Bumble Inc. (NASDAQ: BMBL), the parent company of Bumble and Badoo,

today reported financial results for the fourth quarter and full

year ended December 31, 2020.

“We are committed to our mission, our customers

and to advancing the business, which fueled our strong fourth

quarter and full year 2020 results,” said Whitney Wolfe Herd,

Founder and CEO of Bumble. “Our significant increase in revenue and

paying users is a direct result of our team’s dedication and

remarkable agility during a challenging pandemic. Looking ahead, we

remain focused on driving scale, investing in our users and

expanding internationally. Our IPO was a pivotal milestone, but we

are just getting started and are excited for the next chapter of

our journey.”

Full year 2020 revenue increased to $582.2

million from $488.9 million in 2019. Full year revenue was

comprised of $40.0 million for the period from January 1, 2020 to

January 28, 2020 and $542.2 million for the period from January 29,

2020 to December 31, 2020. Full year 2020 Total Paying Users

increased 22% year over year to 2.5 million.

Fourth Quarter 2020 Operational and Financial

Results:(All comparisons relative to the Fourth

Quarter 2019)

-

Revenue increased 31.1% to $165.6 million, compared to $126.3

million. Bumble app revenue increased 46.6% to $105.8 million and

Badoo app and other revenue increased 10.5% to $59.8 million.

-

Total Paying Users increased 32.5% to 2.7 million, compared to 2.0

million.

-

Total ARPPU was $20.02, compared to $19.99.

-

Net loss was $(26.1) million, or (15.7)% of revenue, compared

to net earnings of $17.2 million, or 13.6% of revenue.

-

Adjusted EBITDA was $44.1 million, or 26.6% of revenue,

compared to $21.9 million, or 17.3% of revenue.

Full Year 2020 Operational and Financial

Results:(All comparisons relative to the Full Year

2019)

-

Revenue was $542.2 million for the period from

January 29, 2020 to December 31, 2020 and $40.0 million

for the period from January 1, 2020 to January 28, 2020,

compared to $488.9 million.

-

Bumble App Revenue was $337.2 million for the period from

January 29, 2020 to December 31, 2020 and $23.3 million

for the period from January 1, 2020 to January 28, 2020,

compared to $275.5 million.

-

Badoo App and Other Revenue was $205.0 million for the period

from January 29, 2020 to December 31, 2020 and

$16.7 million for the period from January 1, 2020 to

January 28, 2020, compared to $213.4 million.

-

Total Paying Users increased 22.2% to 2.5 million, compared to 2.1

million.

-

Total ARPPU was $18.89, compared to $19.22.

-

Net (loss) earnings was $(110.2) million, or (20.3)% of

revenue, for the period from January 29, 2020 to December 31,

2020 and $(32.6) million, or (81.4)% of revenue, for the

period from January 1, 2020 to January 28, 2020, compared

to $85.8 million, or 17.6% of revenue.

-

Adjusted EBITDA was $143.1 million, or 26.4% of revenue,

for the period from January 29, 2020 to December 31, 2020 and

$9.4 million, or 23.4% of revenue, for the period from

January 1, 2020 to January 28, 2020, compared to

$101.8 million, or 20.8% of revenue.

“During the fourth quarter, we demonstrated our

ability to continue to scale the business and rapidly adapt to the

pandemic, while expanding Adjusted EBITDA,” added Anu Subramanian,

CFO of Bumble. “Looking ahead, we believe we are well positioned to

drive growth in users and capitalize on our significant market

opportunity.”

*Please see “Definitions” section below for the

definition of “Paying Users”

Key Operating Metrics:

| (in thousands, except

ARPPU) |

|

QuarterEndedDecember31,

2020 |

|

|

QuarterEndedDecember31,

2019 |

|

|

Bumble App Paying Users |

|

|

1,268.7 |

|

|

|

890.6 |

|

| Badoo

App and Other Paying Users |

|

|

1,424.6 |

|

|

|

1,142.9 |

|

| Total

Paying Users |

|

|

2,693.3 |

|

|

|

2,033.5 |

|

| Bumble

App Average Revenue per Paying User |

|

$ |

27.79 |

|

|

$ |

27.00 |

|

| Badoo

App and Other Average Revenue per Paying User |

|

$ |

13.10 |

|

|

$ |

14.52 |

|

| Total

Average Revenue per Paying User |

|

$ |

20.02 |

|

|

$ |

19.99 |

|

|

|

|

|

|

|

|

|

|

|

Financial Outlook:

Bumble anticipates Revenue and Adjusted EBITDA

for the quarter ending March 31, 2021 and year ending December 31,

2021 to be:

First quarter 2021:

- Revenue in the range of $163 to $165 million

- Adjusted EBITDA in the range of $41 to $42 million.

