UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported):

November 12, 2014

CYTOSORBENTS CORPORATION

(Exact name of registrant as specified in

its charter)

| Nevada |

000-51038 |

98-0373793 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

7 Deer Park Drive, Suite K,

Monmouth Junction, New Jersey |

08852 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (732) 329-8885

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 12, 2014, CytoSorbents Corporation (the “Company”) conducted a conference call during which members of

its senior management team discussed financial results for the third quarter and nine months ended September 30, 2014, a business

update, and certain other information. The transcript of the conference call is furnished herewith as Exhibit 99.1.

On November 12, 2014, the Company issued a press release announcing

its financial results for the third quarter and nine months ended September 30, 2014. A copy of the press release is furnished

herewith as Exhibit 99.2.*

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description |

| 99.1 |

Transcript of the CytoSorbents Corporation Conference Call on November 12, 2014, 4:15 pm EST. |

| 99.2 |

CytoSorbents Corporation Press Release, dated November 12, 2014. |

* The information

in Item 2.02 of this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: November 17, 2014 |

CYTOSORBENTS CORPORATION |

|

| |

|

|

|

| |

By: |

/s/ Dr. Phillip P. Chan |

|

| |

Name: |

Dr. Phillip P. Chan |

|

| |

Title: |

President and Chief Executive Officer |

|

Exhibit 99.1

CytoSorbents Corporation (OTCBB: CTSO)

Q3 2014 Earnings and Operating Results

Conference Call

November 12, 2014 @ 4:15 pm Eastern

This official company transcript has been edited for clarity

and does not differ materially from the actual conference call. Slide numbers have been inserted to allow readers to follow along

with the associated presentation.

Operator:

Good day, everyone and welcome to the CytoSorbents

2014 Third Quarter Financial and Operating Results Conference Call. Today’s call is being recorded and at this time I’d

like to turn the conference over to our moderator, Amy Vogel. Please go ahead, Amy.

Amy Vogel – Moderator:

Thank you operator and good afternoon.

Welcome to CytoSorbents Third Quarter 2014 Operating and Financial Results Conference Call. With us today are:

| · | Dr. Phillip Chan, Chief Executive Officer

and President |

| · | Vincent Capponi, Chief Operating Officer |

| · | Kathleen Bloch, Chief Financial Officer |

| · | Dr. Christian Steiner, VP of Sales and

Marketing from Germany, and |

| · | Chris Cramer, VP of Business Development |

Before I turn the call over to Dr. Chan,

I’d like to remind listeners that during the call, management's prepared remarks may contain forward-looking statements which

are subject to risks and uncertainties. Management may make additional forward-looking statements in response to your questions

today. Therefore, the Company claims protection under Safe Harbor for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. Actual results may differ from results discussed today and therefore, we refer you to a more detailed

discussion of these risks and uncertainties in the Company's filings with the SEC. Any projections as to the Company's future performance

represented by management include estimates today as of November 12, 2014 and the Company assumes no obligation to update these

projections in the future as market conditions change.

During today’s conference call, we

will first have an overview presentation covering the financial and operational highlights for the quarter by Dr. Chan and Ms.

Bloch. We again have taken everyone’s submitted questions and will do our best to address them in the presentation, and also

in the Q&A session with management to follow. Thanks everyone again for participating. If we do not answer your question, we

would ask that you contact the Company directly after the call today.

At this time, I would like to turn the

call over to Dr. Phillip Chan. Please go ahead Dr. Chan.

Phillip Chan - CEO:

Thank you very much, Amy, and thank you

everyone for joining the call today. It's a pleasure to be here and welcome. As usual, following a short introduction for new and

potential investors with some recent operational highlights, Kathy will go over our financial progress for the third quarter of

2014. We will then discuss at length our plan to up-list to the NASDAQ Capital Market, answer some frequently asked questions and

review the actions for which we are seeking shareholder consent. Then the rest of the management team will have their remarks that

incorporate answers to many of the questions we have received from our analysts and shareholders. An official transcript of today's

call will be available in the next few days on our website at www.cytosorbents.com.

Slide 4: If we can fast-forward

to Slide 4. CytoSorbents is an emerging leader in the $20 billion critical care immunotherapy space and we are leading the prevention

or treatment of life threatening inflammation in the intensive care unit.

Slide 5: Most of us know that inflammation

plays a protective role in the body, protecting us against injury and infection. But most of us may not know that inflammation

actually plays a significant detrimental role in nearly every known disease. These can be life-threatening conditions like sepsis

and trauma, autoimmune diseases like rheumatoid arthritis and psoriasis, heart disease, peripheral artery disease, cancer, cancer

cachexia, neurodegenerative diseases such as Alzheimer’s and multiple sclerosis, and many others. The problem is that uncontrolled

inflammation wreaks havoc on the body and can be deadly.

Slide 6: The problem is that severe,

uncontrolled inflammation can lead to organ failure. Organ failure occurs when vital organs like the lungs, the heart, the kidneys,

or the liver stops working, which is incompatible with life. Organ failure causes nearly half of all deaths in the ICU today, but

little can be done to treat or prevent it. And that is where we come in.

Slide 7: CytoSorb® removes the

fuel to the fire of inflammation and represents a powerful immunotherapy tool to control inflammation. CytoSorb® is approved

in the European Union as the only specifically approved extracorporeal cytokine filter and is clinically proven to reduce key cytokines

in blood in critically-ill patients. CytoSorb® is approved for use in any situation where cytokines are elevated and has also

been safe in more than 3,500 human treatments, with no serious device related adverse events reported.

Slide 8: The heart of our technology

is a highly biocompatible, very porous, state-of-the-art polymer bead that acts like a tiny sponge to remove harmful substances

from blood. If you magnify these beads up close, they are roughly the size of a grain of salt and each bead has millions of pores

and channels that are capable of removing substances from blood. Big things like cells cannot get into the pores and go around

the beads, very small things go through the beads, but appropriately sized molecules will get trapped in the vast network of pores

and channels in every single bead and permanently eliminated from blood. Our technology is protected by 32 issued U.S. patents

and multiple applications pending. We manufacture these beads at our ISO 13485 certified facility in New Jersey, and our beads

are one of the highest-grade medical sorbents on the medical market today.

Slide 9: The goal of CytoSorb®

is to try to prevent or treat organ failure, the leading cause of death in the intensive care unit. Our goal is to hopefully help

stabilize patients while improving patient outcome and survival while decreasing the costs of ICU and patient care. Because we

sit at the nexus of inflammation in so many of the diseases that you see in this slide as well as many others, we truly believe

that we have the potential to revolutionize critical care medicine.

Slide 10: CytoSorb® is available

for sale in all 28 countries of the European Union and is currently marketed in 19 countries around the world. We sell the product

direct in Germany, Austria and Switzerland with our direct sales force, and we have now established distribution in the U.K., Ireland,

Netherlands, Turkey, Russia, India, Taiwan, and most of the countries of the Middle East, covering a total of approximately 1.7

billion lives. We are currently expanding to other EU countries and countries outside the EU that will accept CE mark approval.

I am pleased to say that we have now achieved registration of CytoSorb® in Saudi Arabia and are now waiting formal Saudi FDA

approval following some initial field tests by the Ministry of Health.

