United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the period ending 31 December 2023

Commission File Number 001-37791

COCA-COLA EUROPACIFIC PARTNERS PLC

Pemberton House, Bakers Road

Uxbridge, UB8 1EZ, United Kingdom

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F ý Form 40-F D Â

COCA-COLA EUROPACIFIC PARTNERS

Preliminary unaudited results for the full year ended 31 December 2023

Solid end to a great year, well placed for FY24 and beyond

| | | | | | | | | | | | | | | | | | | | | | | |

| FY 2023 Metric[1] | As Reported | | Comparable [1] | Change vs 2022 |

| As Reported | Comparable [1] | Comparable Fx-Neutral [1] |

| Total CCEP | Volume (M UC)[2] | 3,279 | | | 3,279 | | (0.5) | % | (0.5) | % | |

| Revenue (€M) | 18,302 | | | 18,302 | | 5.5 | % | 5.5 | % | 8.0 | % |

| Cost of sales (€M) | 11,582 | | | 11,576 | | 4.5 | % | 4.5 | % | 6.5 | % |

| Operating expenses (€M) | 4,488 | | | 4,353 | | 6.0 | % | 6.5 | % | 8.5 | % |

| Operating profit (€M) | 2,339 | | | 2,373 | | 12.0 | % | 11.0 | % | 13.5 | % |

| Profit after taxes (€M) | 1,669 | | | 1,701 | | 9.5 | % | 9.0 | % | 11.5 | % |

| Diluted EPS (€) | 3.63 | | | 3.71 | | 10.5 | % | 9.5 | % | 12.0 | % |

Revenue per UC[2] (€) | | | 5.70 | | | | 8.5 | % |

Cost of sales per UC[2] (€) | | | 3.61 | | | | 7.5 | % |

| Comparable Free cash Flow (€M) | | | 1,734 | | | | |

| | | | | | |

| Dividend per share[3] (€) | | 1.84 | | Maintained dividend payout ratio of c.50% |

| | | | | | | |

| Europe | Volume (M UC)[2] | 2,644 | | | 2,644 | | 0.5 | % | 0.5 | % | |

| Revenue (€M) | 14,553 | | | 14,553 | | 7.5 | % | 7.5 | % | 8.5 | % |

| Operating profit (€M) | 1,842 | | | 1,888 | | 20.5 | % | 13.0 | % | 14.0 | % |

Revenue per UC[2] (€) | | | 5.56 | | | | 8.0 | % |

| | | | | | | |

| API | Volume (M UC)[2] | 635 | | | 635 | | (5.0) | % | (5.0) | % | |

| Revenue (€M) | 3,749 | | | 3,749 | | (1.0) | % | (1.0) | % | 5.5 | % |

| Operating profit (€M) | 497 | | | 485 | | (11.0) | % | 3.5 | % | 10.5 | % |

Revenue per UC[2] (€) | | | 6.30 | | | | 11.0 | % |

DAMIAN GAMMELL, CHIEF EXECUTIVE OFFICER, SAID:

“2023 was a great year for CCEP. This is testament to the hard work of our colleagues to whom we are extremely grateful, alongside our customers and brand partners. Our focus on leading brands, strong customer relationships and solid in-market execution served us well. We delivered solid top and bottom-line growth and generated impressive free cash flow. We drove solid gains in revenue per unit case through our revenue and margin growth management, along with our price and promotion strategy across a broad pack offering. Across our developed markets, transactions outpaced volume and we grew both share and household penetration. We progressed our long-term transformation strategy in Indonesia, and today, we completed the exciting acquisition, with Aboitiz[4], of Coca-Cola Beverages Philippines[5].

“We are well placed for FY24 and beyond. We are stronger and better, more diverse and robust, and our categories remain resilient despite ongoing macroeconomic and geopolitical volatility. We have fantastic activation plans, focusing on the Paris Olympics and the UEFA Euros, to engage customers and consumers. And we continue to actively manage our pricing and promotional spend to remain relevant to our consumers, balancing affordability and premiumisation. Along with our focus on productivity, this will all ultimately drive our free cash flow.

“We remain confident in the future, continuing to invest for the long-term. A record dividend in FY23 and our recent inclusion into the Nasdaq 100, combined with our FY24 guidance, demonstrate the strength of our business and our ability to deliver continued shareholder value. Supported by strong relationships with our brand partners, we have the platform and momentum, now including the Philippines, to go even further together whilst continuing to be a great partner for our customers and a great place to work for our colleagues.”

___________________________

Note: All footnotes included after the ‘About CCEP’ section

Revenue

FY Reported +5.5%; Fx-neutral +8.0%[6]

•Delivered more revenue growth YTD for our retail customers than any of our FMCG peers in Europe & our NARTD peers in Australia & New Zealand (NZ)[7]

•NARTD value share gains[7] across measured channels both in-store (+10bps) & online (+90bps), & increased household penetration in Europe (+70bps)[8]

•Transactions ahead of volume growth in Europe, Australia & NZ

•Comparable volume -0.5%[9]

◦By geography:

▪Europe +0.5%[9] reflecting solid in-market execution, resilient consumer demand offset by mixed summer weather

▪API -5.0%[9] reflecting solid in-market execution driving continued volume growth in Australia & NZ offset by softer consumer spending in Indonesia & the strategic SKU portfolio rationalisation

◦By channel: Away from Home (AFH) -1.5%[9] & Home 0.0%[9]

•Strong revenue per unit case +8.5%[2],[6] (Europe: +8.0%; API: +11.0%) driven by positive headline price increases & promotional optimisation alongside favourable mix

Q4 Reported +5.0%; Fx-neutral +7.0%[6]

•Comparable volume +1.0%[9]

◦By geography:

▪Europe +2.0%[9] reflecting solid in-market execution & cycling disruption last year relating to a customer negotiation

▪API -3.0%[9] reflecting solid in-market execution driving underlying volume growth in Australia & NZ offset by softer consumer spending in Indonesia & the strategic SKU portfolio rationalisation

◦By channel: AFH -1.0%[9] & Home +3.0%[9]

•Strong revenue per unit case +6.0%[2],[6] (Europe: +5.5%; API: +8.5%) driven by positive headline price increases & promotional optimisation alongside favourable mix

Operating profit

FY Reported +12.0%; Fx-neutral +13.5%[6]

•Cost of sales per unit case +7.5%[2],[6] reflecting increased revenue per unit case driving higher concentrate costs, inflation in commodities & manufacturing

•Comparable operating profit of €2,373m, +13.5%[6] reflecting strong top-line, our efficiency programmes & continuous efforts on discretionary spend optimisation

•Comparable diluted EPS of €3.71, +12.0%[6] (reported +10.5%)

Dividend

•Full year dividend per share of €1.84[3], +9.5% vs 2022, maintaining annualised total dividend payout ratio of approximately 50%

Joint acquisition of Coca-Cola Beverages Philippines, Inc. (CCBPI)

•CCEP confirms it has, together with Aboitiz Equity Ventures Inc., completed the acquisition of CCBPI from The Coca-Cola Company

•See separate release on Investors section of our website for more detail including provision of adjusted financial information on a FY basis for FY23 (https://ir.cocacolaep.com/financial-reports-and-results/financial-releases)

Other

•Comparable free cash flow: generated impressive comparable free cash flow of €1,734m[1][10] reflecting strong performance & working capital initiatives (net cashflows from operating activities of €2,806m)

◦Supporting return to the top end of our target leverage range (2.5 to 3.0x Net debt:Comparable EBITDA[1],[11]) by the end of 2023, as previously guided

◦At the end of 2023, Net debt: Comparable EBITDA[1][11] was 3.0x (end of FY22: 3.5x). This excludes the acquisition of CCBPI, which is expected to have a modest impact

•Comparable ROIC[1] increased by 120bps to 10.3% (reported 9.5%) driven by the increase in comparable profit after tax & continued focus on capital allocation

•Strategic portfolio choices: CCEP will move forward independently from both Beam Suntory & Capri Sun. See H1 2023 release on our website for more detail

(https://ir.cocacolaep.com/financial-reports-and-results/financial-releases)

| | | | | | | | | | | | | | |

| SUSTAINABILITY HIGHLIGHTS | | | |

•Retained MSCI AAA rating, inclusion on Carbon Disclosure Project A List for Climate & on the Bloomberg Gender Equality index

•Received approval from the Science Based Targets initiative (SBTi) of CCEP's long-term 2040 net zero & 2030 greenhouse gas reduction targets

•Exceeded target of 50% recycled plastic in our packaging: closed 2023 at 54.9%[12] (2022: 48.5%)

•Achieved carbon neutral certification for a further six manufacturing sites (five in Iberia and one in NZ); now a global total of 14 sites

•Partnered with The Coca-Cola Company, other bottlers & Greycroft, a seed-to-growth venture capital firm, to create a sustainability-focused venture capital fund

The outlook for FY24 reflects our current assessment of market conditions. Unless stated otherwise, guidance is on an adjusted[13] comparable & FX-neutral basis. Guidance is therefore provided on the basis that the acquisition of CCBPI occurred on 1 Jan 2023.

