0001817004

false

0001817004

2023-10-13

2023-10-13

0001817004

dei:FormerAddressMember

2023-10-13

2023-10-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 13, 2023

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Entry

into the Securities Purchase Agreement and Promissory Note

On

October 13, 2023, EzFill Holdings, Inc. (the “Company”) and AJB Capital Investments, LLC (“AJB” or the “Investor”)

entered into a securities purchase agreement (the “Agreement”) wherein the Company agreed to issue a promissory note in the

principal amount of $320,000 (the “Note”), convertible following an event of default into shares of common stock, par value

$0.0001 per share, (the “Common Stock”) of the Company. The Note has an original issue discount of $48,000 (the “OID”),

to cover the Investor’s monitoring costs associated with the purchase and sale of the Note, which is included in the principal

balance. The purchase price will be $272,000, computed as follows: the Principal Amount minus the OID (the “Purchase Price”).

AJB holds approximately 9% of the Company’s issued and outstanding Common Stock.

On

the closing date, the Investor paid a purchase price of $272,000 to the Company and the Company delivered the executed

note along with 260,000 shares of its Common Stock (the “Commitment Fee Shares”). Pursuant to the Note, the Company agreed

to reserve 460,000 shares for issuance upon a conversion of the Note. The Company will hold a special meeting of shareholders, which

may also be at the annual meeting of shareholders, on or before the 60th day following the date of the Agreement in order

to obtain shareholder approval. The Agreement was executed in reliance upon Regulation D, the Investor is an “accredited investor”

as that term is defined in Rule 501(a) of Regulation D.

The

Note is convertible into shares of the Company’s Common Stock following an event of default. The Note has an interest rate of the

lesser of (i) eighteen percent (18%) per annum and (ii) the maximum amount permitted under law from the due date thereof until the same

is paid (the “Default Interest”). Default Interest will begin accruing upon an event of default and will be computed on the

basis of a 360-day year and the actual number of days elapsed. The principal amount, along with any other amounts, will be due on January

13, 2024. The Note can be prepaid in whole or in part without penalty.

The

Investor has the right, only following an Event of Default and ending on the date of payment of the default, to convert all or any part

of the outstanding and unpaid principal, interest, penalties, and all other amounts under the Note into fully paid and non-assessable

shares of the Company’s Common Stock, as such Common Stock exists on the date of issuance of the shares underlying the Note, or

any shares of capital stock or other securities of the Company into which such Common Stock shall thereafter be changed or reclassified

(the “Conversion Shares”).

The

conversion price shall equal (x) until the date of approval of the holders of a majority of the Company’s outstanding voting Common

Stock: (a) $1.23 (the “Nasdaq Minimum Price”) and (b) the lower of the average VWAP over the ten (10) trading day period

either (i) ending on date of conversion of the Note or (ii) the date hereof and (y) following the date of the Shareholder Approval, the

greater of the average VWAP over the ten (10) Trading Day period either (i) ending on the date of conversion of this Note or (ii) $0.20

(the “Floor Price”). No conversion may be effected under this Note at a price per share less than the Floor Price, notwithstanding

the receipt of approval from the Company’s shareholders.

The

Note is subject to adjustment upon certain events such as distributions and mergers, and has anti-dilution protections for issuance of

securities by the Company at a price that is lower than the then-current conversion price except for certain exempt issuances. In addition,

if, at any time while the Note is issued and outstanding, the Company issues any convertible securities or rights to purchase stock,

warrants, or securities pro rata to the record holders of any class of Common Stock, then the Investor will be entitled to acquire,

upon the terms applicable to such sales, the aggregate number of shares it could have acquired if the Note had been converted.

On

October 13, 2023, the Company and its transfer agent, Worldwide Stock Transfer, entered into an irrevocable letter agreement with respect

to the issuance of 260,000 Commitment Shares and the reservation of 460,000 shares of Common Stock of the Company to be

issued upon conversion of the Note.

Upon the Investor’s

request, the Company will instruct its transfer agent to issue from time to time following Closing certificate(s) or book entry statement(s)

for an aggregate amount of 260,000 shares of Common Stock, such that the Investor will never be in possession of more than 9.99% of the

issued and outstanding Common Stock of the Company; provided, however that (i) this ownership restriction described in the Agreement

can be waived by the Investor, in whole or in part, upon 61 days’ prior written notice, (ii) the Company will not issue such shares until

such time as Investor’s ownership is less than 9.99%, or (iii) upon request by Investor, the Company shall issue pre-funded warrants

providing the Investor with the same economic benefits as if the shares had been issued to it.

Second

Amendment to Securities Purchase Agreement

Also

on October 13, 2023, the Company and AJB entered into a second amendment to the security agreement (the “Amendment”), which

amends the security agreement dated April 19, 2023, pursuant to which the Company granted a security interest in its assets to secure

the obligations of the Company in respect to that promissory note in the principal amount of $1,500,000, as amended on May 17 and August

3, 2023. The security agreement was previously amended on September 22, 2023. The second amendment to the security agreement revises

the Obligations definition in Section 1 to include the new agreements.

The

information set forth above is qualified in its entirety by reference to the Agreement, the Note and the Amendment, which are incorporated

herein by reference and attached hereto as Exhibits 10.1, 10.2 and 10.3.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits3

+

Pursuant to Item 601(b)(10)(iv) of Regulation S-K promulgated by the U.S. Securities and Exchange Commission, certain portions of this

exhibit have been omitted because it is both not material and the type of information that the Company treats as private or confidential.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

October 18, 2023

| EZFILL

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name:

|

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit 10.1

Exhibit 10.2

Exhibit 10.3

v3.23.3

Cover

|

Oct. 13, 2023 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 13, 2023

|

| Entity File Number |

001-40809

|

| Entity Registrant Name |

EZFILL

HOLDINGS, INC.

|

| Entity Central Index Key |

0001817004

|

| Entity Tax Identification Number |

84-4260623

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

67

NW 183rd Street

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33169

|

| City Area Code |

305

|

| Local Phone Number |

791-1169

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

EZFL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

2999

NE 191st Street

|

| Entity Address, Address Line Two |

Ste 500

|

| Entity Address, City or Town |

Aventura

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33180

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

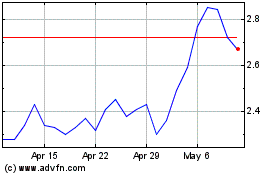

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Apr 2024 to May 2024

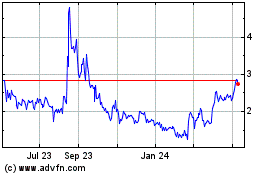

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From May 2023 to May 2024