Slide 11: We have also been fortunate

to have received a tremendous amount of government support for our technology. More than $15 million in federal funding has gone

into the development of this technology. First of all, DARPA, which is the leading research funding agency of the Department of

Defense that has been responsible for funding such innovations as the Internet, global positioning satellites, robotic surgery

and wheelchairs that can climb stairs, awarded us a $3.8 million five-year contract as part of their Dialysis-Like Therapeutics

program to treat sepsis and they have tasked us with removing cytokines and pathogen derived toxins. We are currently in year three

of that program.

The U.S. Army also awarded us a Phase I

and Phase II SBIR contract valued at $1.15 million for trauma and burn injury research with our technology. The U.S. Air Force

is funding a 30-patient randomized controlled human pilot study in trauma and rhabdomyolysis valued at $3 million. This FDA approved

trial has begun enrollment. The U.S. Department of Health and Human Services awarded us a $0.5 million grant because of the potential

of our technology to save lives and reduce cost under the QTDP program. One of our major collaborators at University of Pittsburgh

received a $7 million five-year grant from the NIH to pursue innovations around our technology for the treatment of sepsis. And

last but not least, we were awarded a Phase I SBIR grant by NHLBI, the National Heart, Lung and Blood Institute, to advance our

HemoDefend platform for the purification of blood transfusion products, to try to improve the quality and safety of blood transfusions.

Slide 12: Now more recently, we

were the winner of the GREAT Tech awards. In October, CytoSorbents was awarded the United Kingdom GREAT Tech award for Health,

sponsored by United Kingdom Trade and Investment and the British Consulate New York. The GREAT Tech awards selected one winner

from each of six categories from a pool of more than 130 high growth companies from New York, New Jersey, Pennsylvania and Connecticut,

and we were recognized for our innovative and potentially revolutionary blood purification technology that could help save lives

and reduce the high cost of ICU care. As part of the award, the Company will receive assistance, access and resources to further

expand into the U.K. with its distribution partner, LINC Medical. The importance of this award is that the United Kingdom is the

third largest medical device market in the European Union.

Slide 13: We also were pleased to

have launched the International CytoSorb® Registry that is now available in both English and German, and is currently active

with registrants that are submitting their data online. The English version is currently under beta testing and will go live in

January.

Slide 14: We also established a

world class Cardiac Surgery Advisory Board in the United States. It consists of major leaders in the area of cardiac surgery from

around the country in such places as University of Kentucky, University of Michigan, Texas Children’s Hospital in Houston,

Cleveland Clinic Foundation, Columbia University and the University of Pittsburgh Medical Center. This group has helped us modify

our clinical trial protocol in cardiac surgery where we are looking to use CytoSorb® intra-operatively in a heart-lung machine

bypass circuit. The goal is to try and help reduce inflammatory mediators that are generated during cardiac surgery in order to

potentially prevent post-operative complications such as organ dysfunction and organ failure. We are currently on track to submit

our IDE application to the FDA to run this pivotal trial, and hopefully will submit by the end of 2014 and begin the trial next

year.

Slide 15: We are also pleased to

announce an expansion of our Biocon partnership. Chris Cramer will discuss this in greater depth in his comments. But according

to Biocon, hundreds of patients have now benefitted from CytoSorb® therapy, and orders from Biocon continue to increase. We

have now expanded the agreement beyond sepsis to now all critical care applications as well as cardiac surgery, with a focus on

trying to control the systemic inflammatory response syndrome that is responsible for causing organ dysfunction and organ failure

in many patients. This partnership continues to be focused on India and select emerging countries. We have negotiated a co-development

agreement where Biocon has committed to conduct and publish results from multiple investigator initiated studies and patient case

studies. Meanwhile, Biocon will continue to market CytoSorb® with their critical care antibiotics as the most comprehensive

treatment of sepsis. I think very importantly, Biocon has also agreed, based on their results and their sales to date, to increase

annual minimum sales targets which should result in significantly increased sales of CytoSorb® over the life of the agreement.

Slide 16: We are also pleased to

announce our first cardiac surgery partnership. Following significant due diligence, we have entered into an initial partnership

with a top four global medical device company in cardiac surgery and other cardiovascular diseases, to use CytoSorb® intra-operatively

during cardiac surgery in the country of France. The partnership has already begun and is expected to continue over a total six-month

evaluation period to determine various market parameters, to obtain clinical data, and to build key opinion leader support in France.

Following a successful evaluation, the two parties plan to jointly determine how to expand upon both the size and geographic footprint

of its partnership. France is currently the second largest medical device market and one of the highest volume cardiac surgery

markets in the European Union. To give you an idea of the top cardiac surgery companies in the space… these include Medtronic,

Sorin, Maquet, as well as Terumo.

Slide 17: And last but not least,

I think there were a number of questions around Ebola, HemoDefend and our cardiac surgery studies. So I wanted to give everyone

a quick update.

In terms of Ebola, CytoSorbents is currently

in five of seven major hospitals in Germany that are prepared to accept Ebola patients. We have communicated with these hospitals

and physicians and have made CytoSorb® an option to potentially treat patients should they wind up being admitted to these

hospitals. We have also had communications with the World Health Organization, the Centers for Disease Control, the FDA, the National

Institutes of Allergy and Infectious Disease, USAMRID of the Department of Defense, treatment hospitals in the United States, and

others. Ebola patients have now undergone dialysis, a critical technical proof-of-concept that supports CytoSorb® use. To date,

however, CytoSorb® has not been used to treat Ebola patients.

In terms of HemoDefend, at the recent American

Association of Blood Bank (AABB) Conference in Philadelphia, data from the RECESS trial, where new blood, meaning blood 10-days

or younger, and old blood, meaning blood 21 days old or greater, was given to patients undergoing complex cardiac surgery. The

data from the RECESS trial showed that the age of blood had no statistically significant impact on progression to organ dysfunction

or death. Although this was not what we expected to see, we do not believe this diminishes the potential value of HemoDefend to

improve the quality and safety of blood by removing contaminants that can cause transfusion reactions. In fact, HemoDefend may

have significant applications in other blood transfusion products where the need is potentially even greater than that seen in

packed red blood cells. We currently await subgroup analysis, particularly in patients receiving more units of blood than average

or patients undergoing more complex types of surgeries where there is a higher risk of hemolysis and injury, as well as a breakdown

of the very high serious adverse event rate approaching 50% in this trial, in these patients undergoing complex cardiac surgery.

We also await the results of the ABLE trial,

a Canadian based trial, where fresh versus standard issue blood has been given to critically-ill patients. That trial has been

completed and we have heard that the results may be released at either the American Society of Hematology meeting in December of

this year or the Society of Critical Care Medicine Conference in January of 2015. While we wait for these, we continue HemoDefend

development.

And last but not least, in cardiac surgery

we have multiple investigator initiated studies ongoing at Hamburg, Vienna, Cologne and others, some of which are expected to be

completed in the next several months provided that enrollment continues during the holiday season. Once we have data from that

we will be pleased to share that with the group.

So with that, let me turn it now over to

Kathy Bloch, our Chief Financial Officer, who will cover Q3 2014 operating and financial highlights. Kathy?

Kathleen Bloch - CFO:

Thank you, Phil. Good afternoon everyone.

Slide 18: For today’s call,

I will be providing an update regarding primarily CytoSorbents’ revenues.

