Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269911

PROSPECTUS SUPPLEMENT NO. 3

(to Prospectus dated September 22, 2023)

FREIGHTOS LIMITED

UP TO 14,850,000 ORDINARY SHARES

UP TO 40,639,421 ORDINARY SHARES BY THE SELLING SECURITYHOLDERS

UP TO 8,550,549 WARRANTS BY THE SELLING SECURITYHOLDERS

This Prospectus Supplement

No. 3 updates, amends, and supplements the prospectus dated September 22, 2023 (as amended and supplemented, the “Prospectus”),

which forms a part of our Post-Effective Amendment No. 1 to Registration Statement on Form F-1, as amended (Registration No. 333-269911).

Capitalized terms used in this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement

is being filed to update, amend, and supplement the information in the Prospectus with the information contained in our Report of Foreign

Private Issuer on Form 6-K furnished to the Securities and Exchange Commission on January 16, 2024 (the “Report”).

Accordingly, we have attached the Report to this prospectus supplement.

This prospectus supplement

is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered

with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement

updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future

reference.

The Freightos Ordinary Shares

and Freightos Warrants are listed on The Nasdaq Stock Market LLC under the symbols “CRGO” and “CRGOW,” respectively.

On January 12, 2024, the last reported sales price of the Freightos Ordinary Shares was $3.27 per share, and on January 12, 2024, the

last reported sales price of the Freightos Warrants was $0.15 per warrant.

We are both an “emerging

growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and a “foreign private issuer”

as defined under the U.S. federal securities laws and, as such, have elected to comply with certain reduced public company disclosure

and reporting requirements. See “Prospectus Summary — Emerging Growth Company” and “Prospectus Summary

— Foreign Private Issuer” in the Prospectus for additional information.

Investing in our securities

involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors”

beginning on page 13 of the Prospectus, and under similar headings in any amendment or supplements to the Prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy

or adequacy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus

supplement is January 16, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-41604

Freightos Limited

(Translation of registrant's name into English)

Technology Park Building 2

1 Derech Agudat Sport HaPo’el

Jerusalem, Israel 9695102

(Address of principal executive office)

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F |

| or Form 40-F: |

x Form 20-F |

¨ Form 40-F |

CONTENTS

Quarterly Results of Operations

On January 16, 2024, Freightos Limited (the “Company”)

announced certain preliminary financial results for the fourth quarter of 2023 and provided information concerning the expected timing

for its full fourth quarter earnings release. A copy of the press release containing that announcement is furnished as Exhibit 99.1 to

this Report of Foreign Private Issuer on Form 6-K (this “Form 6-K”).

Exhibits

Incorporation by Reference

The information in this Form 6-K (including in

Exhibit 99.1 hereto) is hereby incorporated by reference into the Company’s registration statement on Form S-8 (File No. 333-270303),

to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently

filed or furnished.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

FREIGHTOS LIMITED |

| Date: January 16, 2024 |

|

| |

/s/ Michael Oberlander |

| |

Name: |

Michael Oberlander |

| |

Title: |

General Counsel |

Exhibit 99.1

Freightos Announces

Record Transactions for Fourth Quarter of 2023 and Date of Fourth Quarter and Full Year Earnings Release

January 16, 2024 – Jerusalem /PRNewswire/ - Freightos Limited

(NASDAQ: CRGO), a leading, vendor-neutral booking and payment platform for the international freight industry, today reported preliminary

Q4 2023 Key Performance Indicators.

| |

|

Actuals* |

|

|

Management’s

Expectations |

|

|

Actuals* |

|

|

Management’s

Expectations |

| |

|

Q4 2023 |

|

|

Q4 2023 |

|

|

FY 2023 |

|

|

FY 2023 |

| |

|

|

|

|

|

|

|

|

|

|

|

| # Transactions (‘000) |

|

|

286.9 |

|

|

|

273.0 - 287.0 |

|

|

|

1,024.7 |

|

|

1,010.5 - 1,021.5 |

| Year over Year Growth |

|

|

36% |

|

|

|

|

|

|

|

53% |

|

|

|

| GBV ($m) |

|

|

187.5 |

|

|

|

$163.5 - $175.0 |

|

|

|

671.7 |

|

|

$647.5 - $659.0 |

| Year over Year Growth |

|

|

10% |

|

|

|

|

|

|

|

10% |

|

|

|

*Numbers are preliminary and subject to change with the full earnings

release

The fourth quarter of 2023 was another quarter of strong performance

by Freightos. With 286.9 thousand transactions, Q4 was the 16th consecutive quarter of record #Transactions booked on Freightos’

platform, bringing full year transactions to surpass the significant one million transaction milestone, exceeding management expectations

for the year. The 36% #Transactions growth from Q4 2022 reflects the ongoing digitalization and platformification of the global freight

industry. In 2023, Freightos confirmed itself as a leading platform by powering over a million real-time global freight-rate comparison,

booking, and shipment management transactions.

Gross Booking Value (GBV) exceeded management expectations, increasing

in the fourth quarter 10% year-on-year as strong #Transactions growth compensated for the reduced freight rates that prevailed in the

market for most of the quarter. While disruption to shipping in the Red Sea did drive a rate increase, this only came in the final days

of the year.

