As

filed with the Securities and Exchange Commission on September 13, 2024

Registration

Number 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

EASTSIDE

DISTILLING, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

20-3937596 |

(State

or Other Jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

I.D.

No.) |

GEOFFREY

GWIN, CHIEF EXECUTIVE OFFICER

Eastside

Distilling, Inc.

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

(971)

888-4264

(Address

and telephone number of Registrant’s principal executive offices

and

name of agent for service of process.)

Copy

to

ROBERT

BRANTL, ESQ.

181

Dante Avenue

Tuckahoe,

New York 10707

Attorney

for Issuer

(917)

513-5701

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☐ |

Smaller

reporting company ☒ |

| Emerging

growth company ☐ |

|

|

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject

to completion, dated September 13, 2024

PROSPECTUS

Eastside

Distilling, Inc.

Common

Stock

Preferred

Stock

Warrants

Units

We

may offer and sell any combination of common stock, preferred stock or warrants, either individually or in units, with a total value

of up to $10,000,000.

This

prospectus provides a general description of securities we may offer and sell from time to time. Each time we sell those securities,

we will provide their specific terms in a supplement to this prospectus. The prospectus supplement may also add, update or change information

contained in this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest in

any securities. This prospectus may not be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement.

We

may offer and sell these securities, from time to time, to or through one or more underwriters, dealers and agents, or directly to purchasers,

on a continuous or delayed basis, at prices and on other terms to be determined at the time of offering. If we use agents, underwriters

or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement.

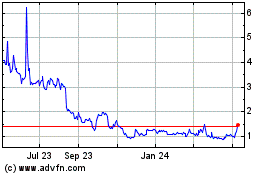

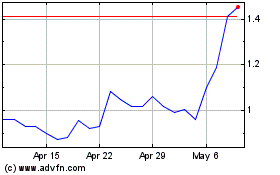

Our

common stock is currently traded on the NASDAQ Capital Market under the trading symbol “EAST.” On September 12, 2024 the

reported closing sale price for our common stock was $0.8438.

As

of September 6, 2024, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was $3,941,790,

which was calculated based on 2,775,909 shares outstanding held by non-affiliates and a per share closing price of $1.42 reported on

the NASDAQ Capital Market on that date. During the prior 12 calendar months and including the date of this prospectus, we have sold securities

pursuant to General Instruction I.B.6 of Form S-3 for aggregate proceeds of $442,007. Pursuant to General Instruction I.B.6, in no event

will we sell securities registered in this registration statement with a value exceeding more than one-third of our public float in any

12-month period if our public float remains below $75 million.

Purchase

of our common stock involves substantial risk. Prior to making a decision about investing in our securities, please review the section

entitled “Risk Factors,” which appears on page 5 of this prospectus, and the section entitled “Risk Factors,”

which begins on page 8 of our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange

Commission on April 1, 2024.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide

you with information different from that contained in this prospectus. We are not making an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “Commission”)

using a “shelf” registration process. Under this shelf registration process, from time to time, we may sell any combination

of the securities described in this prospectus in one or more offerings, up to a total dollar amount of $10,000,000. We have provided

to you in this prospectus a general description of the securities we may offer. Each time we sell securities under this shelf registration

process, we will provide a prospectus supplement that will contain specific information about the terms of the offering. We may also

authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings.

We may also add, update or change in the prospectus supplement or free writing prospectus any of the information contained in this prospectus.

To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement or free writing

prospectus, you should rely on the information in the prospectus supplement or free writing prospectus, as applicable; provided that,

if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example,

a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the document having the

later date modifies or supersedes the earlier statement. You should read both this prospectus and any prospectus supplement together

with additional information described under the next heading “Where You Can Find More Information.”

We

have not authorized any dealer, salesman or other person to give any information or to make any representations other than those contained

or incorporated by reference in this prospectus and the accompanying prospectus supplement. You must not rely upon any information or

representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. This prospectus

and the accompanying supplement to this prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate, nor do this prospectus and the accompanying supplement to this prospectus

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus and

the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front cover of this document or

that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by

reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities sold on a later date.

We

have proprietary rights to trademarks, trade names and service marks appearing in this prospectus that are important to our business.

Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus without the ® and TM symbols,

but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable

law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names

and service marks appearing in this prospectus are the property of their respective owners. We do not intend our use or display of other

parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship

with, or endorsement or sponsorship of us by, these other parties.

THIS

PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

WHERE

YOU CAN FIND MORE INFORMATION

We

file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

web site address is www.eastsidedistilling.com. The information on our web site, however, is not, and should not be deemed to

be, a part of this prospectus.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Documents

establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated

by reference in the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries

and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents

for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s

website, as provided above.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

This

prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been

filed with the SEC (other than Current Reports or portions thereof furnished under Item 2.02 or Item 7.01 of Form 8–K):

| |

● |

the

description of our common stock contained in our registration statement on Form 8-A filed with the SEC on August 8, 2017, including

any amendments or reports filed for the purposes of updating this description; |

| |

|

|

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024, and Amendment No. 1 to our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 30, 2024; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 13, 2024, and our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 14, 2024; and |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 4, 2024, January 26, 2024, March 11, 2024, April 10, 2024, May 21, 2024,

June 5, 2024, July 10, 2024, August 16, 2024, September 4, 2024, September 5, 2024 and September 10, 2024 (except for such portions

of our Current Reports filed pursuant to Item 2.02 or Item 7.01 of such report, which shall not be deemed incorporated by reference

herein). |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, including

all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the

registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference

into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You

may obtain a free copy of any of the filings that are incorporated by reference in this prospectus by writing or by telephoning us at

the following address or telephone number:

Eastside

Distilling, Inc.

