KANZHUN LIMITED (“BOSS Zhipin” or the “Company”) (Nasdaq: BZ; HKEX:

2076), a leading online recruitment platform in China, today

announced its unaudited financial results for the quarter ended

September 30, 2024.

Third Quarter 2024

Highlights

- Total paid

enterprise customers1 in the twelve

months ended September 30, 2024 were 6.0 million, an increase of

22.4% from 4.9 million in the twelve months ended September 30,

2023.

- Average

monthly active users

(MAU)2 for the third quarter of

2024 were 58.0 million, an increase of 30.0% from 44.6 million for

the same quarter of 2023.

-

Revenues for the third quarter of 2024 were

RMB1,911.6 million (US$272.4 million), an increase of 19.0% from

RMB1,606.6 million for the same quarter of 2023.

-

Income from operations for the

third quarter of 2024 was RMB330.2 million (US$47.1 million), an

increase of 26.5% from RMB261.0 million for the same quarter of

2023. Adjusted income from

operations3 for the third quarter of 2024

was RMB605.3 million (US$86.2 million), an increase of 10.2% from

RMB549.4 million for the same quarter of 2023.

- Net

income for the third quarter of 2024 was RMB463.8 million

(US$66.1 million), an increase of 8.9% from RMB425.7 million for

the same quarter of 2023. Adjusted net

income3 for the third quarter of 2024 was

RMB738.9 million (US$105.3 million), an increase of 3.5% from

RMB714.1 million for the same quarter of 2023.

Mr. Jonathan Peng Zhao, Founder, Chairman and

Chief Executive Officer of the Company, remarked, “While the

overall recruitment market environment remained challenging in the

third quarter, our strategical emphasis on key growth engines

continue to yield positive results. Robust user growth, solid

enterprise retention and stable ARPPU (average revenue per paying

enterprise user), all attest the resilience of our business model

in the face of headwinds and the sustainability of our monetization

approach. Our unwavering commitment to shareholder returns, coupled

with ongoing share repurchase efforts, underscores the management’s

resolute confidence in the Company’s long-term growth

trajectory.”

Mr. Phil Yu Zhang, Chief Financial Officer of

the Company, elaborated, “We delivered solid sets of financial

results in the third quarter with revenues up by 19.0% year-on-year

and net income hitting quarterly record high. Our cost structure

remained stable, meanwhile achieved a robust 30.0% year-on-year MAU

growth, showcasing improved marketing efficiency. As we continue to

focus on sustainable cost control, the strong operating leverage

inherent in our business model will further enhance our

profitability in the coming quarters.”

__________________

1 Paid enterprise customers are defined as

enterprise users and company accounts from which we recognize

revenues for our online recruitment services.2 Monthly active users

refer to the number of verified user accounts, including both job

seekers and enterprise users, that logged on to our mobile

application in a given month at least once.3 It is a non-GAAP

financial measure, excluding the impact of share-based compensation

expenses. For more information about the non-GAAP financial

measures, please see the section of “Non-GAAP Financial

Measures.”

Third Quarter 2024 Financial

Results

Revenues

Revenues were RMB1,911.6 million (US$272.4

million) for the third quarter of 2024, representing an increase of

19.0% from RMB1,606.6 million for the same quarter of 2023.

- Revenues from

online recruitment services to enterprise customers were RMB1,889.1

million (US$269.2 million) for the third quarter of 2024,

representing an increase of 18.7% from RMB1,591.5 million for the

same quarter of 2023. This increase was mainly driven by the paid

enterprise user growth.

- Revenues from

other services, which mainly comprise paid value-added services

offered to job seekers, were RMB22.5 million (US$3.2 million) for

the third quarter of 2024, representing an increase of 49.0% from

RMB15.1 million for the same quarter of 2023, mainly benefiting

from expanded user base.

Operating cost and expenses

Total operating cost and expenses were

RMB1,586.9 million (US$226.1 million) for the third quarter of

2024, representing an increase of 16.8% from RMB1,358.7 million for

the same quarter of 2023. Total share-based compensation expenses

were RMB275.1 million (US$39.2 million) for the third quarter of

2024, representing a decrease of 4.6% from RMB288.4 million for the

same quarter of 2023.

