false

0001517175

0001517175

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January

13, 2025

THE CHEFS’ WAREHOUSE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-35249 |

20-3031526 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer Identification No.) |

100 East Ridge Road

Ridgefield, Connecticut 06877

(Address of principal executive offices)

Registrant’s telephone number, including area

code: (203) 894-1345

(Former name or former address, if changed since last

report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 |

CHEF |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

The Chefs’ Warehouse, Inc.

(NASDAQ:CHEF) (the “Company”) today issued a press release announcing its preliminary outlook for fiscal year 2025. A copy

of this press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Based on current trends in the business, the Company

is providing the following financial guidance for fiscal year 2025:

| · | Net sales to be in the range of $3.94 billion to $4.04 billion; |

| · | Gross profit to be in the range of $951 million to $976 million; and |

| · | Adjusted EBITDA(1) to be in the range of $233 million to $246 million. |

| |

(1) |

Adjusted EBITDA is a non-GAAP measure. Please see the schedule accompanying the press release in Exhibit 99.1 for a reconciliation of Adjusted EBITDA to the measure’s most directly comparable GAAP measure. |

The information contained herein is being furnished

pursuant to Item 7.01 of Form 8-K, “Regulation FD Disclosure.” This information shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference

in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing. The furnishing of this information will not be deemed an admission as to the materiality of any information contained

herein.

Forward-Looking Statements

Statements in this report regarding the Company’s

business that are not historical facts are “forward-looking statements” that involve risks and uncertainties and are based

on current expectations and management estimates; actual results may differ materially. The risks and uncertainties which could impact

these statements include, but are not limited to the following: our success depends to a significant extent upon general economic conditions,

including disposable income levels and changes in consumer discretionary spending; the relatively low margins of our business, which are

sensitive to inflationary and deflationary pressures and intense competition; the effects of rising costs, decreases in supply or the

interruption of commodities, ingredients, packaging, other raw materials, distribution and labor; fuel prices and their impact on distribution,

packaging and energy costs; our ability to grow our operations whether through expansion of our operations in existing markets or penetration

of new markets, and our effective management of that growth; our continued ability to promote and protect our brand successfully, to anticipate

and respond to new and existing customer demands, and to develop new products and markets to compete effectively; our ability and the

ability of our supply chain partners to continue to operate distribution centers and other work locations without material disruption,

and to procure ingredients, packaging and other raw materials when needed despite disruptions in the supply chain or labor shortages;

economic and other developments, or events, including adverse weather conditions, in the jurisdictions in which we operate; risks associated

with the expansion of our business; our possible inability to identify new acquisitions or to integrate recent or future acquisitions,

or our failure to realize anticipated revenue enhancements, cost savings or other synergies from recent or future acquisitions; other

factors that affect the food industry generally, including: recalls if products become adulterated or misbranded, liability if product

consumption causes injury, ingredient disclosure and labeling laws and regulations and the possibility that customers could lose confidence

in the safety and quality of certain food products; new information or attitudes regarding diet and health or adverse opinions about the

health effects of the products we distribute; our ability to maintain independent certifications associated with our products; changes

in disposable income levels and consumer purchasing habits; competitors’ pricing practices and promotional spending levels; fluctuations

in the level of our customers’ inventories, credit, payment of accounts and other related business risks; and the risks associated

with third-party suppliers, including the risk that any failure by one or more of our third-party suppliers to comply with food safety

or other laws and regulations may disrupt our supply of raw materials or certain products or injure our reputation; our ability to recruit

and retain senior management and a highly skilled and diverse workforce; the influence of significant corporate decisions due to the concentration

of ownership among existing officers, directors

and their affiliates; unanticipated expenses, including, without limitation, litigation

or legal settlement expenses and impairment charges; changing rules, public disclosure regulations and stakeholder expectations on ESG-related

matters; climate change, or the legal, regulatory or market measures being implemented to address climate change; the cost and adequacy

of our insurance policies; the impact and effects of public health crises, pandemics and epidemics and the adverse impact thereof on our

business, financial condition, and results of operations; interruption of operations due to information technology system failures, cybersecurity

incidents, or other disruptions to use of technology and networks; the possibility that information technology investments may not produce

anticipated results; significant governmental regulation and any potential failure to comply with such regulations; federal, state, provincial

and local tax rules in the United States and the foreign countries in which we operate, including tax reform and legislation; risks relating

to our substantial indebtedness; our ability to raise additional capital and/or obtain debt or other financing, on commercially reasonable

terms or at all; our ability to meet future cash requirements, including the ability to access financial markets effectively and maintain

sufficient liquidity; the effects of currency movements in the jurisdictions in which we operate as compared to the U.S. dollar; changes

in the method of determining Secured Overnight Financing Rate (“SOFR”), or the replacement of SOFR with an alternative rate;

and the effects of international trade disputes, tariffs, quotas and other import or export restrictions on our international procurement,

sales and operations. Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as

such, speak only as of the date made. A more detailed description of these and other risk factors is contained in the Company’s

most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 27, 2024

and other reports filed by the Company with the SEC since that date. The Company is not undertaking to update any information until required

by applicable laws. Any projections of future results of operations are based on a number of assumptions, many of which are outside the