Slide 19: For the quarter ended

September 30, 2014, we achieved record CytoSorb® quarterly sales of $1.0M, that is the first time in our Company history, and

it is in fact a 406% increase over product sales of approximately $204K in the same period of 2013.

In fact, quarterly sales of $1.0M have

exceeded CytoSorb® sales for the entire year of 2013 which were $822K.

Product gross margins for Q3 2014 were

approximately 65%.

Slide 20: For the first nine months

of 2014 our total revenue was approximately $3.2M which is an increase of 111% compared to total revenues of approximately $1.5M

for the first nine months of 2013.

CytoSorb® product sales fueled the

increase in total revenues, with $2.3 million in sales in the first nine months of 2013, a 346% increase from $508K in CytoSorb®

revenue in the first nine months of 2013.

Grant income for the nine months ended

September 30, 2014 was approximately $985K, which is tracking similarly to our grant income of approximately $1.0M for the nine

months ended September 30, 2013.

For the first nine months of 2014 our blended

gross margins were approximately 44%, and our CytoSorb® product gross margins were approximately 66%.

Slide 21: So let’s look at

the Company’s historical quarterly sales for each of the last nine quarters since we began commercialization of CytoSorb®

in late 2012.

With our record third quarter product sales

of more than $1.0M, the Company has posted its fifth consecutive quarter of double-digit quarter-over-quarter growth. Our quarter

over quarter growth between Q3 2014 and Q2 2014 was 56%. Our current annual run rate is now in excess of $4.1 million, as compared

to an annual run rate of approximately $814K one year ago.

Slide 22: Next, we’ll look

at our chart summarizing our twelve-trailing months of CytoSorb® product sales and once again it continues to demonstrate the

positive trend that sales are taking overall. Sales for the twelve months ended September 30, 2014 were approximately $2.6 million,

as compared to sales for the twelve months ended September 30, 2013 of approximately $406,000. This represents an increase of more

than $1.3 million, or a year over year product sales increase of 331%.

With regard to expectations, sales momentum

remains strong.

The Company has always stated that sales

growth would be achieved as a result of its revenue multipliers: 1) the direct sales team is reaching down past the KOLs directly

to the treating physicians in the ICUs; 2) we are in multiple ICUs in each treating hospital, 3) we are being used for many different

applications including sepsis, cardiac surgery, pancreatitis, and burn injury, to name a few, 4) repeat orders from existing distributors;

and 5) the establishment of distributor relationships in new territories.

Our balance sheet remains secure with $7.8

million in cash and short-term investments at September 30, 2014, and we are continuing to execute on our stated path for the commercialization

of CytoSorb.

Now, I’d like to turn the call back

to Phil to discuss the benefits of the up-listing. Phil?

Phillip Chan - CEO:

Slide 23: Well, thank you very much,

Kathy. Now I would like to go into more detail about the planned up-listing to the NASDAQ Capital Market and a quick summary of

the approvals we we are seeking in our recently sent proxy statement. I also want to clear up some misperceptions about some of

these issues and answer a number of frequently asked questions concerning the planned reverse split.

Slide 24: As we have said before,

we believe that there are many potential benefits of up-listing. First and foremost, we believe that up-listing to the NASDAQ Capital

Market will increase our visibility in the investor community. Currently many institutional investors, because our stock is under

a dollar on the OTCBB, cannot invest in our company for a number of restrictive reasons. We believe that these reasons would go

away once we do an up-listing and that they would no longer be restricted from owning our shares.

We also believe that our analyst coverage

and the news releases will be more impactful. Many of the analysts that currently cover our company are focused predominantly on

institutional investors who cannot currently own our stock. If we are successful in up-listing, we believe that this analyst coverage

would be much more impactful. Another potential benefit of up-listing is increased liquidity for investors. As I will show you

some data in just a moment, the average daily trading volume increased by three times in the three months following an OTC to NASDAQ

national market up-listing.

In addition, the median stock appreciation

of 2013 OTC to NASDAQ up-listed companies was 69% in 2013 and the median stock appreciation of 2014 OTC to NASDAQ up-listed companies

was 15% in 2014. These are based on historical data and past results do not predict future performance. We also cannot predict

the performance of our stock post-split or post-up-listing. And we can also provide no assurances that our application for listing

to the NASDAQ Capital Market will be accepted. However, we are in the midst of this currently and we are very encouraged by our

potential to be up-listed by the end of the year.

Another positive benefit is that, many

shareholders who currently buy and sell our stock have found it very difficult to find brokers who will accept stock certificates.

In fact this is the case for most OTC Bulletin Board companies. This problem would go away with an up-listing to a national market.

This has been a chronic problem for many people and the source of great frustration in owning shares in our company.

Another potential benefit of up-listing

is increased credibility. As we all know credibility is extremely important amongst investors, strategic partners, journalists

as well as customers. Along with the NASDAQ up-listing, we are subject to very rigorous governance standards, SEC reporting and

Sarbanes Oxley compliance standards. Also we believe that by up-listing to a national market, we can eliminate the perceived stigma

of being a "penny stock".

And finally, another potential benefit

of up-listing is the potential for lower costs of capital and less shareholder dilution. As a nationally listed company, we would

have many more options to raise capital at attractive rates.

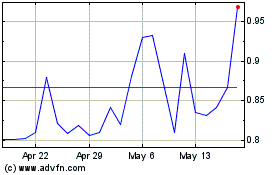

Slide 25: On this slide we are basically

just looking at some data provided by NASDAQ where it is showing the average daily volume in the three months prior to an up-list,

or an upgrade as they call it, from the OTCBB to the NASDAQ, and then the average daily volume three months after the upgrade.

You can see that there is a three-fold increase in trading volume, supporting the notion that there would be increased liquidity

following an up-listing.

Slides 26 – 28: Also if you

look at the next several slides, what you see here is the class of 2013 OTC upgrades to the NASDAQ, and again, the median stock

appreciation for these companies was 69% in 2013. Once our slide deck is published you will be able to see these data in greater

detail. And for the 2014 class of OTC upgrades to the NASDAQ, again, the median stock appreciation was 15% through October 2014.

Slide 29: So the question many have

asked is why are we up-listing now? The answer to that is that CytoSorbents is an evolving company whose fundamentals continue

to improve. We believe our profile compares favorably to other recently up-listed healthcare companies. What I have done here is

list many of the features of our company and put it all onto one slide so that investors can see the tremendous progress that we

have made.

First of all, CytoSorb® is approved

in the European Union with direct sales and distribution in 19 countries worldwide and growing. We address a massive multibillion-dollar

market opportunity, addressing a major unmet medical need of critical care, as well as cardiac surgery. We have demonstrated strong

growth with total trailing 12-month revenues of $4.1 million, of which $2.6 million are CytoSorb® sales. As Kathy mentioned,

we have now exhibited five quarters of double-digit increases in CytoSorb® sales and we have now had our first $1 million product

sales quarter in Q3 of 2014. We have solid product gross margins of 65% and we now have cash and short-term investments of approximately

$7.8 million.

We now have 45 employees across our U.S.

corporation and our subsidiary in Berlin, Germany. This is tremendous growth from where we were just three years ago. We are currently

vertically integrated and we are an ISO 13485 certified medical device manufacturer producing our polymer as well as our CytoSorb®

cartridges out of our New Jersey facility. We have now had a strategic partnership with Biocon focused on India and select emerging

countries. And we have now established an initial partnership with a major cardiac surgery device company for a first initial evaluation

in France.

