UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Carver Bancorp, Inc.

(Name of Registrant as Specified in Its Charter)

Dream Chasers Capital Group LLC

Gregory Lewis

Shawn Herrera

Kevin Winters

Jeffrey Bailey

Jeffrey Anderson

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a6(i)(1) and 0-11. |

On November 19, 2024, Dream Chasers Capital Group sent the following

letter to shareholders.

November 19, 2024

Dear Fellow Carver Shareholders:

You have received mailings about the Board of Directors (the “Board”)

election at the annual meeting of shareholders of Carver Bancorp, Inc. (“Carver”, or the “Company”) on December

12, 2024. At the heart of the matter, it is simple: Under this Board, there has been a -79%1

decline in Carver’s share price over the last ten years and the bank continues to lose millions every year. It is time for new leadership

on the Board.

We encourage you to vote FOR Mr. Jeffrey “Jeff” Anderson

and Mr. Jeffrey Bailey on the enclosed BLUE proxy card to drive urgent action to return Carver to profitability and

growth.

The Board has taken a stock that traded at $15.00 per share in 2021

and sent it plummeting to $1.682 per share when we filed our proxy statement. The Board

seems to have no answers: last week, Carver disclosed another quarter of unacceptable performance, losing $2.1 million in the second quarter

of 20243. That’s even worse than the $1.48 million loss in the same quarter

of 2023.

A Track Record of Losses: Carver’s

Net Income Since 2014 (in Thousands)4

We Need New, Experienced Voices with Records

of Success on the Board, NOW

We have nominated two highly capable, independent candidates for the

Board. Mr. Jeffrey “Jeff” Anderson is the former CFO of J.P. Morgan’s Northeast retail banking centers, overseeing $100B

in assets. Mr. Anderson has spent over 30 years in banking, with roles at J.P. Morgan, AIG, Bank of America and Goldman Sachs improving

profitability and delivering shareholder value. Jeffrey John Bailey is a highly successful business owner and entrepreneur, and Carver’s

largest individual shareholder.

Mr. Anderson and Mr. Bailey will put you, the shareholder, first,

so that Carver can return to profitability, drive shareholder value and fulfill its mission to help the community build wealth.

Sincerely,

Greg Lewis

Dream Chasers Capital Group

VOTE today using the enclosed BLUE proxy

card

Vote FOR the Dream Chasers Nominees, Mr.

Jeffrey “Jeff” Anderson and Mr. Jeffrey John Bailey

WITHOLD your vote for the Opposed Company

Nominees

Vote AGAINST Proposal 4, the nonbinding

advisory vote on executive compensation

We make no recommendation on Proposals 2 or 3

If you received a white proxy card from the Company,

you may use it to vote the above positions

|

To VOTE, follow the instructions in the

attached Proxy Statement or on the BLUE proxy card

Dream Chasers has retained Okapi Partners

LLC to assist in communicating with shareholders in connection with the proxy solicitation and to assist in efforts to obtain proxies.

If you have any questions concerning

the Proxy Statement, would like to request additional copies of the Proxy Statement or need help voting your shares, please contact:

Okapi Partners LLC

1212 Avenue of the Americas, 17th Floor

New York, New York 10036

Shareholders Call Toll-Free: +1 (877) 629-6356

Banks and Brokers Call Collect: +1 (212) 297-0720

Email: info@okapipartners.com

|

1

Source: S&P Capital IQ Pro. Returns are for the period ended October 23, 2024, one day

prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement.

2

Stock price as of October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s

preliminary proxy statement.

3

As disclosed in the Form 10-Q filed by the Company with the SEC on November 14, 2024, found

at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001016178/000101617824000026/carv-20240930.htm

4

Source: S&P Capital IQ Pro. Carver’s pre-tax income in 2018 would have been -$4.3M

excluding a $9.6M gain on sale, as disclosed in the Form 10-K filed by the Company with the SEC on June 29, 2018, found at https://www.sec.gov/Archives/edgar/data/1016178/000101617818000008/fy201810kdocument.htm

On November 19, 2024, Dream Chasers Capital Group first used the following

presentation in connection with its solicitation of proxies.

