchase of property and equipment | (16,163) | | | (744) | | | | | (16,979) | | | (1,390) | | | | |

| | | | | | | | | | | | |

| Purchase of short-term investments | — | | | (14) | | | | | — | | | (135) | | | | |

| Proceeds from sales of short-term investments | — | | | 4,532 | | | | | — | | | 20,532 | | | | |

| Purchase of held-to-maturity investments | — | | | — | | | | | (77,051) | | | (130,145) | | | | |

| Proceeds from maturities of held-to-maturity investments | — | | | — | | | | | 102,740 | | | 131,187 | | | | |

| Net cash (used in) / provided by investing activities | (16,908) | | | 3,774 | | | | | 7,654 | | | 20,049 | | | | |

| | | | | | | | | | | | |

| Cash Flows From Financing Activities: | | | | | | | | | | | | |

| Proceeds from the exercise of common stock options | 22 | | | — | | | | | 113 | | | 54 | | | | |

| Taxes paid related to net share settlement of equity awards | (986) | | | (20) | | | | | (1,023) | | | (101) | | | | |

| Repurchase and retirement of common stock | (244) | | | — | | | | | (244) | | | — | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net cash used in financing activities | (1,208) | | | (20) | | | | | (1,154) | | | (47) | | | | |

| | | | | | | | | | | | |

| Effect of foreign exchange rate changes on cash balances | (7) | | | 17 | | | | | (33) | | | 20 | | | | |

| Net decrease in cash and cash equivalents and restricted cash | (9,694) | | | (4,426) | | | | | (655) | | | (5,030) | | | | |

Cash and cash equivalents and restricted cash - beginning | 38,060 | | | 43,819 | | | | | 29,021 | | | 44,423 | | | | |

Cash and cash equivalents and restricted cash - ending | $ | 28,366 | | | $ | 39,393 | | | | | $ | 28,366 | | | $ | 39,393 | | | | |

| | | | | | | | | | | | |

| Reconciliation to the unaudited interim condensed consolidated balance sheets | | | | | | | | | | | | |

Cash and cash equivalents | $ | 26,308 | | | $ | 37,348 | | | | | $ | 26,308 | | | $ | 37,348 | | | | |

Restricted cash | 2,058 | | | 2,045 | | | | | 2,058 | | | 2,045 | | | | |

| Total cash, cash equivalents and restricted cash | $ | 28,366 | | | $ | 39,393 | | | | | $ | 28,366 | | | $ | 39,393 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Non-cash investing and financing activities | | | | | | | | | | | | |

New leases under ASC 842 entered into during the period(1) | $ | 3,777 | | | $ | 146 | | | | | $ | 6,358 | | | $ | 7,312 | | | | |

Common stock issued for settlement of earn-out(1) | — | | | — | | | | | 3,022 | | | 1,785 | | | | |

| Purchases of PPE and capitalized software in accounts payable and accrued expenses | 3,348 | | | — | | | | | 3,633 | | | — | | | | |

| Derecognition of ROU assets | (6,367) | | | — | | | | | (6,367) | | | — | | | | |

| Derecognition of lease liabilities | 6,367 | | | — | | | | | 6,367 | | | — | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) Prior year amounts have been updated to conform to current period presentation.

Key Metrics and Non-GAAP Financial Information

DISAGGREGATED REVENUE BY PRODUCT LINE

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Passenger segment | | | | | | | | | | | |

| Short Distance | $ | 20,908 | | | $ | 19,184 | | | | | $ | 30,718 | | | $ | 29,609 | | | |

| Jet and Other | 8,696 | | | 7,406 | | | | | 14,374 | | | 15,485 | | | |

| Total | $ | 29,604 | | | $ | 26,590 | | | | | $ | 45,092 | | | $ | 45,094 | | | |

| | | | | | | | | | | |

| Medical segment | | | | | | | | | | | |

| MediMobility Organ Transport | $ | 38,341 | | | $ | 34,399 | | | | | 74,367 | | | 61,166 | | | |

| Total | $ | 38,341 | | | $ | 34,399 | | | | | $ | 74,367 | | | $ | 61,166 | | | |

| | | | | | | | | | | |

| Total Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| | | | | | | | | | | |