Company’s control and should not be construed in any manner as a guarantee that such results will in fact occur. These projections

are subject to change and could differ materially from final reported results. The Company may from time to time update these publicly

announced projections, but it is not obligated to do so.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| THE CHEFS’ WAREHOUSE, INC. |

| |

|

| By: |

/s/Alexandros Aldous |

Name:

Title: |

Alexandros Aldous

General Counsel, Corporate Secretary, Chief Government Relations Officer & Chief Administrative Officer |

Date: January 13, 2025

The Chefs’ Warehouse Announces

Preliminary Fiscal Year 2025 Guidance

Company to Host Investor Day on March

13, 2025

Ridgefield, CT, January 13, 2025 - The Chefs’

Warehouse, Inc. (NASDAQ: CHEF) (the “Company” or “Chefs’”), a premier distributor of specialty food products

in the United States, the Middle East, and Canada, today announced its preliminary outlook for fiscal year 2025.

Based on current trends in the business, the Company

is providing the following financial guidance for fiscal year 2025:

| · | Net sales in the range of $3.94

billion and $4.04 billion; |

| · | Gross profit to be between $951

million and $976 million; and |

| · | Adjusted EBITDA, a non-GAAP measure,

to be between $233 million and $246 million. |

The Company’s full year diluted share count

is forecasted to be between 46.3 and 47.0 million shares and assumes no future share repurchases. The Company expects its senior

convertible notes due in 2028 to be dilutive for the full year and accordingly, has included in the forecasted fully diluted share count

approximately 6.5 million shares that could be issued upon conversion of the notes.

Investor Day

The Company plans to host an Investor Day on March

13, 2025, in New York City, which will also be webcast live from the Company’s investor relations website. A replay will be available

shortly after the event.

Non-GAAP Financial Measures

We present forecasted EBITDA and adjusted EBITDA ranges for fiscal

2025, which are not measurements determined in accordance with the U.S. Generally Accepted Accounting Principles (“GAAP”),

because we believe these measures provide additional metrics to evaluate our forecasted results and which we believe, when considered

with both our forecasted GAAP results and the reconciliation to forecasted net income, provide a more complete understanding of our business

than could be obtained absent this disclosure. We use EBITDA and adjusted EBITDA, together with financial measures prepared in accordance

with GAAP, such as revenue and cash flows from operations, to assess our historical and prospective operating performance and to enhance

our understanding of our core operating performance. The use of EBITDA and adjusted EBITDA as performance measures permits a comparative

assessment of our operating performance relative to our GAAP performance while isolating the effects of some items that vary from period

to period without any correlation to core operating performance or that vary widely among similar companies.

Other companies may calculate these non-GAAP financial measures differently,

and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should

only be used as supplemental measures of our operating performance.

Please see the schedule accompanying this release for a reconciliation

of forecasted EBITDA and adjusted EBITDA to these measures’ most directly comparable GAAP measure.

Forward-Looking Statements

Statements in this press release regarding the

Company’s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties

and are based on current expectations and management estimates; actual results may differ materially. The risks and uncertainties which

could impact these statements include, but are not limited to the following: our success depends to a significant extent upon general

economic conditions, including disposable income levels and changes in consumer discretionary spending; the relatively low margins of

our business, which are sensitive to inflationary and deflationary pressures and intense competition; the effects of rising costs, decreases

in supply or the interruption of commodities, ingredients, packaging, other raw materials, distribution and labor; fuel prices and their

impact on distribution, packaging and energy costs; our ability to grow our operations whether through expansion of our operations in

existing markets or penetration of new markets, and our effective management of that growth; our continued ability to promote and protect

our brand successfully, to anticipate and respond to new and existing customer demands, and to develop new products and markets to compete

effectively; our ability and the ability of our supply chain partners to continue to operate distribution centers and other work locations

without material disruption, and to procure ingredients, packaging and other raw materials when needed despite disruptions in the supply

chain or labor shortages; economic and other developments, or events, including adverse weather conditions, in the jurisdictions in which

we operate; risks associated with the expansion of our business; our possible inability to identify new acquisitions or to integrate recent

or future acquisitions, or our failure to realize anticipated revenue enhancements, cost savings or other synergies from recent or future

acquisitions; other factors that affect the food industry generally, including: recalls if products become adulterated or misbranded,

liability if product consumption causes injury, ingredient disclosure and labeling laws and regulations and the possibility that customers

could lose confidence in the safety and quality of certain food products; new information or attitudes regarding diet and health or adverse

opinions about the health effects of the products we distribute; our ability to maintain independent certifications associated with our

products; changes in disposable income levels and consumer purchasing habits; competitors’ pricing practices and promotional spending

levels; fluctuations in the level of our customers’ inventories, credit, payment of accounts and other related business risks; and

