UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-37385

Baozun Inc.

No. 1-9, Lane 510, West Jiangchang Road

Shanghai 200436

The People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

EXPLANATORY NOTE

We made an announcement

dated June 12, 2024 with The Stock Exchange of Hong Kong Limited in relation to the poll results of the annual general meeting of

shareholders held on June 12, 2024. For details, please refer to exhibit 99.2 to this current report on Form 6-K.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Baozun Inc. |

| |

|

|

| |

By: |

/s/ Vincent

Wenbin Qiu |

| |

Name: |

Vincent Wenbin Qiu |

| |

Title: |

Chief Executive Officer |

Date: June

12, 2024

Exhibit Index

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“aims,” “future,” “intends,” “plans,” “believes,” “estimates,”

“confident,” “potential,” “continues,” “ongoing,” “targets,” “guidance,”

“going forward,” “outlook” or other similar expressions. Statements that are not historical facts, including

but not limited to statements about Baozun’s beliefs and expectations, are forward-looking statements. Forward-looking statements

involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to Baozun’s filings with the United States Securities and Exchange Commission

and its announcements, notices or other documents published on the website of The Stock Exchange of Hong Kong Limited. All information

provided in this announcement is as of the date hereof and is based on assumptions that Baozun believes to be reasonable as of this date,

and Baozun undertakes no obligation to update such information, except as required under applicable law.

Exhibit 99.1

Baozun

Announces Results of Annual General Meeting of Shareholders

SHANGHAI, June

12, 2024 -- Baozun Inc. (NASDAQ: BZUN and HKEX: 9991) (“Baozun” or the “Company”), a leading brand e-commerce

solution provider and digital commerce enabler in China, announced today that its annual general meeting of shareholders (the “AGM”)

was held in Hong Kong on Wednesday, June 12, 2024 at 2:00 p.m., Hong Kong time (or 2:00 a.m. on Wednesday,

June 12, 2024, New York time), and all the proposed resolutions set out in the notice and circular of AGM were duly passed

at the AGM.

About

Baozun Inc.

Founded

in 2007, Baozun Inc. is a leader in brand e-commerce service, brand management, and digital commerce service. It serves more than 450

brands from various industries and sectors around the world, including East and Southeast Asia, Europe and North

America.

Baozun Inc. comprises

three major business lines - Baozun e-Commerce (BEC), Baozun Brand Management (BBM) and Baozun International (BZI) and is committed

to accelerating high-quality and sustainable growth. Driven by the principle that “Technology Empowers the Future

Success,” Baozun's business lines are devoted to empowering their clients' business and navigating their new phase of

development.

For more information, please

visit http://ir.baozun.com.

Safe

Harbor Statement

This announcement

contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continues,” “ongoing,” “targets,” “guidance,” “going forward,”

“looking forward,” “outlook” or other similar expressions. Statements that are not historical facts, including but

not limited to statements about Baozun's beliefs and expectations, are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement, including but not limited to Baozun's filings with the United States Securities and Exchange Commission and its announcements,

notices or other documents published on the website of The Stock Exchange of Hong Kong Limited. All information provided in this announcement

is as of the date hereof and is based on assumptions that Baozun believes to be reasonable as of this date, and Baozun undertakes no

obligation to update such information, except as required under applicable law.

For investor

and media inquiries, please contact:

Baozun Inc.

Ms. Wendy Sun

Email: ir@baozun.com

Exhibit 99.2

Hong Kong Exchanges and Clearing

Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation

as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance

upon the whole or any part of the contents of this announcement.

Under

our weighted voting rights structure, our share capital comprises Class A

ordinary shares and Class B ordinary shares. Each Class A

ordinary share entitles the holder to exercise one vote, and each Class B

ordinary share entitles the holder to exercise ten votes, respectively, on any resolution tabled at our general meetings, except as may

otherwise be required by law or by the Rules Governing the Listing

of Securities on The Stock Exchange of Hong Kong Limited or provided for in our memorandum and articles of association. Shareholders and

prospective investors should be aware of the potential risks of investing in a company with a weighted voting rights structure. Our American

depositary shares, each representing three of our Class A ordinary

shares, are listed on the Nasdaq Global Select Market in the United States under the symbol BZUN.

Baozun

Inc.