SEGMENT INFORMATION: REVENUE, FLIGHT PROFIT, FLIGHT MARGIN, ADJUSTED EBITDA WITH RECONCILIATION TO TOTAL ADJUSTED EBITDA

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Passenger | $ | 29,604 | | | $ | 26,590 | | | | | $ | 45,092 | | | $ | 45,094 | | | |

| Medical | 38,341 | | | 34,399 | | | | | 74,367 | | | 61,166 | | | |

| Total Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| | | | | | | | | | | |

| Passenger | $ | 7,317 | | | $ | 4,642 | | | | | $ | 9,426 | | | $ | 7,454 | | | |

| Medical | 9,037 | | | 5,727 | | | | | 17,067 | | | 10,079 | | | |

Total Flight Profit(1) | $ | 16,354 | | | $ | 10,369 | | | | | $ | 26,493 | | | $ | 17,533 | | | |

| | | | | | | | | | | |

| Passenger | 24.7 | % | | 17.5 | % | | | | 20.9 | % | | 16.5 | % | | |

| Medical | 23.6 | % | | 16.6 | % | | | | 22.9 | % | | 16.5 | % | | |

| Total Flight Margin | 24.1 | % | | 17.0 | % | | | | 22.2 | % | | 16.5 | % | | |

| | | | | | | | | | | |

| Passenger | $ | 782 | | | $ | (2,075) | | | | | $ | (1,869) | | | $ | (5,130) | | | |

| Medical | 5,524 | | | 3,023 | | | | | 9,933 | | | 4,903 | | | |

| | | | | | | | | | | |

| Adjusted unallocated corporate expenses and software development | (5,348) | | | (5,396) | | | | | (10,652) | | | (11,945) | | | |

| Total Adjusted EBITDA | $ | 958 | | | $ | (4,448) | | | | | $ | (2,588) | | | $ | (12,172) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Includes $438 and $52 of depreciation and amortization for owned aircraft and vehicles in the three months ended June 30, 2024 and 2023, respectively and $521 and $84 in the six months ended June 30, 2024 and 2023, respectively.

SEATS FLOWN - ALL PASSENGER FLIGHTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

Seats flown – all passenger flights | 44,037 | | | 41,637 | | | | | 71,745 | | | 70,187 | | | |

REVENUE, FLIGHT PROFIT, FLIGHT MARGIN, ADJUSTED SG&A, ADJUSTED EBITDA

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Flight Profit(1) | 16,354 | | | 10,369 | | | | | 26,493 | | | 17,533 | | | |

| Flight Margin | 24.1 | % | | 17.0 | % | | | | 22.2 | % | | 16.5 | % | | |

| Adjusted SG&A | 15,834 | | | 14,869 | | | | | 29,602 | | | 29,789 | | | |

| Adjusted SG&A as a percentage of revenue | 23.3 | % | | 24.4 | % | | | | 24.8 | % | | 28.0 | % | | |

| Depreciation and amortization included in cost of revenue | 438 | | | 52 | | | | | 521 | | | 84 | | | |

| Adjusted EBITDA | $ | 958 | | | $ | (4,448) | | | | | $ | (2,588) | | | $ | (12,172) | | | |

| Adjusted EBITDA as a percentage of revenue | 1.4 | % | | (7.3) | % | | | | (2.2) | % | | (11.5) | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Includes $438 and $52 of depreciation and amortization for owned aircraft and vehicles in the three months ended June 30, 2024 and 2023, respectively and $521 and $84 in the six months ended June 30, 2024 and 2023, respectively.

RECONCILIATION OF REVENUE LESS COST OF REVENUE TO FLIGHT PROFIT AND GROSS PROFIT

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| Less: | | | | | | | | | | | |

Cost of revenue(1) | 51,591 | | | 50,620 | | | | | 92,966 | | | 88,727 | | | |

| Depreciation and amortization | 971 | | | 1,644 | | | | | 2,211 | | | 3,115 | | | |

| Stock-based compensation | 35 | | | 40 | | | | | 113 | | | 80 | | | |

Other(2) | 4,012 | | | 3,604 | | | | | 6,981 | | | 6,028 | | | |

| Gross Profit | $ | 11,336 | | | $ | 5,081 | | | | | $ | 17,188 | | | $ | 8,310 | | | |