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

971-888-4264

Attn:

Investor Relations

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or

any accompanying prospectus supplement.

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed modified,

superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus or in any subsequently

filed document that also is or is deemed to be incorporated by reference in this prospectus modifies, supersedes or replaces such statement.

Any statement so modified, superseded or replaced, will not be deemed, except as so modified, superseded or replaced, to constitute a

part of this prospectus.

DISCLOSURE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference into this prospectus contain certain “forward-looking statements”

within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking

statements describe our expectations for the future, and are generally preceded by words indicating anticipation or speculation. Such

statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events or results to differ materially

from those projected in the forward-looking statements. Risks and uncertainties that may cause actual results to differ from our expectations

include, but are not limited to, the Company’s ability to execute its business model and strategic plan, the Company’s ability

to obtain capital, and the Company’s ability to withstand competitive pressures. Detailed discussion of the risks that may interfere

with our plans can be found in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December

31, 2023, which is available on our website as well as on the SEC’s EDGAR website.

summary

As

used in this prospectus, the terms “we,” “our” and “us” refers to Eastside Distilling, Inc. and its

subsidiaries.

This

summary highlights selected information contained elsewhere in this prospectus or in documents incorporated by reference. This summary

does not contain all of the information that you should consider before making an investment decision. This prospectus supplement and

the accompanying prospectus include or incorporate by reference information about this offering, our business and our financial and operating

data. You should carefully read the entire prospectus, the accompanying prospectus supplement, including under the sections titled “Risk

Factors” included therein, and the documents incorporated by reference into this prospectus and the accompanying prospectus supplement,

before making an investment decision. The occurrence of any of these risks might cause you to lose all or part of your investment in

the offered securities.

Our

Company

Eastside

Distilling, Inc. operate in three segments. Our Craft Canning + Printing (“Craft C+P”) segment provides digital can printing

and canning services to the craft beverage industry in Washington and Oregon. In addition to mobile co-packing services we offer co-packing

services from a single fixed site in Portland, Oregon. Our Spirits segment manufactures, blends, bottles, markets and sells a wide variety

of alcoholic beverages under recognized brands in 30 U.S. states. Our corporate segment consists of key accounting personnel and corporate

expenses such as public company and board costs, as well as interest on debt.

Craft

C+P primarily services the craft beer, cider and kombucha beverage segments. Craft C+P offers digital can printing to customers and co-packing

services, as well as operates mobile lines in Seattle and Spokane, Washington; and Portland, Oregon. Our spirits brands span several

alcoholic beverage categories, including whiskey, vodka, rum and tequila. We sell our products on a wholesale basis to distributors through

open states, and brokers in control states.

Our

strategy has been to utilize our public company stature to our advantage and position to expand our two distinct businesses – Craft

C+P and Spirits. Our Craft C+P subsidiary aims to grow and vertically integrate its business to expand its product offerings and improve

its competitive position. Our spirits portfolio is to be positioned as a leading regional craft spirits provider that develops brands,

expands geographic presence growing revenue and cash flow.

Corporate

Information

Our

executive offices are located at 2321 NE Argyle Street, Suite D, Portland, Oregon 97211. Our telephone number is (971) 888-4264 and our

internet address is www.eastsidedistilling.com.

The

information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information

contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

Our common stock is listed on The Nasdaq Capital Market under the symbol “EAST”.

RISK

FACTORS

Investment

in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. Before investing in any

of our securities, you should carefully consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as amended, which is incorporated herein by reference.

You should also carefully consider the risk factors and other information contained in the applicable prospectus supplement and any applicable

free writing prospectus before acquiring any of such securities. The realization of any of these risks might cause you to lose all or

part of your investment in the offered securities.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise indicated

in any prospectus supplement, we intend to use the net proceeds from the sale of securities under this prospectus for general corporate

purposes, which may include capital expenditures, working capital and general and administrative expenses. We may also use a portion

of the net proceeds to acquire or invest in businesses and products that are complementary to our own, although we have no current plans,

commitments or agreements with respect to any acquisitions as of the date of this prospectus.

