0001125376false00011253762023-10-252023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

The Ensign Group, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-33757 | | 33-0861263 |

| | | | | |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 29222 Rancho Viejo Road, Suite 127, | | |

| San Juan Capistrano, | CA | | 92675 |

| | | |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (949) 487-9500

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | ENSG | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 25, 2023 The Ensign Group, Inc. (the Company) issued a press release reporting the financial results of the Company for its third quarter ended September 30, 2023. A copy of the press release is attached to this Current Report as Exhibit 99.1.

The press release includes supplemental “non-GAAP financial measures.” Specifically, the press release refers to Adjusted Net Income, Adjusted Earnings per Share, EBITDA, Adjusted EBITDA, Adjusted EBITDAR, Adjusted EBT and Funds from Operations (FFO) for our real estate segment. Regulation G, Conditions for Use of Non-GAAP Financial Measures, and other provisions of the Securities Exchange Act of 1934, as amended, define and prescribe the conditions for use of certain non-GAAP financial information. EBITDA consists of net income before (a) other (income) expense, net, (b) provisions for income taxes and (c) depreciation and amortization. Adjusted EBITDA consists of net income before (a) other (income) expense, net, (b) provisions for income taxes, (c) depreciation and amortization, (d) stock-based compensation expense, (e) acquisition related costs, (f) costs incurred related to new systems implementation, (g) legal costs and adjustments and (h) gain on business interruption recoveries and sale of assets. Adjusted EBITDAR consists of net income before (a) other (income) expense, net, (b) provisions for income taxes, (c) depreciation and amortization, (d) rent-cost of services, (e) stock-based compensation expense, (f) acquisition related costs, (g) costs incurred related to new systems implementation, (h) legal costs and adjustments and (i) gain on business interruption recoveries and sale of assets. Adjusted EBT consists of (a) income before provision for income taxes, (b) stock-based compensation expense, (c) acquisition related costs, (d) costs incurred related to new systems implementation, (e) legal costs and adjustments, (f) gain on business interruption recoveries and sale of assets, (g) write-off of deferred financing fees and (h) depreciation and amortization of patient base intangible assets. Funds from Operations (FFO) for our real estate segment consists of segment income, excluding depreciation and amortization related to real estate, gains or losses from sales of real estate, insurance recoveries related to real estate and impairment of depreciable real estate assets. The Company believes that the presentation of adjusted net income, adjusted earnings per share, EBITDA, adjusted EBITDA, adjusted EBT and FFO provides important supplemental information to management and investors to evaluate the Company’s operating performance. Adjusted EBITDAR is a financial valuation measure that is not specified in GAAP. This measure is not displayed as a performance measure as it excludes rent expense, which is a normal and recurring operating expense. The Company believes disclosure of adjusted net income, adjusted net income per share, EBITDA, adjusted EBITDA, adjusted EBITDAR, adjusted EBT and FFO has substance because the excluded revenues and expenses are infrequent in nature and are variable in nature, or do not represent current revenues or cash expenditures. A material limitation associated with the use of these measures as compared to the GAAP measures of net income and diluted earnings per share is that they may not be comparable with the calculation of net income and diluted earnings per share for other companies in the Company's industry. These non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. For further information regarding why the Company believes that this non-GAAP measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the Company's periodic filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Report on Form 10-Q. The Company’s periodic filings are available on the SEC's website at www.sec.gov or under the "Financials" link of the Investor Relations section on Ensign’s website at http://www.ensigngroup.net.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| | | |

| Exhibit No. | | Description |

| | | |

| | Press Release of the Company dated October 25, 2023 |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | | | | |

| | | | | |

Dated: October 25, 2023 | THE ENSIGN GROUP, INC. | |

| | By: | /s/ Suzanne D. Snapper | |

| | | Suzanne D. Snapper | |

| | | Chief Financial Officer, Executive Vice President and Director (principal financial officer and accounting officer and duly authorized officer) | |

| |

The Ensign Group Reports Third Quarter 2023 Results;

Raises 2023 Earnings Guidance

Conference Call and Webcast scheduled for tomorrow, October 26, 2023 at 10:00 am PT

SAN JUAN CAPISTRANO, California – October 25, 2023 – The Ensign Group, Inc. (Nasdaq: ENSG), the parent company of the Ensign(TM) group of companies, which provide post-acute healthcare services and invest in the long-term healthcare industry, primarily in skilled nursing and senior living facilities, announced operating results for the third quarter of 2023, reporting GAAP diluted earnings per share of $1.11 and adjusted earnings per share(1) of $1.20 for the quarter ended September 30, 2023.

Highlights Include:

▪GAAP diluted earnings per share for the quarter was $1.11 and adjusted diluted earnings per share(1) was $1.20, an increase of 12.1% and 15.4%, respectively, over the prior year quarter.

▪GAAP net income was $63.9 million and adjusted net income(1) was $69.0 million for the quarter, an increase of 13.7% and 16.6%, respectively, over the prior year quarter.

▪Consolidated GAAP and adjusted revenues for the quarter were $940.8 million, an increase of 22.2% over the prior year quarter.

▪Total skilled services(2) revenue for the quarter was $903.0 million, an increase of 22.1% over the prior year quarter, and total skilled services(2) segment income was $117.8 million, an increase of 15.8% over the prior year quarter.

▪Same store and transitioning occupancy increased by 290 and 270 basis points, respectively, over the prior year quarter.

▪Same store and transitioning combined managed care revenue increased by 13.8% and managed care census increased by 6.6%, over the prior year quarter.

▪Standard Bearer(2) revenue was $21.0 million for the quarter, an increase of 12.0% from prior year quarter and FFO was $13.6 million for the quarter, an increase of 8.7% from the prior year quarter.

(1) See "Reconciliation of GAAP to Non-GAAP Financial Information".

(2) Our Skilled Services and Standard Bearer Segments are defined and outlined in Note 8 on Form 10-Q.

Operating Results

“We are proud to report another strong quarter and are pleased that we have been able to continue to improve our clinical and financial results across our portfolio,” said Barry Port, Ensign’s Chief Executive Officer. “During the quarter we saw continued improvement in occupancies and managed care revenues, which is particularly impressive given persistent labor market pressures and the return of more typical seasonality. More specifically, we were pleased to see same store occupancy of 79.5%, which grew by 290 basis points over the prior year quarter and by 97 basis points sequentially over the second quarter. All of these results are all made possible by the relentless efforts of our caregivers and their continued endurance and strength, all while many of our same store leaders and clinicians were transitioning 51 recently acquired operations. We look forward to even more clinical and financial success during the remainder of the year as our focus is following and protecting the operational principles that got us here,” Port added.

Port continued, “We also continue to build stronger relationships with our managed care partners due to better coordination of care, increased capabilities and strong clinical outcomes. As a result, we saw increased volume in our same store and transitioning combined managed care census and managed care revenue, which increased during the quarter by 6.6% and 13.8%, respectively, over the prior year. As expected, we saw a seasonal decrease to skilled mix during the quarter, however due to our local operators' strong clinical reputations, we are continuing to see elevated skilled mix when compared to pre-covid levels. This continued growth in skilled mix demonstrates the increasing and sustainable demand for skilled post-acute services, including within the context of our managed care patients.”

