false

0001874097

0001874097

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): November

6, 2024

CYNGN INC.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-40932 |

|

46-2007094 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1015 O’Brien Dr.

Menlo Park, CA 94025

(Address of principal executive offices) (Zip Code)

(650) 924-5905

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

CYN |

|

The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition

On November 6, 2024, Cyngn

Inc. (the “Company”) issued a press release announcing its financial results for the fiscal third quarter ended September

30, 2024. The full text of the press release is furnished herewith as Exhibit 99.1.

The information disclosed

under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be incorporated by reference into

any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act except as expressly

set forth in such filing.

Item 9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date: November 7, 2024

| |

CYNGN INC. |

| |

|

| |

By: |

/s/ Donald Alvarez |

| |

|

Donald Alvarez |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

Cyngn

Reports Third Quarter 2024 Financial Results

Recent Operating Highlights:

| ● | Executed

its first paid DriveMod Forklift Deployment. |

| | | |

| ● | Signed

a commercial contract with a major automotive service equipment manufacturer. |

| | | |

| ● | Executed

LOI to sell multiple DriveMod Tuggers to global automotive supplier. |

| | | |

| ● | Successfully

completed DriveMod Tugger Initial Deployment with a major defense contractor. |

| | | |

| ● | Hired

Experienced Industrial Automation VP of Sales, Marty Petraitis. |

| | | |

| ● | Started

deploying its next-gen 12,000 lb. DriveMod Tugger at customer facilities. |

| | | |

| ● | Expanded

its sales channels through Motrec dealers and 3rd party system integrators that combine for

billions of dollars of robotics and material handling equipment annual sales. |

| | | |

| ● | Secured

its 20th and 21st U.S. Patent. |

| | | |

| ● | Expanded

DriveMod capabilities to outdoor operations in response to demand. |

Menlo Park, California, November 6, 2024 —

Cyngn (or the “Company”) (Nasdaq: CYN), developer of industrial autonomous vehicles, today announced financial results for

its third quarter, ended September 30, 2024.

“Our third quarter marked meaningful additional

commercial traction of our autonomous DriveMod technology,” said Lior Tal, Cyngn CEO. “Building on the progress we made with

direct sales efforts in the first half of the year, including being selected by Deere to supply the DriveMod Tugger, we have expanded

our strategy to increase our channel sales efforts.

“We have also achieved a significant milestone

with the first paid deployment of our DriveMod Forklift, an important progression into sales activities after initial R&D and projects

focused on funding development.”

“Through our OEM partner Motrec, we are able

to expand our sales strategy beyond direct sales by leveraging a strong incumbent dealer network while also adding specialized distributors

and system integrators like Kennedy Robotics AI and RobotLAB.

“By expanding our sales and distribution

collaborations, we are enhancing our sales channels and creating consistent opportunities that strengthen our sales pipeline.”

In addition to increasing lead generation and building

a more robust pipeline, we also hired Marty Petraitis, a seasoned vet of the industrial automation industry, as our VP of Sales to capitalize

on our growing opportunities. Broadly, our sales pipeline has matured into more advanced stages as per the process outlined in our recent

update. We are actively converting more Pilot Purchases, creating a larger pool of existing and newly onboarded customers to grow into

Fleet Purchases.

We are continuing to see validation of our solution

through traction in heavy manufacturing industries like automotive and defense, highlighted by the first deployments of our next-generation

12,000 lb. DriveMod Tugger at customer facilities and multiple new customer contracts and LOIs as outlined above.

The next-gen DriveMod Tugger boasts increased towing

capacity and enhanced autonomous capabilities that enable it to support outdoor operations. These improvements have expanded our use

cases, broadened the environments where our autonomous vehicles deliver value, and ultimately created new sales opportunities.

Having ramped up the production of our DriveMod

Tugger, we have also been able to shift to revenue-generating activities with our autonomous forklift solution. Our first paid DriveMod

Forklift deployment marks a key turning point in monetizing the valuable solution offered by an autonomous forklift.