| Gross Margin | 16.7 | % | | 8.3 | % | | | | 14.4 | % | | 7.8 | % | | |

| | | | | | | | | | | |

| Gross Profit | $ | 11,336 | | | $ | 5,081 | | | | | $ | 17,188 | | | $ | 8,310 | | | |

| Reconciling items: | | | | | | | | | | | |

| Depreciation and amortization | 971 | | | 1,644 | | | | | 2,211 | | | 3,115 | | | |

| Stock-based compensation | 35 | | | 40 | | | | | 113 | | | 80 | | | |

Other(2) | 4,012 | | | 3,604 | | | | | 6,981 | | | 6,028 | | | |

| Flight Profit | $ | 16,354 | | | $ | 10,369 | | | | | $ | 26,493 | | | $ | 17,533 | | | |

| Flight Margin | 24.1 | % | | 17.0 | % | | | | 22.2 | % | | 16.5 | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) Cost of revenue consists of flight costs paid to operators of aircraft and vehicles, landing fees, depreciation of aircraft and vehicles, ROU asset amortization, internal costs incurred in generating organ ground transportation revenue using the Company's owned vehicles and costs of operating our owned aircraft including fuel, management fees paid to the operator, maintenance costs and pilot salaries.

(2) Other costs include credit card processing fees, staff costs, commercial costs and establishment costs.

RECONCILIATION OF TOTAL OPERATING EXPENSES TO ADJUSTED SG&A

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total operating expenses | 80,094 | | | 73,198 | | | | | 141,476 | | | 131,296 | | | |

| Subtract: | | | | | | | | | | | |

| Cost of revenue | 51,591 | | | 50,620 | | | | | 92,966 | | | 88,727 | | | |

| SG&A | $ | 28,503 | | | $ | 22,578 | | | | | $ | 48,510 | | | $ | 42,569 | | | |

| SG&A as percentage of Revenue | 42.0 | % | | 37.0 | % | | | | 40.6 | % | | 40.1 | % | | |

| Adjustments to reconcile SG&A to Adjusted SG&A | | | | | | | | | | | |

| | | | | | | | | | | |

| Subtract: | | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization included in SG&A | 1,121 | | | 1,758 | | | | | 2,632 | | | 3,378 | | | |

| | | | | | | | | | | |

| Stock-based compensation | 5,546 | | | 2,797 | | | | | 10,089 | | | 6,018 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Legal and regulatory advocacy fees(1)(2) | 139 | | | — | | | | | 262 | | | 423 | | | |

| | | | | | | | | | | |

| Executive severance costs | — | | | 119 | | | | | — | | | 265 | | | |

| SOX readiness costs | 82 | | | 35 | | | | | 82 | | | 35 | | | |

Contingent consideration compensation (earn-out)(3) | — | | | 3,000 | | | | | — | | | 2,661 | | | |

| | | | | | | | | | | |

| M&A transaction costs | 22 | | | — | | | | | 84 | | | — | | | |

| Impairment of intangible assets | 5,759 | | | — | | | | | 5,759 | | | $ | — | | | |

| Adjusted SG&A | $ | 15,834 | | | $ | 14,869 | | | | | $ | 29,602 | | | $ | 29,789 | | | |

| Adjusted SG&A as percentage of Revenue | 23.3 | % | | 24.4 | % | | | | 24.8 | % | | 28.0 | % | | |

(1) For the six months ended June 30, 2024, represents legal advocacy fees related to the Drulias lawsuit that we do not consider representative of legal and regulatory advocacy costs that we will incur from time to time in the ordinary course of our business.

(2) For the six months ended June 30, 2023, represents certain legal and regulatory advocacy fees for certain proposed restrictions at East Hampton Airport and potential operational restrictions on large jet aircraft at Westchester Airport, that we do not consider representative of legal and regulatory advocacy costs that we will incur from time to time in the ordinary course of our business.

(3) Trinity’s contingent consideration, 2023 was the last year subject to an earn-out payment.