PLAN

OF DISTRIBUTION

We

may sell the securities covered by this prospectus to one or more underwriters for public offering and sale by them, and may also sell

the securities to investors directly or through agents. We will name any underwriter or agent involved in the offer and sale of securities

in the applicable prospectus supplement. We have reserved the right to sell or exchange securities directly to investors on our own behalf

in jurisdictions where we are authorized to do so. We may distribute the securities from time to time in one or more transactions:

| |

● |

at

a fixed price or prices, which may be changed; |

| |

● |

at

market prices prevailing at the time of sale; |

| |

● |

at

prices related to such prevailing market prices; or |

| |

● |

at

negotiated prices. |

We

may solicit directly offers to purchase the securities being offered by this prospectus. We may also designate agents to solicit offers

to purchase the securities from time to time. We will name in a prospectus supplement any agent involved in the offer or sale of our

securities. Unless otherwise indicated in a prospectus supplement, an agent will be acting on a best efforts basis, and a dealer will

purchase securities as a principal for resale at varying prices to be determined by the dealer.

If

we utilize an underwriter in the sale of the securities being offered by this prospectus, we will execute an underwriting agreement with

the underwriter at the time of sale and we will provide the name of any underwriter in the prospectus supplement that the underwriter

will use to make resales of the securities to the public. In connection with the sale of the securities, we, or the purchasers of securities

for whom the underwriter may act as agent, may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter

may sell the securities to or through dealers, and those dealers may receive compensation in the form of discounts, concessions or commissions

from the underwriters or commissions from the purchasers for whom they may act as agent.

We

will describe in the applicable prospectus supplement any compensation we pay to underwriters, dealers or agents in connection with the

offering of the securities, and any discounts, concessions or commissions allowed by underwriters to participating dealers. Underwriters,

dealers and agents participating in the distribution of the securities may be deemed to be underwriters within the meaning of the Securities

Act, and any discounts and commissions received by them and any profit realized by them on resale of the securities may be deemed to

be underwriting discounts and commissions. We may enter into agreements to indemnify underwriters, dealers and agents against civil liabilities,

including liabilities under the Securities Act, and to reimburse them for certain expenses. We may grant underwriters who participate

in the distribution of our securities under this prospectus an option to purchase additional securities to cover any over-allotments

in connection with the distribution.

Any

common stock that we offer under this prospectus will be listed on the NASDAQ Capital Market, but any other securities may or may not

be listed on a national securities exchange. To facilitate the offering of securities, certain persons participating in the offering

may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This may include over-allotments

or short sales of the securities, which involves the sale by persons participating in the offering of more securities than we sold to

them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market

or by exercising their over-allotment option. In addition, these persons may stabilize or maintain the price of the securities by bidding

for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating

in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The effect

of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise

prevail in the open market. These transactions may be discontinued at any time.

We

may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately

negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties

may sell securities covered by this prospectus and the applicable prospectus supplement, including short sale transactions. If so, the

third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings

of stock, and they may use securities received from us in settlement of those derivatives to close out any related open borrowings of

stock. The third party in these sale transactions will be an underwriter and will be identified in the applicable prospectus supplement

or in a post-effective amendment to the registration statement relating to this prospectus. In addition, we may otherwise loan or pledge

securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. The financial

institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent

offering of other securities.

To

the extent required pursuant to Rule 424(b) of the Securities Act, or other applicable rule, we will file a prospectus supplement to

describe the terms of any offering of our securities covered by this prospectus. The prospectus supplement will disclose:

| |

● |

The

terms of the offer; |

| |

● |

The

names of any underwriters, including any managing underwriters, as well as any dealers or agents; |

| |

● |

The

purchase price of the securities to be sold by us; |

| |

● |

Any

delayed delivery arrangements; |

| |

● |

Any

underwriting discounts, commissions or other items constituting underwriters’ compensation and any commissions paid to agents;

and |

| |

● |

Other

facts material to the transaction. |

We

will bear substantially all of the costs, expenses and fees in connection with the registration of our securities under this prospectus.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business

for which they will receive compensation.

DESCRIPTION

OF CAPITAL STOCK

General

As

of the date of this prospectus, our authorized capital stock consists of 106,000,000 shares. The authorized shares consist of 6,000,000

shares of common stock, par value of $0.0001 per share, and 100,000,000 shares of preferred stock, par value of $0.0001 per share. The

equity securities currently outstanding are 2,962,900 shares of common stock, 2,500,000 shares of Series B Preferred Stock and 117,598

shares of Series C Preferred Stock. Our common stock is traded on the NASDAQ Capital Market under the symbol “EAST”.

The

following description summarizes the material terms of our capital stock. This summary is, however, subject to the provisions of our

certificate of incorporation and bylaws. For greater detail about our capital stock, please refer to our certificate of incorporation

and bylaws.

Common

Stock

Each

holder of common stock is entitled to one vote for each share held on all matters to be voted upon by the stockholders. At any meeting

of the stockholders, a quorum as to any matter shall consist of a majority of the votes entitled to be cast on the matter, except where

a larger quorum is required by law.

Holders

of our common stock are entitled to receive dividends declared by our board of directors out of funds legally available for the payment

of dividends, subject to the rights, if any, of preferred stockholders. In the event of our liquidation, dissolution or winding up, holders

of common stock are entitled to share ratably in all of our assets remaining after we pay our liabilities and distribute the liquidation

preference of any then outstanding preferred stock. The rights, preferences and privileges of holders of common stock are subject to,

and may be adversely affected by, the rights of holders of any series of preferred stock that we may designate and issue in the future.