A Stronger Carver November 19, 2024

Executive Summary 2 (1) All share price data as of October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement. Source: S&P Capital IQ Pro. (2) As measured against the S&P U.S. BMI Banks Index, as of October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement. Source: S&P Capital IQ Pro. ▪ Dream Chasers Capital Group (“DCCG”) represents shareholders with a substantial stake in Carver Bancorp, Inc. (“Carver”) ▪ DCCG is nominating two directors – Jeffrey “Jeff” Anderson and Jeffrey Bailey – to put an end to years of operating losses and value destruction overseen by the current Board of Directors (the “Board”) ▪ Indeed, under the current Board, Carver has generated operating losses in all but one year over the last decade and suffered a massive ~79% decline in share value (1) ▪ Carver’s performance has been equally appalling in recent years, underperforming the bank index by 45%, 97% and 94% over the last one, three and five years, respectively (2) ▪ Given Carver’s continued operating losses and dwindling capital levels, DCCG believes there is an urgent need for new leadership to steady the ship and chart a new course for the bank ▪ To that end, Mr. Anderson and Mr. Bailey have the record of success and experience necessary to help guide the bank back to profitability and lead to what we hope is a significant increase in long - term shareholder value DCGG Urges Shareholders to Vote FOR Mr. Anderson and Mr. Bailey and Oppose Carver’s Nominees

A Legacy of Shareholder Value Destruction 3 Source: S&P Capital IQ Pro. (1) Through October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement. 1 - Year Total Shareholder Return (1) 3 - Year Total Shareholder Return (1) 5 - Year Total Shareholder Return (1) 10 - Year Total Shareholder Return (1) 19% 64% CARV S&P U.S BMI Banks Index - 89% CARV S&P U.S BMI Banks Index 8% - 46% CARV S&P U.S BMI Banks Index 48% - 79% CARV S&P U.S BMI Banks Index 158%

A Decade of Losses 4 Source: S&P Capital IQ Pro, https://www.sec.gov/Archives/edgar/data/1016178/000101617818000008/fy201810kdocument.htm . (1) CARV’s pre - tax income in 2018 would have been - $4.3M excluding a $9.6M gain on sale. Carver Net Income to Common Since 2014 ($000s) ($1,324) ($1,152) ($1,767) ($2,853) ($5,423) ($5,936) ($3,896) ($847) ($4,401) 2014 FY 2015 FY 2016 FY 2017 FY In the Last Decade, Carver Has Lost Nearly $25M After - Tax and Reported Just One Profitable Year Due to a One - Time Gain on Sale in 2018 (1) 2018 FY (1) 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY $2,148

Worst - in - Class Performance vs. NY Area Peers 5 Source: S&P Capital IQ Pro. Note: NY peers include banks with $500M to $1.5B in assets headquartered in the New York - Newark - Jersey City MSA, including: Bogota Financial Corp (NASDAQ: BSBK), ES Bancshares (NASDAQ: ESBS), First Commerce Bancorp, Inc. (OTC: CMRB), Magyar Bancorp, Inc. (NASDAQ: MGYR), Nmb Financial Corp (OTC: NMBF), SR Bancorp (NASDAQ: SRBK). All CARV data is for Carver Bancorp, the consolidated entity, in order to facilitate comparison with peers. (1) One day prior to the filing of DCCG’s preliminary proxy statement. Price / Tangible Book Value (10/23/24 1 ) 2023 Return on Average Assets 2023 Efficiency Ratio 2023 Expenses / Average Earning Assets 0.48x 0.58x 0.68x 0.76x CARV 25th Percentile Median 75th Percentile 0.16% 0.28% 0.94% - 0.62% CARV 25th Percentile Median 75th Percentile 116.3% 93.0% 86.0% 65.5% CARV 25th Percentile Median 75th Percentile 4.34% 2.38% 2.00% 1.98% CARV 25th Percentile Median 75th Percentile

Poor Performance Compared to Other Banks Serving African American Communities 6 Source: S&P Capital IQ Pro. Note: Peers include selected banks serving African American communities and have assets under $800 million. All Carver Federal Savings Bank data is for the bank subsidiary of Carver Bancorp, in order to facilitate comparison with peers. 2023 Return on Average Assets 2023 Efficiency Ratio 2.06% 1.11% 0.66% 0.29% - 0.27% Citizens Trust Bank The Harbor Bank of Maryland OneUnited Bank Industrial Bank Carver Federal Savings Bank 48.2% 78.1% 82.0% 86.1% 106.4% Citizens Trust Bank Industrial Bank The Harbor Bank of Maryland OneUnited Bank Carver Federal Savings Bank

An Unsustainable, Loss - Making Business Model 7 Source: S&P Capital IQ Pro. CARV 2023 Profitability Profile ($M) $22.8 $3.6 ($30.7) ($4.3) Net Interest Income Noninterest Income Revenue Noninterest Expense Pre - Provision Net Revenue $26.4 Carver Doesn’t Generate Enough Revenue to Cover its Costs, Leading to Continued Capital Deterioration

