false

0001817004

0001817004

2024-02-19

2024-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 19, 2024

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Next Charging, LLC Global Amendment

On February 19, 2024, EzFill

Holdings, Inc. (the “Company”) and Next Charging, LLC (“Next”) entered into a global amendment (the “Next

Global Amendment”) to the promissory notes dated as of July 5, 2023; August 2, 2023; August 30, 2023; September 6, 2023; September

13, 2023; November 3, 2023; November 21, 2023; December 4, 2023; December 13, 2023; December 18, 2023; December 20, 2023; December 27,

2023; January 5, 2024; January 16, 2024; January 25, 2024; and February 7, 2024 (each a “Note” and collectively the “Notes”).

The

Next Global Amendment revised Section 8, Events of Default, to add to paragraph 3, “Notwithstanding anything to the contrary set

forth herein, the Conversion Price shall not exceed a price of $1.54 per share.”

AJB Capital Investments, LLC Global Amendment

Also on February 19, 2024,

the Company and AJB Capital Investments, LLC entered into a global amendment (the “AJB Global Amendment”) to the promissory

notes dated as of April 19, 2023, as amended on May 17, 2023, September 22, 2023 and October 13, 2023 (each an “AJB Note”

and collectively the “AJB Notes”).

The AJB Global Amendment revised

Section 1.2(a) of the AJB Notes to add, “Notwithstanding anything to the contrary set forth herein, the Conversion Price shall

not exceed a price of $1.54 per share.”

Next Promissory Note

On

February 20, 2024, the Company and Next entered into a promissory note (the “February Note”) for the sum of $165,000

(the “Loan”) to be used for the Company’s working capital needs. The February Note has an original issue discount

(“OID”) equal to $15,000, which is 10% of the aggregate original principal amount of the Loan. The unpaid principal balance

of the February Note has a fixed rate of interest of 8% per annum for the first nine months, afterward, the February Note

will begin to accrue interest on the entire balance at 18% per annum.

Unless

the February Note is otherwise accelerated, or extended in accordance with the terms and conditions therein, the balance of the

February Note, along with accrued interest, will be due on April 20, 2024 (the “Maturity Date”). The Maturity Date

will automatically be extended for 2 month periods, unless Next sends 10 days written notice, prior to the end of any 2 month period,

that it does not wish to extend the February Note, at which point the end of the then current 2 month period shall be the Maturity

Date. Notwithstanding the foregoing, upon the Company completing a capital raise of at least $3,000,000, the entire outstanding principal

and interest through the Maturity Date will be immediately due.

If

the Company defaults on the February Note, (i) the unpaid principal and interest sums, along with all other amounts payable, multiplied

by 150% will be immediately due, and (ii) Next will have the right to convert all or any part of the outstanding and unpaid principal,

interest, penalties, and all other amounts under the February Note into fully paid and non-assessable shares of the Company’s

common stock. The conversion price shall equal the greater of the average VWAP over the ten (10) Trading Day period prior to the conversion

date; or $0.70 (the “Floor Price”). The conversion price will not exceed a price of $1.54 per share.

The

Company and Next have agreed that the total cumulative number of shares issued to Next under the February Note, together with the

other previously issued notes and other transaction documents, may not exceed the requirements of Nasdaq Listing Rule 5635(d)

(“Nasdaq 19.99% Cap”), which limitation will not apply following shareholder approval. If the Company is unable to

obtain shareholder approval to issue the shares to Next in excess of the Nasdaq 19.99% Cap, then any remaining outstanding balance

of the February Note must be repaid in cash at Next’s request.

The

February Note contains a protection for Next in the event the Company effectuates a split of its common stock. In the event of

a stock split, if the February Note is issued and outstanding and has not been converted, then the number of shares and the price

for any conversion under the February Note will be adjusted by the same ratios or multipliers of, any such subdivision, split,

reverse split.

