Consolidated Communications Holdings, Inc. (Nasdaq:CNSL) (the

“Company”) reported results for the third quarter 2016.

Third quarter financial summary:

- Revenue was $191.5 million.

- Net cash from operations was $58.1 million.

- Adjusted EBITDA was $77.1 million.

- Dividend payout ratio was 74.4%.

“I am pleased with the solid financial results for the quarter

and the strong growth in our fiber-based commercial and carrier

sales,” said Bob Udell, President and Chief Executive

Officer. “We delivered another comfortable dividend payout

ratio and our year-to-date payout of 69.2% is right on plan.”

“During the third quarter, we closed on both the acquisition in

Illinois of Champaign Telephone Company, a fiber-based business

communications provider, and the sale of our rural independent

local exchange company in Iowa,” added Udell. “These

transactions strengthen our strategic focus on expanding our fiber

footprint and delivering fiber-based products and services.”

“Finally, in early October, we completed a refinancing of our

secured bank facility. This transaction is expected to

improve our annual cash interest expenses by approximately $2.0

million. In addition, it extended our maturities by three

years and increased our revolver capacity to $110.0 million from

$75.0 million. We could not have been more pleased with the

results of the transaction, and I would like to thank all of our

investors and underwriters for their support,” Udell

concluded.

Financial Results for the Third Quarter

- Total revenues were $191.5 million, compared to $194.0 million

for the same period last year. Growth in strategic revenues

were offset by declines in legacy voice revenues, network access

and subsidy step-downs from CAF II and Texas USF support.

- Income from operations was $22.7 million, compared to $13.6

million in the third quarter of 2015. Included in the third

quarter last year was $9.6 million of integration and severance

charges tied to the Enventis synergy efforts and an early

retirement offer made to, and accepted by, certain employees.

- Interest expense, net was $19.1 million compared to $19.2

million for the same period last year.

- Other income, net was $8.4 million, compared to $10.5 million

for the same period in 2015.

- On a GAAP basis, net income and net income per share were $7.0

million and $0.14, respectively. Adjusted diluted net income

per share excludes certain items in the manner described in the

table provided in this release. Adjusted diluted net income

per share was $0.16 for the current quarter, compared to $0.18 the

same period last year.

- Cash distributions from our Verizon Wireless partnerships were

$8.6 million compared to $20.0 million last year. The third

quarter of 2015 included a non-recurring cash distribution for the

partnership owned towers that Verizon sold to American Tower.

- Adjusted EBITDA was $77.1 million compared to $89.4 million for

the same period in 2015. As mentioned above, the third

quarter last year included non-recurring cash distributions from

the Company’s partnerships.

- The total net debt to last 12-month adjusted EBITDA ratio was

4.34.

Financial Results for the Nine Months Ended September

30, 2016

- Revenues were $567.3 million, net cash from operating

activities was $173.6 million and adjusted EBITDA was $233.7

million.

Cash Available to Pay Dividends For the

quarter, cash available to pay dividends, or CAPD, was $26.4

million, and the dividend payout ratio was 74.4%. At

September 30, 2016, cash and cash equivalents were $33.4

million. Capital expenditures for the quarter were $31.9

million.

Financial Guidance The Company is updating its

full year 2016 guidance as outlined below.

| |

|

|

|

|

|

|

|

2016 Updated

Guidance |

|

2016 Original

Guidance |

|

|

|

|

|

|

| Cash

Interest Expense |

|

$72.0

million to $73.0 million |

|

$73.0

million to $75.0 million |

| Cash

Income Taxes |

|

Less

than $1.0 million |

|

$1.0

million to $3.0 million |

| Capital

Expenditures |

|

$125.0

million to $130.0 million |

|

$125.0

million to $130.0 million |

|

|

|

|

|

|

Dividend PaymentsOn October 31, 2016, the

Company’s board of directors declared its next quarterly dividend

of $0.38738 per common share, which is payable on February 1, 2017

to stockholders of record at the close of business on January 13,

2017. This will represent the 46th consecutive quarterly

dividend paid by the Company.

