Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V:

ELBM) (“

Electra” or the

“

Company”) is pleased to announce that it has

received a non-binding term sheet from the holders of the existing

secured notes issued by the Company on February 13, 2023 (the

“

Existing Notes”) for a financing transaction (the

“

Financing”) which would result in gross proceeds

to the Company of US$5 million. These funds will enable the Company

to initiate certain early works and winter preparations at the

Ontario Refinery project site in Temiskaming Shores, Ontario, as

well as being used for general corporate purposes.

“Given our objective of resuming construction

shortly upon completing the project financing package, part of our

preparations for the final phase of construction of North America’s

only cobalt sulfate refinery is initiating some early works before

winter sets in,” said Electra CEO, Trent Mell. “This liquidity

strengthens our balance sheet as we work to complete this package,

and we are grateful for our lenders’ ongoing support of our

business plan.”

“Reducing heavy reliance on China in the EV

materials supply chain continues to be a focus for North American

policymakers,” Mell continued. “Electra’s Refinery is expected to

be the first of its kind in North America, with the potential, when

operating at full utilization, to produce enough cobalt sulfate for

one million electric vehicles each year.”

The Financing will consist of the offer and sale

of secured convertible notes (the “Notes”) in the

principal amount of US$4 million and US$1 million of common shares

(each, a “Share”) at a price of US$0.543 per

Share. The Notes will be issued together with

4,545,454 detachable common share purchase warrants (each, a

“New Warrant”) entitling the holders to acquire an

equivalent number of common shares at a price of C$1.00 per share

for a period of twenty-four months following issuance. The Notes

will rank pari passu to the Existing Notes, will bear interest at a

rate of 12.0% per annum, payable quarterly in cash, and will mature

on November 12, 2027. The Notes will also be guaranteed by

substantially all of the Company’s subsidiaries and will be secured

on a first lien basis by substantially all of the assets of the

Company and its subsidiaries. At the option of the holder, the

Notes will be convertible into common shares at an effective

conversion price of US$0.62445 per share, representing a 15%

premium to the price of the Shares issuable in connection with the

Financing.

Conversion of the Notes and the New Warrants

will be restricted to the extent it will result in a holder owning

more than 9.9% of the outstanding common share capital of the

Company.

The completion of the Financing is subject to a

number of conditions and uncertainties, including the completion of

customary definitive documentation and receipt of any required

regulatory approvals. All securities to be issued in connection

with the Financing will be subject to restrictions on resale in

accordance with applicable securities laws. No finders’ fees or

commissions are payable in connection with the Financing. The term

sheet for the Financing is non-binding, and there is no guarantee

that the Company or the holders of the Existing Notes will complete

the financing on the terms described in this release or on any

other terms.

The securities to be issued have not been

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any

applicable U.S. state securities laws, and may not be offered or

sold in the United States absent registration or an available

exemption from the registration requirement of the U.S. Securities

Act and applicable U.S. state securities laws.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

In connection with completion of the Financing,

the holders of the Existing Notes intend to waive certain existing

events of default regarding the non-payment of interest under the

Existing Notes and failure to register the resale of the common

shares issuable pursuant to the terms of the Existing Notes and the

Existing Warrants (as defined below) and to defer payment of all

outstanding interest amounts until February 15, 2025, at which

point all deferred interest amounts will be payable in cash.

Subject to completion of the Financing and

receipt of any required regulatory approvals, the Company also

intends to the amend the terms of an aggregate of 10,796,054

outstanding share purchase warrants (the “Existing

Warrants”). The Existing Warrants were issued in

connection with the offering of the Existing Notes on February 13,

2023, and are currently exercisable at a price of C$1.00 until

February 13, 2028.

Under the proposed amendments to the Existing

Warrants, the exercise price will be reduced to C$0.85 per Share.

In addition, the Existing Warrants will be amended to include a

revised acceleration clause such that the term of the Existing

Warrants will be reduced to thirty days in the event the closing

price of the common shares on the TSX Venture Exchange exceeds

C$0.85 by twenty percent or more for ten consecutive trading dates,

with the reduced term beginning seven calendar days after such ten

consecutive-trading-day period. Upon the occurrence of an

acceleration event, holders of the Existing Warrants may exercise

the Existing Warrants on a cashless basis, based on the value of

the Existing Warrants at the time of exercise, subject to

compliance with the policies of the TSX Venture Exchange.

About Electra Battery

Materials

Electra is a processor of low-carbon,

ethically-sourced battery materials. Currently focused on

developing North America’s only cobalt sulfate refinery, Electra is

executing a phased strategy to onshore the electric vehicle supply

chain and provide a North American solution for EV battery

materials refining. In addition to building North America’s only

cobalt sulfate refinery, its strategy includes integrating black

mass recycling, potential cobalt sulfate processing in Bécancour,

Quebec, and exploring nickel sulfate production potential within

North America. For more information, please visit

www.ElectraBMC.com.

ContactHeather SmilesVice President, Investor

Relations & Corporate Development Electra Battery

Materialsinfo@ElectraBMC.com 1.416.900.3891

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking

Statements

This news release may contain forward-looking

statements and forward-looking information (together,

“forward-looking statements”) within the meaning of applicable

securities laws and the United States Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, are forward-looking statements, including

statements in this release about the terms of the Financing and

related waivers and changes to the Existing Notes and Existing

Warrants. Generally, forward-looking statements can be identified

by the use of terminology such as “plans”, “expects”, “estimates”,

“intends”, “anticipates”, “believes” or variations of such words,

or statements that certain actions, events or results “may”,

“could”, “would”, “might”, “occur” or “be achieved”.

Forward-looking statements are based on certain assumptions, and

involve risks, uncertainties and other factors that could cause

actual results, performance, and opportunities to differ materially

from those implied by such forward-looking statements. Among the

bases for assumptions with respect to the potential for additional

government funding are discussions and indications of support from

government actors based on certain milestones being achieved.

Factors that could cause actual results to differ materially from

these forward-looking statements are set forth in the management

discussion and analysis and other disclosures of risk factors for

Electra Battery Materials Corporation, filed on SEDAR+ at

www.sedarplus.com and with on EDGAR at www.sec.gov. Other factors

that could lead actual results to differ materially include changes

with respect to government or investor expectations or actions as

compared to communicated intentions, and general macroeconomic and

other trends that can affect levels of government or private

investment. Although the Company believes that the information and

assumptions used in preparing the forward-looking statements are

reasonable, undue reliance should not be placed on these

statements, which only apply as of the date of this news release,

and no assurance can be given that such events will occur in the

disclosed times frames or at all. Except where required by

applicable law, the Company disclaims any intention or obligation

to update or revise any forward-looking statement, whether as a

result of new information, future events or otherwise.

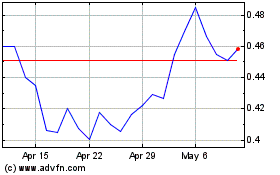

Electra Battery Materials (NASDAQ:ELBM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Electra Battery Materials (NASDAQ:ELBM)

Historical Stock Chart

From Jan 2024 to Jan 2025