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA

(in thousands except percentages, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Net loss | $ | (11,326) | | | $ | (12,232) | | | | | $ | (15,560) | | | $ | (22,424) | | | |

| | | | | | | | | | | |

| Depreciation and amortization | 1,559 | | | 1,810 | | | | | 3,153 | | | 3,462 | | | |

| Stock-based compensation | 5,546 | | | 2,797 | | | | | 10,089 | | | 6,018 | | | |

| Change in fair value of warrant liabilities | 913 | | | 2,462 | | | | | (2,565) | | | 1,896 | | | |

| Realized loss from sales of short-term investments | — | | | 14 | | | | | — | | | 95 | | | |

| | | | | | | | | | | |

| Interest income | (1,788) | | | (2,077) | | | | | (3,860) | | | (4,031) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Income tax expense (benefit) | 52 | | | (376) | | | | | (32) | | | (572) | | | |

Legal and regulatory advocacy fees(1)(2) | 139 | | | — | | | | | 262 | | | 423 | | | |

| Executive severance costs | — | | | 119 | | | | | — | | | 265 | | | |

| SOX readiness costs | 82 | | | 35 | | | | | 82 | | | 35 | | | |

Contingent consideration compensation (earn-out)(3) | — | | | 3,000 | | | | | — | | | 2,661 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| M&A transaction costs | 22 | | | — | | | | | 84 | | | — | | | |

| Impairment of intangible assets | 5,759 | | | — | | | | | 5,759 | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted EBITDA | $ | 958 | | | $ | (4,448) | | | | | $ | (2,588) | | | $ | (12,172) | | | |

| Revenue | $ | 67,945 | | | $ | 60,989 | | | | | $ | 119,459 | | | $ | 106,260 | | | |

| Adjusted EBITDA as a percentage of Revenue | 1.4 | % | | (7.3) | % | | | | (2.2) | % | | (11.5) | % | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) For the six months ended June 30, 2024, represents legal advocacy fees related to the Drulias lawsuit that we do not consider representative of legal and regulatory advocacy costs that we will incur from time to time in the ordinary course of our business.

(2) For the six months ended June 30, 2023, represents certain legal and regulatory advocacy fees for certain proposed restrictions at East Hampton Airport and potential operational restrictions on large jet aircraft at Westchester Airport, that we do not consider representative of legal and regulatory advocacy costs that we will incur from time to time in the ordinary course of our business.

(3) Trinity’s contingent consideration, 2023 was the last year subject to an earn-out payment.

RECONCILIATION OF NET CASH PROVIDED BY / (USED IN) OPERATING ACTIVITIES TO FREE CASH FLOW

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| Net cash provided by / (used in) operating activities | $ | 8,429 | | | $ | (8,197) | | | | | $ | (7,122) | | | $ | (25,052) | | | |

| Capitalized software development costs | (745) | | | — | | | | | (1,056) | | | — | | | |

| Purchase of property and equipment | (16,163) | | | (744) | | | | | (16,979) | | | (1,390) | | | |

Free Cash Flow | $ | (8,479) | | | $ | (8,941) | | | | | $ | (25,157) | | | $ | (26,442) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

LAST TWELVE MONTHS DISAGGREGATED REVENUE BY PRODUCT LINE

(in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended |

| | Last Twelve Months | | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 |

| Product Line: | | | | | | | | | | | |

| Short Distance | | $ | 71,809 | | | | $ | 20,908 | | | $ | 9,810 | | | $ | 10,703 | | | $ | 30,388 | |

| Jet and Other | | 26,765 | | | | 8,696 | | | 5,678 | | | 4,784 | | | 7,607 | |

| MediMobility Organ Transport | | 139,805 | | | | 38,341 | | | 36,026 | | | 31,991 | | | 33,447 | |

| Total Revenue | | $ | 238,379 | | | | $ | 67,945 | | | $ | 51,514 | | | $ | 47,478 | | | $ | 71,442 | |

About Blade Air Mobility

Blade Air Mobility provides air transportation and logistics for hospitals across the United States, where it is one of the largest transporters of human organs for transplant, and for passengers, with helicopter and fixed wing services primarily in the Northeast United States and Southern Europe. Based in New York City, Blade's asset-light model, coupled with its exclusive passenger terminal infrastructure and proprietary technologies, is designed to facilitate a seamless transition from helicopters and fixed-wing aircraft to Electric Vertical Aircraft (“EVA” or “eVTOL”), enabling lower cost air mobility that is both quiet and emission-free.