Conference Call Information The Company

will host a conference call today at 11:00 a.m. ET / 10:00 a.m. CT

to discuss third quarter earnings and developments with respect to

the Company. The live webcast and replay can be accessed from

the “Investor Relations” section of the Company’s website at

http://ir.consolidated.com. The live conference call dial-in

number is 1-877-374-3981 with conference ID 94247732. A

telephonic replay of the conference call will be available through

November 10, 2016 and can be accessed by calling

1-855-859-2056.

Use of Non-GAAP Financial Measures This press

release, as well as the conference call, includes disclosures

regarding “EBITDA”, “adjusted EBITDA”, “cash available to pay

dividends” and the related “dividend payout ratio”, “total net debt

to last twelve month adjusted EBITDA coverage ratio”, “adjusted

diluted net income per share” and “adjusted net income attributable

to common stockholders”, all of which are non-GAAP financial

measures and described in this section as not being in compliance

with Regulation S-X. Accordingly, they should not be

construed as alternatives to net cash from operating or investing

activities, cash and cash equivalents, cash flows from operations,

net income or net income per share as defined by GAAP and are not,

on their own, necessarily indicative of cash available to fund cash

needs as determined in accordance with GAAP. In addition, not all

companies use identical calculations, and the non-GAAP financial

measures may not be comparable to other similarly titled measures

of other companies. A reconciliation of the differences

between these non-GAAP financial measures and the most directly

comparable financial measures presented in accordance with GAAP is

included in the tables that follow.

Adjusted EBITDA is comprised of EBITDA, adjusted for certain

items as permitted or required by the lenders under our credit

agreement in place at the end of each quarter in the periods

presented. The tables that follow include an explanation of

how adjusted EBITDA is calculated for each of the periods presented

with the reconciliation to net income. EBITDA is defined as

net earnings before interest expense, income taxes, depreciation

and amortization on a historical basis.

Cash available to pay dividends represents adjusted EBITDA plus

cash interest income less (1) cash interest expense, (2) capital

expenditures and (3) cash income taxes; this calculation differs in

certain respects from the similar calculation used in our credit

agreement.

We present adjusted EBITDA, cash available to pay dividends and

the related dividend payout ratio for several reasons.

Management believes adjusted EBITDA, cash available to pay

dividends and the dividend payout ratio are useful as a means to

evaluate our ability to fund our estimated uses of cash (including

interest on our debt) and pay dividends. In addition, we have

presented adjusted EBITDA, cash available to pay dividends and the

dividend payout ratio to investors in the past because they are

frequently used by investors, securities analysts and other

interested parties in the evaluation of companies in our industry,

and management believes presenting them here provides a measure of

consistency in our financial reporting. Adjusted EBITDA and cash

available to pay dividends, referred to as Available Cash in our

credit agreement, are also components of the restrictive covenants

and financial ratios contained in our credit agreement that

requires us to maintain compliance with these covenants and limit

certain activities, such as our ability to incur debt and to pay

dividends. The definitions in these covenants and ratios are

based on adjusted EBITDA and cash available to pay dividends after

giving effect to specified charges. In addition, adjusted

EBITDA, cash available to pay dividends and the dividend payout

ratio provide our board of directors with meaningful information to

determine, with other data, assumptions and considerations, our

dividend policy and our ability to pay dividends under the

restrictive covenants in our credit agreement and to measure our

ability to service and repay debt. We present the related

“total net debt to last twelve month adjusted EBITDA coverage

ratio” principally to put other non-GAAP measures in context and

facilitate comparisons by investors, security analysts and others;

this ratio differs in certain respects from the similar ratio used

in our credit agreement. These measures differ in certain

respects from the ratios used in our senior notes

indenture.

These non-GAAP financial measures have certain

shortcomings. In particular, adjusted EBITDA does not

represent the residual cash flows available for discretionary

expenditures, since items such as debt repayment and interest

payments are not deducted from such measure. Similarly, while

we may generate cash available to pay dividends, we are not

required to use any such cash to pay dividends, and the payment of

any dividends is subject to declaration by our board of directors,

compliance with applicable law and the terms of our credit

agreement. Because adjusted EBITDA is a component of the

dividend payout ratio and the ratio of total net debt to last

twelve month adjusted EBITDA, these measures are also subject to

the material limitations discussed above. In addition, the

ratio of total net debt to last twelve month adjusted EBITDA is

subject to the risk that we may not be able to use the cash on the

balance sheet to reduce our debt on a dollar-for-dollar basis.

