false

--12-31

0001534708

0001534708

2024-10-07

2024-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 7, 2024

EASTSIDE

DISTILLING, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38182 |

|

20-3937596 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (971) 888-4264

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

EAST |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

3.01 | Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard. |

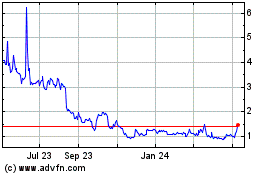

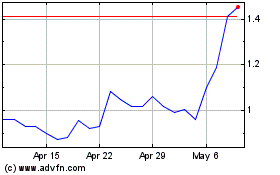

On

April 8, 2024, Eastside Distilling, Inc. (“Eastside”) received a deficiency letter from the Nasdaq Staff notifying

Eastside that its stockholders’ equity as reported in its Annual Report on Form 10-K for the period ending December 31, 2023, did

not satisfy the continued listing requirement under Nasdaq Listing Rule 5550(b)(1) (the “Equity Rule”) for the Nasdaq

Capital Market, which requires that a listed company’s stockholders’ equity be at least $2.5 million. As reported on its

most recent Form 10-K, Eastside’s stockholders’ equity as of December 31, 2023 was $853,000.

On

June 3, 2024 the NASDAQ Staff extended to October 7, 2024 the date by which Eastside may regain compliance with the Equity Rule.

Under

Item 1.01 below, we describe (a) the closing on October 7, 2024 of several equity-for-debt exchanges and other transactions pursuant

to the First Amended and Restated Debt Exchange Agreement dated October 3, 2023 (the “DEA”) and, immediately following

the closing under the DEA, (b) the closing of the merger of Beeline Financial Holdings, Inc. into a wholly-owned subsidiary of Eastside.

Based upon the closing of those transactions and management’s preliminary calculation of Eastside’s results of operations

for the quarter ended September 30, 2024, Eastside believes that, as of October 7, 2024, it has regained compliance with the Equity Rule.

NASDAQ

has advised Eastside that it will continue to monitor Eastside’s ongoing compliance with the Equity Rule and, if at the time when

Eastside files its next periodic report with the SEC Eastside does not evidence compliance with the Equity Rule, Eastside’s common

stock may be subject to delisting from NASDAQ.

| Item

5.03 | Amendments

to Articles of Incorporation |

On

October 7, 2024 Eastside filed with the Nevada Secretary of State a Certificate of Designation of 255,474 shares of Series D Preferred

Stock and a Certificate of Designation of 200,000 shares of Series E Preferred Stock and a Certificate of Designation of 70,000,000 shares

of Series F Preferred Stock and a Certificate of Designation of Series F-1 Preferred Stock. The material terms of each class of Preferred

Stock are:

Series

D Preferred Stock. Each share of Series D Preferred Stock has a stated value of $10.00. The holder of Series D Preferred Stock has

no voting rights by reason of those shares, except that the approval by holders of more than 50% of the outstanding Series D Preferred

Stock will be required for any corporate action that would adversely affect the preferences, privileges or rights of the Series D Preferred

Stock. In the event that Eastside declares a dividend payable in cash or stock to holders of any class of Eastside’s stock, the

holder of a share of Series D Preferred Stock will be entitled to receive an equivalent dividend on an as-converted basis. In the event

of a liquidation of Eastside, the holders of Series D Preferred Stock will share in the distribution of Eastside’s net assets on

an as-converted basis, subordinate only to the senior position of the Series B Preferred Stock. Each share of Series D Preferred Stock

will be convertible into common stock by a conversion ratio equal to the stated value of the Series D share divided by the Series D Conversion

Price. The initial Series D Conversion Price is $1.80 per common share, which is subject to equitable adjustment. The number of shares

of common stock into which a holder may convert Series D Preferred Stock is limited by a Beneficial Ownership Limitation, which restricts

the portion of the cumulative voting power in Eastside that the holder and its affiliates may own after the conversion to 9.99%.

Series

E Preferred Stock. Each share of Series E Preferred Stock has a stated value of $10.00. The holder of Series E Preferred Stock has

no voting rights by reason of those shares, except that the approval by holders of more than 50% of the outstanding Series E Preferred

Stock will be required for any corporate action that would adversely affect the preferences, privileges or rights of the Series E Preferred

Stock. In the event that Eastside declares a dividend payable in cash or stock to holders of any class of Eastside’s stock, the

holder of a share of Series E Preferred Stock will be entitled to receive an equivalent dividend on an as-converted basis. In the event

of a liquidation of Eastside, the holders of Series E Preferred Stock will share in the distribution of Eastside’s net assets on

an as-converted basis, subordinate only to the senior position of the Series B Preferred Stock. Commencing 390 days after the closing

under the DEA (the “Measurement Date”), each share of Series E Preferred Stock will be convertible into common stock

by a conversion ratio equal to the stated value of the Series E share divided by the Series E Conversion Price. The Series E Conversion

Price on and after the Measurement Date will equal the average of the VWAPs for the five trading days immediately preceding the Measurement

Date, subject to a “Floor Price” of $0.25 per share. The Series E Conversion Price and the Floor Price will be subject to

equitable adjustment in the event of stock splits and the like. The number of shares of common stock into which a holder may convert

Series E Preferred Stock is limited by a Beneficial Ownership Limitation, which restricts the portion of the cumulative voting power

in Eastside that the holder and its affiliates may own after the conversion to 9.99%.

Series

F Preferred Stock. Each share of Series F Preferred Stock has a stated value of $0.50. The holder of Series F Preferred Stock has

no voting rights by reason of those shares, except that the approval by holders of more than 50% of the outstanding Series F Preferred

Stock will be required for any corporate action that would adversely affect the preferences, privileges or rights of the Series F Preferred

Stock. In the event that Eastside declares a dividend payable in cash or stock to holders of any class of Eastside’s stock, the

holder of a share of Series F Preferred Stock will be entitled to receive an equivalent dividend on an as-converted basis. In the event

of a liquidation of Eastside, the holders of Series F Preferred Stock will share in the distribution of Eastside’s net assets on

an as-converted basis, subordinate only to the senior position of the Series B Preferred Stock.

If

the shareholders of Eastside approve the conversion of the Series F Preferred Stock at a meeting to be called for that purpose, each

share of Series F Preferred Stock will be convertible into common stock by a conversion ratio equal to the stated value of the Series

F share divided by the Series F Conversion Price. The initial Series F Conversion Price is $0.50 per common share, which is subject to

a “Floor Price” equal to 20% of the “Minimum Price” as defined in the Nasdaq Rules. The Series F Conversion Price

and the Floor Price are subject to equitable adjustment. In addition, if during the next two years the sum of the common shares outstanding

on October 7, 2024 plus shares issuable on conversion of Preferred Stock plus shares issuable on conversion of securities issued in the

initial financing of the post-merger company plus shares issued to settle pre-existing liabilities (collectively, the “Measuring

Shares”) exceeds 14,848,485, then the Series F Conversion Price will be adjusted to retain the ratio of common share issuable

on conversion to the Measuring Shares. Likewise, if the number of Measuring Shares on October 7, 2025 is less than 14,848,485, then the

Series F Conversion Price will be adjusted to retain the ration of the Measuring Shares to the number of shares issuable on conversion.