Full year 2021:

- Revenue in the range of $716 to $726 million

- Adjusted EBITDA in the range of $173 to $178 million.

Actual results may differ materially from

Bumble’s Financial Outlook as a result of, among other things, the

factors described under “Forward-Looking Statements” below.

With regards to the Non-GAAP Adjusted EBITDA

outlook provided above, a reconciliation to GAAP net earnings

(loss) has not been provided as the quantification of certain items

included in the calculation of GAAP net earnings (loss) cannot be

calculated or predicted at this time without unreasonable efforts.

For example, the non-GAAP adjustment for stock-based compensation

expense requires additional inputs such as number of shares granted

and market price that are not currently ascertainable, and the

non-GAAP adjustment for certain legal, tax and regulatory reserves

and expenses depends on the timing and magnitude of these expenses

and cannot be accurately forecasted. For the same reasons, the

Company is unable to address the probable significance of the

unavailable information, which could have a potentially

unpredictable, and potentially significant, impact on its future

GAAP financial results.

Conference Call and Webcast Information

Bumble will host a conference call and live

webcast to discuss its fourth quarter and full year 2020 financial

results at 4:30 p.m. Eastern Time today, March 10, 2021. To listen

to the live conference call, please dial toll free (833) 362-0206

or (914) 987-7675, access code 1162237, approximately 10 minutes

prior to the start of the call. A webcast of the call and other

information related to the call will be accessible on the Investors

section of the Company’s website at https://ir.bumble.com. A

webcast replay will be available approximately two hours after the

conclusion of the live event.

Definitions

Bumble App Average Revenue per Paying User is

calculated based on Bumble App Revenue in any measurement period,

divided by Bumble App Paying Users in such period divided by the

number of months in the period.

Bumble App Paying User is a user that has

purchased or renewed a Bumble subscription plan and/or made an

in-app purchase on the Bumble app in a given month. We calculate

Bumble App Paying Users as a monthly average, by counting the

number of Bumble App Paying Users in each month and then dividing

by the number of months in the relevant measurement period.

Badoo App and Other Average Revenue per Paying

User is calculated based on Badoo App and Other Revenue in any

measurement period, excluding any revenue generated from

advertising and partnerships or affiliates, divided by Badoo App

and Other Paying Users in such period divided by the number of

months in the period.

Badoo App and Other Paying User is a user that

has purchased or renewed a subscription plan and/or made an in-app

purchase on the Badoo app in a given month (or made a purchase on

one of our other apps that we owned and operated in a given month,

or purchase on other third-party apps that used our technology in

the relevant period). We calculate Badoo App and Other Paying Users

as a monthly average, by counting the number of Badoo App and Other

Paying Users in each month and then dividing by the number of

months in the relevant measurement period.

Predecessor refers to Worldwide Vision Limited

and its consolidated subsidiaries. Worldwide Vision Limited

operated the trade of Bumble Inc. prior to the consummation of the

acquisition (the “Sponsor Acquisition”) on January 29, 2020 of a

majority stake in Worldwide Vision Limited by a group of investment

funds managed by The Blackstone Group Inc.

Successor refers to Buzz Holdings L.P. and its

consolidated subsidiaries. Buzz Holdings L.P. was formed

primarily as a vehicle to finance the Sponsor Acquisition.

Following completion of the initial public offering on February 16,

2021, Bumble Inc. is now the holding company of the group.

