UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13A-16 OR 15D-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2024

Commission

file number: 001-39360

SKILLFUL

CRAFTSMAN EDUCATION TECHNOLOGY LIMITED

Floor

4, Building 1, No. 311, Yanxin Road

Huishan

District, Wuxi

Jiangsu

Province, PRC 214000

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F

☐

INFORMATION

CONTAINED IN THIS FORM 6-K REPORT

On

September 24, 2024, Skillful Craftsman Education Technology Limited, a Cayman Islands exempted company with limited liability (the “Company”),

entered into a Promissory Note Purchase Agreement (the “Agreement”) with Mr. Xuejun Ji, a major shareholder of the Company,

Mr. Peng Wang, a director of the Board of the Company (the “Board”) and Mr. Bin Fu, Chairman of the Board and

Chief Executive Officer of the Company (the “Purchasers”). Pursuant to the Agreement, the Company sold Promissory Notes to

the Purchasers with a principal amount of $1,000,000 and a term of twelve (12) months (the “Notes”). The Notes bear interest

at the rate of 6% per annum, which are payable on September 23, 2025. The Notes were sold to the Purchasers pursuant to an exemption

from registration under Regulation S, promulgated under the Securities Act of 1933, as amended. The foregoing description of the Agreement

and Notes does not purport to be complete and is qualified in its entirety by reference to the complete text of Agreement and Form of

Note, copies of which are filed as exhibits hereto and are incorporated herein by reference.

Exhibits

Index

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

SKILLFUL

CRAFTSMAN EDUCATION TECHNOLOGY LIMITED |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/

Bin Fu |

| |

Name: |

Bin

Fu |

| |

Title: |

Chief

Executive Officer |

Date:

September 26, 2024

Exhibit

10.1

PROMISSORY

NOTE PURCHASE AGREEMENT

This

Promissory Note Purchase Agreement (the “Agreement”), is made on September 24, 2024, by and among Skillful Craftsman Education

Technology Limited, a Cayman Islands exempted company (the “Company”) and each purchaser identified on the signature

pages hereto (each, including its successors and assigns, a “Purchaser” and collectively the “Purchasers”).

WHEREAS,

Purchasers desire to purchase from the Company notes in the aggregate sum of One Million Dollars USD ($1,000,000) be evidenced by 6%

Promissory Notes.

AGREEMENT

In

consideration of the mutual promises contained herein and other good and valuable consideration, receipt of which is hereby acknowledged,

the parties to this Agreement agree as follows:

1.

Issuance of the Notes.

(a)

Subject to the terms and conditions of this Agreement, Purchasers agree to purchase at the Closing (as defined below), and the Company

agrees to sell and issue to the Purchasers its 6% Promissory Notes (hereinafter called “Notes” and “Note” to

each Purchaser) in the aggregate principal amount of $1,000,000 to be dated on September 24, 2024 to mature on that is twelve (12) months

after the Issue Date, as defined in the Notes, to bear interest on the unpaid principal thereof at the rate of 6% per annum

until maturity, payable on September 23 of 2025, respectively, commencing on Issue Date, and after maturity at the rate of 6%

per annum until Notes are fully paid, and to be substantially in the Note to be issued to each Purchaser in Exhibit A attached

hereto. The purchase price of each Note shall be equal to one hundred percent (100%) of the principal amount of such Note.

(b)

For the purposes of calculating interest for any period for which the interest shall be payable, such interest shall be calculated on

the basis of a 30-day month and a 360 days year. The Company will promptly and punctually pay to notes holders (the “Holders”)

the interest on the Notes held by Holders without presentment of the original copies of the Notes. In the event that any of the Holders

shall sell or transfer the Notes, it shall notify the Company of the name and address of the transferee and send the assignment notice

to the Company for approval.

(c)

Closing and Delivery.

i)

The purchase and sale of the Notes shall take place at such time and place as the Company and Purchasers may agree upon (which time and

place are designated as the “Closing”).

ii)

At the Closing, (i) the Company shall deliver to each Purchaser the Note against payment of the purchase price by such Purchaser and

the signature page to this Agreement and the Note, and ii) each Purchaser shall deliver to the Company its payment of the purchase price

therefor by wire transfer to a bank designated by the Company, the signature page to this Agreement.

2.

Representations and Warranties of the Company. As of the Closing and on the date hereof, the Company hereby represents and warrants

to the Purchasers that:

(a)

Organization, Good Standing and Qualification. The Company and each of its subsidiaries, is an entity duly incorporated or otherwise

organized and validly existing under the laws of each jurisdiction in which it owns or leases properties or conducts any business so

as to require such qualification, with the requisite power and authority to own and use its properties and assets and to carry on its

business as currently conducted.