•Revenue: comparable growth of ~4% in line with our mid-term strategic objectives

•More balanced between volumes & price/mix than FY23

•Two extra selling days in Q4

•Cost of sales per unit case: comparable growth of 3-4%

•Expect commodity inflation to grow low single-digit

•FY24 hedge coverage at ~80%[14]

•Taxes increase driven by Netherlands

•Concentrate directly linked to revenue per unit case through the incidence pricing model

•Operating profit: comparable growth of ~7% in line with our mid-term strategic objectives

•Continued focus on optimising discretionary spend & delivering efficiency programmes

•FY24 supported by first year of next €350-400m efficiency programme to be delivered by the end of FY28 (cash cost to deliver included within FCF guidance): expect ~€60-70m to be delivered in FY24

•Other:

•Finance costs: weighted average cost of net debt of ~2%

•Comparable effective tax rate: ~25%

•Comparable free cash flow: ~€1.7bn in line with our mid-term strategic objectives

•Capital expenditure: ~5% of revenue excluding leases

•Dividend payout ratio: ~50%[15] based on comparable EPS

| | | | | | | | | | | | | | |

Fourth-quarter & Full-Year Revenue Performance by Geography[1] |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fourth-quarter | | Full Year |

| | Fx-Neutral | | | Fx-Neutral |

| € million | % change | % change | | € million | % change | % change |

| Great Britain | 812 | | 2.0 | % | 2.0 | % | | 3,235 | | 5.0 | % | 6.5 | % |

France[16] | 535 | | 6.0 | % | 6.0 | % | | 2,321 | | 11.0 | % | 11.0 | % |

| Germany | 760 | | 16.5 | % | 16.5 | % | | 3,018 | | 12.5 | % | 12.5 | % |

Iberia[17] | 755 | | 9.0 | % | 9.0 | % | | 3,325 | | 9.5 | % | 9.5 | % |

Northern Europe[18] | 630 | | 3.0 | % | 5.0 | % | | 2,654 | | 0.5 | % | 4.0 | % |

| Total Europe | 3,492 | | 7.0 | % | 7.5 | % | | 14,553 | | 7.5 | % | 8.5 | % |

API[19] | 1,026 | | (1.0) | % | 5.5 | % | | 3,749 | | (1.0) | % | 5.5 | % |

| Total CCEP | 4,518 | | 5.0 | % | 7.0 | % | | 18,302 | | 5.5 | % | 8.0 | % |

France

•Q4 volume decline reflects poor weather conditions & cycling strong Q4 World Cup activation.

•Fuze Tea continued to perform well achieving double-digit volume growth for both Q4 (+29.5%) and FY (+41.0%). Monster, Sprite & Powerade also outperformed in Q4 & FY.

•Revenue/UC[20] growth driven by headline price increase implemented in the first quarter.

Germany

•Q4 volume growth reflects cycling disruption last year relating to a customer negotiation.

•Continued volume growth in Coca-Cola Zero Sugar & Fanta. Monster, Fuze Tea & Powerade achieved double-digit volume growth for both Q4 & FY.

•Revenue/UC[20] growth driven by headline price increase implemented in the third quarter & positive brand mix e.g. FY Monster volume +34.0%.

Great Britain

•Q4 volume broadly flat.

•Monster realised double-digit volume growth for both Q4 & FY.

•Revenue/UC[20] growth driven by headline price increase implemented at the end of the second quarter & positive brand mix e.g. FY Monster volume +16.5% & successful launch of Jack Daniel’s & Coca-Cola.

Iberia

•Q4 volume growth driven by the AFH channel & resilient consumer demand.

•Coca-Cola Zero Sugar, Sprite & Monster volumes performed well. Royal Bliss achieved double-digit volume growth in Q4 (+12.0%), supported by launch in Portugal.

•Revenue/UC[20] growth driven by headline price increase implemented in the first quarter & positive mix.

Northern Europe

•Q4 volume growth reflects solid in-market execution & promotional optimisation.

•Monster, Powerade & Aquarius volumes outperformed for both Q4 & FY.

•Revenue/UC[20] growth driven by headline price increase implemented across our markets & positive pack mix led by the recovery of the AFH channel e.g. FY small glass volume +4.5%.

API

•Q4 volume decline reflects the strategic de-listings within Australia’s bulk water portfolio & softer consumer spending in Indonesia.

•Coca-Cola Zero Sugar, Monster & Powerade volume outperformed for both Q4 & FY.

•Revenue/UC[20] growth driven by headline price increase implemented across our markets during the first half & promotional optimisation in Australia.

___________________________

Note: All values are unaudited and all references to volumes are on a comparable basis. All changes are versus 2022 equivalent period unless stated otherwise

| | | | | | | | | | | | | | |

Fourth-quarter & Full-Year Volume Performance by Category[1],[9] |

Comparable volumes, changes versus equivalent 2022 period.

| | | | | | | | | | | | | | | | | | | |

| Fourth-quarter | | Full Year |

| % of Total | | % Change | | % of Total | | % Change |

| Sparkling | 86.0 | % | | 1.5 | % | | 85.0 | % | | 0.0 | % |

Coca-ColaTM | 60.0 | % | | 0.5 | % | | 59.0 | % | | 0.0 | % |

| Flavours, Mixers & Energy | 26.0 | % | | 4.0 | % | | 26.0 | % | | 1.0 | % |

| Stills | 14.0 | % | | (2.0) | % | | 15.0 | % | | (5.0) | % |

| Hydration | 7.0 | % | | (3.5) | % | | 7.5 | % | | (7.0) | % |

RTD Tea, RTD Coffee, Juices & Other[21] | 7.0 | % | | (0.5) | % | | 7.5 | % | | (3.0) | % |

| Total | 100.0 | % | | 1.0 | % | | 100.0 | % | | (0.5) | % |

Coca-ColaTM

•Q4 & FY growth across all key markets reflecting outperformance of Coca-Cola Zero Sugar (Q4:+3.5%; FY:+4.0%) supported by targeted campaigns & innovation.

•Coca-Cola Zero Sugar gained FY value share[7] of Total Cola +40bps, led by GB +120bps.

Flavours, Mixers & Energy

•Fanta Q4 +1.0%, reflecting strong consumer demand supported by flavour extensions.

•Q4 & FY Energy +14.0% led by Monster, continuing to gain distribution & share through exciting innovation e.g. launch of Monster Green Zero Sugar.

Hydration

•Q4 Water -9.5%; Q4 Sport +11.5%

•FY Water -13.5% driven by strategic portfolio choices (SKU rationalisation in Indonesia, the exit of large PET packs in Germany (Vio) & Iberia (Aquabona), & Mount Franklin bulk packs in Australia).

•FY Sports +9.0% growth in Powerade across all markets[22] driven by continued favourable consumer trends in this category.

RTD Tea, RTD Coffee, Juices & Other[21]

•Q4 Juice drinks -6.0%

•Q4 RTD Tea/Coffee +9.0% reflecting continued growth in Fuze Tea across Europe (+27.5%).

•FY performance reflecting strategic SKU rationalisation in Indonesia, partially offset by continued growth in Fuze Tea across Europe (+23.5%).