Non-GAAP Financial Measures

We report our financial results in accordance

with GAAP, however, management believes that certain non-GAAP

financial measures provide users of our financial information with

useful supplemental information that enables a better comparison of

our performance across periods. These measures include: Adjusted

EBITDA, Adjusted EBITDA Margin, Free Cash Flow and Free Cash Flow

Conversion. We believe Adjusted EBITDA and Adjusted EBITDA Margin

provide visibility to the underlying continuing operating

performance by excluding the impact of certain expenses, including

income tax provision, interest (income) expense, depreciation and

amortization, stock-based compensation expense, foreign exchange

loss (gain), changes in fair value of contingent earn-out liability

and interest rate swaps, transaction costs and one-time litigation

costs, as management does not believe these expenses are

representative of our core earnings. In addition to Adjusted EBITDA

and Adjusted EBITDA Margin, we believe Free Cash Flow and Free Cash

Flow Conversion provide useful information regarding how cash

provided by operating activities compares to the capital

expenditures required to maintain and grow our business, and our

available liquidity, after funding such capital expenditures, to

service our debt, fund strategic initiatives and strengthen our

balance sheet, as well as our ability to convert our earnings to

cash. Additionally, we believe such metrics are widely used by

investors, securities analysis, ratings agencies and other parties

in evaluating liquidity and debt-service capabilities. We calculate

Free Cash Flow and Free Cash Flow Conversion using methodologies

that we believe can provide useful supplemental information to help

investors better understand underlying trends in our business.

Our non-GAAP financial measures may not be

comparable to similarly titled measures used by other companies,

have limitations as analytical tools and should not be considered

in isolation, or as substitutes for analysis of our operating

results as reported under GAAP. Additionally, we do not consider

our non-GAAP financial measures as superior to, or a substitute

for, the equivalent measures calculated and presented in accordance

with GAAP.

Adjusted Earnings before Interest, Taxes,

Depreciation and Amortization (“Adjusted EBITDA”) is defined as net

earnings (loss) excluding income tax (benefit) provision, interest

expense (income), depreciation and amortization, stock-based

compensation expense, foreign exchange loss (gain), changes in fair

value of contingent earn-out liability, changes in fair value of

interest rate swaps, transaction costs and one-time litigation

costs.

Adjusted EBITDA Margin represents Adjusted

EBITDA as a percentage of revenue.

Free Cash Flow is defined as net cash provided

by (used in) operating activities less capital expenditures.

Free Cash Flow Conversion represents Free Cash

Flow as a percentage of Adjusted EBITDA.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include

without limitation statements reflecting our current views with

respect to, among other things, our operations, our financial

performance and our industry and other non-historical statements,

including without limitation the statements in the “Financial

Outlook” section of this press release. In some cases, you can

identify these forward-looking statements by the use of words such

as “outlook,” “believe(s),” “expect(s),” “potential,”

“continue(s),” “may,” “will,” “should,” “could,” “would,”

“seek(s),” “predict(s),” “intend(s),” “trends,” “plan(s),”

“estimate(s),” “anticipates,” “projection,” “will likely result”

and or the negative version of these words or other comparable

words of a future or forward-looking nature. Such forward-looking

statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could

cause actual outcomes or results to differ materially from those

indicated in these statements. These factors include, but are not

limited to, the following:

- our ability to retain existing

users or attract new users and to convert users to paying

users

- competition and changes in the

competitive landscape of our market

- our ability to distribute our

dating products through third parties, such as Apple App Store or

Google Play Store, and offset related fees

- the impact of data security

breaches or cyber attacks on our systems and the costs of

remediation related to any such incidents

- the continued development and

upgrading of our technology platform and our ability to adapt to

rapid technological developments and changes in a timely and

cost-effective manner

- our ability to obtain, maintain,

protect and enforce intellectual property rights and successfully

defend against claims of infringement, misappropriation or other

violations of third-party intellectual property

- our ability to comply with complex

and evolving U.S. and international laws and regulations relating

to our business, including data privacy laws

- foreign currency exchange rate

fluctuations

- risks relating to certain of our

international operations, including successful expansion into new

markets

- Affiliates of The Blackstone Group

Inc.’s (“Blackstone”) and our Founder’s control of us

- the outsized voting rights of

affiliates of Blackstone and our Founder

- the inability to attract hire and

retain a highly qualified and diverse workforce, or maintain our

corporate culture

- changes in business or

macroeconomic conditions, including the impact of the Coronavirus

Disease 2019 (“COVID-19”) (and other widespread health emergencies

or pandemics) and measures taken in response, lower consumer

confidence in our business or in the online dating industry

generally, recessionary conditions, increased unemployment rates,

stagnant or declining wages, political unrest, armed conflicts or

natural disasters

For additional information on these and other

factors that could cause Bumble’s actual results to differ

materially from expected results, please see our prospectus, dated

February 10, 2021, filed with the Securities and Exchange

Commission (the “SEC”) pursuant to Rule 424(b)(4) of the Securities

Act of 1933, as amended, on February 12, 2021, as such factors may

be updated from time to time in our periodic filings with the SEC,

which are accessible on the SEC’s website at www.sec.gov. The

forward-looking statements included in this press release are made

only as of the date of this press release, and we undertake no

obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

About Bumble

Bumble Inc. is the parent company of Badoo and

Bumble, two of the world’s highest-grossing dating apps with

millions of users worldwide. The Bumble platform enables people to

connect and build equitable and healthy relationships. Founded by

CEO Whitney Wolfe Herd in 2014, the Bumble app is one of the first

dating apps built with women at the center, and the Badoo app,

which was founded in 2006, is one of the pioneers of web and mobile

dating products. Bumble currently employs over 700 people in

offices in Austin, Barcelona, London, and Moscow.

