UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

SEC

FILE NUMBER: 001-39360

CUSIP

NUMBER: G8211A 108

| (Check

one): |

☐ Form

10-K ☒ Form 20-F ☐ Form 11-K ☐ Form 10-Q ☐ Form

10-D ☐ Form N-CEN ☐ Form N-CSR |

| |

|

|

| |

For

Period Ended: |

March

31, 2024 |

| |

|

|

| |

☐ Transition

Report on Form 10-K

☐ Transition

Report on Form 20-F

☐ Transition

Report on Form 11-K

|

| |

☐ Transition

Report on Form 10-Q

For

the Transition Period Ended: _______________________________ |

| |

Read

Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing

in this form shall be construed to imply that the Commission has verified any information contained herein. |

| |

If

the notification relates to a portion of the filing checked above, identify the item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

Skillful

Craftsman Education Technology Limited

Full

name of registrant:

N/A

Former

name if applicable:

Floor

4, Building 1, No. 311, Yanxin Road

Address

of principal executive office (Street and number):

Huishan

District, Wuxi, Jiangsu Province, PRC 214000

City,

state and zip code

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed. (Check box if appropriate.)

| |

(a) |

The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

|

|

| ☒ |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

of transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof will be filed on or before the

fifth calendar day following the prescribed due date; and |

| |

|

|

| |

(c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III — NARRATIVE

State

below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof,

could not be filed within the prescribed time period.

Skillful Craftsman Education Technology Limited (the “Company”)

was unable to file its Annual Report on Form 20-F for the fiscal year ended March 31, 2024 within the prescribed time period without unreasonable

effort or expense because additional time is required to complete the preparation of the Company’s financial statements in time

for filing. The Company anticipates filing its Form 20-F on or before the fifteenth calendar day following the prescribed due date.

PART

IV — OTHER INFORMATION

| (1) |

Name

and telephone number of person to contact in regard to this notification |

| Bin

Fu |

|

(86)

0510 |

|

81805788 |

| (Name) |

|

(Area

Code) |

|

(Telephone

Number) |

| (2) |

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment

Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s)

been filed? If answer is no, identify report(s). |

Yes

☒ No ☐

| (3) |

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be

reflected by the earnings statements to be included in the subject report or portion thereof? |

Yes

☒ No ☐

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why

a reasonable estimate of the results cannot be made.

Part

IV. (3) Anticipated Significant Changes in Results of Operations

We

anticipate reporting the following significant changes in the results of operations from the same period of the last fiscal year:

Revenue

Revenue

decreased by 82% from $11.3 million for the fiscal year 2023 to $2.0 million for the fiscal year 2024. The decrease in revenue was primarily

due to an 80% decrease in revenue generated from online education services from $10.2 million for the fiscal year 2023 to $2.0

million for the fiscal year 2024. The decrease in the revenue from the online education services was primarily due to a decrease in online

VIP membership revenue from $8.0 million in the fiscal year 2023 to $6.4 million in the fiscal year 2024, as a result of the intensified

competition in the vocational education market in China. Also, in the fiscal year 2023 and 2024, certain competitors provided

students with free access to their online education platforms due to the long-term impact of COVID-19, resulting in a decrease in

the number of fee-paying members of the VIE and a decrease in the revenue generated from the VIE’s online education services.

Cost

of Revenue

Cost

of revenue decreased from $27.3 million in the fiscal year 2023 to $1.8 million in the fiscal year 2024, representing a decrease of

$25.5 million, or 93%. The decrease of cost of revenue was mainly caused by a decrease of the impairment of intangible asset for the

amount of $8.1 million, the impairment for property, plant and equipment for the amount of $5.7 million, the

amortization expense for the amount of $5.8million, the depreciation expenses of server hardware for the amount of $3.9 million, and

the maintenance service fee for the amount of $1.4 million,

Operating

Expenses

Operating

expenses decreased from $4.1 million for the fiscal year ended March 31, 2023 to $2.0 million for the fiscal year ended March

31, 2024, representing an decrease of $2.1 million, or 51%. Operating expenses primarily consisted of sales and marketing expenses and

general and administrative expenses.

Sales

and marketing expenses decreased from $0.5 million for the fiscal year ended March 31, 2023 to $0.2 million for the fiscal year

ended March 31, 2024. The decrease was mainly because a $0.2 million decrease of the promotion fee.

General

and administrative expenses decreased by 52% to $1.8 million for the fiscal year 2024 from $3.7 million for the fiscal year 2023. The

decrease was mainly because the cost saving policy that the Company decreased of management’s salary and bonus.

Investment

Income, Net

Net

investment income increased from an income of $0.7 million for the fiscal year 2023 to $1.7 million for the fiscal year 2024, representing

an increase of $1.0 million, or 135%. The increase was primarily because the VIE’s investments in Fujian Pingtan Ocean Fishery

Corporation.

Other

Income

Net

other income was $0.7 million for the fiscal year ended March 31, 2024, compared with net other income of $0.2 million for the fiscal

year ended March 31, 2023, and a sharp increase due to the cancelation payment of the management compensation.

Income

(Loss) Before Tax

Loss

before tax was $4.6 million for the fiscal year 2024, compared with loss before tax of $20.5 million for the fiscal year 2023.

Net

Profit (Loss)

As

a result of the foregoing, we had a net loss of $4.6 million for the fiscal year 2024, representing a change of $16.3 million from a

net loss of $20.9 million for the fiscal year 2023.

Skillful

Craftsman Education Technology Limited

(Name

of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

August 13, 2024 |

By |

/s/

Bin Fu |

| |

|

Bin

Fu |

| |

|

Chief

Executive Officer and Chairman of the Board of Directors |

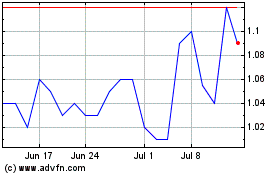

Skillful Craftsman Educa... (NASDAQ:EDTK)

Historical Stock Chart

From Dec 2024 to Dec 2024

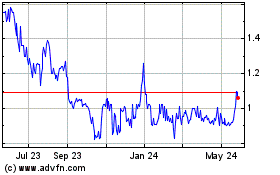

Skillful Craftsman Educa... (NASDAQ:EDTK)

Historical Stock Chart

From Dec 2023 to Dec 2024