Cipher Mining Provides First Quarter 2024 Business Update

07 May 2024 - 9:00PM

Cipher Mining Inc.

(NASDAQ: CIFR) (“Cipher” or the

“Company”) today announced results for its first quarter ended

March 31, 2024, with an update on its operations and deployment

strategy.

“We are delighted to announce results for the first quarter of

2024 in which we delivered another quarter of record net income on

both a GAAP and Non-GAAP basis,” said Tyler Page, CEO of

Cipher.

“We continue to invest heavily in our expansion, and the early

stages of construction at our new Black Pearl data center are well

underway. We’ve already cleared and leveled over 50 acres, and we

will start laying concrete foundations this month. Because of this

progress, and our strong financial position, we have decided to

accelerate our plans and build the entire 300 MW data center in

2025. We expect to be at ~9.3 EH/s by the end of Q3 2024, and at

least ~25.1 EH/s by the end of 2025.”

“We are confident our team’s proven execution and the Company’s

best-in-class unit economics will continue to position Cipher as a

top miner in this new post-halving environment.”

Finance and Operations Highlights

- Produced first quarter 2024 GAAP net income of $40 million, and

non-GAAP adjusted earnings of $63 million

- 30 MW expansion at each of Bear and Chief JV data centers,

delivering an additional ~1.25 EH/s of self-mining capacity, on

track for completion in second quarter 2024

- 300 MW data center at Black Pearl on track for energization in

2025 with land cleared and leveled for construction

Business Update Call and Webcast

Cipher will host a conference call and webcast today at 8:00

a.m. Eastern Time to discuss the first quarter 2024 results and

management’s outlook for operations and growth plans. The live

webcast and a webcast replay of the conference call can be accessed

from the investor relations section of Cipher’s website at

https://investors.ciphermining.com. To access this conference call

by telephone, register here to receive dial-in numbers and a unique

PIN to join the call.

About Cipher

Cipher is an emerging technology company focused on the

development and operation of bitcoin mining data centers. Cipher is

dedicated to expanding and strengthening the Bitcoin network's

critical infrastructure. Together with its diversely talented team

and strategic partnerships, Cipher aims to be a market leader in

bitcoin mining growth and innovation. To learn more about Cipher,

please visit https://www.ciphermining.com/.

Forward Looking Statements

This press release contains certain forward-looking statements

within the meaning of the federal securities laws of the United

States. The Company intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 and includes this statement for purposes of complying

with these safe harbor provisions. Any statements made in this

press release that are not statements of historical fact, including

statements about our beliefs and expectations regarding our future

results of operations and financial position, business strategy,

timing and likelihood of success, potential expansion of and

additional bitcoin mining data centers, expectations regarding the

operations of mining centers, and management plans and objectives,

are forward-looking statements and should be evaluated as such.

Forward-looking statements include information concerning possible

or assumed future results of operations, including descriptions of

our business plan and strategies. These forward-looking statements

generally are identified by the words “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“strategy,” “future,” “forecasts,” “opportunity,” “predicts,”

“potential,” “would,” “will likely result,” “continue,” and similar

expressions (including the negative versions of such words or

expressions).

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Cipher and our

management, are inherently uncertain. Such forward-looking

statements are subject to risks, uncertainties, and other factors

that could cause actual results to differ materially from those

expressed or implied by such forward looking statements. New risks

and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: volatility in the price of Cipher’s securities due to a

variety of factors, including changes in the competitive and

regulated industry in which Cipher operates, variations in

performance across competitors, changes in laws and regulations

affecting Cipher’s business, and the ability to implement business

plans, forecasts, and other expectations and to identify and

realize additional opportunities. The foregoing list of factors is

not exhaustive. You should carefully consider the foregoing factors

and the other risks and uncertainties described in the “Risk

Factors” section of our Annual Report on Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on March 5, 2024, and in

Cipher’s subsequent filings with the Securities and Exchange

Commission. These filings identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Cipher assumes no obligation and,

except as required by law, does not intend to update or revise

these forward-looking statements, whether as a result of new

information, future events, or otherwise.