Michael

Farkas is the managing member of Next (the “Managing Member”). The Managing Member is also the beneficial owner of approximately

20% of the Company’s issued and outstanding common stock. Additionally and as previously reported on a Current Report on Form 8-K

that was filed with the Securities and Exchange Commission on August 16, 2023, on August 10, 2023, and on November 8, 2023, the Company,

the members (the “Members”) of Next and its Managing Member, as an individual and also as the representative of the Members,

entered into an Exchange Agreement (the “Exchange Agreement”), pursuant to which the Company agreed to acquire from the Members

100% of the membership interests of Next in exchange for the issuance by the Company to the Members of shares of common stock, par value

$0.0001 per share, of the Company. Upon consummation of the transactions contemplated by the Exchange Agreement (the “Closing”),

Next will become a wholly-owned subsidiary of the Company. As of the date of this Current Report on Form 8-K, the Closing has not occurred.

The

information set forth above is qualified in its entirety by reference to the Next Global Amendment, the AJB Global Amendment and

the February Note, which are each incorporated herein by reference and attached hereto as Exhibit 10.1, 10.2 and 10.3,

respectively.

Item 3.01 Notice of Delisting or Failure to

Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed, on

August 22, 2023, the Company received a letter from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock Market

LLC (“Nasdaq”) indicating that the Company’s stockholders’ equity did not comply with the minimum $2,500,000

stockholders’ equity requirement for continued listing set forth in Listing Rule 5550(b) (the “Equity Rule”). Upon

submission of the Company’s plan to regain compliance, the Staff granted the Company an extension until February 20, 2024 to comply

with this requirement.

On February 21, 2024, the

Company received a delist determination letter (the “Delist Letter”) from the Staff advising the Company that the Staff had

determined that the Company did not meet the terms of the extension. Specifically, the Company did not complete its proposed transaction

to regain compliance with the Equity Rule and evidence compliance on or before February 20, 2024.

The Company plans to request an appeal of the Staff’s determination. At a hearing,

the Company intends to present its plan for regaining compliance with the Equity Rule, and may request a further extension to complete the execution of its plan. No assurance can be provided that Nasdaq will ultimately accept the Company’s plan or that

the Company will ultimately regain compliance with the Equity Rule.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

February 23, 2024

| EZFILL

HOLDINGS, INC. |

|

| |

|

| By: |

/s/

Yehuda Levy |

|

| Name:

|

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit

10.1

GLOBAL

AMENDMENT TO PROMISSORY NOTES

This

GLOBAL AMENDMENT TO PROMISSORY NOTES (the “Amendment”) is dated effective as of February 19, 2024 (the “Amendment

Effective Date”), by and between EzFill Holdings, Inc., a Delaware Corporation (the “Company”)

and Next Charging, LLC a Florida limited liability company (“Next” and together with the Company, the

“Parties”).

WHEREAS,

the Company and Next entered into and executed certain Promissory Notes, dated as of, July 5, 2023; August 2, 2023; August 30, 2023;

September 6, 2023; September 13, 2023; November 3, 2023; November 21, 2023; December 4, 2023; December 13, 2023; December 18, 2023; December

20, 2023; December 27, 2023; January 5, 2024; January 16, 2024; January 25, 2024; and February 7, 2024 (collectively the “Notes”);

and

WHEREAS,

the Company and Next would like to amend the Notes to change certain terms to the Notes.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1.

Recitals. The recitations set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2.

Capitalized Terms. All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the Notes, except

as otherwise specifically set forth herein.

3.

Conflicts. In the event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and

provisions of the Notes, the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or ambiguity.

4.

Amendment to Notes.

The

following language shall be added to paragraph 3 of Section 8:

Notwithstanding

anything to the contrary set forth herein, the Conversion Price shall not exceed a price of $1.54 per share.

5.

Not a Novation. This Amendment is a modification of the Notes only and not a novation.

6.