Holders of common stock have no preemptive or other subscription or conversion rights. There are no redemption or sinking fund provisions

applicable to the common stock.

The

transfer agent and registrar for our common stock is Transfer Online, Inc. 512 SE Salmon Street, Portland, Oregon 97214 (Telephone: (503)

227-2950).

Series

B Preferred Stock

Each

share of Series B Preferred Stock has a stated value of $1.00, and the class of stock has a liquidation preference of $2.5 million. The

Series B Preferred Stock is convertible into shares of the Company’s common stock pursuant to the terms and conditions set forth

in a Certificate of Designation Establishing Series B Preferred Stock of the Company with a conversion price of $62.00 per share. The

holder of Series B Preferred Stock has voting rights on an as-converted basis. The Series B Preferred Stock accrues dividends at a rate

of 6% per annum, payable annually on the last day of December of each year. Dividends shall accrue from day to day, whether or not declared,

and shall be cumulative. Dividends are payable at the Company’s option either in cash or “in kind” in shares of common

stock; provided, however that dividends may only be paid in cash following the fiscal year in which the Company has net income (as shown

in its audited financial statements contained in its Annual Report on Form 10-K for such year) of at least $0.5 million. For “in-kind”

dividends, holders will receive that number of shares of common stock equal to (i) the amount of the dividend payment due such stockholder

divided by (ii) the volume weighted average price of the common stock for the 90 trading days immediately preceding a dividend date (“VWAP”).

Series

C Preferred Stock

Each

share of Series C Preferred Stock has a stated value of $28.025, and the class of 117,598 shares that remain outstanding have a liquidation

preference of $3,296,684. The holder of Series C Preferred Stock has no voting rights by reason of those shares, except that the approval

by holders of more than 50% of the outstanding Series C Preferred Stock is required for any corporate action that would adversely affect

the preferences, privileges or rights of the Series C Preferred Stock. In the event that the Company declares a dividend payable in cash

or stock to holders of any class of the Company’s stock, the holder of a share of Series C Preferred Stock will be entitled to

receive an equivalent dividend on an as-converted basis. Each share of Series C Preferred Stock is convertible into common stock by a

conversion ratio equal to the stated value of the Series C share divided by the Series C Conversion Price. The initial Series C Conversion

Price is $3.05 per common share, which is subject to reduction under certain circumstances. The number of shares of common stock into

which a holder may convert Series C Preferred Stock is limited by a Beneficial Ownership Limitation, which restricts the portion of the

cumulative voting power in the Company that the holder and its affiliates may own after the conversion to 9.99%. The Beneficial Ownership

Limitation may be increased to 19.99% by the holder upon 61 days advance notice to the Company.

Undesignated

Preferred Stock

The

board of directors has the authority, without stockholder approval, subject to limitations prescribed by law, to provide for the issuance

of the shares of preferred stock in one or more series, and by filing a certificate pursuant to the applicable law of the State of Nevada,

to establish from time to time the number of shares to be included in each such series, and to fix the designation, powers, preferences

and rights of the shares of each series and the qualifications, limitations or restrictions, including, but not limited to, the following:

| |

● |

the

number of shares constituting that series; |

| |

|

|

| |

● |

dividend

rights and rates; |

| |

|

|

| |

● |

voting

rights; |

| |

|

|

| |

● |

conversion

terms; |

| |

|

|

| |

● |

rights

and terms of redemption (including sinking fund provisions); and |

| |

|

|

| |

● |

rights

of the series in the event of liquidation, dissolution or winding up. |

All

shares of preferred stock offered hereby will, when issued, be fully paid and nonassessable and will not have any preemptive or similar

rights. Our board of directors could authorize the issuance of shares of preferred stock with terms and conditions that could have the

effect of discouraging a takeover or other transaction that might involve a premium price for holders of the shares or which holders

might believe to be in their best interests.

We

will set forth in a prospectus supplement relating to the series of preferred stock being offered the following items:

| |

● |

the

title and stated value of the preferred stock; |

| |

|

|

| |

● |

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock; |

| |

● |

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation applicable to the preferred stock; |

| |

|

|

| |

● |

whether

dividends are cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock will accumulate; |

| |

|

|

| |

● |

the

provisions for a sinking fund, if any, for the preferred stock; |

| |

|

|

| |

● |

the

provision for redemption, if applicable, of the preferred stock; |

| |

|

|

| |

● |

any

listing of the preferred stock on any securities exchange; |

| |

|

|

| |

● |

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into common stock, including the conversion

price (or manner of calculation) and conversion period; |

| |

|

|

| |

● |

voting

rights, if any, of the preferred stock; |

| |

|

|

| |

● |

a

discussion of any material and/or special United States federal income tax considerations applicable to the preferred stock; |

| |

|

|

| |

● |

the

relative ranking and preferences of the preferred stock as to dividend rights and rights upon the liquidation, dissolution or winding

up of our affairs; |

| |

|

|

| |

● |

any

limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the class or series of preferred

stock as to dividend rights and rights upon liquidation, dissolution or winding up of our affairs; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The

transfer agent and registrar for any series of preferred stock will be set forth in the applicable prospectus supplement.