Mr. Port, added, “Due to our solid results during the quarter, as well as continued strength from our recent acquisitions, we are increasing our annual 2023 earnings guidance to between $4.73 to $4.79 per diluted share, up from $4.70 to $4.78 per diluted share. This new midpoint of our 2023 earnings guidance represents an increase of 15.0% over our 2022 results and is 30.8% higher than our 2021 results. We are also raising our annual revenue guidance to between $3.72 billion and $3.73 billion, up from our previous guidance of $3.69 billion to $3.73 billion. We are excited about the upcoming year and are confident that our partners will continue to manage and innovate through all the lingering challenges on the labor front."

Chad Keetch, Ensign’s Chief Investment Officer and Executive Vice President noted the progress the Company is making with its newly acquired operations. He said, “As we expected, we continued to add to our growing portfolio and are very excited about the six new operations and four real estate assets we added during the quarter and since, bringing the number of operations in our newly acquired bucket to 51. We have been patient and look forward to seeing our discipline paying off as these new operations continue to improve. As a result of skilled services expansions in 2023, occupancy and skilled mix days for the skilled nursing operations in the recently acquired bucket was 77.4% and 26.1%, respectively, for the quarter. When compared to our same store occupancy and skilled mix days of 79.5% and 30.7%, respectively, there is enormous upside in each of these new operations as they continue to transform into “same store” caliber operations. We are very optimistic about the organic growth potential within our existing portfolio as our new acquisitions are already contributing to our results, in many cases ahead of schedule.”

Speaking to the Company’s financial health, Ms. Snapper, Ensign’s Executive Vice President and Chief Financial Officer reported that the Company’s liquidity remains strong with approximately $467.9 million of cash on hand and $593.3 million of available capacity under its line-of-credit. Ms. Snapper also indicated that, “Management’s guidance is based on diluted weighted average common shares outstanding of approximately 57.7 million and a 25.0% tax rate. In addition, the guidance assumes, among other things, normalized health insurance costs, management’s current expectations regarding reimbursement rates and recovery of the COVID-19 pandemic. It also excludes one-time charges, acquisition-related costs and amortization costs related to intangible assets acquired and share-based compensation.”

A discussion of the Company's use of non-GAAP financial measures is set forth below. A reconciliation of net income to adjusted EBT, EBITDA, adjusted EBITDAR, adjusted EBITDA and FFO for our real estate segment, as well as, a reconciliation of GAAP earnings per share, net income to adjusted net income and adjusted net earnings per share appear in the financial data portion of this release. More complete information is contained in the company’s Interim Report on Form 10-Q for the period ended September 30, 2023 which is expected to be filed with the SEC today and can be viewed on the Company’s website at http://www.ensigngroup.net.

Growth and Real Estate Highlights

Mr. Keetch added additional commentary on the Company’s continued acquisition activity. “We continue to see a steady pipeline of new opportunities and are beginning to see the effects of higher interest rates on pricing, with more real estate opportunities coming to market at reasonable prices due to tighter financial markets. We also continue to see evidence that many operators are struggling and, as a result, we still expect there will be lots of opportunities that will arise. However, as we always remind you, we do not set arbitrary growth goals and will remain true to our disciplined acquisition strategy, only growing when we have the right leaders in place and the pricing is right.” Keetch said.

The recent acquisitions include the following operations:

•Ashley River Healthcare, a 125-bed skilled nursing facility located in Charleston, South Carolina;

•The Reserve Healthcare and Rehabilitation, a 135-bed skilled nursing facility located in Hanahan, South Carolina and

•Providence Place, a 45-bed skilled nursing facility located in Kansas City, Kansas.

Standard Bearer also announced the following real estate acquisitions:

•Rehabilitation and Nursing Center of the Rockies, a 96-bed skilled nursing facility located in Fort Collins, Colorado, which will be operated by an independent operating subsidiary of Ensign;

•Belmont Terrace, a 95-bed skilled nursing facility located in Bremerton, Washington, which will be operated by an independent operating subsidiary of Ensign;

•Puget Sound Transitional Care, a 125-bed skilled nursing facility located in Des Moines, Washington which will be operated by an independent operating subsidiary of Ensign; and

•Avamere Rehabilitation at Ridgemont and The Villas at Ridgemont, consisting of 96 licensed skilled nursing beds and 46 independent living units, located in Port Orchard, Washington, which will be operated by a third-party operator.

Ensign's growing portfolio consists of 296 healthcare operations, 26 of which also include senior living operations, across thirteen states. Ensign now owns 112 real estate assets, 82 of which it operates. Keetch noted that Ensign’s overall strategy will continue to include both leasing and acquiring the real estate and that the Company is actively looking for performing and underperforming operations in several states.

“Looking forward, we are poised to grow with over a billion dollars in dry powder for future investments. But more importantly, our local leaders are constantly recruiting future CEOs of our operations and we have a deep bench of CEO’s-in-training that are eagerly preparing for their opportunity to lead. We look forward to actively seeking opportunities to acquire real estate and to lease both well-performing and struggling skilled nursing, senior living and other healthcare related businesses in our current footprint and in a few new states,” Keetch added.

The Company continues to provide additional disclosure on Standard Bearer, which is comprised of 107 properties owned by the Company and leased to 78 affiliated skilled nursing and senior living operations and 30 operations that are leased to third party operators. Keetch noted that each of these properties are subject to triple-net, long-term leases and generated rental revenue of $21.0 million for the quarter, of which $17.0 million was derived from Ensign affiliated operations. Also, for the quarter, Ensign reported $13.6 million in FFO.

The Company paid a quarterly cash dividend of $0.0575 per share of Ensign common stock. Ms. Snapper noted that the Company’s liquidity remains strong and that the Company plans to continue its long history of paying dividends into the future, noting that in December of 2022 that the Company increased the annual dividend for the 21th consecutive year.

Conference Call

A live webcast will be held Thursday, October 26, 2023 at 10:00 a.m. Pacific time (1:00 p.m. Eastern time) to discuss Ensign’s third quarter of 2023 financial results. To listen to the webcast, or to view any financial or statistical information required by SEC Regulation G, please visit the Investors Relations section of Ensign’s website at http://investor.ensigngroup.net. The webcast will be recorded, and will be available for replay via the website until 5:00 p.m. Pacific time on Friday, November 24, 2023.