Effect on Notes. Except as expressly amended by this Amendment, all of the terms and provisions of the Notes shall remain and

continue in full force and effect after the execution of this Amendment, are hereby ratified and confirmed, and incorporated herein by

this reference.

7.

Execution. This Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered

one and the same Amendment. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf’

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf’ signature page was an

original thereof.

IN

WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the day and year first above written.

| |

NEXT

CHARGING, LLC |

| |

|

|

| |

By:

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

EZFILL

HOLDINGS, INC. |

| |

|

|

| |

By:

|

|

| |

Name:

|

Yehuda

Levy |

| |

Title:

|

Interim

Chief Executive Officer |

Exhibit

10.2

GLOBAL

AMENDMENT TO PROMISSORY NOTES

This

GLOBAL AMENDMENT TO PROMISSORY NOTES (the “Amendment”) is dated effective as of February 19, 2024 (the “Amendment

Effective Date”), by and between EzFill Holdings, Inc., a Delaware Corporation (the “Company”)

and AJB Capital Investments, LLC, a Delaware limited liability company (“AJB” and together with the

Company, the “Parties”).

WHEREAS,

the Company and AJB entered into and executed that certain Promissory Note, dated as of April 19, 2023, (the “April 2023

Note”) and as amended by that certain Amended and Restated Promissory Note, dated May 17, 2023 (the “Amended

and Restated Note”); and

WHEREAS,

on September 22, 2023, the Company issued to AJB an additional Promissory Note in a principal amount of up to $600,000 (the “September

2023 Note”); and

WHEREAS,

on October 13, 2023, the Company issued to AJB an additional Promissory Note in a principal amount of up to $320,000 (the “October

2023 Note” the April 2023 Note, the Amended and Restated Note, the September 2023 Note, and the October 2023 Note collectively

to be referred to as the “Notes”); and

WHEREAS,

the Company and AJB would like to amend the Notes to change certain terms set forth in the Notes.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants of the parties hereinafter expressed and other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto, each intending to be legally bound, agree

as follows:

1.

Recitals. The recitations set forth in the preamble of this Amendment are true and correct and incorporated herein by this reference.

2.

Capitalized Terms. All capitalized terms used in this Amendment shall have the same meaning ascribed to them in the Notes, except

as otherwise specifically set forth herein.

3.

Conflicts. In the event of any conflict or ambiguity by and between the terms and provisions of this Amendment and the terms and

provisions of the Notes, the terms and provisions of this Amendment shall control, but only to the extent of any such conflict or ambiguity.

4.

Amendment to Notes.

Section

1.2(a) of the Notes is hereby amended to add the following language

Notwithstanding

anything to the contrary set forth herein, the Conversion Price shall not exceed a price of $1.54 per share.

5.

Not a Novation. This Amendment is a modification of the Notes only and not a novation.

6.

Effect on Notes and Transaction Documents. Except as expressly amended by this Amendment, all of the terms and provisions of the

Notes and the Transaction Documents shall remain and continue in full force and effect after the execution of this Amendment, are hereby

ratified and confirmed, and incorporated herein by this reference.

7.

Execution. This Amendment may be executed in one or more counterparts, all of which taken together shall be deemed and considered

one and the same Amendment. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf’

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf’ signature page was an

original thereof.

[signature

page follows]

IN

WITNESS WHEREOF, the parties hereto have duly executed this Amendment as of the day and year first above written.

| |

AJB

CAPITAL INVESTMENTS, LLC |

| |

|

|

| |

By:

|

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

EZFILL

HOLDINGS, INC. |

| |

|

|

| |

By:

|

|

| |

Name:

|

Yehuda

Levy |

| |

Title:

|

Interim

Chief Executive Officer |

Exhibit

10.3

PROMISSORY

NOTE

| $165,000 |

February

20, 2024 |

FOR

VALUE RECEIVED, EZFILL HOLDINGS, INC., a Delaware corporation having an address of 67 NW 183rd St., Aventura, Florida

33169 (the “Borrower”), hereby promises to pay to the order of, the Next Charging, LLC. a Florida company having an

address of 407 Lincoln Road, Ste 9F, Miami Beach, Fl. 33139 (the “Lender”), at Lender’s offices, or such other

place as Lender shall designate in writing from time to time, the principal sum of $165,000.00 (the “Loan”), in US

Dollars, together with interest thereon as hereinafter provided.