Management believes these ratios are useful as a means to evaluate

our ability to incur additional indebtedness in the

future.

We present the non-GAAP measures adjusted diluted net income per

share and adjusted diluted net income attributable to common

stockholders because our net income and net income per share are

regularly affected by items that occur at irregular intervals or

are non-cash items. We believe that disclosing these measures

assists investors, securities analysts and other interested parties

in evaluating both our company over time and the relative

performance of the companies in our industry.

About Consolidated Communications Consolidated

Communications provides business and broadband communications

services across its 11-state service area to carrier, commercial

and consumer customers. For more than a century, the Company has

consistently provided innovative, reliable, high-quality products

and services. The Company offers a wide range of communications

solutions including: High-Speed Internet, Data, Digital TV, Phone,

managed and cloud services and wireless backhaul over an extensive

fiber optic network.

Safe Harbor The Securities and Exchange

Commission (“SEC”) encourages companies to disclose forward-looking

information so that investors can better understand a company’s

future prospects and make informed investment decisions.

Certain statements in this press release are forward-looking

statements and are made pursuant to the safe harbor provisions of

the Securities Litigation Reform Act of 1995. These

forward-looking statements reflect, among other things, our current

expectations, plans, strategies, and anticipated financial results.

There are a number of risks, uncertainties, and conditions

that may cause our actual results to differ materially from those

expressed or implied by these forward-looking statements.

These risks and uncertainties include a number of factors

related to our business, including economic and financial market

conditions generally and economic conditions in our service areas;

various risks to shareholders of not receiving dividends and risks

to our ability to pursue growth opportunities if we continue to pay

dividends according to the current dividend policy; various risks

to the price and volatility of our common stock; changes in the

valuation of pension plan assets; the substantial amount of debt

and our ability to repay or refinance it or incur additional debt

in the future; our need for a significant amount of cash to service

and repay the debt and to pay dividends on the common stock;

restrictions contained in our debt agreements that limit the

discretion of management in operating the business; regulatory

changes, including changes to subsidies, rapid development and

introduction of new technologies and intense competition in the

telecommunications industry; risks associated with our possible

pursuit of acquisitions; system failures; losses of large customers

or government contracts; risks associated with the rights-of-way

for the network; disruptions in the relationship with third party

vendors; losses of key management personnel and the inability to

attract and retain highly qualified management and personnel in the

future; changes in the extensive governmental legislation and

regulations governing telecommunications providers and the

provision of telecommunications services; telecommunications

carriers disputing and/or avoiding their obligations to pay network

access charges for use of our network; high costs of regulatory

compliance; the competitive impact of legislation and regulatory

changes in the telecommunications industry; and liability and

compliance costs regarding environmental regulations. A detailed

discussion of these and other risks and uncertainties that could

cause actual results and events to differ materially from such

forward-looking statements are discussed in more detail in our

filings with the Securities and Exchange Commission, including our

reports on Form 10-K and Form 10-Q. Many of these

circumstances are beyond our ability to control or predict.

Moreover, forward-looking statements necessarily involve

assumptions on our part. These forward-looking statements

generally are identified by the words “believe”, “expect”,

“anticipate”, “estimate”, “project”, “intend”, “plan”, “should”,

“may”, “will”, “would”, “will be”, “will continue” or similar

expressions. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results, performance or achievements of Consolidated

Communications Holdings, Inc. and its subsidiaries to be different

from those expressed or implied in the forward-looking statements.

All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

the cautionary statements that appear throughout this press

release. Furthermore, forward-looking statements speak only

as of the date they are made. Except as required under the

federal securities laws or the rules and regulations of the

Securities and Exchange Commission, we disclaim any intention or

obligation to update or revise publicly any forward-looking

statements. You should not place undue reliance on

forward-looking statements.