DESCRIPTION

OF WARRANTS

General

We

may issue warrants for the purchase of our preferred stock or common stock, or any combination thereof. Warrants may be issued independently

or together with our preferred stock or common stock and may be attached to or separate from any offered securities. Each series of warrants

will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent. The warrant

agent will act solely as our agent in connection with the warrants. The warrant agent will not have any obligation or relationship of

agency or trust for or with any holders or beneficial owners of warrants. This summary of certain provisions of the warrants is not complete.

For the terms of a particular series of warrants, you should refer to the prospectus supplement for that series of warrants and the warrant

agreement for that particular series.

The

prospectus supplement relating to a particular series of warrants to purchase our common stock or preferred stock will describe the terms

of the warrants, including the following:

| |

● |

the

title of the warrants; |

| |

|

|

| |

● |

the

offering price for the warrants, if any; |

| |

● |

the

aggregate number of warrants; |

| |

● |

the

designation and terms of the common stock or preferred stock that may be purchased upon exercise of the warrants; |

| |

● |

if

applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with

each security; |

| |

● |

if

applicable, the date from and after which the warrants and any securities issued with the warrants will be separately transferable; |

| |

● |

the

number of shares of common stock or preferred stock that may be purchased upon exercise of a warrant and the exercise price for the

warrants; |

| |

● |

the

dates on which the right to exercise the warrants shall commence and expire; |

| |

● |

if

applicable, the minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

● |

the

currency or currency units in which the offering price, if any, and the exercise price are payable; |

| |

● |

if

applicable, a discussion of material U.S. federal income tax considerations; |

| |

● |

the

antidilution provisions of the warrants, if any; |

| |

● |

the

redemption or call provisions, if any, applicable to the warrants; |

| |

● |

any

provisions with respect to holder’s right to require us to repurchase the warrants upon a change in control or similar event;

and |

| |

● |

any

additional terms of the warrants, including procedures, and limitations relating to the exchange, exercise and settlement of the

warrants. |

Holders

of equity warrants will not be entitled:

| |

● |

to

vote, consent or receive dividends; |

| |

|

|

| |

● |

receive

notice as stockholders with respect to any meeting of stockholders for the election of our directors or any other matter; or |

| |

|

|

| |

● |

exercise

any rights as stockholders of Eastside Distilling, Inc. |

DESCRIPTION

OF UNITS

We

may issue, in one more series, units consisting of common stock, preferred stock and/or warrants for the purchase of common stock or

preferred stock in any combination. While the terms we have summarized below will apply generally to any units that we may offer under

this prospectus, we will describe the particular terms of any series of units in more detail in the applicable prospectus supplement.

The terms of any units offered under a prospectus supplement may differ from the terms described below.

General

Each

unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit

will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide

that the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date.

We

will describe in the applicable prospectus supplement the terms of the series of units, including:

| |

● |

the

designation and terms of the units, including whether and under what circumstances the securities comprising the units may be held

or transferred separately; |

| |

|

|

| |

● |

any

provisions of the governing unit agreement that differ from those described below; and |

| |

● |

any

provisions for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising the units. |

The

provisions described in this section, as well as those described under “Description of Capital Stock,” “Description

of Debt Securities” and “Description of Warrants,” will apply to each unit and to any common stock, preferred stock

or warrant included in each unit, respectively.

Issuance

in Series

We

may issue units in such amounts and in such numerous distinct series as we determine.

Enforceability

of Rights by Holders of Units

Each

unit agent will act solely as our agent under the applicable unit agreement and will not assume any obligation or relationship of agency

or trust with any holder of any unit. A single bank or trust company may act as unit agent for more than one series of units. A unit

agent will have no duty or responsibility in case of any default by us under the applicable unit agreement or unit, including any duty

or responsibility to initiate any proceedings at law or otherwise, or to make any demand upon us. Any holder of a unit may, without the

consent of the related unit agent or the holder of any other unit, enforce by appropriate legal action its rights as holder under any

security included in the unit.

CERTAIN

PROVISIONS OF NEVADA LAW;

THE

COMPANY’S ARTICLES

OF INCORPORATION AND BYLAWS

Anti-takeover

Effects of Our Articles of Incorporation and Bylaws

The

authority granted by our charter to the Board of Directors to authorize classes of Preferred Stock with either specified voting rights

or rights providing the holders with voting control over the approval of certain extraordinary corporate action could be used to create

voting impediments or to frustrate persons seeking to effect a merger or to otherwise gain control of the Company, either by diluting

their stock ownership or by vesting voting control over the acquisition in other persons..