For more information about Bumble, please visit bumble.com and

follow @Bumble on social platforms.

Source: Bumble Inc.

Investor Contactir@team.bumble.com

Media Contactpress@team.bumble.com

Buzz Holdings

L.P.Consolidated Balance

Sheets(in thousands, except par value

amounts)

|

|

|

Successor |

|

|

|

Predecessor |

|

|

|

|

December 31,2020 |

|

|

|

December 31,2019 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

128,029 |

|

|

|

$ |

57,449 |

|

| Accounts receivable |

|

|

41,595 |

|

|

|

|

34,234 |

|

| Loans to related

companies |

|

|

— |

|

|

|

|

42,043 |

|

| Other current assets |

|

|

81,387 |

|

|

|

|

36,106 |

|

| Total current

assets |

|

|

251,011 |

|

|

|

|

169,832 |

|

| Right-of-use assets |

|

|

11,711 |

|

|

|

|

16,291 |

|

| Lease receivable |

|

|

1,069 |

|

|

|

|

1,011 |

|

| Property and equipment,

net |

|

|

16,833 |

|

|

|

|

14,033 |

|

| Goodwill |

|

|

1,540,915 |

|

|

|

|

— |

|

| Intangible assets, net |

|

|

1,812,410 |

|

|

|

|

1,241 |

|

| Deferred tax assets, net |

|

|

— |

|

|

|

|

7,055 |

|

| Other noncurrent assets |

|

|

3,319 |

|

|

|

|

835 |

|

| Total

assets |

|

$ |

3,637,268 |

|

|

|

$ |

210,298 |

|

| LIABILITIES AND BUZZ

HOLDINGS L.P. OWNERS’ / WORLDWIDE VISION

LIMITED SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

23,741 |

|

|

|

$ |

8,066 |

|

| Deferred revenue |

|

|

31,269 |

|

|

|

|

24,749 |

|

| Accrued expenses and other

current liabilities |

|

|

180,986 |

|

|

|

|

88,649 |

|

| Current portion of long-term

debt, net |

|

|

5,338 |

|

|

|

|

— |

|

| Total current

liabilities |

|

|

241,334 |

|

|

|

|

121,464 |

|

| Long-term debt, net |

|

|

820,876 |

|

|

|

|

— |

|

| Deferred tax liabilities |

|

|

428,087 |

|

|

|

|

— |

|

| Other liabilities |

|

|

62,190 |

|

|

|

|

59,152 |

|

| Total

liabilities |

|

$ |

1,552,487 |

|

|

|

$ |

180,616 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

|

| Buzz Holdings L.P.

owners’ / Worldwide Vision

Limited shareholders’ equity: |

|

|

|

|

|

|

|

|

|

| Limited Partners’ interest

(2,453,785 Class A units and 153,274 Class B units issued and

outstanding as of December 31, 2020) |

|

|

1,903,121 |

|

|

|

|

— |

|

| Issued share capital ($0.0001

par value; 126,424 shares authorized; 108,431 shares issued and

outstanding as of December 31, 2019) |

|

|

— |

|

|

|

|

11 |

|

| Additional paid-in

capital |

|

|

— |

|

|

|

|

3,449 |

|

| Accumulated other

comprehensive income |

|

|

180,852 |

|

|

|

|

644 |

|

| Treasury stock (6,940 shares

as of December 31, 2019) |

|

|

— |

|

|

|

|

(3,788 |

) |

| Retained earnings |

|

|

— |

|

|

|

|

23,352 |

|

| Total Buzz Holdings

L.P. owners’ / Worldwide Vision

Limited shareholders’ equity |

|

|

2,083,973 |

|

|

|

|

23,668 |

|

| Noncontrolling interests |

|

|

808 |

|

|

|

|

6,014 |

|

| Total owners’ /

shareholders’ equity |

|

|

2,084,781 |

|

|

|

|

29,682 |

|

| Total liabilities and

owners’ / shareholders’ equity |

|

$ |

3,637,268 |

|

|

|

$ |

210,298 |

|

| |

|

|

|

|

|

|

|

|

|

Buzz Holdings

L.P.Consolidated Statements of

Operations(in thousands, except per unit

data)