Contacts:Investor Contact:Josh

KaneHead of Investor Relations at Cipher

Miningjosh.kane@ciphermining.com

Media Contact:Ryan Dicovitsky / Kendal

TillDukas Linden Public RelationsCipherMining@DLPR.com

|

CIPHER MINING INC.CONDENSED CONSOLIDATED

BALANCE SHEETS(in thousands, except for share and per

share amounts) |

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

88,675 |

|

|

$ |

86,105 |

|

|

Accounts receivable |

|

680 |

|

|

|

622 |

|

|

Receivables, related party |

|

430 |

|

|

|

245 |

|

|

Prepaid expenses and other current assets |

|

2,910 |

|

|

|

3,670 |

|

|

Bitcoin |

|

123,307 |

|

|

|

32,978 |

|

|

Derivative asset |

|

34,228 |

|

|

|

31,878 |

|

|

Total current assets |

|

250,230 |

|

|

|

155,498 |

|

|

Property and equipment, net |

|

238,541 |

|

|

|

243,815 |

|

|

Deposits on equipment |

|

30,187 |

|

|

|

30,812 |

|

|

Intangible assets, net |

|

8,162 |

|

|

|

8,109 |

|

|

Investment in equity investees |

|

52,621 |

|

|

|

35,258 |

|

|

Derivative asset |

|

66,722 |

|

|

|

61,713 |

|

|

Operating lease right-of-use asset |

|

6,823 |

|

|

|

7,077 |

|

|

Security deposits |

|

23,855 |

|

|

|

23,855 |

|

|

Total assets |

$ |

677,141 |

|

|

$ |

566,137 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

7,520 |

|

|

$ |

4,980 |

|

|

Accounts payable, related party |

|

- |

|

|

|

1,554 |

|

|

Accrued expenses and other current liabilities |

|

18,661 |

|

|

|

22,439 |

|

|

Finance lease liability, current portion |

|

3,595 |

|

|

|

3,404 |

|

|

Operating lease liability, current portion |

|

1,204 |

|

|

|

1,166 |

|

|

Warrant liability |

|

- |

|

|

|

250 |

|

|

Total current liabilities |

|

30,980 |

|

|

|

33,793 |

|

|

Asset retirement obligation |

|

18,708 |

|

|

|

18,394 |

|

|

Finance lease liability |

|

10,121 |

|

|

|

11,128 |

|

|

Operating lease liability |

|

6,025 |

|

|

|

6,280 |

|

|

Deferred tax liability |

|

10,383 |

|

|

|

5,206 |

|

|

Total liabilities |

|

76,217 |

|

|

|

74,801 |

|

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized,

none issued and outstanding as of March 31, 2024 and

December 31, 2023 |

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value, 500,000,000 shares authorized,

312,649,102 and 296,276,536 shares issued as of March 31, 2024

and December 31, 2023, respectively, and 306,543,330 and

290,957,862 shares outstanding as of March 31, 2024, and

December 31, 2023, respectively |

|

313 |

|

|

|

296 |

|

|

Additional paid-in capital |

|

697,494 |

|

|

|

627,822 |

|

|

Accumulated deficit |

|

(96,877 |

) |

|

|

(136,777 |

) |

|

Treasury stock, at par, 6,105,772 and 5,318,674 shares at

March 31, 2024 and December 31, 2023, respectively |

|

(6 |

) |

|

|

(5 |

) |

|

Total stockholders’ equity |

|

600,924 |

|

|

|

491,336 |

|

|

Total liabilities and stockholders’ equity |

$ |

677,141 |

|

|

$ |

566,137 |

|

|

|

|

|

|

|

|

|

CIPHER MINING INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except for share

and per share amounts)(unaudited) |

|

|

|

|

Three months ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Revenue - bitcoin mining |

