Clearside Biomedical, Inc. (Nasdaq: CLSD), a biopharmaceutical

company revolutionizing the delivery of therapies to the back of

the eye through the suprachoroidal space (SCS®), today reported

financial results for the second quarter ended June 30, 2024, and

provided a corporate update.

“Our Phase 2b ODYSSEY clinical trial utilizing

CLS-AX (axitinib injectable suspension) in patients with wet AMD

continues to advance on track and on time with topline data

expected in late Q3 2024,” said George Lasezkay, PharmD, JD,

President and Chief Executive Officer. “In July, the Safety Review

Committee reviewed masked safety data and noted that there have

been no drug-related Serious Adverse Events (SAEs), including no

endophthalmitis or retinal vasculitis, and recommended the trial

continue as planned without modifying the protocol. Both arms of

the ODYSSEY trial have completed six months of treatment, with

CLS-AX being re-dosed per protocol in the CLS-AX arm. Re-dosing

with CLS-AX is an important and differentiating feature of the

ODYSSEY trial, and the re-dosing data will be valuable as we

evaluate the effects of CLS-AX in this chronic disease and plan our

Phase 3 clinical development program.”

Dr. Lasezkay continued, “Several noteworthy

events have also occurred featuring our commercial product,

XIPERE®1, for the treatment of patients with macular edema

associated with uveitis. Most importantly, our Asia-Pacific

partner, Arctic Vision, reported positive results from their Phase

3 trial for XIPERE, known as ARCATUS in China, and announced that

new drug applications (NDAs) for ARCATUS have been accepted for

review in Australia and Singapore. In addition, data presented on

the real-world use of XIPERE in the United States has shown the

product has excellent durability as 87.7% of eyes did not require

an injected or implanted corticosteroid for 6 months after a single

dose of XIPERE2.”

“In May 2024, consensus guidelines for drug

delivery by suprachoroidal administration, co-authored by 16

practicing retinal physicians, were published in the prominent

journal, RETINA®. The article describes the physicians’ best

practices for injection into the suprachoroidal space. These

valuable guidelines, combined with our progress with CLS-AX and the

promising real-world and Phase 3 data from XIPERE continue to

demonstrate the advantages of suprachoroidal administration

utilizing our proprietary SCS Microinjector® to deliver therapies

to the back of the eye for the treatment of a variety of retinal

diseases,” concluded, Dr. Lasezkay,

Key Highlights

- Topline data

expected in late third quarter of 2024 from Phase 2b ODYSSEY

clinical trial of CLS-AX using suprachoroidal delivery in

neovascular age-related macular degeneration (wet AMD).

- Clearside’s

Asia-Pacific partner, Arctic Vision, reported positive topline

results from its Phase 3 clinical trial of ARCATUS® for the

treatment of uveitic macular edema in China and announced that NDAs

for ARCATUS have been officially accepted in Australia and

Singapore.

- Clearside hosted

its Suprachoroidal Delivery Key Opinion Leader webinar highlighting

broad applicability and real-world experience with suprachoroidal

drug delivery and SCS development opportunities, including wet AMD

and geographic atrophy. The replay of this event is available on

the Clearside website under the Investors section: Events and

Presentations.

- Ophthalmology

Science published an article summarizing safety and tolerability

data from OASIS, Clearside’s Phase 1/2a Open-Label, Dose-Escalation

trial of CLS-AX (axitinib injectable suspension) in wet AMD. The

full publication can be accessed here.

- RETINA®, The

Journal of Retinal and Vitreous Diseases published consensus

guidelines for drug delivery via Suprachoroidal Space (SCS®)

injection. The full publication can be accessed here.

- Clearside’s gene

therapy partner, REGENXBIO, reported progress on their ABBV-RGX-314

programs delivered via suprachoroidal injection with Clearside’s

SCS Microinjector®. REGENEXBIO announced that they expect to

initiate a global pivotal trial in the first half of 2025 for the

treatment of diabetic retinopathy, and that their Phase 2 ALTITUDE®

trial is now enrolling a new cohort of patients with

center-involved diabetic macular edema (DME). In addition,

REGENEXBIO announced their AAVIATE® Phase 2 trial in wet AMD is

initiating enrollment in a new cohort at dose level 4.3

- Multiple data

presentations on the use of Clearside’s suprachoroidal delivery

platform were featured at prominent medical meetings, including the

Association for Research in Vision and Ophthalmology (ARVO),

Clinical Trials at the Summit and Retinal Imaging Biomarkers and

Endpoints Summit.

