Form 8-K - Current report

19 January 2024 - 12:00AM

Edgar (US Regulatory)

NJ false 0001913971 0001913971 2024-01-18 2024-01-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 18, 2024

Date of Report (Date of earliest event reported)

PRINCETON BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

001-41589 |

|

88-4268702 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Ident. No.) |

|

|

|

|

|

183 Bayard Lane, Princeton, New Jersey |

|

08540 |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

(609) 921-1700

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered or to be registered pursuant to Section 12(b) of the Act

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, no par value |

|

BPRN |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

On January 18, 2024, Princeton Bancorp, Inc. (“Princeton Bancorp” or “the Company”) released a presentation to investors about the Transaction (as defined below). The presentation is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The preceding information, as well as Exhibit 99.1 referenced therein, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On January 18, 2024, Princeton Bancorp and Cornerstone Financial Corporation (“CFC”) jointly issued a press release announcing that they had entered into a definitive agreement and plan of merger pursuant to which Princeton Bancorp will acquire CFC (the “Transaction”). A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

Cautionary Notes on Forward-Looking Statements

This communication contains forward-looking statements, including statements about future results. Investors are cautioned that all forward-looking statements involve risks and uncertainty. These forward-looking statements may include: management plans relating to the Transaction; the expected timing of the completion of the Transaction; the ability to complete the Transaction; the ability to obtain any required regulatory, stockholder or other approvals, authorizations or consents; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating to the Transaction; any statements of expectation or belief; any projections or plans related to certain financial or operational metrics; and any statements of assumptions underlying any of the foregoing. Statements preceded by, followed by or that include the words “may,” “could,” “should,” “pro forma,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan” or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important economic, regulatory, legal and technological factors, among others, that could cause the Company’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements.

Factors that could cause or contribute to such differences include, but are not limited to, those included under the “Risk Factor” section and elsewhere in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in Part II, Item 1A of its quarterly report on Form 10-Q for the quarter-ended March 31, 2023, as well as those disclosed in the Company’s other periodic reports filed with the SEC, and the possibility that expected benefits of the Transaction may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the Transaction may not be timely completed, if at all; that prior to the completion of the Transaction or thereafter, the Company’s and CFC’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies related to the Transaction; that required

regulatory, stockholder or other approvals, authorizations or consents in connection with the Transaction are not obtained or other customary closing conditions are not satisfied in a timely manner or at all; reputational risks and the reaction of the companies’ stockholders, customers, employees and other constituents to the Transaction; and diversion of management time as a result of the matters related to the Transaction. These risks, as well as other risks associated with the Transaction, will be more fully discussed in the prospectus of the Company and proxy statement of CFC that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the Transaction. The list of factors presented here, and the list of factors that will be presented in the registration statement on Form S-4, is not, and should not be, considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. For any forward-looking statements made in this communication or in any documents, the Company or CFC claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results.

Additional Information about the Proposed Transaction

This communication is being made in respect of the proposed transaction involving the Company and CFC.

In connection with the proposed transaction with CFC, the Company intends to file a registration statement on Form S-4 containing a prospectus of the Company and proxy statement of CFC and other documents with the SEC. Before making any voting or investment decision, the investors and stockholders of CFC are urged to carefully read the entire prospectus of the Company and proxy statement of CFC when they become available and any other documents filed by the Company with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about the Company, CFC and/or the proposed transaction. When available, copies of the prospectus of the Company and proxy statement of CFC will be mailed to the stockholders of CFC. CFC investors and stockholders are also urged to carefully review and consider the Company’s public filings with the SEC, including but not limited to its Annual Reports on Form 10-K, proxy statements, Current Reports on Form 8-K and Quarterly Reports on Form 10-Q. When available, copies of the prospectus of the Company and the proxy statement of CFC also may be obtained free of charge at the SEC’s web site at http://www.sec.gov. You may also obtain these documents, free of charge, from the Company by accessing the Company’s website at https://thebankofprinceton.com/ under the tab “Investor Relations” and then under the heading “Financial Information” under the sub-heading “Public Filings”.

