Capital Southwest Announces Leadership Changes

19 February 2025 - 8:41AM

Capital Southwest Corporation (“Capital Southwest” or the

“Company”) (Nasdaq: CSWC), an internally managed business

development company focused on providing flexible financing

solutions to support the acquisition and growth of middle market

businesses, announced today that Chief Financial Officer Michael

Sarner has been appointed by the Board of Directors (the “Board”)

to succeed Bowen Diehl as President and Chief Executive Officer of

Capital Southwest. Mr. Sarner has also been appointed to serve on

the Board. Both appointments are effective February 17, 2025. Mr.

Diehl will continue to serve the Company in an advisory capacity

for at least another year.

In addition, Chris Rehberger has been promoted from Executive

Vice President of Finance and Treasurer to Chief Financial Officer,

Treasurer & Secretary of the Company, and Tabitha Geiger has

been promoted from Deputy Compliance Officer to Chief Compliance

Officer of the Company, effective February 17, 2025.

“On behalf of the Board, we want to both acknowledge and

celebrate Bowen’s long career at Capital Southwest,” said David

Brooks, Chairman of the Board. “We greatly appreciate the

leadership he has provided to Capital Southwest over the past

decade and we wish him the very best. Succession planning has

always been a priority for the Company, and Michael, Bowen and the

Board are all in agreement that it is time to transition the

leadership of Capital Southwest. Michael and Bowen have both been

fully immersed in the strategy and operations of the Company, which

will make this a smooth transition.”

“I couldn’t be more optimistic about the future of Capital

Southwest under Michael’s leadership. He has worked tirelessly by

my side over the past decade building a best-in-class BDC and,

together with the rest of our leadership team, I am confident the

firm has the right team to continue executing Capital Southwest’s

strategy going forward,” said Bowen Diehl. “I am very proud of what

we have built here together and I am grateful for having had the

opportunity over the past ten years to lead Capital Southwest’s

transformation into a BDC with one of the most robust business

models in the industry. While stepping down is clearly bittersweet,

succession planning is an important part of a company’s evolution,

and I very much look forward to supporting Capital Southwest in any

way that Michael and the team find helpful, in the short term as an

advisor, and in the long term as a fellow shareholder.”

Mr. Sarner joined Capital Southwest in 2015 and brings more than

thirty years of financial, treasury and BDC experience to his new

role. He has been instrumental in planning and executing on both

the corporate and capitalization strategy for Capital Southwest,

raising over $2 billion in both debt and equity. In addition to

serving as Chief Financial Officer, Mr. Sarner also served as the

Company’s Chief Compliance Officer and Secretary. He also has

served on the Investment Committee for the entirety of his time

with Capital Southwest. Previously, he spent fifteen years at

American Capital in a variety of financial roles, including

Executive Vice President and Treasurer.

“I’m honored to be entrusted with Capital Southwest’s future,”

said Michael Sarner, President and Chief Executive Officer. “The

Company is well-positioned for growth with a strong and cohesive

leadership team – including Chris with whom I’ve worked closely

with for the past two decades. I look forward to fostering the

growth of the entire Capital Southwest team, as well as providing

leadership for the Company with a renewed vision for the

future.”

Mr. Rehberger joined Capital Southwest in 2015 and has twenty

years of experience in corporate finance roles within the BDC

space. Mr. Rehberger additionally spent ten years in corporate

finance roles at American Capital working alongside Mr. Sarner. Mr.

Rehberger earned a bachelor’s in commerce with a concentration in

finance from the McIntire School and a master’s from the Darden

School of Business, both from the University of Virginia.

Ms. Geiger has almost a decade of experience. Previously, she

spent eight years in compliance consulting with IQ-EQ, where she

was responsible for implementing and overseeing compliance programs

for private equity, venture capital and hedge fund managers. Ms.

Geiger earned a BS in Agricultural Communications and Journalism

from Texas A&M University and her JD from South Texas College

of Law. She is licensed to practice law in Texas.

About Capital SouthwestCapital Southwest

Corporation (Nasdaq: CSWC) is a Dallas, Texas-based, internally

managed business development company with approximately

$1.7 billion in investments at fair value as of December 31,

2024. Capital Southwest is a middle market lending firm focused on

supporting the acquisition and growth of middle market businesses

with $5 million to $50 million investments across the

capital structure, including first lien, second lien and

non-control equity co-investments. As a public company with a

permanent capital base, Capital Southwest has the

flexibility to be creative in its financing solutions and to invest

to support the growth of its portfolio companies over long periods

of time.

Media Relations Contact:Lauren

DiGeronimolaurend@trailrunnerint.com

Investor Relations Contact:Michael

Sarnermsarner@capitalsouthwest.com

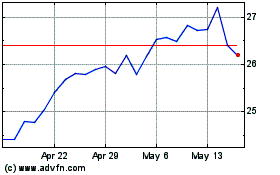

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Jan 2025 to Feb 2025

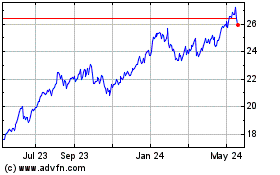

Capital Southwest (NASDAQ:CSWC)

Historical Stock Chart

From Feb 2024 to Feb 2025