- Tables Follow –

| |

| Consolidated Communications Holdings,

Inc. |

| Condensed Consolidated Balance

Sheets |

| (Dollars in thousands, except par value) |

| (Unaudited) |

| |

September

30, |

December

31, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

ASSETS |

|

|

| Current assets: |

|

|

| Cash and

cash equivalents |

$ |

33,403 |

|

|

$ |

15,878 |

|

| Accounts

receivable, net |

|

68,447 |

|

|

|

68,848 |

|

| Income

tax receivable |

|

9,132 |

|

|

|

23,867 |

|

| Prepaid

expenses and other current assets |

|

18,081 |

|

|

|

17,815 |

|

| Total current

assets |

|

129,063 |

|

|

|

126,408 |

|

| |

|

|

| Property, plant and

equipment, net |

|

1,065,528 |

|

|

|

1,093,261 |

|

| Investments |

|

106,916 |

|

|

|

105,543 |

|

| Goodwill |

|

760,998 |

|

|

|

764,630 |

|

| Other intangible

assets |

|

34,758 |

|

|

|

43,497 |

|

| Other assets |

|

6,896 |

|

|

|

5,187 |

|

| Total assets |

$ |

2,104,159 |

|

|

$ |

2,138,526 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

| Current

liabilities: |

|

|

| Accounts

payable |

$ |

15,010 |

|

|

$ |

12,576 |

|

| Advance

billings and customer deposits |

|

29,255 |

|

|

|

27,616 |

|

| Dividends

payable |

|

19,623 |

|

|

|

19,551 |

|

| Accrued

compensation |

|

17,569 |

|

|

|

21,883 |

|

| Accrued

interest |

|

17,564 |

|

|

|

9,353 |

|

| Accrued

expense |

|

38,154 |

|

|

|

42,384 |

|

| Current

portion of long-term debt and capital lease obligations |

|

14,429 |

|

|

|

10,937 |

|

| Total current

liabilities |

|

151,604 |

|

|

|

144,300 |

|

| |

|

|

| Long-term debt and

capital lease obligations |

|

1,377,549 |

|

|

|

1,377,892 |

|

| Deferred income

taxes |

|

238,359 |

|

|

|

236,529 |

|

| Pension and other

post-retirement obligations |

|

109,035 |

|

|

|

112,966 |

|

| Other long-term

liabilities |

|

16,091 |

|

|

|

16,140 |

|

| Total liabilities |

|

1,892,638 |

|

|

|

1,887,827 |

|

| |

|

|

|

|

|

|

|

| Shareholders'

equity: |

|

|

| Common

stock, par value $0.01 per share; 100,000,000 shares |

|

|

|

authorized, 50,654,989 and 50,470,096, shares outstanding |

|

|

| as of

September 30, 2016 and December 31, 2015, respectively |

|

507 |

|

|

|

505 |

|

|

Additional paid-in capital |

|

239,559 |

|

|

|

281,738 |

|

| Retained

earnings (deficit) |

|

- |

|

|

|

(881 |

) |

|

Accumulated other comprehensive loss, net |

|

(33,792 |

) |

|

|

(35,699 |

) |

|

Noncontrolling interest |

|

5,247 |

|

|

|

5,036 |

|

| Total

shareholders' equity |

|

211,521 |

|

|

|

250,699 |

|

| Total

liabilities and shareholders' equity |

$ |

2,104,159 |

|

|

$ |

2,138,526 |

|

| |

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Condensed Consolidated Statements of