The global forklift market is expected to double

to $103.9 billion by 2031. The opportunity for autonomous forklifts is significant, and this milestone positions us for the critical

next steps that will result in the DriveMod Forklift being widely available to under-served forklift automation applications that require

>10,000 lb. load capacity and use non-standard pallets.

When reviewing the financial information below,

note that all share and per share information, Common stock and Additional paid-in capital, has been restated to reflect the 1-for-100

reverse stock split effected on July 3, 2024.

Q3 2024 Three Month Financial Review:

| ● | Third quarter revenue was $47.6 thousand compared to $25.2

thousand in the third quarter of 2023. Similar to prior year, third quarter 2024 revenue consisted of EAS software subscriptions from

DriveMod Stockchaser vehicle deployments. |

| ● | Total costs and expenses of $5.6 million in the third quarter

of 2024 were consistent with the third quarter of 2023. However, R&D expenses in 2024 decreased by $133.6 thousand and G&A expenses

decreased by $60.3 thousand, and these decreases were offset by an increase in cost of revenue of $114.8 thousand. The decrease in R&D

expense was primarily driven by capitalizing costs for specific customers and capitalizing costs related to the development of software.

The decrease in G&A expenses is due to a decrease in personnel costs, reduced insurance premiums and spending improvements on general

office expenses. The increase in cost of revenue is driven by more customer deployments in 2024. Headcount at the end of the third quarter

of 2024 was 81 versus 85 at the end of the third quarter of 2023. |

| ● | Net loss for the third quarter was $(5.4) million compared

to $(5.5) million in the corresponding quarter of 2023. Third quarter 2024 net loss per share was $(2.74), based on basic and diluted

weighted average shares outstanding of approximately 1,982 thousand in the quarter. This compares to a net loss per share of $(11.03)

in the third quarter of 2023, based on approximately 496 thousand basic and diluted weighted average shares outstanding. |

Q3 2024 Nine Month Financial Review:

| ● | Year-to-date third quarter revenue was $61.8 thousand compared

to $1.4 million in the third quarter of 2023. Third quarter 2024 revenue consisted of EAS software subscriptions from DriveMod Stockchaser

vehicle deployments whereas prior year revenue was the result of NRE contracts. |

| ● | Total costs and expenses in the third quarter were $17.3

million, down from $19.4 million in the third quarter of 2023. This decrease was primarily due to a decrease in R&D expenses of $547.7

thousand, a $666.9 thousand reduction in G&A expenses, and a $835.8 thousand decrease in cost of revenue. The decrease in R&D

expense was primarily driven by capitalizing costs for specific customers and capitalizing costs related to the development of software

while the decrease in G&A expenses is due to a decrease in personnel costs, reduced insurance premiums and spending improvements

on general office expenses. The decrease in cost of revenue is driven by the lower costs associated with EAS revenue compared to the

NRE contracts in 2023. |

| ● | Net loss for the third quarter was $(17.2) million compared

to $(17.5) million in the corresponding quarter of 2023. Third quarter 2024 net loss per share was $(12.91), based on basic and diluted

weighted average shares outstanding of approximately 1,333.3 thousand in the period. This compares to a net loss per share of $(35.50)

for the nine months of 2023, based on approximately 491.7 thousand basic and diluted weighted average shares outstanding during the period. |

Balance Sheet Highlights:

Cyngn’s cash and short-term investments at September

30, 2024 total $2.8 million compared to $8.2 million as of December 31, 2023. At the end of the same period, working capital was $2.6

million and total stockholders’ equity was $6.65 million, as compared to year-end working capital of $7.4 million and total stockholders’

equity of $10.6 million, respectively as of December 31, 2023. The Company had no debt as of September 30, 2024 and December 31, 2023

and to date, no one on the current management team has sold any shares of Company stock

For more information on Cyngn, visit the Investor Relations

Page of the Company’s website.