Participants in the Solicitation

The Company, CFC and certain of their respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of CFC’s stockholders in connection with the Transaction. Information about the directors and executive officers of the Company and their ownership of Company common stock is set forth in the proxy statement for the Company’s 2023 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on April 3, 2023. Additional information regarding the interests of those participants and other persons who may be deemed participants in the solicitation of proxies of CFC’s stockholders in connection with the Transaction may be obtained by reading the proxy statement of CFC and prospectus of the Company regarding the Transaction when they become available. Once available, free copies of the proxy statement of the CFC and prospectus of the Company may be obtained as described on the previous page.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

For The Bank of Princeton:

Edward J. Dietzler, President and CEO

Phone: (609) 454-0717

Or

For Cornerstone:

Gene D’Orazio, President and CEO

Phone: (856) 380-8050

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PRINCETON BANCORP. INC. |

| Dated: January 18, 2024 |

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ George S. Rapp |

|

|

|

|

|

|

George S. Rapp |

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer |

Investor Presentation January 18, 2024

Acquisition of 5 1 2 242 111 33 200 111 51 191 191 191 Exhibit 99.1

Forward Looking Statements This

presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about the financial condition, results of operations, asset quality trends and profitability of The

Bank of Princeton (“BPRN”). Forward-looking statements are not historical facts but instead express only management’s current expectations and forecasts of future events or long-term-goals, many of which, by their nature, are

inherently uncertain and outside of BPRN’s control. Forward-looking statements are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and other similar expressions, as well

as any statements related to future expectations of performance or conditional verbs, such as “will,” “would,” “should,” “could” or “may.” BPRN’s actual results and financial

condition may differ, possibly materially, from those indicated in these forward-looking statements. Factors that could cause BPRN’s actual results to differ materially from those described in the forward-looking statements include impacts

from COVID-19 pandemic on local, national and global economic conditions; higher default rates on loans made to our customers related to the COVID-19 pandemic and its impact on our customers’ operations and financial condition; unexpected

changes in interest rates or disruptions in the mortgage markets related to COVID-19 or other responses to the health crisis; and the other factors contained in BPRN’s periodic reports and registration statements, filed with the Securities and

Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2022, and Quarterly Report on Form 10-Q, which have been filed with the Securities and Exchange Commission and are available on BPRN’s website

(www.thebankofprinceton.com) and on the Securities and Exchange Commission’s website (www.sec.gov) . Forward-looking statements are not guarantees of future performance and should not be relied upon as representing management’s views as

of any subsequent date. BPRN undertakes no obligation to updated forward-looking statements, whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Measures This presentation contains certain financial

information determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include “Core Deposits” and “Tangible Common

Equity ratio.” BPRN believes that these non-GAAP financial measures provide both management and investors a more completed understanding of BPRN’s deposit profile and capital. These non-GAAP financial measures are supplemental and are

not substitute for any analysis based on GAAP financial measures. Because not all companies use the same calculation of “Core Deposits” and “Tangible Common Equity ratio,” this presentation may not be comparable to other

similarly titled measures as calculated by other companies. Disclosure Statement

Low risk, market fill-in transaction

that enhances the core banking franchise Adds scale in the Greater Philadelphia market with 6 branches and an attractive core funding base Opportunity for significant cost savings and operational enhancements Significant cash EPS accretion (~16%1 in

2025) on a relative basis with Cornerstone owning 8% of the pro forma company Manageable TBV dilution with an earnback period of ~2.5 years2 Acquisition priced at a discount to tangible book value (75% P/TBV) Internal rate of return >30%

Materially accretive to ROAA and ROAE Attractive pricing metrics and deal structure (minimum net worth requirement) mitigates risk in the transaction Low execution risk: Cornerstone comprises less than 15% of pro forma balance sheet Strong pro forma

capital position (TCE/TA of 10.4%3) with enhanced capital generation going forward Prudent Acquisition Financially Attractive Strategic Rationale Strategically Compelling (1) Excludes the impact of purchase accounting rate marks, CDI and CECL

amortization (2) Tangible book value earnback calculated using the crossover method (3) Pro forma TCE/TA is estimated and shown at the transaction close

$321M Assets $276M Loans $290M

Deposits 0.08% ROAA 1.52% Cost of deposits 3.61% NIM $20M Market Cap1 7.4% TCE/TA 0.14% NPAs / Assets Loan & Deposit Composition Cornerstone Financial Corporation (CFIC) Source: S&P Capital IQ Pro; Financial data as of or for the quarter

ended September 30, 2023 Note: Jumbo time deposits defined as time deposits greater than $100 thousand (1) Market capitalization as of January 17, 2024 Company Overview Branch Footprint 2023Q3 Highlights Holding company for Cornerstone Bank,

headquartered in Mount Laurel, New Jersey Founded in 1999 Operates 6 branches serving consumers and businesses throughout the Greater Philadelphia market CFIC (6) CFIC HQ $276M Loans $290M Deposits

Pro Forma Highlights1 Pro Forma

Franchise Source: Company provided documents; S&P Capital IQ Pro (1) Balance sheet pro forma highlights estimated at close; includes merger adjustments assumed in the transaction Pro Forma Branch Network NJ NY PA BPRN Branches (29) CFIC Branches