About Ensign™

The Ensign Group, Inc.'s independent operating subsidiaries provide a broad spectrum of skilled nursing and senior living services, physical, occupational and speech therapies and other rehabilitative and healthcare services at 296 healthcare facilities in Arizona, California, Colorado, Idaho, Iowa, Kansas, Nebraska, Nevada, South Carolina, Texas, Utah, Washington and Wisconsin. As part of its investment strategy, the Company will also acquire, lease and own healthcare real estate to service the post-acute care continuum through acquisition and investment opportunities in healthcare properties. Ensign’s new business venture operating subsidiaries also offer several other post-acute-related services, including mobile x-ray, non-emergency transportation services, long-term care pharmacy and other consulting services also across several states. Each of these operations is operated by a separate, independent operating subsidiary that has its own management, employees and assets. References herein to the consolidated "Company" and "its" assets and activities, as well as the use of the terms "we," "us," "its" and similar verbiage, are not meant to imply that The Ensign Group, Inc. has direct operating assets, employees or revenue, or that any of the facilities, the Service Center, Standard Bearer or the captive insurance subsidiary are operated by the same entity. More information about Ensign is available at http://www.ensigngroup.net.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This press release contains, and the related conference call and webcast will include, forward-looking statements that are based on management’s current expectations, assumptions and beliefs about its business, financial performance, operating results, the industry in which it operates and other future events. Forward-looking statements can often be identified by words such as "anticipates," "expects," "intends," "plans," "predicts," "believes," "seeks," "estimates," "may," "will," "should," "would," "could," "potential," "continue," "ongoing," similar expressions, and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding growth prospects, future operating and financial performance, and acquisition activities. They are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to materially and adversely differ from those expressed in any forward-looking statement.

These risks and uncertainties relate to the Company’s business, its industry and its common stock and include: reduced prices and reimbursement rates for its services; its ability to acquire, develop, manage or improve operations, its ability to manage its increasing borrowing costs as it incurs additional indebtedness to fund the acquisition and development of operations; its ability to access capital on a cost-effective basis to continue to successfully implement its growth strategy; its operating margins and profitability could suffer if it is unable to grow and manage effectively its increasing number of operations; competition from other companies in the acquisition, development and operation of facilities; its ability to defend claims and lawsuits, including professional liability claims alleging that our services resulted in personal injury, and other regulatory-related claims; and the application of existing or proposed government regulations, or the adoption of new laws and regulations, that could limit its business operations, require it to incur significant expenditures or limit its ability to relocate its operations if necessary. Additionally, our business and operations in 2023 continue to be impacted by the unprecedented nature of the changes in the regulations and environment, we are unable to predict the full extent and duration of the financial impact of these changes on our business, financial condition and results of operations. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s periodic filings with the Securities and Exchange Commission, including its Form 10-Q and 10-K, for a more complete discussion of the risks and other factors that could affect Ensign’s business, prospects and any forward-looking statements. Except as required by the federal securities laws, Ensign does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changing circumstances or any other reason after the date of this press release.

Contact Information

Investor/Media Relations, The Ensign Group, Inc., (949) 487-9500, ir@ensigngroup.net.

SOURCE: The Ensign Group, Inc.

THE ENSIGN GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| | | | | |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| | | | | | | | | |

| (In thousands, except per share data) | | |

| REVENUE | | | | | | | | | |

| Service revenue | $ | 935,324 | | | $ | 765,883 | | | $ | 2,733,343 | | | $ | 2,203,386 | | | |

| Rental revenue | 5,467 | | | 4,122 | | | 15,634 | | | 12,550 | | | |

| TOTAL REVENUE | $ | 940,791 | | | $ | 770,005 | | | $ | 2,748,977 | | | $ | 2,215,936 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Expense: | | | | | | | | | |

| Cost of services | 741,069 | | | 601,623 | | | 2,160,080 | | | 1,720,905 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Rent—cost of services | 50,357 | | | 38,907 | | | 146,754 | | | 111,897 | | | |

| General and administrative expense | 51,127 | | | 39,247 | | | 156,448 | | | 116,030 | | | |

| Depreciation and amortization | 18,446 | | | 15,941 | | | 53,154 | | | 45,475 | | | |

| TOTAL EXPENSES | $ | 860,999 | | | $ | 695,718 | | | $ | 2,516,436 | | | $ | 1,994,307 | | | |

| Income from operations | 79,792 | | | 74,287 | | | 232,541 | | | 221,629 | | | |

| Other income (expense): | | | | | | | | | |

| Interest expense | (2,024) | | | (2,108) | | | (6,083) | | | (6,864) | | | |

| Other income (expense) | 4,277 | | | 276 | | | 15,022 | | | (3,127) | | | |

| Other income (expense), net | $ | 2,253 | | | $ | (1,832) | | | $ | 8,939 | | | $ | (9,991) | | | |

| Income before provision for income taxes | 82,045 | | | 72,455 | | | 241,480 | | | 211,638 | | | |

| Provision for income taxes | 18,077 | | | 16,213 | | | 53,453 | | | 47,505 | | | |

| | | | | | | | | |

| | | | | | | | | |

| NET INCOME | $ | 63,968 | | | $ | 56,242 | | | $ | 188,027 | | | $ | 164,133 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Less: net income (loss) attributable to noncontrolling interests | 105 | | | 63 | | | 319 | | | (77) | | | |

| Net income attributable to The Ensign Group, Inc. | $ | 63,863 | | | $ | 56,179 | | | $ | 187,708 | | | $ | 164,210 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| NET INCOME PER SHARE ATTRIBUTABLE TO THE ENSIGN GROUP INC. | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Basic | $ | 1.14 | | | $ | 1.02 | | | $ | 3.38 | | | $ | 3.00 | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted | $ | 1.11 | | | $ | 0.99 | | | $ | 3.28 | | | $ | 2.89 | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | | | | | | | | | |

| Basic | 55,829 | | | 54,882 | | | 55,582 | | | 54,819 | | | |

| Diluted | 57,337 | | | 56,761 | | | 57,245 | | | 56,829 | | | |

THE ENSIGN GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| |

| | | |

| | | |

| (In thousands) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 467,870 | | | $ | 316,270 | |

| Accounts receivable—less allowance for doubtful accounts of $9,422 and $7,802 at September 30, 2023 and December 31, 2022, respectively | 472,123 | | | 408,432 | |

| | | |

| Investments—current | 16,433 | | | 15,441 | |

| | | |

| Prepaid expenses and other current assets | 37,921 | | | 40,982 | |

| | | |

| | | |

| Total current assets | 994,347 | | | 781,125 | |

| Property and equipment, net | 1,067,902 | | | 992,010 | |

| Right-of-use assets | 1,773,751 | | | 1,450,995 | |

| Insurance subsidiary deposits and investments | 86,818 | | | 67,652 | |

| | | |

| Deferred tax assets | 39,968 | | | 39,643 | |

| Restricted and other assets | 35,979 | | | 37,291 | |

| Intangible assets, net | 6,347 | | | 6,437 | |

| Goodwill | 76,869 | | | 76,869 | |

| | | |

| | | |

| TOTAL ASSETS | $ | 4,081,981 | | | $ | 3,452,022 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 77,091 | | | $ | 77,087 | |