|

|

|

Successor |

|

|

|

Predecessor |

|

|

Successor |

|

|

|

Predecessor |

|

|

|

|

QuarterEndedDecember31,

2020 |

|

|

|

QuarterEndedDecember31,

2019 |

|

|

Period fromJanuary

29,throughDecember31,

2020 |

|

|

|

Period fromJanuary

1,throughJanuary28,

2020 |

|

|

YearEndedDecember31,

2019 |

|

|

Revenue |

|

$ |

165,605 |

|

|

|

$ |

126,301 |

|

|

$ |

542,192 |

|

|

|

$ |

39,990 |

|

|

$ |

488,940 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

44,612 |

|

|

|

|

34,713 |

|

|

|

146,629 |

|

|

|

|

10,790 |

|

|

|

139,767 |

|

|

Selling and marketing expense |

|

|

48,077 |

|

|

|

|

40,561 |

|

|

|

152,588 |

|

|

|

|

11,157 |

|

|

|

142,902 |

|

|

General and administrative expense |

|

|

50,495 |

|

|

|

|

19,706 |

|

|

|

178,615 |

|

|

|

|

44,907 |

|

|

|

67,079 |

|

|

Product development expense |

|

|

17,079 |

|

|

|

|

10,195 |

|

|

|

46,994 |

|

|

|

|

4,087 |

|

|

|

39,205 |

|

|

Depreciation and amortization expense |

|

|

25,996 |

|

|

|

|

1,831 |

|

|

|

91,767 |

|

|

|

|

408 |

|

|

|

6,734 |

|

|

Total operating costs and expenses |

|

|

186,259 |

|

|

|

|

107,006 |

|

|

|

616,593 |

|

|

|

|

71,349 |

|

|

|

395,687 |

|

|

Operating (loss) income |

|

|

(20,654 |

) |

|

|

|

19,295 |

|

|

|

(74,401 |

) |

|

|

|

(31,359 |

) |

|

|

93,253 |

|

| Interest

(expense) income |

|

|

(7,430 |

) |

|

|

|

156 |

|

|

|

(22,134 |

) |

|

|

|

50 |

|

|

|

202 |

|

| Other

expense, net |

|

|

(8,999 |

) |

|

|

|

(1,989 |

) |

|

|

(5,525 |

) |

|

|

|

(882 |

) |

|

|

(1,473 |

) |

|

(Loss) earnings before tax |

|

|

(37,083 |

) |

|

|

|

17,462 |

|

|

|

(102,060 |

) |

|

|

|

(32,191 |

) |

|

|

91,982 |

|

| Income

tax benefit (provision) |

|

|

11,017 |

|

|

|

|

(250 |

) |

|

|

(8,126 |

) |

|

|

|

(365 |

) |

|

|

(6,138 |

) |

|

Net (loss) earnings |

|

|

(26,066 |

) |

|

|

|

17,212 |

|

|

|

(110,186 |

) |

|

|

|

(32,556 |

) |

|

|

85,844 |

|

| Net

earnings attributable to noncontrolling interests |

|

|

908 |

|

|

|

|

5,111 |

|

|

|

808 |

|

|

|

|

1,917 |

|

|

|

19,698 |

|

| Net

(loss) earnings attributable to Buzz Holdings L.P. owners /

Worldwide Vision Limited shareholders |

|

$ |

(26,974 |

) |

|

|

$ |

12,101 |

|

|

$ |

(110,994 |

) |

|

|

$ |

(34,473 |

) |

|

$ |

66,146 |

|

|

Net loss per unit attributable to Buzz Holdings

L.P. owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per unit |

|

$ |

(0.01 |

) |

|

|

|

— |

|

|

$ |

(0.05 |

) |

|

|

|

— |

|

|

|

— |

|

|

Diluted loss per unit |

|

$ |

(0.01 |

) |

|

|

|

— |

|

|

$ |

(0.05 |

) |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buzz Holdings

L.P.Consolidated Statements of Cash

Flows(in thousands)

|

|

|

Successor |

|

|

|

Predecessor |

|

|

Successor |

|

|

|

Predecessor |

|

|

|

|

Quarter EndedDecember31,

2020 |

|

|

|

Quarter EndedDecember31,

2019 |

|

|

Period fromJanuary

29,throughDecember31,

2020 |

|

|

|

Period fromJanuary

1,throughJanuary28,

2020 |

|

|

YearEndedDecember31,

2019 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) earnings |

|

$ |

(26,066 |

) |

|

|

$ |

17,212 |

|

|

$ |

(110,186 |

) |

|

|

$ |

(32,556 |

) |

|

$ |

85,844 |

|

| Adjustments to reconcile net

(loss) earnings to net cash provided by (used in) operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