Pay Package for New CEO Lacks Performance Incentives 8 Source: https://www.sec.gov/Archives/edgar/data/1016178/000094337424000375/form8k_091124.htm This is a Huge Amount of Compensation for Bank with Carver’s Track Record of Consistent Losses, Almost all in Cash and not Tied to Shareholder Value or Performance Measures $700k Guaranteed Salary $500k Cash Bonus Opportunity $100k Annual Equity Grant Initially tied to “qualitative” factors that have little to do with shareholder value creation

Our Nominees Have the Expertise to Deliver Urgent Change 9 These Nominees Will Serve as Shareholder Advocates on a Board that has Neglected Shareholders for Too Long • 30+ years of experience in banking and financial services, including roles with J.P. Morgan, Bank of America, AIG, and Goldman Sachs • Roles focused on finance and expense management, retail banking strategy, technology implementation and management • Served as CFO for J.P. Morgan’s Northeast Region Retail Banking business, which included over 800 banking centers with $3.7 billion in revenue, $1.7 billion in pretax earnings, $100 billion in deposits and investments, and $15 billion in loans Jeffrey “Jeff” Anderson Jeffrey Bailey • CEO of Dunham Metals, a California manufacturer of specialized metal parts • Oversaw 25x increase in revenue at Dunham since 1988 • Serves customers in complex, regulated industries, including aerospace, automotive, maritime and medical equipment • Carver’s largest individual shareholder

Carver’s Sitting Directors Have Not Delivered 10 (4) Institutional Strategy Committee focus areas as disclosed in the Definitive Proxy Statement filed with the SEC on October 31, 2024, available at sec.gov/Archives/edgar/data/1016178/000110465924113051/tm2425801d1_defc14a.htm (5) Ms. Joseph holds options to acquire an additional 667 shares within 60 days of the filing date of Carver’s Proxy Statement filed with the SEC, as disclosed in the Definitive Proxy Statement filed with the SEC on October 31, 2024, available at sec.gov/Archives/edgar/data/1016178/000110465924113051/tm2425801d1_defc14a.htm • Member of the Board’s Executive Committee, which has been ineffective at driving shareholder returns and overall results • Member of the Board’s Compensation Committee, which has handsomely rewarded executives despite consistent poor performance and implemented compensation structure for new CEO that lacks performance incentives or shareholder alignment • Unaligned with shareholder interests, owning just 1,000 shares of Carver stock (2) (1) Reflects total shareholder return from Mr. Knuckles appointment effective October 1, 2013 (see https://www.globenewswire.com/news - release/2013/09/27/576527/7036/en/Carver - Bancorp - Inc - Appoints - Three - New - Board - Members - Lewis - Jones - III - Kenneth - Knuckles - and - Colvin - Grannum.html ) through October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement (2) Mr. Knuckles holds options to acquire an additional 1,000 shares within 60 days of the filing date of Carver’s Proxy Statement filed with the SEC, as disclosed in the Definitive Proxy Statement filed with the SEC on October 31, 2024, available at sec.gov/Archives/edgar/data/1016178/000110465924113051/tm2425801d1_defc14a.htm (3) Reflects total shareholder return from Ms. Joseph’s Board appointment effective August 28, 2019 ( see https://www.sec.gov/Archives/edgar/data/1016178/000094337419000408/form8k.htm ) through October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement Kenneth Knuckles • Member of the Board since 2013, with total shareholder return over his tenure of - 78% (1) Jillian Joseph • Member of the Board since 2019, with total shareholder return over her tenure of - 45% (3) • Member of the Board’s Institutional Strategy Committee, which has a “primary focus on (i) sustainable profitability and growth, and (ii) capital planning” but has overseen consistent losses for the duration of Ms. Joseph’s tenure (4) • Unaligned with shareholder interests, owning just 1,000 shares of Carver stock (5)

A Tried - and - True Plan for Restoring Profitability and Returns 11 ▪ DCCG’s plan for growth at the “New Carver” is simple: adopt a strategy similar to those of the most successful banking institutions, such as JPMorgan ▪ The model involves: x Taking Carver’s existing consumer banking services and establishing a broker dealer and other licenses so it can offer additional wealth building services, such as brokerage accounts x Implementing a marketing and technology plan to drive customer and deposit acquisition x Offering a broad array of wealth products which will attract customers and deposits and lead to new fees and commission revenues ▪ Operating at a loss is not acceptable for one quarter, let alone a decade – Mr. Anderson and Mr. Bailey will evaluate all options to restore Carver to profitability and ensure an acceptable return for shareholders ▪ As shareholders ourselves, we have meaningful “skin in the game” and are incentivized to execute successfully on behalf of all shareholders Mr. Anderson and Mr. Bailey will be independent Board members: They will evaluate Carver’s strategy and financials upon joining the Board, and apply their experience and expertise to drive the right strategy for shareholders

