Japanese Yen Strengthens, Erases May Losses

06 June 2016 - 4:00PM

Dow Jones News

HONG KONG—Asian currencies weakened in trading on Monday,

reversing some gains following Friday's U.S. jobs report that all

but wiped out expectations the U.S. Federal Reserve would raise

interest rates this month.

The yen weakened 0.5% to 107.089 against the U.S. dollar on

Monday. It reached its strongest level against the greenback in a

month late Friday, when the Japanese currency stood as strong as

106.35 against the U.S. dollar.

Friday's move erased all of the weakness the yen had seen during

May, when the currency fell 4.1% to 110.68 by the month's end—the

biggest one-month depreciation in a year-and-a-half. That helped

reversed some gains in the yen since the Bank of Japan introduced

negative interest rates at the end of January, a move that

convinced some in the market that monetary policy had reached its

limit.

Japan's Chief Cabinet Secretary Yoshihide Suga said Monday that

the government is "closely watching movements in the market with

careful attention," adding that sharp moves in currency markets

weren't desirable.

Elsewhere on Monday, the Chinese yuan appreciated to as much as

6.5518 against the U.S. dollar. The People's Bank of China

strengthened its yuan-fixing against the greenback by the most in

five weeks.

But analysts were thrown off by the fact that the yuan didn't

strengthen more in the wake of the dollar's selloff, prompting

speculation that China's central bank is again quietly weakening

its exchange rate.

Data released Friday showed the U.S. economy added just 38,000

jobs during May, far below the 158,000 expected by markets. That

produced a surge for Asian currencies as investors pushed out their

expectations of when the Federal Reserve will raise interest rates

to later in the summer, leaving the U.S. dollar weaker

accordingly.

Sue Trinh, head of Asia currency strategy at RBC Capital Markets

in Hong Kong, said the weaker payrolls number and weaker dollar had

boosted the yen the most, "given it's the most highly leveraged

currency to Federal Reserve rate hike expectations," she said.

Efforts by Japanese government officials to talk down the resurgent

yen would be closely watched in the lead-up to the Bank of Japan's

policy meeting ending June 16.

Also Monday, the Nikkei Stock Average sank as much as 1.9%

before recovering later in the trading session, as investors bet

that the stronger yen would weigh on the earnings of exporters. The

index was last down 0.7%, paring declines as the weaker yen lifted

stocks.

Chinese markets fluctuated between gains and losses in early

trading. In Hong Kong, the Hang Seng Index fell 0.2%, while the

Shanghai Composite was last flat.

For much of the past year, Beijing has stated that it would

allow market forces to play a greater role in determining its

exchange rate. However, considerable skepticism exists that policy

makers are doing as they say.

Zhou Hao, senior emerging markets economist for Asia at

Commerzbank, said the yuan should have been fixed stronger than

what the market rate had suggested -- one indicator that Chinese

policy makers are attempting to engineer weakness in the yuan.

"China is still trying to manage its currency and the exchange

rate," he said. "China doesn't want to lose control and follow the

market."

The yuan will likely trade in a broadly stable range for the

next few weeks as Federal Reserve expectations are repriced. "Right

now the renminbi isn't in focus; it's the U.S. that's in the

spotlight," Mr. Zhou added, using another name China's currency is

known by.

Following the U.S. nonfarm payrolls report, investors sharply

reduced bets that the Federal Reserve would raise rates during the

next two months. Fed fund futures priced in a 4% chance of a rate

increase in June, compared with a 20.6% probability before the

release of the employment figures, according to data from CME

Group. The market views July as more likely, but expectations of an

increase still fell from 58.4% to 31%.

Attention will turn Monday night in Asia hours to a speech by

Fed Chairwoman Janet Yellen at the World Affairs Council of

Philadelphia for signs of how the U.S. central bank views the

latest employment data.

Megumi Fujikawa in Tokyo contributed to this article.

(END) Dow Jones Newswires

June 06, 2016 01:45 ET (05:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

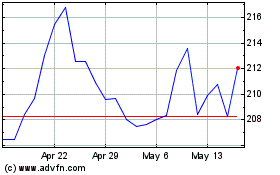

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

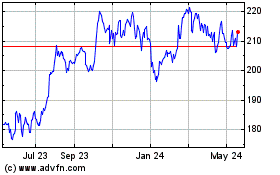

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024