(b)

Authorization. The execution of this Agreement and the issuance of the Notes have been duly authorized by all necessary corporate

action of the Company. The Agreement and the Notes, when executed and delivered by the Company, shall constitute valid and legally

binding obligations of the Company, enforceable against the Company in accordance with their respective terms except as limited by applicable

bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, and other laws of general application affecting enforcement

of creditors’ rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief,

or other equitable remedies.

(c)

Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any

notice to, or make any filing or registration with, any governmental authority or any court or other federal, state, local or other governmental

authority or other Person in connection with the execution, delivery and performance by the Company of this Agreement, offer, issue and

sale of the Notes, other than the disclosure filing required for this Agreement.

(d)

SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company

under the Securities Act and the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the

date hereof (the foregoing materials, including the exhibits thereto, documents incorporated by reference therein, being collectively

referred to herein as the “SEC Reports”).

3. Representations

and Warranties of Purchaser. Each Purchaser, for itself and for no other Purchasers, hereby represents and warrants as of the

date hereof and as of the Closing date to the Company as follows (unless as made of a specific date stated therein, in which case

they shall be accurate as of such date):

(a)

Authorization. Such Purchaser has full power and authority to enter into this Agreement. This Agreement, when executed and delivered

by such Purchaser, will constitute a valid and legally binding obligation of such Purchaser, enforceable in accordance with its terms,

except as limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance, and any other laws of general

application affecting enforcement of creditors’ rights generally, and as limited by laws relating to the availability of a specific

performance, injunctive relief, or other equitable remedies.

(b)

Purchase Entirely for Own Account; Regulation S. This Agreement is made with such Purchaser in reliance upon such Purchaser’s

representation to the Company, which by such Purchaser’s execution of this Agreement, such Purchaser hereby confirms, that the

Note to be acquired by such Purchaser will be acquired for investment for such Purchaser’s own account, not as a nominee or agent,

and not with a view to the resale or distribution of any part thereof, and that such Purchaser has no present intention of selling, granting

any participation in, or otherwise distributing the same. By executing this Agreement, such Purchaser further represents that such Purchaser

does not presently have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations

to such person or to any third person, with respect to any of the Note. Such Purchaser has not been formed for the specific purpose of

acquiring the Note. In connection therewith, Such Purchaser confirms that it is neither a U.S. Person, as such term is defined in Regulation

S, nor located within the United States, and that the transaction will be between non-U.S. Persons, and take place outside of the United

States. Such Purchaser further confirms that it is not acquiring the Note for the account or benefit of any U.S. person. Such Purchaser

understands that Regulation S in available only for offers and sales of securities outside of the United States, and will fully comply

with Regulation S.

(c)

Knowledge. Such Purchaser is aware of the Company’s business affairs and financial condition and has acquired sufficient

information about the Company to reach an informed and knowledgeable decision to acquire the Note. Such Purchaser acknowledges and understands

that any investment in the Company is highly speculative and subject to a high degree of risk which could result in the loss of such

Purchaser’s entire investment.

(d)

Restricted Securities. Such Purchaser understands that the Note has not been, and may not be, registered under the Securities

Act of 1933, as amended (the “Securities Act”), by reason of a specific exemption from the registration provisions

of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of such

Purchaser’s representations as expressed herein. Such Purchaser understands that the Note is a “restricted security”

under applicable U.S. federal and state securities laws and that, pursuant to these laws, such Purchaser must hold the Note indefinitely

unless it is registered with the Securities and Exchange Commission and qualified by state authorities, or an exemption from such registration

and qualification requirements is available. Such Purchaser acknowledges that the Company has no obligation to register or qualify the

Note for resale. Such Purchaser further acknowledges that if an exemption from registration or qualification is available, it may be

conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Note, and

on requirements relating to the Company which are outside of such Purchaser’s control, and which the Company is under no obligation

and may not be able to satisfy.

(e)

Legends. Such Purchaser understands that the Note, and any securities issued in respect thereof or exchange therefor, may bear

one or all of the following legends:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED

UNDER

THE SECURITIES ACT OF 1933, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND

NOT

WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION

THEREOF.

NO SUCH SALE OR DISTRIBUTION MAY BE EFFECTED WITHOUT AN EFFECTIVE

REGISTRATION

STATEMENT RELATED THERETO ORAN OPINION OF COUNSEL IN A FORM

SATISFACTORY

TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED UNDER

THE

SECURITIES ACT OF 1933.”