We have 40+ investigator initiated studies

being planned with many enrolling, Christian will talk about this in a little bit, and more than 150 key opinion leaders. The United

States cardiac surgery pivotal trial IDE application will be filed soon. And we also have a trauma trial here also enrolling. We

have had a tremendous amount of technology validation by major government organizations including DARPA, the U.S. Army, the U.S.

Air Force, NIH and NHLBI. And we have been able to attract a world-class trauma board, cardiac surgery advisory board, as well

as a sepsis advisory board to help advise the company.

Last but not least, we are currently covered

by four analysts from Brean Capital, H.C. Wainwright, Merriman Capital and Zacks. Our goal was to have the fundamentals and progress

in place to warrant and maintain a NASDAQ listing and to be able to attract institutional investors. We believe that our company

is well-positioned to do this now.

Now with that, let me turn it back over

to Kathy who will briefly describe the tremendous progress we’ve made on the path to up-listing. Kathy?

Kathleen Bloch - CFO:

Slide 30: Thanks Phil. We have been

very busy preparing for the up-listing. In the previous conference call we talked about the progress we have made, including choosing

DLA Piper as our legal advisor, the adoption of a Code of Business Conduct and Ethics as well as an Insider Trading Policy, both

of which are required governance items for the major exchanges. We also formally established NASDAQ compliant committees of the

Board of Directors, and have adopted a charter for each Committee, also required.

In addition, since our last call we have

simplified our capital structure with the conversion on October 9, 2014 of 100 percent of our Series A and Series B preferred shareholders

to common shareholders. This was a very important step in the up-listing process, since we believe most institutional investors

would prefer to invest in a company that does not have preferred shares with priority interests.

Of course it is also necessary for us to

complete a reverse stock split to bring our Stock Price to the minimum price required by NASDAQ for up-listing companies. In that

regard, on November 6, 2014, we filed our proxy with a Consent Solicitation to our shareholders asking that they approve five actions

recommended by our Board of Directors. Phil will talk more about those later.

We also benefit from analyst coverage by

Brean, HC Wainwright, Merriman, and Zacks.

And as Phil discussed previously, we have

made significant operating progress, led by increasing CytoSorb® sales.

Yesterday we filed our application to up-list

to the NASDAQ National Market. NASDAQ has assigned us a listing analyst and they will now begin their review process.

And the two remaining steps toward the

up-listing are currently underway. We have selected a consultant who will assist management with the documentation and testing

of our system of internal controls, another requirement for a Company traded on a major exchange. And we are continuing investor

outreach in an attempt to generate interest in our stock, particularly among institutional investors. And based upon all of this

progress we believe we are in a strong position to execute the up-listing before the end of this year.

And, now, I’ll turn the call back

over to Phil. Phil?

Phillip Chan - CEO:

Thank you very much, Kathy.

Slide 31: I would also note that

we do not believe that the up-list is a singular event. We absolutely plan to support the company following the up-list with a

very defined strategy. Following the up-list we have several goals.

First is to continue to drive growth in

CytoSorb® sales. We will continue to build key opinion leaders support, drive deep into accounts, and expand to multiple indications

in multiple ICUs within each hospital. We plan to continue geographic expansion with new distributors and strategic partners, drive

country by country product registrations and also invest in the support infrastructure of both direct and distributor sales.

We also plan to continue to pursue strategic

partnerships for CytoSorb® and for our pipeline. We also plan to prioritize clinical data with build out of our clinical trial

capability, start of the U.S. pivotal cardiac surgery trial, obtain data from investigator initiated studies, make progress in

our U.S. Air Force funded trauma pilot and other funded studies, as well as continue to build upon the data being held by the CytoSorb®

registry.

We also plan to continue to aggressively

spread the word on CytoSorbents via meetings with institutional investors, investor conferences, additional analyst coverage and

an upgraded PR strategy. We also plan to aggressively pursue research grant programs in new product development.

Slide 32: All of you have now been

sent a consent solicitation statement seeking your approval of five proposals needed to up-list. Your vote is required before December

1, 2014. The first item is to approve a 25:1 reverse split for our common stock. The second is to reduce authorized common stock

from 800 million to 50 million shares. The third is to reduce authorized preferred stock from 100 million to 5 million shares.

The fourth is to approve the 2014 Long-Term Incentive Plan for CytoSorbents employees. And the fifth is to change the domicile

of the company from the State of Nevada to the State of Delaware. We would encourage you to review your proxy statement. Most of

the reasons why we are doing this are contained therein, as well as in the press release that came out very recently on this consent

solicitation.

Slide 33: What I want to do now

is to try to clear up some misperceptions of what we are trying to do. In particular, there is considerable misperception on the

effect of decreasing the authorized shares of common stock from 800 million to 50 million shares.

Now most don't realize this, but this is

actually a protective provision that the Board is putting in place to prevent the excessive issuance of new shares. I think people

misunderstand some terms and so I thought we should define these terms for our shareholders.

First, the total authorized shares. This

is what you are voting for. The total authorized shares are the total number of shares authorized, or voted for by shareholders,

that a company can issue and sell. In fact, all companies have an authorized share number.

The second term is total outstanding shares.

This is the total number of issued and outstanding shares, after giving effect to the reverse split to be approved by shareholders,

which now also includes common shares from the conversion of the Series A and Series B Preferred Shares. The total outstanding

shares are often reflected in a stock float or the shares that are available for trading.

Next is the fully-diluted share count.

This includes the total outstanding shares plus shares underlying outstanding warrants, options, and others. When companies talk

about acquiring another company for a certain amount of money and this is then translated into a price per share, it's typically

the fully-diluted share count that is used because it consists of all the ownership of the company.

The final definition is the authorized

but unissued share count. This is a very important concept. These are shares that are currently authorized by shareholders but

are currently not issued or otherwise allocated. They can be issued and sold by the company to raise needed capital to grow the

business; for example to run clinical studies, to expand manufacturing, or for general working purposes. Or they can be used to

retain and attract key talent that is necessary for the success of the company. Without available shares, companies cannot raise

capital and run the risk of bankruptcy or illiquidity to the peril of all shareholders. We believe that a strategy of careful investment

to drive growth while limiting shareholder dilution is the correct strategy to pursue now, to enhance the return on investment

to all shareholders.

As many of our long-term shareholders know,

we have been very conscious about preventing shareholder dilution which is why we have applied for grants and have obtained a tremendous

amount of non-dilutive funding with the goal in mind of protecting our shareholder’s interest. But at this current time with

our phase of rapid growth, we believe that investing in growth versus being too focused on preventing shareholder dilution, is

in fact the best way to achieve increases in shareholder value.

Slide 34: Slide 34 goes over what

our capital structure looks like. After giving effect to a 25:1 reverse split, our capital structure will approximately look as

follows. We would have approximately 23 million shares outstanding. We would have approximately 4 million shares underlying warrants,

options, and others. And the sum of these two numbers, 23 million plus 4 million, make up the fully-diluted share count. I would

note that this does not include the 2.4 million of unallocated shares under the 2014 Option Plan, assuming stockholder approval.

Now what remains is the authorized but

unissued shares of 23 million, making the total authorized shares, adding the fully-diluted share count plus these authorized but

unissued shares, of 50 million.