(6) CFIC HQ Philadelphia NYC Trenton Low risk, market fill-in transaction that provides increased scale in the Greater Philadelphia market $2.3B Assets $1.8B Loans $2.0B Deposits 10.4% TCE/TA 1.02% 2025 ROAA

$276M $1.5B $1.8B Pro Forma Pro Forma

Loan & Deposit Composition Source: S&P Capital IQ Pro; Financial data as of or for the quarter ended September 30, 2023 Note: Pro forma data excludes purchase accounting adjustments; jumbo time deposits defined as time deposits greater than

$100 thousand Loan Portfolio Composition Deposit Portfolio Composition Yield on Loans: 6.37% Yield on Loans: 5.24% Yield on Loans: 6.20% $290M $1.6B $1.9B Pro Forma Cost of Deposits: 2.56% Cost of Deposits: 1.52% Cost of Deposits: 2.40%

100% stock consideration 0.24 shares

of BPRN common stock for each share of CFIC common stock Implied price per share of $8.16 for an aggregate deal value of $17.9M1 Minimum net worth requirement with exchange ratio adjustment mechanism Approximately 92% BPRN / 8% CFIC Deal value /

tangible book value: 75% Deal value / (2025E earnings + cost savings2): 3.6x Cost savings of $5.7 million (pre-tax) or 50% of CFIC’s noninterest expense base 75% phased-in for 2024 and 100% thereafter Gross credit mark on loans of $3.7 million

(1.3% of gross loans) $1.5 million allocated to purchase credit deteriorated (PCD) loans $2.2 million allocated to non-PCD loans Day-2 CECL reserve equal to $2.2 million $10.3 million rate mark write-down of loan portfolio $2.5 million write-down of

other assets $1.0 million rate mark write-down on deposits $8.7 million core deposit intangible amortized over 10 years using the sum of years method $7.2M in pre-tax merger charges CFIC preferred equity of $3.3 million is repaid at par value at

transaction close Expected closing in the 2nd or 3rd quarter of 2024 CFIC shareholder approval and customary regulatory approvals Key Transaction Assumptions Transaction Terms & Key Modeling Assumptions (1) Based on BPRN’s market price of

$34.00 as of January 17, 2024 and assumes 2,191,999 CFIC shares outstanding (2) Assumes $5.7 million of pre-tax cost savings (50% of CFIC’s non-interest expense base) Consideration Multiples Timing and Approvals Ownership

Financial Impact Summary (1) Excludes

the impact of purchase accounting rate marks (AOCI, loans and deposits) (2) Cash EPS accretion also excludes CDI and CECL amortization (3) Tangible book value earnback calculated using the crossover method (4) Pro forma capital ratios are estimated

and shown at the transaction close Earnings Impact TBV Impact Pro Forma Capital4 (5.7%) Dilution at Close 2.5 years Earnback3 ~8% 2024E EPS Accretion ~21% 2025E EPS Accretion 10.4% TCE / TA 10.7% Leverage Ratio 12.2% Tier 1 Ratio 13.4% TRBC Ratio

GAAP Metrics Non-GAAP Metrics1 (Excl. AOCI & Rate Marks) ~5% 2024E Cash EPS Accretion2 ~16% 2025E Cash EPS Accretion2 (2.3%) Dilution at Close 1.6 years Earnback3 10.8% TCE / TA 11.1% Leverage Ratio 12.6% Tier 1 Ratio 13.8% TRBC Ratio

Exhibit 99.2

PRINCETON BANCORP, INC.

FOR IMMEDIATE

RELEASE

PRINCETON BANCORP, INC. AGREES TO ACQUIRE

CORNERSTONE FINANCIAL CORPORATION

PRINCETON and MOUNT LAUREL, NJ, January 18, 2024 – Princeton Bancorp, Inc. (NASDAQ – BPRN), the parent company of The Bank

of Princeton, Princeton, New Jersey, and Cornerstone Financial Corporation (OTC – “CFIC”) (“Cornerstone”), the parent company of Cornerstone Bank, Mount Laurel, New Jersey, jointly announced today that they have entered into

a definitive agreement and plan of merger pursuant to which Princeton Bancorp will acquire Cornerstone in a transaction valued at approximately $17.9 million. Under the terms of the merger agreement, which has been approved by the boards of

directors of both companies, Cornerstone will merge with, into and under the charter of Princeton Bancorp. In the merger, each share of Cornerstone common stock outstanding will be exchanged for 0.24 shares of Princeton Bancorp, subject to

adjustment, having a value of $8.16 per share based on the $34.00 closing price of Princeton Bancorp common stock on January 17, 2024. Each share of Cornerstone’s preferred stock outstanding will be exchanged for its stated value of $1,000

per share. The transaction is subject to receipt of all required banking regulatory approvals, Cornerstone stockholder approval and certain financial and other contingencies. The transaction is expected to close in the second or third quarter of

2024.