The number of shares of common stock into which a holder may convert Series F Preferred Stock will be limited by a Beneficial Ownership

Limitation, which restricts the portion of the cumulative voting power in Eastside that the holder and its affiliates may own after the

conversion to 4.99%.

| Item

1.01 | Entry

into a Material Definitive Agreement |

First

Amended and Restated Debt Exchange Agreement

On

September 4, 2024, Eastside and its subsidiary, Craft Canning & Bottling, LLC (“Craft”) entered into a Debt Exchange

Agreement with The B.A.D. Company, LLC (the “SPV”), Aegis Security Insurance Company (“Aegis”),

Bigger Capital Fund, LP (“Bigger”), District 2 Capital Fund, LP (“District 2”), LDI Investments,

LLC (“LDI”), William Esping ((“Esping”), WPE Kids Partners (“WPE”) and Robert

Grammen (“Grammen”). Subsequent to the execution of the Debt Exchange Agreement, the assets of the SPV were distributed

to its members, i.e. Aegis, Bigger, District 2 and LDI. To reflect the effect of the distribution on the transactions contemplated by

the Debt Exchange Agreement, the parties, on October 3, 2024, executed the First Amended and Restated Debt Exchange Agreement (the “Debt

Agreement”). The seven parties to the Debt Agreement with Eastside and Craft are referred to in this Report collectively as

the “Investors”.

Subsequent

to execution of the Debt Exchange Agreement, Eastside organized a subsidiary named “Bridgetown Spirits Corp.” and assigned

to Bridgetown Spirits Corp. all of the assets held by Eastside in connection with its business of manufacturing and marketing spirits.

Bridgetown Spirits Corp. issued 1,000,000 shares of common stock to Eastside.

On

October 7, 2024, a closing was held pursuant to the terms of the Debt Agreement. At that closing, the following transactions were completed:

| ● | Aegis,

Bigger, District 2 and LDI transferred to Eastside a total of 31,234 shares of Eastside Series

C Preferred Stock and 119,873 shares of Eastside Common Stock. The Investors also released

Eastside from liability for $4,137,581 of senior secured debt and $2,465,169 of unsecured

debt. In consideration of their surrender of stock and release of debt, Eastside caused Craft

to be merged into a limited liability company owned by the Investors. |

| ● | Eastside

issued a total of 255,474 shares of Series D Preferred Stock to Bigger and District 2, and

Bigger and District 2 released Eastside from liability for $2,554,746 of unsecured debt. |

| ● | Eastside

issued a total of 200,000 shares of Series E Preferred Stock to Bigger and District 2, and

Bigger and District 2 released Eastside from liability for $2,000,000 of unsecured debt. |

| ● | Eastside

transferred a total of 108,899 shares of Bridgetown Spirits Corp. to Bigger, District 2,

Esping, WPE and Grammen, and those Investors released Eastside from unsecured debt in the

aggregate amount of $888,247. |

| | | |

| ● | Eastside

issued a total of 190,000 shares of common stock to Esping, WPE and Grammen, and those Investors

released Eastside from liability for $187,189 of unsecured debt. |

The

Debt Agreement also provides that on November 7, 2024, Eastside will transfer a total of 361,101 shares of Bridgetown Spirits Corp. to

Aegis, Bigger, District 2 and LDI. In consideration for those shares, those four Investors will surrender to Eastside a total of 580,899

shares of Eastside common stock.

Upon

completion of the transaction contemplated by the Debt Agreement, Eastside will no longer be involved in the business of canning, and

will be involved in the spirits business as owner of 53% of the capital stock of Bridgetown Spirits Corp.

| Item

2.01 | Completion

of Acquisition of Assets |

| Item

3.02 | Unregistered

Sale of Equity Securities |

Agreement

and Plan of Merger and Reorganization

On

September 4, 2024, Eastside entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”)

with East Acquisition Inc. (“Merger Sub”) and Beeline Financial Holdings, Inc. (“Beeline”). Beeline

is a privately-held mortgage technology company that operates an end-to-end, all-digital, AI-enhanced platform for homeowners and property

investors. On October 7, 2024, the parties executed Amendment No. 1 to the Merger Agreement.

On

October 7, 2024, immediately after the closing under the Debt Agreement, a closing was held pursuant to the Merger Agreement (the “Merger

Closing”). Beeline merged into Merger Sub and become a wholly-owned subsidiary of Eastside, with the name of the surviving

corporation being changed to Beeline Financial Holdings, Inc. In the Merger, the shareholders of Beeline gained the right to receive

a total of 69,482,229 shares of Series F Preferred Stock and a total of 517,771 shares of Series F-1 Preferred Stock. In addition, each

option to purchase shares of Beeline common stock outstanding at the time of the Merger was converted into an option to purchase shares

of Eastside common stock measured by the same ratio.

The

sale of the Eastside common stock and Series F Preferred Stock to the shareholders of Beeline was carried out in a transaction exempt

from registration pursuant to SEC Regulation 506(b).

| Item

5.02 | Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Directors

and Officers

Pursuant

to the terms of the Merger Agreement, in connection with the closing of the Merger, the Board of Directors voted to increase the number

of members of the Board of Directors from four to six and appointed to the vacancies two individuals designated by Beeline: Joe Freedman

and Joe Caltabiano. In addition, the Eastside Board of Directors appointed Christopher Moe, the Chief Financial Officer of Beeline, to

serve as the Chief Financial Officer of Eastside. Information concerning the three new members of management follows:

Joe

Freedman, Director. Mr. Freedman joined the Board of Directors of Beeline in 2023. He also serves as Lead Director for Red

Cat Holdings Inc. (Nasdaq: RCAT) and as a member of the Boards of Directors of ResiCom Capital Partners, a real estate investment firm,

and Fluid Capital Network, a financial services company. In 2006, Mr. Freedman co-founded Event Works Rental, a full service event rental

company, and served on its board until 2023. In 2009, he co-founded RFx Legal, a pioneer in automating and optimizing legal services

procurement, and served on its board until it was purchased in 2012. In 2002 Mr. Freedman co-founded Richmond Title, and served as its

CEO and Board member until it was acquired in 2006. In 1992 he founded AMICUS Legal Staffing, Inc., a national legal search firm, and

served as its CEO until it was acquired in 1996. Mr. Freedman is a past president of the Nashville Chapter of Entrepreneurs Organization,

as currently serves as its Governance Chair. He also founded Drones for Good Worldwide, a 501(c)(3) organization that provides life-saving

drones for humanitarian efforts worldwide. Mr. Freedman earned a B.S. in Finance from Louisiana State University and a J.D. degree from

Northwestern California University School of Law.

Joe

Caltabiano, Director. Mr. Caltabiano’s career is currently focused on emerging medicine industries. As co-founder and

CEO of Healing Realty Trust, a real estate investment company, he is devoted to developing clinical infrastructure necessary to support

the administration of healthcare services and novel therapies in the behavioral health market. As founder of JSC Fund, Mr. Caltabiano

helps uncover and advance opportunities in cannabis and other regulated sectors. Mr. Caltabiano helped pioneer the cannabis industry

by co-founding Cresco Labs, one of North America’s larges vertically integrated cannabis operators, which he grew into a multi-state

operator with annualized revenue of over $250 million. Before focusing on emerging medicine industries, Mr. Caltabiano served as Senior

Vice President of Mortgage Banking at Guaranteed Rate, one of the largest mortgage providers in the U.S. Mr. Caltabiano has been honored

as Man of the Year by the Chicago Leukemia & Lymphoma Society

Christopher

R. Moe, Chief Financial Officer. Since 2023 Mr. Moe has served as the Chief Financial Officer of Beeline Financial Holdings,

Inc. an AI assisted all digital home loan lending and title platform designed to simplify the process of home financing. From 2018 until

2023, he was the Chief Financial Officer and a Director of Yates Electrospace Corporation, a heavy payload contested logistics drone

producer. From 2013 to 2028, Mr. Moe was the Chairman, Chief Executive Officer, and co-Founder of ProBrass Inc., a brass cartridge case

manufacturing company that was acquired by Vairog. Earlier he was the Chief Financial Officer of Vectrix Holdings Limited, a subsidiary

of GP Industries Ltd (G20:SGX), an international developer and manufacturer of electric motorcycles, and Chief Financial Officer and

a Director of Mission Motor Company, a company focused on advanced EV and hybrid powertrains for automobile and power sports applications.