$ |

48,137 |

|

|

$ |

21,895 |

|

|

Costs and operating expenses (income) |

|

|

|

|

|

|

Cost of revenue |

|

14,820 |

|

|

|

8,141 |

|

|

Compensation and benefits |

|

13,036 |

|

|

|

11,937 |

|

|

General and administrative |

|

6,077 |

|

|

|

5,483 |

|

|

Depreciation and amortization |

|

17,244 |

|

|

|

11,655 |

|

|

Change in fair value of derivative asset |

|

(7,359 |

) |

|

|

(5,328 |

) |

|

Power sales |

|

(1,173 |

) |

|

|

(98 |

) |

|

Equity in (gains) losses of equity investees |

|

(738 |

) |

|

|

750 |

|

|

Gains on fair value of bitcoin |

|

(40,556 |

) |

|

|

(4,264 |

) |

|

Other gains |

|

- |

|

|

|

(2,260 |

) |

|

Total costs and operating expenses (income) |

|

1,351 |

|

|

|

26,016 |

|

|

Operating income (loss) |

|

46,786 |

|

|

|

(4,121 |

) |

|

Other income (expense) |

|

|

|

|

|

|

Interest income |

|

786 |

|

|

|

76 |

|

|

Interest expense |

|

(400 |

) |

|

|

(401 |

) |

|

Change in fair value of warrant liability |

|

250 |

|

|

|

(37 |

) |

|

Other expense |

|

(1,958 |

) |

|

|

- |

|

|

Total other income (expense) |

|

(1,322 |

) |

|

|

(362 |

) |

|

Income (loss) before taxes |

|

45,464 |

|

|

|

(4,483 |

) |

|

Current income tax expense |

|

(386 |

) |

|

|

(17 |

) |

|

Deferred income tax expense |

|

(5,178 |

) |

|

|

(53 |

) |

|

Total income tax expense |

|

(5,564 |

) |

|

|

(70 |

) |

| Net

income (loss) |

$ |

39,900 |

|

|

$ |

(4,553 |

) |

| Net

income (loss) per share - basic and diluted |

$ |

0.13 |

|

|

$ |

(0.02 |

) |

|

Weighted average shares outstanding - basic |

|

296,641,499 |

|

|

|

248,654,082 |

|

|

Weighted average shares outstanding - diluted |

|

304,397,979 |

|

|

|

248,654,082 |

|

|

CIPHER MINING INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(in thousands)(unaudited) |