Background on Cornerstone

Cornerstone

Financial Corporation is a New Jersey based bank holding company headquartered in Mount Laurel, New Jersey and is the holding company for Cornerstone Bank, a New Jersey state chartered commercial bank. Cornerstone had approximately $321 million

in assets, $276 million in loans, $290 million of deposits, and $23.8 million in consolidated common stockholders’ equity as of September 30, 2023. Cornerstone Bank commenced operations in October of 1999 and conducts

business from its main office in Moorestown and from five additional branch offices located in Medford, Burlington City, Cherry Hill, Voorhees and Woodbury, New Jersey.

Transaction Highlights

| |

• |

|

The purchase price equates to approximately 75% of Cornerstone’s tangible book value as of

September 30, 2023. Based on current estimated purchase accounting adjustments, the transaction is expected to be 5.7% dilutive to Princeton Bancorp’s tangible book value per share, with a projected earn-back period of 2.5 years.

|

| |

• |

|

The transaction is also expected to be 21% accretive to Princeton Bancorp’s 2025 earnings per share on a

GAAP basis and 16% accretive on a cash basis. |

| |

• |

|

Following the transaction, Princeton Bancorp will have approximately $2.3 billion in total assets,

$1.8 billion in loans and $2.0 billion in deposits, with 28 branches in New Jersey, five branches in the Philadelphia, Pennsylvania area and two in the New York City metropolitan area. |

| |

• |

|

Under the terms of the merger agreement, if the sum of Cornerstone’s common stockholders’ equity and

allowance for loan losses as of the month end immediately prior to the Closing Date, as calculated in accordance with the merger agreement, is less than the sum of Cornerstone’s stockholders’ equity and allowance for loan losses at

September 30, 2023, as calculated in accordance with the merger agreement ($26.8 million), the exchange ratio will be reduced to reflect the amount of the deficiency. |

| |

• |

|

As of the effective time of the Merger, one member of the board of directors of Cornerstone, to be selected by

the Nominating/Governance Committee of Princeton Bancorp, will be appointed to the board of directors of Princeton Bancorp. |

| |

• |

|

Support agreements to vote in favor of the merger were received from the directors and executive officers of

Cornerstone. |

|

| The Bank of Princeton

January 18, 2024 Page

2 |

| |

Management Commentary

Edward J. Dietzler, President and CEO, stated, “We are thrilled to announce the agreement with Cornerstone Financial. Cornerstone represents the second

acquisition we have announced in the last 15 months, and further supports our growth in the southern New Jersey market, while doing so in a manner that is minimally dilutive to tangible book value and accretive to our earnings. It provides a great

opportunity to combine two community banks that share a deep commitment to their local markets, fills in our South Jersey branch presence and enhances our core banking franchise. We are excited to welcome Cornerstone’s employees, customers, and

shareholders to Princeton Bancorp, and we believe this transaction will enhance our long-term profitability metrics and earnings growth rate. This acquisition aligns with our continued vision of being the premier community bank in all of our

markets.”

Gene D’Orazio, the President and CEO of Cornerstone Bank, stated, “We are excited to join The Bank of Princeton, a strong,

well-managed organization that shares a common philosophy focused on supporting customers, employees, and communities. As part of a larger organization, we believe our customers will benefit from expanded financial products and resources, as well as

greater access to additional full-service bank locations throughout the Philadelphia and South Jersey market. We also believe that our employees will have greater opportunities for growth and advancement as part of a larger community bank with such

an outstanding reputation. Finally, we believe our shareholders will also benefit as part of a dividend paying larger bank with greater liquidity and strong earnings power.”

Advisors

Raymond James & Associates, Inc.

served as financial advisor to Princeton Bancorp, and Stevens & Lee, P.C. is serving as its legal counsel. Janney Montgomery Scott served as financial advisor to Cornerstone and rendered a fairness opinion. Windels Marx Lane &

Mittendorf, LLP is serving as legal counsel to Cornerstone.

About Princeton Bancorp, Inc.