Any

legend required by the Blue Sky laws of any state to the extent such laws are applicable to the shares represented by the certificate

so legended.

4.

Miscellaneous.

(a)

Successors and Assigns. The terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective

successors and assigns of the parties. Nothing in this Agreement is intended to confer upon any party other than the parties hereto or

their respective successors, except as expressly provided in this Agreement.

(b)

Governing Law; Venue. All questions concerning the construction, validity, enforcement and interpretation of this Agreement and

Notes (the “Transaction Documents”) shall be governed by and construed and enforced in accordance with the internal laws

of the State of New York, without regard to the principles of conflicts of law thereof. Each party agrees that all legal proceedings

concerning the interpretations, enforcement and defense of the transactions contemplated by this Agreement and any other Transaction

Documents (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members,

employees or agents) shall be commenced exclusively in the state and federal courts sitting in the New York City, New York. Each party

hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in New York City, for the adjudication

of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein (including with respect

to the enforcement of any of the Transaction Documents), and hereby irrevocably waives, and agrees not to assert in any suit, action

or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding

is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents

to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified mail or overnight

delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Agreement and agrees that such

service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit

in any way any right to serve process in any other manner permitted by law.

(c)

Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in

writing and shall be deemed given and effective on the earliest of: (i) the date of transmission, if such notice or communication is

delivered via facsimile at or prior to 5:30 p.m. (New York City time) on a Business Day, (ii) the next Business Day after the date of

transmission, if such notice or communication is delivered via facsimile on a day that is not a business day or later than 5:30 p.m.

(New York City time) on any Business Day, (iii) the second (2nd) business day following the date of mailing, if sent by U.S. nationally

recognized overnight courier service or (iv) upon actual receipt by the party to whom such notice is required to be given. The address

for such notices and communications shall be as set forth on the signature pages attached hereto. “Business Day” means any

day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions

in the State of New York are authorized or required by law or other governmental action to close.

(d)

Counterparts and Execution. This Agreement may be executed in two or more counterparts, all of which when taken together shall

be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to

each other party, it being understood that the parties need not sign the same counterpart. In the event that any signature is delivered

by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding

obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile

or “.pdf” signature page were an original thereof.

(e)

Titles and Subtitles. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered

in construing or interpreting this Agreement.

(f)

Amendments and Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument

signed, in the case of an amendment, by the Company and a Purchaser as to such Purchaser’s obligations hereunder only and without

any effect whatsoever on the obligations between the Company and the other Purchasers, or, in the case of a waiver, by the party granting

the waiver. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be

a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement

hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right.

(g)

Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, the parties agree

to renegotiate such provision in good faith, in order to maintain the economic position enjoyed by each party as close as possible to

that under the provision rendered unenforceable. In the event that the parties cannot reach a mutually agreeable and enforceable replacement

for such provision, then (i) such provision shall be excluded from this Agreement, (ii) the balance of the Agreement shall be interpreted

as if such provision were so excluded and (iii) the balance of the Agreement shall be enforceable in accordance with its terms.

(h)

Entire Agreement. This Agreement, and the documents referred to herein constitute the entire agreement between the parties hereto

pertaining to the subject matter hereof, and any and all other written or oral agreements existing between the parties hereto are expressly

canceled.

(i)

Legal Expenses. All parties to this Agreement shall be responsible for their own legal expenses.

(j)

Construction. The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise

the Transaction Documents and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against

the drafting party shall not be employed in the interpretation of the Transaction Documents or any amendments thereto. In addition, each

and every reference to share prices and shares of Ordinary Shares in any Transaction Document shall be subject to adjustment for reverse

and forward stock splits, stock combinations and other similar transactions of the Ordinary Shares that occur after the date of this

Agreement. The English version of this Agreement, regardless of whether a translation in any other language is or will be made, shall

be the only authentic version.

