false

0001124524

0001124524

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

CRYOPORT, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-34632 |

|

88-0313393 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

112 Westwood Place, Suite 350

Brentwood, TN 37027 |

| (Address of principal executive offices, including zip code) |

| |

|

|

|

|

| Registrant’s telephone number, including area code: (949) 470-2300 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.001 par value |

|

CYRX |

|

The NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Repurchase Program

On August 6, 2024, Cryoport, Inc. (the “Company”)

issued a press release announcing that the Company’s Board of Directors had authorized a repurchase program to purchase up to $200,000,000

of the Company’s common stock and/or convertible senior notes (the “2024 Repurchase Program”). The 2024 Repurchase Program

became effective on August 1, 2024 and remains in effect through December 31, 2027. The size and timing of any repurchase will depend

on a number of factors, including the market price of the Company’s common stock, general market and economic conditions, and applicable

legal requirements.

Convertible Note Repurchase

On August 6, 2024, the Company entered into separate,

privately negotiated transactions (the “Agreements”) with certain holders of its existing 0.75% Convertible Senior Notes due

2026 (the “2026 Notes”) to repurchase approximately $160 million aggregate principal amount of the 2026 Notes at a repurchase

price of $885 for each $1,000 principal amount of the 2026 Notes repurchased, plus accrued and unpaid interest. The repurchase of the

2026 Notes was made under the 2024 Repurchase Program. The 2026 Notes repurchases are expected to close on August 9, 2024, subject to

customary closing conditions. Following such closings, approximately $186.2 million principal amount of the 2026 Notes will remain outstanding,

from an initial issued principal balance of $402.5 million.

A copy of the press release issued by the Company

on August 6, 2024 discussing the repurchase program and the convertible note repurchase is attached as Exhibit 99.1.

The information, including the exhibit attached

hereto, in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as otherwise expressly stated in

such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 6, 2024 |

Cryoport Inc. |

|

| |

|

|

| |

/s/ Robert Stefanovich |

|

| |

Robert Stefanovich |

|

| |

Chief Financial Officer |

|

Exhibit 99.1

Cryoport Announces $200 Million Repurchase Program

and the Repurchase of $160 Million of Convertible Senior Notes

| · | $200 million repurchase program authorized to repurchase common stock and/or

convertible notes |

| · | Repurchasing approximately $160 million of 0.75% Senior Notes due in 2026

at an 11.5% discount to par value |

| · | Principal balance reduced to approximately $186.2 million |

NASHVILLE, Tennessee, August 6, 2024 -

Cryoport, Inc. (Nasdaq: CYRX) (“Cryoport” or the “Company”), a global leader in supply chain solutions

for the life sciences, today announced that the Company’s Board of Directors had authorized a repurchase program to purchase up

to $200 million of the Company’s common stock and/or convertible senior notes (the “2024 Repurchase Program”). The

2024 Repurchase Program became effective on August 1, 2024 and remains in effect through December 31, 2027.

The Company also announced that it has entered into agreements with

certain holders of its 0.75% Convertible Senior Notes due in 2026 (the “2026 Notes”) to repurchase $160 million in aggregate

principal amount of the 2026 Notes (the “Transactions”) for an aggregate repurchase price of $141.6 million, plus accrued

and unpaid interest. The Transactions were made under the 2024 Repurchase Program.

Jerrell Shelton, CEO of Cryoport, commented, “We

are pleased to complete this opportunistic repurchase of our 2026 Notes. With our strong cash position, we are in a position to reduce

our outstanding debt and further strengthen our balance sheet, while also maintaining considerable liquidity to support our long-term

growth plans.”

The Transactions are expected to close on August

9, 2024, subject to the satisfaction of customary closing conditions. Following such closings, approximately $186.2 million principal

amount of the 2026 Notes will remain outstanding, from an initial issued principal balance of $402.5 million.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy these securities, nor shall there be any offer or sale of these securities in any state or

jurisdiction in which the offer, solicitation, or sale would be unlawful prior to the registration or qualification thereof under the

securities laws of any such state or jurisdiction.

About Cryoport, Inc

Cryoport, Inc.

(Nasdaq: CYRX), is a global leader in supply chain solutions for the Life Sciences with an emphasis on cell & gene therapies. Cryoport

enables manufacturers, contract manufacturers (CDMO's), contract research organizations (CRO's), developers, and researchers to carry

out their respective business with products and services that are designed to derisk services and products and provide certainty. We

provide a broad array of supply chain solutions for the life sciences industry. Through our platform of critical products and solutions

including advanced temperature-controlled packaging, informatics, specialized bio-logistics services, bio-storage, bio-services, and

cryogenic systems, we are "Enabling the Future of Medicine™" worldwide, through our innovative systems, compliant procedures,

and agile approach to superior supply chain management.

Our corporate headquarters,

located in Nashville, Tennessee, is complemented by over 50 global locations in 17 countries, with key sites in the United States, United

Kingdom, France, the Netherlands, Belgium, Portugal, Germany, Japan, Australia, India, and China.

For more information,

visit www.cryoportinc.com or follow via LinkedIn at https://www.linkedin.com/company/cryoportinc or @cryoport on X, formerly

known as Twitter at www.x.com/cryoport for live updates.

Forward-Looking Statements

Statements in this press

release which are not purely historical, including statements regarding Cryoport's intentions, hopes, beliefs, expectations, representations,

projections, plans or predictions of the future, are forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include, but are not limited to, those related to the amount of 2026 Notes to be

repurchased and the timing of completion of the repurchases. Factors that could cause actual results to differ materially include, but

are not limited to, risks and uncertainties associated with the effect of changing economic and geopolitical conditions; changes in the

convertible note and other capital markets; and other factors discussed in Cryoport's SEC reports, including in the "Risk Factors"

section of its most recently filed periodic reports on Form 10-K and Form 10-Q, as well as in its subsequent filings with the SEC. The

forward-looking statements contained in this press release speak only as of the date hereof and Cryoport cautions investors not to place

undue reliance on these forward-looking statements. Except as required by law, Cryoport disclaims any obligation, and does not undertake

to update or revise any forward-looking statements in this press release.

Cryoport Investor Contacts:

Todd Fromer / Scott Eckstein

KCSA Strategic Communications

cryoport@kcsa.com

v3.24.2.u1

Cover

|

Aug. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity File Number |

001-34632

|

| Entity Registrant Name |

CRYOPORT, INC.

|

| Entity Central Index Key |

0001124524

|

| Entity Tax Identification Number |

88-0313393

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

112 Westwood Place

|

| Entity Address, Address Line Two |

Suite 350

|

| Entity Address, City or Town |

Brentwood

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37027

|

| City Area Code |

949

|

| Local Phone Number |

470-2300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

CYRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

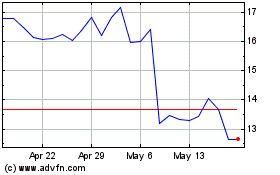

CryoPort (NASDAQ:CYRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

CryoPort (NASDAQ:CYRX)

Historical Stock Chart

From Nov 2023 to Nov 2024