UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Amendment No. 5)

RULE 13e-3 TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

Brookfield

Property Partners L.P.

(Name of the Issuer)

Brookfield Property Partners L.P.

Brookfield Asset Management Inc.

BPY Arrangement

Corporation

(Name of Persons Filing Statement)

Limited Partnership

Units

(Title of Class of Securities)

G16249107

(CUSIP Number of Class of Securities)

Bryan K. Davis

Brookfield Property Partners L.P.

73 Front Street, 5th Floor

Hamilton, HM 12, Bermuda

Telephone: (441) 294-3309

|

|

Justin B. Beber

Brookfield Asset Management Inc.

BPY Arrangement Corporation

Brookfield Place

181 Bay Street, Suite 300

Toronto, Ontario M5J 2T3

Telephone: (416) 363-9491

|

(Name, Address, and Telephone Numbers of Persons

Authorized to Receive Notices

and Communications on Behalf of Persons Filing Statement)

Copies to:

Mile T. Kurta

Torys LLP

1114 Avenue

of the Americas,

23rd Fl.

New York,

New York

10036

(212) 880-6000

|

Karrin Powys-Lybbe

Torys LLP

79 Wellington St. W.

30th Fl.

Toronto, ON M5K 1N2

(416) 865-0400

|

Mark Gerstein

Julian

Kleindorfer

Latham &

Watkins LLP

885 Third Avenue

New York, New

York 10022

(212) 906-1200

|

Sheldon Freeman

Michelle Vigod

Goodmans LLP

Bay Adelaide Centre -

West Tower

333 Bay Street, Suite

3400

Toronto, ON M5H

2S7

(416) 979-2211

|

Mark S. Opper

David H. Roberts

Goodwin Procter LLP

100 Northern Avenue

Boston, Massachusetts

02210

(617) 570-1000

|

This statement is filed in connection with (check the appropriate box):

|

|

a.

|

¨

|

|

The filing of solicitation materials or an information statement subject to Regulation 14A (§§240.14a-1 through 240.14b-2), Regulation 14C (§§240.14c-1 through 240.14c-101) or Rule 13e-3(c) (§240.13e-3(c)) under the Securities Exchange Act of 1934 (the “Act”).

|

|

|

b.

|

x

|

|

The filing of a registration statement under the Securities Act of 1933.

|

|

|

c.

|

¨

|

|

A tender offer.

|

|

|

d.

|

¨

|

|

None of the above.

|

Check the following box if the soliciting materials

or information statement referred to in checking box (a) are preliminary copies: ¨

Check the following box if the filing is a final amendment reporting

the results of the transaction: ¨

Calculation of Filing Fee

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

$6,224,601,119.16

|

|

$679,103.98

|

* Calculated solely for purposes of determining

the filing fee. The transaction value was calculated based on the market value of limited partnership units of Brookfield Property

Partners L.P. (“BPY Units”) (the securities to be acquired as described in this Transaction Statement on Schedule 13E-3)

in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended, as follows: the sum of (i) the product

of (w) $17.76, the average of the high and low prices per BPY Unit on April 20, 2021 as quoted on the Nasdaq Stock Market, multiplied

by (x) 289,587,416 BPY Units and (ii) the product of (y) $18.50, the average of the high and low prices per BPY Unit on

May 24, 2021 as quoted on the Nasdaq Stock Market, multiplied by (z) 58,461,006 BPY Units. The aforementioned estimated number

of BPY Units relates to the number of BPY Units (which includes BPY Units underlying certain equity awards of BPY and certain outstanding

exchangeable securities) to be acquired by the Purchaser Parties (as defined below) pursuant to the transaction in this Transaction Statement

on Schedule 13E-3.

** Determined in accordance with Rule 0-11

under the Exchange Act at a rate equal to $109.10 per $1,000,000 of transaction value.

x

Check the box if any part of the fee is offset as provided by §240.0-11(a)(2) and identify the filing with which the offsetting

fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

Amount Previously Paid: $

77,198.90*

Form or Registration No.: Schedule

13E-3

Filing Party: Brookfield Property Partners

L.P., Brookfield Asset Management Inc. and BPY Arrangement Corporation

Date Filed: May 28, 2021

Amount Previously Paid: $

40,775.00*

Form or Registration No.: Registration

Statement on Form F-4

Filing Party: Brookfield Asset Management

Inc., Brookfield Property Preferred L.P., Brookfield Property Partners L.P., Brookfield Property L.P., Brookfield BPY Holdings Inc., Brookfield

BPY Retail Holdings II Inc., BPY Bermuda Holdings Limited, BPY Bermuda Holdings II Limited, BPY Bermuda Holdings IV Limited, BPY Bermuda