Nevada

Anti-Takeover laws

The

“business combination” provisions of Sections 78.411 to 78.444 of the Nevada Revised Statutes (“NRS”) prohibit

a Nevada corporation with at least 200 stockholders from engaging in various “combination” transactions with any interested

stockholder: for a period of three years after the date of the transaction in which the person became an interested stockholder, unless

the transaction is approved by the board of directors prior to the date the interested stockholder obtained such status; or after the

expiration of the three-year period, unless:

| ● |

the

transaction is approved by the board of directors or a majority of the voting power held by disinterested stockholders, or |

| |

|

| ● |

if

the consideration to be paid by the interested stockholder is at least equal to the highest of: (a) the highest price per share paid

by the interested stockholder within the three years immediately preceding the date of the announcement of the combination or in

the transaction in which it became an interested stockholder, whichever is higher, (b) the market value per share of common stock

on the date of announcement of the combination and the date the interested stockholder acquired the shares, whichever is higher,

or (c) for holders of preferred stock, the highest liquidation value of the preferred stock, if it is higher. |

A

“combination” is defined to include mergers or consolidations or any sale, lease exchange, mortgage, pledge, transfer or

other disposition, in one transaction or a series of transactions, with an “interested stockholder” having: (a) an aggregate

market value equal to five per cent or more of the aggregate market value of the assets of the corporation, (b) an aggregate market value

equal to five per cent or more of the aggregate market value of all outstanding shares of the corporation, or (c) ten per cent or more

of the earning power or net income of the corporation.

In

general, an “interested stockholder” is a person who, together with affiliates and associates, owns (or within three years,

did own) ten per cent or more of a corporation’s voting stock. The statute could prohibit or delay mergers or other takeover or

change in control attempts and, accordingly, may discourage attempts to acquire our company even though such a transaction may offer

our stockholders the opportunity to sell their stock at a price above the prevailing market price.

Limitation

on Liability and Indemnification Matters

We

are a Nevada corporation, and accordingly, we are subject to the corporate laws under the NRS. Articles 5 and 6 of our Amended and Restated

Articles of Incorporation (“Articles”), Article VII of our Amended and Restated Bylaws (“Bylaws”) and the Nevada

Revised Business Statutes, contain indemnification and personal liability limitation provisions.

Limitation

of Personal Liability of Directors and Officers

Our

Articles provide that our directors and officers will not be personally liable to us or to our stockholders for damages for breach of

fiduciary duty as a director or officer; provided, however, that the limitation on personal liability will not eliminate or limit the

liability of a director or officer for (i) acts or omissions that involve intentional misconduct, fraud, or a knowing violation of law

or (ii) the unlawful payment of distributions.

Indemnification

Pursuant

to our Articles and Bylaws, we will indemnify and hold harmless, to the fullest extent permitted by the Nevada Revised Statutes or any

other applicable laws, any person serving or who served as a director, officer, employee or agent of us, or who is or was serving at

our request as a director, officer, employee, trustee, or agent of another corporation, partnership, joint venture, trust, or other enterprise

who is a party or is threatened to be made a party to any action, suit or proceedings, whether civil, criminal, administrative, or investigative,

threatened, pending, or completed, action, suit, or proceeding, including an action by or in the right of the corporation, against expenses

(including attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by such person in

connection with such action, suit, or proceeding if such person acted in good faith and in a manner such person reasonably believed to

be in or not opposed to the best interests of our corporation, and with respect to any criminal action or proceeding, had no reasonable

cause to believe such person’s conduct was unlawful. With respect to actions brought by or in the right of the corporation, we

are required to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or completed

action or suit by or in the right of our corporation to procure a judgment in our favor by reason of the fact that such person is or

was an serving as our agent against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection

with the defense or settlement of such action or suit if such person acted in good faith and in a manner he reasonably believed to be

in or not opposed to the best interests of our corporation, except that no indemnification will be made in respect of any claim, issue,

or matter as to which the agent will have been adjudged to be liable to us by a court of competent jurisdiction, as described in greater

detail in our Bylaws. The payment of expenses includes the requirement that we pay expenses in defending an action or proceeding in advance

of final disposition of such action or proceeding upon receipt of an undertaking by the indemnified party to repay such payment if it

is ultimately determined that such person is not entitled to indemnification. Such indemnification is not exclusive of any other right

to indemnification provided by law or otherwise.

Our

Bylaws also provide that we may enter into indemnification agreements with our officers and directors. Our Articles provide that we may

purchase and maintain insurance on behalf of any person who is or was a director or officer of our corporation as a director of officer

of another corporation, or as its representative in a partnership, joint venture, trust, or other enterprise against any liability asserted

against such person and incurred in any such capacity or arising out of such status, whether or not we would have the power to indemnify

such person.

The

limitation of liability and indemnification provisions in our Articles and Bylaws may discourage stockholders from bringing a lawsuit

against directors for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against directors

and officers, even though an action, if successful, might benefit us and our stockholders. A stockholder’s investment may be harmed

to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

There is no pending litigation or proceeding naming any of our directors or officers as to which indemnification is being sought, nor

are we aware of any pending or threatened litigation that may result in claims for indemnification by any director or officer.

Disclosure

of Commission Position of Indemnification for Securities Act Liabilities

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons

pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the SEC, such indemnification is against

public policy as expressed in the Securities Act, and is, therefore, unenforceable.