He also held executive finance positions with GH Ventures, Kirkland Investment Corporation, St. Louis Ship Industries, Wasserstein, Perella

& Co.’s merchant banking fund and Citicorp’s Leveraged Capital Group.

Mr.

Moe currently serves as an independent director and chair of the audit committee for Red Cat Holdings, Inc. (RCAT:Nasdaq). His current

non-profit service includes serving on the Advisory Board of Innovate Newport and as Trustee Emeritus of The Pennfield School. He is

the former Vice Chairman of the Choir School of Newport County and former Treasurer of the Zabriskie Memorial Church of Saint John the

Evangelist. Mr. Moe served as a Captain of United States Marines and deployed with the 31st Marine Expeditionary Unit twice

to the Western Pacific and Indian Ocean. He holds a BA degree in English from Brown University and an MBA from the Harvard Business School.

Employment

Agreement: Chief Executive Officer

The

Merger Agreement provided that, as a condition to closing of the Merger, The Employment Agreement between Eastside and Geoffrey Gwin,

Eastside’s Chief Executive Officer, would be amended in a manner satisfactory to Eastside, Beeline and Mr. Gwin. Accordingly, at

the time of the Merger, Eastside’s Employment Agreement with Geoffrey Gwin was amended as follows:

| a. | The

performance bonuses in Employment Agreement were replaced by cash bonus of $90,000. |

| b. | The

Company issued 400,000 shares of common stock to Mr. Gwin, which will vest on the earlier

of March 31, 2025 or the date on which Mr. Gwin’s employment is terminated without

cause. |

| c. | The

Company covenanted that, in the event that the conversion price of the Series F Preferred

Stock is reduced, the Company will issue to Mr. Gwin a number of common shares equal to one

percent of the additional shares issued as a result of the adjustment. |

| d. | The

Company agreed to issue 100,000 shares of common stock to Mr. Gwin if he is terminated by

the Company without cause. |

Item

9.01 Financial Statements and Exhibits

Financial

Statements

Audited

financial statements of Beeline Financial Holdings Inc. for the years ended December 31, 2023 and 2022 – to be filed by amendment.

Pro

forma financial statements showing the pro forma retroactive effect of the merger of Beeline Financial Holdings Inc. into East Acquisition,

Inc. on the financial statements of Eastside Distilling Inc. for the years ended December 31, 2023 and 2022 and the six months ended

June 30, 2024.

Exhibits

| 3-a |

Certificate of Designation of Series D Preferred Stock filed on October 7, 2024 |

| 3-b |

Certificate of Designation of Series E Preferred Stock filed on October 7, 2024 |

| 3-c |

Certificate of Designation of Series F Preferred Stock filed on October 7, 2024 |

| 3-d |

Certificate of Designation of Series F-1 Preferred Stock filed on October 7, 2024 |

| 10-a |

First Amended and Restated Debt Exchange Agreement dated October 3, 2024 among Eastside Distilling, Inc., Craft Canning & Bottling, LLC, Aegis Security Insurance Company, Bigger Capital Fund, LP, District 2 Capital Fund, LP, LDI Investments, LLC, William Esping, WPE Kids Partners and Robert Grammen. |

| 10-b |

Agreement and Plan of Merger and Reorganization by and among Eastside Distilling, Inc., East Acquisition Inc. and Beeline Financial Holdings, Inc. dated September 4, 2024 – filed as an exhibit to the Current Report on Form 8-K dated September 4, 2024 and incorporated herein by reference. |

| 10-c |

First Amendment to Agreement and Plan of Merger and Reorganization dated October 7, 2024. |

| 10-d |

Amendment No. 1 dated October 7, 2024 to Executive Employment Agreement dated July 3, 2024 between Eastside Distilling, Inc. and Geoffrey Gwin. |

| 104 |

Cover

page interactive data file (embedded within the iXBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

October 7, 2024

| |

EASTSIDE

DISTILLING, INC. |

| |

|

|

| |

By:

|

/s/

Geoffrey Gwin |

| |

|

Geoffrey

Gwin |

| |

|

Chief

Executive Officer |

Exhibit

3.a

EXHIBIT

A

TO

CERTIFICATE

OF DESIGNATION

ESTABLISHING

SERIES D PREFERRED STOCK OF

EASTSIDE

DISTILLING, INC.

A

Nevada Corporation

Eastside

Distilling, Inc., a Nevada corporation (the “Corporation”), hereby establishes and designates Two Hundred Fifty-Five

Thousand Four Hundred Seventy Four (255,474) shares of its preferred stock, $0.0001 par value per share, as Series D Preferred Stock

(the “Series D Preferred Stock”). The voting powers, designations, preferences, privileges, limitations, restrictions,

and relative rights of the Series D Preferred Stock relative to those of the common stock, par value $0.0001 per share, of the Corporation

(the “Common Stock”) and any other class or series of stock of the Corporation are set forth in this Certificate

of Designation Establishing Series D Preferred Stock of the Corporation (the “Certificate”).

1.

Stated Value. Each share of Series D Preferred Stock shall have a stated value equal to $10.00 (the “Stated Value”).

2.

Liquidation. Upon the liquidation, dissolution and winding up of the Corporation, or upon the effective date of a consolidation,

merger or statutory share exchange in which the Corporation is not the surviving entity (generically, a “Liquidation Event”),

the holder of each share of the Series D Preferred Stock (a “Holder”) shall be entitled to a distribution prior

to and in preference of the holders of the Common Stock and in pari passu with the holders of the Series C Preferred Stock and the holders

of the Series E Preferred Stock. Notwithstanding the forgoing, upon a Liquidation Event, the holders of each share of the Corporation’s

Series B Preferred Stock will be entitled to a distribution prior to and in preference of the Holders of Series D Preferred Stock in

accordance with the terms of the Certificate of Designation Establishing Series B Preferred Stock of Eastside Distilling, Inc. In determining

the appropriate distribution of available cash among the Holders of Series D Preferred Stock, each share of Series D Preferred Stock

shall be deemed to have been converted into the number of shares of the Corporation’s Common Stock into which that Holder’s

Series D Preferred Stock could be converted on the record date for the distribution without taking into account the restriction on conversion

set forth in Section 5.3.7 hereof.

3.

Dividends. In the event the Corporation declares a dividend payable in cash or stock to holders of any class of stock, the Holder

of each share of Series D Preferred Stock shall be entitled to receive a dividend equal in amount and kind to that payable to the holder

of the number of shares of the Corporation’s Common Stock into which that Holder’s Series D Preferred Stock could be converted

on the record date for the distribution without taking into account the restriction on conversion set forth in Section 5.3.7 hereof.

4.

Voting.