About

Cyngn

Cyngn develops

and deploys scalable, differentiated autonomous vehicle technology for industrial organizations. Cyngn’s self-driving solutions allow

existing workforces to increase productivity and efficiency. The Company addresses significant challenges facing industrial organizations

today, such as labor shortages, costly safety incidents, and increased consumer demand for eCommerce.

Cyngn’s DriveMod

Kit can be installed on new industrial vehicles at end of line or via retrofit, empowering customers to seamlessly adopt self-driving

technology into their operations without high upfront costs or the need to completely replace existing vehicle investments.

Cyngn’s flagship

product, its Enterprise Autonomy Suite, includes DriveMod (autonomous vehicle system), Cyngn Insight (customer-facing suite of AV fleet

management, teleoperation, and analytics tools), and Cyngn Evolve (internal toolkit that enables Cyngn to leverage data from the field

for artificial intelligence, simulation, and modeling). For all terms referenced within, please refer to the Company’s annual report

on Form 10-K with the SEC filed on March 7, 2024.

Find Cyngn on:

| ● | Website: https://cyngn.com |

| | | |

| ● | Twitter: https://twitter.com/cyngn |

| | | |

| ● | LinkedIn: https://www.linkedin.com/company/cyngn |

| | | |

| ● | YouTube: https://www.youtube.com/@cyngnhq |

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statement

that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,”

“anticipates,” “believes,” “will,” “will likely result,” “will continue,” “plans

to,” “potential,” “promising,” and similar expressions. These statements are based on management’s current expectations

and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from

those described in the forward-looking statements, including the risk factors described from time to time in the Company’s reports to

the Securities and Exchange Commission (SEC), including, without limitation the risk factors discussed in the Company’s annual report

on Form 10-K filed with the SEC on March 7, 2024. Readers are cautioned that it is not possible to predict or identify all the risks,

uncertainties and other factors that may affect future results No forward-looking statement can be guaranteed, and actual results may

differ materially from those projected. Cyngn undertakes no obligation to publicly update any forward-looking statement, whether as a

result of new information, future events, or otherwise.

CYNGN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 47,584 | | |

$ | 25,210 | | |

$ | 61,762 | | |

$ | 1,448,961 | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 157,251 | | |

| 42,414 | | |

| 285,949 | | |

| 1,121,732 | |

| Research and development | |

| 2,795,583 | | |

| 2,929,225 | | |

| 9,149,357 | | |

| 9,697,099 | |

| General and administrative | |

| 2,602,952 | | |

| 2,663,272 | | |

| 7,913,222 | | |

| 8,580,113 | |

| Total costs and expenses | |

| 5,555,786 | | |

| 5,634,911 | | |

| 17,348,528 | | |

| 19,398,944 | |

| Loss from operations | |

| (5,508,202 | ) | |

| (5,609,701 | ) | |

| (17,286,766 | ) | |

| (17,949,983 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| | | |

| | | |

| | | |

| | |

| Interest income, net | |

| 46,336 | | |

| 32,905 | | |

| 45,994 | | |

| 98,698 | |

| Other income | |

| 34,467 | | |

| 105,284 | | |

| 24,342 | | |

| 397,616 | |

| Total other income, net | |

| 80,803 | | |

| 138,189 | | |

| 70,336 | | |

| 496,314 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (5,427,399 | ) | |

$ | (5,471,512 | ) | |

$ | (17,216,430 | ) | |

$ | (17,453,669 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common stockholders, basic and diluted | |

$ | (2.74 | ) | |

$ | (11.03 | ) | |

$ | (12.91 | ) | |

$ | (35.50 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | |

| 1,981,907 | | |

| 496,009 | | |

| 1,333,255 | | |

| 491,656 | |

CYNGN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

(Unaudited) | | |

| |

| | |

September 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Assets | |

| | |

| |

| Current assets | |

| | |

| |

| Cash | |

$ | 1,974,441 | | |

$ | 3,591,623 | |

| Short-term investments | |

| 812,750 | | |

| 4,561,928 | |

| Prepaid expenses and other current assets | |

| 1,664,063 | | |

| 1,316,426 | |

| Total current assets | |

| 4,451,254 | | |

| 9,469,977 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 2,067,411 | | |

| 1,486,672 | |

| Right of use asset, net | |

| 474,149 | | |

| 992,292 | |

| Intangible assets, net | |

| 1,488,328 | | |

| 1,084,415 | |

| Total Assets | |

$ | 8,481,142 | | |

$ | 13,033,356 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 190,488 | | |