There are three important notes to make

about this. First, the reason why we asking shareholders to approve a reduction in the authorized share count from 800 million

to 50 million is because a reverse split does not automatically decrease the authorized share count. We are therefore reducing

the number of shares that the company can issue after the split to only 23 million, versus the ability to issue up to 773 million

shares, a protective feature for shareholders [*Corrected from the original statement].

The second very important thing to note,

and this is a common misperception amongst shareholders, is that setting the authorized share count to 50 million does not mean

that shareholders incur immediate dilution. If we never sell or issue, or if we only issue or sell part of the authorized but unissued

shares, shareholders will not incur, or only partially incur, dilution to their ownership. However, the authorized but unissued

shares give the company the flexibility to fund and grow the business that would hopefully benefit all shareholders.

If we do wind up selling authorized but

unissued shares to raise capital, the fully diluted share count would increase and therefore shareholders would incur a proportional

level of dilution. However, the dilution is offset in part by the increase in net value of the company from the cash that is raised

from the sale of these shares, and hopefully by the growth achieved by the infusion of new capital.

Slide 35: The second common misperception

is the reverse split, and particularly the reverse split ratio. First of all, why do we need a reverse split? We need a reverse

split for two reasons. One is to meet the minimum $4 per share price requirement to be a NASDAQ Capital Market company. The second

is to make the total number of shares in the company a manageable and practical number that is acceptable to institutional investors.

So why is the reverse split at a ratio of 25:1 then? Well, this ratio is arbitrary but was selected because it achieved the goals

that we just talked about. And it's very important for investors to note, the size of the ratio, whether or not it be 5:1, 10:1,

25:1, 100:1, does not change your ownership or the share value of your shares and is not in itself dilutive. This is simply a math

exercise.

Another question is, would waiting until

we are further along be better? Well, as we have stated many times, there are many benefits of up-listing that we can't access

any other way. We believe that we are ready and that any delay to up-listing is counter-productive to the short and long-term goals

of the company and is in fact a disservice to our shareholders. There currently is a lack of purchase power in the current shareholder

base. I think all of us can witness this on a daily basis by looking at the muted effect of positive news releases and the drifting

average daily trading volume. Up-listing is intended to bring in new, long-term institutional shareholders with deep pockets who

can potentially take large positions in our stock and in doing so potentially shift the supply-demand curve of our stock in our

favor.

Slide 36: Another question “Is

the reverse split a good thing or a bad thing?” Well, it depends on why the reverse is split is being done.

Consider these three scenarios. The first

scenario is Company “X” whose fundamentals are deteriorating with a drop in the stock price. In order to maintain a

national exchange listing, they need to meet the minimum share price requirement and therefore need to enact a reverse split. The

problem is that in many cases, this is generally unsuccessful as the stock price continues to deteriorate as the fundamentals and

the business deteriorates.

In the second scenario, Company “Y”

has stagnant growth and fundamentals but wants a higher share price because of the perceived stigma of being a penny stock and

the perceived premium of being a higher priced stock. So it does a reverse is split, solely for the purpose of increasing the share

price. I think history has shown that the results here are mixed.

But as I have shown you data on the vast

number of companies that are making this up-listing from the OTC bulletin board to the NASDAQ for the purposes of growing, this

is really where we differ from the previous two situations.

In the third situation, Company “C”

is growing rapidly and seeks to up-list to the NASDAQ Capital Market to target a significantly larger investor base that includes

institutional investors. The fundamentals of this company are increasing and the goal of the up-listing is to improve visibility,

credibility and liquidity of the company and the stock, as well as reduce the cost of capital and increase the interest in the

company and its stock.

We believe that CytoSorbents is such an

example. Although there can be no guarantees about post-split stock performance, NASDAQ has again summarized their historical data

that shows that the median stock appreciation has been positive for companies undergoing the path that we are taking.

Slide 37: Another question that

we have received is “Where did the rest of my shares go? Have I been diluted by 25 times and have I been cheated?”

The answer to this is absolutely no. No ownership percentage has been taken from you or will be taken from you under this reverse

split. And no dilution will be incurred solely by the reverse split. What you should really try to think about is your ownership

as a percentage of the company rather than in share numbers.

What I have done is put together a simple

example of how a reverse, or forward split for that matter, affects a shareholder's ownership and value of his or her shares. This

is only an illustrative example but in principle is similar to the reverse split we are proposing. What you can see here is that

in a reverse split, it doesn't matter if it's a 25 to 1 or 10 to 1 or 5 to 1. What happens is that there is a simultaneous reduction

in both your shares but also the fully diluted shares of the company. Because of that, your percent ownership remains the same

and because of that, the value of your shares also remains the same.

In a forward split, where you are getting

more shares for every share that you have, it's the same phenomenon. It is a math exercise. Whether or not it's 1:5, 1:10 or 1:25,

at the end of the day your ownership is still the same, the value of your shares is still the same. This is a very important concept

for investors to understand. We would be happy to answer any other questions about this once you have had a chance to digest this

information. Please feel free to reach out to us.

Slide 38: Another question is “Wouldn’t

I make more money if the reverse split was at a lower ratio and I had more shares?” So it's the same with all your other

stock holdings whether or not you own Apple, Microsoft, Google or Intel or whatever the stock maybe. You need to look at the percent

increase in the share price, not the absolute dollar increase. When you do this, you can see that whether or not the stock is that

$6.25 with a 25:1 reverse split, or $1.25 with a 5:1 reverse split…if the stock increases 50%, you make the same amount

of money and your ownership continues to remain the same. The same can be said if the stock increase is 300%. There is no difference.

What we are proposing with the 25:1 reverse

split is simply a math exercise to meet the minimum share price requirements of the NASDAQ as well as to make a final, fully diluted

share count manageable to outside institutional investors.

Slide 39: Another commonly asked

question is “Isn't it easier for a $0.25 stock on the OTCBB to go to $1, which represents a four-fold increase, than for

a $6.25 stock to go to $25 on the NASDAQ, also a four-fold increase?”

What I would say to this is: The stock

price of any company is simply a matter of supply and demand. If supply exceeds demand than the stock price will fall. If demand

exceeds supply, then the stock price will rise. We believe that making the stock available to a vast pool of investment capital

held by institutional investors that cannot buy our stock today on the OTCQB or BB, combined with good news, can improve demand

for our stock and, again, shift this supply-demand curve in our favor.

Although it's true that low float penny

stocks have been known to be very volatile and can increase by significant percentages, these are often not sustainable increases

in market cap value. For investors this can be fraught with danger depending when the stock is bought and sold.

And although no guarantee can be made about

the post-split or post-uplisting stock performance, our goal with the up-listing is to build increased liquidity and a sustainable

increase in share price that will benefit all shareholders regardless of when you buy or sell. You are encouraged to read the consent

solicitation statement for more details.

Slide 40: On this next slide, what

I have tried to do is demonstrate this volatility that I was talking about on the OTC bulletin board compared to stock appreciation

on either the S&P 500 Index or the Russell 2000 Index, which is the index for small cap stocks. The chart on the left is the

Bloomberg San Diego OTC Bulletin Board Small Cap Index from the period of 2010 to 2014. And what you can see is that after all

this time, there is surely a lot of volatility, but ultimately there has been very little in the way of return. In contrast, looking

at the S&P 500 Index and the Russell 2000 Index, both of them have advanced 100% during this period of time with much more

stability.