4.1

General. Except as required by applicable law and as set forth in Section 4.2 below, the Holders of Series D Preferred Stock shall

have no voting rights by reason thereof; provided for the avoidance of doubt, that nothing in this Section 4.1 shall be deemed

to limit a Holder’s voting rights with respect to shares of any other class of the Corporation’s capital stock held by such

Holder from time to time.

4.2

Series D Preferred Stock Protective Provisions. The affirmative vote at a meeting duly called for such purpose, or the written

consent without a meeting, of the Holders of more than fifty percent (50%) of the then outstanding shares of Series D Preferred Stock,

voting or consenting (as the case may be) separately as a class, shall be required in order to effect any amendment, restatement, amendment

and restatement, supplement or other change or modification to the Corporation’s Articles of Incorporation (the “Articles”),

Bylaws or this Certificate, to the extent that such amendment, restatement, amendment and restatement, supplement or other modification

or change, as applicable, would adversely affect any of the preferences, privileges, relative rights or other rights of the Series D

Preferred Stock, and any such amendment, restatement, amendment and restatement, supplement or other change or modification purported

to be effected without such vote or consent shall be null and void ab initio, and of no force or effect.

5.

Conversion. The Holders of the Series D Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

5.1

Right to Convert.

5.1.1

Conversion Ratio. Each share of Series D Preferred Stock shall be convertible, at the option of the Holder thereof, at any time

and from time to time, and without the payment of additional consideration by the Holder thereof, into such number of fully paid and

non-assessable shares of Common Stock equal to the ratio determined by dividing (A) the Stated Value of such share of Series D Preferred

Stock by (B) the Series D Conversion Price (as defined below) in effect at the time of conversion (the “Conversion Ratio”).

The “Series D Conversion Price” shall initially be One Dollar and Eighty Cents ($1.80). The Series D Conversion

Price shall be subject to adjustment as provided in Sections 5.4 through 5.7 below, and for the avoidance of doubt, any adjustment to

the Series D Conversion Price as provided in Section 5.4 through 5.7 below shall result in a concordant adjustment to the number of shares

of Common Stock into which each share of Series D Preferred Stock may be converted pursuant to the formula set forth in the first sentence

of this Section 5.1.1 for determining the Conversion Ratio.

5.1.2

Termination of Conversion Rights. In the event of a liquidation, dissolution, or winding up of the Corporation or a Liquidation

Event, the Conversion Rights shall terminate at the close of business on the last full day preceding the date fixed for payment of any

amounts distributable to the Holders of Series D Preferred Stock by reason of such event.

5.2

Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series D Preferred Stock. In lieu

of any fractional shares to which the Holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied

by the fair market value of a share of Common Stock as determined in good faith by the Board of Directors of the Corporation. Whether

or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series

D Preferred Stock the Holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable

upon such conversion.

5.3

Mechanics of Conversion.

5.3.1

Notice of Conversion. In order for a Holder of Series D Preferred Stock to convert shares of Series D Preferred Stock into shares

of Common Stock, such Holder shall (a) provide written notice to the Corporation that such Holder elects to convert all or any number

of such Holder’s shares of Series D Preferred Stock on the form of conversion notice attached

hereto as Annex A (a “Notice of Conversion”), duly completed and executed. The Notice of Conversion

shall state the Holder’s name or the names of the nominees in which the Holder wishes the shares of Common Stock to be issued.

The calculations set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error. The

“Conversion Date” with respect to any conversion of Series D Preferred Stock hereunder (or the date on which

any such conversion shall be deemed effective), shall be the date on which the Notice of Conversion with respect to such conversion is

delivered to the Corporation. The shares of Common Stock issuable upon conversion of the specified shares of Series D Preferred

Stock in a Notice of Conversion shall be deemed to be outstanding of record as of the Conversion Date with respect to such Notice of

Conversion. Not later than two (2) Trading Days following the Conversion Date with respect to any conversion of Series D Preferred Stock

hereunder (the “Share Delivery Date”), the Corporation shall cause the shares of Common Stock issuable upon

conversion of the shares of Series D Preferred Stock specified in the applicable Notice of Conversion to be transmitted by the Corporation’s

transfer agent to the Holder or its nominee’s balance account with The Depository Trust Company through its Deposit Withdrawal

Agent Commission System, provided that at least one of the following two conditions is met as of the Conversion Date: (1) there is an

effective registration statement permitting the issuance of the shares of Common Stock issuable upon conversion of the shares of Series

D Preferred Stock specified in the Notice of Conversion or the resale of such shares of Common Stock by the Holder and (2) the shares

of Common Stock issuable upon conversion of the shares of Series D Preferred Stock specified in the Notice of Conversion are eligible

for resale by the Holder pursuant to Rule 144 promulgated under the Securities Act of 1933, as amended (the “DWAC Delivery

Conditions”); provided, that solely in the case that neither of the DWAC Delivery Conditions is met as of the Conversion

Date, the Corporation shall cause the shares of Common Stock issuable upon conversion of the shares of Series D Preferred Stock specified

in the Notice of Conversion to be transmitted by no later than the Share Delivery Date by the Corporation’s transfer agent to the

account of the Holder or its nominee by book entry transfer, and shall cause the Transfer Agent to deliver to the Holder evidence of

such book entry transfer by no later than the Share Delivery Date. In addition, upon delivery of any Notice of Conversion to the Corporation

by a Holder, by no later than the Share Delivery Date, the Corporation shall (i) pay in cash to the Holder such amount as provided in

Subsection 5.2 in lieu of any fraction of a share of Common Stock otherwise issuable upon such conversion and (ii) pay all declared but

unpaid dividends on the shares of Series D Preferred Stock so converted. If the Corporation fails for any reason to cause delivery to

the Holder or its nominee of the shares of Common Stock issuable upon a conversion of Series D Preferred Stock in accordance with this

Section 5.3.1 on or prior to the applicable Share Delivery Date, the Corporation shall pay to the Holder, in cash, as liquidated damages

and not as a penalty, for each $1,000 of shares of Common Stock issuable pursuant to such conversion (based on the number of shares of

Common Stock issuable pursuant to such conversion and the VWAP of the Common Stock on the applicable Conversion Date), $5 per Trading

Day (increasing to $10 per Trading Day on the fifth Trading Day after such liquidated damages begin to accrue) for each Trading Day after

such Share Delivery Date until such shares of Common Stock are delivered or the Holder rescinds such conversion.

5.3.2

Rescission Rights. If the Corporation fails to cause its transfer agent to transmit to the Holder or its nominee the shares of

Common Stock issuable upon a conversion of Series D Preferred Stock in accordance with the provisions of Section 5.3.1 on or prior to

the applicable Share Delivery Date, the Holder will have the right to rescind such conversion by written notice to the Corporation.