$ | 196,963 | |

| Accrued expenses and other current liabilities | |

| 1,136,258 | | |

| 1,201,142 | |

| Current operating lease liability | |

| 505,231 | | |

| 682,718 | |

| Total current liabilities | |

| 1,831,977 | | |

| 2,080,823 | |

| | |

| | | |

| | |

| Non-current operating lease liability | |

| - | | |

| 317,344 | |

| Total liabilities | |

| 1,831,977 | | |

| 2,398,167 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Preferred stock, Par $0.00001, 10 million shares authorized; no shares issued and outstanding as of September 30, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Common stock, Par $0.00001; 200,000,000 shares authorized, 2,026,575 and 759,831 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | |

| 20 | | |

| 8 | |

| Additional paid-in capital | |

| 183,883,194 | | |

| 170,652,800 | |

| Accumulated deficit | |

| (177,234,049 | ) | |

| (160,017,619 | ) |

| Total stockholders’ equity | |

| 6,649,165 | | |

| 10,635,189 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 8,481,142 | | |

$ | 13,033,356 | |

CYNGN INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Net loss | |

$ | (17,216,430 | ) | |

$ | (17,453,669 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 692,848 | | |

| 707,337 | |

| Stock-based compensation | |

| 1,871,466 | | |

| 2,517,890 | |

| Realized gain on short-term investments | |

| (105,414 | ) | |

| (396,141 | ) |

| Patent impairment | |

| 118,831 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses, operating lease right-of-use assets, and other current assets | |

| (345,122 | ) | |

| 261,034 | |

| Accounts payable | |

| (6,475 | ) | |

| 78,414 | |

| Accrued expenses, lease liabilities, and other current liabilities | |

| (559,715 | ) | |

| (154,967 | ) |

| Net cash used in operating activities | |

| (15,550,011 | ) | |

| (14,440,102 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (739,947 | ) | |

| (904,417 | ) |

| Acquisition of intangible asset | |

| (540,756 | ) | |

| (698,527 | ) |

| Disposal of assets | |

| - | | |

| 130,898 | |

| Purchase of short-term investments | |

| (6,755,408 | ) | |

| (17,050,782 | ) |

| Proceeds from maturity of short-term investments | |

| 10,610,000 | | |

| 24,892,000 | |

| Net cash provided by investing activities | |

| 2,573,889 | | |

| 6,369,172 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from at-the-market equity financing, net of issuance costs | |

| 6,789,427 | | |

| 1,012,511 | |

| Proceeds from private placement offering and pre-funded warrants, net of offering costs | |

| 4,570,110 | | |

| - | |

| Proceeds from exercise of stock options | |

| - | | |

| 8,527 | |

| Issuance of stock dividend, net of issuance costs | |

| (597 | ) | |

| - | |

| Net cash provided by financing activities | |

| 11,358,940 | | |

| 1,021,038 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| (1,617,182 | ) | |

| (7,049,892 | ) |

| Cash, beginning of period | |

| 3,591,623 | | |

| 10,586,273 | |

| Cash, end of period | |

$ | 1,974,441 | | |

$ | 3,536,381 | |

8

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

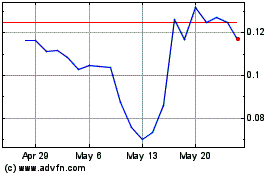

CYNGN (NASDAQ:CYN)

Historical Stock Chart

From Jan 2025 to Feb 2025

CYNGN (NASDAQ:CYN)

Historical Stock Chart

From Feb 2024 to Feb 2025