Citi Trends Narrows Loss - Analyst Blog

18 March 2013 - 8:20PM

Zacks

Value-priced retailer of urban fashion apparel and accessories,

Citi Trends Inc. (CTRN) reported

better-than-expected fourth quarter and fiscal 2012 results. The

company posted loss per share of 5 cents, narrowing substantially

from a loss per share of 36 cents reported in the year-ago quarter.

Moreover, the company’s quarterly loss compared favorably with the

Zacks Consensus Estimate of a loss of 7 cents per share.

For fiscal 2012, Citi Trends’ loss per share of 15 cents narrowed

compared with a loss of 69 cents reported in fiscal 2011, while it

also bettered the Zacks Consensus Estimate of a loss of 17 cents

per share.

Turning to Numbers

We note that Citi Trends’ fourth-quarter and full-year sales

results include one additional week as compared with the prior-year

periods.

For the fourth quarter (14 weeks ended Feb 2, 2013), Citi Trends

reported preliminary sales of $175.7 million, down 1.5% from $178.4

million in the prior-year quarter (13 weeks ended Jan 28, 2012).

The additional week made for nearly $8.8 million of net sales in

fourth-quarter 2012. The fourth-quarter sales missed the Zacks

Consensus Estimate of $186 million.

The decline in sales results for the quarter were mainly attributed

to the loss of tax refund driven sales in the last two weeks of

January this year, as the Internal Revenue Service pushed back the

2012 tax refund date to Jan 30 instead of the usual refunds date of

Jan 13. This delay in refunds impacted the company’s fourth-quarter

comparable store sales by 7.5%. As a result, the company’s

comparable store sales for the fourth quarter (14 weeks ended Feb

2, 2013) plummeted 11.8% compared with the year-ago 14 weeks period

ended Feb 4, 2012.

By month, the company’s comparable store sales inched up 1% in

November, while it declined 10% in December and 28% in January.

Barring the sales decline in the last two weeks of January,

comparable sales in the first three weeks of January rose 10%.

However, for fiscal 2012 (53 weeks ended Feb 2, 2013), the

company’s net sales rose 2.2% to $654.7 million from $640.8 million

reported in fiscal 2011 (52 weeks ended Jan 28, 2012). The fiscal

2012 sales missed the Zacks Consensus Estimate of $665 million.

Comparable store sales for the 53 weeks ended Feb 2, 2013 were down

5.6% compared with the 53 weeks ended Feb 4, 2012.

Citi Trends' gross profit for the quarter augmented 6.8% to $57.5

million from $53.8 million in the year-ago quarter, whereas gross

margin expanded 250 basis points to 32.7%. The growth in gross

margin was attributed to a substantial decline in clearance

markdowns versus last year.

Selling, general and administrative expenses in the quarter

increased 0.9% year over year to $52.7 million, while depreciation

and amortization expenses waned 11.8% to $5.8 million. The

company's loss from operations came in at $1.5 million,

significantly below the year-ago period loss from operations of

$9.2 million.

Financials

Citi Trends had no debt on its balance sheet at the end of fiscal

2012. Cash and cash equivalents were $37.3 million compared with

$42.0 million at the end of fiscal 2011. Shareholders' equity

totaled $196.0 million compared with $196.4 million in the

prior-year period.

Stores Count

During fiscal 2012, Citi Trends slightly paced up its stores with

the opening of 4 new stores and relocation or expansion of 4

stores. Simultaneously, the company shuttered 2 stores. This

brought the company’s total store count to 513 at the end of fiscal

2012. The company operates across 29 states in the Southeast,

Mid-Atlantic and Midwest regions as well as in the states of Texas

and Calif.

Outlook

Looking into fiscal 2013, the company remains stringently focused

on improving its sales via enhancing the variety of its ladies

business. Though the significance of the company’s Urban Brands

continues to decline and non-branded business is not poised to make

loss from the branded business, the company expects to gain from

better focus on its ladies business in 2013.

Though the company has made significant progress on resolving

pricing issues and remains on track to resolve fashion issues in

2013, the company expects its first and fourth quarter of fiscal

2013 to be impacted by the shift of one week of fiscal 2013 in

fiscal 2012, due to the additional week that was accounted for in

fiscal 2012. Nevertheless, the company is expected to benefit from

the movement of the tax refund related sales into fiscal 2013.

A Look at Zacks Rank

Citi Trends currently holds a Zacks Rank #5 (Strong Sell). Stocks

that are performing well among apparel-shoe retailers include

New York & Company Inc. (NWY), which has a

Zacks Rank #2 (Buy), Gap Inc. (GPS) and

Abercrombie & Fitch Inc. Inc. (ANF) , both of

which carry a Zacks Rank #3 (Hold).

ABERCROMBIE (ANF): Free Stock Analysis Report

CITI TRENDS INC (CTRN): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

NEW YORK & CO (NWY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

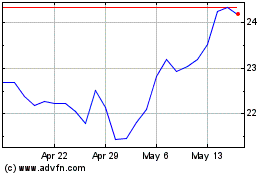

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

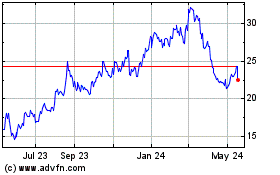

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024