1.

ORIGINAL ISSUE DISCOUNT. The Borrower agrees that the funding of the Loan shall be made by the Lender with original issue

discount in an amount equal to 10% of the aggregate original principal amount of the Loan (i.e. $15,000).

2.

INTEREST RATE. The unpaid principal balance of this Promissory Note (the “Note”) from day to day outstanding

shall bear a fixed rate of interest equal to 8% per annum for the first nine months and after the first nine months will begin to accrue

interest on the entire balance at 18% per annum.

3.

PREVIOUS NOTE. The disbursement of funds on the note entered into by the Borrower and Lender on August second has been

completed. This Note is for additional funds.

4.

PAYMENT OF PRINCIPAL AND INTEREST. Unless this Note is otherwise accelerated, or extended in accordance with the terms

and conditions hereof, the entire outstanding principal balance of this Note plus all accrued interest shall be due and payable in full

on April 20, 2024 (the “Maturity Date”). The Maturity Date shall automatically be extended for 2 month periods, unless

Lender sends 10 days written notice, prior to end of any two month period, that it does not wish to extend the note at which point the

end of the then current two month period shall be the Maturity Date. Notwithstanding the above, upon Borrower completing a capital raise

(debt or equity) of at least $3,000,000 the entire outstanding principal and interest through the Maturity Date shall be immediately

due and payable.

5.

APPLICATION OF PAYMENTS. Except as otherwise specified herein, each payment or prepayment, if any, made under this Note

shall be applied to pay late charges, accrued and unpaid interest, principal, and any other fees, costs and expenses which Borrower is

obligated to pay under this Note.

6.

TENDER OF PAYMENT. Payment on this Note is payable on or before 5:00 p.m. on the due date thereof, at the office of Lender

specified above and shall be credited on the date the funds become available, in Lender’s account, in lawful money of the United

States.

7.

REPRESENTATIONS AND WARRANTIES. Borrower represents and warrants to Lender as follows:

7.2.

Execution of Loan Documents. This Note has been duly executed and delivered by Borrower. Execution, delivery and performance

of this Note will not: (i) violate any contracts previously entered into by Borrower, provision of law, order of any court, agency or

other instrumentality of government, or any provision of any indenture, agreement or other instrument to which he is a party or by which

he is bound; (ii) result in the creation or imposition of any lien, charge or encumbrance of any nature; and (iii) require any authorization,

consent, approval, license, exemption of, or filing or registration with, any court or governmental authority.

7.3.

Obligations of Borrower. This Note is a legal, valid and binding obligation of Borrower, enforceable against him in accordance

with its terms, except as the same may be limited by bankruptcy, insolvency, reorganization or other laws or equitable principles relating

to or affecting the enforcement of creditors’ rights generally.

7.4.

Litigation. There is no action, suit or proceeding at law or in equity or by or before any governmental authority, agency

or other instrumentality now pending or, to the knowledge of Borrower, threatened against or affecting Borrower or any of its properties

or rights which, if adversely determined, would materially impair or affect: (i) Borrower’s right to carry on its business substantially

as now conducted (and as now contemplated); (ii) its financial condition; or (iii) its capacity to consummate and perform its obligations

under this Note.

7.5.

No Defaults. Borrower is not in default in the performance, observance or fulfillment of any of the obligations, covenants

or conditions contained herein or in any material agreement or instrument to which he is a party or by which he is bound.

7.6.