| | | |

| Accrued wages and related liabilities | 311,509 | | | 289,810 | |

| Lease liabilities—current | 80,956 | | | 65,796 | |

| Accrued self-insurance liabilities—current | 50,197 | | | 48,187 | |

| | | |

| | | |

| Other accrued liabilities | 148,128 | | | 97,309 | |

| Current maturities of long-term debt | 3,916 | | | 3,883 | |

| | | |

| Total current liabilities | 671,797 | | | 582,072 | |

| Long-term debt—less current maturities | 146,453 | | | 149,269 | |

| Long-term lease liabilities—less current portion | 1,657,955 | | | 1,355,113 | |

| Accrued self-insurance liabilities—less current portion | 97,502 | | | 83,495 | |

| Other long-term liabilities | 42,832 | | | 33,273 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total equity | 1,465,442 | | | 1,248,800 | |

| TOTAL LIABILITIES AND EQUITY | $ | 4,081,981 | | | $ | 3,452,022 | |

THE ENSIGN GROUP, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

The following table presents selected data from our condensed consolidated statements of cash flows for the periods presented:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| |

| 2023 | | 2022 |

| | | |

| NET CASH PROVIDED BY/(USED IN): | (In thousands) |

| Operating activities | $ | 291,397 | | | $ | 222,337 | |

| Investing activities | (137,754) | | | (143,771) | |

| Financing activities | (2,043) | | | (31,903) | |

| | | |

| Net increase in cash and cash equivalents | 151,600 | | | 46,663 | |

| Cash and cash equivalents beginning of period | 316,270 | | | 262,201 | |

| | | |

| | | |

| Cash and cash equivalents at end of period | $ | 467,870 | | | $ | 308,864 | |

THE ENSIGN GROUP, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands, except per share data)

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME

The following table reconciles net income to Non-GAAP net income for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income attributable to The Ensign Group, Inc. | $ | 63,863 | | | $ | 56,179 | | | $ | 187,708 | | | $ | 164,210 | |

| | | | | | | |

| | | | | | | |

| Non-GAAP adjustments | | | | | | | |

| | | | | | | |

| | | | | | | |

Stock-based compensation expense(a) | 7,237 | | | 5,898 | | | 22,691 | | | 16,681 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of services - gain on business interruption recoveries and sale of assets | (259) | | | (900) | | | (1,009) | | | (3,467) | |

| | | | | | | |

Cost of services - legal adjustments(b) | — | | | 859 | | | (818) | | | 4,212 | |

Cost of services - acquisition related costs(c) | 150 | | | 245 | | | 722 | | | 416 | |

Interest expense - write-off of deferred financing fees(d) | — | | | — | | | — | | | 566 | |

Depreciation and amortization - patient base(e) | 135 | | | 86 | | | 182 | | | 213 | |

| | | | | | | |

General and administrative - legal costs (f) | 2,783 | | | — | | | 2,783 | | | — | |

| General and administrative - costs incurred related to new systems implementation | — | | | 321 | | | 875 | | | 390 | |

| | | | | | | |

| | | | | | | |

Provision for income taxes on Non-GAAP adjustments(g) | (4,946) | | | (3,528) | | | (13,274) | | | (10,225) | |

| Non-GAAP Income | $ | 68,963 | | | $ | 59,160 | | | $ | 199,860 | | | $ | 172,996 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Average number of diluted shares outstanding | 57,337 | | | 56,761 | | | 57,245 | | | 56,829 | |

| | | | | | | |

| Diluted Earnings Per Share | | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income | $ | 1.11 | | | $ | 0.99 | | | $ | 3.28 | | | $ | 2.89 | |

| | | | | | | |

| Adjusted Diluted Earnings Per Share | | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income | $ | 1.20 | | | $ | 1.04 | | | $ | 3.49 | | | $ | 3.04 | |

| | | | | | | |

| Footnotes: | | | | | | | |

| | | | |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| (a) Represents stock-based compensation expense incurred. | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cost of services | $ | 5,053 | | | $ | 3,893 | | | $ | 15,271 | | | $ | 10,938 | |

| General and administrative | 2,184 | | | 2,005 | | | 7,420 | | | 5,743 | |

| Total Non-GAAP adjustment | $ | 7,237 | | | $ | 5,898 | | | $ | 22,691 | | | $ | 16,681 | |

| | | | | | | |

| | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

|

| (b) Legal adjustments relate to findings attributable to our ancillary services subsidiary, which includes the portion attributable to non-controlling interest. |

| (c) Represents costs incurred to acquire operations that are not capitalizable. |

| (d) Represents the write-off of deferred financing fees associated with the amendment of the credit facility. |

| (e) Included in depreciation and amortization are amortization expenses related to patient base intangible assets at newly acquired skilled nursing and senior living facilities. |

| (f) Legal costs incurred in connection with the medical directors related matter. |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

|

|

| | | | | | | |

|

| | | | | | | |

| | | | |

|

|

| (g) Represents an adjustment to the provision for income tax to our historical year to date effective tax rate of 25.0%. |

|

| | |

| | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

THE ENSIGN GROUP, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands)

The table below reconciles net income to EBITDA, Adjusted EBITDA and Adjusted EBITDAR for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | |

| 2023 | | 2022 | | 2023 | | 2022 |

| Consolidated Statements of Income Data: | | | | | | | |

| Net income | $ | 63,968 | | | $ | 56,242 | | | $ | 188,027 | | | $ | 164,133 | |

| Less: net income (loss) attributable to noncontrolling interests | 105 | | | 63 | | | 319 | | | (77) | |

| | | | | | | |

| Add: Other (income) expense, net | (2,253) | | | 1,832 | | | (8,939) | | | 9,991 | |

| Provision for income taxes | 18,077 | | | 16,213 | | | 53,453 | | | 47,505 | |

| Depreciation and amortization | 18,446 | | | 15,941 | | | 53,154 | | | 45,475 | |

| | | | | | | |

| | | | | | | |

| EBITDA | $ | 98,133 | | | $ | 90,165 | | | $ | 285,376 | | | $ | 267,181 | |

| Adjustments to EBITDA: | | | | | | | |

| Stock-based compensation expense | 7,237 | | | 5,898 | | | 22,691 | | | 16,681 | |

| | | | | | | |

Legal costs and adjustments(a) | 2,783 | | | 859 | | | 1,965 | | | 4,212 | |

| Gain on business interruption recoveries and sale of assets | (259) | | | (900) | | | (1,009) | | | (3,467) | |

| | | | | | | |

Acquisition related costs(b) | 150 | | | 245 | | | 722 | | | 416 | |

| | | | | | | |

| Costs incurred related to new systems implementation | — | | | 321 | | | 875 | | | 390 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| ADJUSTED EBITDA | $ | 108,044 | | | $ | 96,588 | | | $ | 310,620 | | | $ | 285,413 | |

| Rent—cost of services | 50,357 | | | 38,907 | | | 146,754 | | | 111,897 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| ADJUSTED EBITDAR | $ | 158,401 | | | | | $ | 457,374 | | | |

| | | | | | | |

| | | | | | | |

(a) Legal costs incurred in connection with the medical directors related matter. Legal adjustments relate to findings attributable to our ancillary services subsidiary, which excludes the portion attributable to non-controlling interests.