LEGAL

MATTERS

Our

counsel, Robert Brantl, Esq., 181 Dante Avenue, Tuckahoe, New York 10707, will issue an opinion about certain legal matters with respect

to the securities.

EXPERTS

The

consolidated financial statements of Eastside Distilling, Inc. for the years ended December 31, 2023 and 2022 that are incorporated by

reference into this prospectus and in the registration statement have been audited by M&K CPAs, PLLC, an independent registered public

accounting firm, to the extent and for the periods set forth in their report incorporated by reference. The consolidated financial statements

are incorporated by reference in reliance upon such report given upon the authority of M&K CPAs, PLLC as experts in auditing and

accounting.

Part

II. INFORMATION NOT REQUIRED IN THE PROSPECTUS

| Item

14. |

Other

Expenses of Issuance and Distribution |

The

following are the expenses that Eastside Distilling, Inc. expects to incur in connection with the registration and distribution of the

securities being registered. All of these expenses (other than the filing fee) are estimated, and will not be certain until after the

registration statement is declared effective and the securities offerings are completed.

| Filing fees | |

$ | 1,476 | |

| Transfer Agent | |

| 3,000 | |

| Legal fees | |

| 25,000 | |

| Accounting fees | |

| 10,000 | |

| Miscellaneous | |

| 4,000 | |

| TOTAL | |

$ | 43,476 | |

| Item

15. |

Indemnification

of Directors and Officers |

Our

officers and directors are indemnified under Nevada law, our Amended and Restated Articles of Incorporation, as amended (the “Articles”),

and our Amended and Restated Bylaws, as amended, against certain liabilities.

Pursuant

to our Articles, we are required to indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that

such person is or was or has agreed to become a director or officer of our company or is serving at our request as a director or officer

of another entity or enterprise or by reason of actions alleged to have been taken or omitted in such capacity or in any other capacity

while serving as a director or officer, to the fullest extent permitted by applicable law, against any and all loss, liability, and expenses,

including attorneys’ fees, costs, judgments, fines, and amounts paid in settlement, actually and reasonably incurred by such person

in connection with such action, suit, or proceeding, including any appeal. This right to indemnification, which is not exclusive of any

other right that such directors or officers may have or hereafter acquire, shall continue for any person who has ceased to be a director

or officer and shall inure to the benefit of such person’s heirs, next of kin, executors, administrators, and legal representatives.

Our

Bylaws provide that we shall indemnify and hold harmless, to the fullest extent permitted by the laws of the State of Nevada, each director

or officer of the corporation who was or is a party to, or is threatened to be made a party to, or is otherwise involved in, any threatened,

pending, or completed action, suit, or proceeding (whether civil, criminal, administrative, or investigative, and including, without

limitation, an action, suit or proceeding by or in the right of the corporation), by reason of the fact that such person is or was a

director or officer of the corporation or is or was serving in any capacity at the request of the corporation as a director, officer,

employee, agent, partner, member, manager, or fiduciary of, or in any other capacity for, another corporation or any partnership, joint

venture, limited liability company, trust, or other enterprise. Such indemnification shall be against all expenses (including attorneys’

fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by such person in connection with such action,

suit, or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the

best interests of the Corporation, and with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s

conduct was unlawful. No such indemnification shall be made to or on behalf of any such director or officer if a final adjudication establishes

that such person’s acts or omissions involved intentional misconduct, fraud, or a knowing violation of law and was material to

the cause of action, or for any expenses of such director or officer incurred in such person’s capacity as a stockholder. Our Bylaws

also require that the expenses of such directors and officers must be paid by the corporation (or through insurance maintained, or other

financial arrangements made, by the corporation) as such expenses are incurred and in advance of the final disposition of such action,

suit, or proceeding, upon receipt of an undertaking by or on behalf of such director or officer to repay the amount if it is ultimately

determined by a court of competent jurisdiction that such person is not entitled to be indemnified by the corporation. Any indemnification

of directors and officers under our Bylaws shall inure to the benefit of such person’s respective heirs, executors, and administrators.

Section

78.7502 of the Nevada Revised Statutes permits a corporation to indemnify a present or former director, officer, employee, or agent of

the corporation, or of another entity or enterprise for which such person is or was serving in such capacity at the request of the corporation,

who was or is a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, except

an action by or in the right of the corporation, against expenses, including attorneys’ fees, judgments, fines, and amounts paid

in settlement actually and reasonably incurred in connection therewith, arising by reason of such person’s service in such capacity

if such person (i) is not liable pursuant to Section 78.138 of the Nevada Revised Statutes, or (ii) acted in good faith and in a manner

which such person reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to a criminal

action or proceeding, had no reasonable cause to believe such person’s conduct was unlawful. In the case of actions brought by

or in the right of the corporation, however, no indemnification may be made for any claim, issue, or matter as to which such person has

been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the corporation or for

amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or

other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, such person is fairly

and reasonably entitled to indemnity for such expenses as the court deems proper.