The sustained #Transactions growth is fueled by the marketplace flywheel

dynamics, as buyer and seller growth bring additional supply and demand which in turn attract additional buyers and sellers. During the

fourth quarter, the number of Unique Buyer Users reached 17.6 thousands, up approximately 12% compared to Q4 2022. The number of sellers

also increased during the quarter, with carriers selling on the platform reaching 45 in Q4 2023, compared to 35 in Q4 2022.

Conference Participation

Freightos' management will participate at the Needham Growth Conference

today, January 16, 2024. A link to the live webcast of the presentation at 8:00 a.m. EST, and to the replay thereafter, is available here:

https://wsw.com/webcast/needham134/register.aspx?conf=needham134&page=crgo&url=https://wsw.com/webcast/needham134/crgo/2243758

Q4 2023 Earnings Call

Financial results for the fourth quarter of 2023 and outlook for the

first quarter and full year of 2024 will be reported before markets open on February 26, 2024. Information about Freightos' financial

results, including a link to the live webcast, will be available on Freightos' investor relations website at https://www.freightos.com/investor-news/.

Freightos' management will host a webcast and conference call to discuss

the results that morning at 8:30 a.m. EST.

To participate in the call, please register at the following link:

https://freightos.zoom.us/webinar/register/WN_2GO5J16IQNiw3KBf9-Befw

Following registration, you will be sent the link to the conference

call which is accessible either via the Zoom app, or alternatively from a dial-in telephone number.

Questions may be submitted in advance to ir@freightos.com or via Zoom

during the call.

A replay of the webcast will be available on Freightos' Investor Relations

website following the call, as well as the call’s transcript.

Definitions

#Transactions: Number of bookings for freight services, and

related services, placed by buyers across the Freightos platform with third-party sellers and with Clearit. Beginning in the third quarter

of 2022, #Transactions include trucking bookings, which were added to the Freightos platform following the acquisition of 7LFreight.

The number of transactions booked on the Freightos platform in any given time period is net of transactions canceled during the same

time period.

GBV: Total value of transactions on the Freightos platform,

which is the monetary value of freight and related services contracted between buyers and sellers on the Freightos platform, plus related

fees charged to buyers and sellers, and pass-through payments such as duties. GBV is converted to U.S. dollars at the time of each transaction

on the Freightos platform. This metric may be similar to what others call gross merchandise value (GMV) or gross services volume (GSV).

We believe that this metric reflects the scale of the Freightos platform and our opportunities to generate platform revenue.

Unique buyer users: Unique buyer users represent the number

of individual users placing bookings, typically counted based on unique email logins. The number of buyers, which counts unique customer

businesses, does not reflect the fact that some buyers are large multinational organizations while others are small or midsize businesses.

Therefore, we find it more useful to monitor the number of unique buyer users than the number of buyer businesses.

Carriers: Number of unique air and ocean carriers who have been

sellers of transactions. For airlines, we count the booking carrier, which includes separate airlines within the same carrier group. We

do not count dozens of other airlines that operate individual segments of air cargo transactions as we do not have a direct booking relationship

with them. Carriers include ocean less-than-container load (LCL) consolidators. In addition, we only count carries when more than five

bookings were placed with them over the course of a quarter.

Certain amounts, percentages and other figures included in this

press release have been subject to rounding adjustments and therefore may not sum.

Contacts

Media:

Tali Aronsky

press@freightos.com

Investors:

ir@freightos.com

About Freightos

Freightos® (NASDAQ: CRGO) operates a leading, vendor-neutral booking

and payment platform for international freight. Freightos’ platform supports supply chain efficiency and agility by enabling real-time

procurement of ocean and air shipping across more than ten thousand importers/exporters, thousands of forwarders, and dozens of airlines

and ocean carriers.

Freightos.com is a premier digital international freight marketplace

for importers and exporters for instant pricing, booking, and shipment management. Thousands of SMBs and enterprises have sourced shipping

services via Freightos across dozens of logistics service providers.

WebCargo® by Freightos is a leading global freight platform connecting

carriers and forwarders. In particular, it is the largest air cargo eBooking platform, enabling simple and efficient freight pricing

and booking between thousands of freight forwarders, including the top twenty global freight forwarders, and hundreds of airlines, ocean

liners and trucking carriers. Airlines on the platform represent over a third of global air cargo capacity. WebCargo also offers software

as a service for forwarders to facilitate digital freight rate management, quoting, and online sales.

Freightos Data calculates the Freightos Baltic Index, the industry’s

key daily benchmark of container shipping prices, the Freightos Air Index, as well as other market intelligence products that improve

supply chain decision-making, planning, and pricing transparency.

Freightos is a widely recognized logistics technology leader with a

worldwide presence and a broad customer network. Incorporated in the Cayman Islands with offices around the world, More information is

available at freightos.com/investors.

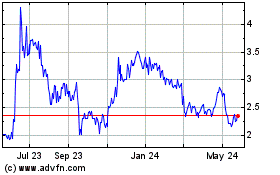

Freightos (NASDAQ:CRGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

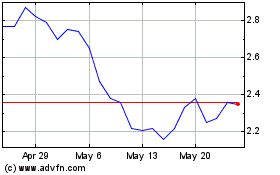

Freightos (NASDAQ:CRGO)

Historical Stock Chart

From Dec 2023 to Dec 2024