5.3.3

Compensation for Buy-In on Failure to Timely Deliver Shares Upon Conversion. In addition to any other rights available to a Holder,

if the Corporation fails to cause its transfer agent to transmit to the Holder or its nominee the shares of Common Stock issuable upon

a conversion of Series D Preferred Stock in accordance with the provisions of Section 5.3.1 on or prior to the applicable Share Delivery

Date, and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s

brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the shares of Common

Stock which the Holder anticipated receiving upon such conversion (a “Buy-In”), then the Corporation shall

(A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage commissions,

if any) for the shares of Common Stock so purchased exceeds (y) the amount obtained by multiplying (1) the number of shares of Common

Stock that the Corporation was required to deliver to the Holder in connection with the conversion at issue times (2) the price at which

the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the number

of shares of Series D Preferred Stock for which such conversion was not honored (in which case such conversion shall be deemed rescinded)

or deliver to the Holder the number of shares of Common Stock that would have been issued had the Corporation timely complied with its

conversion and delivery obligations hereunder. The Holder shall provide the Corporation written notice indicating the amounts payable

to the Holder in respect of the Buy-In and, upon request of the Corporation, evidence of the amount of such loss. Nothing herein shall

limit a Holder’s right to pursue any other remedies available to it hereunder under any other Section hereof or under applicable

law with respect to the Corporation’s failure to timely deliver shares of Common Stock upon conversion of the Series D Preferred

Stock as required pursuant to the terms hereof; provided, however, that any amount payable by the Corporation to a Holder pursuant to

this Section 5.3.3 shall be reduced by any amount paid by the Corporation to that Holder as liquidated damages pursuant to Section 5.3.1

hereof.

5.3.4

Reservation of Shares. The Corporation shall at all times when the Series D Preferred Stock shall be outstanding, reserve and

keep available out of its authorized but unissued capital stock, for the purpose of effecting the conversion of the Series D Preferred

Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect the conversion of

all outstanding Series D Preferred Stock; and if at any time the number of authorized but unissued shares of Common Stock shall not be

sufficient to effect the conversion of all then outstanding shares of Series D Preferred Stock, the Corporation shall take such corporate

action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient

for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary

amendment to the Articles.

5.3.5

Effect of Conversion. All shares of Series D Preferred Stock which shall have been converted as herein provided shall no longer

be deemed to be outstanding and all rights with respect to such shares shall immediately cease and terminate on the Conversion Date,

except only the right of the Holders thereof (i) to receive shares of Common Stock in exchange therefor on or prior to the applicable

Share Delivery Date in accordance with Section 5.3.1, (ii) to receive payment in lieu of any fraction of a share otherwise issuable upon

such conversion as provided in Subsection 5.2, (iii) to receive payment of any dividends declared but unpaid thereon, and (iv) if the

Corporation fails to transmit to the Holder or its nominee the shares of Common Stock issuable upon a conversion of Series D Preferred

Stock in accordance with the provisions of Section 5.3.1 on or prior to the applicable Share Delivery Date, to payment of liquidated

damages in accordance with Section 5.3.1 and to any payment due in respect of a Buy-In in accordance with Section 5.3.2, as applicable.

Any shares of Series D Preferred Stock so converted shall be retired and cancelled and may not be reissued as shares of such series,

and the Corporation may thereafter take such appropriate action (without the need for stockholder action) as may be necessary to reduce

the authorized number of shares of Series D Preferred Stock accordingly. Notwithstanding anything to the contrary set forth herein and

for the avoidance of doubt, any shares of Series D Preferred Stock subject to a conversion that is rescinded by a Holder in accordance

with this Section 5 shall not be deemed converted and all rights of such Holder with respect to such shares of Series D Preferred Stock

shall remain intact as if such conversion had never occurred.

5.3.6

Taxes. The Corporation shall pay any and all issue and other similar taxes that may be payable in respect of any issuance or delivery

of shares of Common Stock upon conversion of shares of Series D Preferred Stock pursuant to this Section 5. The Corporation shall not,

however, be required to pay any tax which may be payable in respect of any transfer involved in the issuance and delivery of shares of

Common Stock in a name other than that in which the shares of Series D Preferred Stock so converted were registered, and no such issuance

or delivery shall be made unless and until the Person or entity requesting such issuance has paid to the Corporation the amount of any

such tax or has established, to the satisfaction of the Corporation, that such tax has been paid.

5.3.7

Conversion Limitations. The Corporation shall not effect any conversion of any shares of Series D Preferred Stock, and a Holder

shall not have the right to effect any such conversion of any of his, her or its shares of Series D Preferred Stock, pursuant to Section

5 or otherwise, to the extent that after giving effect to such conversion, the Holder (together with the Holder’s Affiliates, and

any other Persons acting as a group together with the Holder or any of the Holder’s Affiliates (such Persons “Attribution

Parties”)), would beneficially own voting stock in excess of the Beneficial Ownership Limitation (as defined below). For

purposes of this Section 5.3.7, the number of shares of Common Stock beneficially owned by the Holder and its Affiliates and Attribution

Parties shall include the number of shares of Common Stock issuable upon any conversion with respect to which a Notice of Conversion

has been given, but shall exclude the number of shares of Common Stock which would be issuable upon (i) conversion of the remaining,

unconverted shares of Series D Preferred Stock beneficially owned by the Holder or any of its Affiliates or Attribution Parties and (ii)

exercise or conversion of the unexercised or nonconverted portion of any other derivative securities of the Corporation subject to a

limitation on conversion or exercise analogous to the limitation contained herein beneficially owned by the Holder or any of its Affiliates

or Attribution Parties. Except as set forth in the preceding sentence, beneficial ownership shall be calculated in accordance with Section

13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations

promulgated thereunder. To the extent that the limitation contained in this Section 5.3.7 applies, the determination of the number of

shares of Series D Preferred Stock that are convertible shall be in the sole discretion of the Holder, and the submission of a Notice

of Conversion shall be deemed to be the Holder’s determination as to the number of shares of Series D Preferred Stock that are

convertible, in each case subject to the Beneficial Ownership Limitation, and the Corporation shall have no obligation to verify or confirm

the accuracy of such determination. In addition, a determination as to any group status as contemplated above shall be determined in

accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. The “Beneficial Ownership

Limitation” shall be 9.99% of the Cumulative Voting Power outstanding immediately after giving effect to the issuance of

shares of Common Stock issuable upon the conversion specified in the Notice of Conversion. For purposes of this Section 5.3.7, the “Cumulative

Voting Power” shall be the sum of the votes that may be cast at a meeting of the Corporation’s shareholders by the

record holders of securities issued by the Corporation which by their terms provide the holder of such securities the right to cast votes

on any proposal presented for vote of the shareholders. For purposes of this Section 5.3.7, in determining the Cumulative Voting Power,

a Holder may rely on the information pertaining to the Cumulative Voting Power reflected in (A) the Corporation’s most recent periodic

or annual report filed with the Securities and Exchange Commission, as the case may be, (B) a more recent public announcement by the

Corporation or (C) a more recent written notice by the Corporation or its transfer agent setting forth the number of shares of Common

Stock and/or the number of shares of other classes of stock with voting rights outstanding. Upon the written request of a Holder (which,

for clarity, includes electronic mail), the Corporation shall within two Trading Days confirm orally and in writing to the Holder the

number of shares of Common Stock and number of shares of other classes of voting stock then outstanding. In any case, the Cumulative

Voting Power shall be determined after giving effect to the conversion or exercise of securities of the Corporation, including the Series

D Preferred Stock, by the Holder or its Affiliates since the date as of which such number of outstanding shares of Common Stock or such

number of outstanding shares of other classes of voting stock, as applicable, was reported. The Holder, upon not less than 61 days’

prior notice to the Corporation, may increase the percentage of Cumulative Voting Power that defines the Beneficial Ownership Limitation

to 19.99%.