25,996 |

|

|

|

|

1,831 |

|

|

|

91,767 |

|

|

|

|

408 |

|

|

|

6,734 |

|

|

Change in fair value of interest swap |

|

|

(242 |

) |

|

|

|

— |

|

|

|

1,586 |

|

|

|

|

— |

|

|

|

— |

|

|

Change in fair value of contingent consideration |

|

|

8,700 |

|

|

|

|

— |

|

|

|

27,800 |

|

|

|

|

— |

|

|

|

— |

|

|

Non-cash lease expense |

|

|

442 |

|

|

|

|

666 |

|

|

|

(109 |

) |

|

|

|

(226 |

) |

|

|

952 |

|

|

Deferred income tax |

|

|

(22,935 |

) |

|

|

|

201 |

|

|

|

(789 |

) |

|

|

|

26 |

|

|

|

201 |

|

|

Stock-based compensation expense |

|

|

14,350 |

|

|

|

|

1,080 |

|

|

|

27,468 |

|

|

|

|

4,156 |

|

|

|

2,160 |

|

|

Net foreign exchange difference |

|

|

1,965 |

|

|

|

|

600 |

|

|

|

6,945 |

|

|

|

|

(198 |

) |

|

|

600 |

|

|

Research and development tax credit |

|

|

(307 |

) |

|

|

|

(593 |

) |

|

|

(1,211 |

) |

|

|

|

— |

|

|

|

(2,374 |

) |

|

Other, net |

|

|

169 |

|

|

|

|

221 |

|

|

|

3,604 |

|

|

|

|

31 |

|

|

|

201 |

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

19,933 |

|

|

|

|

15,192 |

|

|

|

10,737 |

|

|

|

|

(17,599 |

) |

|

|

(5,971 |

) |

|

Other current assets |

|

|

(23,261 |

) |

|

|

|

(24,802 |

) |

|

|

(46,949 |

) |

|

|

|

(2,175 |

) |

|

|

(21,144 |

) |

|

Accounts payable |

|

|

9,649 |

|

|

|

|

(1,556 |

) |

|

|

2,970 |

|

|

|

|

12,984 |

|

|

|

(252 |

) |

|

Deferred revenue |

|

|

1,479 |

|

|

|

|

287 |

|

|

|

22,169 |

|

|

|

|

289 |

|

|

|

1,360 |

|

|

Legal liabilities |

|

|

(5,249 |

) |

|

|

|

(268 |

) |

|

|

(18,374 |

) |

|

|

|

(521 |

) |

|

|

(1,811 |

) |

|

Accrued expenses and other current liabilities |

|

|

50,576 |

|

|

|

|

20,357 |

|

|

|

38,806 |

|

|

|

|

32,075 |

|

|

|

34,523 |

|

|

Other liabilities |

|

|

21 |

|

|

|

|

369 |

|

|

|

27 |

|

|

|

|

— |

|

|

|

369 |

|

| Net cash provided by

(used in) operating activities |

|

|

55,220 |

|

|

|

|

30,797 |

|

|

|

56,261 |

|

|

|

|

(3,306 |

) |

|

|

101,392 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(4,853 |

) |

|

|

|

(3,337 |

) |

|

|

(10,632 |

) |

|

|

|

(1,045 |

) |

|

|

(9,674 |

) |

|

Acquisition of business, net of cash acquired |

|

|

(36,444 |

) |

|

|

|

— |

|

|

|

(2,837,706 |

) |

|

|

|

— |

|

|

|

— |

|

|

Other, net |

|

|

(1,866 |

) |

|

|

|

25 |

|

|

|

(2,313 |

) |

|

|

|

16 |

|

|

|

(1,722 |

) |

| Net cash used in

investing activities |

|

|

(43,163 |

) |

|

|

|

(3,312 |

) |

|

|

(2,850,651 |

) |

|

|

|

(1,029 |

) |

|

|

(11,396 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from repayments of loans to related companies |