No Untrue Statements. No document, certificate or statement furnished to Lender by or on behalf of Borrower contains any

untrue statement of a material fact or omits to state a material fact necessary in order to make the statements contained herein and

therein not misleading. Borrower acknowledges that all such statements, representations and warranties shall be deemed to have been relied

upon by Lender as an inducement to make the Loan to Borrower.

7.7.

Documentary and Intangible Taxes. Borrower shall be liable for all documentary stamp and intangible taxes assessed at the

closing of the Loan or from time to time during the life of the Loan.

7.8.

The loan funds shall be used solely for Borrower’s working capital needs.

8.

EVENTS OF DEFAULT. Each of the following shall constitute an event of default hereunder (an “Event of Default”):

(a) the failure of Borrower to pay any amount of principal or interest hereunder with three (3) business days from when it becomes due

and payable; (b) Borrower becoming insolvent or declaring bankruptcy; (c) the discovery that any of the Borrower representations were

untrue; or (d) the occurrence of any other default in any material term, covenant or condition hereunder, and the continuance of such

breach for a period of ten (10) days after written notice thereof shall have been given to Borrower. Borrower shall promptly notify Lender

of the occurrence of any default, Event of Default, adverse litigation or material adverse change in its financial condition.

If

an Event of Default occurs, (i) all sums of Principal and Interest and all other amounts payable hereunder multiplied by 150% the then

remaining unpaid hereon shall be immediately due and payable, and (ii) The Lender shall have the right to convert all or any part of

the outstanding and unpaid principal, interest, penalties, and all other amounts under this Note into fully paid and non-assessable shares

of Common Stock.

The

conversion price (as adjusted, the “Conversion Price”) shall equal the greater of the average VWAP over the ten (10) Trading

Day period prior to the conversion date; or (b) $0.70 (the “Floor Price”). Notwithstanding anything to the contrary contained

in this Note the Lender and the Borrower agree that the total cumulative number of Common Shares issued to Lender hereunder together

with all other Transaction Documents may not exceed the requirements of Nasdaq Listing Rule 5635(d) (“Nasdaq 19.99% Cap”),

except that such limitation will not apply following Shareholder Approval. If the Borrower is unable to obtain Shareholder Approval to

issue Common Shares to the Lender in excess of the Nasdaq 19.99% Cap, any remaining outstanding balance of this Note must be repaid in

cash at the request of the Lender. Notwithstanding anything to the contrary set forth herein, the Conversion Price shall not exceed a

price of $1.54 per share.

9.

REMEDIES. If an Event of Default exists, Lender may exercise any right, power or remedy permitted by law or as set forth

herein, including, without limitation, the right to declare the entire unpaid principal amount hereof and all interest accrued hereon,

to be, and such principal, interest and other sums shall thereupon become, immediately due and payable.

10.

MISCELLANEOUS.

10.2.

Disclosure of Financial Information. Lender is hereby authorized to disclose any financial or other information about Borrower

to any regulatory body or agency having jurisdiction over Lender and to any present, future or prospective participant or successor in

interest in any loan or other financial accommodation made by Lender to Borrower, so long as there is a mandatory requirement to provide

such disclosure. The information provided may include, without limitation, amounts, terms, balances, payment history, return item history

and any financial or other information about Borrower.

10.3.

Integration. This Note constitutes the sole agreement of the parties with respect to the transaction contemplated hereby

and supersede all oral negotiations and prior writings with respect thereto.

10.4.

