Fourth Quarter Results (All comparisons refer to the

fourth quarter of 2023, except as noted)

- Net income of $4.6 million, or $0.33 per diluted common

share.

- Successfully terminated defined benefit pension plan resulting

in one-time expense of $3.5 million.

- Increase in net interest margin to 3.55% from 3.30%.

- Increase in facility expense transaction volumes of 20.3%.

- Completed acquisition of AcuAudit from Acuitive Solutions

LLC.

- Maintained exceptional credit quality, with no non-performing

loans or charge-offs.

- Repurchased 79,713 shares of Company stock at weighted average

price of $44.02.

Cass Information Systems, Inc. (Nasdaq:

CASS), (the Company or Cass) reported fourth quarter

2024 earnings of $0.33 per diluted share, as compared to $0.61 in

the fourth quarter of 2023 and $0.21 in the third quarter of 2024.

Net income for the period was $4.6 million, a decrease of 45.4%

from $8.4 million in the same period in 2023 and an increase of

$2.9 million, or 56.4%, as compared to the third quarter of 2024.

For the year ended December 31, 2024, the Company reported net

income and earnings per diluted share of $19.2 million and $1.39,

respectively, as compared to $30.1 million and $2.18, respectively,

for the year ended December 31, 2023.

Martin Resch, the Company’s President and Chief Executive

Officer, noted, “We closed 2024 operationally on a strong note and

have significant momentum for enhanced profitability as we enter

2025. We expect our net interest margin to continue to increase

given the current interest rate environment. We see average earning

assets returning to the level we had prior to the cyber event at

our CassPay client, which resulted in a $100 million balance

decrease early in 2024. We have leveraged our new AI enabled

technology platforms to gain operating efficiencies in our payments

business, and will continue to do so throughout 2025, resulting in

lower headcount even as our transaction volumes continue to

increase. The launch of Amplify, our partnership with Lupeon and

our acquisition of AcuAudit provides us with a unique opportunity

to market a best-in-class transportation payments solution,

covering all geographies and transportation modes. The termination

of the defined benefit pension plan will remove close to $1 million

of annual operating costs. Finally, and most importantly, we

continue to win new business reflecting our market leadership

position and trust that our clients have in our ability to deliver

value.”

Resch continued, “Net income during 2024 was negatively impacted

by a combination of $7.8 million of bad debt expense on a funding

receivable related to a facility client, a pension termination loss

of $3.5 million and the cyber event at a CassPay client. These

events and their related financial impact are now behind us and we

have significant tailwinds as described above. These tailwinds,

combined with indications that freight indices are approaching

positive territory for the first time since 2022 (Cass

Transportation Index Report), set up for a positive revenue and

profitability environment for Cass in coming quarters.”

Fourth Quarter 2024 Highlights

Transportation Dollar Volumes – Transportation dollar

volumes were $9.0 billion during the fourth quarter of 2024, a

decrease of 0.6% as compared to the fourth quarter of 2023 and a

decrease of 1.1% as compared to the third quarter of 2024. The

decrease in dollar volumes was due to a decrease in the average

dollars per transaction to $1,008 during the fourth quarter of 2024

as compared to $1,036 in the fourth quarter of 2023 and $993 in the

third quarter of 2024. Transportation dollar volumes are key to the

Company’s revenue as higher volumes generally lead to an increase

in payment float, which generates interest income, as well as an

increase in payments in advance of funding, which generates

financial fees.

Facility Expense Dollar Volumes – Facility expense dollar

volumes totaled $5.3 billion during the fourth quarter of 2024, an

increase of 9.1% as compared to the fourth quarter of 2023 and a

decrease of 8.4% as compared to the third quarter of 2024. The

increase as compared to the fourth quarter of 2023 is largely

reflective of new client volume. The decrease as compared to the

third quarter of 2024 is largely due to seasonality in client

energy usage.

Processing Fees – Processing fees decreased $466,000, or

2.2%, over the same period in the prior year. The decrease in

processing fees was largely driven by an decrease in fees in the

Company’s Waste division and a decrease in ancillary fees,

partially offset by increases in facility and transportation

transaction volumes of 20.3% and 2.1%, respectively.

Financial Fees – Financial fees, earned on a

transactional level basis for invoice payment services when making

customer payments, decreased $753,000, or 6.6%. The decrease in

financial fee income was primarily due to the decline in

transportation dollar volumes of 0.6% in addition to changes in the

manner certain vendors receive payments. The Company has had recent

success signing clients for the Amplify by Cass working capital

solution which is expected to begin to have a positive impact on

financial fees during the second half of 2025.