(b) Costs incurred to acquire operations that are not capitalizable.

THE ENSIGN GROUP, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(In thousands, except per share data)

The table below reconciles income before provision for income taxes to Adjusted EBT for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| | | | | | | | | |

Consolidated Statements of Income Data: | (In thousands) | | |

| Income before provision for income taxes | $ | 82,045 | | | $ | 72,455 | | | $ | 241,480 | | | $ | 211,638 | | | |

| | | | | | | | | |

| Stock-based compensation expense | 7,237 | | | 5,898 | | | 22,691 | | | 16,681 | | | |

| | | | | | | | | |

Legal costs and adjustments(a) | 2,783 | | | 859 | | | 1,965 | | | 4,485 | | | |

| Gain on business interruption recoveries and sale of assets | (259) | | | (900) | | | (1,009) | | | (3,467) | | | |

| | | | | | | | | |

| | | | | | | | | |

Write-off of deferred financing fees(b) | — | | | — | | | — | | | 566 | | | |

Acquisition related costs(c) | 150 | | | 245 | | | 722 | | | 416 | | | |

| Costs incurred related to new systems implementation | — | | | 321 | | | 875 | | | 390 | | | |

Depreciation and amortization - patient base(d) | 135 | | | 86 | | | 182 | | | 213 | | | |

| ADJUSTED EBT | $ | 92,091 | | | $ | 78,964 | | | $ | 266,906 | | | $ | 230,922 | | | |

(a) Legal costs incurred in connection with the medical directors related matter. Legal adjustments relate to findings attributable to our ancillary services subsidiary, which includes the portion attributable to non-controlling interests.

(b) Represents the write-off of deferred financing fees associated with the amendment of the credit facility.

(c) Costs incurred to acquire operations that are not capitalizable.

(d) Included in depreciation and amortization are amortization expenses related to patient base intangible assets at newly acquired skilled nursing and senior living facilities.

THE ENSIGN GROUP, INC.

UNAUDITED SELECT PERFORMANCE INDICATORS

The following tables summarize our selected performance indicators for our skilled services segment along with other statistics, for each of the dates or periods presented: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| | 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

| TOTAL FACILITY RESULTS: | (Dollars in thousands) |

| Skilled services revenue | $ | 902,967 | | | $ | 739,318 | | | $ | 163,649 | | | 22.1 | % |

| Number of facilities at period end | 258 | | | 222 | | | 36 | | | 16.2 | % |

| Number of campuses at period end* | 26 | | | 26 | | | — | | | — | % |

| Actual patient days | 2,190,540 | | | 1,846,699 | | | 343,841 | | | 18.6 | % |

| Occupancy percentage — Operational beds | 78.9 | % | | 75.7 | % | | | | 3.2 | % |

| Skilled mix by nursing days | 29.1 | % | | 31.6 | % | | | | (2.5) | % |

| Skilled mix by nursing revenue | 48.4 | % | | 51.6 | % | | | | (3.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| | 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

SAME FACILITY RESULTS:(1) | (Dollars in thousands) |

| Skilled services revenue | $ | 692,257 | | | $ | 649,690 | | | $ | 42,567 | | | 6.6 | % |

| Number of facilities at period end | 189 | | | 189 | | | — | | | — | % |

| Number of campuses at period end* | 24 | | | 24 | | | — | | | — | % |

| Actual patient days | 1,660,683 | | | 1,596,942 | | | 63,741 | | | 4.0 | % |

| Occupancy percentage — Operational beds | 79.5 | % | | 76.6 | % | | | | 2.9 | % |

| Skilled mix by nursing days | 30.7 | % | | 33.0 | % | | | | (2.3) | % |

| Skilled mix by nursing revenue | 49.8 | % | | 53.1 | % | | | | (3.3) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

TRANSITIONING FACILITY RESULTS:(2) | (Dollars in thousands) |

| Skilled services revenue | $ | 62,979 | | | $ | 59,773 | | | $ | 3,206 | | | 5.4 | % |

| Number of facilities at period end | 22 | | | 22 | | | — | | | — | % |

| Number of campuses at period end* | 1 | | | 1 | | | — | | | — | % |

| Actual patient days | 165,645 | | | 158,856 | | | 6,789 | | | 4.3 | % |

| Occupancy percentage — Operational beds | 76.2 | % | | 73.5 | % | | | | 2.7 | % |

| Skilled mix by nursing days | 20.0 | % | | 23.1 | % | | | | (3.1) | % |

| Skilled mix by nursing revenue | 36.1 | % | | 40.5 | % | | | | (4.4) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

RECENTLY ACQUIRED FACILITY RESULTS:(3) | (Dollars in thousands) |

| Skilled services revenue | $ | 147,731 | | | $ | 29,855 | | | $ | 117,876 | | | NM |

| Number of facilities at period end | 47 | | | 11 | | | 36 | | | NM |

| Number of campuses at period end* | 1 | | | 1 | | | — | | | NM |

| Actual patient days | 364,212 | | | 90,901 | | | 273,311 | | | NM |

| Occupancy percentage — Operational beds | 77.4 | % | | 65.6 | % | | | | NM |

| Skilled mix by nursing days | 26.1 | % | | 22.6 | % | | | | NM |

| Skilled mix by nursing revenue | 46.9 | % | | 39.3 | % | | | | NM |

* Campus represents a facility that offers both skilled nursing and senior living services. Revenue and expenses related to skilled nursing and senior living services have been allocated and recorded in the respective operating segment.

(1)Same Facility results represent all facilities purchased prior to January 1, 2020.

(2)Transitioning Facility results represent all facilities purchased from January 1, 2020 to December 31, 2021.

(3)Recently Acquired Facility (Acquisitions) results represent all facilities purchased on or subsequent to January 1, 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| | 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

| TOTAL FACILITY RESULTS: | (Dollars in thousands) |

| Skilled services revenue | $ | 2,638,090 | | | $ | 2,128,567 | | | $ | 509,523 | | | 23.9 | % |

| Number of facilities at period end | 258 | | | 222 | | | 36 | | | 16.2 | % |

| Number of campuses at period end* | 26 | | | 26 | | | — | | | — | % |

| Actual patient days | 6,363,107 | | | 5,287,690 | | | 1,075,417 | | | 20.3 | % |

| Occupancy percentage — Operational beds | 78.3 | % | | 75.0 | % | | | | 3.3 | % |

| Skilled mix by nursing days | 30.7 | % | | 32.1 | % | | | | (1.4) | % |

| Skilled mix by nursing revenue | 50.6 | % | | 52.3 | % | | | | (1.7) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| | 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