Holdings V Limited and BPY Bermuda Holdings VI Limited

Date Filed: May 27, 2021

Amount Previously Paid: $279,026.47*

Form or Registration No.: Registration

Statement on Form F-4

Filing Party: Brookfield Asset Management

Inc., Brookfield Property Preferred L.P., Brookfield Property Partners L.P., Brookfield Property L.P., Brookfield BPY Holdings Inc., Brookfield

BPY Retail Holdings II Inc., BPY Bermuda Holdings Limited, BPY Bermuda Holdings II Limited, BPY Bermuda Holdings IV Limited, BPY Bermuda

Holdings V Limited and BPY Bermuda Holdings VI Limited

Date Filed: April 26, 2021

|

Amount Previously Paid: $282,103.61*

Form or Registration No.: Schedule 13E-3

Filing Party: Brookfield Property Partners L.P., Brookfield

Asset Management Inc. and BPY Arrangement Corporation

Date Filed: April 26, 2021

|

*Represents filing fee associated with the acquisition

of BPY Units (which includes BPY Units underlying certain equity awards of BPY and certain outstanding exchangeable securities) by the

Purchaser Parties as described in this Transaction Statement on Schedule 13E-3.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS: APPROVED OR DISAPPROVED OF THIS TRANSACTION; PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION;

OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

INTRODUCTION

This Amendment No. 5

(“Amendment No. 5”) to the Rule 13e-3 Transaction Statement on Schedule 13E-3, together with the exhibits

hereto (as amended to the date hereof, this “Schedule 13E-3”), is being filed with the Securities and Exchange Commission

(the “SEC”) by Brookfield Asset Management Inc., a corporation organized under the laws of Ontario, Canada (“BAM”),

BPY Arrangement Corporation, a corporation organized under the laws of Ontario (“Purchaser Sub” and together with BAM,

the “Purchaser Parties”), and Brookfield Property Partners L.P., a Bermuda exempted limited partnership (“BPY”

and together with the Purchaser Parties, the “Filing Persons”). BAM, New LP (as defined in this Schedule 13E-3) and

the Guarantors (as defined in this Schedule 13E-3) have filed with the SEC a registration statement on Form F-4 (File Nos. 333-255512,

333-255512-01, 333-255512-02, 333-255512-03, 333-255512-04, 333-255512-05, 333-255512-06, 333-255512-07, 333-255512-08, 333-255512-09

and 333-255512-10) (as amended by Amendments No. 1 and No. 2 to the registration statement on Form F-4 and the final prospectus

on Form 424(b)(3), the “Registration Statement”), which includes a circular/prospectus (the “circular/prospectus”),

to register under the U.S. Securities Act of 1933, as amended (the “Securities Act”), BAM Shares, New LP Preferred

Units and the related Guarantees (each as defined below). The Registration Statement became effective under the Securities Act on June 8,

2021 and the final circular/prospectus was mailed to BPY Unitholders on or about June 17, 2021.

Defined terms used herein

but not defined in this Amendment No. 5 shall have the meanings given to them in this Schedule 13E-3.

Item 15. Additional Information.

(c) Other Material information.

Item 15(c) of this Schedule 13E-3 is hereby amended and supplemented

by adding the following thereto:

On July 16, 2021, BPY held the

Meeting, at which BPY Unitholders voted to approve the Arrangement and the Arrangement Resolution by the affirmative vote of BPY Unitholders

meeting the Standard Approval Threshold and the Majority of the Minority Threshold.

Item 16. Exhibits.

Item 16 of this Schedule 13E-3 is hereby amended and supplemented by

adding the following thereto:

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: July 16, 2021

|

BROOKFIELD PROPERTY PARTNERS L.P., by its general partner, BROOKFIELD PROPERTY PARTNERS LIMITED

|

|

|

|

|

|

By:

|

/s/ Jane Sheere

|

|

|

|

Name: Jane Sheere

|

|

|

|

Title: Secretary

|

|

Dated: July 16, 2021

|

BROOKFIELD ASSET MANAGEMENT INC.

|

|

|

|

|

|

By:

|

/s/ Kathy Sarpash

|

|

|

|

Name: Kathy Sarpash

|

|

|

|

Title: Senior Vice President

|

|

Dated: July 16, 2021

|

BPY ARRANGEMENT CORPORATION

|

|

|

|

|

|

By:

|

/s/ Allen Yi

|

|

|

|

Name: Allen Yi

|

|

|

|

Title: Senior Vice President

|

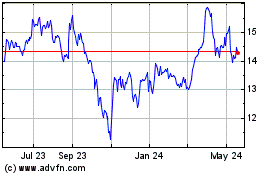

Brookfield Property Part... (NASDAQ:BPYPP)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brookfield Property Part... (NASDAQ:BPYPP)

Historical Stock Chart

From Nov 2023 to Nov 2024