Liberty Broadband Corporation (“Liberty Broadband”) (Nasdaq:

LBRDA, LBRDK, LBRDP) will hold a virtual special meeting of its

holders of Series A common stock (“LBRDA”), Series B common stock

(“LBRDB”), Series C common stock (“LBRDK”) and Series A cumulative

redeemable preferred stock (“LBRDP”) on Wednesday, February 26,

2025 at 11:30 a.m. M.T. At the special meeting, holders of shares

of LBRDA, LBRDB and LBRDP will be asked to consider and vote on a

proposal to approve the adoption of the Agreement and Plan of

Merger, dated November 12, 2024, by and among Liberty Broadband,

Charter Communications, Inc. (“Charter”) (Nasdaq: CHTR), Fusion

Merger Sub 1, LLC, a wholly owned subsidiary of Charter (“Merger

LLC”), and Fusion Merger Sub 2, Inc., a wholly owned subsidiary of

Merger LLC, pursuant to which, among other things, Liberty

Broadband will combine with Charter (the “Transaction”).

Information regarding the Transaction and matters on which

holders of shares of LBRDA, LBRDB and LBRDP are being asked to vote

is available in the definitive proxy materials filed by Liberty

Broadband with respect to the special meeting. Assuming completion

of the divestiture of the business of Liberty Broadband’s

subsidiary GCI, LLC and satisfaction of all other conditions to

closing, the Transaction is expected to be completed on June 30,

2027 unless otherwise agreed.

Additional Special Meeting

Details

The special meeting will be held via the Internet and will be a

completely virtual meeting of holders of LBRDA, LBRDB, LBRDK and

LBRDP. Holders of LBRDA, LBRDB and LBRDP as of the record date for

the special meeting will be able to attend the meeting, submit

questions and vote their shares electronically during the meeting

via the Internet by visiting

www.virtualshareholdermeeting.com/LBRD2025SM. The record date for

the special meeting is 5:00 p.m., New York City time, on January

13, 2025. Stockholders will need the 16-digit control number that

is printed in the box marked by the arrow on the stockholder’s

proxy card for the special meeting to enter the virtual special

meeting website. A technical support number will become available

at the virtual meeting link 10 minutes prior to the scheduled

meeting time.

In addition, access to the special meeting will be available on

the Liberty Broadband website. All interested persons should visit

https://www.libertybroadband.com/investors/news-events/ir-calendar

to access the webcast. An archive of the webcast will also be

available on this website after appropriate filings have been made

with the SEC.

Forward-Looking Statements

This communication includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including certain statements relating to the Transaction

and the proposed timing and other matters related to the

Transaction. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and

state securities laws. These forward-looking statements generally

can be identified by phrases such as “possible,” “potential,”

“intends” or “expects” or other words or phrases of similar import

or future or conditional verbs such as “will,” “may,” “might,”

“should,” “would,” “could,” or similar variations. These

forward-looking statements involve many risks and uncertainties

that could cause actual results and the timing of events to differ

materially from those expressed or implied by such statements,

including, without limitation, the satisfaction of conditions to

the Transaction. These forward-looking statements speak only as of

the date of this communication, and Liberty Broadband expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statement contained herein to

reflect any change in Liberty Broadband’s expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based. Please refer to the publicly

filed documents of Liberty Broadband, including its definitive

proxy statement materials for the special meeting and its most

recent Forms 10-K and 10-Q, as such risk factors may be amended,

supplemented or superseded from time to time by other reports

Liberty Broadband subsequently files with the SEC, for additional

information about Liberty Broadband and about the risks and

uncertainties related to Liberty Broadband’s business which may

affect the statements made in this communication.

Additional Information

Nothing in this press release shall constitute a solicitation to

buy or an offer to sell shares of common stock of Liberty Broadband

or Charter. The proposed offer and issuance of shares of Charter

common stock in the Transaction will be made only pursuant to the

effective registration statement on Form S-4, which includes a

proxy statement of Liberty Broadband and a prospectus and proxy

statement of Charter. Liberty Broadband and Charter stockholders

and other investors are urged to read the registration statement,

together with all relevant SEC filings regarding the Transaction,

and any other relevant documents filed as exhibits therewith, as

well as any amendments or supplements to those documents, because

they contain important information about the Transaction. The joint

proxy statement/prospectus and other relevant materials for the

proposed transaction will be provided to all LBRDA, LBRDB, LBRDK,

LBRDP and Charter stockholders. Copies of these SEC filings are

available, free of charge, at the SEC's website

(http://www.sec.gov). Copies of the filings together with the

materials incorporated by reference therein are available, without

charge, by directing a request to Liberty Broadband Corporation,

12300 Liberty Boulevard, Englewood, Colorado 80112, Attention:

Investor Relations, Telephone: (844) 826-8735 or Charter

Communications, Inc., 400 Washington Blvd., Stamford, CT 06902,

Attention: Investor Relations, Telephone: (203) 905-7801.