5.4

Adjustment for Stock Splits and Combinations. If the Corporation shall at any time or from time to time after the filing date

of this Certificate (the “Effective Date”) effect a subdivision of the outstanding Common Stock, the Series

D Conversion Price in effect immediately before that subdivision shall be proportionately decreased so that the number of shares of Common

Stock issuable on conversion of each share of such series shall be increased in proportion to such increase in the aggregate number of

shares of Common Stock outstanding. If the Corporation shall at any time or from time to time after the Effective Date combine the outstanding

shares of Common Stock, the Series D Conversion Price in effect immediately before the combination shall be proportionately increased

so that the number of shares of Common Stock issuable on conversion of each share of such series shall be decreased in proportion to

such decrease in the aggregate number of shares of Common Stock outstanding. Any adjustment under this subsection shall become effective

at the close of business on the date the subdivision or combination becomes effective.

5.5

Adjustment for Certain Dividends and Distributions. In the event the Corporation at any time or from time to time after the Effective

Date shall make or issue, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or other

distribution payable on Common Stock in additional shares of Common Stock, then and in each such event the Series D Conversion Price

in effect immediately before such event shall be decreased as of the time of such issuance or, in the event such a record date shall

have been fixed, as of the close of business on such record date, by multiplying the Series D Conversion Price then in effect by a fraction:

(1)

the numerator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of such

issuance or the close of business on such record date, and

(2)

the denominator of which shall be the total number of shares of Common Stock issued and outstanding immediately prior to the time of

such issuance or the close of business on such record date plus the number of shares of Common Stock issuable in payment of such dividend

or distribution.

Notwithstanding

the foregoing, (a) if such record date shall have been fixed and such dividend is not fully paid or if such distribution is not fully

made on the date fixed therefor, the Series D Conversion Price shall be recomputed accordingly as of the close of business on such record

date and thereafter the Series D Conversion Price shall be adjusted pursuant to this subsection as of the time of actual payment of such

dividends or distributions; and (b) no such adjustment shall be made if the Holders of Series D Preferred Stock simultaneously receive

a dividend or other distribution of shares of Common Stock in a number equal to the number of shares of Common Stock as they would have

received if all outstanding shares of Series D Preferred Stock had been converted into Common Stock on the date of such event.

5.6

Adjustments for Other Dividends and Distributions. In the event the Corporation at any time or from time to time after the Effective

Date shall make or issue, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or other

distribution payable in securities of the Corporation (other than a distribution of shares of Common Stock in respect of outstanding

shares of Common Stock) or in other property and the provisions of Section 5.5 do not apply to such dividend or distribution, then and

in each such event provision shall be made so that the Holders of the Series D Preferred Stock shall receive upon conversion thereof,

in addition to the number of shares of Common Stock receivable thereupon, the kind and amount of securities of the Corporation, cash

or other property which they would have been entitled to receive had the Series D Preferred Stock been converted into Common Stock on

the date of such event and had they thereafter, during the period from the date of such event to and including the conversion date, retained

such securities receivable by them as aforesaid during such period, giving application to all adjustments called for during such period

under this paragraph with respect to the rights of the Holders of the Series D Preferred Stock; provided, however, that

no such provision shall be made if the holders of Series D Preferred Stock receive, simultaneously with the distribution to the holders

of Common Stock, a dividend or other distribution of such securities, cash or other property in an amount equal to the amount of such

securities, cash or other property as they would have received if all outstanding shares of Series D Preferred Stock had been converted

into Common Stock on the date of such event.

5.7

Adjustment for Merger or Reorganization, etc. If there shall occur any reorganization, recapitalization, reclassification, consolidation

or merger involving the Corporation in which Common Stock (but not the Series D Preferred Stock) is converted into or exchanged for securities,

cash or other property (other than a transaction covered by Subsections 5.5 or 5.6), then, following any such reorganization, recapitalization,

reclassification, consolidation or merger, each share of Series D Preferred Stock shall thereafter be convertible, in lieu of Common

Stock into which it was convertible prior to such event, into the kind and amount of securities, cash or other property which a holder

of the number of shares of Common Stock of the Corporation issuable upon conversion of one share of Series D Preferred Stock immediately

prior to such reorganization, recapitalization, reclassification, consolidation or merger would have been entitled to receive pursuant

to such transaction; and, in such case, appropriate adjustment (as determined in good faith by the Board of Directors of the Corporation)

shall be made in the application of the provisions in this Section 5.7 with respect to the rights and interests thereafter of the Holders

of the Series D Preferred Stock, to the end that the provisions set forth in this Section 5.7 (including provisions with respect to changes

in and other adjustments of the Series D Conversion Price) shall thereafter be applicable, as nearly as reasonably may be, in relation

to any securities or other property thereafter deliverable upon the conversion of the Series D Preferred Stock.

5.8

Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Series D Conversion Price pursuant

to this Section 5, the Corporation at its expense shall, as promptly as reasonably practicable but in any event not later than fifteen

(15) days thereafter, compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Series

D Preferred Stock a certificate setting forth such adjustment or readjustment (including the kind and amount of securities, cash or other

property into which the Series D Preferred Stock is convertible) and showing in detail the facts upon which such adjustment or readjustment

is based. The Corporation shall, as promptly as reasonably practicable after the written request at any time of any Holder of Series

D Preferred Stock (but in any event not later than five (5) days thereafter), furnish or cause to be furnished to such Holder a certificate

setting forth (i) the Series D Conversion Price then in effect (reflecting all adjustments and readjustments pursuant to this Section

5), and (ii) the number of shares of Common Stock and the amount, if any, of other securities, cash or property which then would be received

upon the conversion of Series D Preferred Stock.

5.9

Notice of Record Date. In the event:

(a)

the Corporation shall take a record of the holders of its Common Stock (or other capital stock or securities at the time issuable upon

conversion of the Series D Preferred Stock) for the purpose of entitling or enabling them to receive any dividend or other distribution,

or to receive any right to subscribe for or purchase any shares of capital stock of any class or any other securities, or to receive

any other security; or

(b)

of any capital reorganization of the Corporation, any reclassification of Common Stock of the Corporation, or any Liquidation Event,

then,

and in each such case, the Corporation will send or cause to be sent to the Holders of the Series D Preferred Stock a notice specifying,

as the case may be, (i) the record date for such dividend, distribution or right, and the amount and character of such dividend, distribution

or right, or (ii) the effective date on which such reorganization, reclassification, consolidation, merger, transfer, dissolution, liquidation

or winding-up is proposed to take place, and the time, if any is to be fixed, as of which the holders of record of Common Stock (or such

other capital stock or securities at the time issuable upon the conversion of the Series D Preferred Stock) shall be entitled to exchange

their shares of Common Stock (or such other capital stock or securities) for securities or other property deliverable upon such reorganization,

reclassification, consolidation, merger, transfer, dissolution, liquidation or winding-up, and the amount per share and character of

such exchange applicable to the Series D Preferred Stock and Common Stock. Such notice shall be sent at least twenty (20) days prior

to the record date or effective date for the event specified in such notice.

6.

No Preemptive Rights. Holders of Series D Preferred Stock shall have no preemptive rights except pursuant to a written agreement

by and between such Holder of Series D Preferred Stock and the Corporation.

7.

Notices. Any and all notices or other communications or deliveries to be provided by the Holders hereunder including, without

limitation, any Notice of Conversion, shall be in writing and delivered personally, by email, or sent by a nationally recognized overnight

courier service, addressed to the Corporation, at 188 Valley Road, Providence, RI 02909, email: cmoe@makeabeeline.com,or such other address

or email address as the Corporation may specify for such purposes by notice to the Holders delivered in accordance with this Section.