- Cost of

revenues was RMB314.0 million (US$44.7 million) for the

third quarter of 2024, representing an increase of 17.4% from

RMB267.5 million for the same quarter of 2023, primarily due to

increases in server and bandwidth cost, payment processing cost and

employee-related expenses.

- Sales and

marketing expenses were RMB522.3 million (US$74.4 million)

for the third quarter of 2024, representing an increase of 14.2%

from RMB457.3 million for the same quarter of 2023, primarily due

to increased advertising expenses mainly resulting from the

marketing campaigns launched during the Paris 2024 Olympic Games

and the UEFA Euro 2024.

- Research

and development expenses were RMB464.2 million (US$66.1

million) for the third quarter of 2024, representing an increase of

12.0% from RMB414.4 million for the same quarter of 2023, primarily

due to increased investments in technology.

- General

and administrative expenses were RMB286.4 million (US$40.8

million) for the third quarter of 2024, representing an increase of

30.5% from RMB219.4 million for the same quarter of 2023, primarily

due to increased employee-related expenses.

Income from operations and adjusted

income from operations

Income from operations was RMB330.2 million

(US$47.1 million) for the third quarter of 2024, representing an

increase of 26.5% from RMB261.0 million for the same quarter of

2023.

Adjusted income from operations was RMB605.3

million (US$86.2 million) for the third quarter of 2024,

representing an increase of 10.2% from RMB549.4 million for the

same quarter of 2023.

Net income and adjusted net

income

Net income was RMB463.8 million (US$66.1

million) for the third quarter of 2024, representing an increase of

8.9% from RMB425.7 million for the same quarter of 2023.

Adjusted net income was RMB738.9 million

(US$105.3 million) for the third quarter of 2024, representing an

increase of 3.5% from RMB714.1 million for the same quarter of

2023.

Net income per American depositary share

(“ADS”) and adjusted net income per ADS

Basic and diluted net income per ADS

attributable to ordinary shareholders for the third quarter of 2024

were RMB1.06 (US$0.15) and RMB1.03 (US$0.15), respectively,

compared to basic and diluted net income per ADS of RMB0.98 and

RMB0.95 for the same quarter of 2023.

Adjusted basic and diluted net income per ADS

attributable to ordinary shareholders3 for the third quarter of

2024 were RMB1.68 (US$0.24) and RMB1.64 (US$0.23), respectively,

compared to adjusted basic and diluted net income per ADS of

RMB1.64 and RMB1.59 for the same quarter of 2023.

Net cash provided by operating

activities

Net cash provided by operating activities was

RMB812.3 million (US$115.8 million) for the third quarter of 2024,

relatively stable compared to that of RMB812.6 million for the same

quarter of 2023.

Cash position

Balance of cash and cash equivalents, short-term

time deposits and short-term investments was RMB14,599.5 million

(US$2,080.4 million) as of September 30, 2024.

Share Repurchase Program

In August 2024, the Company’s board of directors

authorized a new share repurchase program effective from August 29,

2024 for a 12-month period, under which the Company may repurchase

up to US$150 million of its shares (including in the form of ADSs).

This share repurchase program operates in conjunction with the

previous share repurchase program that became effective on March

20, 2024 for a 12-month period, under which the Company may

repurchase up to US$200 million of its shares (including in the

form of ADSs).

Outlook

For the fourth quarter of 2024, the Company

currently expects its total revenues to be between RMB1.795 billion

and RMB1.81 billion, representing a year-on-year increase of 13.6%

to 14.6%. This forecast reflects the Company’s current views on the

market and operational conditions in China, which are subject to

change and cannot be predicted with reasonable accuracy as of the

date hereof.

Conference Call Information

The Company will host a conference call at

7:00AM U.S. Eastern Time on Wednesday, December 11, 2024 (8:00PM

Beijing Time on Wednesday, December 11, 2024) to discuss the

financial results.

Participants are required to pre-register for

the conference call

at:https://register.vevent.com/register/BI637f58180286482692b41611b0e8df0a

Upon registration, participants will receive an

email containing participant dial-in numbers and unique personal

PIN. This information will allow you to gain immediate access to

the call. Participants may pre-register at any time, including up

to and after the call start time.

Additionally, a live and archived webcast of the

conference call will be available on the Company's investor

relations website at https://ir.zhipin.com.