Net Interest Income – Net interest income increased

$730,000, or 4.3%. The increase in net interest income was

attributable to an increase in the net interest margin to 3.55% in

the fourth quarter of 2024 from 3.30% in the fourth quarter of

2023, partially offset by a decline in average interest-earning

assets of $52.8 million, or 2.5%. The expansion in the net interest

margin is largely due to an increase in the weighted-average yield

on loans to 5.38% from 4.95% in the same quarter last year due to

loan growth and fixed rate loans maturing and being re-priced in a

higher interest rate environment.

Provision for Credit Losses - The Company recorded a

provision for credit losses of $93,000 during the fourth quarter of

2024 as compared to a release of credit losses of $215,000 in the

fourth quarter of 2023. The provision for credit losses for the

fourth quarter of 2024 was largely driven by an increase in total

loans of $3.6 million, or 0.3%, as compared to September 30, 2024

as well as an increase in unfunded commitments on new faith-based

construction loans.

Personnel Expenses - Personnel expenses increased $3.5

million, or 11.7%. Salaries and commissions increased $410,000, or

1.7%, as compared to the fourth quarter of 2023 primarily as a

result of merit increases. The Company has reduced its FTE count to

1,147 at December 31, 2024 as compared to 1,170 at September 30,

2024 and 1,202 at June 30, 2024. The December 31, 2024 FTE count

includes 14 from AcuAudit. Salaries and commissions increased

$421,000 as compared to the third quarter of 2024 due to an

increase in employee profit sharing of $1.0 million, partially

offset by the decline in FTEs.

Net periodic pension cost increased $3.5 million. The Company

recorded a one-time non-cash expense of $3.5 million in the fourth

quarter of 2024 related to the termination of its noncontributory

defined-benefit pension plan. The termination of the plan is

expected to reduce run rate operating expense by approximately $1.0

million on an annual basis. Excluding the impact of the one-time

pension termination expense, personnel expenses were flat with the

same quarter in the prior year.

Non-Personnel Expenses - Non-personnel expenses increased

$765,000, or 7.1%. Equipment expense increased $378,000 due to an

increase in depreciation expense on software related to recently

completed technology initiatives.

Loans - When compared to December 31, 2023, ending loans

increased $67.7 million, or 6.7%.

Payments in Advance of Funding – Average payments in

advance of funding decreased $8.4 million, or 4.0%, primarily due

to a 0.6% decrease in transportation dollar volumes, which led to

fewer dollars advanced to freight carriers, as well as the

continued consolidation of freight carriers.

Goodwill and Other Intangible Assets - When compared to

September 30, 2024, goodwill and other intangible assets increased

$6.3 million. In December 2024, the Company acquired AcuAudit, a

premier freight audit platform for ocean and international air

freight, from Acuitive Solutions LLC. The Asset Purchase Agreement

reflects a base purchase price of $3.0 million and an earnout based

on annualized recurring revenue at the end of 24 months. Current

annualized recurring revenue is approximately $2.5 million. The

Company expects the impact of the acquisition to be EBITDA neutral

in 2025 and a minimal negative impact to diluted earnings per share

driven by intangible amortization.

Deposits – Average deposits decreased $19.0 million, or

1.8%, when compared to the fourth quarter of 2023. The Company has

experienced a migration of client funds from non-interest bearing

to interest-bearing driven by the higher interest rate environment

prior to the recent 100 basis point cumulative decline in the

Federal Funds rate from September 2024 to December 2024.

Accounts and Drafts Payable - Average accounts and drafts

payable decreased $54.5 million, or 4.9%. The decrease in these

balances, which are non-interest bearing, are primarily reflective

of a cyber event at a CassPay client during the first quarter of

2024, which decreased average balances by approximately $100.0

million, and a decrease in transportation dollar volumes of 0.6%,

partially offset by an increase in facility dollar volumes of 9.1%.

Accounts and drafts payable are a significant source of funding

generated by payment float from transportation and facility

clients.

Shareholders’ Equity - Total shareholders’ equity has

decreased $779,000 since December 31, 2023 primarily as a result of

dividends of $16.5 million and the repurchase of Company stock of

$7.2 million, partially offset by net income of $19.2 million.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of

integrated information and payment management solutions. Cass

enables enterprises to achieve visibility, control and efficiency

in their supply chains, communications networks, facilities and

other operations. Disbursing over $90 billion annually on behalf of

clients, and with total assets of $2.4 billion, Cass is uniquely

supported by Cass Commercial Bank. Founded in 1906 and a wholly

owned subsidiary, Cass Commercial Bank provides sophisticated

financial exchange services to the parent organization and its

clients. Cass is part of the Russell

2000®. More information is

available at www.cassinfo.com.

