UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Carver Bancorp, Inc.

(Name of Registrant as Specified in Its Charter)

Dream Chasers Capital Group LLC

Gregory Lewis

Shawn Herrera

Kevin Winters

Jeffrey Bailey

Jeffrey Anderson

(Name of Person(s) Filing Proxy Statement if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a6(i)(1) and 0-11. |

Dream Chasers Urges Institutional Shareholders

to Join Retail Holders to Drive Change at Carver

Letter calls on National Community Investment

Fund, Bank of America, J.P. Morgan, American Express and other community-focused investors to help drive improved performance

Says continued support of under-performing Board

does the community and Carver no good

Urges all shareholders to vote for change: Vote

FOR Mr. Jeffrey “Jeff” Anderson and Mr. Jeffrey Bailey for the Board of Directors using the BLUE proxy card and

vote WITHHOLD on Carver’s under-performing Directors

ISS Finds That Carver’s “long history

of TSR and operational underperformance suggest that the bank needs to rethink its strategy and its approach to execution”

New York, NY (December 2, 2024)—Dream Chasers Capital Group LLC

(“Dream Chasers”) today called on large financial institutions and funds that have invested in Carver Bancorp, Inc. (“Carver,”

or the “Company”) (NASDAQ: CARV) to support nominees that will drive change on the Carver Board of Directors (the “Board”).

While these investors’ support of Carver over the years has been admirable, we can all agree it is counterproductive to support

a Board that has presided over a prolonged period of poor performance.

In an open letter, Dream Chasers urged institutional shareholders to

vote for Mr. Jeffrey “Jeff” Anderson and Mr. Jeffrey Bailey for election to the Board ahead of the December 12, 2024 Annual

Meeting of Shareholders.

“We are encouraged by the support of many retail investors who

have watched the value of their Carver shares drop significantly,” said Greg Lewis, Chief Executive Officer of Dream Chasers Capital

Group. “Our nominees’ experience and perspective on how to drive profitability, support the community and move Carver forward

can only benefit institutional shareholders. If Carver’s Board thinks Jeff Anderson, an accomplished former J.P. Morgan executive

who oversaw $10O billion in deposits, is not qualified then we are not sure who is qualified. Jeff Bailey is a highly successful

businessman and Carver’s largest individual shareholder who will bring the voice of the shareholder to the Board.”

Lewis continued, “No bank or investment fund would tolerate such

prolonged poor performance in their own organizations, and we shouldn’t accept it from Carver. Mr. Anderson and Mr. Bailey

will work hard for institutional shareholders as well as for the individual investor with only a small number of shares. We encourage

all shareholders to vote for change and support these highly qualified and independent nominees. We stand ready to work with all retail

and institutional shareholders to make sure Carver’s best days are ahead.”

As Dream Chasers has pointed out, Carver’s Board has presided

over losses of nearly $25 million over the last decade, and just one year of annual profits in the last ten1.

Shareholders have seen the value of their investments decline by 79% over ten years2.

1

Reflects net income attributable to Carver Bancorp for the years 2014 to 2023, according to Company SEC filings and S&P Capital IQ

Pro.

2

CARV share price and shareholder returns data as of October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s

preliminary proxy statement. Source: S&P Capital IQ Pro.

Recently, Institutional Shareholder Services reported that Carver’s

performance and corporate governance are lacking, telling institutional investors in a recent report that3:

| · | Carver’s “long history of TSR and operational underperformance

suggest that the bank needs to rethink its strategy and its approach to execution,” |

| · | The “company's overall operating results have been poor for the last

several years, and have continued to be disappointing thus far in FY 2025,” and |

| · | “The company's corporate governance framework includes several features

that do not align with the best interest of shareholders.” |

Dream Chasers urged institutional investors to conclude that there

is a clear case for change on the Board.

The full text of the letter to institutional shareholders is below:

Dear Fellow Carver Shareholders:

After a decade of poor performance, it is time for change on the Carver

Bancorp (“Carver” or the “Company”) Board of Directors (the “Board”) to improve the value of our investments.

Over the years, a number of financial institutions such as Goldman

Sachs, Bank of America, J.P. Morgan, American Express and the National Community Investment Fund have invested in Carver in order to support

an African American operated bank that serves lower- and middle-income communities in New York.

While that investment in Carver is admirable, we think continuing to

support a Board that has presided over prolonged losses and shareholder value destruction is a mistake. Simply put, it does the

community and Carver no good to back a Board that has overseen operating losses, share price declines, and poor performance for such a

long period of time. If Carver is to continue its vital, decades-long service to New York communities, it must perform better.