•Jack Daniel’s & Coca-Cola performed well since launch e.g. now #1 ARTD[23] value brand in GB[24]

___________________________

Note: All references to volumes are on a comparable basis. All changes are versus 2022 equivalent period unless stated otherwise

| | |

Conference Call (with presentation) |

•23 February 2024 at 11:30 GMT, 12:30 CEST & 6:30 a.m. EDT; accessible via www.cocacolaep.com

•Replay & transcript will be available at www.cocacolaep.com

•Integrated Report for publication: 15 March 2024

•First-quarter 2024 trading update: 25 April 2024

•Financial calendar available here: https://ir.cocacolaep.com/financial-calendar/

Investor Relations

Sarah Willett Awais Khan Raj Sidhu

sarah.willett@ccep.com awais.khan@ccep.com raj.sidhu@ccep.com

Media Relations

ccep@portland-communications.com

Coca-Cola Europacific Partners is one of the world’s leading consumer goods companies. We make, move and sell some of the world’s most loved brands – serving nearly 600 million consumers and helping over 2 million customers across 31 countries grow.

We combine the strength and scale of a large, multi-national business with an expert, local knowledge of the customers we serve and communities we support.

The Company is currently listed on Euronext Amsterdam, NASDAQ (and a constituent of the Nasdaq 100), London Stock Exchange and on the Spanish Stock Exchanges, trading under the symbol CCEP.

For more information about CCEP, please visit www.cocacolaep.com & follow CCEP on LinkedIn @Coca-Cola Europacific

Partners | LinkedIn.

___________________________

1.Refer to ‘Note Regarding the Presentation of Alternative Performance Measures’ for further details & to ‘Supplementary Financial Information’ for a reconciliation of reported to comparable results; Change percentages against prior year equivalent period unless stated otherwise

2.A unit case equals approximately 5.678 litres or 24 8-ounce servings

3.25 April 2023 declared first half interim dividend of €0.67 dividend per share, paid 25 May 2023; 1 November 2023 declared second half interim dividend of €1.17 dividend per share, paid 5 December 2023

4.Aboitiz Equity Ventures Inc.

5.Coca-Cola Beverages Philippines, Inc.

6.Comparable & FX-neutral

7.External data sources: Nielsen & IRI Period FY 23. Total CCEP excluding Indo

8.Increased households (+70bps) FY for GB & FR, P11 YTD for Spain, P10 YTD for Germany, Netherlands & Belgium

9.No selling day shift in Q4 or FY23; CCEP reported volume for Q4 +1.0% & FY23 -0.5%

10.Adjusted for royalty income proceeds (€89m) arising from the ownership of certain mineral rights in Australia. See note ‘Regarding the Presentation of Alternative Performance Measures’ for further details

11.Adjusted for items impacting comparability. Refer to ‘Note Regarding the Presentation of Alternative Performance Measures’ for further details

12.Unassured & provisional

13.Financial information adjusted as if the acquisition of CCBPI occurred at the beginning of the period presented for illustrative purposes only, it is not intended to estimate or predict future financial performance or what actual results would have been. Acquisition completed on 23 February 2024. Prepared on a basis consistent with CCEP accounting policies & include provisional transaction accounting adjustments for the period 1 January to 23 February

14.Includes the Philippines

15.Dividends subject to Board approval

16.Includes France & Monaco

17.Includes Spain, Portugal & Andorra

18.Includes Belgium, Luxembourg, the Netherlands, Norway, Sweden & Iceland

19.Includes Australia, New Zealand & the Pacific Islands, Indonesia & Papua New Guinea

20.Revenue per unit case

21.RTD refers to ready to drink; Other includes Alcohol & Coffee

22.In all listed markets, Powerade not listed in Indonesia

23.ARTD refers to alcohol ready to drink

24.Combined portfolio of Jack Daniel’s & Coca-Cola and Jack Daniel’s & Coca-Cola Zero Sugar, external data source Nielsen last 12 weeks ending 27 January 2024

| | | | | | | | | | | | | | |

Forward-Looking Statements |

This document contains statements, estimates or projections that constitute “forward-looking statements” concerning the financial condition, performance, results, guidance and outlook, dividends, consequences of mergers, acquisitions, joint ventures, and divestitures, including the joint venture with Aboitiz Equity Ventures Inc. (AEV) and acquisition of Coca-Cola Beverages Philippines, Inc. (CCBPI), strategy and objectives of Coca-Cola Europacific Partners plc and its subsidiaries (together CCEP or the Group). Generally, the words “ambition”, “target”, “aim”, “believe”, “expect”, “intend”, “estimate”, “anticipate”, “project”, “plan”, “seek”, “may”, “could”, “would”, “should”, “might”, “will”, “forecast”, “outlook”, “guidance”, “possible”, “potential”, “predict”, “objective” and similar expressions identify forward-looking statements, which generally are not historical in nature.

Forward-looking statements are subject to certain risks that could cause actual results to differ materially from CCEP’s historical experience and present expectations or projections. As a result, undue reliance should not be placed on forward-looking statements, which speak only as of the date on which they are made. These risks include but are not limited to:

1. those set forth in the “Risk Factors” section of CCEP’s 2022 Annual Report on Form 20-F filed with the SEC on 17 March 2023 and as updated and supplemented with the additional information set forth in the “Principal Risks and Risk Factors” section of the H1 2023 Half-year Report filed with the SEC on 2 August 2023;

2. risks and uncertainties relating to the global supply chain and distribution, including impact from war in Ukraine and increasing geopolitical tensions and conflicts including in the Middle East and Asia Pacific region, such as the risk that the business will not be able to guarantee sufficient supply of raw materials, supplies, finished goods, natural gas and oil and increased state-sponsored cyber risks;

3. risks and uncertainties relating to the global economy and/or a potential recession in one or more countries, including risks from elevated inflation, price increases, price elasticity, disposable income of consumers and employees, pressure on and from suppliers, increased fraud, and the perception or manifestation of a global economic downturn;

4. risks and uncertainties relating to potential global energy crisis, with potential interruptions and shortages in the global energy supply, specifically the natural gas supply in our territories. Energy shortages at our sites, our suppliers and customers could cause interruptions to our supply chain and capability to meet our production and distribution targets;

5. risks and uncertainties relating to potential water use reductions due to regulations by national and regional authorities leading to a potential temporary decrease in production volume; and

6. risks and uncertainties relating to the integration and operation of the joint venture with AEV and acquisition of CCBPI, including the risk that our integration of CCBPI’s business and operations may not be successful or may be more difficult, time consuming or costly than expected.

Due to these risks, CCEP’s actual future financial condition, results of operations, and business activities, including its results, dividend payments, capital and leverage ratios, growth, including growth in revenue, cost of sales per unit case and operating profit, free cash flow, market share, tax rate, efficiency savings, achievement of sustainability goals, including net zero emissions and recycling initiatives, capital expenditures, our agreements relating to and results of the joint venture with AEV and acquisition of CCBPI, and ability to remain in compliance with existing and future regulatory compliance, may differ materially from the plans, goals, expectations and guidance set out in forward-looking statements. These risks may also adversely affect CCEP’s share price. Additional risks that may impact CCEP’s future financial condition and performance are identified in filings with the SEC which are available on the SEC’s website at www.sec.gov. CCEP does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required under applicable rules, laws and regulations. Any or all of the forward-looking statements contained in this filing and in any other of CCEP’s public statements may prove to be incorrect.

| | | | | | | | | | | | | | |

Note Regarding the Presentation of Alternative Performance Measures |

Alternative Performance Measures

We use certain alternative performance measures (non-IFRS performance measures) to make financial, operating and planning decisions and to evaluate and report performance. We believe these measures provide useful information to investors and as such, where clearly identified, we have included certain alternative performance measures in this document to allow investors to better analyse our business performance and allow for greater comparability. To do so, we have excluded items affecting the comparability of period-over-period financial performance as described below. The alternative performance measures included herein should be read in conjunction with and do not replace the directly reconcilable IFRS measures.

The alternative performance measures in this document have been calculated in a manner consistent with those set forth in CCEP’s 2022 Annual Report on Form 20-F filed with the SEC on 17 March 2023, and the title of certain non-IFRS measures has been updated to better reflect their comparable nature.

For purposes of this document, the following terms are defined:

‘‘As reported’’ are results extracted from our unaudited consolidated financial statements. Refer to pages 17-20.