SAME FACILITY RESULTS:(1) | (Dollars in thousands) |

| Skilled services revenue | $ | 2,058,291 | | | $ | 1,909,387 | | | $ | 148,904 | | | 7.8 | % |

| Number of facilities at period end | 189 | | | 189 | | | — | | | — | % |

| Number of campuses at period end* | 24 | | | 24 | | | — | | | — | % |

| Actual patient days | 4,895,304 | | | 4,680,168 | | | 215,136 | | | 4.6 | % |

| Occupancy percentage — Operational beds | 78.9 | % | | 75.5 | % | | | | 3.4 | % |

| Skilled mix by nursing days | 32.2 | % | | 33.1 | % | | | | (0.9) | % |

| Skilled mix by nursing revenue | 51.8 | % | | 53.4 | % | | | | (1.6) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

TRANSITIONING FACILITY RESULTS:(2) | (Dollars in thousands) |

| Skilled services revenue | $ | 186,948 | | | $ | 171,428 | | | $ | 15,520 | | | 9.1 | % |

| Number of facilities at period end | 22 | | | 22 | | | — | | | — | % |

| Number of campuses at period end* | 1 | | | 1 | | | — | | | — | % |

| Actual patient days | 489,310 | | | 462,848 | | | 26,462 | | | 5.7 | % |

| Occupancy percentage — Operational beds | 76.0 | % | | 72.1 | % | | | | 3.9 | % |

| Skilled mix by nursing days | 21.8 | % | | 23.4 | % | | | | (1.6) | % |

| Skilled mix by nursing revenue | 38.9 | % | | 41.8 | % | | | | (2.9) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 | | Change | | % Change |

| | | | | | | |

RECENTLY ACQUIRED FACILITY RESULTS:(3) | (Dollars in thousands) |

| Skilled services revenue | $ | 392,851 | | | $ | 47,752 | | | $ | 345,099 | | | NM |

| Number of facilities at period end | 47 | | | 11 | | | 36 | | | NM |

| Number of campuses at period end* | 1 | | | 1 | | | — | | | NM |

| Actual patient days | 978,493 | | | 144,674 | | | 833,819 | | | NM |

| Occupancy percentage — Operational beds | 76.4 | % | | 69.1 | % | | | | NM |

| Skilled mix by nursing days | 27.5 | % | | 28.0 | % | | | | NM |

| Skilled mix by nursing revenue | 49.7 | % | | 45.8 | % | | | | NM |

* Campus represents a facility that offers both skilled nursing and senior living services. Revenue and expenses related to skilled nursing and senior living services have been allocated and recorded in the respective operating segment.

(1)Same Facility results represent all facilities purchased prior to January 1, 2020.

(2)Transitioning Facility results represent all facilities purchased from January 1, 2020 to December 31, 2021.

(3)Recently Acquired Facility (Acquisitions) results represent all facilities purchased on or subsequent to January 1, 2022.

THE ENSIGN GROUP, INC.

SKILLED NURSING AVERAGE DAILY REVENUE RATES AND

PERCENT OF SKILLED NURSING REVENUE AND DAYS BY PAYOR

(Unaudited)

The following table reflects the change in skilled nursing average daily revenue rates by payor source, excluding services that are not covered by the daily rate(1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| | Same Facility | | Transitioning | | Acquisitions | | Total |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | |

| SKILLED NURSING AVERAGE DAILY REVENUE RATES |

| Medicare | $ | 721.35 | | | $ | 684.58 | | | $ | 699.44 | | | $ | 669.29 | | | $ | 800.93 | | | $ | 652.66 | | | $ | 735.66 | | | $ | 682.41 | |

| Managed care | 544.85 | | | 511.35 | | | 539.53 | | | 487.16 | | | 560.44 | | | 422.21 | | | 546.36 | | | 508.13 | |

| Other skilled | 584.77 | | | 566.00 | | | 518.59 | | | 514.55 | | | 433.72 | | | 425.91 | | | 562.61 | | | 552.31 | |

| Total skilled revenue | 615.02 | | | 593.71 | | | 612.82 | | | 587.23 | | | 663.54 | | | 510.11 | | | 622.12 | | | 590.36 | |

| Medicaid | 277.82 | | | 258.54 | | | 274.44 | | | 262.17 | | | 263.95 | | | 236.02 | | | 275.09 | | | 257.57 | |

| Private and other payors | 263.19 | | | 251.48 | | | 251.08 | | | 244.55 | | | 267.56 | | | 180.79 | | | 262.97 | | | 248.01 | |

| Total skilled nursing revenue | $ | 379.79 | | | $ | 368.27 | | | $ | 339.42 | | | $ | 335.24 | | | $ | 368.46 | | | $ | 293.23 | | | $ | 374.85 | | | $ | 361.74 | |

(1) These rates exclude state relief funding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| | Same Facility | | Transitioning | | Acquisitions | | Total |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | |

| SKILLED NURSING AVERAGE DAILY REVENUE RATES |

| Medicare | $ | 715.73 | | | $ | 690.28 | | | $ | 688.45 | | | $ | 666.01 | | | $ | 776.42 | | | $ | 673.95 | | | $ | 724.85 | | | $ | 688.09 | |

| Managed care | 530.73 | | | 509.18 | | | 527.77 | | | 492.19 | | | 548.39 | | | 439.40 | | | 532.41 | | | 507.32 | |

| Other skilled | 594.85 | | | 570.37 | | | 522.06 | | | 533.80 | | | 468.14 | | | 428.56 | | | 576.60 | | | 558.30 | |

| Total skilled revenue | 612.20 | | | 595.47 | | | 608.25 | | | 589.74 | | | 659.01 | | | 498.57 | | | 618.43 | | | 592.79 | |

| Medicaid | 273.04 | | | 258.77 | | | 268.26 | | | 250.64 | | | 251.06 | | | 234.47 | | | 269.05 | | | 257.20 | |

| Private and other payors | 263.13 | | | 249.86 | | | 253.81 | | | 249.37 | | | 260.58 | | | 181.23 | | | 261.99 | | | 248.66 | |

| Total skilled nursing revenue | $ | 381.33 | | | $ | 369.26 | | | $ | 340.74 | | | $ | 329.84 | | | $ | 364.26 | | | $ | 305.09 | | | $ | 375.58 | | | $ | 364.06 | |

(1) These rates exclude state relief funding and include sequestration reversal of 1% for the second quarter in 2022 and 2% for the first quarter of 2022.