Operations |

| (Dollars in thousands, except per share

amounts) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

Nine Months

Ended |

|

|

September

30, |

|

September

30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

$ |

191,541 |

|

|

$ |

193,958 |

|

|

$ |

567,258 |

|

|

$ |

587,546 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Cost of

services and products |

|

85,646 |

|

|

|

83,209 |

|

|

|

246,129 |

|

|

|

249,477 |

|

| Selling,

general and administrative |

|

|

|

|

|

|

|

|

expenses |

|

39,935 |

|

|

|

51,044 |

|

|

|

119,664 |

|

|

|

136,737 |

|

| Loss on

impairment |

|

- |

|

|

|

- |

|

|

|

610 |

|

|

|

- |

|

|

Depreciation and amortization |

|

43,224 |

|

|

|

46,057 |

|

|

|

130,855 |

|

|

|

133,264 |

|

| Income from

operations |

|

22,736 |

|

|

|

13,648 |

|

|

|

70,000 |

|

|

|

68,068 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

| Interest

expense, net of interest income |

|

(19,075 |

) |

|

|

(19,174 |

) |

|

|

(56,827 |

) |

|

|

(60,277 |

) |

| Loss on

extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(41,242 |

) |

| Other

income, net |

|

8,419 |

|

|

|

10,491 |

|

|

|

24,262 |

|

|

|

25,839 |

|

| Income (loss) before

income taxes |

|

12,080 |

|

|

|

4,965 |

|

|

|

37,435 |

|

|

|

(7,612 |

) |

| Income tax expense

(benefit) |

|

4,991 |

|

|

|

2,220 |

|

|

|

22,287 |

|

|

|

(2,258 |

) |

| Net income (loss) |

|

7,089 |

|

|

|

2,745 |

|

|

|

15,148 |

|

|

|

(5,354 |

) |

| |

|

|

|

|

|

|

|

| Less: net income

attributable to noncontrolling interest |

|

77 |

|

|

|

150 |

|

|

|

211 |

|

|

|

209 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to common shareholders |

$ |

7,012 |

|

|

$ |

2,595 |

|

|

$ |

14,937 |

|

|

$ |

(5,563 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) per basic and diluted common shares |

|

|

|

|

|

|

|

|

attributable to common shareholders |

$ |

0.14 |

|

|

$ |

0.05 |

|

|

$ |

0.29 |

|

|

$ |

(0.11 |

) |

|

|

|

|

|

|

|

|

|

| Consolidated

Communications Holdings,

Inc. |

| Condensed Consolidated

Statements of Cash

Flows |

| (Dollars in

thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

Nine Months

Ended |

|

|

|

|

|

September

30, |

|

September

30, |

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| OPERATING

ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

Net income (loss) |

|

$ |

7,089 |

|

|

$ |

2,745 |

|

|

$ |

15,148 |

|

|

$ |

(5,354 |

) |

|

|

|

Adjustments to

reconcile net income (loss) to cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and