寶尊電商有限公司*

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock

Code: 9991)

POLL

RESULTS OF THE ANNUAL GENERAL MEETING HELD ON JUNE 12, 2024

References

are made to the circular (the “Circular”) of Baozun Inc. (the “Company”) incorporating, amongst

others, the notice (the “Notice”) of the annual general meeting of the Company (the “AGM”) dated

May 10, 2024. Unless otherwise defined herein, capitalized terms in this announcement shall have the same meanings as defined in

the Circular.

The board of directors (the “Board”)

of the Company is pleased to announce that at the AGM held on June 12, 2024, the Notice of which was given to the Shareholders on

May 10, 2024, all the proposed resolutions as set out in the Notice were taken by poll. The poll results are as follows:

Ordinary Resolutions |

Number

of Votes Cast

(approximate % of total number of votes cast) |

Total

Number of

Votes Cast |

Total

Number of

Voting Shares |

| For |

Against |

Abstain |

| 1. |

To

receive, consider and adopt the audited consolidated financial statements for the year ended December 31, 2023 together with

the report of the directors of the Company (the “Directors”) and the independent auditor’s report. |

Class A

ordinary shares (“Class A Shares”) |

55,989,116

(99.885482%) |

64,191

(0.114518%) |

105,857

(–%) |

56,053,307 |

56,053,307 |

| Class B

ordinary shares (“Class B Shares”) |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

| Total |

188,996,496

(99.966047%) |

64,191

(0.033953%) |

105,857

(–%) |

189,060,687 |

69,354,045 |

Ordinary

Resolutions |

Number

of Votes Cast

(approximate % of total number of votes cast) |

Total

Number of

Votes Cast |

Total

Number of

Voting Shares |

| For |

Against |

Abstain |

| 2. |

(a) To

re-elect the following retiring Directors: |

|

|

| (i) Mr. Vincent

Wenbin Qiu as Director. |

Class A

Shares |

41,115,755

(73.389115%) |

14,908,568

(26.610885%) |

134,841

(–%) |

56,024,323 |

56,024,323 |

| Class B

Shares |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

| Total |

174,123,135

(92.113192%) |

14,908,568

(7.886808%) |

134,841

(–%) |

189,031,703 |

69,325,061 |

| (ii) Mr. Junhua

Wu as Director. |

Class A

Shares |

40,481,902

(72.269700%) |

15,533,139

(27.730300%) |

144,123

(–%) |

56,015,041 |

56,015,041 |

| Class B

Shares |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

| Total |

173,489,282

(91.782383%) |

15,533,139

(8.217617%) |

144,123

(–%) |

189,022,421 |

69,315,779 |

| (b) To

authorize the board of Directors (the “Board”) to fix the Directors’ fees. |

Class A

Shares |

55,829,599

(99.704479%) |

165,477

(0.295521%) |

164,088

(–%) |

55,995,076 |

55,995,076 |

| Class B

Shares |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

| Total |

188,836,979

(99.912447%) |

165,477

(0.087553%) |

164,088

(–%) |

189,002,456 |

69,295,814 |

| 3. |

To

re-appoint Deloitte Touche Tohmatsu as auditor of the Company and authorize the Board to fix its remuneration. |

Class A

Shares |

55,890,520

(99.677605%) |

180,771

(0.322395%) |

87,873

(–%) |

56,071,291 |

56,071,291 |

| Class B

Shares |

13,300,738

(100.000000%) |

0

(0.000000%) |

0

(–%) |

13,300,738 |

13,300,738 |

| Total |

69,191,258

(99.739418%) |

180,771

(0.260582%) |

87,873

(–%) |

69,372,029 |

69,372,029 |

Ordinary

Resolutions |

Number

of Votes Cast

(approximate % of total number of votes cast) |

Total

Number of

Votes Cast |

Total

Number of

Voting Shares |

| For |

Against |

Abstain |

| 4. |

To

give a general mandate to the Directors to allot, issue and deal with additional Class A ordinary shares or American depositary

shares of the Company (the “ADSs”) and/or resell treasury shares of the Company (if permitted under the Rules Governing

the Listing of Securities on The Stock Exchange of Hong Kong Limited) not exceeding 20% of the number of the issued shares of the