We encourage you to support the successful, qualified and independent

nominees that Dream Chasers Capital Group (“Dream Chasers”) has put forward. Jeffrey “Jeff” Anderson is

an accomplished financial services and retail banking executive. Jeffrey Bailey is a successful business leader and Carver’s largest

individual shareholder. These nominees have the independent judgment, financial experience, and focus on profitability and shareholder

returns that is desperately needed on Carver’s Board.

As you are undoubtedly aware, Carver has posted losses totaling nearly

$25 million in the last decade. The Company has earned an annual profit just once in that span, thanks to the sale of their headquarters

building in 2018 that turned another year of losses into a one-time gain4. Shareholders

– including you – have suffered, with a 10-year total shareholder return of -79%.

We should have a higher standard in our community. None of you

would tolerate such lackluster performance in your own organizations. How can it be acceptable at Carver?

3

Permission to use quotes neither sought nor obtained.

4

Income before taxes would have been -$4.3 million excluding the $9.6 million gain on sale, as reported in Carver’s 2018 Form 10-K

filed with the SEC, which can be found at https://www.sec.gov/Archives/edgar/data/1016178/000101617818000008/fy201810kdocument.htm

When the National Community Investment Fund (the “Fund”)

bought 378,7885 Carver shares last summer, it said that it did so because of the Bank’s

“mission-aligned impact and growth potential”. Since then, Carver’s shares have declined by 36%, meaning the Fund’s

$1 million investment is now worth $636,363.846. To better protect its own interests

– and to advance the Fund’s own mission – we think it is crucial to demand better results, a return to profitability,

and new voices on the Board.

Similarly, when Goldman Sachs, Morgan Stanely, American Express and

others invested $55 million in Carver in 2011, Goldman’s then CEO said that it was doing so to “ensure that these neighborhoods

continue to grow and thrive”7. The firms who have invested in Carver should demand

better results, and recognize that a bank losing money year after year is missing the opportunity to support their communities and neighborhoods.

Recently, Institutional Shareholder Services (“ISS”), a

leading proxy advisory firm, pointed out that Carver’s “long history of TSR and operational underperformance suggest that

the bank needs to rethink its strategy and its approach to execution”. Yet, despite the clearly abysmal performance, ISS suggests

that there isn’t a “case for change” on the Board. Ask yourselves: If a decade of losses does not constitute a

case for change, then what does?

The time to take action to ensure Carver’s long-term success,

profitability and role in the community is now. We must not allow further losses and shareholder value declines to prevent Carver from

serving the communities in New York that need its services.

We urge you to support Mr. Anderson and Mr. Bailey to join the Board

and help Carver return to growth. If you have any questions concerning the proxy materials or need assistance voting your shares, please

contact our proxy solicitor, Okapi Partners by calling (877) 629-6356 (toll-free) or via email at info@okapipartners.com.

We stand ready to work with you to make certain that Carver’s

future is bright.

Sincerely,

Greg Lewis

Dream Chasers Capital Group

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable

terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject

to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven,

correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Dream Chasers Capital Group

LLC (“Dream Chasers”) or any of the other participants in the proxy solicitation prove to be incorrect, the actual results

may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation

by Dream Chasers that the future plans, estimates or expectations contemplated will ever be achieved.

5

Source: https://www.prnewswire.com/news-releases/carver-bancorp-inc-successfully-completes-1-000-000-private-placement-with-national-community-investment-fund-301892135.html

6

Based on CARV share price on October 23, 2024, one day prior to the filing of Dream Chasers Capital Group’s preliminary proxy statement.

Source: S&P Capital IQ Pro.

7

Source: https://www.globenewswire.com/news-release/2011/06/29/450410/7036/en/Carver-Bancorp-Inc-Raises-55-Million-in-New-Equity-Capital-From-Institutional-Investors.html

Certain statements and information included herein may have been sourced

from third parties. Dream Chasers does not make any representations regarding the accuracy, completeness or timeliness of such third party

statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither

been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support

from such third parties for the views expressed herein.

Dream Chasers disclaims any obligation to update the information herein

or to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect

events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated

or unanticipated events.

IMPORTANT INFORMATION AND WHERE TO FIND IT

DREAM CHASERS STRONGLY ADVISES ALL STOCKHOLDERS

OF THE COMPANY TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS

FILED BY DREAM CHASERS WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL

BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO

AVAILABLE ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI

PARTNERS LLC, 1212 AVENUE OF THE AMERICAS, 17TH FLOOR, NEW YORK, NEW YORK 10036-1600. STOCKHOLDERS CAN CALL TOLL-FREE: (877)

629-6356.