Slide 41: So with that, we again

recommend that you review the consent solicitation statement, the proxy statement that you have been sent, and vote in favor of

the following five proposals before December 1, 2014. The earlier you get in your vote, the better. This is a key step towards

up-listing to NASDAQ and something that we believe will benefit all shareholders.

Slide 42: And with that I would

like to finalize my comments with this slide. This is Joseph Rubin, our Co-founder and Board Director, who passed away recently.

Many of you have seen our press release on his tremendous lifetime achievements. We want to take a moment and commemorate Joe's

involvement in the Company and the massive contributions he has made to the Company since its inception.

I would like to now go to the Q&A session

with management, and with that I will turn it back to Amy.

Amy Vogel - Moderator:

Thank you Dr. Chan. Over the last week,

we have collected a number of questions from investors.

Q: Christian, could you please give

us an update on the development of the commercialization of CytoSorb?

Christian Steiner

Yes, certainly. First of all we are excited

and proud that we have reached this milestone exceeding $1M in CytoSorb® product revenue for one quarter. This was

a major effort of the sales team and reflects our progress in the commercialization of our CytoSorb® therapy. This success

is based on a strong re-order business in our direct sales and excellent progress of our distribution partners, both in old and

new markets. The growth of our unit sales was even higher than our dollar revenues suggest, since the Euro to dollar exchange rate

went down and the majority of our business in Europe is done in Euros.

Commercialization includes a massive amount

of effort in addition to the actual sales process. For example:

| · | It has been very difficult to find and

hire the right sales reps that are best suited for our business. However, we have 7 reps currently and will have 10 reps at the

beginning of the new year as planned |

| · | We are also adding new support people

to our direct sales team as well as leadership on the distribution side to allow us to grow faster, and to help manage our rapidly

increasing distributor business |

| · | Training and education of new sales personnel

and new distribution partners and continued education of the current sales force is critical. In the past quarter alone, we conducted

four training sessions at our Berlin office, and 5 training sessions at distributors. |

| · | Clinical data is critically important

for the further development and commercialization of the therapy. As Phillip mentioned, we are pleased with the launch of our International

CytoSorb® Registry after ethics board approval and successful beta-testing completion. This study project is now running and

many German-speaking centers have started using the Registry. The English platform is in beta-testing and will launch officially

in early January 2015. Many international sites have already announced their interest to participate. |

| · | The Investigator Initiated Trials are

also a very important part of our strategy to generate additional clinical data. Of the more than 40 studies being planned, eleven

trials are actively recruiting patients and another six to eight studies will start recruitment in the next several weeks. More

than twenty other projects are in either in preparation or in ethics committee review. To speed up and oversee the development

in this field we have hired a European Medical Director who will start in the first quarter of 2015. |

| · | Reimbursement is also very important in

establishing new therapies and usually requires both medical as well as health-economics evidence. We are actively seeking to improve

the reimbursement situation in a number of countries |

All this work is normally not visible to

the public, but is expected to lead us to new performance levels in the coming weeks, months and quarters.

Q: Christian, can you elaborate a little

bit more on the progress with the distribution business?

We continue our aggressive geographic expansion

in the EU and in countries outside of Europe that accept European regulatory approval and will have more to discuss before the

end of the year. One of the challenges we face is the transfer of knowledge about how to best use CytoSorb. We have begun to formalize

this during distributor training. This has worked very well with our partners in India and Turkey, for example. In India we recently

organized a roadshow together with Biocon where one of our experienced key opinion leaders in Germany was able to teach more than

350 thought leaders in India in a multi-city lecture series. We already had more than 70 sites in India before the roadshow and

we look forward to see how this number will grow as a result of our marketing efforts, as well as the increased number of applications,

including cardiac surgery, that Biocon will go after.

As Phil mentioned, another major success

was the registration of CytoSorb® in Saudi Arabia after a long and demanding process. We have already trained the sales team

of our partner TechnoOrbits, and CytoSorb® has been used to now treat the first patients in a field test by the Ministry of

Health. Pending this evaluation, we hope to obtain SFDA approval that would extend throughout the Gulf Cooperation Council countries

of the Middle East.

Q: Thank you Christian, can you please

comment on the acceptance of the CytoSorb® Therapy by key opinion leaders?

Sure. As you can remember, from the beginning

we have counted and reported the number of key opinion leaders that were using or were committed to using our CytoSorb® therapy

in patient care or in clinical studies. I think we have now outgrown this way of measuring our progress since we can now see the

growing acceptance from the number of treatments, re-orders, and projects that we are doing. It is clear that the current acceptance

is based on high interest and especially because of the positive experiences users are seeing with our CytoSorb® therapy. Nevertheless

we know that we owe the medical community hard data and medical evidence. So we are working on this. While we were very focused

on the German speaking community in the beginning, since this is covered by our direct sales team, we are now starting to have

more projects prepared on an international basis. This could only be achieved with help of our successes so far.

Q: Thanks. One last question: German

University hospitals have treated a number of Ebola patients. Was anyone of these patients treated with CytoSorb?

No, not as of now. Germany does have seven

centers with approximately 50 ICU beds where the equipment is adequate and the personnel have been trained and educated to treat

Ebola patients. Five of these University hospitals are already using CytoSorb® in different indications. All sites are informed

about the availability of the therapy and the current state of knowledge. However, it is of course solely the decision of the treating

medical doctors on what therapies are applied to help these patients suffering from such a terrible disease. But we have received

positive feedback from a number of doctors at these sites, who think that our cytokine reduction approach makes a lot of sense.

Q: Thanks very much Christian. Another

topic on many people’s minds is the progress regarding the new manufacturing facility. Vince, can you provide us an update?

Vince Capponi

As I mentioned in previous quarterly updates,

we had initiated a number of infrastructure upgrades to accommodate further growth within our existing facility. These upgrades

would allow us to increase production capacity within our current manufacturing facility with minimal cost. We have now completed

those infrastructure upgrades and have begun the process of hiring manufacturing personnel to complete a second shift. The addition

of a second shift provides additional capacity to bridge our transition from the current location into a new facility.

Since our last meeting we have identified

and contracted with an engineering firm for the new manufacturing, R&D and corporate center. We are completing the initial

engineering phase of the project focusing on the manufacturing and office layout while concurrently working with our recently-signed

real estate broker to identify a new site. Our objective is to identify an existing facility that will not require extensive modification

to keep costs down and expedite facility renovations to allow for occupancy in a timely manner. The new manufacturing facility

is a progressive step to a final manufacturing facility and is expected to be able to meet our production needs for the next several

years, while increasing operational efficiency and helping us to work through any scaling issues.

Q: Chris, can you tell us more about

the recent Biocon partnership expansion announcement? What’s changing and what can we expect from the partnership moving

forward?

Chris Cramer

Thanks Amy. Biocon has been an exceptional

partner and I’m very excited about our expanded relationship. Let me just add some color commentary to what Phil talked about

earlier in the call.