The following tables set forth our percentage of skilled nursing patient revenue and days by payor source for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| | Same Facility | | Transitioning | | Acquisitions | | Total |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | |

| PERCENTAGE OF SKILLED NURSING REVENUE |

| Medicare | 20.8 | % | | 26.1 | % | | 19.6 | % | | 24.6 | % | | 28.9 | % | | 18.9 | % | | 22.0 | % | | 25.7 | % |

| Managed care | 20.2 | | | 19.0 | | | 12.7 | | | 11.9 | | | 13.2 | | | 7.9 | | | 18.6 | | | 18.0 | |

| Other skilled | 8.8 | | | 8.0 | | | 3.8 | | | 4.0 | | | 4.8 | | | 12.5 | | | 7.8 | | | 7.9 | |

| Skilled mix | 49.8 | | | 53.1 | | | 36.1 | | | 40.5 | | | 46.9 | | | 39.3 | | | 48.4 | | | 51.6 | |

| Private and other payors | 7.9 | | | 7.2 | | | 8.7 | | | 8.4 | | | 8.2 | | | 5.2 | | | 8.0 | | | 7.2 | |

| | | | | | | | | | | | | | | |

| Medicaid | 42.3 | | | 39.7 | | | 55.2 | | | 51.1 | | | 44.9 | | | 55.5 | | | 43.6 | | | 41.2 | |

| TOTAL SKILLED NURSING | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| | Same Facility | | Transitioning | | Acquisitions | | Total |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | |

| PERCENTAGE OF SKILLED NURSING DAYS |

| Medicare | 10.9 | % | | 14.0 | % | | 9.5 | % | | 12.3 | % | | 13.3 | % | | 8.5 | % | | 11.2 | % | | 13.6 | % |

| Managed care | 14.1 | | | 13.7 | | | 8.0 | | | 8.2 | | | 8.7 | | | 5.5 | | | 12.7 | | | 12.8 | |

| Other skilled | 5.7 | | | 5.3 | | | 2.5 | | | 2.6 | | | 4.1 | | | 8.6 | | | 5.2 | | | 5.2 | |

| Skilled mix | 30.7 | | | 33.0 | | | 20.0 | | | 23.1 | | | 26.1 | | | 22.6 | | | 29.1 | | | 31.6 | |

| Private and other payors | 11.5 | | | 10.5 | | | 11.8 | | | 11.6 | | | 11.2 | | | 8.5 | | | 11.5 | | | 10.5 | |

| | | | | | | | | | | | | | | |

| Medicaid | 57.8 | | | 56.5 | | | 68.2 | | | 65.3 | | | 62.7 | | | 68.9 | | | 59.4 | | | 57.9 | |

| TOTAL SKILLED NURSING | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | Same Facility | | Transitioning | | Acquisitions | | Total |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | |

| PERCENTAGE OF SKILLED NURSING REVENUE |

| Medicare | 23.0 | % | | 26.2 | % | | 22.3 | % | | 25.3 | % | | 31.4 | % | | 17.0 | % | | 24.2 | % | | 25.9 | % |

| Managed care | 20.1 | | | 19.2 | | | 12.7 | | | 12.4 | | | 13.1 | | | 9.3 | | | 18.5 | | | 18.4 | |

| Other skilled | 8.7 | | | 8.0 | | | 3.9 | | | 4.1 | | | 5.2 | | | 19.5 | | | 7.9 | | | 8.0 | |

| Skilled mix | 51.8 | | | 53.4 | | | 38.9 | | | 41.8 | | | 49.7 | | | 45.8 | | | 50.6 | | | 52.3 | |

| Private and other payors | 7.5 | | | 7.0 | | | 8.5 | | | 8.2 | | | 7.9 | | | 3.8 | | | 7.6 | | | 7.0 | |

| | | | | | | | | | | | | | | |

| Medicaid | 40.7 | | | 39.6 | | | 52.6 | | | 50.0 | | | 42.4 | | | 50.4 | | | 41.8 | | | 40.7 | |

| TOTAL SKILLED NURSING | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | Same Facility | | Transitioning | | Acquisitions | | Total |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | | | | |

| PERCENTAGE OF SKILLED NURSING DAYS |

| Medicare | 12.3 | % | | 14.0 | % | | 11.0 | % | | 12.5 | % | | 14.8 | % | | 7.7 | % | | 12.6 | % | | 13.7 | % |

| Managed care | 14.4 | | | 13.9 | | | 8.2 | | | 8.3 | | | 8.7 | | | 6.5 | | | 13.1 | | | 13.2 | |

| Other skilled | 5.5 | | | 5.2 | | | 2.6 | | | 2.6 | | | 4.0 | | | 13.8 | | | 5.0 | | | 5.2 | |

| Skilled mix | 32.2 | | | 33.1 | | | 21.8 | | | 23.4 | | | 27.5 | | | 28.0 | | | 30.7 | | | 32.1 | |

| Private and other payors | 10.9 | | | 10.4 | | | 11.4 | | | 10.8 | | | 11.0 | | | 6.4 | | | 10.9 | | | 10.3 | |

| | | | | | | | | | | | | | | |

| Medicaid | 56.9 | | | 56.5 | | | 66.8 | | | 65.8 | | | 61.5 | | | 65.6 | | | 58.4 | | | 57.6 | |

| TOTAL SKILLED NURSING | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

THE ENSIGN GROUP, INC.

UNAUDITED REVENUE BY PAYOR SOURCE

The following table sets forth our service revenue by payor source and as a percentage of total service revenue for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| 2023 | | 2022 |

| Revenue | | % of Revenue | | Revenue | | % of Revenue |

Medicaid(1) | $ | 374,838 | | | 40.1 | % | | $ | 302,615 | | | 39.5 | % |

| Medicare | 237,531 | | | 25.4 | | | 211,104 | | | 27.6 | |

| Medicaid — skilled | 62,452 | | | 6.6 | | | 50,643 | | | 6.6 | |

| Total Medicaid and Medicare | 674,821 | | | 72.1 | | | 564,362 | | | 73.7 | |

| Managed care | 170,747 | | | 18.3 | | | 132,663 | | | 17.3 | |

Private and other(2) | 89,756 | | | 9.6 | | | 68,858 | | | 9.0 | |

| SERVICE REVENUE | $ | 935,324 | | | 100.0 | % | | $ | 765,883 | | | 100.0 | % |

(1) Medicaid payor includes revenue for senior living operations and revenue related to state relief funding.(2) Private and other payors also includes revenue from senior living operations and all payors generated in other ancillary services.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| 2023 | | 2022 | | |

| Revenue | | % of Revenue | | Revenue | | % of Revenue | | | | |

Medicaid(1) | $ | 1,074,883 | | | 39.3 | % | | $ | 863,091 | | | 39.2 | % | | | | |

| Medicare | 733,335 | | | 26.8 | | | 610,009 | | | 27.7 | | | | | |

| Medicaid — skilled | 182,394 | | | 6.7 | | | 146,355 | | | 6.6 | | | | | |

| Total Medicaid and Medicare | 1,990,612 | | | 72.8 | | | 1,619,455 | | | 73.5 | | | | | |

| Managed care | 488,511 | | | 17.9 | | | 389,036 | | | 17.7 | | | | | |

Private and other(2) | 254,220 | | | 9.3 | | | 194,895 | | | 8.8 | | | | | |

| SERVICE REVENUE | $ | 2,733,343 | | | 100.0 | % | | $ | 2,203,386 | | | 100.0 | % | | | | |

(1) Medicaid payor includes revenue for senior living operations and revenue related to state relief funding.

