false

0001817004

0001817004

2023-11-01

2023-11-01

0001817004

dei:FormerAddressMember

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C., 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 1, 2023

EZFILL

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40809 |

|

84-4260623 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

67

NW 183rd Street, Miami, Florida 33169

(Address

of principal executive offices, including Zip Code)

305-791-1169

(Registrant’s

telephone number, including area code)

2999

NE 191st Street, Ste 500, Aventura Florida 33180

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

EZFL |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

Entry

into the amendment to the Securities Purchase Agreement

As

previously reported on EzFill Holdings, Inc.’s (the “Company”) Current Report on Form 8-K filed with the Securities

and Exchange Commission (the “Commission”) on April 21, 2023, on April 19, 2023 the Company entered into a Securities Purchase

Agreement (the “Purchase Agreement”) with AJB Capital Investments, LLC (“AJB” or the “Investor”)

with respect to the sale and issuance to the Investor of: (i) an initial commitment fee in the amount of $700,000 in the form of 2,000,000

shares (the “Commitment Fee Shares”) of the Company’s common stock (the “Common Stock”) and (ii) a promissory

note in the aggregate principal amount of $1,500,000 (the “Note”). As previously reported on the Company’s Current

Reports on Form 8-K filed with the Commission on May 18, 2023; August 4, 2023; and September 21, 2023 the Company and AJB entered into

certain Amendments to the Purchase Agreement (the “Amended Purchase Agreement”).

On

November 1, 2023, the Company and AJB executed an additional amendment to the Amended Purchase Agreement (the “November Amendment”),

retroactively effective as of October 25, 2023, providing the Company until November 30, 2023 to obtain the Shareholder Approval required

by the Purchase Agreement.

The

information set forth above is qualified in its entirety by reference to the November Amendment, which is incorporated herein by reference

and attached hereto as Exhibit 10.1.

Entry

into the Promissory Note

On

September 13, 2023, the Company and Next Charging, LLC (“Next”) entered into a promissory note (the “Note”) for

the sum of $165,000 (the “Loan”). The Note has an original issue discount (“OID”) equal to $10,000, which is

10% of the aggregate original principal amount of the Loan. The unpaid principal balance of the Note has a fixed rate of interest of

8% per annum for the first nine months, afterward, the Note will begin to accrue interest on the entire balance at 18% per annum.

Unless

the Note is otherwise accelerated, or extended in accordance with the terms and conditions therein, the balance of the Note, along with

accrued interest, will be due on January 3, 2024 (the “Maturity Date”). The Maturity Date will automatically be extended

for 2 month periods, unless Next sends 10 days written notice, prior to the end of any 2 month period, that it does not wish to extend

the Note, at which point the end of the then current 2 month period shall be the Maturity Date. Notwithstanding the foregoing, upon the

Company completing a capital raise of at least $3,000,000, the entire outstanding principal and interest through the Maturity Date will

be immediately due.

If

the Company defaults on the Note, (i) the unpaid principal and interest sums, along with all other amounts payable, multiplied by 150%

will be immediately due, and (ii) Next will have the right to convert all or any part of the outstanding and unpaid principal, interest,

penalties, and all other amounts under the Note into fully paid and non-assessable shares of the Company’s common stock. The conversion

price will be the average closing price over the 10 trading days ending on the date of conversion.

Michael

Farkas is the managing member of Next (the “Managing Member”). The Managing Member is also the beneficial owner of approximately

20% of the Company’s issued and outstanding common stock. Additionally and as previously reported on a Current Report on

Form 8-K that was filed with the Securities and Exchange Commission on August 16, 2023, on August 10, 2023, the Company, the members

(the “Members”) of Next and its Managing Member, as an individual and also as the representative of the Members, entered

into an Exchange Agreement (the “Exchange Agreement”), pursuant to which the Company agreed to acquire from the Members 100%

of the membership interests of Next in exchange for the issuance by the Company to the Members of shares of common stock, par value $0.0001

per share, of the Company. Upon consummation of the transactions contemplated by the Exchange Agreement (the “Closing”),

Next will become a wholly-owned subsidiary of the Company. As of the date of this Current Report on Form 8-K, the Closing has not occurred.

The

information set forth above is qualified in its entirety by reference to the Note, which is incorporated herein by reference and attached

hereto as Exhibit 10.2.

Item

3.02. Unregistered Sales of Equity Securities.

To

the extent required by this Item 3.02, the information contained in Item 1.01 is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits3

+

Pursuant to Item 601(b)(10)(iv) of Regulation S-K promulgated by the U.S. Securities and Exchange Commission, certain portions of this

exhibit have been omitted because it is both not material and the type of information that the Company treats as private or confidential.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 3, 2023

| EZFILL

HOLDINGS, INC. |

|

| |

|

|

| By: |

/s/

Yehuda Levy |

|

| Name:

|

Yehuda

Levy |

|

| Title: |

Interim

Chief Executive Officer |

|

Exhibit

10.1

Exhibit

10.2

v3.23.3

Cover

|

Nov. 01, 2023 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity File Number |

001-40809

|

| Entity Registrant Name |

EZFILL

HOLDINGS, INC.

|

| Entity Central Index Key |

0001817004

|

| Entity Tax Identification Number |

84-4260623

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

67

NW 183rd Street

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33169

|

| City Area Code |

305

|

| Local Phone Number |

791-1169

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

EZFL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

2999

NE 191st Street

|

| Entity Address, Address Line Two |

Ste 500

|

| Entity Address, City or Town |

Aventura

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33180

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

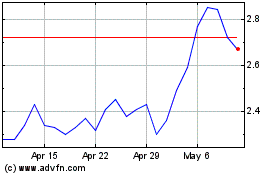

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Apr 2024 to May 2024

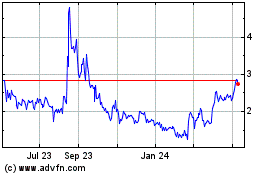

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From May 2023 to May 2024