“Adjusted” includes the results of CCEP as if the CCBPI acquisition had occurred at the beginning of the period presented, including provisional acquisition accounting adjustments, accounting policy reclassifications and the impact of debt financing costs in connection with the acquisition.

"Comparable’’ is defined as results excluding items impacting comparability, which include restructuring charges, income arising from the ownership of certain mineral rights in Australia, gain on sale of sub-strata and associated mineral rights in Australia, net impact related to European flooding, gains on the sale of property, accelerated amortisation charges, expenses related to legal provisions, impact of a defined benefit plan amendment arising from legislative changes in respect of the minimum retirement age and acquisition and integration related costs. Comparable volume is also adjusted for selling days.

‘‘Adjusted comparable” is defined as adjusted results excluding items impacting comparability, as described above.

‘‘Fx-neutral’’ is defined as period results excluding the impact of foreign exchange rate changes. Foreign exchange impact is calculated by recasting current year results at prior year exchange rates.

‘‘Capex’’ or “Capital expenditures’’ is defined as purchases of property, plant and equipment and capitalised software, plus payments of principal on lease obligations, less proceeds from disposals of property, plant and equipment. Capex is used as a measure to ensure that cash spending on capital investment is in line with the Group’s overall strategy for the use of cash.

‘‘Comparable Free cash flow’’ is defined as net cash flows from operating activities less capital expenditures (as defined above) and net interest payments, adjusted for items that are not reasonably likely to recur within two years, nor have occurred within the prior two years. Comparable free cash flow is used as a measure of the Group’s cash generation from operating activities, taking into account investments in property, plant and equipment, non-discretionary lease and net interest payments while excluding the effects of items that are unusual in nature to allow for better period over period comparability. Comparable free cash flow reflects an additional way of viewing our liquidity, which we believe is useful to our investors, and is not intended to represent residual cash flow available for discretionary expenditures. Refer to page 14 for additional information.

‘‘Comparable EBITDA’’ is calculated as Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA), after adding back items impacting the comparability of period over period financial performance. Comparable EBITDA does not reflect cash expenditures, or future requirements for capital expenditures or contractual commitments. Further, comparable EBITDA does not reflect changes in, or cash requirements for, working capital needs, and although depreciation and amortisation are non-cash charges, the assets being depreciated and amortised are likely to be replaced in the future and comparable EBITDA does not reflect cash requirements for such replacements.

‘‘Net Debt’’ is defined as borrowings adjusted for the fair value of hedging instruments and other financial assets/liabilities related to borrowings, net of cash and cash equivalents and short term investments. We believe that reporting net debt is useful as it reflects a metric used by the Group to assess cash management and leverage. In addition, the ratio of net debt to comparable EBITDA is used by investors, analysts and credit rating agencies to analyse our operating performance in the context of targeted financial leverage.

‘‘ROIC” or “Return on invested capital” is defined as reported profit after tax attributable to shareholders divided by the average of opening and closing invested capital for the year. Invested capital is calculated as the addition of borrowings and equity attributable to shareholders less cash and cash equivalents and short term investments.

“Comparable ROIC” adjusts reported profit after tax for items impacting the comparability of period-over-period financial performance and is defined as comparable operating profit after tax attributable to shareholders divided by the average of opening and closing invested capital for the year. Comparable ROIC is used as a measure of capital efficiency and reflects how well the Group generates comparable operating profit relative to the capital invested in the business.

‘‘Dividend payout ratio’’ is defined as dividends as a proportion of comparable profit after tax.

Additionally, within this document, we provide certain forward-looking non-IFRS financial information, which management uses for planning and measuring performance. We are not able to reconcile forward-looking non-IFRS measures to reported measures without unreasonable efforts because it is not possible to predict with a reasonable degree of certainty the actual impact or exact timing of items that may impact comparability throughout year.

Unless otherwise stated, percent amounts are rounded to the nearest 0.5%.

| | | | | | | | | | | | | | |

Supplementary Financial Information - Items Impacting Comparability - Reported to Comparable |

The following provides a summary reconciliation of items impacting comparability for the years ended 31 December 2023 and 31 December 2022:

| | | | | | | | | | | | | | | |

| Full Year 2023 | | | |

| In millions of € except share data which is calculated prior to rounding | | Operating profit | Profit after taxes | Diluted earnings per share (€) | |

| As Reported | | 2,339 | | 1,669 | | 3.63 | | |

| | | | | |

| Items impacting comparability | | | | | |

Restructuring charges [1] | | 94 | | 79 | | 0.18 | | |

Acquisition and Integration related costs [2] | | 12 | | 14 | | 0.03 | | |

European flooding [3] | | (9) | | (7) | | (0.02) | | |

Coal royalties [4] | | (18) | | (12) | | (0.03) | | |

Property sale [5] | | (54) | | (38) | | (0.08) | | |

Litigation [6] | | 17 | | 12 | | 0.03 | | |

Accelerated amortisation [7] | | 27 | | 19 | | 0.04 | | |

Sale of sub-strata and associated mineral rights [8] | | (35) | | (35) | | (0.07) | | |

| Comparable | | 2,373 | | 1,701 | | 3.71 | | |

| | | | | | | | | | | | | | | |

| Full Year 2022 | | | |

| In millions of € except share data which is calculated prior to rounding | | Operating profit | Profit after taxes | Diluted earnings per share (€) | |

| As Reported | | 2,086 | | 1,521 | | 3.29 | | |

| | | | | |

| Items impacting comparability | | | | | |

Restructuring charges [1] | | 163 | | 121 | | 0.27 | | |

Acquisition and Integration related costs [2] | | 3 | | 3 | | 0.01 | | |

European flooding [3] | | (11) | | (8) | | (0.02) | | |

Coal royalties [4] | | (96) | | (67) | | (0.15) | | |

Defined benefit plan amendment [9] | | (7) | | (6) | | (0.01) | | |

| Comparable | | 2,138 | | 1,564 | | 3.39 | | |

__________________________

[1] Amounts represent restructuring charges related to business transformation activities.

[2] Amounts represent costs incurred in connection with the proposed acquisition of CCBPI for the year ended 31 December 2023 as well as integration costs related to the acquisition of CCL recognised during the year ended 31 December 2022.

[3] Amounts represent the incremental expense incurred offset by the insurance recoveries collected as a result of the July 2021 flooding events, which impacted the operations of our production facilities in Chaudfontaine and Bad Neuenahr.

[4] Amounts represent royalty income arising from the ownership of certain mineral rights in Australia. The royalty income was recognised as “Other income” in our consolidated income statement for the years ended 31 December 2023 and 31 December 2022, respectively.

[5] Amounts represent gains mainly attributable to the sale of property in Germany. The gains on disposal were recognised as “Other income” in our consolidated income statement for the year ended 31 December 2023.

[6] Amounts relate to the establishment of a provision in connection with an ongoing labour law matter in Germany.

[7] Amounts represent accelerated amortisation charges associated with the discontinuation of the relationship between CCEP and Beam Suntory upon expiration of the current contractual agreements.

[8] Amounts represent the considerations received relating to the sale of the sub-strata and associated mineral rights in Australia. The transaction completed in April 2023 and the proceeds were recognised as “Other income” in our consolidated income statement for the year ended 31 December 2023.