Forward Looking Information

This information contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include future financial and operating results,

expectations, intentions, and other statements that are not

historical facts. Such statements are based on current beliefs and

expectations of the Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties

include the impact of economic and market conditions, inflationary

pressures, risks of credit deterioration, interest rate changes,

governmental actions, market volatility, security breaches and

technology interruptions, energy prices and competitive factors,

among others, as set forth in the Company’s most recent Annual

Report on Form 10-K and subsequent reports filed with the

Securities and Exchange Commission. Actual results may differ

materially from those set forth in the forward-looking

statements.

Note to Investors

The Company has used, and intends to continue using, the

Investors portion of its website to disclose material non-public

information and to comply with its disclosure obligations under

Regulation FD. Accordingly, investors are encouraged to monitor

Cass’s website in addition to following press releases, SEC

filings, and public conference calls and webcasts.

Consolidated Statements of Income

(unaudited)

($ and numbers in thousands, except per

share data)

Quarter Ended

December 31, 2024

Quarter Ended

September 30, 2024

Quarter Ended

December 31, 2023

Year Ended December

31,

2024

Year Ended December

31,

2023

Processing fees

$

20,262

$

20,053

$

20,728

$

82,671

$

79,566

Financial fees

10,714

11,177

11,467

43,297

45,985

Total fee revenue

$

30,976

$

31,230

$

32,195

$

125,968

$

125,551

Interest and fees on loans

14,428

14,567

12,796

55,362

50,825

Interest and dividends on securities

4,104

4,007

4,352

16,931

18,215

Interest on federal funds sold and

other short-term investments

3,844

4,200

4,573

15,752

13,720

Total interest income

$

22,376

$

22,774

$

21,721

$

88,045

$

82,760

Interest expense

4,612

5,156

4,687

20,258

16,266

Net interest income

$

17,764

$

17,618

$

17,034

$

67,787

$

66,494

(Provision for) release of credit

losses

(93

)

140

215

(447

)

550

Loss on sale of investment

securities

(33

)

--

(13

)

(46

)

(173

)

Other

1,757

1,562

1,305

5,927

5,089

Total revenues

$

50,371

$

50,550

$

50,736

$

199,189

$

197,511

Salaries and commissions

24,271

23,850

23,861

96,356

93,474

Share-based compensation

570

898

342

3,168

4,139

Net periodic pension cost

3,588

195

476

4,172

878

Other benefits

4,632

4,924

4,921

19,695

20,203

Total personnel expenses

$

33,061

$

29,867

$

29,600

$

123,391

$

118,694

Occupancy

868

890

890

3,446

3,560

Equipment

2,328

2,107

1,950

8,305

7,138

Bad debt expense

--

6,559

--

7,847

--

Other

8,350

7,475

7,941

31,981

30,763

Total operating expenses

$

44,607

$

46,898

$

40,381

$

174,970

$

160,155

Income from operations before

income taxes

$

5,764

$

3,652

$

10,355

$

24,219

$

37,356

Income tax expense

1,170

714

1,945

5,051

7,297

Net income

$

4,594

$

2,938

$

8,410

$

19,168

$

30,059

Basic earnings per share

$

.34

$

.22

$

.62

$

1.42

$

2.22

Diluted earnings per share

$

.33

$

.21

$

.61

$

1.39

$

2.18

Share data:

Weighted-average common

shares outstanding

13,436

13,504

13,467

13,502

13,530

Weighted-average common

shares outstanding assuming

dilution

13,718

13,786

13,755

13,778

13,816

Consolidated Balance Sheets

($ in thousands)

(unaudited) December 31,

2024

(unaudited) September 30,

2024

December 31, 2023

Assets:

Cash and cash equivalents

$

349,728

$

230,556

$

372,468

Securities available-for-sale, at fair

value

528,021

550,756

627,117

Loans

1,081,989

1,078,387

1,014,318

Less: Allowance for credit losses

(13,395

)

(13,447

)

(13,089

)

Loans, net

$

1,068,594

$

1,064,940

$

1,001,229

Payments in advance of funding

208,530

207,202

198,861

Premises and equipment, net

34,174

34,295

30,093

Investments in bank-owned life

insurance

50,325

49,885

49,159

Goodwill and other intangible assets

26,359

20,098

20,654

Accounts and drafts receivable from

customers

66,281

30,892

110,651

Other assets

63,069

72,136

68,390

Total assets

$

2,395,081

$

2,260,760

$

2,478,622

Liabilities and shareholders’ equity:

Deposits

Non-interest bearing

$

251,230

$

392,573

$

524,359

Interest-bearing

716,686

654,750

616,455

Total deposits

$

967,916

$

1,047,323

$

1,140,814

Accounts and drafts payable

1,149,276

936,463

1,071,369

Other liabilities

48,859

39,327

36,630

Total liabilities

$

2,166,051

$

2,023,113

$

2,248,813

Shareholders’ equity:

Common stock

$

7,753

$

7,753

$

7,753

Additional paid-in capital

205,593

205,026

208,007

Retained earnings

148,487

148,092

145,782

Common shares in treasury, at cost

(87,615

)

(84,139

)

(84,264

)

Accumulated other comprehensive loss

(45,188

)

(39,085

)

(47,469

)

Total shareholders’ equity

$

229,030

$

237,647

$

229,809

Total liabilities and shareholders’

equity

$

2,395,081

$

2,260,760

$

2,478,622

Average Balances (unaudited)

($ in thousands)

Quarter Ended

December 31, 2024

Quarter Ended

September 30, 2024

Quarter Ended

December 31, 2023

Year Ended December 31,

2024

Year Ended December 31,

2023

Average interest-earning assets

$

2,022,794

$

2,001,740

$

2,075,641

$

2,011,554

$

2,076,950

Average loans

1,065,944

1,072,824

1,025,259

1,048,732

1,055,668

Average securities available-for-sale

555,674

535,423

615,666

578,817

665,146

Average short-term investments

348,632

338,464

356,887

326,233

287,243

Average payments in advance of funding

200,963

202,976

209,364

202,860

234,865

Average assets

2,366,992

2,340,870

2,414,665

2,349,397

2,419,608

Average non-interest bearing deposits

399,778

404,364

464,924

414,711

512,608

Average interest-bearing deposits

638,180

630,204

592,055

634,581

571,067

Average interest-bearing liabilities

638,191

630,215

592,066

634,592

573,308

Average accounts and drafts payable

1,055,928

1,033,070

1,110,415

1,030,520

1,081,245

Average shareholders’ equity

$

231,993

$

231,785

$

207,834

$

228,944

$

211,069

Consolidated Financial Highlights

(unaudited)

($ and numbers in thousands, except

ratios)

Quarter Ended

December 31, 2024

Quarter Ended

September 30, 2024

Quarter Ended

December 31, 2023

Year Ended December 31,

2024

Year Ended December 31,

2023

Return on average equity

7.88

%

5.04

%

16.06

%

8.37

%

14.24

%

Return on average assets

0.77

%

0.50

%

1.38

%

0.82

%

1.24

%

Net interest margin (1)

3.55

%

3.55

%

3.30

%

3.42

%

3.25

%

Average interest-earning assets yield

(1)

4.46

%

4.57

%

4.20

%

4.43

%

4.04

%

Average loan yield

5.38

%

5.40

%

4.95

%

5.28

%

4.81

%

Average investment securities yield

(1)

2.87

%

2.86

%

2.63

%

2.82

%

2.63

%

Average short-term investment yield

4.39

%

4.94

%

5.08

%

4.83

%

4.78

%

Average cost of total deposits

1.77

%

1.98

%

1.76

%

1.93

%

1.50

%

Average cost of interest-bearing

deposits

2.88

%

3.25

%

3.14

%

3.19

%

2.85

%

Average cost of interest-bearing

liabilities

2.87

%

3.25

%

3.14

%

3.19

%

2.84

%

Allowance for credit losses to loans

1.24

%

1.25

%

1.29

%

1.24

%

1.29

%

Non-performing loans to total loans

--

%

--

%

--

%

--

%

--

%

Net loan charge-offs (recoveries) to

loans

--

%

--

%

--

%

--

%

--

%

Common equity tier 1 ratio

13.84

%

14.54

%

14.73

%

13.84

%

14.73

%

Total risk-based capital ratio

14.61

%

15.31

%

15.49

%

14.61

%

15.49

%

Leverage ratio

10.57

%

11.05

%

10.71

%

10.57

%

10.71

%

Transportation invoice volume

8,919

9,160

8,733

35,729

35,949

Transportation dollar volume

$

8,994,440

$

9,097,739

$

9,044,772

$

36,113,169

$

38,288,478

Facility expense transaction volume

4,218

4,316

3,505

17,135

13,857

Facility expense dollar volume

$

5,291,143

$

5,778,291

$

4,848,064

$

21,438,282

$

19,836,821

(1) Yields are presented on

tax-equivalent basis assuming a tax rate of 21%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123487493/en/

Cass Investor Relations ir@cassinfo.com

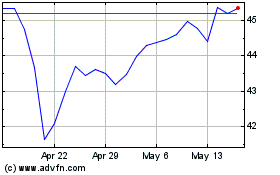

Cass Information Systems (NASDAQ:CASS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cass Information Systems (NASDAQ:CASS)

Historical Stock Chart

From Jan 2024 to Jan 2025