Carver is an Important Bank, and Must Return to Profitability to Serve its Communities 12 ▪ Carver was founded in 1948 to serve African American communities, customers and institutions that were historically underserved by banks (1) ▪ Carver continues to serve lower - and middle - income New Yorkers, businesses and community organizations in Harlem, Brooklyn and Queens ▪ Carver is one of a dwindling number of African American operated banks ▪ Our nominees care deeply about these communities, and are committed to improving Carver’s performance so that it can continue its important role ▪ Mr. Anderson was raised in Harlem, and serves on three non - profit organization Boards of Directors based there ▪ Mr. Bailey invested in Carver because of its opportunity to serve underserved communities Dream Chasers Capital Group, Mr. Anderson and Mr. Bailey are committed to restoring Carver’s profitability so that it can deepen its role in the community (1) For more information on Carver’s history and founding, visit: https://www.carverbank.com/about - carver/why - carver

IMPORTANT DISCLAIMERS 13 CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING STATEMENTS The information herein contains “forward - looking statements.” Specific forward - looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable terminology. Similarly, statements that describe our objectives, plans or goals are forward - looking. Forward - looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Dream Chasers Capital Group LLC (“Dream Chasers”) or any of the other participants in the proxy solicitation prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward - looking statements should not be regarded as a representation by Dream Chasers that the future plans, estimates or expectations contemplated will ever be achieved. Certain statements and information included herein may have been sourced from third parties. Dream Chasers does not make any representations regarding the accuracy, completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support from such third parties for the views expressed herein. Dream Chasers disclaims any obligation to update the information herein or to disclose the results of any revisions that may be made to any projected results or forward - looking statements herein to reflect events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated or unanticipated events. IMPORTANT INFORMATION AND WHERE TO FIND IT DREAM CHASERS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY DREAM CHASERS WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI PARTNERS LLC, 1212 AVENUE OF THE AMERICAS, 17TH FLOOR, NEW YORK, NEW YORK 10036 - 1600 . STOCKHOLDERS CAN CALL TOLL - FREE: (877) 629 - 6356 .

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable

terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject

to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven,

correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Dream Chasers Capital Group

LLC (“Dream Chasers”) or any of the other participants in the proxy solicitation prove to be incorrect, the actual results

may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation

by Dream Chasers that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein may have been sourced

from third parties. Dream Chasers does not make any representations regarding the accuracy, completeness or timeliness of such third party

statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither

been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support

from such third parties for the views expressed herein.

Dream Chasers disclaims any obligation to update the information herein

or to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect

events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated

or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Dream Chasers, Gregory Lewis, Shawn Herrera,

Kevin Winters, Jeffrey Bailey and Jeffrey Anderson (“collectively, the Participants”) are participants in the solicitation

of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”). On

November 4, 2024, the Participants filed with the U.S. Securities and Exchange Commission (the “SEC”) their definitive proxy

statement and accompanying BLUE universal proxy card or voting instruction form in connection with their solicitation of proxies from

the shareholders of the Company for the Annual Meeting.

IMPORTANT INFORMATION AND WHERE TO FIND IT

DREAM CHASERS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY

TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY DREAM

CHASERS WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE

AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE

ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI

PARTNERS LLC, 1212 AVENUE OF THE AMERICAS, 17TH FLOOR, NEW YORK, NEW YORK 10036-1600. STOCKHOLDERS CAN CALL TOLL-FREE: (877)

629-6356.

Contacts

For Media:

Breitenbush Partners

Andrew Wilson, (773) 425-4991

awilson@breitenbushpartners.com

For Investors:

Okapi Partners

Bruce Goldfarb/Tony Vecchio

(877) 629-6356

(212) 297-0720

info@okapipartners.com

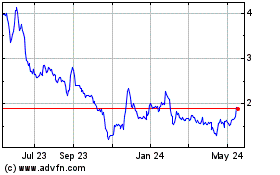

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Dec 2024 to Jan 2025

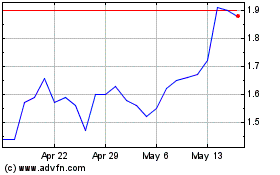

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Jan 2024 to Jan 2025