[9] Amounts represent the impact of a plan amendment arising from legislative changes in respect of the minimum retirement age.

| | | | | | | | | | | | | | |

Supplemental Financial Information - Operating Profit - Reported to Comparable |

Revenue

| | | | | | | | | | | | | | | | | | | | | | | |

Revenue CCEP In millions of €, except per case data which is calculated prior to rounding. FX impact calculated by recasting current year results at prior year rates. | Fourth-Quarter Ended | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change | | 31 December 2023 | 31 December 2022 | % Change |

| As reported | 4,518 | | 4,295 | | 5.0 | % | | 18,302 | | 17,320 | | 5.5 | % |

| Adjust: Impact of fx changes | 79 | | n/a | n/a | | 396 | | n/a | n/a |

| Fx-neutral | 4,597 | | 4,295 | | 7.0 | % | | 18,698 | | 17,320 | | 8.0 | % |

| | | | | | | |

| Revenue per unit case | 5.73 | | 5.41 | | 6.0 | % | | 5.70 | | 5.25 | | 8.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Revenue Europe In millions of €, except per case data which is calculated prior to rounding. FX impact calculated by recasting current year results at prior year rates. | Fourth-Quarter Ended | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change | | 31 December 2023 | 31 December 2022 | % Change |

| As reported | 3,492 | | 3,258 | | 7.0 | % | | 14,553 | | 13,529 | | 7.5 | % |

| Adjust: Impact of fx changes | 13 | | n/a | n/a | | 147 | | n/a | n/a |

| Fx-neutral | 3,505 | | 3,258 | | 7.5 | % | | 14,700 | | 13,529 | | 8.5 | % |

| | | | | | | |

| Revenue per unit case | 5.54 | | 5.26 | | 5.5 | % | | 5.56 | | 5.14 | | 8.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue API In millions of €, except per case data which is calculated prior to rounding. FX impact calculated by recasting current year results at prior year rates. | Fourth-Quarter Ended | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change | | | 31 December 2023 | 31 December 2022 | % Change | |

| As reported | 1,026 | | 1,037 | | (1.0) | % | | | 3,749 | | 3,791 | | (1.0) | % | |

| Adjust: Impact of fx changes | 66 | | n/a | n/a | | | 249 | | n/a | n/a | |

| Fx-neutral | 1,092 | | 1,037 | | 5.5 | % | | | 3,998 | | 3,791 | | 5.5 | % | |

| | | | | | | | | |

| Revenue per unit case | 6.45 | | 5.94 | | 8.5 | % | | | 6.30 | | 5.67 | | 11.0 | % | |

| | | | | | | | | | | | | | |

Revenue by Geography In millions of € | | Year ended 31 December 2023 |

| As reported | Reported

% change | Fx-Neutral

% change |

|

| Great Britain | | 3,235 | | 5.0 | % | 6.5 | % |

| Germany | | 3,018 | | 12.5 | % | 12.5 | % |

Iberia[1] | | 3,325 | | 9.5 | % | 9.5 | % |

France[2] | | 2,321 | | 11.0 | % | 11.0 | % |

| Belgium and Luxembourg | | 1,078 | | 3.5 | % | 3.5 | % |

| Netherlands | | 718 | | 5.5 | % | 5.5 | % |

| Norway | | 376 | | (7.0) | % | 5.5 | % |

| Sweden | | 398 | | (5.5) | % | 2.0 | % |

| Iceland | | 84 | | (3.5) | % | 1.0 | % |

| | | | |

| Total Europe | | 14,553 | | 7.5 | % | 8.5 | % |

| Australia | | 2,385 | | 2.0 | % | 9.5 | % |

New Zealand and Pacific Islands | | 679 | | 4.5 | % | 11.0 | % |

| Indonesia and Papua New Guinea | | 685 | | (14.5) | % | (10.5) | % |

| Total API | | 3,749 | | (1.0) | % | 5.5 | % |

| Total CCEP | | 18,302 | | 5.5 | % | 8.0 | % |

[1] Iberia refers to Spain, Portugal & Andorra.

[2] France refers to continental France & Monaco.

Volume

| | | | | | | | | | | | | | | | | | | | | | | |

Comparable Volume - Selling Day Shift CCEP

In millions of unit cases, prior period volume recast using current year selling days | Fourth-Quarter Ended | | Year Ended |

31 December 2023 | 31 December 2022 | % Change | | 31 December 2023 | 31 December 2022 | % Change |

| Volume | 802 | | 794 | | 1.0 | % | | 3,279 | | 3,300 | | (0.5) | % |

| Impact of selling day shift | n/a | — | | n/a | | n/a | — | | n/a |

| Comparable volume - Selling Day Shift adjusted | 802 | | 794 | | 1.0 | % | | 3,279 | | 3,300 | | (0.5) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Comparable Volume - Selling Day Shift Europe

In millions of unit cases, prior period volume recast using current year selling days | Fourth-Quarter Ended | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change | | 31 December 2023 | 31 December 2022 | % Change |

| Volume | 632 | | 619 | | 2.0 | % | | 2,644 | | 2,631 | | 0.5 | % |

| Impact of selling day shift | n/a | — | | n/a | | n/a | — | | n/a |

| Comparable volume - Selling Day Shift adjusted | 632 | | 619 | | 2.0 | % | | 2,644 | | 2,631 | | 0.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Comparable Volume - Selling Day Shift API

In millions of unit cases, prior period volume recast using current year selling days | Fourth-Quarter Ended | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change | | 31 December 2023 | 31 December 2022 | % Change |

| Volume | 170 | | 175 | | (3.0) | % | | 635 | | 669 | | (5.0) | % |

| Impact of selling day shift | n/a | — | | n/a | | n/a | — | | n/a |

| Comparable volume - Selling Day Shift adjusted | 170 | | 175 | | (3.0) | % | | 635 | | 669 | | (5.0) | % |

Cost of Sales

| | | | | | | | | | | | | | | | | |

Cost of Sales In millions of €, except per case data which is calculated prior to rounding. FX impact calculated by recasting current year results at prior year rates. | | | Year Ended |

| | | | 31 December 2023 | 31 December 2022 | % Change |

| As reported | | | | | 11,582 | | 11,096 | | 4.5 | % |

| Adjust: Total items impacting comparability | | | | | (6) | | (8) | | n/a |

Adjust: Restructuring charges [1] | | | | | (9) | | (19) | |

Adjust: European flooding [2] | | | | | 9 | | 11 | |

Adjust: Litigation [3] | | | | | (6) | | — | |

| Comparable | | | | | 11,576 | | 11,088 | | 4.5 | % |

| Adjust: Impact of fx changes | | | | | 249 | | n/a | n/a |

| Comparable & fx-neutral | | | | | 11,825 | | 11,088 | | 6.5 | % |

| | | | | | | |

| Cost of sales per unit case | | | | | 3.61 | | 3.36 | | 7.5 | % |

[1] Amounts represent restructuring charges related to business transformation activities.

[2] Amounts represent the incremental expense incurred offset by the insurance recoveries collected as a result of the July 2021 flooding events, which impacted the operations of our production facilities in Chaudfontaine and Bad Neuenahr.

[3] Amounts relate to the establishment of a provision in connection with an ongoing labour law matter in Germany.

For the year ending 31 December 2023, reported cost of sales were €11,582 million, up 4.5% versus 2022.

Comparable cost of sales for the same period were €11,576 million, up 4.5% versus 2022. Cost of sales per unit case increased by 7.5% on a comparable and fx-neutral basis, reflecting increased revenue per unit case driving higher concentrate costs, and inflation in commodities and manufacturing.

Operating expenses

| | | | | | | | | | | | | | | | | |

Operating Expenses In millions of €. FX impact calculated by recasting current year results at prior year rates. | | | Year Ended |

| | | | 31 December 2023 | 31 December 2022 | % Change |

| As reported | | | | | 4,488 | | 4,234 | | 6.0 | % |

| Adjust: Total items impacting comparability | | | | | (135) | | (140) | | n/a |

Adjust: Restructuring charges [1] | | | | | (85) | | (144) | |

Adjust: Acquisition and Integration related costs [2] | | | | | (12) | | (3) | |

Adjust: Litigation [3] | | | | | (11) | | — | |

Adjust: Accelerated amortisation [4] | | | | | (27) | | — | |

Adjust: Defined benefit plan amendment [5] | | | | | — | | 7 | |

| Comparable | | | | | 4,353 | | 4,094 | | 6.5 | % |

| Adjust: Impact of fx changes | | | | | 96 | | n/a | n/a |

| Comparable & fx-neutral | | | | | 4,449 | | 4,094 | | 8.5 | % |

[1] Amounts represent restructuring charges related to business transformation activities.

[2] Amounts represent costs incurred in connection with the proposed acquisition of CCBPI for the year ended 31 December 2023 as well as integration costs related to the acquisition of CCL recognised during the year ended 31 December 2022.

[3] Amounts relate to the establishment of a provision in connection with an ongoing labour law matter in Germany.

[4] Amounts represent accelerated amortisation charges associated with the discontinuation of the relationship between CCEP and Beam Suntory upon expiration of the current contractual agreements.

[5] Amounts represent the impact of a plan amendment arising from legislative changes in respect of the minimum retirement age.

For the year ending 31 December 2023, reported operating expenses were €4,488 million, up 6.0% versus 2022.