|

|

— |

|

|

|

|

— |

|

|

|

41,929 |

|

|

|

|

— |

|

|

|

— |

|

|

Debt issuance costs |

|

|

(4,824 |

) |

|

|

|

— |

|

|

|

(21,105 |

) |

|

|

|

— |

|

|

|

— |

|

|

Limited Partners’ interest |

|

|

25,626 |

|

|

|

|

— |

|

|

|

2,360,412 |

|

|

|

|

— |

|

|

|

— |

|

|

Proceeds from term loan |

|

|

275,000 |

|

|

|

|

— |

|

|

|

850,000 |

|

|

|

|

— |

|

|

|

— |

|

|

Repayment of term loan |

|

|

(2,125 |

) |

|

|

|

— |

|

|

|

(5,000 |

) |

|

|

|

— |

|

|

|

— |

|

|

Issuance of loans |

|

|

— |

|

|

|

|

(41,965 |

) |

|

|

— |

|

|

|

|

— |

|

|

|

(41,965 |

) |

|

Proceeds from issuance of shares |

|

|

— |

|

|

|

|

104 |

|

|

|

— |

|

|

|

|

— |

|

|

|

104 |

|

|

Dividends paid |

|

|

(360,000 |

) |

|

|

|

— |

|

|

|

(360,000 |

) |

|

|

|

— |

|

|

|

(23,359 |

) |

|

Other, net |

|

|

— |

|

|

|

|

24 |

|

|

|

— |

|

|

|

|

— |

|

|

|

24 |

|

| Net cash (used in)

provided by financing activities |

|

|

(66,323 |

) |

|

|

|

(41,837 |

) |

|

|

2,866,236 |

|

|

|

|

— |

|

|

|

(65,196 |

) |

|

Effects of exchange rate changes on cash and cash equivalents |

|

|

6,199 |

|

|

|

|

(1,151 |

) |

|

|

2,513 |

|

|

|

|

813 |

|

|

|

(640 |

) |

| Net (decrease)