Section

78.751 of the Nevada Revised Statutes permits any discretionary indemnification under Section 78.7502 of the Nevada Revised Statutes,

unless ordered by a court or advanced to a director or officer by the corporation in accordance with the Nevada Revised Statutes, to

be made by a corporation only as authorized in each specific case upon a determination that indemnification of the director, officer,

employee, or agent is proper in the circumstances. Such determination must be made (1) by the stockholders, (2) by the board of directors

by majority vote of a quorum consisting of directors who were not parties to the action, suit, or proceeding, (3) if a majority vote

of a quorum consisting of directors who were not parties to the action, suit, or proceeding so orders, by independent legal counsel in

a written opinion, or (4) if a quorum consisting of directors who were not parties to the action, suit, or proceeding cannot be obtained,

by independent legal counsel in a written opinion.

We

maintain a liability insurance policy that covers certain liabilities of directors and officers of our corporation arising out of claims

based on acts or omissions in their capacities as directors or officers.

The

exhibits listed in the accompanying Exhibit Index are filed (except where otherwise indicated) as part of this Registration Statement.

A.

The undersigned Registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, post-effective amendments to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of estimated maximum offering range may

be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Filing

Fees Table” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement.

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or

any material change to such information in the registration statement; provided, however, that subparagraphs (i), (ii) and (iii)

above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports

filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of

1934, as amended, (“Exchange Act”), that are incorporated by reference in the registration statement, or is contained in

a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the

offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date

an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the

registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or

prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective

date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such effective date.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6)

That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report

pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless

in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

(8)

That:

(i)

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part

of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant to Rule

424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared

effective.

(ii)

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned

thereunto duly authorized, in the City of Portland and the State of Oregon on the 13th day of September, 2024.

| |

EASTSIDE

DISTILLING, INC. |

| |

|

|

| |

By:

|

/s/

Geoffrey Gwin |

| |

|

Geoffrey

Gwin, Chief Executive Officer |

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following person in

the capacities and on the date indicated.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Geoffrey Gwin |

|

Chief

Executive Officer; Chief |

|

September

13, 2024 |

| Geoffrey

Gwin |

|

Financial

Officer (Principal Executive, |

|

|

| |

|

Financial

and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Robert Grammen |

|

Director |

|

September

13, 2024 |

| Robert

Grammen |

|

|

|

|

| |

|

|

|

|

| /s/

Stephanie Kilkenny |

|

Director |

|

September

13, 2024 |

| Stephanie

Kilkenny |

|

|

|

|

| |

|

|

|

|

| /s/

Eric Finnsson |

|

Director |

|

September

13, 2024 |

| Eric

Finnsson |

|

|

|

|

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoint Geoffrey Gwin his or her

true and lawful attorney and agent, to do any and all acts and things in my name and behalf in my capacity as director or officer and

to execute any and all instruments for me and in my name in the capacities indicated below, which said attorney and agent may deem necessary

or advisable to enable said corporation to comply with the Securities Act of 1933, as amended, and any rules, regulations, and requirements

of the Securities and Exchange Commission, in connection with this Registration Statement, including specifically, but without limitation,

power and authority to sign for us or any of us in our names and in the capacities indicated below, any and all amendments (including

post-effective amendments) to this Registration Statement, any and all supplements to the prospectus in this Registration Statement,

or any related registration statement that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as

amended; and we do hereby ratify and confirm all that the said attorney and agent shall do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following person in

the capacities and on the date indicated.

| /s/

Robert Grammen |

|

Director |

|

September

13, 2024 |

| Robert

Grammen |

|

|

|

|

| |

|

|

|

|

| /s/

Stephanie Kilkenny |

|

Director |

|

September

13, 2024 |

| Stephanie

Kilkenny |

|

|

|

|

| |

|

|

|

|

| /s/

Eric Finnsson |

|

Director |

|

September

13, 2024 |

| Eric

Finnsson |

|

|

|

|

INDEX

TO EXHIBITS

| * |

To be filed by amendment or by a report filed under the Securities

Exchange Act of 1934, as amended, and incorporated herein by reference. |

| ** |

Filed herewith |

Exhibit

5

ROBERT

BRANTL, ESQ.

181

Dante Avenue

Tuckahoe,

NY 10707

914-693-3026

September

13, 2024

Eastside

Distilling, Inc.

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

Re:

Registration Statement on Form S-3 (the “Registration Statement”)

Ladies

and Gentlemen:

I

have acted as counsel to Eastside Distilling, Inc., a Nevada corporation (the “Company”), in connection with its filing on

September 13, 2024 with the Securities and Exchange Commission (the “Commission”) of a registration statement on Form S-3

(the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), pertaining

to the registration of securities for sale from time to time. This opinion is being furnished in accordance with the requirements of

Item 601(b)(5) of Regulation S-K under the Act, and no opinion is expressed herein as to any matter pertaining to the contents

of the Registration Statement, the Prospectus or any Prospectus Supplement (both as herein defined) other than as to (i) the enforceability

of the Warrant Agreements and the Warrants (each as herein defined) and (ii) the validity of the shares of the Common Stock and