Comparable operating expenses were €4,353 million for the same period, up 6.5% versus 2022, reflecting the impact of inflation, partially offset by the benefit of ongoing efficiency programmes and our continuous efforts on discretionary spend optimisation.

Restructuring charges of €85 million were recognised within reported operating expenses for the year ending 31 December 2023, which are primarily attributable to severance charges related to various transformation initiatives.

Restructuring charges of €144 million were recognised within reported operating expenses for the year ending 31 December 2022, which are primarily attributable to €82 million of expense recognised in connection with the transformation of the full service vending operations and related initiatives in Germany.

Operating profit

| | | | | | | | | | | | | | |

Operating Profit CCEP In millions of €. FX impact calculated by recasting current year results at prior year rates. | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change |

| As reported | | 2,339 | | 2,086 | | 12.0 | % |

| Adjust: Total items impacting comparability | | 34 | | 52 | | n/a |

| Comparable | | 2,373 | | 2,138 | | 11.0 | % |

| Adjust: Impact of fx changes | | 51 | | n/a | n/a |

| Comparable & fx-neutral | | 2,424 | | 2,138 | | 13.5 | % |

| | | | | | | | | | | | | | |

Operating Profit Europe In millions of €. FX impact calculated by recasting current year results at prior year rates. | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change |

| As reported | | 1,842 | | 1,529 | | 20.5 | % |

| Adjust: Total items impacting comparability | | 46 | | 141 | | n/a |

| Comparable | | 1,888 | | 1,670 | | 13.0 | % |

| Adjust: Impact of fx changes | | 19 | | n/a | n/a |

| Comparable & fx-neutral | | 1,907 | | 1,670 | | 14.0 | % |

| | | | | | | | | | | | | | | |

Operating Profit API In millions of €. FX impact calculated by recasting current year results at prior year rates. | | Year Ended |

| 31 December 2023 | 31 December 2022 | % Change | |

| As reported | | 497 | | 557 | | (11.0) | % | |

| Adjust: Total items impacting comparability | | (12) | | (89) | | n/a | |

| Comparable | | 485 | | 468 | | 3.5 | % | |

| Adjust: Impact of fx changes | | 32 | | n/a | n/a | |

| Comparable & fx-neutral | | 517 | | 468 | | 10.5 | % | |

| | | | | | | | | | | | | | |

Supplemental Financial Information - Effective Tax Rate |

The reported effective tax rate was 24% and 22% for the years ended 31 December 2023 and 31 December 2022, respectively.

The increase in the reported effective tax rate to 24% in 2023 (2022: 22%) is largely due to the increase in the UK statutory tax rate to a weighted average of 23.5% and the review of uncertain tax positions.

The comparable effective tax rate was 24% and 22% for the years ended 31 December 2023 and 31 December 2022, respectively.

| | | | | | | | |

Income tax In millions of € | Year Ended |

| 31 December 2023 | 31 December 2022 |

| As reported | 534 | | 436 | |

| Adjust: Total items impacting comparability | 4 | | 9 | |

Adjust: Restructuring charges [1] | 15 | | 42 | |

Adjust: European flooding [2] | (2) | | (3) | |

Adjust: Defined benefit plan amendment [3] | — | | (1) | |

Adjust: Coal royalties [4] | (6) | | (29) | |

Adjust: Property sale [5] | (16) | | — | |

Adjust: Litigation [6] | 5 | | — | |

Adjust: Accelerated amortisation [7] | 8 | | — | |

| Comparable | 538 | | 445 | |

__________________________

[1] Amounts represent the tax impact of restructuring charges related to business transformation activities.

[2] Amounts represent the tax impact of the incremental expense incurred offset by the insurance recoveries collected as a result of the July 2021 flooding events, which impacted the operations of our production facilities in Chaudfontaine and Bad Neuenahr.

[3] Amounts represent the tax impact of a plan amendment arising from legislative changes in respect of the minimum retirement age.

[4] Amounts represent the tax impact of royalty income arising from the ownership of certain mineral rights in Australia. The royalty income was recognised as “Other income” in our consolidated income statement for the years ended 31 December 2023 and 31 December 2022, respectively.

[5] Amounts represent the tax impact of gains mainly attributable to the sale of property in Germany. The gains on disposal were recognised as “Other income” in our consolidated income statement for the year ended 31 December 2023.

[6] Amounts represent the tax impact related to the establishment of a provision in connection with an ongoing labour law matter in Germany.

[7] Amounts represent the tax impact of accelerated amortisation charges associated with the discontinuation of the relationship between CCEP and Beam Suntory upon expiration of the current contractual agreements.

| | | | | | | | | | | | | | |

Supplemental Financial Information - Comparable Free Cash Flow |

| | | | | | | | | | | | | | |

Comparable Free Cash Flow In millions of € | | Year Ended |

| 31 December 2023 | | 31 December 2022 |

| Net cash flows from operating activities | | 2,806 | | | 2,932 | |

| Less: Purchases of property, plant and equipment | | (672) | | | (500) | |

| Less: Purchases of capitalised software | | (140) | | | (103) | |

| Add: Proceeds from sales of property, plant and equipment | | 101 | | | 11 | |

| Less: Payments of principal on lease obligations | | (148) | | | (153) | |

| Less: Net interest payments | | (124) | | | (130) | |

Adjust: Items impacting comparability [1] | | (89) | | | (252) | |

| Comparable Free Cash Flow | | 1,734 | | | 1,805 | |

[1] During the year ended 31 December 2023, the Group has received net of tax cash proceeds of €89 million in connection with the royalty income arising from the ownership of certain mineral rights in Australia. During the year ended 31 December 2022, €252 million of cash proceeds were received from the regional tax authorities of Bizkaia (Basque Region), in connection with the ongoing dispute in Spain regarding the refund of historical VAT amounts related to the period 2013-2016. The proceeds associated with these specific events have been included within the Group’s net cash flows from operating activities for the years ended 31 December 2023 and 31 December 2022, respectively. Given the unusual nature and to allow for better period over period comparability, our comparable free cash flow measure excludes the cash impact related to these items.

| | | | | | | | | | | | | | |

Supplemental Financial Information - Borrowings |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Debt In millions of € | As at | | Credit Ratings As of 22 February 2024 | | | | |

| 31 December 2023 | | 31 December 2022 | | | Moody’s | | Fitch Ratings |

| Total borrowings | 11,396 | | | 11,907 | | | Long-term rating | | Baa1 | | BBB+ |

Fair value of hedges related to borrowings[1] | 28 | | | (83) | | | Outlook | | Stable | | Stable |

Other financial assets/liabilities[1] | 20 | | | 25 | | | Note: Our credit ratings can be materially influenced by a number of factors including, but not limited to, acquisitions, investment decisions and working capital management activities of TCCC and/or changes in the credit rating of TCCC. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. |

Adjusted total borrowings[1] | 11,444 | | | 11,849 | | |

Less: cash and cash equivalents[2] | (1,419) | | | (1,387) | | |

Less: short term investments[3] | (568) | | | (256) | | |

| Net debt | 9,457 | | | 10,206 | | |

___________________[1] Net debt includes adjustments for the fair value of derivative instruments used to hedge both currency and interest rate risk on the Group’s borrowings. In addition, net debt also includes other financial assets/liabilities relating to cash collateral pledged by/to external parties on hedging instruments related to borrowings.

[2] Cash and cash equivalents as at 31 December 2023 and 31 December 2022 includes €42 million and €102 million respectively of cash in Papua New Guinea Kina. Presently, there are government-imposed currency controls which impact the extent to which the cash held in Papua New Guinea can be converted into foreign currency and remitted for use elsewhere in the Group.

