By Gunjan Banerji

Chicago-based Cboe Global Markets Inc. is trying to convince

investors that new products and a technology upgrade can pull it

out of a year-long share-price slump.

Shares of one of the country's oldest and biggest options

exchange-operators have tumbled 23% since the start of last year to

become the worst-performing U.S. exchange-operator in that period.

Rivals CME Group Inc., Nasdaq, Inc. and Intercontinental Exchange

Inc. gained at least 3% during that time.

The question now is whether the exchange-operator can branch out

beyond its marquee product, the Cboe Volatility Index, or VIX -- a

widely watched gauge that tracks expectations for future market

turmoil -- and its derivatives. The company's stock hasn't seen the

boost from market turbulence that many expected. And how well Cboe

can capitalize on a coming shift to newer technology remains to be

seen, analysts say.

Few companies are as poised to benefit from market volatility as

Cboe, leading some investors and analysts to say it may be a good

time to dive back in. The company is undergoing one of the biggest

transformations in decades, moving to new technology and

potentially shifting its headquarters.

"It's a pretty good time to take a look at Cboe," said Mike

Bailey, director of research at FBB Capital Partners, who owns

shares of competitor CME. He said the company's valuations have

gotten so low that it is becoming more attractive to buy, but

investors need to be prepared for severe swings in the shares.

One issue giving investors pause is the slide in trading volume

of some of its lucrative VIX options and futures, which are sharply

down from 2017 and 2018 averages. Average daily futures' volumes

hit at least a two-year low in February after claims of their

manipulation and a collapse in trading of exchange-traded products

linked to them clouded the product last year. The futures volumes

have rebounded slightly in March, as have options volumes.

More generally, assets sitting in exchange-traded products

linked to volatility have also fallen since the beginning of 2018,

FactSet data show, potentially leading to less activity in Cboe's

proprietary products. Those types of ETPs were wildly popular as a

way to execute the so-called short volatility trade before it took

a beating last February, and spurred activity in other wagers

linked to market swings.

Several analysts said they expect muted growth in the VIX

volumes in 2019. However, trading could pick up in the long-term,

especially if market turbulence persists, they said. A spokeswoman

for Cboe said that traders use S&P 500 options, another key

proprietary product, interchangeably with ones on VIX. She said

that though VIX options trading receded in 2018, VIX futures and

S&P 500 options had record years.

Christopher Harris, an analyst at Wells Fargo Securities

following exchanges, said that despite recent setbacks, he is

optimistic that Cboe's proprietary products will continue to drive

growth in Cboe's share price.

"We like the stock," he said. "As much as the [VIX] products

have grown...I don't think they're fully mature yet."

But some worry Cboe is overly reliant on VIX and S&P 500.

Cboe Chief Executive Edward Tilly used to repeatedly ask his

product development team what they could "VIX" next, said people

familiar with the discussions.

"Cboe looks more like a one-trick pony," Mr. Bailey said.

"You're basically betting on VIX and S&P options."

The Cboe spokeswoman said the company sees "significant

opportunity ahead" in the volatility space. Ongoing product

development, including for VIX products, is a cornerstone of its

growth strategy. She said the company is "focused on driving

long-term shareholder value" and through 2018 Cboe outperformed the

S&P 500 over the past five years.

Cboe said this month that it would join with index provider MSCI

Inc. to launch volatility indexes based on international stocks.

But it can be tough to strike success with new wagers: Cboe

recently decided to abandon bitcoin futures, launched in late 2017,

amid lackluster trading volumes. Corporate bond futures, which it

introduced in the fall, have recorded less than 100 trades a day on

average. Its successful products can record hundreds of thousands

of trades a day. Cboe said this is normal for a new product.

The company should finish moving its technology to Bats Global

Markets', the upstart exchange it bought in 2017, later this year.

The tie-up transformed Cboe into a behemoth in both stocks and

options and opened the door for it to make its old-school

floor-trading culture more technology-savvy. The move will bring a

long-needed upgrade to Cboe's antiquated platform and allow faster

and more frequent technology updates.

Better technology can also spur volumes in VIX and other

products, analysts said. Moving options trading on the S&P 500

index to a so-called hybrid platform that blends open outcry and

electronic trading stoked more trading in them.

"People should be really excited about what Bats technology can

bring to Cboe," said Joanna Fields, founder of Aplomb Strategies,

Inc., who once worked on Cboe's options trading floor in

Chicago.

In the latest sign of change at the company, the

exchange-operator recently said it could move its headquarters,

where it has been since 1984, to someplace else in Chicago. Though

floor trading has dwindled across the country, old-fashioned hand

signals and shouting still dominate the trading floor for S&P

500 and VIX options at Cboe.

Chris Isaacson, the new chief operating officer, oversaw a

transition to an all-electronic pad for tracking orders. Until

recently, floor brokers at Cboe were using decade-old technology to

record options orders executed through the open outcry pits.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

March 24, 2019 09:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

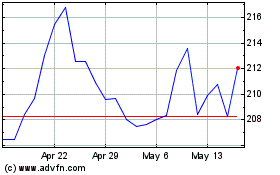

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024