Contacts

For Media:

Breitenbush Partners

Andrew Wilson, (773) 425-4991

awilson@breitenbushpartners.com

For Investors:

Okapi Partners

Bruce Goldfarb/Tony Vecchio

(877) 629-6356

(212) 297-0720

info@okapipartners.com

About Dream Chasers Capital Group

Dream Chasers Capital Group LLC is a New York City based minority

owned investment firm. More information can be found at www.dreamchaserscapitalgroup.com.

Additionally, on December 2, 2024, Dream Chasers posted the following

text on certain social media sites, including Stocktwits:

It is time for a change at Carver $CARV

Dream Chasers Capital Group

encourages all shareholders to vote FOR Jeffrey

“Jeff” Anderson and Jeff Bailey to join Carver’s Board to return to profitability, growth and shareholder value creation.

Shareholders have lost money for years, while executives

and Board members continue to get handsomely rewarded. We need new voices on the Board.

The deadline to vote is December 12 – so VOTE

today by following the voting instructions on the Blue proxy card you’ve received from Dream Chasers Capital Group.

If you need assistance voting your Blue proxy

card, please contact our proxy solicitor, Okapi Partners at (877) 629-6356 (toll-free) or via email at info@okapipartners.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information herein contains “forward-looking statements.”

Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and

include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “potential,” “targets,” “forecasts,”

“seeks,” “could,” “should” or the negative of such terms or other variations on such terms or comparable

terminology. Similarly, statements that describe our objectives, plans or goals are forward-looking. Forward-looking statements are subject

to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven,

correct. If one or more of the risks or uncertainties materialize, or if any of the underlying assumptions of Dream Chasers Capital Group

LLC (“Dream Chasers”) or any of the other participants in the proxy solicitation prove to be incorrect, the actual results

may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation

by Dream Chasers that the future plans, estimates or expectations contemplated will ever be achieved.

Certain statements and information included herein may have been sourced

from third parties. Dream Chasers does not make any representations regarding the accuracy, completeness or timeliness of such third party

statements or information. Except as may be expressly set forth herein, permission to cite such statements or information has neither

been sought nor obtained from such third parties. Any such statements or information should not be viewed as an indication of support

from such third parties for the views expressed herein.

Dream Chasers disclaims any obligation to update the information herein

or to disclose the results of any revisions that may be made to any projected results or forward-looking statements herein to reflect

events or circumstances after the date of such information, projected results or statements or to reflect the occurrence of anticipated

or unanticipated events.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Dream Chasers, Gregory Lewis, Shawn Herrera,

Kevin Winters, Jeffrey Bailey and Jeffrey Anderson (“collectively, the Participants”) are participants in the solicitation

of proxies from the shareholders of the Company for the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”). On

November 4, 2024, the Participants filed with the U.S. Securities and Exchange Commission (the “SEC”) their definitive proxy

statement and accompanying BLUE universal proxy card or voting instruction form in connection with their solicitation of proxies from

the shareholders of the Company for the Annual Meeting.

IMPORTANT INFORMATION AND WHERE TO FIND IT

DREAM CHASERS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY

TO READ ITS DEFINITIVE PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT AND OTHER PROXY MATERIALS FILED BY DREAM

CHASERS WITH THE SEC AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE

AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS ARE ALSO AVAILABLE

ON THE SEC WEBSITE, FREE OF CHARGE, OR BY DIRECTING A REQUEST TO THE PARTICIPANTS’ PROXY SOLICITOR, OKAPI

PARTNERS LLC, 1212 AVENUE OF THE AMERICAS, 17TH FLOOR, NEW YORK, NEW YORK 10036-1600. STOCKHOLDERS CAN CALL TOLL-FREE: (877)

629-6356.

Contacts

For Media:

Breitenbush Partners

Andrew Wilson, (773) 425-4991

awilson@breitenbushpartners.com

For Investors:

Okapi Partners

Bruce Goldfarb/Tony Vecchio

(877) 629-6356

(212) 297-0720

info@okapipartners.com

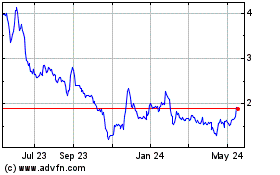

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Jan 2025 to Feb 2025

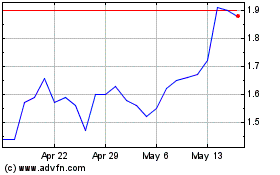

Carver Bancorp (NASDAQ:CARV)

Historical Stock Chart

From Feb 2024 to Feb 2025