Electra Announces $20 Million Strategic Investment Proposal

10 September 2024 - 9:30PM

Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V:

ELBM) (“

Electra” or the

“

Company”) today provided an update on its

financing strategy for North America’s first battery grade cobalt

refinery, announcing that it has received a non-binding term sheet

for a $20 million prepayment facility from an arms-length strategic

player in the battery materials sector. Several other financing

discussions have been advancing alongside this proposal to raise

the $60 million for project completion plus amounts for working

capital and operations during the construction and commissioning

phases.

Electra CEO, Trent Mell, commented, "Interest

from sophisticated strategic partners indicates strong confidence

in Electra, and with the continued support of investors,

governments and downstream customers, we are well-positioned to

realize our vision of a North American battery materials supply

chain."

The strategic investment announced today is

equal to the $20 million award Electra received from the U.S.

Department of Defense pursuant to Title III of the Defense

Production Act (DPA) last month. More than 90% of battery grade

cobalt is produced by Chinese companies today, and none in North

America.

Electra owns a low carbon, permitted

hydrometallurgical refining complex north of Toronto that

historically produced nickel and cobalt. The facility is being

expanded and modified to provide North America battery makers with

a domestic source of cobalt sulfate for lithium-ion batteries. The

refining complex was also the location of a year-long battery

recycling demonstration plant in 2023. The Company estimates that

an additional $60 million in capital costs are required to complete

the $250 million cobalt facility.

If consummated, the investment would be

comprised of an immediate investment of $10 million and a follow-on

investment of $10 million during the refinery’s commissioning

phase. As partial compensation, Electra would provide marketing

rights for a portion of future production until the facility is

repaid. This investment is intended to provide working capital and

general and administrative coverage over and above the remaining

construction costs. The transaction is subject to conditions

precedent, including developments in parallel financing discussions

that are well advanced.

Electra continues to make steady progress in

securing other non-dilutive sources of financing, including

government programs, to complete the construction and commissioning

of the refinery. Once fully commissioned, Electra’s facility could

produce up to 6,500 tonnes of cobalt per year, which could support

the production of over 1 million EVs annually. LG Energy Solution

intends to purchase up to 80% of capacity over the first five years

of operation.

At this time, the strategic investment term

sheet is a non-binding proposal, and a confirmation of the proposal

was received on September 3, 2024. The progression to binding

documentation is subject to finalization of diligence and

negotiation of customary closing materials and is progressing in

line with all parties’ agreed timeline. Discussions with other

strategic partners are expected to continue until today’s proposal

becomes binding.

Electra’s near-term priority is to recommission

and expand its low carbon Canadian cobalt refinery, which has

already been derisked through the delivery of long lead equipment

and the operation of a black mass demonstration plant in the legacy

refinery. The Company’s longer-term vision includes nickel

production and battery recycling, thereby onshoring additional

critical mineral refining processes needed for the North American

electric vehicle battery supply chain.

Company Update

The Company also announces that in accordance

with its Long-Term Incentive Plan approved by shareholders at its

August 13, 2024 annual general meeting, it has granted an aggregate

of C$96,250 in deferred share units (DSUs) in connection with

Directors remuneration, which is issued in lieu of cash

compensation otherwise payable. DSUs vest after twelve months but

may not be exercised until a Director ceases to serve the Company.

DSU grants ensure alignment of interests with the Company’s

shareholders.

About Electra Battery

Materials

Electra is a processor of low-carbon,

ethically-sourced battery materials. Currently focused on

developing North America’s only cobalt sulfate refinery, Electra is

executing a phased strategy to onshore the electric vehicle supply

chain and provide a North American solution for EV battery

materials refining. In addition to building North America’s only

cobalt sulfate refinery, its strategy includes integrating black

mass recycling, potential cobalt sulfate processing in Bécancour,

Quebec, and exploring nickel sulfate production potential within

North America. For more information, please visit

www.ElectraBMC.com.

Contacts

Heather SmilesVice President, Investor Relations & Corporate

Development Electra Battery Materialsinfo@ElectraBMC.com

1.416.900.3891

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Note Regarding

Forward-Looking StatementsThis news release may contain

forward-looking statements and forward-looking information

(together, “forward-looking statements”) within the meaning of

applicable securities laws and the United States Private Securities

Litigation Reform Act of 1995. All statements, other than

statements of historical facts, are forward-looking statements.

Generally, forward-looking statements can be identified by the use

of terminology such as “plans”, “expects”, “estimates”, “intends”,

“anticipates”, “believes” or variations of such words, or

statements that certain actions, events or results “may”, “could”,

“would”, “might”, “occur” or “be achieved”. Forward-looking

statements are based on certain assumptions, and involve risks,

uncertainties and other factors that could cause actual results,

performance, and opportunities to differ materially from those

implied by such forward-looking statements. Factors that could

cause actual results to differ materially from these

forward-looking statements are set forth in the management

discussion and analysis and other disclosures of risk factors for

Electra Battery Materials Corporation, filed on SEDAR+ at

www.sedarplus.com and with on EDGAR at www.sec.gov. Other factors

that could lead actual results to differ materially include changes

with respect to government or investor expectations or actions as

compared to communicated intentions, and general macroeconomic and

other trends that can affect levels of government or private

investment. Although the Company believes that the information and

assumptions used in preparing the forward-looking statements are

reasonable, undue reliance should not be placed on these

statements, which only apply as of the date of this news release,

and no assurance can be given that such events will occur in the

disclosed times frames or at all. Except where required by

applicable law, the Company disclaims any intention or obligation

to update or revise any forward-looking statement, whether as a

result of new information, future events or otherwise.

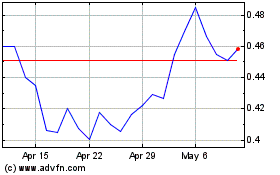

Electra Battery Materials (NASDAQ:ELBM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Electra Battery Materials (NASDAQ:ELBM)

Historical Stock Chart

From Nov 2023 to Nov 2024