As you know, we initiated our relationship

in September 2013 to launch CytoSorb® in India and select emerging markets to enable physicians to treat sepsis. As Biocon

began working with its customers, it became very clear that they were increasingly identifying other conditions where high levels

of cytokines have also been known to cause organ failure. In particular, we saw a broader opportunity to treat patients experiencing

a Systemic Inflammatory Response Syndrome, also known as SIRS, brought about by cytokine storm. SIRS is caused by a wide range

of life-threatening conditions seen in the intensive care unit and can also be caused by surgical interventions, particularly cardiac

surgery.

Throughout my discussions with Biocon,

we identified an opportunity to address this market need and felt strongly that we could accelerate product adoption by continuing

to build the CytoSorb® clinical evidence base. That said, there are several important new developments to highlight.

| · | First, the approved applications have

grown to encompass all critical care applications in the intensive care unit. While sepsis will continue to be a strategic focus,

Biocon will now also promote CytoSorb® for a broad range of conditions involving the SIRS response including lung injury, post-operative

SIRS, pancreatitis, burns, trauma, and tropical diseases such as Dengue Fever and malaria to name a few. |

| · | Additionally, because Biocon has a strong

Cardiac Care commercial organization and CytoSorb® can be used to attempt to control inflammation associated with cardiac surgery,

Biocon will now promote CytoSorb® for intra-operative use during cardiac surgery. |

| · | Finally, Biocon will take a leadership

role in developing new clinical evidence by coordinating and publishing results from multiple Investigator Initiated Trials and

patient case studies. To ensure that we have a voice in guiding these studies, these efforts will be jointly overseen through a

Clinical Trial Steering Committee consisting of representatives from both companies. |

So, let me take a moment to explain what

this means and how this will benefit CytoSorbents.

| · | First, these are large markets and we’ll

now have the ability to help more patients. For example, there are more than one million new cases of severe sepsis in India each

year. Cardiovascular disease is also a major problem. About 100,000 cardiac surgery procedures are performed in India each year.

This number is expected to grow rapidly as, according to the World Health Organization, it is a small fraction of the 2.5 million

patients that are in need of heart surgery. |

| · | Next, top line product revenue will benefit.

Given the strong market demand, we’ve agreed to increase annual minimum sales targets which will result in significantly

increased revenue to CytoSorbents. |

| · | Lastly, new clinical evidence will be

created. Biocon will lead these efforts, using their resources and key opinion leaders in its network. These are costs that CytoSorbents

otherwise would have borne. Also, the results of these studies and publications will support product adoption not only in the expanded

Biocon territory, but will also benefit CytoSorb® sales efforts elsewhere. |

Overall, I believe this is a major step

forward in advancing our partnership and it sends a strong signal about the future of CytoSorb. I look forward to taking our relationship

with Biocon to the next level.

Q: You recently announced an initial

partnership with a leading global medical device company in the treatment of cardiovascular disease. Can you talk about the goals

of this initial partnership and what it means for CytoSorbents?

Cardiac surgery is a large and strategically

important opportunity for the company. There are about 1.5 million cardiac procedures performed each year worldwide and the number

of people suffering from cardiovascular diseases is growing. Similar to the ICU conditions that CytoSorb® can be used for,

high risk cardiac surgery patients may routinely suffer the same harmful effects of excess inflammation that if left untreated,

can cause organ injury. We are very excited because we believe CytoSorb® holds the promise to improve patient safety while

decreasing serious complications and their high associated costs, particularly in those undergoing complex cardiothoracic procedures.

Because of the particular nature of this

partnership, we’ve jointly agreed with the partner not to disclose their name at this time. While we cannot mention them

by name, suffice to say we are in excellent company, working with one of the leading global medical device companies in the treatment

of cardiovascular disease. They are known throughout the world for their long tradition of innovation and have influenced nearly

all of the modern equipment used by cardiothoracic surgeons and their teams today.

Under the terms of this agreement, the

partnership will commence with an initial market evaluation period to determine various market parameters, obtain clinical data,

and build key opinion leader support in France. Following a successful evaluation, the parties will jointly determine how to expand

upon both the size and geographic footprint of the partnership.

The focus of this initial collaboration

will be to introduce CytoSorb® to, and work with, some of the top cardiac professionals in France. Currently, we’re working

with the partner to simultaneously register the product in France and to start educating select KOLs on our product. Over the coming

months, we’ll work these physicians to implement CytoSorb® in their clinical practice and gain valuable insights. The

experience gained during the market evaluation period will enable us to build support for CytoSorb® and strategically position

it for success in the intra-operative cardiac surgery market.

I’m confident that with a positive

evaluation in France, we will be able to broaden our relationship with this partner. At such time in the future, we will be able

to release more information about this partnership.

Thanks, Chris. We’ve covered

the major questions. Dr. Chan, do you have any closing remarks?

Dr. Chan:

Thank

you, Amy. Thank you everyone for participating on the call today. If you have any additional questions, feel free to forward them

to Ms. Amy Vogel at avogel@CytoSorbents.com and we will try to address them in our next

update. Thank you again and have a great evening.

Operator: Thank you. That

does conclude our conference for today. I’d like to thank everyone for their participation and have a great day.

Exhibit 99.2

CytoSorbents Achieves First $1M in

Quarterly CytoSorb Sales in Q3 2014

MONMOUTH JUNCTION, NJ--(November 12, 2014)

- CytoSorbents Corporation (OTCQB: CTSO), a critical care immunotherapy company commercializing its CytoSorb® cytokine adsorber

to treat critically-ill patients in multiple countries worldwide, reported third quarter financial and operational results for

the three and nine months ended September 30, 2014.

Q3 2014 Total

Revenue of $1.2M, Driven by Record CytoSorb® sales of $1.0M. Trailing 12-month CytoSorb® Sales Increased to $2.6M

Recent Financial Highlights:

| · | For the first time, we achieved record quarterly CytoSorb® sales of $1.0M, a 5x increase over

sales of $204K in the same period in 2013. Product sales were driven by continued usage and strong reorders from direct customers

and distributors |

| · | Quarterly CytoSorb® sales of $1.0M have exceeded CytoSorb® sales of $822K for the entire

year of 2013 |

| · | Product gross margins for Q3 2014 were approximately 65% |

| · | Total revenue for the first nine months of 2014, which also includes grant income, grew to $3.2M,

more than double the $1.5M in total revenue for the same period in 2013. CytoSorb® sales fueled the increase in total revenues,

with $2.3M in product sales in the first nine months of 2014, a more than 4x increase compared to $508K in CytoSorb revenue in

the first nine months of 2013 |

| · | Trailing 12-month CytoSorb® sales increased to $2.6M, up 56% from $1.8M reported in the last

quarter |

| · | Healthy cash and short term investments of $7.8M |

Recent Operational Highlights

| · | Announced an expansion of our one year

old exclusive partnership with Biocon, the premier biotechnology company in India, which increases the fields of use of CytoSorb®

to all critical care and cardiac surgery applications in India and select emerging countries. The expansion also formalized a commitment

by Biocon to fund, conduct and publish results from multiple investigator initiated studies and patient case reports. In addition,

we have mutually agreed to an increase in the annual minimum sales required under the agreement |

| · | Announced the initial partnership with a top-four global medical device company, focused on cardiac

surgery and other cardiovascular diseases, to use CytoSorb® intra-operatively during cardiac surgery in France. The partnership

has now commenced and, over a total of 6 months, will determine various market parameters, obtain clinical data, and build thought

leader support in France. Following a successful evaluation, the parties plan to jointly determine how to expand upon both the

size and geographic footprint of its partnership |

| · | CytoSorbents was named the Health sector winner at the 2014 GREAT Tech Awards Gala. Sponsored by