Any and all notices or other communications or deliveries to be provided by the Corporation hereunder shall be in writing and delivered

personally, or sent by a nationally recognized overnight courier service or email addressed to each Holder at the address or email address

of such Holder appearing on the books of the Corporation, or such other address or email address as such Holder may specify for such

purposes by notice to the Corporation delivered in accordance with this Section. Any notice or other communication or deliveries hereunder

shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via

email at the email address specified in or pursuant to this Section prior to 5:30 p.m. (New York City time) on any date, (ii) the date

immediately following the date of transmission, if such notice or communication is delivered via email at the email address specified

in or pursuant to this Section between 5:30 p.m. and 11:59 p.m. (New York City time) on any date, (iii) the second Trading Day following

the date of mailing, if sent by nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such

notice is required to be given.

8.

Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Affiliate”

means, as applied to any Person, any other Person directly or indirectly controlling, controlled by, or under common control with, that

Person. For the purposes of this definition, “control” (including, with correlative meanings, the terms “controlling,”

“controlled by” and “under common control with”), as applied to any Person, means possession, directly or indirectly,

of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting

power, by contract or otherwise.

“Person”

means any individual, corporation, partnership, limited liability company, joint venture, estate, trust, unincorporated association,

any other person or entity, and any federal, state, county or municipal government or any bureau, department or agency thereof and any

fiduciary acting in such capacity on behalf of any of the foregoing.

“Trading

Day” means a day on which the shares of the Corporation’s Common Stock are traded on the Nasdaq Capital Market; provided,

however, that in the event that the shares of Common Stock are not listed or quoted on the Nasdaq Capital Market, then Trading Day shall

mean any day except Saturday, Sunday and any day which shall be a legal holiday or a day on which banking institutions in the State of

New York or State of Nevada are authorized or required by law or other government action to close.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the

date in question: the NYSE American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York

Stock Exchange, or the OTC Markets QB Tier (or any successors to any of the foregoing).

“VWAP”

means, for any date, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the

Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m.

(New York City time) to 4:02 p.m. (New York City time)).

*

* * * *

ANNEX

A

NOTICE

OF CONVERSION

(TO

BE EXECUTED BY THE REGISTERED HOLDER IN ORDER TO

CONVERT

SHARES OF SERIES D PREFERRED STOCK)

Dated:

___________

The

undersigned Holder hereby irrevocably elects to convert the number of shares of Series D Preferred Stock indicated below, into shares

of common stock, par value $0.0001 per share (the “Common Stock”), of Eastside Distilling, Inc., a Nevada corporation

(the “Corporation”), as of the date written above. No fee will be charged to the Holder for any conversion.

Conversion

Calculations:

Number

of shares of Series D Preferred Stock owned prior to Conversion:_______________________________

Number

of shares of Series D Preferred Stock to be Converted:_______________________________________

Stated

Value of Series D Preferred Stock to be Converted ($10 per share): _______________________________

Applicable

Series D Conversion Price: ________________________________

Applicable

Conversion Ratio: __________________________________

Number

of shares of Common Stock to be Issued:_________________________________________________

The

shares of Common Stock shall be issued in the name of undersigned Holder or to its nominee as specified below:

_____________________________________

The

shares of Common Stock shall be issued to the following DWAC Account Number:

| DTC

Participant: |

|

DTC

Number: |

|

| Account

Number: |

|

|

|

Name

of Holder: _________________________________________

Signature

of Authorized Signatory of Holder: _____________________________

Name

of Authorized Signatory: _____________________________________________

Title

of Authorized Signatory: _____________________________________

Exhibit

3.b

EXHIBIT

A

TO

CERTIFICATE

OF DESIGNATION

ESTABLISHING

SERIES E PREFERRED STOCK OF

EASTSIDE

DISTILLING, INC.

A

Nevada Corporation

Eastside

Distilling, Inc., a Nevada corporation (the “Corporation”), hereby establishes and designates Two Hundred Thousand

(200,000) shares of its preferred stock, $0.0001 par value per share, as Series E Preferred Stock (the “Series E Preferred

Stock”). The voting powers, designations, preferences, privileges, limitations, restrictions, and relative rights of the

Series E Preferred Stock relative to those of the common stock, par value $0.0001 per share, of the Corporation (the “Common

Stock”) and any other class or series of stock of the Corporation are set forth in this Certificate of Designation Establishing

Series E Preferred Stock of the Corporation (the “Certificate”).

Capitalized

terms in this Certificate have the meaning given in Section 9 of this Certificate or defined within the text of this Certificate.

1.

Stated Value. Each share of Series E Preferred Stock shall have a stated value equal to Ten Dollars ($10.00) (the “Stated

Value”).

2.

Liquidation. Upon the liquidation, dissolution and winding up of the Corporation, or upon the effective date of a consolidation,

merger or statutory share exchange in which the Corporation is not the surviving entity (generically, a “Liquidation Event”),

the holder of each share of the Series E Preferred Stock (a “Holder”) shall be entitled to a distribution prior to and in

preference of the holders of the Common Stock and in pari passu with the holders of the Series C Preferred Stock and the holders of the

Series D Preferred Stock. Notwithstanding the forgoing, upon a Liquidation Event, the holders of each share of the Corporation’s

Series B Preferred Stock will be entitled to a distribution prior to and in preference of the Holders of Series E Preferred Stock in

accordance with the terms of the Certificate of Designation Establishing Series B Preferred Stock of Eastside Distilling, Inc. In determining

the appropriate distribution of available cash among the Holders of Series E Preferred Stock, each share of Series E Preferred Stock

shall be deemed to have been converted into the number of shares of the Corporation’s Common Stock into which that Holder’s

Series E Preferred Stock could be converted on the record date for the distribution (the “Record Date”) without

taking into account either (a) the restriction on conversion set forth in Section 5.3.7 hereof or (b) the restriction on conversion prior

to the Measurement Date set forth in Section 5.1.1. In the event that the Liquidation Event occurs prior to the Measurement Date, the

Series E Conversion Price for purposes of the Liquidation Event alone shall be the greater of (a) the five day average VWAP preceding

the Record Date as if the Measurement Date was the Record Date or (b) the Floor Price defined in Section 5.1.2 hereof.

3.

Dividends. In the event the Corporation declares a dividend payable in cash or stock to holders of any class of stock, the Holder

of each share of Series E Preferred Stock shall be entitled to receive a dividend equal in amount and kind to that payable to the holder

of the number of shares of the Corporation’s Common Stock into which that Holder’s Series E Preferred Stock could be converted

on the record date for the distribution without taking into account the restriction on conversion set forth in Section 5.3.7 hereof.

4.

Voting.

4.1

General. Except as required by applicable law and as set forth in Section 4.2 below, the Holders of Series E Preferred Stock shall

have no voting rights by reason thereof; provided for the avoidance of doubt, that nothing in this Section 4.1 shall be deemed

to limit a Holder’s voting rights with respect to shares of any other class of the Corporation’s capital stock held by such

Holder from time to time.

4.2

Series E Preferred Stock Protective Provisions. The affirmative vote at a meeting duly called for such purpose, or the written

consent without a meeting, of the Holders of more than fifty percent (50%) of the then outstanding shares of Series E Preferred Stock,

voting or consenting (as the case may be) separately as a class, shall be required in order to effect any amendment, restatement, amendment

and restatement, supplement or other change or modification to the Corporation’s Articles of Incorporation (the “Articles”),

Bylaws or this Certificate, to the extent that such amendment, restatement, amendment and restatement, supplement or other modification

or change, as applicable, would adversely affect any of the preferences, privileges, relative rights or other rights of the Series E

Preferred Stock, and any such amendment, restatement, amendment and restatement, supplement or other change or modification purported

to be effected without such vote or consent shall be null and void ab initio, and of no force or effect.