amortization |

|

|

43,224 |

|

|

|

46,057 |

|

|

|

130,855 |

|

|

|

133,264 |

|

|

|

|

Deferred income

taxes |

|

|

469 |

|

|

|

4,213 |

|

|

|

7,993 |

|

|

|

4,218 |

|

|

|

|

Cash distributions from

wireless partnerships in excess of/(less than) earnings |

|

|

(97 |

) |

|

|

9,396 |

|

|

|

(1,250 |

) |

|

|

7,840 |

|

|

|

|

Non- cash stock-based

compensation |

|

|

862 |

|

|

|

742 |

|

|

|

2,666 |

|

|

|

2,265 |

|

|

|

|

Amortization of

deferred financing |

|

|

815 |

|

|

|

770 |

|

|

|

2,413 |

|

|

|

2,592 |

|

|

|

|

Loss on extinguishment

of debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

41,242 |

|

|

|

|

Other adjustments,

net |

|

|

382 |

|

|

|

226 |

|

|

|

1,017 |

|

|

|

924 |

|

|

|

|

Changes in operating

assets and liabilities, net |

|

|

5,342 |

|

|

|

7,672 |

|

|

|

14,749 |

|

|

|

(19,354 |

) |

| |

|

Net cash

provided by operating activities |

|

|

58,086 |

|

|

|

71,821 |

|

|

|

173,591 |

|

|

|

167,637 |

|

| INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

Business acquisition,

net of cash acquired |

|

|

(13,422 |

) |

|

|

- |

|

|

|

(13,422 |

) |

|

|

- |

|

| |

|

Purchase of property,

plant and equipment, net |

|

|

(31,887 |

) |

|

|

(34,581 |

) |

|

|

(94,158 |

) |

|

|

(100,119 |

) |

| |

|

Proceeds from sale of

investments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

846 |

|

| |

|

Proceeds from sale of

assets |

|

|

20,913 |

|

|

|

61 |

|

|

|

20,963 |

|

|

|

118 |

|

| |

|

Net cash

used in investing activities |

|

|

(24,396 |

) |

|

|

(34,520 |

) |

|

|

(86,617 |

) |

|

|

(99,155 |

) |

| FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

Proceeds from bond

offering |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

294,780 |

|

| |

|

Proceeds on issuance of

long-term debt |

|

|

24,000 |

|

|

|

21,000 |

|

|

|

31,000 |

|

|

|

61,000 |

|

| |

|

Payment of capital

lease obligation |

|

|

(945 |

) |

|

|

(214 |

) |

|

|

(1,757 |

) |

|

|

(658 |

) |

| |

|

Payment on long-term

debt |

|

|

(28,275 |

) |

|

|

(21,275 |

) |

|

|

(39,825 |

) |

|

|

(80,825 |

) |

| |

|

Redemption of senior

notes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(261,874 |

) |

| |

|

Payment of financing

costs |

|

|

- |

|

|

|

(337 |

) |

|

|

- |

|

|

|

(4,805 |

) |

| |

|

Share repurchases for

minimum tax withholding |

|

|

- |

|

|

|

- |

|

|

|

(71 |

) |

|

|

(282 |

) |

| |

|

Dividends on common

stock |

|

|

(19,622 |

) |

|

|

(19,567 |

) |

|

|

(58,796 |

) |

|

|

(58,643 |

) |

| |

|

Net cash used by

financing activities |

|

|

(24,842 |

) |

|

|

(20,393 |

) |

|

|

(69,449 |

) |

|

|

(51,307 |

) |

| Net change

in cash and cash equivalents |

|

|

8,848 |

|

|

|

16,908 |

|

|

|

17,525 |

|

|

|

17,175 |

|

| Cash and

cash equivalents at beginning of period |

|

|

24,555 |

|

|

|

6,946 |

|

|

|

15,878 |

|

|

|

6,679 |

|

| Cash and

cash equivalents at end of period |

|

$ |

33,403 |

|

|

$ |

23,854 |

|

|

$ |

33,403 |

|

|

$ |

23,854 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Consolidated Revenue by

