LSE, Deutsche Bö rse Reach Merger Agreement

16 March 2016 - 7:10PM

Dow Jones News

London Stock Exchange Group PLC and Deutsche Bö rse AG on

Wednesday agreed to an all-share merger, creating Europe's biggest

securities-markets operator worth more than $30 billion.

Under the merger, a new U.K. company will be formed—UK TopCo—of

which 45.6% will be owned by LSE shareholders with Deutsche Bö rse

shareholders owning the rest.

LSE shareholders will get 0.4421 UK TopCo shares for each share

held, and Deutsche Bö rse shareholders will get one UK TopCo share

for each of their shares.

The combined company will be worth about $30.5 billion based on

Tuesday's closing share prices.

The two exchange operators announced last month that they were

in talks. Since then, U.S. rival Intercontinental Exchange Inc.,

the operator of the New York Stock Exchange, has said it was

considering making an offer for LSE. Chicago's CME Group Inc. might

also be in the running, according to a person familiar with the

matter. Hong Kong Exchanges & Clearing Ltd. has said it is

closely watching the discussions between LSE and Deutsche Bö

rse.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

March 16, 2016 03:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

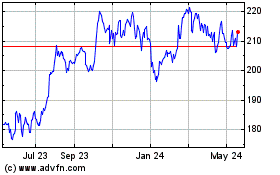

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

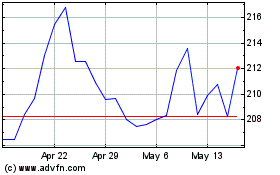

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024