(h)

WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY,

THE PARTIES EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY,

IRREVOCABLY AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

[Signature

pages follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Securities Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

| SKILLFUL

CRAFTSMAN EDUCATION TECHNOLOGY LIMITED |

|

| |

|

|

| By: |

/s/

Dawei Chen |

|

| Name: |

Dawei

Chen |

|

| Title: |

Chief

Financial Officer |

|

Address

for Notice:

Skillful

Craftsman Education Technology Limited

Floor

4, Building 1, No. 311, Yanxin Road, Huishan District Wuxi, Jiangsu Province, PRC 214000

E-Mail:

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK SIGNATURE PAGE FOR PURCHASERS FOLLOW]

[PURCHASER

SIGNATURE PAGES TO SECURITIES PURCHASE AGREEMENT]

IN

WITNESS WHEREOF, the undersigned have caused this Promissory Note Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

Name

of Purchaser: Xuejun Ji

Signature

of Authorized Signatory of Purchaser: /s/ Xuejun Ji

Name

of Authorized Signatory:

Title

of Authorized Signatory:

Email

Address of Authorized Signatory:

Address

for Notice to Purchaser: Bel-Air, No.38 Bel-Air Avenue, Hong Kong

Address

for Delivery of Notes to Purchaser (if not same as address for notice):

Subscription

Amount: $400,000

[PURCHASER

SIGNATURE PAGES TO SECURITIES PURCHASE AGREEMENT]

IN

WITNESS WHEREOF, the undersigned have caused this Promissory Note Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

Name

of Purchaser: Bin Fu

Signature

of Authorized Signatory of Purchaser:/s/Bin Fu

Name

of Authorized Signatory:

Title

of Authorized Signatory:

Email

Address of Authorized Signatory:

Address

for Notice to Purchaser: Xiangmihu Haoting, Xiangmihu Street, Futian District, Shenzhen

Address

for Delivery of Notes to Purchaser (if not same as address for notice):

Subscription

Amount: $200,000

[PURCHASER

SIGNATURE PAGES TO SECURITIES PURCHASE AGREEMENT]

IN

WITNESS WHEREOF, the undersigned have caused this Promissory Note Purchase Agreement to be duly executed by their respective authorized

signatories as of the date first indicated above.

Name

of Purchaser: Peng Wang

Signature

of Authorized Signatory of Purchaser: /s/Peng Wang

Name

of Authorized Signatory:

Title

of Authorized Signatory:

Email

Address of Authorized Signatory:

Address

for Notice to Purchaser: Lanqiying Community, No. 101 Chengfu Road, Haidian District, Beijing

Address

for Delivery of Notes to Purchaser (if not same as address for notice):

Subscription

Amount: $400,000

EXHIBIT

A

PROMISSORY

NOTES

[See

Attached]

Exhibit 10.2

THIS

PROMISSORY NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AND HAS BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO,

OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISTRIBUTION MAY BE EFFECTED WITHOUT EXCEPT PURSUANT TO AN EFFECTIVE

REGISTRATION STATEMENT OR AN APPLICABLE EXEMPTION FROM REGISTRATION AND AN OPINION OF COUNSEL IN A FORM SATISFACTORY TO THE COMPANY TO

THE EFFECT THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933.

SKILLFUL

CRAFTSMAN EDUCATION TECHNOLOGY LIMITED

PROMISSORY

NOTE

| $[

] |

Issue Date: September 24, 2024 |

For

value received, Skillful Craftsman Education Technology Limited a Cayman Islands exempted company (the “Company”),

promises to pay to [ ], an individual and resident of China (the “Holder”), the principal sum of [ ] Hundred

Thousand Dollars ($_____) (the “Principal Amount”). Interest shall accrue from the Issue Date of this Note

on the unpaid principal amount at a rate equal to six percent (6.0%) per annum. This Promissory Note (this “Note”)

is issued on the Issue Date hereof pursuant to that certain Promissory Note Purchase Agreement, dated on September 24, 2024, by and between

the Company and Holder (the “Purchase Agreement”). This Note is subject to the following terms and conditions.

1.

Maturity; Interest Payments.

(a)

This Note will mature and become due and payable on the date that is twelve (12) months from the Issue Date (“the Initial

Term”); provided that Holder may, in its sole discretion, elect to extend the Initial Term for up to an additional

twelve (12) months from the end of the Initial Term by written notice to the Company ten (10) days prior to the end of the Initial Term

(the “Extended Term” and such date at the end of the Initial Term as maybe extended any Extended Term, the

“Maturity Date”).

(b)

Interest shall accrue on this Note from the Issue Date, and such accrued interest (the “Interest”) shall be

due and payable to the Holder September 23, 2025 that is twelve months following the Issue Date. All accrued Interest maybe paid to the

Holder in immediately available funds.