|

|

|

|

Three months ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

Net income (loss) |

$ |

39,900 |

|

|

$ |

(4,553 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

Depreciation |

|

17,097 |

|

|

|

11,655 |

|

|

Amortization of intangible assets |

|

147 |

|

|

|

- |

|

|

Amortization of operating right-of-use asset |

|

254 |

|

|

|

222 |

|

|

Share-based compensation |

|

8,317 |

|

|

|

8,810 |

|

|

Equity in (gains) losses of equity investees |

|

(738 |

) |

|

|

750 |

|

|

Non-cash lease expense |

|

392 |

|

|

|

401 |

|

|

Other operating activities |

|

1,958 |

|

|

|

- |

|

|

Income taxes |

|

5,564 |

|

|

|

53 |

|

|

Bitcoin received as payment for services |

|

(48,079 |

) |

|

|

(21,717 |

) |

|

Change in fair value of derivative asset |

|

(7,359 |

) |

|

|

(5,328 |

) |

|

Change in fair value of warrant liability |

|

(250 |

) |

|

|

37 |

|

|

Gains on fair value of bitcoin |

|

(40,556 |

) |

|

|

(4,264 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(58 |

) |

|

|

(183 |

) |

|

Receivables, related party |

|

(185 |

) |

|

|

(189 |

) |

|

Prepaid expenses and other current assets |

|

760 |

|

|

|

2,975 |

|

|

Security deposits |

|

- |

|

|

|

(12 |

) |

|

Accounts payable |

|

2,540 |

|

|

|

2,913 |

|

|

Accounts payable, related party |

|

- |

|

|

|

(1,529 |

) |

|

Accrued expenses and other current liabilities |

|

(6,123 |

) |

|

|

65 |

|

|

Lease liabilities |

|

(217 |

) |

|

|

(248 |

) |

|

Net cash used in operating activities |

|

(26,636 |

) |

|

|

(10,142 |

) |

|

Cash flows from investing activities |

|

|

|

|

|

|

Proceeds from sale of bitcoin |

|

- |

|

|

|

20,958 |

|

|

Deposits on equipment |

|

(4,536 |

) |

|

|

(1,106 |

) |

|

Purchases of property and equipment |

|

(7,902 |

) |

|

|

(17,947 |

) |

|

Purchases and development of software |

|

(200 |

) |

|

|

- |

|

|

Capital distributions from equity investees |

|

- |

|

|

|

3,807 |

|

|

Investment in equity investees |

|

(18,319 |

) |

|

|

(3,094 |

) |

|

Net cash (used in) provided by investing activities |

|

(30,957 |

) |

|

|

2,618 |

|

|

Cash flows from financing activities |

|

|

|

|

|

|

Proceeds from the issuance of common stock |

|

66,171 |

|

|

|

- |

|

|

Offering costs paid for the issuance of common stock |

|

(1,623 |

) |

|

|

- |

|

|

Repurchase of common shares to pay employee withholding taxes |

|

(3,177 |

) |

|

|

(481 |

) |

|

Principal payments on financing lease |

|

(1,208 |

) |

|

|

- |

|

|

Net cash provided by (used in) financing activities |

|

60,163 |

|

|

|

(481 |

) |

| Net

increase (decrease) in cash and cash equivalents |

|

2,570 |

|

|

|

(8,005 |

) |

|

Cash and cash equivalents, beginning of the period |

|

86,105 |

|

|

|

11,927 |

|

|

Cash and cash equivalents, end of the period |

$ |

88,675 |

|

|

$ |

3,922 |

|

|

Supplemental disclosure of noncash investing and financing

activities |

|

|

|

|

|

|

Reclassification of deposits on equipment to property and

equipment |

$ |

5,161 |

|

|

$ |

71,533 |

|

|

Bitcoin received from equity investees |

$ |

1,694 |

|

|

$ |

317 |

|

|

Settlement of related party payable related to master services and

supply agreement |

$ |

1,554 |

|

|

$ |

- |

|

|

Equity method investment acquired for non-cash consideration |

$ |

- |

|

|

$ |

1,925 |

|

|

Property and equipment purchases in accounts payable, accounts

payable, related party and accrued expenses |

$ |

- |

|

|

$ |

5,940 |

|

|

Deposits on equipment in accounts payable, accounts payable,

related party and accrued expenses |

$ |

- |

|

|

$ |

691 |

|

|

Finance lease cost in accrued expenses |

$ |

- |

|

|

$ |

1,017 |

|

Non-GAAP Financial Measures

The following are reconciliations of our Adjusted Earnings, in

each case excluding the impact of (i) the non-cash change in fair

value of derivative asset, (ii) share-based compensation expense,

(iii) depreciation and amortization, (iv) deferred income tax

expense, (v) nonrecurring gains and losses and (vi) the non-cash

change in fair value of warrant liability, to the most directly

comparable GAAP measures for the periods indicated (in

thousands):

|

|

|

Three months ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Reconciliation of Adjusted Earnings: |

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

39,900 |

|

|

$ |

(4,553 |

) |

|

Change in fair value of derivative asset |

|

|

(7,359 |

) |

|

|

(5,328 |

) |

|

Share-based compensation expense |

|

|

8,317 |

|

|

|

8,810 |

|

|

Depreciation and amortization |

|

|

17,244 |

|

|

|

11,655 |

|

|

Deferred income tax expense |

|

|

5,178 |

|

|

|

53 |

|

|

Other gains - nonrecurring |

|

|

- |

|

|

|

(2,260 |

) |

|

Change in fair value of warrant liability |

|

|

(250 |

) |

|

|

37 |

|

|

Adjusted earnings |

|

|

63,030 |

|

|

|

8,414 |

|

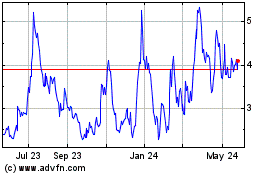

Cipher Mining (NASDAQ:CIFR)

Historical Stock Chart

From Jan 2025 to Feb 2025

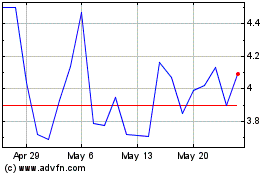

Cipher Mining (NASDAQ:CIFR)

Historical Stock Chart

From Feb 2024 to Feb 2025