5.

Conversion. The Holders of the Series E Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

5.1

Right to Convert.

5.1.1

Conversion Ratio. On and after the Measurement Date, each share of Series E Preferred Stock shall be convertible, at the option

of the Holder thereof, at any time and from time to time, and without the payment of additional consideration by the Holder thereof,

into such number of fully paid and non-assessable shares of Common Stock equal to the ratio determined by dividing (A) the Stated Value

of such share of Series E Preferred Stock by (B) the Series E Conversion Price (as defined below) in effect at the time of conversion

(the “Conversion Ratio”).

5.1.2

Conversion Price. The “Series E Conversion Price” shall initially be Two Dollars ($2.00). On the Measurement

Date, the Series E Conversion Price shall be automatically adjusted to equal the greater of (a) the Floor Price or (b) the average of

the VWAPs for the five Trading Days immediately preceding the Measurement Date. For purposes of this Certificate of Designation, the

“Floor Price” shall be Twenty-Five Cents ($0.25). The Series E Conversion Price and the Floor Price shall be

also subject to equitable adjustment as provided in Sections 5.4 through 5.7 below, and for the avoidance of doubt, any adjustment to

the Series E Conversion Price as provided in this Section 5.1.2 or in Section 5.4 through 5.7 below shall result in a concordant adjustment

to the number of shares of Common Stock into which each share of Series E Preferred Stock may be converted pursuant to the formula set

forth in Section 5.1.1 for determining the Conversion Ratio.

5.1.3

Termination of Conversion Rights. In the event of a liquidation, dissolution, or winding up of the Corporation or a Liquidation

Event, the Conversion Rights shall terminate at the close of business on the last full day preceding the date fixed for payment of any

amounts distributable to the Holders of Series E Preferred Stock by reason of such event.

5.2

Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series E Preferred Stock. In lieu

of any fractional shares to which the Holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied

by the fair market value of a share of Common Stock as determined in good faith by the Board of Directors of the Corporation. Whether

or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series

E Preferred Stock the Holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable

upon such conversion.

5.3

Mechanics of Conversion.

5.3.1

Notice of Conversion. In order for a Holder of Series E Preferred Stock to convert shares of Series E Preferred Stock into shares

of Common Stock, such Holder shall (a) provide written notice to the Corporation that such Holder elects to convert all or any number

of such Holder’s shares of Series E Preferred Stock on the form of conversion notice attached hereto as Annex A (a “Notice

of Conversion”), duly completed and executed. The Notice of Conversion shall state the Holder’s name or the names

of the nominees in which the Holder wishes the shares of Common Stock to be issued. The calculations set forth in the Notice of Conversion

shall control in the absence of manifest or mathematical error. The “Conversion Date” with respect to any conversion

of Series E Preferred Stock hereunder (or the date on which any such conversion shall be deemed effective), shall be the date on which

the Notice of Conversion with respect to such conversion is delivered to the Corporation. The shares of Common Stock issuable upon conversion

of the specified shares of Series E Preferred Stock in a Notice of Conversion shall be deemed to be outstanding of record as of the Conversion

Date with respect to such Notice of Conversion. Not later than two (2) Trading Days following the Conversion Date with respect to any

conversion of Series E Preferred Stock hereunder (the “Share Delivery Date”), the Corporation shall cause the

shares of Common Stock issuable upon conversion of the shares of Series E Preferred Stock specified in the applicable Notice of Conversion

to be transmitted by the Corporation’s transfer agent to the Holder or its nominee’s balance account with The Depository

Trust Company through its Deposit Withdrawal Agent Commission System, provided that at least one of the following two conditions is met

as of the Conversion Date: (1) there is an effective registration statement permitting the issuance of the shares of Common Stock issuable

upon conversion of the shares of Series E Preferred Stock specified in the Notice of Conversion or the resale of such shares of Common

Stock by the Holder and (2) the shares of Common Stock issuable upon conversion of the shares of Series E Preferred Stock specified in

the Notice of Conversion are eligible for resale by the Holder pursuant to Rule 144 promulgated under the Securities Act of 1933, as

amended (the “DWAC Delivery Conditions”); provided, that solely in the case that neither of the DWAC

Delivery Conditions is met as of the Conversion Date, the Corporation shall cause the shares of Common Stock issuable upon conversion

of the shares of Series E Preferred Stock specified in the Notice of Conversion to be transmitted by no later than the Share Delivery

Date by the Corporation’s transfer agent to the account of the Holder or its nominee by book entry transfer, and shall cause the

Transfer Agent to deliver to the Holder evidence of such book entry transfer by no later than the Share Delivery Date. In addition, upon

delivery of any Notice of Conversion to the Corporation by a Holder, by no later than the Share Delivery Date, the Corporation shall

(i) pay in cash to the Holder such amount as provided in Subsection 5.2 in lieu of any fraction of a share of Common Stock otherwise

issuable upon such conversion and (ii) pay all declared but unpaid dividends on the shares of Series E Preferred Stock so converted.

If the Corporation fails for any reason to cause delivery to the Holder or its nominee of the shares of Common Stock issuable upon a

conversion of Series E Preferred Stock in accordance with this Section 5.3.1 on or prior to the applicable Share Delivery Date, the Corporation

shall pay to the Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of shares of Common Stock issuable pursuant

to such conversion (based on the number of shares of Common Stock issuable pursuant to such conversion and the VWAP of the Common Stock

on the applicable Conversion Date), $5 per Trading Day (increasing to $10 per Trading Day on the fifth Trading Day after such liquidated

damages begin to accrue) for each Trading Day after such Share Delivery Date until such shares of Common Stock are delivered or the Holder

rescinds such conversion.

5.3.2

Rescission Rights. If the Corporation fails to cause its transfer agent to transmit to the Holder or its nominee the shares of

Common Stock issuable upon a conversion of Series E Preferred Stock in accordance with the provisions of Section 5.3.1 on or prior to

the applicable Share Delivery Date, the Holder will have the right to rescind such conversion by written notice to the Corporation.

5.3.3

Compensation for Buy-In on Failure to Timely Deliver Shares Upon Conversion. In addition to any other rights available to a Holder,

if the Corporation fails to cause its transfer agent to transmit to the Holder or its nominee the shares of Common Stock issuable upon

a conversion of Series E Preferred Stock in accordance with the provisions of Section 5.3.1 on or prior to the applicable Share Delivery

Date, and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s

brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the shares of Common

Stock which the Holder anticipated receiving upon such conversion (a “Buy-In”), then the Corporation shall

(A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage commissions,

if any) for the shares of Common Stock so purchased exceeds (y) the amount obtained by multiplying (1) the number of shares of Common

Stock that the Corporation was required to deliver to the Holder in connection with the conversion at issue times (2) the price at which

the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the number

of shares of Series E Preferred Stock for which such conversion was not honored (in which case such conversion shall be deemed rescinded)

or deliver to the Holder the number of shares of Common Stock that would have been issued had the Corporation timely complied with its

conversion and delivery obligations hereunder. The Holder shall provide the Corporation written notice indicating the amounts payable

to the Holder in respect of the Buy-In and, upon request of the Corporation, evidence of the amount of such loss. Nothing herein shall