(c)

Notwithstanding the foregoing, the entire unpaid Principal Amount, together with accrued and unpaid interest thereon, shall become

immediately due and payable upon (i) the insolvency of the Company, the commission of any act of bankruptcy by the Company, or the

execution by the Company of a general assignment for the benefit of creditors; (ii) the filing by or against the Company of a

petition in bankruptcy or any petition for relief under the federal bankruptcy act or the continuation of such petition without

dismissal for a period of ninety (90) days or more; (iii) the appointment of a receiver or trustee to take possession of the

property or assets of the Company or (iv) the occurrence of an Event of Default. An “Event of Default”

shall exist upon a material breach or default by the Company of its obligations under this Note or the Purchase Agreement and

the Company has failed to cure such breach or default within thirty (30) days following notice by the Holder of the occurrence of

such breach or default.

2.

Payment; Prepayment. All payments shall be made in lawful money of the United States of America at such place as the Holder hereof

may from time to time designate in writing to the Company. Payment shall be credited first to the accrued interest then due and payable

and the remainder applied to principal. The Note may not be prepaid without the prior written consent of the Holder.

3.

Transfer; Successors and Assigns. The terms and conditions of this Note shall inure to the benefit of and be binding upon the

respective successors and assigns of the parties. The Holder may assign, pledge, or otherwise transfer this Note without the prior

written consent of the Company. Subject to the preceding sentence, this Note maybe transferred only upon surrender of the original

copy of this Note for registration of transfer, duly endorsed, or accompanied by a duly executed written instrument of transfer in

form satisfactory to the Company. Thereupon, a new note for the same principal amount and interest will be issued to, and registered

in the name of, the transferee as Holder. Interest and principal are payable only to the registered holder of this Note.

4. Governing

Law; Venue. This Note and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall

be governed, construed and interpreted in accordance with the internal laws of the State of New York, without giving effect to

principles of conflicts of law. Venue for any dispute arising out of this Agreement shall be exclusively in the state and federal

courts located in New

York

City, New York and each party hereby expressly consents to the personal jurisdiction of such courts and irrevocably waives any objection

to such venue based on forum nonconveniens.

5.

Notices. Whenever notice is required to be given under this Note, unless otherwise provided herein, such notice shall be given

in accordance with the subsection of the Purchase Agreement titled “Notices.”

6. Stockholders,

Officers and Directors Not Liable. In no event shall any stockholder, officer or director of the Company be liable for any

amounts due or payable pursuant to this Note.

7. Loss

of Note. Upon receipt by the Company of evidence satisfactory to it of the loss, theft, destruction or mutilation of this Note

or any Note exchanged for it, and indemnity satisfactory to the Company (in case of loss, theft or destruction) or surrender and

cancellation of such Note (in the case of mutilation), the Company will make and deliver in lieu of such Note a new Note of like

tenor.

8. Waiver

of Jury Trial. THE PARTIES HEREBY AGREE TO WAIVE THEIR RIGHT TOA JURY TRIAL OF ANY CLAIM OR CAUSE OF ACTION BASED UPON OR

ARISING OUT OF THIS NOTE. THE SCOPE OF THIS WAIVER IS INTENDED TO BE ALL ENCOMPASSING OF ANY AND ALL DISPUTES THAT MAY BE FILED IN

ANY COURT AND THAT RELATE TO THE SUBJECT MATTER OF THIS TRANSACTION, INCLUDING, WITHOUT LIMITATION, CONTRACT CLAIMS, TORT CLAIMS,

BREACH OF DUTY CLAIMS, AND ALL OTHER COMMON LAW AND STATUTORY CLAIMS.

[signature

page follows]

IN

WITNESS WHEREOF, the undersigned have executed this Promissory Note as of the Issue Date set forth above.

| COMPANY: |

|

| |

|

| SKILLFUL

CRAFTSMAN EDUCATION TECHNOLOGY LIMITED |

|

| |

|

|

| By: |

/s/Dawei

Chen |

|

| Name: |

Dawei

Chen |

|

| Title:

|

Chief

Financial Officer |

|

| |

|

|

| AGREED

TO AND ACCEPTED: |

|

| |

|

|

| By: |

/s/ |

|

| Name: |

|

|

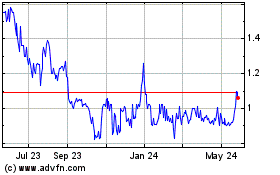

Skillful Craftsman Educa... (NASDAQ:EDTK)

Historical Stock Chart

From Dec 2024 to Jan 2025

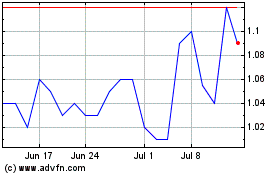

Skillful Craftsman Educa... (NASDAQ:EDTK)

Historical Stock Chart

From Jan 2024 to Jan 2025