Participants in Solicitation

Liberty Broadband anticipates that the following individuals

will be participants (the “Liberty Broadband Participants”) in the

solicitation of proxies from holders of shares of LBRDA, LBRDB and

LBRDP in connection with the proposed transaction: John C. Malone,

Chairman of the Liberty Broadband board of directors and Liberty

Broadband’s interim Chief Executive Officer, Gregg L. Engles, Julie

D. Frist, Richard R. Green, Sue Ann R. Hamilton, J. David Wargo and

John E. Welsh III, all of whom are members of the Liberty Broadband

board of directors, and Brian J. Wendling, Liberty Broadband’s

Chief Accounting Officer and Principal Financial Officer.

Information regarding the Liberty Broadband Participants, including

a description of their direct or indirect interests, by security

holdings or otherwise, and Liberty Broadband’s transactions with

related persons is set forth in the sections entitled “Proposal 1 –

The Election of Directors Proposal”, “Director Compensation”,

“Proposal 3 – The Incentive Plan Proposal”, “Proposal 4 – The

Say-On-Pay Proposal”, “Executive Officers”, “Executive

Compensation”, “Security Ownership of Certain Beneficial Owners and

Management—Security Ownership of Management” and “Certain

Relationships and Related Party Transactions” contained in Liberty

Broadband’s definitive proxy statement for its 2024 annual meeting

of stockholders, which was filed with the SEC on April 25, 2024

(which is available at:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1611983/000110465924051479/tm242809d6_def14a.htm)

and other documents subsequently filed by Liberty Broadband with

the SEC. To the extent holdings of Liberty Broadband stock by the

directors and executive officers of Liberty Broadband have changed

from the amounts of Liberty Broadband stock held by such persons as

reflected therein, such changes have been or will be reflected on

Statements of Change in Ownership on Form 4 or amendments to

beneficial ownership reports on Schedules 13D filed with the SEC.

Free copies of these documents may be obtained as described

above.

Charter anticipates that the following individuals will be

participants (the “Charter Participants”) in the solicitation of

proxies from holders of Charter common stock in connection with the

proposed transaction: Eric L. Zinterhofer, Non-Executive Chairman

of the Charter board of directors, W. Lance Conn, Kim C. Goodman,

Gregory B. Maffei, John D. Markley, Jr., David C. Merritt, James E.

Meyer, Steven A. Miron, Balan Nair, Michael A. Newhouse, Mauricio

Ramos and Carolyn J. Slaski, all of whom are members of the Charter

board of directors, Christopher L. Winfrey, President, Chief

Executive Officer and Director, Jessica M. Fischer, Chief Financial

Officer, and Kevin D. Howard, Executive Vice President, Chief

Accounting Officer and Controller. Information about the Charter

Participants, including a description of their direct or indirect

interests, by security holdings or otherwise, and Charter’s

transactions with related persons is set forth in the sections

entitled “Proposal No. 1: Election of Directors”, “Compensation

Committee Interlocks and Insider Participation”, “Compensation

Discussion and Analysis”, “Certain Beneficial Owners of Charter

Class A Common Stock”, “Certain Relationships and Related

Transactions”, “Proposal No. 2: Increase the Number of Shares in

2019 Stock Incentive Plan”, “Pay Versus Performance” and “CEO Pay

Ratio” contained in Charter’s definitive proxy statement for its

2024 annual meeting of shareholders, which was filed with the SEC

on March 14, 2024 (which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/1091667/000119312524067965/d534477ddef14a.htm)

and other documents subsequently filed by Charter with the SEC. To

the extent holdings of Charter stock by the directors and executive

officers of Charter have changed from the amounts of Charter stock

held by such persons as reflected therein, such changes have been

or will be reflected on Statements of Change in Ownership on Form 4

filed with the SEC.

About Liberty Broadband

Corporation

Liberty Broadband Corporation (Nasdaq: LBRDA, LBRDK, LBRDP)

operates and owns interests in a broad range of communications

businesses. Liberty Broadband’s principal assets consist of its

interest in Charter Communications and its subsidiary GCI. GCI

provides data, mobile, video, voice and managed services to

consumer, business, government and carrier customers throughout

Alaska, serving more than 200 communities. The company has invested

$4.7 billion in its Alaska network and facilities over the past 45

years. Through a combination of ambitious network initiatives, GCI

continues to expand and strengthen its statewide network

infrastructure to deliver the best possible connectivity to its

customers and close the digital divide in Alaska.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122594510/en/

Liberty Broadband Corporation Shane Kleinstein,

720-875-5432

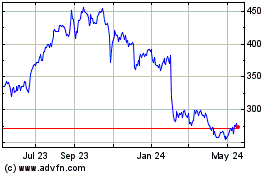

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

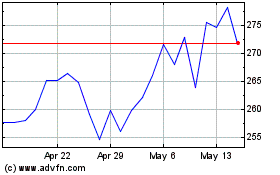

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jan 2024 to Jan 2025