the risks associated with third-party suppliers, including the risk that any failure by one or more of our third-party suppliers to comply

with food safety or other laws and regulations may disrupt our supply of raw materials or certain products or injure our reputation; our

ability to recruit and retain senior management and a highly skilled and diverse workforce; the influence of significant corporate decisions

due to the concentration of ownership among existing officers, directors and their affiliates; unanticipated expenses, including, without

limitation, litigation or legal settlement expenses and impairment charges; changing rules, public disclosure regulations and stakeholder

expectations on ESG-related matters; climate change, or the legal, regulatory or market measures being implemented to address climate

change; the cost and adequacy of our insurance policies; the impact and effects of public health crises, pandemics and epidemics and the

adverse impact thereof on our business, financial condition, and results of operations; interruption of operations due to information

technology system failures, cybersecurity incidents, or other disruptions to use of technology and networks; the possibility that information

technology investments may not produce anticipated results; significant governmental regulation and any potential failure to comply with

such regulations; federal, state, provincial and local tax rules in the United States and the foreign countries in which we operate, including

tax reform and legislation;

risks relating to our substantial indebtedness; our ability to raise additional capital and/or obtain debt

or other financing, on commercially reasonable terms or at all; our ability to meet future cash requirements, including the ability to

access financial markets effectively and maintain sufficient liquidity; the effects of currency movements in the jurisdictions in which

we operate as compared to the U.S. dollar; changes in the method of determining Secured Overnight Financing Rate (“SOFR”),

or the replacement of SOFR with an alternative rate; and the effects of international trade disputes, tariffs, quotas and other import

or export restrictions on our international procurement, sales and operations. Any forward-looking statements are made pursuant to the

Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. A more detailed description of these and

other risk factors is contained in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission

(“SEC”) on February 27, 2024 and other reports filed by the Company with the SEC since that date. The Company is not

undertaking to update any information until required by applicable laws. Any projections of future results of operations are based on

a number of assumptions, many of which are outside the Company’s control and should not be construed in any manner as a guarantee

that such results will in fact occur. These projections are subject to change and could differ materially from final reported results.

The Company may from time to time update these publicly announced projections, but it is not obligated to do so.

About The Chefs’ Warehouse

The Chefs’ Warehouse, Inc. (http://www.chefswarehouse.com)

is a premier distributor of specialty food products in the United States, the Middle East and Canada focused on serving the specific needs

of chefs who own and/or operate some of the nation’s leading menu-driven independent restaurants, fine dining establishments, country

clubs, hotels, caterers, culinary schools, bakeries, patisseries, chocolateries, cruise lines, casinos and specialty food stores. The

Chefs’ Warehouse, Inc. carries and distributes more than 70,000 products to more than 44,000 customer locations throughout the United

States, the Middle East and Canada.

Contact:

Investor Relations

Jim Leddy, CFO, (718) 684-8415

THE CHEFS’ WAREHOUSE, INC.

RECONCILIATION OF ADJUSTED EBITDA GUIDANCE

FOR FISCAL 2025

| (unaudited - in millions) | |

Low-End | |

High-End |

| Net Income: | |

| 68.0 | | |

| 72.0 | |

| Provision for income tax expense | |

| 29.0 | | |

| 31.0 | |

| Depreciation and amortization | |

| 74.0 | | |

| 76.0 | |

| Interest expense | |

| 42.0 | | |

| 44.0 | |

| EBITDA | |

| 213.0 | | |

| 223.0 | |

| Adjustments: | |

| | | |

| | |

| Stock compensation (1) | |

| 17.5 | | |

| 18.5 | |

| Duplicate rent (2) | |

| 1.5 | | |

| 2.5 | |

| Other operating expenses (3) | |

| 0.5 | | |

| 1.0 | |

| Moving expenses (4) | |

| 0.5 | | |

| 1.0 | |

| Adjusted EBITDA | |

$ | 233.0 | | |

$ | 246.0 | |

| 1. |

Represents non-cash stock compensation

expense associated with awards of restricted shares of our common stock and stock options to our key employees and our independent

directors. |

| |

|

| 2. |

Represents rent and occupancy costs expected to be incurred in connection

with our facility consolidations while we are unable to use those facilities. |

| |

|

| 3. |

Represents non-cash changes in the fair value of contingent earn-out

liabilities related to our acquisitions, non-cash charges related to asset disposals, asset impairments, including intangible asset

impairment charges, certain third-party deal costs incurred in connection with our acquisitions or financing arrangements and certain

other costs. |

| |

|

| 4. |

Represents moving expenses

for the consolidation and expansion of several of our distribution facilities. |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

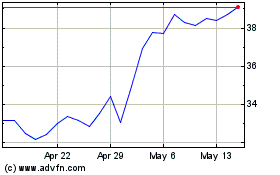

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Jan 2025 to Feb 2025

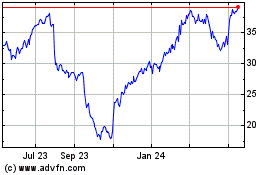

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Feb 2024 to Feb 2025