increase in cash and cash equivalents and restricted

cash |

|

|

(48,067 |

) |

|

|

|

(15,503 |

) |

|

|

74,359 |

|

|

|

|

(3,522 |

) |

|

|

24,160 |

|

|

Cash and cash equivalents and restricted cash, beginning of the

period |

|

|

176,353 |

|

|

|

|

72,952 |

|

|

|

53,927 |

|

|

|

|

57,449 |

|

|

|

33,289 |

|

| Cash and cash

equivalents and restricted cash, end of the period |

|

$ |

128,286 |

|

|

|

$ |

57,449 |

|

|

$ |

128,286 |

|

|

|

$ |

53,927 |

|

|

$ |

57,449 |

|

| Less restricted cash |

|

|

257 |

|

|

|

|

— |

|

|

|

257 |

|

|

|

|

— |

|

|

|

— |

|

| Cash and cash

equivalents, end of the period |

|

$ |

128,029 |

|

|

|

$ |

57,449 |

|

|

$ |

128,029 |

|

|

|

$ |

53,927 |

|

|

$ |

57,449 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to NON-GAAP Measures

Reconciliation of Net (Loss) Earnings to Adjusted

EBITDA

|

|

|

Successor |

|

|

|

Predecessor |

|

|

Successor |

|

|

|

Predecessor |

|

| (in thousands, except

percentages) |

|

QuarterEndedDecember

31,2020 |

|

|

|

QuarterEndedDecember

31,2019 |

|

|

Period fromJanuary

29,throughDecember

31,2020 |

|

|

|

Period fromJanuary

1,throughJanuary

28,2020 |

|

|

YearEndedDecember

31,2019 |

|

|

Net (loss) earnings |

|

$ |

(26,066 |

) |

|

|

$ |

17,212 |

|

|

$ |

(110,186 |

) |

|

|

$ |

(32,556 |

) |

|

$ |

85,844 |

|

| Add

back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

tax (benefit) provision |

|

|

(11,017 |

) |

|

|

|

250 |

|

|

|

8,126 |

|

|

|

|

365 |

|

|

|

6,138 |

|

| Interest

expense (income) |

|

|

7,430 |

|

|

|

|

(156 |

) |

|

|

22,134 |

|

|

|

|

(50 |

) |

|

|

(202 |

) |

|

Depreciation and amortization |

|

|

25,996 |

|

|

|

|

1,831 |

|

|

|

91,767 |

|

|

|

|

408 |

|

|

|

6,734 |

|

|

Stock-based compensation expense |

|

|

14,350 |

|

|

|

|

1,080 |

|

|

|

27,468 |

|

|

|

|

336 |

|

|

|

2,160 |

|

|

Litigation costs (recoveries), net of

insurance proceeds(1) |

|

|

1,357 |

|

|

|

|

— |

|

|

|

(6,008 |

) |

|

|

|

— |

|

|

|

— |

|

| Foreign

exchange loss (2) |

|

|

9,212 |

|

|

|

|

1,654 |

|

|

|

14,133 |

|

|

|

|

523 |

|

|

|

1,160 |

|

| Changes

in fair value of interest rate swaps(3) |

|

|

(242 |

) |

|

|

|

— |

|

|

|

1,586 |

|

|

|

|

— |

|

|

|

— |

|

|

Transaction costs(4) |

|

|

14,403 |

|

|

|

|

— |

|

|

|

66,251 |

|

|

|

|

40,345 |

|

|

|

— |

|

| Changes

in fair value of contingent earn-out liability |

|

|

8,700 |

|

|

|

|

— |

|

|

|

27,800 |

|

|

|

|

— |

|

|

|

— |

|

| Adjusted

EBITDA |

|

$ |

44,123 |

|

|

|

$ |

21,871 |

|

|

$ |

143,071 |

|

|

|

$ |

9,371 |

|

|

$ |

101,834 |

|

| Net

(loss) earnings margin |

|

|

(15.7 |

)% |

|

|

|

13.6 |

% |

|

|

(20.3 |

)% |

|

|

|

(81.4 |

)% |

|

|

17.6 |

% |

| Adjusted

EBITDA Margin |

|

|

26.6 |

% |

|

|

|

17.3 |

% |

|

|

26.4 |

% |

|

|

|

23.4 |

% |

|

|

20.8 |

% |

________

|

(1) |

Represents certain litigation costs and insurance proceeds

associated with pending litigations or settlements of litigation.

For additional information, refer to Note 17, Commitments and

Contingencies, within the audited consolidated financial statements

and Item 3. Legal Proceedings in our Annual Report on Form 10-K for

the year ended December 31, 2020. |

|

(2) |

Represents foreign exchange loss due to foreign currency

transactions. |

|

(3) |

Represents fair value (gain) or loss on interest rate swaps. |

|

(4) |

Represents transaction costs and professional service fees related

to the Sponsor Acquisition and the initial public offering. |

Reconciliation of Net Cash Provided By (Used In)

Operating Activities to Free Cash Flow

|

|

|

Successor |

|

|

|

Predecessor |

|

|

Successor |

|

|

|

Predecessor |

|

| (in thousands, except

percentages) |

|

QuarterEndedDecember

31,2020 |

|

|

|

QuarterEndedDecember

31,2019 |

|

|

Period fromJanuary

29,throughDecember

31,2020 |

|

|

|

Period fromJanuary

1,throughJanuary

28,2020 |

|

|

YearEndedDecember

31,2019 |

|

|

Net cash provided by (used in) operating activities |

|

$ |

55,220 |

|

|

|

$ |

30,797 |

|

|

$ |

56,261 |

|

|

|

$ |

(3,306 |

) |

|

$ |

101,392 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital

expenditures |

|

|

(4,853 |

) |

|

|

|

(3,337 |

) |

|

|

(10,632 |

) |

|

|

|

(1,045 |

) |

|

|

(9,674 |

) |

| Free

Cash Flow |

|

$ |

50,367 |

|

|

|

$ |

27,460 |

|

|

$ |

45,629 |

|

|

|

$ |

(4,351 |

) |

|

$ |

91,718 |

|

|

Operating Cash Flow Conversion(1) |

|

|

(211.8 |

)% |

|

|

|

178.9 |

% |

|

|

(51.1 |

)% |

|

|

|

10.2 |

% |

|

|

118.1 |

% |

| Free

Cash Flow Conversion |

|

|

114.2 |

% |

|

|

|

125.6 |

% |

|

|

31.9 |

% |

|

|

|

(46.4 |

)% |

|

|

90.1 |

% |

________

|

(1) |

Operating Cash Flow Conversion is calculated based on net cash

provided by (used in) operating activities as a percentage of net

earnings (loss) in any measurement period. |

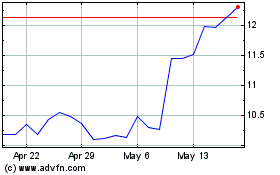

Bumble (NASDAQ:BMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bumble (NASDAQ:BMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024