- Glenn Yiu, MD, PhD,

Professor of Ophthalmology at the University of California, Davis,

was appointed to Clearside’s Scientific Advisory Board (SAB) in

July 2024. Dr. Yiu, a board-certified vitreoretinal surgeon, leads

the translational research program at UC Davis studying AMD and

other retinal diseases, with focus on ocular imaging technologies,

gene editing and delivery, and animal models of retinal

disease.

- Tony Gibney was

appointed to Clearside’s Board of Directors in April 2024. Mr.

Gibney is an experienced biotechnology executive and former

investment banker who brings over 25 years of experience dedicated

to advising biotechnology companies on business strategy,

collaborations, financings, and mergers and acquisitions.

Second Quarter 2024 Financial

Results

- License and other revenue for the

second quarter of 2024 was $90,000, compared to $1.0 million for

the second quarter of 2023. The revenue primarily related to

payments pursuant to Clearside’s license agreements and revenue for

services and the sales of SCS Microinjector kits to licensees.

- Research and development expenses

for the second quarter of 2024 were $4.6 million, compared to $4.9

million for the second quarter of 2023. The decrease was primarily

related to the CLS-AX program ($0.2 million), development of the

SCS Microinjector ($0.2 million), and preclinical work ($0.1

million). This was partially offset by a $0.2 million increase in

employee related costs.

- General and administrative expenses

remained constant at $3.1 million in the second quarter of 2024 and

2023.

- Interest income for the second

quarter of 2024 was $0.4 million compared to $0.5 million for the

second quarter of 2023. The decrease was due to the lower balance

of cash, cash equivalents and short-term investments.

- Other income for the second quarter

of 2024 was $1.9 million, compared to $0 for the second quarter of

2023. Other income for the second quarter of 2024 was due to the

change in fair value of the warrant liabilities from the prior

March 31, 2024 valuation date.

- Non-cash interest expense remained

constant at $2.3 million in the second quarter of 2024 and 2023.

Non-cash interest expense was comprised of imputed interest on the

liability related to the sales of future royalties and the

amortization of the associated issuance costs.

- Net loss for the second quarter of

2024 was $7.6 million, or $0.10 per share of common stock, compared

to net loss of $9.1 million, or $0.15 per share of common stock,

for the second quarter of 2023.

- As of June 30, 2024, Clearside’s

cash, cash equivalents and short-term investments totaled $29.4

million. The Company believes it will have sufficient resources to

fund its planned operations into the third quarter of 2025.

Additional Information

In lieu of a second quarter 2024 conference

call, the Company hosted a Suprachoroidal Delivery Key Opinion

Leader Webinar on Wednesday, July 24, 2024. The replay of this

event is available on the Clearside website under the Investors

section: Events and Presentations. Quarterly earnings conference

calls are expected to resume with the third quarter 2024 financial

results.

About Clearside Biomedical,

Inc.

Clearside Biomedical, Inc. is a

biopharmaceutical company revolutionizing the delivery of therapies

to the back of the eye through the suprachoroidal space (SCS®).

Clearside’s SCS injection platform, utilizing the Company’s

patented SCS Microinjector®, enables an in-office, repeatable,

non-surgical procedure for the targeted and compartmentalized

delivery of a wide variety of therapies to the macula, retina, or

choroid to potentially preserve and improve vision in patients with

sight-threatening eye diseases. Clearside is developing its own

pipeline of small molecule product candidates for administration

via its SCS Microinjector. The Company’s lead program, CLS-AX

(axitinib injectable suspension), for the treatment of neovascular

age-related macular degeneration (wet AMD), is in Phase 2b clinical

testing. Clearside developed and gained approval for its first

product, XIPERE® (triamcinolone acetonide injectable suspension)

for suprachoroidal use, which is available in the U.S. through a

commercial partner. Clearside also strategically partners its SCS

injection platform with companies utilizing other ophthalmic

therapeutic innovations. For more information, please visit

clearsidebio.com and follow us on LinkedIn and X.