[3] Short term investments are term cash deposits with maturity dates when acquired of greater than three months and less than one year. These short term investments are held with counterparties that are continually assessed with a focus on preservation of capital and liquidity. Short term term investments as at 31 December 2023 and 31 December 2022 includes €33 million and €49 million respectively of assets in Papua New Guinea Kina, subject to the same currency controls outlined above.

| | | | | | | | | | | | | | |

| Supplemental Financial Information - Comparable EBITDA |

| | | | | | | | | | | | | | |

Comparable EBITDA In millions of € | | Year Ended |

| 31 December 2023 | | 31 December 2022 |

| Reported profit after tax | | 1,669 | | | 1,521 | |

| Taxes | | 534 | | | 436 | |

| Finance costs, net | | 120 | | | 114 | |

| Non-operating items | | 16 | | | 15 | |

| Reported operating profit | | 2,339 | | | 2,086 | |

Depreciation and amortisation[1] | | 792 | | | 816 | |

| Reported EBITDA | | 3,131 | | | 2,902 | |

| | | | |

| | | | |

| | | | |

| Items impacting comparability | | | | |

| | | | |

Restructuring charges[2] | | 83 | | | 119 | |

Defined benefit plan amendment[3] | | — | | | (7) | |

Acquisition and integration related costs[4] | | 12 | | | 3 | |

Litigation[5] | | 17 | | | — | |

European flooding[6] | | (9) | | | (11) | |

Property sale[7] | | (54) | | | — | |

Sale of sub-strata and associated mineral rights[8] | | (35) | | | — | |

Coal royalties[9] | | (18) | | | (96) | |

| Comparable EBITDA | | 3,127 | | | 2,910 | |

| | | | |

| Net debt to reported EBITDA | | 3.0 | | | 3.5 | |

| | | | |

| Net debt to comparable EBITDA | | 3.0 | | | 3.5 | |

______________________

[1] Amounts include accelerated amortisation charges associated with the discontinuation of the relationship between CCEP and Beam Suntory upon expiration of the current contractual agreements for the year ended 31 December 2023.

[2] Amounts represent restructuring charges related to business transformation activities, excluding accelerated depreciation included in the depreciation and amortisation line.

[3] Amounts represent the impact of a plan amendment arising from legislative changes in respect of the minimum retirement age.

[4] Amounts represent costs incurred in connection with the proposed acquisition of CCBPI for the year ended 31 December 2023 as well as integration costs related to the acquisition of CCL recognised during the year ended 31 December 2022.

[5] Amounts relate to the establishment of a provision in connection with an ongoing labour law matter in Germany.

[6] Amounts represent the incremental expense incurred offset by the insurance recoveries collected as a result of the July 2021 flooding events, which impacted the operations of our production facilities in Chaudfontaine and Bad Neuenahr.

[7] Amounts represent gains mainly attributable to the sale of property in Germany. The gains on disposal were recognised as “Other income” in our consolidated income statement for the year ended 31 December 2023.

[8] Amounts represent the considerations received relating to the sale of the sub-strata and associated mineral rights in Australia. The transaction completed in April 2023 and the proceeds were recognised as “Other income” in our consolidated income statement for the year ended 31 December 2023.

[9] Amounts represent royalty income arising from the ownership of certain mineral rights in Australia. The royalty income was recognised as “Other income” in our consolidated income statement for the years ended 31 December 2023 and 31 December 2022, respectively.

| | | | | | | | | | | | | | |

| Supplemental Financial Information - Return on invested capital |

| | | | | | | | | | | | | | |

ROIC In millions of € | Year Ended |

| 31 December 2023 | | | 31 December 2022 |

| Reported profit after tax | 1,669 | | | | 1,521 | |

| Taxes | 534 | | | | 436 | |

| Finance costs, net | 120 | | | | 114 | |

| Non-operating items | 16 | | | | 15 | |

| Reported operating profit | 2,339 | | | | 2,086 | |

Items impacting comparability[1] | 34 | | | | 52 | |

Comparable operating profit[1] | 2,373 | | | | 2,138 | |

Taxes[2] | (570) | | | | (474) | |

| Non-controlling interest | — | | | | (13) | |

| Comparable operating profit after tax attributable to shareholders | 1,803 | | | | 1,651 | |

| Opening borrowings less cash and cash equivalents and short term investments | 10,264 | | | | 11,675 | |

| Opening equity attributable to shareholders | 7,447 | | | | 7,033 | |

| Opening Invested Capital | 17,711 | | | | 18,708 | |

| Closing borrowings less cash and cash equivalents and short term investments | 9,409 | | | | 10,264 | |

| Closing equity attributable to shareholders | 7,976 | | | | 7,447 | |

| Closing Invested Capital | 17,385 | | | | 17,711 | |

| | | | |

| Average Invested Capital | 17,548 | | | | 18,210 | |

| | | | |

| ROIC | 9.5 | % | | | 8.4 | % |

| | | | |

| Comparable ROIC | 10.3 | % | | | 9.1 | % |

____________________

[1] Reconciliation from reported to comparable operating profit is included in the Supplementary Financial Information - Items impacting comparability section.

[2] Tax rate used is the comparable effective tax rate for the year (2023: 24.0%; 2022: 22.2%).

| | | | | | | | | | | | | | |

Discussions with U.S. Securities and Exchange Commission (SEC) |

During 2023, the Company received written correspondence from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) regarding their review of CCEP’s Annual Report (Form 20-F) for the year ended 31 December 2022. As of 23 February 2024, there is an open comment concerning the Company’s long-standing accounting policy and disclosures related to the treatment of the TCCC bottling rights as indefinite-lived intangible assets. As of 31 December 2022, the Company has indefinite-lived intangible assets of €11,874 million related to the TCCC bottling arrangements that were recognised as a result of business combinations and valued on perpetual cash flows basis. The accounting policy is disclosed in the notes to the 2022 Consolidated Financial Statements, more specifically Note 7 (“Intangible assets and goodwill”) and Note 3 (“Significant judgements and estimates”). The Company has responded to the comments and will continue engaging with the Staff if further comments are raised.

If the Company’s accounting policy was reevaluated to limit the useful economic life of the intangible assets to the remaining contractual terms of the bottler’s agreements with TCCC, the Company’s historical and current consolidated financial statements would need to be adjusted to reduce the fair value of the intangible assets and related deferred tax liabilities, with an equivalent increase in goodwill effective as of the acquisition dates. Further, amortisation expense on the intangible assets would be recognised over the remaining contractual life of the agreements in place at acquisition. All resulting balance sheet and income statement effects would be non-cash and would not impact CCEP’s generation and use of distributable profits.

CCEP’s unaudited consolidated results contained in this release were prepared in accordance with its existing accounting policies and judgments, which the Company believes are appropriate and consistent with those applied during the preparation of prior period audited financial statements.

Coca-Cola Europacific Partners plc

Consolidated Income Statement (Unaudited)

| | | | | | | | | | | | | | |

| | Year Ended |

| | 31 December 2023 | | 31 December 2022 |

| | € million | | € million |

| Revenue | | 18,302 | | | 17,320 | |

| Cost of sales | | (11,582) | | | (11,096) | |

| Gross profit | | 6,720 | | | 6,224 | |

| Selling and distribution expenses | | (3,178) | | | (2,984) | |

| Administrative expenses | | (1,310) | | | (1,250) | |

| Other Income | | 107 | | | 96 | |

| Operating profit | | 2,339 | | | 2,086 | |

| Finance income | | 65 | | | 67 | |

| Finance costs | | (185) | | | (181) | |

| Total finance costs, net | | (120) | | | (114) | |

| Non-operating items | | (16) | | | (15) | |

| Profit before taxes | | 2,203 | | | 1,957 | |

| Taxes | | (534) | | | (436) | |

| Profit after taxes | | 1,669 | | | 1,521 | |

| | | | |

| Profit attributable to shareholders | | 1,669 | | | 1,508 | |

| Profit attributable to non-controlling interests | | — | | | 13 | |

| Profit after taxes | | 1,669 | | | 1,521 | |

| | | | |

| Basic earnings per share (€) | | 3.64 | | | 3.30 | |

| Diluted earnings per share (€) | | 3.63 | | | 3.29 | |

The financial information presented does not constitute statutory accounts as defined in section 434 of the Companies Act 2006 (‘the Act’). A copy of the statutory accounts for the year ended 31 December 2022 has been delivered to the Registrar of Companies for England and Wales. The auditor’s report on those accounts was unqualified, did not include a reference to any matters to which the auditor drew attention by way of emphasis without qualifying the report and did not contain a statement under sections 498(2) or 498(3) of the Act.