Category |

| (Dollars in thousands) |

| (Unaudited) |

| |

| |

|

|

|

|

|

| |

Q3'15 |

Q4'15 |

Q1'16 |

Q2'16 |

Q3'16 |

|

Commercial and carrier: |

|

|

|

|

|

| Data and

transport services (includes VoIP) |

$ |

47,198 |

|

$ |

47,969 |

|

$ |

49,112 |

|

$ |

48,558 |

|

$ |

49,653 |

|

| Voice

services |

|

25,463 |

|

|

25,288 |

|

|

25,025 |

|

|

25,323 |

|

|

25,098 |

|

|

Other |

|

3,208 |

|

|

3,621 |

|

|

2,624 |

|

|

2,703 |

|

|

3,481 |

|

|

|

|

75,869 |

|

|

76,878 |

|

|

76,761 |

|

|

76,584 |

|

|

78,232 |

|

|

Consumer: |

|

|

|

|

|

| Broadband

(VoIP, Data and Video) |

|

52,956 |

|

|

52,863 |

|

|

54,559 |

|

|

53,103 |

|

|

51,363 |

|

| Voice

services |

|

15,143 |

|

|

14,829 |

|

|

14,491 |

|

|

14,028 |

|

|

13,717 |

|

|

|

|

68,099 |

|

|

67,692 |

|

|

69,050 |

|

|

67,131 |

|

|

65,080 |

|

|

|

|

|

|

|

|

| Equipment

sales and service |

|

14,759 |

|

|

10,080 |

|

|

9,640 |

|

|

10,448 |

|

|

17,695 |

|

|

Subsidies |

|

13,905 |

|

|

13,524 |

|

|

13,074 |

|

|

12,982 |

|

|

11,681 |

|

| Network

access |

|

16,912 |

|

|

16,563 |

|

|

16,813 |

|

|

16,305 |

|

|

15,536 |

|

| Other

products and services |

|

4,414 |

|

|

3,454 |

|

|

3,508 |

|

|

3,421 |

|

|

3,317 |

|

| Total operating

revenue |

$ |

193,958 |

|

$ |

188,191 |

|

$ |

188,846 |

|

$ |

186,871 |

|

$ |

191,541 |

|

| |

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Schedule of Adjusted EBITDA

Calculation |

| (Dollars in thousands) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

Nine Months

Ended |

| |

September

30, |

|

September

30, |

| |

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Net income (loss) |

$ |

7,089 |

|

|

$ |

2,745 |

|

|

$ |

15,148 |

|

|

$ |

(5,354 |

) |

| Add (subtract): |

|

|

|

|

|

|

|

| Income

tax expense (benefit) |

|

4,991 |

|

|

|

2,220 |

|

|

|

22,287 |

|

|

|

(2,258 |

) |

| Interest

expense, net |

|

19,075 |

|

|

|

19,174 |

|

|

|

56,827 |

|

|

|

60,277 |

|

|

Depreciation and amortization |

|

43,224 |

|

|

|

46,057 |

|

|

|

130,855 |

|

|

|

133,264 |

|

| EBITDA |

|

74,379 |

|

|

|

70,196 |

|

|

|

225,117 |

|

|

|

185,929 |

|

| |

|

|

|

|

|

|

|

| Adjustments to EBITDA

(1): |

|

|

|

|

|

|

|

| Other,

net (2) |

|

1,993 |

|

|

|

9,103 |

|

|

|

7,373 |

|

|

|

53,148 |

|

|

Investment income (accrual basis) |

|

(8,735 |

) |

|

|

(10,601 |

) |

|

|

(24,636 |

) |

|

|

(26,046 |

) |

|

Investment distributions (cash basis) |

|

8,638 |

|

|

|

19,996 |

|

|

|

23,218 |

|

|

|

34,162 |

|

| Non-cash

compensation (3) |

|

862 |

|

|

|

742 |

|

|

|

2,666 |

|

|

|

2,265 |

|

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

77,137 |

|

|

$ |

89,436 |

|

|

$ |

233,738 |

|

|

$ |

249,458 |

|

| |

|

|

|

|

|

|

|

|

Footnotes for Adjusted EBITDA: |

| (1)

These adjustments reflect those required or permitted by the

lenders under our credit agreement. |

| (2)

Other, net includes income attributable to noncontrolling

interests, acquisition and non-recurring related |

| costs, and

certain miscellaneous items. |

| (3)

Represents compensation expenses in connection with our Restricted

Share Plan, which because |

| of the

non-cash nature of the expenses are excluded from adjusted

EBITDA. |

| |

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Cash Available to Pay Dividends |

| (Dollars in thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

Nine Months

Ended |

|

|

September 30,

2016 |

|

|

September 30,

2016 |

| |

|

|

|

|

| Adjusted EBITDA |

$ |

77,137 |

|

|

|

$ |

233,738 |

|

| |

|

|

|

|

| - Cash interest

expense |

|

(18,257 |

) |

|

|

|

(54,759 |

) |

| - Capital

expenditures |

|

(31,887 |

) |

|

|

|

(94,158 |

) |

| - Cash income

(taxes)/refund |

|

(616 |

) |

|

|

|

132 |

|

| |

|

|

|

|

| Cash available to pay

dividends |

$ |

26,377 |

|

|

|

$ |

84,953 |

|

| |

|

|

|

|

| Dividends Paid |

$ |

19,622 |

|

|

|

$ |

58,796 |

|

| Payout Ratio |

|

74.4 |

% |

|

|

|

69.2 |

% |

| |

|

|

|

|

| Note:

The above calculation excludes the principal payments on our

debt |

| |

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Total Net Debt to LTM Adjusted EBITDA

Ratio |

| (Dollars in thousands) |

| (Unaudited) |

|

|

|

| Summary of Outstanding

Debt |

|

| Term loan, net of

discount $2,872 |

$ |

882,103 |

|

| Revolving loan |

|

8,000 |

|

| Senior unsecured notes

due 2022, net of discount $4,453 |

|

495,547 |

|

| Capital leases |

|

17,141 |

|

| Total debt as of

September 30, 2016 |

$ |

1,402,791 |

|

| Less deferred debt

issuance costs |

|

(10,813 |

) |

| Less cash on hand |

|

(33,403 |

) |

| Total net debt as of

September 30, 2016 |

$ |

1,358,575 |

|

| |

|

| Adjusted EBITDA for the

last |

|

| twelve

months ended September 30, 2016 |

$ |

313,184 |

|

| |

|

| Total Net Debt to last

twelve months |

|

| Adjusted

EBITDA |

4.34x |

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Adjusted Net Income

and Net Income Per Share |

| (in thousands, except per share amounts) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