Company (excluding treasury shares) (the “Issue Mandate”). |

Class A

Shares |

30,724,927

(54.833066%) |

25,308,648

(45.166934%) |

125,589

(–%) |

56,033,575 |

56,033,575 |

| Class B

Shares |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

Total

|

163,732,307

(86.612082%) |

25,308,648

(13.387918%) |

125,589

(–%) |

189,040,955 |

69,334,313 |

| 5. |

To

give a general mandate to the Directors to buy back Class A ordinary shares or ADSs not exceeding 10% of the number of the issued

shares of the Company (excluding treasury shares). |

Class A

Shares |

55,984,450

(99.811630%) |

105,657

(0.188370%) |

69,057

(–%) |

56,090,107 |

56,090,107 |

| Class B

Shares |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

| Total |

188,991,830

(99.944126%) |

105,657

(0.055874%) |

69,057

(–%) |

189,097,487 |

69,390,845 |

| 6. |

To

extend the Issue Mandate by the number of Class A ordinary shares or ADSs bought back by the Company. |

Class A

Shares |

30,894,798

(55.103944%) |

25,171,603

(44.896056%) |

92,763

(–%) |

56,066,401 |

56,066,401 |

| Class B

Shares |

133,007,380

(100.000000%) |

0

(0.000000%) |

0

(–%) |

133,007,380 |

13,300,738 |

| Total |

163,902,178

(86.686889%) |

25,171,603

(13.313111%) |

92,763

(–%) |

189,073,781 |

69,367,139 |

Notes:

| (a) | As a majority of the votes were cast in favour of each of the resolutions numbered 1 to 6 above, such resolutions were duly passed

as ordinary resolutions. |

| (b) | As at the date of the AGM, the total number of issued Shares was 184,089,962 Shares, comprising 170,789,224 Class A Shares

and [13,300,738] Class B Shares (with 2,533,803 Class A Shares represented by 844,601 ADSs being bought back by the Company

but pending cancellation) and the Company does not have any treasury shares. |

| (c) | In accordance with the Listing Rules, each Class A Share and each Class B Share shall entitle its holder to one vote on

a poll at the AGM in respect of the resolution numbered 3 above. Each Class A Share shall entitle its holder to one vote and each

Class B Share shall entitle its holder to ten votes in respect of the resolutions numbered 1, 2 and 4 to 6 above. |

| (d) | None of the Shareholder were required to abstain from voting in respect of the resolutions at the AGM. None of the Shareholders have

stated their intention in the Circular to vote against or to abstain from voting on any of the resolutions proposed at the AGM. There

were no Shares entitling the holders to attend and abstain from voting in favour of any resolution at the AGM as set out in Rule 13.40

of the Listing Rules. |

| (e) | Accordingly, the total number of Shares

entitling the holders to attend and vote for or against on the resolutions numbered 1 to

6 above at the AGM was 181,556,159 Shares, comprising 168,255,421 Class A Shares and

13,300,738 Class B Shares. |

| (f) | Computershare Hong Kong Investor Services Limited, the Company’s Hong Kong branch share registrar, was appointed as the scrutineer

for the purpose of vote-taking at the AGM. |

| (g) | Directors of the Company, namely, Mr. Vincent

Wenbin Qiu, Mr. Junhua Wu and Mr. Satoshi Okada, and independent Directors of the

Company, namely, Mr. Yiu Pong Chan and Mr. Benjamin Changqing Ye attended

the AGM. Mr. Steve Hsien-Chieng Hsia was unable to attend the AGM due to other business

commitments. |

| | By order of the Board |

| | | Baozun Inc. |

| | | Mr. Vincent Wenbin Qiu |

| | | Chairman |

Hong Kong, June 12, 2024

As at the date of this announcement,

our board of directors comprises Mr. Vincent Wenbin Qiu as the chairman, Mr. Junhua Wu and Mr. Satoshi Okada as directors,

and Mr. Yiu Pong Chan, Mr. Steve Hsien-Chieng Hsia and Mr. Benjamin Changqing Ye as independent directors.

* for

identification purposes only

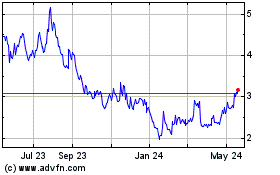

Baozun (NASDAQ:BZUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

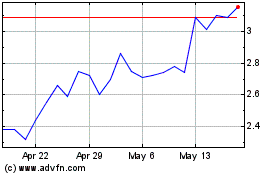

Baozun (NASDAQ:BZUN)

Historical Stock Chart

From Dec 2023 to Dec 2024