Princeton Bancorp, Inc. is the holding company for The Bank of Princeton, a community bank founded in 2007. The Bank is a New Jersey state-chartered commercial

bank with 22 branches in New Jersey, including three in Princeton and others in Bordentown, Browns Mills, Chesterfield, Cream Ridge, Deptford, Fort Lee, Hamilton, Kingston, Lakewood, Lambertville, Lawrenceville, Monroe, New Brunswick, Palisades

Park, Pennington, Piscataway, Princeton Junction, Quakerbridge and Sicklerville. There are also five branches in the Philadelphia, Pennsylvania area and two in the New York City metropolitan area. The Bank of Princeton is a member of the

Federal Deposit Insurance Corporation (“FDIC”).

About Cornerstone

Cornerstone Financial Corporation is a New Jersey based bank holding company headquartered in Mount Laurel, New Jersey and is the holding company for

Cornerstone Bank, a New Jersey state chartered commercial bank. Cornerstone Bank commenced operations in October, 1999 and conducts business from its main office in Moorestown and from five additional branch offices located in Medford, Burlington

City, Cherry Hill, Voorhees and Woodbury, New Jersey More information is available at https://www.cornerstonebank.net.

Statements made in this

release, other than those concerning historical financial information, may be considered forward-looking statements, which speak only as of the date of this release and are based on current expectations and involve a number of assumptions. These

include statements as to the anticipated benefits of the merger, including future financial and operating results, cost savings and enhanced revenues that may be realized from the merger as well as other statements of expectations regarding the

merger and any other statements regarding future results or expectations. Each of Princeton Bancorp and Cornerstone intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of these safe harbor provisions. The entities’ respective abilities to predict results, or the actual effect of future

|

| The Bank of Princeton

January 18, 2024 Page

3 |

| |

plans or strategies, is inherently uncertain. Factors that could have a material effect on the operations and future prospects of each of Princeton Bancorp and Cornerstone and the resulting

entity, include but are not limited to: (1) the businesses of the Princeton Bancorp and Cornerstone may not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; (2) expected revenue

synergies and cost savings from the merger may not be fully realized or realized within the expected timeframe; (3) revenues following the merger may be lower than expected; (4) customer and employee relationships and business operations

may be disrupted by the merger; (5) the ability to obtain required regulatory and shareholder approvals, and the ability to complete the merger on the expected timeframe may be more difficult, time-consuming or costly than expected;

(6) changes in interest rates, general economic conditions, legislation and regulation, and monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury, the Federal Deposit Insurance Corporation and the Board of

Governors of the Federal Reserve System; (7) the ongoing impact of higher inflation levels, higher interest rates and general economic and recessionary concerns, all of which could impact economic growth and could cause a reduction in financial

transactions and business activities, including decreased deposits and reduced loan originations, (8) our ability to manage liquidity in a rapidly changing and unpredictable market, (9) the global impact of the military conflicts in the

Ukraine and the Middle East, (10) the quality and composition of the loan and securities portfolios, demand for loan products, deposit flows, competition, and demand for financial services in the companies’ respective market areas;

(11) the implementation of new technologies, and the ability to develop and maintain secure and reliable electronic systems; (12) accounting principles, policies, and guidelines; and (13) other risk factors detailed from time to time

in filings made by Princeton Bancorp with the SEC. Forward-looking statements reflect Princeton Bancorp and Cornerstone management’s analysis as of the date of this release, even if subsequently made available by Princeton Bancorp and

Cornerstone on their respective websites or otherwise. Princeton Bancorp and Cornerstone undertake no obligation to update or clarify these forward-looking statements, whether as a result of new information, future events or otherwise. For a list of

other factors which would affect the operations and future prospects of each of Princeton Bancorp and the resulting entity in the merger, see Princeton Bancorp’s filings with the SEC under the Securities Exchange Act of 1934, including those

risk factors identified in the “Risk Factor” section and elsewhere in Princeton Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2022, and in Part II, Item 1A

of its quarterly report on Form 10-Q for the quarter-ended March 31, 2023.

For The Bank of

Princeton:

Edward J. Dietzler, President and CEO

Phone:

(609) 454-0717

or

For Cornerstone:

Gene D’Orazio, President and CEO

Phone: (856) 380-8050

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

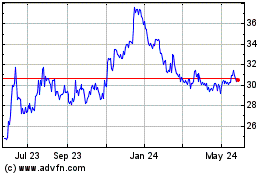

Princeton Bancorp (NASDAQ:BPRN)

Historical Stock Chart

From Apr 2024 to May 2024

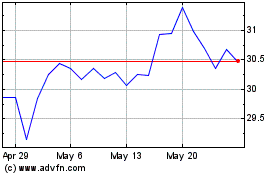

Princeton Bancorp (NASDAQ:BPRN)

Historical Stock Chart

From May 2023 to May 2024