Cautionary Note Regarding

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “believe”, “expect”, “may”, “plan”,

“potential”, “will”, and similar expressions, and are based on

Clearside’s current beliefs and expectations. These forward-looking

statements include statements regarding the clinical development of

CLS-AX, the expected timing of topline results from the ODYSSEY

clinical trial, the potential benefits of CLS-AX, Clearside’s

suprachoroidal delivery technology and Clearside’s SCS

Microinjector® and Clearside’s ability to fund its operations into

the third quarter of 2025. These statements involve risks and

uncertainties that could cause actual results to differ materially

from those reflected in such statements. Risks and uncertainties

that may cause actual results to differ materially include

uncertainties inherent in the conduct of clinical trials,

Clearside’s reliance on third parties over which it may not always

have full control and other risks and uncertainties that are

described in Clearside’s Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the U.S. Securities and

Exchange Commission (SEC) on March 12, 2024 and Clearside’s other

Periodic Reports filed with the SEC. Any forward-looking statements

speak only as of the date of this press release and are based on

information available to Clearside as of the date of this release,

and Clearside assumes no obligation to, and does not intend to,

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

1XIPERE® (triamcinolone acetonide injectable

suspension) for suprachoroidal use is being commercialized by

Bausch + Lomb who has the exclusive license for the

commercialization and development of XIPERE in the United States

and Canada. Arctic Vision has the exclusive license for the

commercialization and development of XIPERE, in Greater China,

South Korea, Australia, New Zealand, India and the ASEAN Countries.

XIPERE was approved by the U.S. Food and Drug Administration in

October 2021 and is commercially available in the U.S. A link to

the full prescribing information is available at

https://www.xipere.com/hcp/#isi.

2Yiu, Glen, “Suprachoroidal Drug Delivery in the

Real World”, Clinical Trials at the Summit Meeting, June 2024

3ALTITUDE® and AAVIATE® are registered

trademarks of REGENXBIO, Inc.

Investor and Media Contacts:

Jenny Kobin Remy Bernarda ir@clearsidebio.com(678) 430-8206

-Financial Tables Follow-

CLEARSIDE BIOMEDICAL, INC.̶Selected

Financial Data (in thousands, except share and per share

data)(unaudited)

| Statements of

Operations Data |

|

Three Months EndedJune 30, |

|

|

Six Months EndedJune 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

License and other revenue |

|

$ |

90 |

|

|

$ |

1,018 |

|

|

$ |

320 |

|

|

$ |

1,022 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

|

— |

|

|

|

213 |

|

|

|

— |

|

|

|

213 |

|

|

Research and development |

|

|

4,603 |

|

|

|

4,948 |

|

|

|

10,218 |

|

|

|

9,399 |

|

|

General and administrative |

|

|

3,077 |

|

|

|

3,127 |

|

|

|

5,901 |

|

|

|

6,285 |

|

|

Total operating expenses |

|

|

7,680 |

|

|

|

8,288 |

|

|

|

16,119 |

|

|

|

15,897 |

|

| Loss

from operations |

|

|

(7,590 |

) |

|

|

(7,270 |

) |

|

|

(15,799 |

) |

|

|

(14,875 |

) |

| Interest

income |

|

|

419 |

|

|

|

458 |

|

|

|

767 |

|

|

|

950 |

|

| Other

income, net |

|

|

1,917 |

|

|

|

— |

|

|

|

418 |

|

|

|

— |

|

| Non-cash

interest expense on liability related to the sales of future

royalties |

|

|

(2,340 |

) |

|

|

(2,294 |

) |

|

|

(4,743 |

) |

|

|

(4,461 |

) |

| Net

loss |

|

$ |

(7,594 |

) |

|

$ |

(9,106 |

) |

|

$ |

(19,357 |

) |

|

$ |

(18,386 |

) |

| Net loss

per share of common stock — basic and diluted |

|

$ |

(0.10 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.30 |

) |

| Weighted

average shares outstanding — basic and diluted |

|

|

74,731,139 |

|

|

|

61,654,520 |

|

|

|

72,292,183 |

|

|

|

61,413,343 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data |

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

$ |

18,238 |

|

|

$ |

28,920 |

|

|

Short-term investments |

|

11,122 |

|

|

|

— |

|

| Total

assets |

|

33,934 |

|

|

|

34,018 |

|

|

Liabilities related to the sales of future royalties, net |

|

46,731 |

|

|

|

41,988 |

|

| Warrant

liabilities |

|

9,121 |

|

|

|

— |

|

| Total

liabilities |

|

62,219 |

|

|

|

49,930 |

|

| Total

stockholders’ deficit |

|

(28,285 |

) |

|

|

(15,912 |

) |

|

|

|

|

|

|

|

|

|

Source: Clearside Biomedical, Inc.

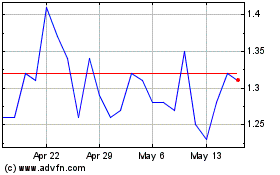

Clearside Biomedical (NASDAQ:CLSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Clearside Biomedical (NASDAQ:CLSD)

Historical Stock Chart

From Dec 2023 to Dec 2024