The financial information presented in the unaudited consolidated income statement, consolidated statement of financial position and consolidated statement of cash flows within this document does not represent the Group’s full consolidated financial statements for the year ended 31 December 2023. This financial information has been extracted from the CCEP’s consolidated financial statements, which will be delivered to the Registrar of Companies in due course. Accordingly, the financial information for 2023 is presented unaudited.

Coca-Cola Europacific Partners plc

Consolidated Statement of Financial Position (Unaudited)

| | | | | | | | | | | | | | | | | |

| | | 31 December 2023 | | 31 December 2022 | | |

| | | € million | | € million | | |

| ASSETS | | | | | | | |

| Non-current: | | | | | | | |

| Intangible assets | | | 12,395 | | | 12,505 | | | |

| Goodwill | | | 4,514 | | | 4,600 | | | |

| Property, plant and equipment | | | 5,344 | | | 5,201 | | | |

| Non-current derivative assets | | | 100 | | | 191 | | | |

| Deferred tax assets | | | 1 | | | 21 | | | |

| Other non-current assets | | | 295 | | | 252 | | | |

| Total non-current assets | | | 22,649 | | | 22,770 | | | |

| Current: | | | | | | | |

| Current derivative assets | | | 161 | | | 257 | | | |

| Current tax assets | | | 58 | | | 85 | | | |

| Inventories | | | 1,356 | | | 1,380 | | | |

| Amounts receivable from related parties | | | 123 | | | 139 | | | |

| Trade accounts receivable | | | 2,547 | | | 2,466 | | | |

| Other current assets | | | 351 | | | 479 | | | |

| Assets held for sale | | | 22 | | | 94 | | | |

Short term investments | | | 568 | | | 256 | | | |

| Cash and cash equivalents | | | 1,419 | | | 1,387 | | | |

| Total current assets | | | 6,605 | | | 6,543 | | | |

| Total assets | | | 29,254 | | | 29,313 | | | |

| LIABILITIES | | | | | | | |

| Non-current: | | | | | | | |

| Borrowings, less current portion | | | 10,096 | | | 10,571 | | | |

| Employee benefit liabilities | | | 191 | | | 108 | | | |

| Non-current provisions | | | 45 | | | 55 | | | |

| Non-current derivative liabilities | | | 169 | | | 187 | | | |

| Deferred tax liabilities | | | 3,378 | | | 3,513 | | | |

| Non-current tax liabilities | | | 75 | | | 82 | | | |

| Other non-current liabilities | | | 46 | | | 37 | | | |

| Total non-current liabilities | | | 14,000 | | | 14,553 | | | |

| Current: | | | | | | | |

| Current portion of borrowings | | | 1,300 | | | 1,336 | | | |

| Current portion of employee benefit liabilities | | | 8 | | | 8 | | | |

| Current provisions | | | 114 | | | 115 | | | |

| Current derivative liabilities | | | 99 | | | 76 | | | |

| Current tax liabilities | | | 253 | | | 241 | | | |

| Amounts payable to related parties | | | 270 | | | 485 | | | |

| Trade and other payables | | | 5,234 | | | 5,052 | | | |

| Total current liabilities | | | 7,278 | | | 7,313 | | | |

| Total liabilities | | | 21,278 | | | 21,866 | | | |

| EQUITY | | | | | | | |

| Share capital | | | 5 | | | 5 | | | |

| Share premium | | | 276 | | | 234 | | | |

| Merger reserves | | | 287 | | | 287 | | | |

| Other reserves | | | (823) | | | (507) | | | |

| Retained earnings | | | 8,231 | | | 7,428 | | | |

| Equity attributable to shareholders | | | 7,976 | | | 7,447 | | | |

| Non-controlling interest | | | — | | | — | | | |

| Total equity | | | 7,976 | | | 7,447 | | | |

| Total equity and liabilities | | | 29,254 | | | 29,313 | | | |

Coca-Cola Europacific Partners plc

Consolidated Statement of Cash Flows (Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Year Ended | | |

| | | 31 December 2023 | | 31 December 2022 | | |

| | | € million | | € million | | |

| Cash flows from operating activities: | | | | | | | |

| Profit before taxes | | | 2,203 | | | 1,957 | | | |

| Adjustments to reconcile profit before tax to net cash flows from operating activities: | | | | | | | |

| Depreciation | | | 653 | | | 715 | | | |

| Amortisation of intangible assets | | | 139 | | | 101 | | | |

| Share-based payment expense | | | 57 | | | 33 | | | |

| Gain on sale of sub-strata and associated mineral rights | | | (35) | | | — | | | |

| Gain on the sale of property | | | (54) | | | — | | | |

| Finance costs, net | | | 120 | | | 114 | | | |

| Income taxes paid | | | (509) | | | (415) | | | |

| Changes in assets and liabilities: | | | | | | | |

| (Increase) in trade and other receivables | | | (5) | | | (282) | | | |

| Decrease/(increase) in inventories | | | 6 | | | (244) | | | |

| Increase in trade and other payables | | | 124 | | | 885 | | | |

| Increase/(decrease) in net payable receivable from related parties | | | 80 | | | (15) | | | |

| (Decrease)/increase in provisions | | | (11) | | | 37 | | | |

| Change in other operating assets and liabilities | | | 38 | | | 46 | | | |

| Net cash flows from operating activities | | | 2,806 | | | 2,932 | | | |

| Cash flows from investing activities: | | | | | | | |

| | | | | | | |

| Purchases of property, plant and equipment | | | (672) | | | (500) | | | |

| Purchases of capitalised software | | | (140) | | | (103) | | | |

| Proceeds from sales of property, plant and equipment | | | 101 | | | 11 | | | |

| | | | | | | |

| Proceeds from sales of intangible assets | | | 37 | | | 143 | | | |

| Proceeds from the sale of sub-strata and associated mineral rights | | | 35 | | | — | | | |

Net (payments)/proceeds of short term investments | | | (342) | | | (207) | | | |

| Investments in equity instruments | | | (5) | | | (2) | | | |

| Proceeds from sale of equity instruments | | | — | | | 13 | | | |

| Interest received | | | 58 | | | — | | | |

| Other investing activity, net | | | (9) | | | — | | | |

| Net cash flows used in investing activities | | | (937) | | | (645) | | | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds from borrowings, net | | | 694 | | | — | | | |

| | | | | | | |

| Changes in short-term borrowings | | | — | | | (285) | | | |

| Repayments on third party borrowings | | | (1,159) | | | (938) | | | |

| Settlement of debt-related cross-currency swaps | | | 69 | | | — | | | |

| | | | | | | |

| Payments of principal on lease obligations | | | (148) | | | (153) | | | |

| Interest paid | | | (182) | | | (130) | | | |

| | | | | | | |

| Dividends paid | | | (841) | | | (763) | | | |

| | | | | | | |

| Exercise of employee share options | | | 43 | | | 13 | | | |

| | | | | | | |

| Transactions with non-controlling interests | | | (282) | | | — | | | |

| Other financing activities, net | | | (16) | | | (20) | | | |

| Net cash flows (used in)/from financing activities | | | (1,822) | | | (2,276) | | | |

| Net change in cash and cash equivalents | | | 47 | | | 11 | | | |

| Net effect of currency exchange rate changes on cash and cash equivalents | | | (15) | | | (31) | | | |

| Cash and cash equivalents at beginning of period | | | 1,387 | | | 1,407 | | | |

| Cash and cash equivalents at end of period | | | 1,419 | | | 1,387 | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorised.

| | | | | | | | |

| COCA-COLA EUROPACIFIC PARTNERS PLC |

| | (Registrant) |

Date: 23 February 2024 | By: | /s/ Manik Jhangiani |

| Name: | Manik Jhangiani |

| Title: | Chief Financial Officer |

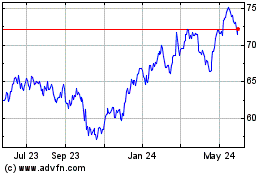

Coca Cola Europacific Pa... (NASDAQ:CCEP)

Historical Stock Chart

From Apr 2024 to May 2024

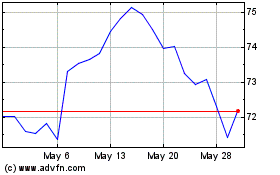

Coca Cola Europacific Pa... (NASDAQ:CCEP)

Historical Stock Chart

From May 2023 to May 2024