(2) Private and other payors also includes revenue from senior living operations and all payors generated in other ancillary services.

THE ENSIGN GROUP, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION BY SEGMENT

(In thousands)

Skilled Services

The table below reconciles net income to EBITDA and Adjusted EBITDA for the skilled services reportable segment for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Statements of Income Data: | | | | | | | |

Segment income(a) | $ | 117,816 | | | $ | 101,750 | | | $ | 348,169 | | | $ | 302,272 | |

| | | | | | | |

| | | | | | | |

| Depreciation and amortization | 9,936 | | | 8,397 | | | 28,417 | | | 24,411 | |

| EBITDA | $ | 127,752 | | | $ | 110,147 | | | $ | 376,586 | | | $ | 326,683 | |

| | | | | | | |

| | | | | | | |

| Adjustments to EBITDA: | | | | | | | |

| Business interruption recoveries | (259) | | | — | | | (1,009) | | | — | |

| Stock-based compensation expense | 4,879 | | | 3,758 | | | 14,740 | | | 10,571 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| ADJUSTED EBITDA | $ | 132,372 | | | $ | 113,905 | | | $ | 390,317 | | | $ | 337,254 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(a) Segment income reflects profit or loss from operations before provision for income taxes and impairment charges from operations. General and administrative expenses are not allocated to the skilled services segment for purposes of determining segment profit or loss.

Standard Bearer

The following table sets forth details of operating results for our revenue and earnings, and their respective components, by Standard Bearer for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Rental revenue generated from third-party tenants | $ | 4,004 | | | $ | 3,708 | | | $ | 11,576 | | | $ | 11,180 | |

| Rental revenue generated from Ensign affiliated operations | 16,976 | | | 15,024 | | | 49,035 | | | 42,343 | |

| TOTAL RENTAL REVENUE | $ | 20,980 | | | $ | 18,732 | | | $ | 60,611 | | | $ | 53,523 | |

Segment income(a) | 7,165 | | | 6,941 | | | 21,517 | | | 20,679 | |

| Depreciation and amortization | 6,429 | | | 5,561 | | | 18,528 | | | 15,798 | |

FFO(b) | $ | 13,594 | | | $ | 12,502 | | | $ | 40,045 | | | $ | 36,477 | |

| | | | | | | |

(a) Segment income reflects profit or loss from operations before provision for income taxes, excluding gain or loss from sale of real estate and insurance recoveries and charges from real estate. Included in Standard Bearer expenses for the three and nine months ended September 30, 2023 is the management fee of $1.3 million and $3.7 million, respectively, and interest of $3.4 million and $9.1 million, respectively, from intercompany agreements between Standard Bearer and The Ensign Group, Inc. and other affiliated entities, including the Service Center. Included in Standard Bearer expenses for the three and nine months ended September 30, 2022 is the management fee of $1.1 million and $3.2 million, respectively, and interest of $2.3 million and $6.1 million, respectively, from intercompany agreements between Standard Bearer and The Ensign Group, Inc. and other affiliated entities, including the Service Center.(b) FFO, in accordance with the definition used by the National Association of Real Estate Investment Trusts, means net income attributable to common stockholders, computed in accordance with U.S. GAAP, excluding gains (or losses) from sales of real estate and impairment of depreciable real estate assets, while including depreciation and amortization related to real estate to earnings.

Discussion of Non-GAAP Financial Measures

EBITDA consists of net income before (a) other (income) expense, net, (b) provisions for income taxes and (c) depreciation and amortization. Adjusted EBITDA consists of net income before (a) other (income) expense, net, (b) provisions for income taxes, (c) depreciation and amortization, (d) stock-based compensation expense, (e) acquisition related costs, (f) costs incurred related to new systems implementation, (g) legal costs and adjustments and (h) gain on business interruption recoveries and sale of assets. Adjusted EBITDAR consists of net income before (a) other (income) expense, net, (b) provisions for income taxes, (c) depreciation and amortization, (d) rent-cost of services, (e) stock-based compensation expense, (f) acquisition related costs, (g) costs incurred related to new systems implementation, (h) legal costs and adjustments and (i) gain on business interruption recoveries and sale of assets. Adjusted EBT consists of (a) income before provision for income taxes, (b) stock-based compensation expense, (c) acquisition related costs, (d) costs incurred related to new systems implementation, (e) legal costs and adjustments, (f) gain on business interruption recoveries and sale of assets, (g) write-off of deferred financing fees and (h) depreciation and amortization of patient base intangible assets. Funds from Operations (FFO) for our real estate segment consists of segment income, excluding depreciation and amortization related to real estate, gains or losses from sales of real estate, insurance recoveries related to real estate and impairment of depreciable real estate assets. The Company believes that the presentation of adjusted net income, adjusted earnings per share, EBITDA, adjusted EBITDA, adjusted EBT and FFO provides important supplemental information to management and investors to evaluate the Company’s operating performance. Adjusted EBITDAR is a financial valuation measure that is not specified in GAAP. This measure is not displayed as a performance measure as it excludes rent expense, which is a normal and recurring operating expense. The Company believes disclosure of adjusted net income, adjusted net income per share, EBITDA, adjusted EBITDA, adjusted EBITDAR, adjusted EBT and FFO has substance because the excluded revenues and expenses are infrequent in nature and are variable in nature, or do not represent current revenues or cash expenditures. A material limitation associated with the use of these measures as compared to the GAAP measures of net income and diluted earnings per share is that they may not be comparable with the calculation of net income and diluted earnings per share for other companies in the Company's industry. These non-GAAP financial measures should not be relied upon to the exclusion of GAAP financial measures. For further information regarding why the Company believes that this non-GAAP measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the Company's periodic filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Report on Form 10-Q. The Company’s periodic filings are available on the SEC's website at www.sec.gov or under the "Financials" link of the Investor Relations section on Ensign’s website at http://www.ensigngroup.net.

v3.23.3

Cover Document

|

Oct. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 25, 2023

|

| Entity Registrant Name |

Ensign Group, Inc

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33757

|

| Entity Tax Identification Number |

33-0861263

|

| Entity Address, Address Line One |

29222 Rancho Viejo Road, Suite 127,

|

| Entity Address, City or Town |

San Juan Capistrano,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92675

|

| City Area Code |

949

|

| Local Phone Number |

487-9500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ENSG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001125376

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

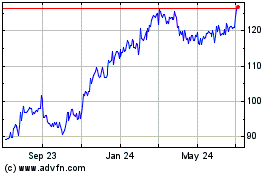

Ensign (NASDAQ:ENSG)

Historical Stock Chart

From Apr 2024 to May 2024

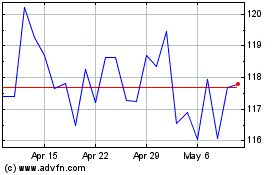

Ensign (NASDAQ:ENSG)

Historical Stock Chart

From May 2023 to May 2024