Borrower’s Obligations Absolute. The obligations of Borrower under this Note shall be absolute and unconditional

and shall remain in full force and effect without regard to, and shall not be released, suspended, discharged, terminated or otherwise

affected by, any circumstance or occurrence whatsoever, including, without limitation:

10.4.1.

any renewal, extension, amendment or modification of, or addition or supplement to or deletion from, this Note, or any other instrument

or agreement referred to therein, or any assignment or transfer of any thereof;

10.4.2.

any waiver, consent, extension, indulgence or other action or inaction under or in respect of any such agreement or instrument or this

Note;

10.4.3.

any furnishing of any additional security to the Borrower or its assignee or any acceptance thereof or any release of any security by

the Lender or its assignee; or

10.4.4.

any limitation on any party’s liability or obligations under any such instrument or agreement or any invalidity or unenforceability,

in whole or in part, of any such instrument or agreement or any term thereof.

10.5.

No Implied Waiver. Lender shall not be deemed to have modified or waived any of its rights or remedies hereunder unless

such modification or waiver is in writing and signed by Lender, and then only to the extent specifically set forth therein. A waiver

in one event shall not be construed as continuing or as a waiver of or bar to such right or remedy in a subsequent event. After any acceleration

of, or the entry of any judgment on, this Note, the acceptance by Lender of any payments by or on behalf of Borrower on account of the

indebtedness evidenced by this Note shall not cure or be deemed to cure any Event of Default or reinstate or be deemed to reinstate the

terms of this Note absent an express written agreement duly executed by Lender and Borrower.

10.6.

No Usurious Amounts. Notwithstanding anything herein to the contrary, it is the intent of the parties that Borrower shall

not be obligated to pay interest hereunder at a rate which is in excess of the maximum rate permitted by law (the “Maximum Rate”).

If by the terms of this Note, Borrower is at any time required to pay interest at a rate in excess of the Maximum Rate, the rate of interest

under this Note shall be deemed to be immediately reduced to the Maximum Rate and the portion of all prior interest payments in excess

of the Maximum Rate shall be applied to and shall be deemed to have been payments in reduction of the outstanding principal balance,

unless Borrower shall notify Lender, in writing, that Borrower elects to have such excess sum returned to it forthwith. Borrower agrees

that in determining whether or not any interest payable under this Note exceeds the Maximum Rate, any non-principal payment, including,

without limitation, late charges, shall be deemed to the extent permitted by law to be an expense, fee or premium rather than interest.

10.7.

Partial Invalidity. The invalidity or unenforceability of any one or more provisions of this Note shall not render any

other provision invalid or unenforceable. In lieu of any invalid or unenforceable provision, there shall be automatically added hereto

a valid and enforceable provision as similar in terms to such invalid or unenforceable provision as may be possible.

10.8.

Binding Effect. The covenants, conditions, waivers, releases and agreements contained in this Note shall bind, and the

benefits thereof shall inure to, the parties hereto and their respective heirs, executors, administrators, successors and assigns; provided,

however, that this Note cannot be assigned by Borrower without the prior written consent of Lender, and any such assignment or attempted

assignment by Borrower shall be void and of no effect with respect to Lender.

10.9.

Modifications. This Note may not be supplemented, extended, modified or terminated except by an agreement in writing signed

by the party against whom enforcement of any such waiver, change, modification or discharge is sought.

10.10.

Sales or Participations. Lender may, from time to time, sell or assign, in whole or in part, or grant participations in,

the Loan, this Note and/or the obligations evidenced thereby. The holder of any such sale, assignment or participation, if the applicable

agreement between Lender and such holder so provides, shall be: (a) entitled to all of the rights, obligations and benefits of Lender;

and (b) deemed to hold and may exercise the rights of setoff or banker’s lien with respect to any and all obligations of such holder

to Borrower, in each case as fully as though Borrower were directly indebted to such holder. Lender may in its discretion give notice

to Borrower of such sale, assignment or participation; however, the failure to give such notice shall not affect any of Lender’s

or such holder’s rights hereunder.

10.11.

Jurisdiction; etc. Borrower hereby consents that any action or proceeding against him be commenced and maintained in any

court in Miami-Dade County Florida and Borrower agrees that the courts in Miami-Dade County Florida shall have jurisdiction with respect

to the subject matter hereof and the person of Borrower. Borrower agrees not to assert any defense to any action or proceeding initiated

by Lender based upon improper venue or inconvenient forum.