United Kingdom Trade & Investment and the British Consulate General New York, the GREAT Tech Awards selected one winner in

each of six categories from a pool of more than 130 high growth companies from New York, New Jersey, Pennsylvania and Connecticut |

| · | We launched our International CytoSorb® Treatment Registry, which has been established and

will be managed by the Center of Clinical Trials at the University of Jena, Germany. The Good Clinical Practice (GCP) compliant

registry will collect worldwide CytoSorb® treatment and pharmacovigilance data, voluntarily submitted by treating physicians,

from critically-ill patients with diseases such as sepsis, trauma, acute respiratory distress syndrome, pancreatitis, burn injury,

liver failure, complications of cardiac surgery, and others |

| · | We remain on target with preparations to up-list to the NASDAQ Capital Market by year end, with

the conversion in October of our Series A and Series B Preferred Stock into Common Stock, creating a clean capital structure. In

addition, last week we issued our definitive consent solicitation statement requesting shareholder consent for certain actions

required for the up-listing. Finally, we recently filed our application to apply for listing on the NASDAQ Capital Market |

| · | With the assistance of our cardiac surgery advisory board, we are well-positioned to submit the

the IDE (Investigational Device Exemption) application for intra-operative usage of CytoSorb® during high risk cardiac surgery

to the FDA before the end of the year |

Dr. Phillip Chan, CytoSorbents’ Chief

Executive Officer, commented “We are very pleased with the continued broad adoption and usage of CytoSorb® in our key

direct, distributor, and partner markets. This is the fifth consecutive quarter where we have achieved double-digit quarter-over-quarter

increases in product sales.”

Dr. Chan continued, “Crossing the

$1M mark in quarterly sales was a milestone in the Company’s history, especially in light of the fact that just one year

ago, our third quarter 2013 sales were only $204K. We expect strong growth to continue into the foreseeable future as the additional

drivers of CytoSorb® sales are anticipated to come online, helping to further accelerate growth. For example:

| · | In our direct territories, our expanded sales and marketing team is doing an excellent job in drilling

down into our accounts and spurring end-user demand and usage amongst the daily treating physicians, for an increasing number of

clinical applications, as well as in many departments in each hospital |

| · | A number of investigator-initiated studies are expected to be completed in the next several months,

with data available soon thereafter, particularly in cardiac surgery and critical illnesses. If positive, we believe these will

help drive additional usage |

| · | We are seeing increasing uptake and reorders from key distributors and our strategic distribution

partner, Biocon, as they achieve success in their marketing efforts and expand usage. We believe our financial results to date

do not yet materially reflect the impact of anticipated sales from our distributors in major territories such as the Middle East,

Russia, and Taiwan, where final product registration or approval is pending |

| · | We continue active discussions with new distributors and potential partners to expand into major

geographic territories throughout the world.” |

Dr. Chan concluded, “We expect to

have more news for shareholders in the coming months. In the meantime, please join us on the earnings call today at 4:15PM EST

where we will cover our progress in greater detail and address a number of questions that have been submitted by investors. In

particular, we will discuss the planned up-listing and consent solicitation statement in much greater detail. The investor

presentation and a written transcript of the conference call will be available within a week of the webcast on our website.”

Conference Call Details:

Date: Tuesday, November 12, 2014

Time: 4:15 PM Eastern

Participant Dial-In: 719-325-2359

Live Presentation Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1047571

An archived recording of the conference call will be available

under the Investor Relations section of the Company’s website at http://www.cytosorbents.com/invest.htm

Financial Results for the First Nine

Months Ended September 30, 2014

For the nine months ended September 30,

2014, the Company generated revenue of approximately $3,249,000 as compared to revenues of approximately $1,543,000, for the nine

months ended 2013, an increase of approximately $1,705,000 or 111%. Revenue from product sales was approximately $2,264,000 for

the nine months ended September 30, 2014, as compared to approximately $508,000 for the nine months ended September 30, 2014, an

increase approximately $1,756,000 or 346%. Product gross margins were approximately 66% for the nine months ended September 30,

2014. Revenue from grants was approximately $978,000 for the nine months ended September 30, 2014, as compared to approximately

$1,036,000 for the nine months ended September 30, 2013.

Our loss from operations for the nine months

ended September 30, 2014 was approximately $4,327,000, as compared to a loss from operations of approximately $4,009,000 for the

nine months ended September 30, 2013.

Financial Results for the Third Quarter

Ended September 30, 2014

CytoSorbents generated revenues of approximately

$1,162,000 and $881,000 for the three months ending September 30, 2014 and September 30, 2013, respectively. Product revenues were

approximately $1,032,000 for the quarter ended September 30, 2014, an increase of approximately 406% as compared to product revenues

of $204,000 for the quarter ended September 30, 2013. Additionally, grant revenue and other income was approximately $131,000 and

$677,000 for the three month periods ended September 30, 2014 and 2013, respectively. Overall blended gross margins were approximately

59%, with product gross margins of approximately 65%.

Our loss from operations for the three

months ending September 30, 2014 was approximately $1,498,000, as compared to a net loss from operations of approximately $965,000

for the three months ended September 30, 2013.

On September 30, 2014 our cash and short-term

investments were approximately $7,780,000, as compared to cash balances of approximately $2,183,000 as of December 31, 2013. This

increase in cash is a direct result of our March 2014 registered offering of our Common Stock from which we received approximately

$9,451,000 in net proceeds.

For additional information please see the

Company’s 10-Q report for the period ended September 30, 2014 filed on November 12, 2014 on http://www.sec.gov.

2014 Fourth Quarter Outlook

CytoSorbents has not historically given

financial guidance on quarterly results until the quarter has been completed. With Q4 2014 still ongoing, we continue to see strong

momentum in CytoSorb® usage and sales and expect our trailing 12 month CytoSorb® sales to continue its upward trend.

About CytoSorbents Corporation

CytoSorbents

Corporation is a critical care focused immunotherapy company using blood purification to control severe inflammation -- with the

goal of preventing or treating multiple organ failure in life-threatening illnesses. Organ failure is the cause of nearly half

of all deaths in the intensive care unit, with little to improve clinical outcome. CytoSorb®, the Company's flagship product,

is approved in the European Union as a safe and effective extracorporeal cytokine adsorber, designed to reduce the "cytokine

storm" that could otherwise cause massive inflammation, organ failure and death in common critical illnesses such as sepsis,

burn injury, trauma, lung injury, and pancreatitis. These are conditions where the risk of death is extremely high, yet no effective

treatments exist. CytoSorbents' purification technologies are based on biocompatible, highly porous polymer beads that can actively

remove toxic substances from blood and other bodily fluids by pore capture and surface adsorption. CytoSorbents has numerous products

under development based upon this unique blood purification technology, protected by 32 issued US patents and multiple applications

pending, including HemoDefend™, ContrastSorb, DrugSorb, and others. Additional information is available for download on the

Company's website: http://www.cytosorbents.com/.

Forward-Looking

Statements

This press release

includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about our plans, objectives,

representations and contentions and are not historical facts and typically are identified by use of terms such as “may,”

“should,” “could,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “continue” and similar words, although some