Exchange Rate

This announcement contains translations of

certain RMB amounts into U.S. dollar (“US$”) amounts at specified

rates solely for the convenience of the reader. Unless otherwise

stated, all translations from RMB to US$ were made at the exchange

rate of RMB7.0176 to US$1.00 on September 30, 2024 as set forth in

the H.10 statistical release of the Federal Reserve Board. The

Company makes no representation that the RMB or US$ amounts

referred could be converted into US$ or RMB, as the case may be, at

any particular rate or at all.

Non-GAAP Financial Measures

In evaluating the business, the Company

considers and uses non-GAAP financial measures, such as adjusted

income from operations, adjusted net income, adjusted net income

attributable to ordinary shareholders, adjusted basic and diluted

net income per ordinary share attributable to ordinary shareholders

and adjusted basic and diluted net income per ADS attributable to

ordinary shareholders as supplemental measures to review and assess

operating performance. The Company defines these non-GAAP financial

measures by excluding the impact of share-based compensation

expenses, which are non-cash expenses, from the related GAAP

financial measures. The Company believes that these non-GAAP

financial measures help identify underlying trends in the business

and facilitate investors’ assessment of the Company’s operating

performance.

The non-GAAP financial measures are not

presented in accordance with U.S. GAAP and may be different from

non-GAAP information used by other companies. The non-GAAP

financial measures have limitations as analytical tools and should

not be considered in isolation or as a substitute for most directly

comparable GAAP financial measures. The Company encourages

investors and others to review its financial information in its

entirety and not rely on a single financial measure.

A reconciliation of the non-GAAP financial

measures to the most directly comparable GAAP financial measures

has been provided in the table captioned “Unaudited Reconciliation

of GAAP and Non-GAAP Results” at the end of this press release.

Safe Harbor Statement

This press release contains statements that may

constitute “forward-looking” statements which are made pursuant to

the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can

be identified by terminology such as “will,” “expects,”

“anticipates,” “aims,” “future,” “intends,” “plans,” “believes,”

“estimates,” “likely to,” and similar statements. The Company may

also make written or oral forward-looking statements in its

periodic reports to the U.S. Securities and Exchange Commission, in

announcements made on the website of The Stock Exchange of Hong

Kong Limited, in its interim and annual reports to shareholders, in

press releases and other written materials and in oral statements

made by its officers, directors or employees to third parties.

Statements that are not historical facts, including but not limited

to statements about the Company’s beliefs, plans, and expectations,

are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. Further information regarding

these and other risks is included in the Company’s filings with the

U.S. Securities and Exchange Commission and The Stock Exchange of

Hong Kong Limited. All information provided in this press release

is as of the date of this press release, and the Company does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

About KANZHUN LIMITED

KANZHUN LIMITED operates the leading online

recruitment platform BOSS Zhipin in China. The Company connects job

seekers and enterprise users in an efficient and seamless manner

through its highly interactive mobile app, a transformative product

that promotes two-way communication, focuses on intelligent

recommendations, and creates new scenarios in the online recruiting

process. Benefiting from its large and diverse user base, BOSS

Zhipin has developed powerful network effects to deliver higher

recruitment efficiency and drive rapid expansion.

For investor and media inquiries, please

contact:

KANZHUN LIMITEDInvestor RelationsEmail:

ir@kanzhun.com

PIACENTE FINANCIAL COMMUNICATIONSEmail:

kanzhun@tpg-ir.com

|

KANZHUN LIMITEDUnaudited Condensed

Consolidated Statements of Operations(All amounts in

thousands, except share and per share data) |

| |

| |

|

For the three months endedSeptember 30, |

|

For the nine months endedSeptember

30, |

| |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

| |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

Online recruitment services to enterprise customers |

|

1,591,500 |

|

|

1,889,102 |

|

|

269,195 |

|

|

4,322,379 |

|

|

5,465,912 |

|

|

778,886 |

|

|

Others |

|

15,136 |

|

|

22,473 |

|

|

3,202 |

|

|

49,418 |

|

|

66,159 |

|

|

9,428 |

|

| Total

revenues |

|

1,606,636 |

|

|

1,911,575 |

|

|

272,397 |

|

|

4,371,797 |

|

|

5,532,071 |

|

|

788,314 |

|

| Operating cost and

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues(1) |

|

(267,529 |

) |

|

(314,026 |

) |

|

(44,748 |

) |

|

(785,015 |

) |

|

(925,997 |

) |

|

(131,954 |

) |

|

Sales and marketing expenses(1) |

|

(457,341 |

) |

|

(522,268 |

) |

|

(74,423 |

) |

|

(1,557,772 |

) |

|

(1,646,707 |

) |

|

(234,654 |

) |

|

Research and development expenses(1) |

|

(414,429 |

) |

|

(464,151 |

) |

|

(66,141 |

) |

|

(1,113,404 |

) |

|

(1,375,449 |

) |

|

(196,000 |

) |

|

General and administrative expenses(1) |

|

(219,428 |

) |

|

(286,432 |

) |

|

(40,816 |

) |

|

(587,000 |

) |

|

(818,114 |

) |

|

(116,580 |

) |

| Total operating cost

and expenses |

|

(1,358,727 |

) |

|

(1,586,877 |

) |

|

(226,128 |

) |

|

(4,043,191 |

) |

|

(4,766,267 |

) |

|

(679,188 |

) |

|

Other operating income, net |

|

13,078 |

|

|

5,485 |

|

|

782 |

|

|

30,113 |

|

|

26,581 |

|

|

3,788 |

|

| Income from

operations |

|

260,987 |

|

|

330,183 |

|

|

47,051 |

|

|

358,719 |

|

|

792,385 |

|

|

112,914 |

|

|

Interest and investment income, net |

|

164,677 |

|

|

158,948 |

|

|

22,650 |

|

|

443,348 |

|

|

468,818 |

|

|

66,806 |

|

|

Foreign exchange (loss)/gain |

|

(517 |

) |

|

(29 |

) |

|

(4 |

) |

|

2,291 |

|

|

64 |

|

|

9 |

|

|

Other income, net |

|

32,444 |

|

|

36,948 |

|

|

5,265 |

|

|

36,973 |

|

|

36,425 |

|

|

5,191 |

|

| Income before income

tax expenses |

|

457,591 |

|

|

526,050 |

|

|

74,962 |

|

|

841,331 |

|

|

1,297,692 |

|

|

184,920 |

|

|

Income tax expenses |

|

(31,874 |

) |

|

(62,223 |

) |

|

(8,867 |

) |

|

(73,354 |

) |

|

(174,891 |

) |

|

(24,922 |

) |

| Net

income |

|

425,717 |

|

|

463,827 |

|

|

66,095 |

|

|

767,977 |

|

|

1,122,801 |

|

|

159,998 |

|

|

Net loss attributable to non-controlling interests |

|

- |

|

|

4,545 |

|

|

648 |

|

|

- |

|

|

12,255 |

|

|

1,746 |

|

| Net income

attributable to ordinary shareholders of KANZHUN

LIMITED |

|

425,717 |

|

|

468,372 |

|

|

66,743 |

|

|

767,977 |

|

|

1,135,056 |

|

|

161,744 |

|

| Weighted average

number of ordinary shares used in computing net income per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

870,358,529 |

|

|

883,762,119 |

|

|

883,762,119 |

|

|

868,329,404 |

|

|

884,476,469 |

|

|

884,476,469 |

|

|

— Diluted |

|

899,718,677 |

|

|

906,841,729 |

|

|

906,841,729 |

|

|

902,411,551 |

|

|

912,733,094 |

|

|

912,733,094 |

|

| Net income per

ordinary share attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

0.49 |

|

|

0.53 |

|

|

0.08 |

|

|

0.88 |

|

|

1.28 |

|

|

0.18 |

|

|

— Diluted |

|

0.47 |

|

|

0.52 |

|

|

0.07 |

|

|

0.85 |

|

|

1.24 |

|

|

0.18 |

|

| Net income per

ADS(2) attributable

to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

0.98 |

|

|

1.06 |

|

|

0.15 |

|

|

1.77 |

|

|

2.57 |

|

|

0.37 |

|

|

— Diluted |

|

0.95 |

|

|

1.03 |

|

|

0.15 |

|

|

1.70 |

|

|

2.49 |

|

|

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Include share-based compensation expenses as follows:

| |

|

For the three months endedSeptember 30, |

|

For the nine months endedSeptember 30, |

| |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| Cost of revenues |

|

12,016 |

|

10,836 |

|

1,544 |

|

34,978 |

|

33,252 |

|

4,738 |

| Sales and marketing

expenses |

|

68,065 |

|

67,505 |

|

9,619 |

|

192,595 |

|

209,459 |

|

29,848 |

| Research and development

expenses |

|

108,507 |

|

102,659 |

|

14,629 |

|

304,937 |

|

315,332 |

|

44,934 |

| General and administrative

expenses |

|

99,780 |

|

94,067 |

|

13,404 |

|

227,051 |

|

307,444 |

|

43,810 |

| Total |

|

288,368 |

|

275,067 |

|

39,196 |

|

759,561 |

|

865,487 |

|

123,330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Each ADS represents two Class A ordinary shares.

|

KANZHUN LIMITEDUnaudited Condensed

Consolidated Balance Sheets(All amounts in thousands) |

| |

| |

|

As of |

| |

|

December 31, 2023 |

|

September 30, 2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

| ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

2,472,959 |

|

2,816,158 |

|

401,299 |

|

Short-term time deposits |

|

6,922,803 |

|

5,757,701 |

|

820,466 |

|

Short-term investments |

|

3,513,885 |

|

6,025,604 |

|

858,642 |

|

Accounts receivable, net |

|

16,727 |

|

29,124 |

|

4,150 |

|

Inventories |

|

- |

|

2,865 |

|

408 |

|

Amounts due from related parties |

|

3,966 |

|

9,061 |

|

1,291 |

|

Prepayments and other current assets |

|

442,697 |

|

506,602 |

|

72,190 |

| Total current

assets |

|

13,373,037 |

|

15,147,115 |

|

2,158,446 |

| Non-current

assets |

|

|

|

|

|

|

|

Property, equipment and software, net |

|

1,793,488 |

|

1,804,596 |

|

257,153 |

|

Intangible assets, net |

|

8,093 |

|

261,677 |

|

37,289 |

|

Goodwill |

|

5,690 |

|

6,528 |

|

930 |

|

Right-of-use assets, net |

|

282,612 |

|

357,728 |

|

50,976 |

|

Long-term investments |

|

2,473,128 |

|

1,235,774 |

|

176,096 |

|

Other non-current assets |

|

4,000 |

|

- |

|

- |

| Total non-current

assets |

|

4,567,011 |

|

3,666,303 |

|

522,444 |

| Total

assets |

|

17,940,048 |

|

18,813,418 |

|

2,680,890 |

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accounts payable |

|

629,216 |

|

81,438 |

|

11,605 |

|

Deferred revenue |

|

2,794,075 |

|

3,071,565 |

|

437,695 |

|

Other payables and accrued liabilities |

|

779,046 |

|

644,624 |

|

91,858 |

|

Operating lease liabilities, current |

|

155,014 |

|

192,097 |

|

27,374 |

| Total current

liabilities |

|

4,357,351 |

|

3,989,724 |

|

568,532 |

|

Non-current liabilities |

|

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

125,079 |

|

166,451 |

|

23,719 |

|

Deferred tax liabilities |

|

28,425 |

|

23,490 |

|

3,347 |

| Total non-current

liabilities |

|

153,504 |

|

189,941 |

|

27,066 |

| Total

liabilities |

|

4,510,855 |

|

4,179,665 |

|

595,598 |

| Total shareholders’