10.12.

Notices. All notices from the Borrower to Lender and Lender to Borrower required or permitted by an provision of this Note

shall be in writing and sent by registered or certified mail or nationally recognized overnight delivery service and addressed to the

address set forth above.

Notice

given as hereinabove provided shall be deemed given on the date of its deposit in the United States Mail and, unless sooner actually

received, shall be deemed received by the party to whom it is address on the third (3rd) calendar day following the date on

which said notice is deposited in the mail, or if a courier system is used, on the date of delivery of the notice. The parties may add,

deleted, or alter any address to which notice is to be provided by providing written notice of such change pursuant to the terms of this

section.

10.13.

Governing Law. This Note shall be governed by and construed in accordance with the substantive laws of the State of Florida

without regard to conflict of laws principles.

10.14.

Waiver of Jury Trial. BORROWER AND LENDER AGREE THAT, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY SUIT, ACTION OR

PROCEEDING, WHETHER CLAIM OR COUNTERCLAIM, BROUGHT BY LENDER OR BORROWER, ON OR WITH RESPECT TO THIS NOTE OR ANY OTHER LOAN DOCUMENT

EXECUTED IN CONNECTION HEREWITH OR THE DEALINGS OF THE PARTIES WITH RESPECT HERETO OR THERETO, SHALL BE TRIED ONLY BY A COURT AND NOT

BY A JURY. LENDER AND BORROWER EACH HEREBY KNOWINGLY, VOLUNTARILY, INTENTIONALLY AND INTELLIGENTLY AND WITH THE ADVICE OF THEIR RESPECTIVE

COUNSEL, WAIVE, TO THE EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT TO A TRIAL BY JURY IN ANY SUCH SUIT, ACTION OR PROCEEDING. FURTHER,

BORROWER WAIVES ANY RIGHT IT MAY HAVE TO CLAIM OR RECOVER, IN ANY SUCH SUIT, ACTION OR PROCEEDING, ANY SPECIAL, EXEMPLARY, PUNITIVE,

CONSEQUENTIAL OR OTHER DAMAGES OTHER THAN, OR IN ADDITION TO, ACTUAL DAMAGES. BORROWER ACKNOWLEDGES AND AGREES THAT THIS SECTION IS A

SPECIFIC AND MATERIAL ASPECT OF THIS NOTE AND THAT LENDER WOULD NOT EXTEND CREDIT TO BORROWER IF THE WAIVERS SET FORTH IN THIS SECTION

WERE NOT A PART OF THIS NOTE.

10.15.

Adjustment Due to Stock Split by Borrower. If, at any time when this Note is issued and outstanding and prior to conversion of

all of the Notes Borrower shall: (i) subdivides outstanding shares of its Common Stock into a larger number of shares, or (ii) combines

(including by way of reverse stock split) outstanding shares of Common Stock into a smaller number of shares, then in each case the number

of shares and the price for any conversion under this Note shall be adjusted in alignment with, in accordance with, and by the same ratios

or multipliers of, any such subdivision, split, reverse split set forth in items (i) and (ii) of this subsection.

[signature

page follows]

Borrower,

intending to be legally bound, has duly executed and delivered this Note as of the day and year first above written.

| BORROWER: |

|

| |

|

| EzFill

Holdings, Inc. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name: |

Yehuda

Levy |

|

| Title: |

CEO |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

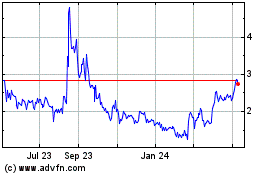

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

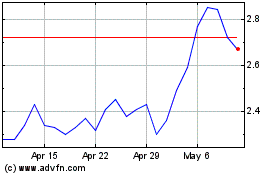

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Apr 2023 to Apr 2024