Nine Months

Ended |

|

|

Sep

30, |

|

Sep

30, |

|

Sep

30, |

|

Sep

30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Net income (loss) |

$ |

7,089 |

|

|

$ |

2,745 |

|

|

$ |

15,148 |

|

|

$ |

(5,354 |

) |

| Transaction and

severance related costs, net of tax |

|

606 |

|

|

|

5,620 |

|

|

|

1,985 |

|

|

|

9,329 |

|

| Impairment charge for

sale of Iowa ILEC, net of tax |

|

- |

|

|

|

- |

|

|

|

248 |

|

|

|

- |

|

| Impairment charge for

sale of CVIN Investment, net of tax |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

573 |

|

| Deferred tax related to

asset held for sale |

|

- |

|

|

|

- |

|

|

|

7,524 |

|

|

|

- |

|

| Loss on extinguishment

of debt, net of tax |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

28,251 |

|

| Non-cash stock

compensation, net of tax |

|

506 |

|

|

|

433 |

|

|

|

1,082 |

|

|

|

1,552 |

|

| Adjusted net

income |

$ |

8,201 |

|

|

$ |

8,798 |

|

|

$ |

25,988 |

|

|

$ |

34,351 |

|

| |

|

|

|

|

|

|

|

| Weighted average number

of shares outstanding |

|

50,294 |

|

|

|

50,174 |

|

|

|

50,292 |

|

|

|

50,166 |

|

| Adjusted diluted net

income per share |

$ |

0.16 |

|

|

$ |

0.18 |

|

|

$ |

0.52 |

|

|

$ |

0.68 |

|

| |

|

|

|

|

|

|

|

| *

Calculations above assume a 41.3% and 41.7% effective tax rate for

the three months ended and 59.4% and 31.5% for the nine |

| months

ended September 30, 2016 and 2015, respectively. |

| |

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Key Operating Statistics |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

30-Sep-16 |

|

30-Jun-16 |

|

% Change in

Qtr |

|

30-Sep-15 |

|

% Change

yoy |

| |

|

|

|

|

|

|

|

|

|

|

| Voice

Connections |

|

|

462,232 |

|

|

|

471,458 |

|

|

|

(2.0 |

%) |

|

|

488,037 |

|

|

|

(5.3 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| Data and

Internet Connections |

|

|

470,474 |

|

|

|

462,559 |

|

|

|

1.7 |

% |

|

|

452,265 |

|

|

|

4.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Video

Connections |

|

|

108,816 |

|

|

|

111,617 |

|

|

|

(2.5 |

%) |

|

|

119,643 |

|

|

|

(9.0 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

Business and Broadband as % of total revenue |

|

82.5 |

% |

|

|

80.9 |

% |

|

|

2.0 |

% |

|

|

80.1 |

% |

|

|

3.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Fiber route network miles (long-haul and

metro) |

|

14,099 |

|

|

|

13,830 |

|

|

|

1.9 |

% |

|

|

13,441 |

|

|

|

4.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| On-net

buildings |

|

|

5,497 |

|

|

|

5,348 |

|

|

|

2.8 |

% |

|

|

4,981 |

|

|

|

10.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Consumer

Customers |

|

|

257,106 |

|

|

|

262,177 |

|

|

|

(1.9 |

%) |

|

|

270,466 |

|

|

|

(4.9 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

| Consumer

ARPU |

|

$ |

84.38 |

|

|

$ |

85.35 |

|

|

|

(1.1 |

%) |

|

$ |

83.93 |

|

|

|

0.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Note: |

| 1) BB%

includes commercial/carrier, equipment sales and service,

directory, consumer broadband and special access. |

| 2) The

acquisition of Champaign Telephone Co. and the sale of our Iowa

ILEC resulted in a net increase of 4,905 data connections and |

| a net

reduction of 4,290 voice connections in the third quarter

2016. |

| |

|

|

|

|

|

|

|

|

|

|

Company Contacts:

Jennifer Spaude

Senior Director of Corporate Communications and IR

507-386-3765

Jennifer.spaude@consolidated.com

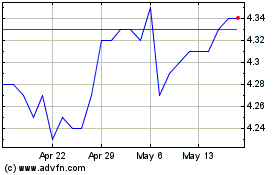

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to May 2024

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From May 2023 to May 2024