For more information, visit www.blade.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical facts and may be identified by the use of words such as "will", “anticipate,” “believe,” “could,” “continue,” “expect,” “estimate,” “may,” “plan,” “outlook,” “future,” "target," and “project” and other similar expressions and the negatives of those terms. These statements, which involve risks and uncertainties, relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to Blade’s future prospects, developments and business strategies. In particular, such forward-looking statements include statements concerning Blade’s future financial and operating performance (including the discussion of 2024 and 2025 financial outlook and guidance), the composition and performance of its fleet, results of operations, industry environment and growth opportunities, new product lines and partnerships, and the development and adoption of EVA technology. These statements are based on management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance.

Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Blade’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements include: our continued incurrence of significant losses; failure of the markets for our offerings to grow as expected, or at all; our ability to effectively market and sell air transportation as a substitute for conventional methods of transportation; reliance on certain customers in our Passenger segment revenue; the inability or unavailability to use or take advantage of the shift, or lack thereof, to EVA technology; our ability to successfully enter new markets and launch new routes and services; any adverse publicity stemming from accidents involving small aircraft, helicopters or charter flights and, in particular, any accidents involving our third-party operators; any change to the ownership of our aircraft and the challenges related thereto; the effects of competition; harm to our reputation and brand; our ability to provide high-quality customer support; our ability to maintain a high daily aircraft usage rate; changes in consumer preferences, discretionary spending and other economic conditions; impact of natural disasters, outbreaks and pandemics, economic, social, weather, geopolitical, growth constraints, and regulatory conditions or other circumstances on metropolitan areas and airports where we have geographic concentration; the effects of climate change, including potential increased impacts of severe weather and regulatory activity; the availability of aircraft fuel; our ability to address

system failures, defects, errors, or vulnerabilities in our website, applications, backend systems or other technology systems or those of third-party technology providers; interruptions or security breaches of our information technology systems; our placements within mobile applications; our ability to protect our intellectual property rights; our use of open source software; our ability to expand and maintain our infrastructure network; our ability to access additional funding; the increase of costs and risks associated with international expansion; our ability to identify, complete and successfully integrate future acquisitions; our ability to manage our growth; increases in insurance costs or reductions in insurance coverage; the loss of key members of our management team; our ability to maintain our company culture; our reliance on contractual relationships with certain transplant centers and Organ Procurement Organizations; effects of fluctuating financial results; our reliance on third-party operators; the availability of third-party operators; disruptions to third-party operators; increases in insurance costs or reductions in insurance coverage for our third-party aircraft operators; the possibility that our third-party aircraft operators may illegally, improperly or otherwise inappropriately operate our branded aircraft; our reliance on third-party web service providers; changes in our regulatory environment; risks and impact of any litigation we may be subject to; regulatory obstacles in local governments; the expansion of domestic and foreign privacy and security laws; the expansion of environmental regulations; our ability to remediate any material weaknesses or maintain internal controls over financial reporting; our ability to maintain effective internal controls and disclosure controls; changes in the fair value of our warrants; and other factors beyond our control. Additional factors can be found in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, each as filed with the U.S. Securities and Exchange Commission. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and Blade undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, changes in expectations, future events or otherwise.

Press Contacts

For Media Relations

Lee Gold

press@blade.com

For Investor Relations

Mathew Schneider

investors@blade.com

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

BLADE AIR MOBILITY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Contained File Information, File Number |

001-39046

|

| Entity Tax Identification Number |

84-1890381

|

| Entity Address, Address Line One |

31 Hudson Yards

|

| Entity Address, Address Line One |

14th Floor

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

967-1009

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001779128

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

New York

|

| Entity Address, State or Province |

NY

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

BLDE

|

| Security Exchange Name |

NASDAQ

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock at a price of $11.50

|

| Trading Symbol |

BLDEW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

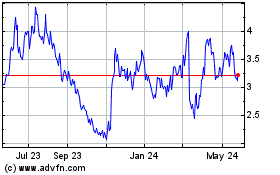

Blade Air Mobility (NASDAQ:BLDE)

Historical Stock Chart

From Oct 2024 to Nov 2024

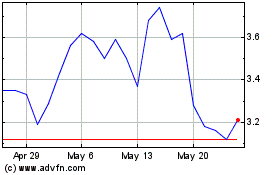

Blade Air Mobility (NASDAQ:BLDE)

Historical Stock Chart

From Nov 2023 to Nov 2024