equity |

|

13,429,193 |

|

14,633,753 |

|

2,085,292 |

| Total liabilities and

shareholders’ equity |

|

17,940,048 |

|

18,813,418 |

|

2,680,890 |

| |

|

|

|

|

|

|

|

KANZHUN LIMITEDUnaudited Condensed

Consolidated Statements of Cash Flows(All amounts in

thousands) |

| |

| |

|

For the three months endedSeptember 30, |

|

For the nine months endedSeptember 30, |

| |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

| |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

Net cash provided by operating activities |

|

812,554 |

|

|

812,290 |

|

|

115,750 |

|

|

2,120,172 |

|

|

2,586,387 |

|

|

368,557 |

|

| Net cash used in investing

activities |

|

(1,058,781 |

) |

|

(698,000 |

) |

|

(99,464 |

) |

|

(9,449,149 |

) |

|

(1,293,771 |

) |

|

(184,361 |

) |

| Net cash (used in)/provided by

financing activities |

|

(43,826 |

) |

|

(753,763 |

) |

|

(107,410 |

) |

|

25,129 |

|

|

(940,188 |

) |

|

(133,976 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(6,096 |

) |

|

(16,759 |

) |

|

(2,389 |

) |

|

(3,356 |

) |

|

(9,229 |

) |

|

(1,315 |

) |

| Net

(decrease)/increase in cash and cash equivalents |

|

(296,149 |

) |

|

(656,232 |

) |

|

(93,513 |

) |

|

(7,307,204 |

) |

|

343,199 |

|

|

48,905 |

|

| Cash and cash equivalents at

beginning of the period |

|

2,740,769 |

|

|

3,472,390 |

|

|

494,812 |

|

|

9,751,824 |

|

|

2,472,959 |

|

|

352,394 |

|

| Cash and cash

equivalents at end of the period |

|

2,444,620 |

|

|

2,816,158 |

|

|

401,299 |

|

|

2,444,620 |

|

|

2,816,158 |

|

|

401,299 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KANZHUN LIMITEDUnaudited Reconciliation of

GAAP and Non-GAAP Results (All amounts in thousands,

except share and per share data) |

| |

| |

|

For the three months ended September

30, |

|

For the nine months ended September

30, |

| |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| Income from operations |

|

260,987 |

|

330,183 |

|

47,051 |

|

358,719 |

|

792,385 |

|

112,914 |

| Add: Share-based compensation

expenses |

|

288,368 |

|

275,067 |

|

39,196 |

|

759,561 |

|

865,487 |

|

123,330 |

| Adjusted income from

operations |

|

549,355 |

|

605,250 |

|

86,247 |

|

1,118,280 |

|

1,657,872 |

|

236,244 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

425,717 |

|

463,827 |

|

66,095 |

|

767,977 |

|

1,122,801 |

|

159,998 |

| Add: Share-based compensation

expenses |

|

288,368 |

|

275,067 |

|

39,196 |

|

759,561 |

|

865,487 |

|

123,330 |

| Adjusted net

income |

|

714,085 |

|

738,894 |

|

105,291 |

|

1,527,538 |

|

1,988,288 |

|

283,328 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

ordinary shareholders of KANZHUN LIMITED |

|

425,717 |

|

468,372 |

|

66,743 |

|

767,977 |

|

1,135,056 |

|

161,744 |

| Add: Share-based compensation

expenses |

|

288,368 |

|

275,067 |

|

39,196 |

|

759,561 |

|

865,487 |

|

123,330 |

| Adjusted net income

attributable to ordinary shareholders of KANZHUN

LIMITED |

|

714,085 |

|

743,439 |

|

105,939 |

|

1,527,538 |

|

2,000,543 |

|

285,074 |

| Weighted average

number of ordinary shares used in computing adjusted net income per

share (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

870,358,529 |

|

883,762,119 |

|

883,762,119 |

|

868,329,404 |

|

884,476,469 |

|

884,476,469 |

|

— Diluted |

|

899,718,677 |

|

906,841,729 |

|

906,841,729 |

|

902,411,551 |

|

912,733,094 |

|

912,733,094 |

| Adjusted net income

per ordinary share attributable to ordinary

shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

0.82 |

|

0.84 |

|

0.12 |

|

1.76 |

|

2.26 |

|

0.32 |

|

— Diluted |

|

0.79 |

|

0.82 |

|

0.12 |

|

1.69 |

|

2.19 |

|

0.31 |

| Adjusted net income

per ADS attributable to ordinary shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

— Basic |

|

1.64 |

|

1.68 |

|

0.24 |

|

3.52 |

|

4.52 |

|

0.64 |

|

— Diluted |

|

1.59 |

|

1.64 |

|

0.23 |

|

3.39 |

|

4.38 |

|

0.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

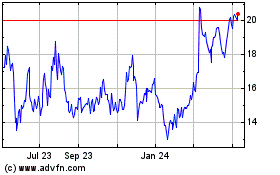

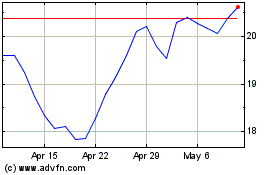

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Dec 2023 to Dec 2024